I love spreadsheets for all facets of life and this next spreadsheet is for tracking my monthly expenses and budget, and to help you get a grasp of your finances. This spreadsheet is for those looking to record their incomes and expenses by categories using a Google spreadsheet.

Here is a list of my other spreadsheets that may help you in your path to financial success!

- The ultimate spreadsheet to track all your credit cards, sign on bonuses, and annual fees.

- Also, check out my travel itinerary planning spreadsheet which is perfect for organizing and planning your trip!

- As well as my Restaurant List Tracker spreadsheet for keeping track of all the restaurants you have been to in your hometown or abroad.

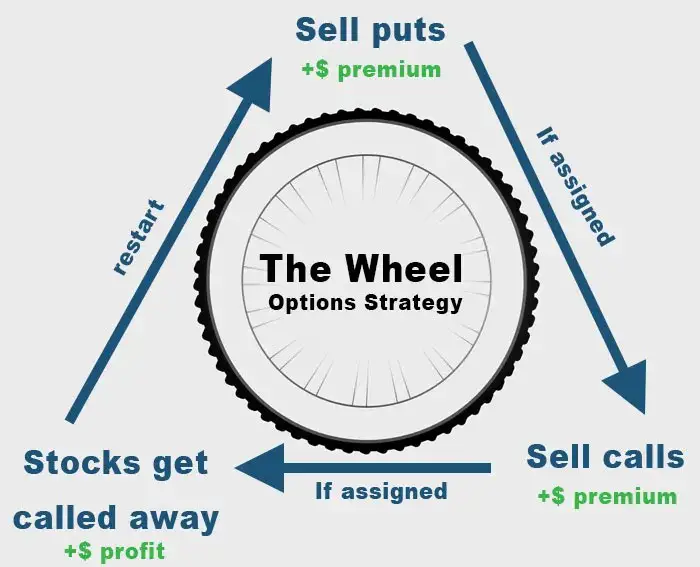

- For those looking to track their stock portfolio, this is the spreadsheet I use to track my stock investments. In addition, I’ve been trading and selling options for the past few years to generate extra income during early retirement and I’ve also created an options tracking spreadsheet for this purpose.

- For a list of all my credit card and travel hack related posts, click here.

Why use a spreadsheet to track your monthly expenses?

Having a firm grasp on your budget is the first step to financial success and freedom. When I first started working coming out of university, I was all over the place with my finances. Between racking up credit card debt, student loans, high cost of living in New York, and just a general sense of YOLOing (before it was a thing, I was in a terrible financial state.

Over the years, I’ve managed to get a grip on my finances by following a close budgeting schedule. This means really looking after how much money comes in and how much money goes out. The one and only secret to maintaining a budget is to be consistent. This means always following your plan and sticking to it. Do not get the urge to deviate. I track my expenses on a monthly basis because it’s a good way to create a start and end date to your expense cycle. Most people get paid once or twice a month and your credit card billing cycle is always on a monthly basis. I get paid twice a month and I like to pay all my bills near the end of the month so I know exactly how much I spent in one month.

There are so many apps to track budgeting but I always found that a spreadsheet is the way to go. This is because services like mint.com will track all of your expenditures that you make with a credit card or debit card but there are other expenses that it doesn’t pick up on like the ones you make with cash.

When is a monthly expenses tracking useful?

Tracking your budget is particularly useful if you are starting out your financial journey. This means you need to keep track of how much money comes in via salary, side hustles, stock dividends etc, vs how much money you spend.

A lot of people spend so much of their lives living paycheck to paycheck even with a high salary because they just don’t have a good grasp of what their money is being spent on. If you don’t have the wherewithal to know exactly how your money is being spent and why you can’t save money, then this spreadsheet is for you.

When budget tracking is not so useful

Monthly budgets are a good way to make sure you know exactly how much money you’ve made and how much you’ve spent. Monthly budgets vs your actual expenditures are a good way to discern if you’re financially responsible.

However, I don’t find it particularly useful because I am already very observant of my spending habits, and my spending changes month to month depending on what big things I may purchase. In addition, I’ve saved and invested so much over the years that I’ve already achieved financial independence. You can’t get to this stage without having a good grasp of your finances.

In addition, my monthly expenditures is something like a few thousand dollars a month. However, due to the size of my portfolio, market moves means my portfolio can move in a day what I spend in a month. Therefore, tracking expenses down to the very dollar is not so useful because I have enough money to cover my day to day expenses.

It’s only when I need to spend a lot of money on a big purchase where I need to be cognizant of where I am with my finances. If I know I have to make a large expense of say many thousands of dollars, this means I might lower my spending in the next month to compensate.

Monthly expenses spreadsheet

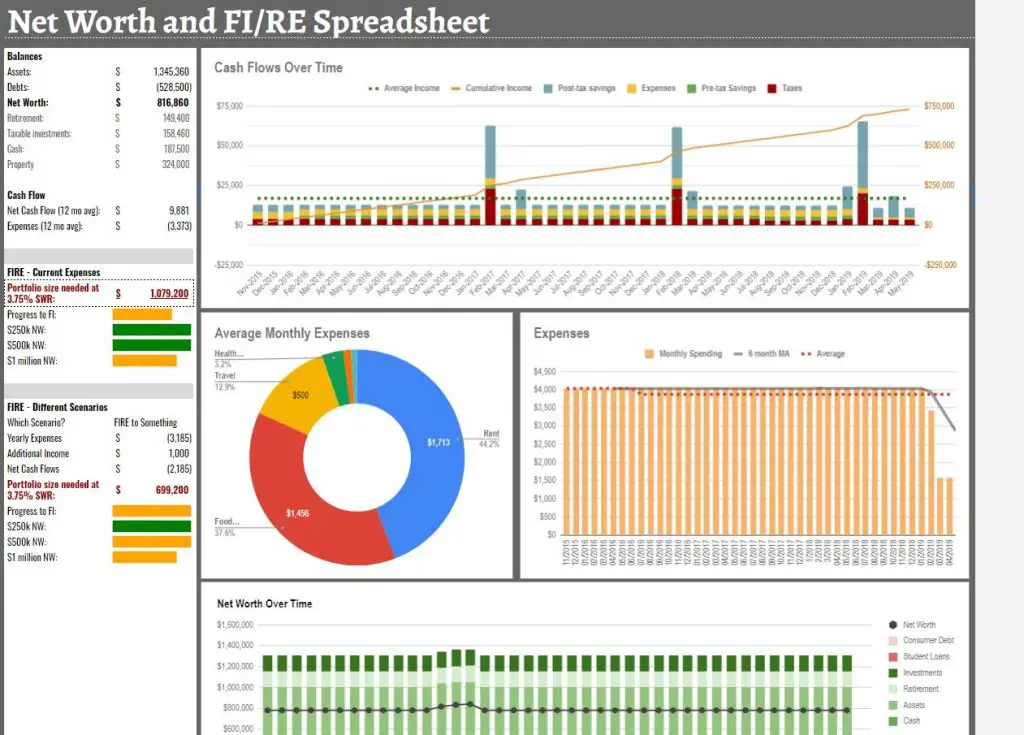

The monthly expenses spreadsheet I created focuses on budgeting by breaking out the spending into numerous categories.

It is not something that makes you list all your transactions on a granular level however. I find that it is a bit pointless to track every transaction you make but rather just combining them by category at the end of the month. You’ll see that in the data tab, you can write down all your expenses by category and by month.

It is not an extremely meticulous spreadsheet that breaks down every single transaction you make, but more of an aggregation tool to help you summarize everything. I am big into charts and think that tracking your finances is best done through a trend of your spending and earning habits. That is why I’ve added numerous charts to the mix.

The spreadsheet is simple, yet effective. Just make sure you update it on a regular basis. I would recommend spending 5-10 minutes updating the spreadsheet once a month with your figures. I don’t always do the exact amount for different expenses because it takes a lot of time but that is also up to you. You can use this spreadsheet if you’re a single person as well as if you’re a couple (just add everything up!).

Keep in mind that this spreadsheet is also what I use to track my own expenses. I will be making updates live and will add additional features to this spreadsheet as time goes on so make sure to check in for updates!

Download Monthly Budget Tracker Spreadsheet

The spreadsheet is in Google Sheets because if I update it in the future, it will be easy to access from anywhere with an internet connection. I prefer this to Microsoft Excel. It’s easy to download it and use with Microsoft Excel as well.

To download offline, click the red button above, then click file > download as > Microsoft Excel

To use it with your own Google profile, just click file > make a copy

Using my Expenses and Budgeting Google Sheet

As someone that works with spreadsheets regularly, I’ve included some functionality like conditional formatting and formulas that an Excel novice might not understand. I will explain everything necessary for those wanting to get the full use out of the spreadsheet. For the most part, anyone with any excel experience should just follow my spreadsheet and populate accordingly. Do not touch cells with formulas because everything is intricately linked. All cells that you should update have been color coded with gray cells.

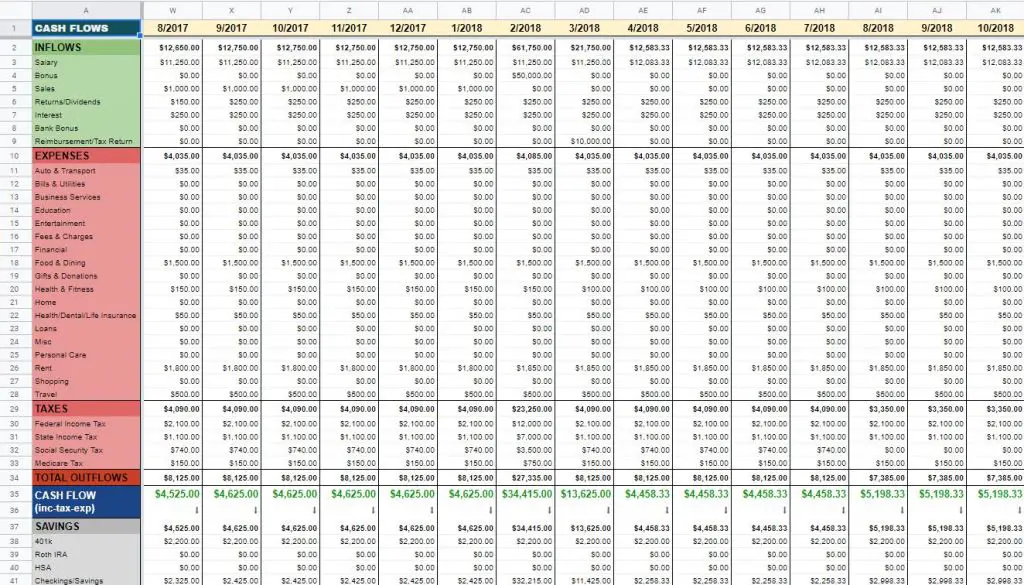

Cash Flows Sheet

This is where you record all of your month to month data. This sheet makes up the crux of the top three tables on the “Dashboard” sheet. In summary, this is where you record how much money you earned over the month, as well as your expenses. I’ve split the expenses into categories that mint.com uses to keep it simple for those that are also using Mint to track their finances.

Do not touch the cells with formulas which are the cells with bold text. Record your taxes as well as this will help organize what is your gross income and net income. There is no formula to calculate taxes because everyone will have a different tax situation depending on their withholdings, state taxes and the like. Just look at your pay stubs and record them accordingly. This is important as you can need to take your net income (salary after taxes) in order to compute the expenses.

For expenses, record your amounts by expense category to the best of your ability. Again, it doesn’t have to be an exact number but just needs to be accurate. You can add more categories if the expenses don’t into these categories. Simply insert a new row in the red section for expenses.

Again, I track all my expenses and income on a monthly basis. You can also change the spreadsheet to your liking if you want to do something on a weekly, quarterly, or yearly basis.

Dashboard Sheet

This is the high level summary for all your information. This is also the tab for all your charts and trends. There is not much to manually change in this sheet so just leave it alone to keep it simple. It will update as you populate the other sheets.

You will see a chart for Average monthly expenses. This will take all the months of data you’ve inputted in the cash flows sheet under expenses and average them out. I find that it is useful to look at expenses over a long period of time since you might have larger one off expenses in one month that doesn’t carry over to the next.

If you want, you could change the charts so it only picks up averages by a certain year. I find that it is helpful to look at my expenses on a yearly basis. Simply change the source data of this chart to only pick up the columns in the “cash flows” sheet that correspond to the year you want. You can copy and paste multiple charts and select the years you want accordingly.

Net Worth Tracking

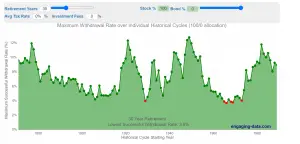

This spreadsheet that I made is actually a consolidation of multiple themes. Budgeting is only one of them. On top of budgeting, I use this spreadsheet to track my net worth which is especially helpful for those that are looking to achieve Financial Independence. I achieved financial independence (or FIRE) in 2020 with the help of this spreadsheet.

Once you’ve become comfortable with managing your budget and see yourself saving and investing consistently, the net worth portion of the spreadsheet is really the next step in financial management.

Stock Trading Spreadsheet

In addition to tracking my net worth, I also keep a track of my stock portfolio using my stock investments spreadsheet. This spreadsheet uses the Google Finance api to track the stocks in my portfolio, as well as display numerous stock financials like market cap, 52 week highs, P/E ratios and more.

In addition, the spreadsheet also has the ability to track your stock purchases and sales. If you’re trading stocks (and not just holding long term), this spreadsheet will help keep track of your unrealized as well as realized gains.

Stock brokerages have fancy apps and online banking portals but I think nothing replaces a good spreadsheet which is why I created this one.