As someone who hit their FIRE goals in 2020, you quickly familiarize yourself with everything related to taxes and just what you might owe to the IRS. While I paid taxes diligently when I was working and accumulating my assets, I’ve worked it out so that I pay zero income taxes while retired.

Yes. I pay no taxes at all anymore to the IRS.

How can you do this? Simply by understanding long term capital gains rate. This post will help you understand just how I withdraw my money from my portfolio with respect to the 4% withdraw rate, spend my money, and how I pay no taxes because of it. Earning $50k a year from a normal job is not the same as withdrawing $50k from a portfolio of stocks. Hint: You keep a lot more of your money in the latter scenario.

Who is this for?

This post is mostly for US citizens and tax residents. Since I’m from the US and have all my assets in US financial institutions, this article will only make sense for those that need to pay up to Uncle Sam at the end of the year.

Nevertheless, I think many other countries also have favorable capital gains tax rates that are different from income tax rates. I know in Germany where I lived for many years, there is also favorable tax brackets for those withdrawing long term capital gains but it’s something miniscule in comparison to the US (like 0-800 euros is taxed at 0%).

In addition, this post is mostly for those that are already retired early or are aspiring to retiring early. If you’re working a normal W2 job, this article probably won’t be as useful because while you can minimize the taxes paid on your capital gains, you’ll still need to pay taxes on your regular income at regular income tax brackets. There’s not much of a way around that.

Understanding long term capital gains tax rates

The meat of this post is primarily centered around capital gains tax rates.

Emphasis is on long term capital gains which is very different from short term capital gains. Remember for something to be considered long term capital gains, it means you must hold the stock/etf for at least 1 year before selling.

If you’re aspiring to reach financial independence and retire early, then it’s likely you’re already buying funds and holding long term. By the time you quit your job and are ready to live off your portfolio, all your stocks will be well over the 1 year mark so you don’t need to worry about this.

Below is a table for the long term capital gains rates as of 2022.

|

Tax-filing status |

Single |

Married, filing jointly |

Married, filing separately |

Head of household |

|---|---|---|---|---|

|

0% |

$0 to $40,400 |

$0 to $80,800 |

$0 to $40,400 |

$0 to $54,100 |

|

15% |

$40,401 to $445,850 |

$80,801 to $501,600 |

$40,401 to $250,800 |

$54,101 to $473,750 |

|

20% |

$445,851 or more |

$501,601 or more |

$250,801 or more |

$473,751 or more |

As you can see, the 0% tax bracket means as a single person, you can sell $40,400 worth of stocks a year and pay zero taxes on this sale.

For example, I own a lot of VGT and VTI ETFs in my portfolio. This means I can sell 40k worth of these ETFs a year and not pay any taxes on the sale.

VGT is currently trading around $430 as I write this. This means I can therefore sell 90 shares of VGT and not incur any taxes. Of course, I would not sell these stocks upfront because the best way to manage your withdrawals during FIRE is to take money when you need to pay your expenses.

Time in the market is always better than timing the market.

Standard Deduction on Income Taxes

Now that you understand capital gains tax rates, it’s time to go over the standard deduction on income taxes. The income tax brackets are probably something you’re very familiar with throughout your journey towards FIRE and just general life.

As of 2022, the income tax brackets are the following:

| Tax Rate | Taxable Income (Single) | Taxable Income (Married Filing Jointly) |

| 10% | Up to $9,950 | Up to $19,900 |

| 12% | $9,951 to $40,525 | $19,901 to $81,050 |

| 22% | $40,526 to $86,375 | $81,051 to $172,750 |

| 24% | $86,376 to $164,925 | $172,751 to $329,850 |

| 32% | $164,926 to $209,425 | $329,851 to $418,850 |

| 35% | $209,426 to $523,600 | $418,851 to $628,300 |

| 37% | Over $523,600 | Over $628,300 |

These income brackets are important if you’re still working as you’ll need to pay taxes accordingly. However, if you are no longer working a traditional full time job but may have some income from let’s say short term capital gains or a side hustle like a travel blog (hint hint) then the standard deduction is what you’ll want.

Here is the standard deduction for 2022:

|

Filing status |

2021 tax year |

2022 tax year |

|---|---|---|

|

Single |

$12,550 |

$12,950 |

|

Married, filing jointly |

$25,100 |

$25,900 |

|

Married, filing separately |

$12,550 |

$12,950 |

|

Head of household |

$18,800 |

$19,400 |

This table states that you can take a no questions asked $12,950 every year as a single person and $25,900 as a married couple before you have to pay any taxes.

Using the standard deduction for side hustles and short term gains

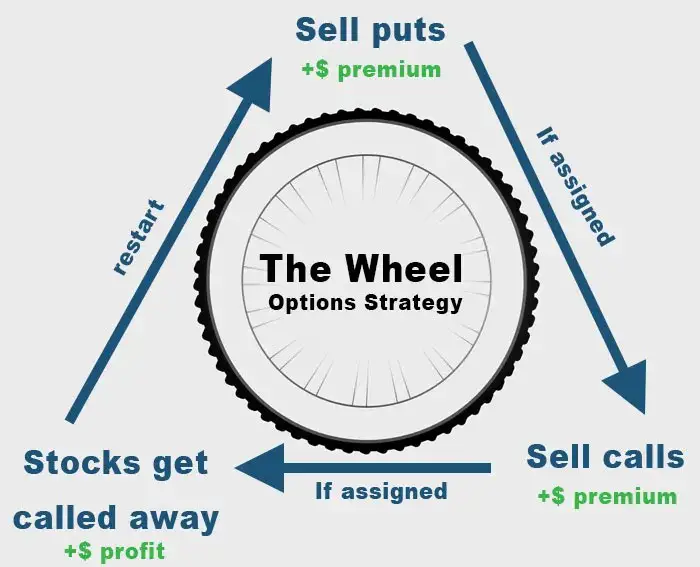

If you have no salaried job where you’re earning traditional income, then this money can be used for side hustles as well as short term capital gains. While most of my income is from selling my long term holdings (thereby incurring the tax rates from the previous sections), sometimes I will sell options like covered calls or cash secured puts that are all a part of my option wheel strategy. In addition, I might make the odd trade here or there throughout the year that is a short term trade.

Using the standard deduction for Roth IRA conversions

Converting your traditional IRA to a Roth IRA is a very popular thing to do when you hit FIRE. You are no longer burdened by big taxes if you were earning a sizeable salary before. Therefore, if you make a small conversion from your traditional IRA to roth IRA, your tax burden would be much smaller than before.

Let’s say you made $100k salary before retiring. If you made a Roth IRA conversion of $40k, you would pay 24% taxes on this withdrawal (according to the table at the top).

If you waited until you are retired, you could make the same $40k conversion and pay less than 10% in taxes. This is because the first $13k of this conversion would be tax free under the standard deduction. The remaining $27k would be taxed at 10% up to $10k and the remaining $17k would be taxed at 12%.

You can’t avoid paying taxes for everything unless you kept this withdrawal to under $13k. Nevertheless, this is a very small price to pay compared to if you were performing a roth ira conversion while working.

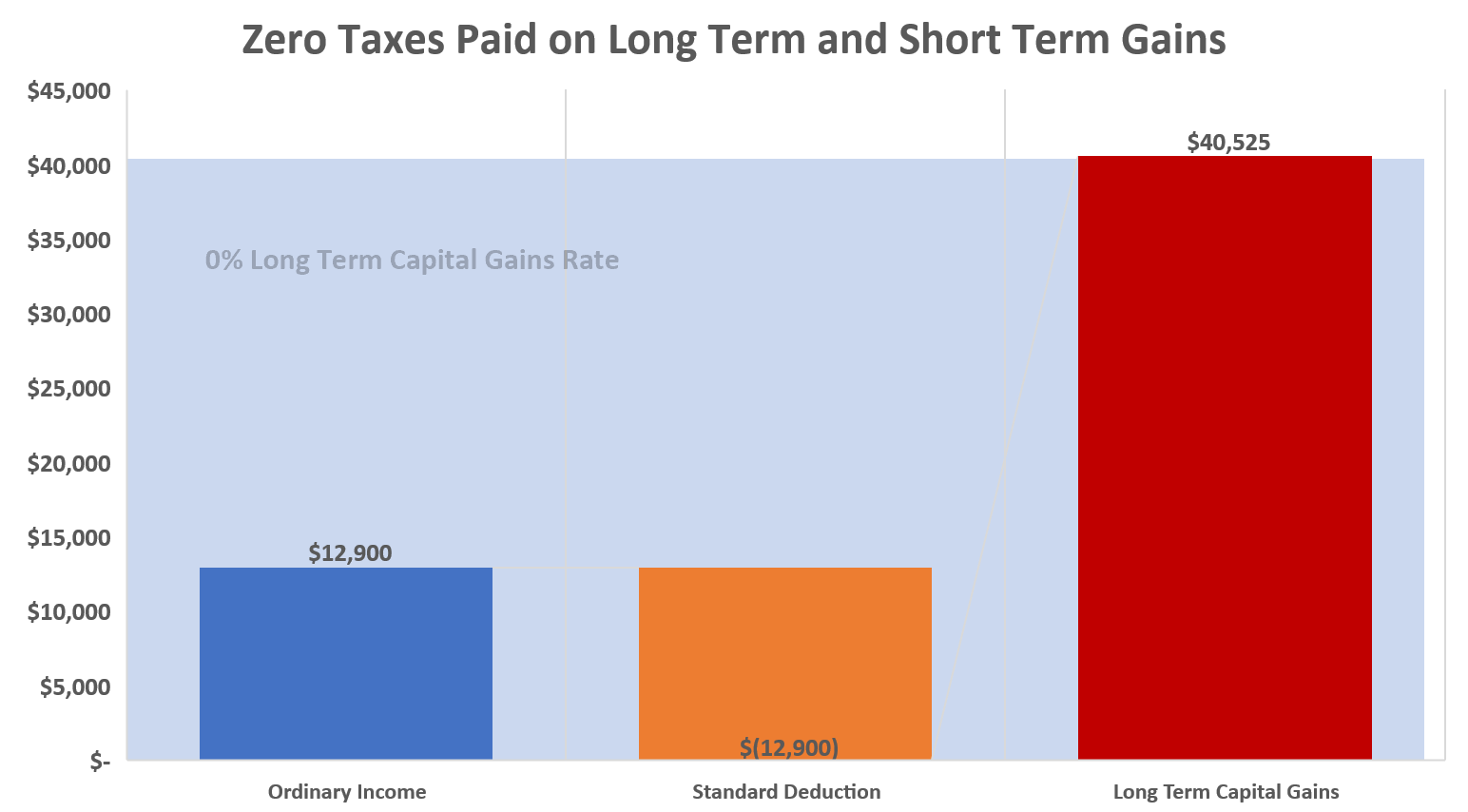

How to have $53k a year without paying any taxes

Finally, we move on to the good part. This is the section where I will go step by step into how you can essentially pay no taxes on up to $53k a year as of 2022.

Again, with taxes, there is no one stop that fits all. Everyone’s situation is different and I am merely writing about how I approach my taxes and my personal financial situation. If your situation is also the same, then this will be more helpful but at the very least I hope this section just helps you get those wheels turning inside your head.

Sell $40,525 worth of long term stock

For simplicity sake, I will just use $40k as this is the threshold for a 0% capital gains tax rate for a single person. This means, I would sell from my existing portfolio of a variety of ETFs like VGT and VTI $40,000 worth of stock. How much I sell of each ETF is another story that warrants its own article.

I generally like to sell my stocks when they are at or near all time highs which on average happens multiple times a year. You can’t time this of course but this is just my general mindset of how I approach it.

If you read how much I spend a year traveling the world, I probably won’t even need to withdraw $40k from my portfolio. For example, I have lived in Bali for under $2,000 a month and lived extremely well. In addition, this blog brings in quite a bit of money as well which helps me lower my withdrawal rate. Nevertheless, I know for sure that I could withdraw $40k from my portfolio and not pay a single dollar in income taxes.

Make $12,500 in ordinary income

Since I have hit FIRE, I am no longer working a traditional salaried job anymore. This means I don’t receive a W2 or any regularly taxed income. Therefore, most of my ordinary income comes from short term capital gains. Remember that short term capital gains are taxed at the same rate as ordinary income and for this purpose, they are essentially the same thing for tax reasons.

I can therefore earn $12.5k from buying and selling stocks that I find appealing, trading the options wheel or just selling outright covered calls.

$12.5k is the magic number because this is the standard deduction for a single person. This means no matter how I make money, the first $12.5k of it is completely tax free because of the standard deduction.

$12.5k is not much money in the grand scheme of things but considering I already have $40k from long term capital gains with zero tax, and extra $12.5k from selling covered calls is just additional money I can have without paying taxes. This money can be spent on more scuba diving around the world or can simply be reinvested into my portfolio.

Double this amount if you’re married

If you’re a married couple also approaching the FIRE stage, then you can double the amounts listed above. If you’re married, you can sell $80k of long term capital gains and pay zero tax and claim $25k in standard deduction. This means you can have a total of $107k of total combined income between long term and ordinary income and pay zero taxes.

As a couple, you can easily reduce your expenses more than if you were a single person and I think $100k+ in cash for two people is more than enough to live in almost any part of the world. You won’t live like a king in some places but you absolutely will live like a king in beautiful places like Cape Town or in Bali.

How this works from a tax perspective

From a tax perspective, it can get a little complicated if you have long term capital gains and short term capital gains / ordinary income.

Under the Internal Revenue Code, this is resolved by applying ordinary income (to fill the bottom tax brackets) first, and then adding the long-term capital gains on top. To the extent there are any tax deductions, those deductions are applied to the ordinary income first, and only apply against long-term capital gains directly once ordinary income has been reduced to zero.

Notably, this is actually the most favorable sequence possible, as it ensures ordinary income (which is otherwise taxed at the highest rates) gets the lowest brackets; while the long-term capital gains do get pushed into the “higher” brackets, since long-term capital gains are already eligible for preferential tax rates, this still comes out with the greatest tax savings.

I will illustrate this with an example of my own tax situation in the section below.

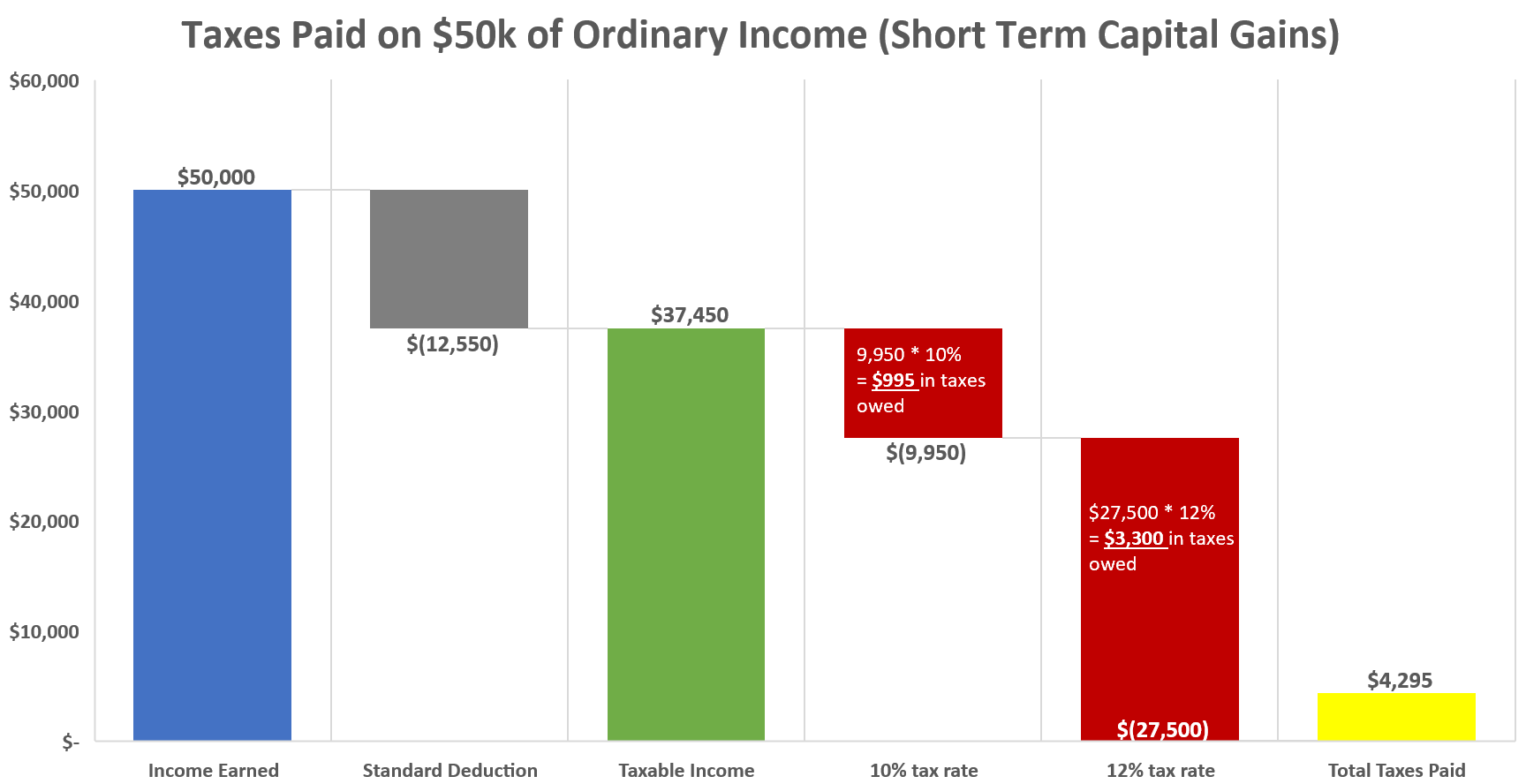

How much taxes I actually paid 2021

In 2021, I made roughly $50k from a few good stock trades as well as selling options as a way to generate income. Therefore, I had to pay taxes on this income albeit at a low tax rate which I have detailed with the chart below.

As you can see from this chart, I was taxed at an 8.5% tax rate ($4,295 / $50,000). Of course this is not 0% tax rate but money earned is always better than not having it at all.

In addition to the short term gains I made from trading, I also withdrew money from my portfolio which incurred long term capital gains tax. My long term gains are added to the short term gains/ordinary income and the long term gains tax rate is determined from that.

Harvest Capital Gains

Harvesting capital losses is a common practice. You can take $3000 of capital losses a year to offset against ordinary income if losses are big enough. However, harvesting capital gains is often overlooked for people who have stopped working.

Let’s say I buy VGT to the tune of $100,000. One year later, the value of this ETF has risen to $140,000. I can sell this for a $40,000 profit and since it’s been over a year, it is taxed at 0%. This wouldn’t work well in my situation because that leaves me with just the standard deduction of $12,950 left to live on if I wanted to avoid paying taxes.

However, if you are married filing jointly, you would have much more room to work with as you would have $81k of long term capital gains and a standard deduction of $25,900. This means that you could have $41k of capital gains and $25,900 of ordinary income left to play with before paying a single dollar in taxes. That is $67k to live off of which is plenty of money for two people.

The $40,000 sale on VGT would be categorized as long term capital gains and be completely tax free. Once you’ve sold it, you could immediately repurchase $40k of VGT which means your cost basis would “step up” to $140k and you’ve essentially locked in that $40,000 gain completely tax free.

Forever!

Summarizing everything

In conclusion, do you want to pay zero taxes? Simply follow these rules:

- Live within reason: You can have $53k as a single person or $106k as a married couple without paying any taxes. You can live like a king in many parts of the world for this. I certainly do.

- Sell stock when you need to

- Leverage Roth IRA conversions

- Harvest capital gains

If you’re pursuing financial independence and retiring early, always know that income earned when you were working is taxed differently than when you withdraw from your portfolio. $40k on a long term portfolio is as good as cash since you don’t need to do anything with the IRS. Happy tax day!

I think it’s important to note for your readers that you could very well withdraw more than $40k from your investments if you wanted and still pay zero tax as an individual, because you likely paid something for the stock you’re selling. Your basis was probably not $0. As you say, it’s a capital GAINS tax, and so you only owe tax on that part. While you’re likely still only selling $40k worth to stick with the 4% rule based on your $1M investment, an individual with $2M could probably sell $80k worth of investments for their 4% withdrawal rate and still owe no taxes at all because their investment possibly ‘only’ doubled from $40k to $80k, a $40k gain. Completely depends on the investment gains for everyone, but when reading through some of your articles it didn’t seem that clear. Enjoyed reading on your site though! Wife and I are “retiring” to this kind of a lifestyle in just a few short years utilizing the same tax advantages you’ve discussed. Cheers!

Hi Curtis, yes that’s exactly right! It is definitely a cost basis calculation. While the $1m and 4% withdrawal rate just happens to equal that of the 0% cap gains tax bracket but definitely this number would change if you had a bigger portfolio.