The most common fear for people applying for more credit cards is that it will hurt their credit score. Without a doubt, the first question I get from people that learn of my credit card schemes, is “won’t that hurt your credit score?” Most are equally as shocked to hear that even with my 15-20 credit cards, my credit score hovers around the 800 range. The truth is that while applying for credit cards causes your score to decrease ever so slightly, there is no significant impact in the long run.

I target new credit cards purely for the insane rewards they provide. I’ve managed to save close to $10,000 on travel over the past few years, and that number will only climb as I continue to travel and open more cards. There’s no denying the value you can get from credit cards, but for the purpose of this post, I will focus primarily on why it doesn’t hurt your credit score.

For those that carry balances, applying for a new credit card with better APR terms can significantly decrease the interest paid and your overall financial well being.

This post is part of my comprehensive guide to travel hacking where I go into detail about how I fly for free, book the cheapest flights, and how to be an overall better traveler!

What really affects your credit score?

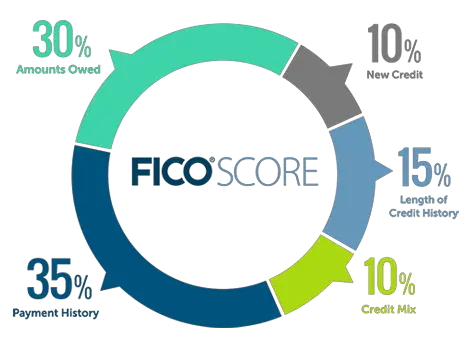

I’ll give you a hint. It’s not applying for too many credit cards. FICO breaks down the factors that feed into their scoring method but the most significant points can be broken down in the following.

Payment History

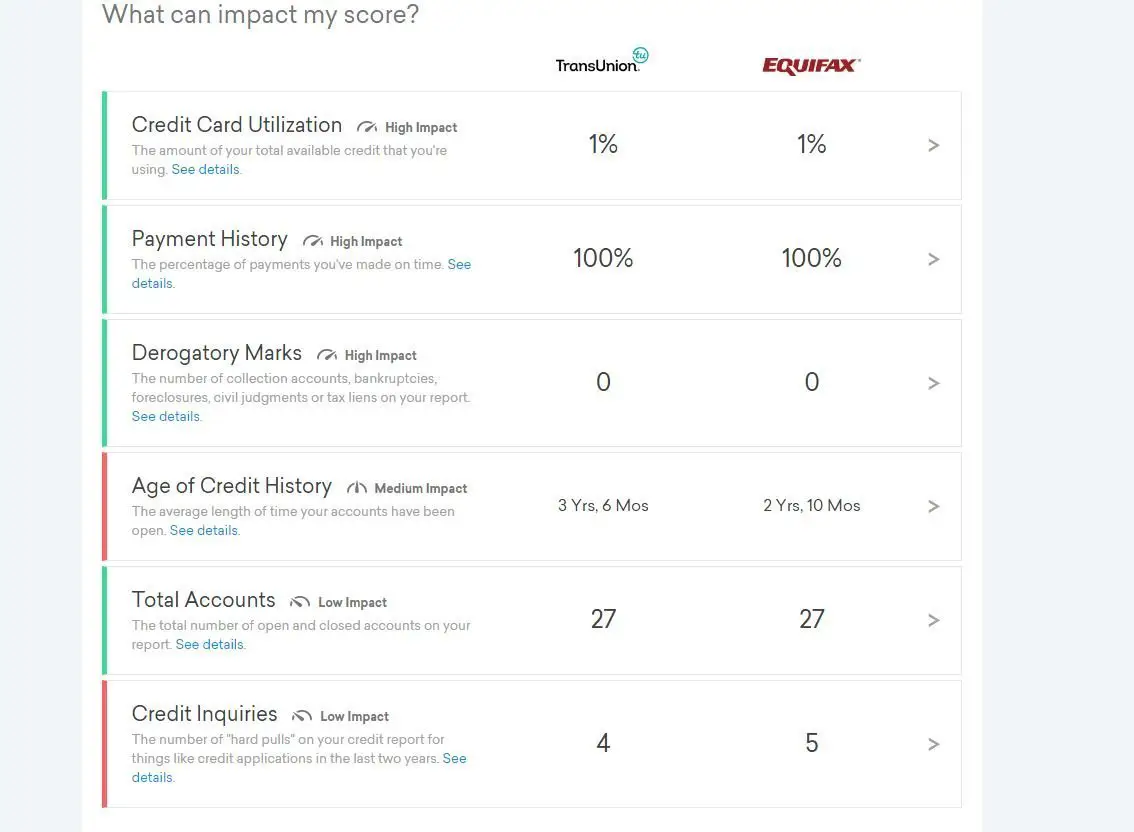

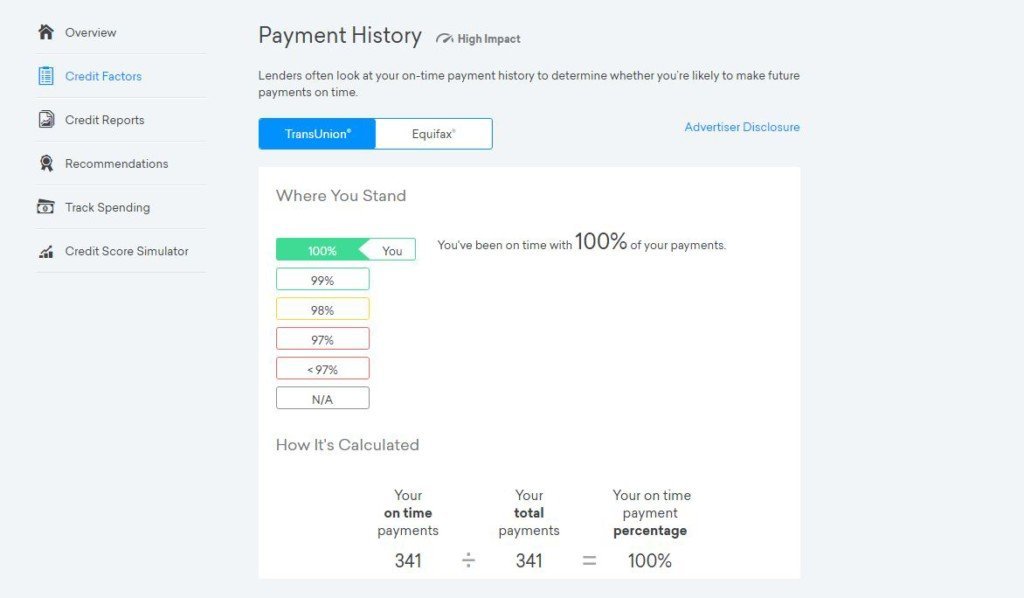

Without a doubt, the most important component of a credit score is paying your credit cards on time. The whole point of someone lending you money is so they get the money back with a little bit extra on top (interest). Lenders don’t care if you carry a balance forward every month, as long as you pay on time. In fact, they’d rather you carry a balance so they get paid interest every month.

However, if you miss or default on a payment, this will have severe impacts on your score. This is telling future lenders that if they lend you money, they may not get it back. You might have your reasons, and they might have the best of intentions. Companies that are processing thousands of applications a day do not have time for any special reasons, and your credit score will reflect that.

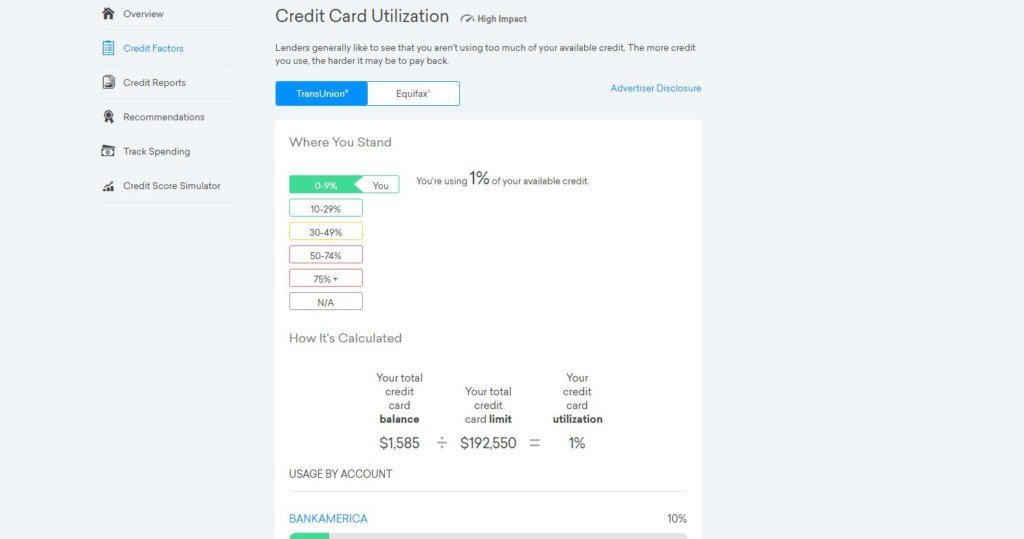

Credit Utilization

The second most important aspect of the credit score is how much credit you utilize. This can simply summarized as

total credit use / total credit limit = credit utilization %

Banks like to see someone that’s responsible with their credit, but they also want to see someone that does not use too much of the credit they have. You want your credit utilization percentage to be as low as possible because this tells lenders you aren’t planning on maxing out your credit and making a run for it.

This is actually where having multiple credit cards will really benefit your credit score. The more cards you have, the higher your total credit limit, and hence the lower your credit utilization % will be. For example:

Person A:

- 1 credit card with $20,000 limit

- Spends $2,000 a month

- Credit utilization = $2,000 / $20,000 = 10%

Person B:

- 10 credit cards with a combined limit of $200,000

- Spends $2,000 a month

- Credit utilization = $2,000 / $200,000 = 1%

It’s clear that person B with multiple credit cards, a large total credit limit, and a small utilization percentage will have a higher credit score and look more credit worthy in the eyes of lenders.

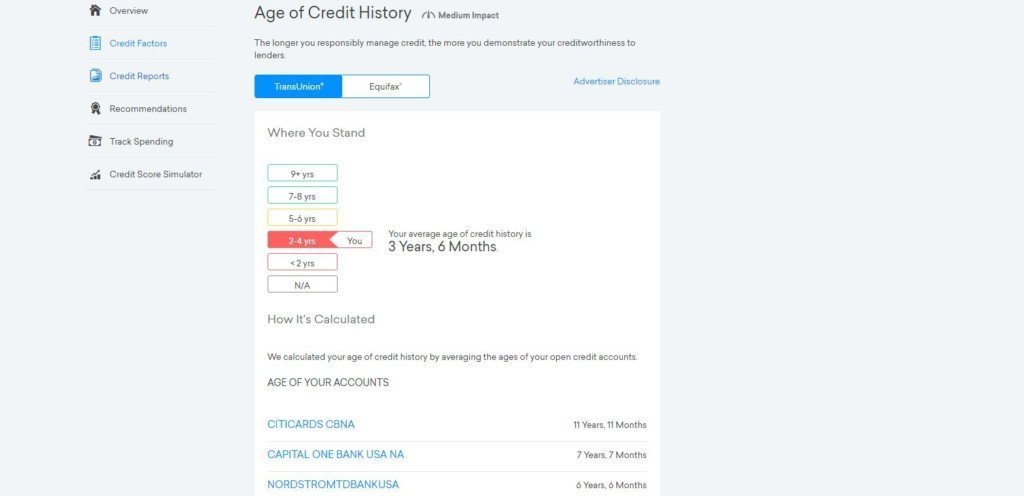

Credit History – Average age of credit

This is the most complicated piece of the credit score puzzle. Lenders like to see that you have a long history of good standing credit. The longer the better because to them, if you’ve been able to keep a credit account in good standing for 10 years, there’s a good chance you will be able to do the same for an additional account. It’s calculated based on the duration of your active accounts divided by total accounts. For example:

- You have 2 credit cards that have been open for 10 years, your average age of credit will be (2 x 10) / 2 = 10 years

- If you apply for 2 new credit cards, your new average age of credit will now become (2 x 10) / 4 = 5 years

- In 2 years time, assuming you apply for no additional accounts, your new average age of will be (2 x 12) + (2 x 2) / 4 = 7 years

New Credit Applications

Every time you apply for a new form of credit, the company will make a “hard pull” of your credit report.

This only makes up a small proportion of your total score, but if you have too many hard pulls in too short a time, you will get denied credit cards because of “too many recent inquiries.”

If you do apply for multiple cards at once, you’ll usually get an initial ding on your credit score (a good estimate is 2-5 points per card). Your score will usually bounce back from that within 3 months.

Does canceling credit cards hurt my credit score?

While most associate applying for new credit cards with a decreasing credit score, closing credit cards has an even worse stigma attached to it. The actual act of closing your card, aka calling your credit provider and telling them you want the account closed, has zero impact on your score. Future lenders won’t see that you canceled a Citi card in 2015. This does however impact your average age of credit, and total credit limit.

If you’re regularly churning credit cards regularly, closing an account that’s been open for a year won’t have a significant impact because it didn’t provide much of a benefit in the first place. Therefore, your credit score will likely fluctuate just 1-5 points.

As someone that churns credit cards, I am regularly canceling credit cards that hold annual fees. At the end of the day, while I do incur minor business expenses, there’s not enough spending in my day to day life to spread across 20 credit cards and earn meaningful rewards. Therefore, after collecting the credit card’s sign on bonus, I will cancel the card before the annual fees hit to maintain my high ROI.

Tip #1: Do not close your oldest accounts

The easiest thing you can do to achieving a high credit score is to not close your oldest accounts. I opened two credit cards in college over a decade ago and while I never use these cards anymore, they are the most important credit cards on my credit report. They also do not carry annual fees, so I will keep them open forever as they will incrementally increase my average age of credit every year.

My recommendation is to never close accounts that do not have annual fees. Even if they go completely unused, they are helping your credit score every day. There are some great cards out there that do not carry annual fees like the Chase Freedom, and AMEX Blue cash and I would highly recommend opening up a few of these cards.

Tip 2: Lenders want to see you opening credit cards, so do it

This might seem counter-intuitive but put yourself in the shoes of a lender. They receive thousands of new applications a day, so to them, you are just a combination of numbers and algorithms. You might think of yourself as someone that’s never skated the rules, and a credit card angel because you’ve only ever had 1 credit card with a $6,000 limit and have always paid on time.

There’s certainly nothing bad about this. However, for a lender that only sees numbers and algorithms, all they see if someone that’s only ever handled a measly credit line of $6,000. Then they ask, “how can they handle an extra $10,000 if they’ve only been able to manage $6,000?”.

The more credit cards you have open, that are in good standing, tells the lenders that you are perfectly equipped in handling credit and to rest assured that your money will be paid back.

Tip 3: Stagger your credit applications

As good practice, I would advise against opening multiple credit cards within a short time frame of each other. Not only will it be more challenging to meet the spend requirements for the sign on bonus, but too many inquiries too quickly may cause certain lenders to reject future applications.

Tip 4: Always pay balances on time

The final recommendation requires little explanation. Always pay your balances on time, and preferably in full. Not paying on time will most significantly decrease your credit score. Not paying in full will lead to interest payments which cut down on the value of your rewards. Even a 99.5% payment record will drop your score!

Never miss a minimum payment.

If, for some reason, you do miss a payment by carelessness, there is still hope. Lenders aren’t in the business of killing your credit score. They just want to get paid. I have missed the due date before one a few occasions. I had a $10 balance from a recurring subscription I thought I had canceled on a credit card I barely use. I called the lender immediately after realizing I missed the payment. I couldn’t get the penalty waived, but they let me pay my balance + the penalty of $25, and promised to not report it to the credit bureaus. Stupid mistake on my part, but $25 is a small price to pay for keeping a clean slate on my credit score.

And now you know

Hopefully this in depth, and personal write up has helped dispel the notion that opening multiple credit cards hurts your score. Hopefully this will comfort you as you open more credit cards (responsibly of course), and enjoy the mind-boggling perks that can be afforded.

For those that are keen to reap the rewards of free flights and hotel stays, I would highly recommend checking your credit score and history using annualcreditreport.com, wallethub.com, or creditkarma.com. Afterwards, read through how I’ve fly around the world free, and which cards I’m targeting in 2017.

Thank you for this detailed write up! I’ll be applying for credit cards without fear now!

Thanks and enjoy the cards!

You can contact the same honest and efficient man i met who helped me to fix my credit via email brainthompson647@gamil.com

Great content! I love reading all about credit.

Thanks Stephanie! Hope it helps you out with your travels and goals!