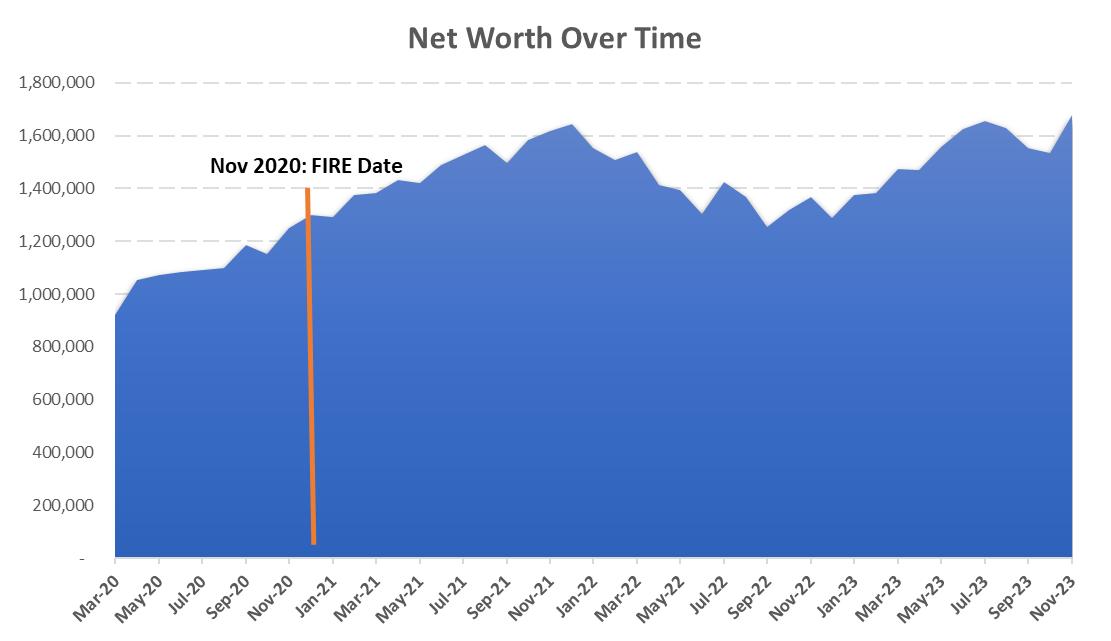

As of November 2023, I am starting my monthly portfolio update for FIRE journey. If you haven’t already read my posts before, I achieved Financial independence back in late 2020 early 2021 with a portfolio of roughly $1.3m invested in mainly ETFs. This ballooned to $1.7m during the peak of the markets in early 2022 before coming back down to Earth later in 2022.

This post will be part of a monthly series of portfolio updates that summarizes how my portfolio performed, what trades I executed, what my monthly expenses were, and my general outlook on the economy/markets. This is by no means financial advice so do not look look at me for sage advice. I make stupid trades and make even worse losses quite frequently.

This is simply the performance of my portfolio and how it has performed on a month to month basis.

Monthly Highlights

- Net worth is near $1.7m m as of November 2023 Month end

- +$0.12m for the month

- Stayed at the Ritz Carlton Maldives for 5 nights completely on points (absolute heaven on Earth)

What is in my portfolio?

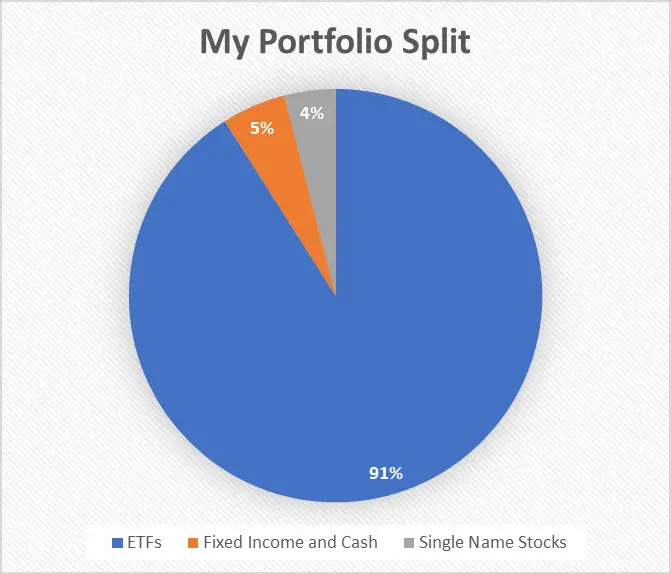

My portfolio is quite simple and straight forward. I have my holdings primarily spread out between a few ETFs, fixed income, and various single name stocks.

Fixed Income

Due to rising rates, I’ve also allocated a small part of my portfolio (<5%) to fixed income products. I’ve been purchasing 5.5% yielding treasury bills with a 3-6 month expiry. I currently have about ~$60k invested in a 3-mo T-Bill that will expire in Dec ME. I plan to buy another 3 month T-Bill upon maturity.

This is guaranteed money with zero risk which I decided to take advantage of while waiting for better entry points. However, it seems like this money probably would have been better used just buying the market but this is opportunity cost I’m willing to sacrifice.

I also purchased I-Bonds in 2022 at the height of inflation peak when I-Bonds were paying 9.5%. The rates have come down significantly since then as inflation itself has come down. I will sell my remaining I-Bonds of $20k in December 2023 when they are eligible for withdrawal.

ETFs

Again, my primary holdings are in a few ETFs. My primary holdings are in VTI, VGT, and VCR. I’ve always been a big proponent of big tech and have been heavily invested in the Nasdaq for over a decade. This has paid off very well for me given the massive bull market of the 2010s.

I used to hold more dividend generating stocks as I was really into this type of investing at a period of time. I currently do not have many dividend specific ETFs as I prefer growth more than income. This kind of goes against the ethos of financial independence but I have enough money coming in from other sources that I don’t need to focus so much on income.

I added to my ETF positions in November as I wanted to capitalize on the October dip. This turned out to be fruitful as the markets had a fierce rally in November.

Single name stocks

Some of the single name stocks I own are the following

- Tesla

- BRK.B

- Netflix

- RITM

These single name stocks make up less than 10% of my total portfolio. I tend to not buy much single name stocks anymore as there’s no point to take on unnecessary risks when I’m already so diversified with my ETFs.

Real Estate

I currently own no real estate. I used to own property in the US but have sold it in 2022 before rates started rising. I am not a big fan of real estate. While it definitely can be a good investment, I don’t think it beats investing in the markets. In addition, real estate is highly illiquid with high transaction costs that few people consider.

Finally, as someone that travels around the world and does not like to be tied down to one location, real estate doesn’t make sense as managing it from afar creates a bunch of headaches. I much prefer to have my money liquid and in the stock market.

Market Commentary – Nov 2023

November 2023 was a month for the bulls. The Fed was dovish for the first time during the hiking cycle and inflation came in light which gave the green light to investors to buy the dip that formed in October. Markets ran up to previous resistance at a blazing pace and some of my ETFs are back at all time highs. The markets rally just as hard as they crash.

I do think rate cuts are coming next year and my guess is somewhere around 1% would be the amount unless some black swan event occurs. The market tends to agree as the CME Fed Funds watch also indicates a similar level of cuts.

Markets have been off their 2021 all time highs for almost 2 years now and statistically speaking, this is on the higher end of time between market highs. Eventually, markets have to rally back to their highs even with adverse market conditions and it’s not a surprise to me that they’re almost there. I suspect this will probably happen either in December or early next year before a pull back. I don’t foresee any major pullbacks in December as seasonality kicks in, trading volumes are lighter, and economic data seems favorable.

There’s still lots of cash sloshing through the system and central bank injections remain strong throughout the past two years. Of course, nothing in the markets happen according to plan, especially mine. It’s just as likely we could see continued elevated inflation and other issues that causes a new bear market.

Market Value of portfolio

Here is a history of my portfolio value. As you can see, it’s moved in line with the markets as should be the case since most of my holdings are in ETFs that track the S&P 500 and the Nasdaq.

Trades executed for the month

I spent November 2023 buying the October dip. I scooped up more shares of my perennial VTI, VGT, and a few single name stocks. I don’t trade in and out of stocks like I used to so unfortunately, you won’t get any good stock tips from me!

- Buy 45 shares of VGT

- Buy 50 shares of VTI

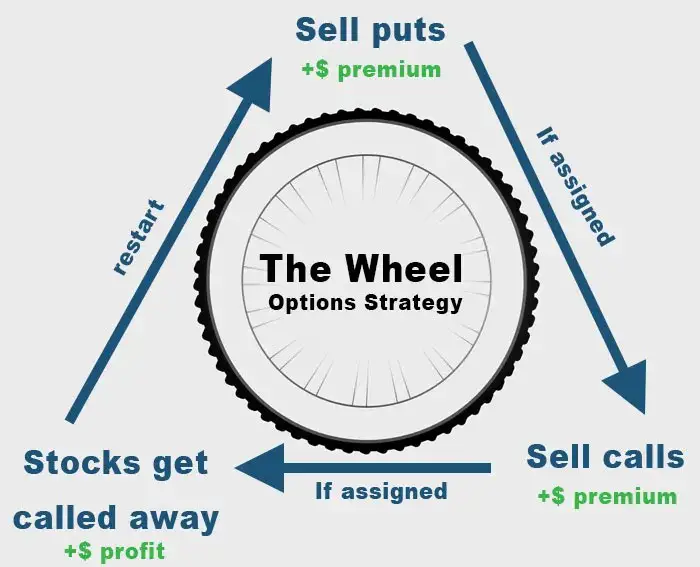

- Sell 10 covered calls on VGT with a 470 strike and Dec 17 expiry

- Sell 1 covered calls on VGT with a 460 strike and Dec 17 expiry

- Sell 12 covered calls on VTI with 230 strike and Dec 17 expiry

I sold covered calls on my holdings like I tend to do every month or two to generate extra income. I like to sell my calls with a 0.15 to 0.2 delta which is generally conservative enough to avoid being called but in recent months, I’ve had to roll contracts a few times as the underlying appreciated much faster than anticipated. I sometimes like to sell 1 or 2 contracts with a strike closer to the money to capture more premium. I like doing this when the markets have had a large run up, is bumping up against resistance, and potentially primed for a pull back.

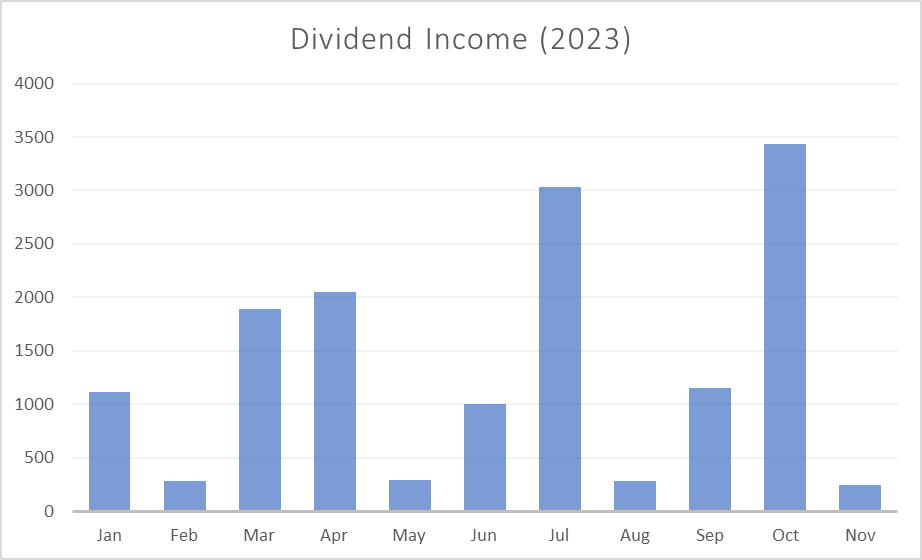

For November, I sold covered calls on my VTI and VGT portfolio which generated roughly $2,900.

Portfolio withdrawals and expenses

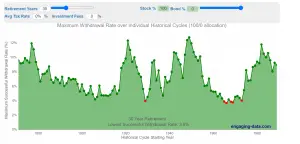

Withdrawals from my portfolio is an important part of the financial independence ethos. The 4% withdrawal rate rule is one of the main concepts of the FIRE movement which I try to adhere to. Generally, I prefer to sell from my portfolio when markets are near or at all time highs to capture, and only when I actually need the cash.

For the month of November 2023, I traveled extensively through the Maldives and spent a boat load of money staying at fancy resorts. In addition, day to day life in Singapore just costs a lot of money so in total, I spent about $5.5k in the month.

I made no withdrawals from the portfolio as I had enough cash coming in from my blog as well as leftover cash from other sources. My blog generates money every month to the tune of ~$3k and I cover exactly how I earn money from blogging in other posts.

In future posts, I will have a chart that breaks down exactly how much income I produced from my portfolio and other income streams against my expenses.