I love spreadsheets for all facets of life and this next spreadsheet is for tracking your net worth, budgeting, and to help plan for a little thing called FIRE (Financial Independence and Retire Early) which is a movement that has gained significant traction over the years. Through my investments, which I go into detail what I’m invested in with this post, I retired early at the age of 34 with a net worth over $1m and this is the spreadsheet I used to track my adventure along the way. In the last year, I’ve traveled the world for a year and my net worth actually increased and this spreadsheet helped me track everything along the way.

I am an avid credit card and points collector as you can read from my comprehensive guide to travel hacking and credit cards which explains everything you ever needed to know about how to use credit cards to maximize traveling.

However, to properly ensure you don’t get yourself into huge amounts of debt and to just better plan for your future life goals, I have another spreadsheet for tracking my net worth and to help keep in tact my monthly budget. This Google Sheets will be all you’ll need! Make sure to also check my other sheets

- The ultimate spreadsheet to track all your credit cards, sign on bonuses, and annual fees.

- Also, check out my travel itinerary planning spreadsheet which is perfect for organizing and planning your trip!

- As well as my Restaurant List Tracker spreadsheet for keeping track of all the restaurants you have been to in your hometown or abroad.

- For those looking to track their stock portfolio, this is the spreadsheet I use to track my stock investments. In addition, I’ve been trading and selling options for the past few years to generate extra income during early retirement and I’ve also created an options tracking spreadsheet for this purpose.

- Finally, my expense splitting spreadsheet for those wanting to organize their expenses with multiple people.

- For a list of all my credit card and travel hack related posts, click here.

Why use a spreadsheet to track Net Worth and budget?

Most people are not financial gurus and managing your money is probably the most overlooked aspect of our education system. We are not taught how to properly manage money as a kid and often times this results in issues in the future. I’m not sure to tell you how to manage your finances or why you should, but rather provide a tool that will help you do these things if you want to use it.

What is net worth?

Net worth is simply your total assets minus your total liabilities. This means all your cash, investments, retirement accounts, property, etc. minus your debts like student loans, mortgages, car payments, credit card debt, etc. This is an easy one number summary of your current financial state.

It is possible to have a negative net worth as well. Fresh grads that start work may likely have thousands in student loans but little in cash or investments because they just started working. Of course, there are many other ways to have negative net worth. I think the net worth trend is more important than the net worth itself as this really gives you an idea of how well you’ve saved, and how your investments have grown/not grown during that time.

Monthly budgets are useful but not overly so

Monthly budgets are a good way to make sure you know exactly how much money you’ve made and how much you’ve spent. However, I don’t find it particularly useful because I am already very observant of my spending habits, and my spending changes month to month depending on what big things I may purchase. Sticking to a “budget” is a great way for those starting out to really have a grasp on what they’re spending but after awhile, it does not matter as much as a net worth tracker unless you plan on materially changing your spending habits.

I have also been an avid user of mint.com as well as Personal Capital over the years. I find that sometimes it is just too much information and it is just not as flexible as I need it to be as I have so many different income streams. This spreadsheet with exactly what I needed to keep things simple and make it perfect for my own situation. Hopefully it helps you out too!

Net Worth, Budgeting, and FIRE spreadsheet

The spreadsheet I created focuses on three things: Net worth tracking, budgeting, and FIRE calculation.

It is not an extremely meticulous spreadsheet that breaks down every single transaction you make, but more of an aggregation tool to help you summarize everything. I am big into charts and think that tracking your finances is best done through a trend of your spending and earning habits. That is why I’ve added numerous charts to the mix.

The spreadsheet is simple, yet effective. Just make sure you update it on a regular basis. I would recommend spending 5-10 minutes updating the spreadsheet once a month with your figures. I don’t always do the exact amount for different expenses because it takes a lot of time but that is also up to you. You can use this spreadsheet if you’re a single person as well as if you’re a couple (just add everything up!).

Keep in mind that this spreadsheet is also what I use to track my own expenses. I will be making updates live and will add additional features to this spreadsheet as time goes on so make sure to check in for updates!

Download Net Worth And Budget Tracker Spreadsheet

The spreadsheet is in Google Sheets because if I update it in the future, it will be easy to access from anywhere with an internet connection. I prefer this to Microsoft Excel. It’s easy to download it and use with Microsoft Excel as well.

To download offline, click the red button above, then click file > download as > Microsoft Excel

To use it with your own Google profile, just click file > make a copy

Using the Net Worth and budgeting spreadsheet

As someone that works with spreadsheets regularly, I’ve included some functionality like conditional formatting and formulas that an Excel novice might not understand. I will explain everything necessary for those wanting to get the full use out of the spreadsheet. For the most part, anyone with any excel experience should just follow my spreadsheet and populate accordingly. Do not touch cells with formulas because everything is intricately linked. All cells that you should update have been color coded with gray cells.

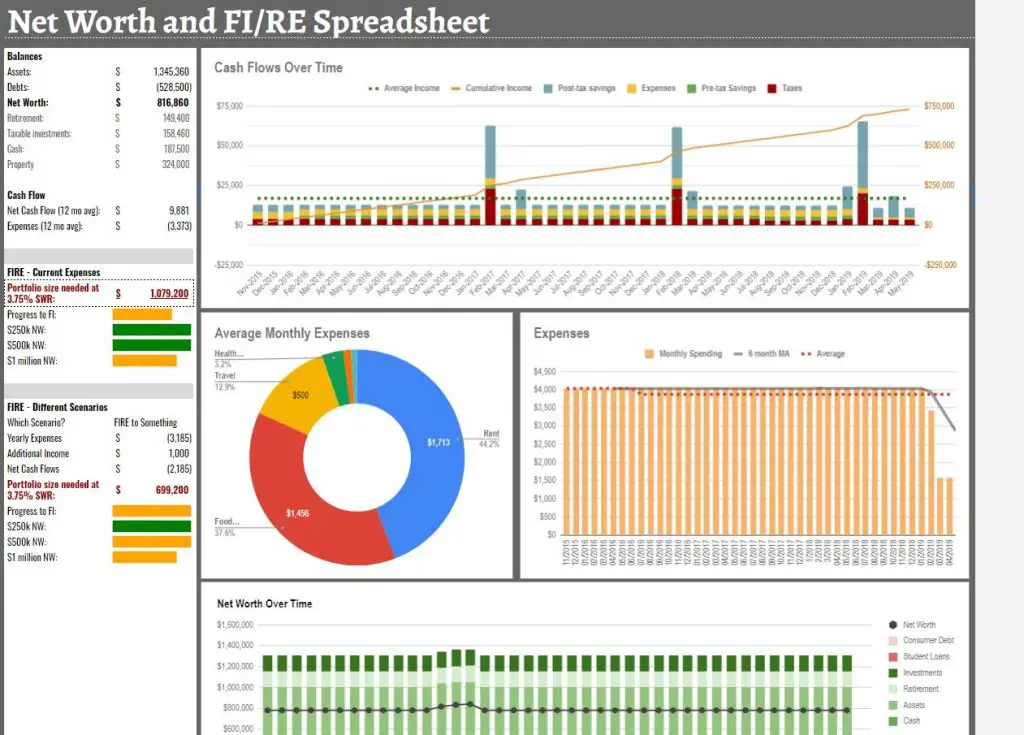

Dashboard Sheet

This is the high level summary for all your information. This is also the tab for all your charts and trends. There is not much to manually change in this sheet so just leave it alone to keep it simple. It will update as you populate the other sheets.

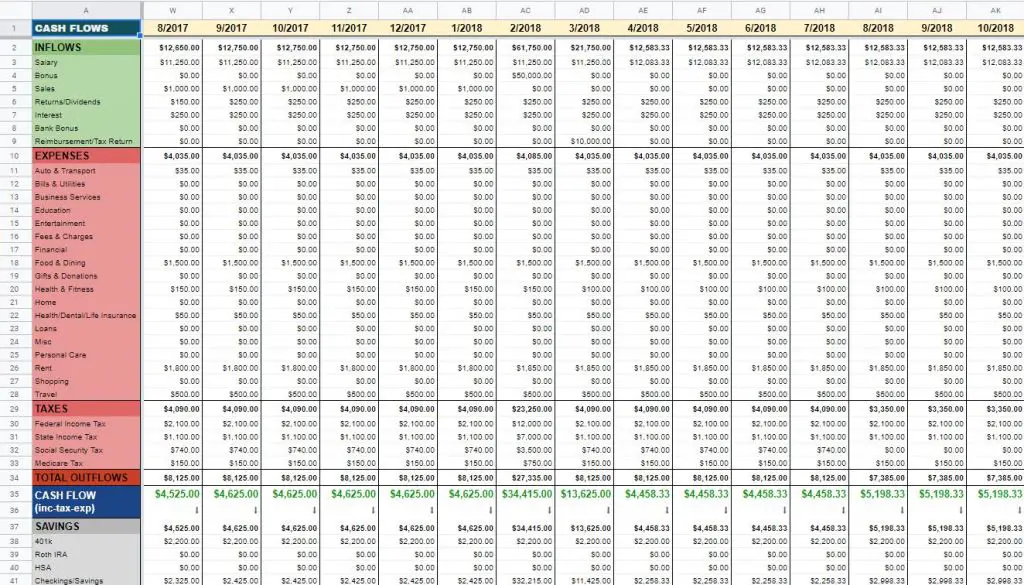

Cash Flows Sheet

This is where you record all of your month to month data. This sheet makes up the crux of the top three tables on the “Dashboard” sheet. In summary, this is where you record how much money you earned over the month, as well as your expenses. I’ve split the expenses into categories that mint.com uses to keep it simple for those that are also using Mint to track their finances.

Do not touch the cells with formulas which are the cells with bold text. Record your taxes as well as this will help organize what is your gross income and net income. For the most part, this sheet should be pretty self-explanatory and when a new month comes along, just insert a new column and copy the previous column.

Cash Flows FI

This is similar to the Cash Flows sheet but with bespoke scenarios for setting your FI/RE goals. If you plan on using this spreadsheet for achieving FI/RE, and also plan to live a different life once you do stop working (work in a big high cost of living city, but want to move to a much cheaper foreign country once you stop working), then make sure to populate this sheet. For expenses, take a guess as to what your expenses in your new life will be and populate accordingly.

Of course, this is not a fool proof way to plan your retirement but should be used as a reference. For example, if you’re planning on moving to Vietnam, the inflation is much higher there and your expenses may change at a much more rapid pace than retiring in the USA.

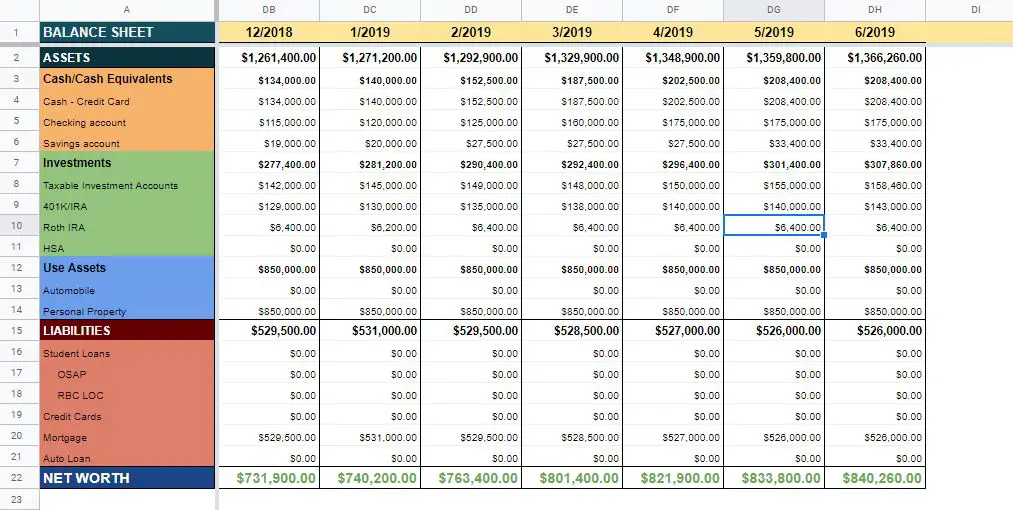

Net Worth Spreadsheet

This sheet will house the crux of all the data for your net worth tracking. I try to keep this relatively simple so not to completely overwhelm users with too much financial information. In short, assets are split into cash, investments, pre-tax investments like 401k and IRA, and your HSA account. As well, I included a row for assets like vehicles and real estate which for some people may be a huge part of your net worth.

As well, if you have any Cryptocurrencies or something similar nature, just simply insert an additional row to add it accordingly. You could insert a row under the Assets area, or insert a row in the investments area depending on how you want to treat this!

In liabilities, this is for standard items like student loans, mortgage, credit cards, auto loans and others. All of this data will update the bottom table on the “Dashboard” sheet. If you have any specific liabilities that don’t fall under these, simply add another row.

Raw Data for Tables

Don’t touch this sheet unless you know what you’re doing and want to extend the amount of history your trends have. This sheet is the data required for those fancy graphs on the “dashboard” page.

Financial Independence and Retire Early Calculations

I added this calculation to the spreadsheet as a means for those that have the financial means to retire early. This will be a very foreign concept to most so I will just briefly touch upon it. Essentially, it is a concept that focuses on minimizing your expenses, maximizing your savings, investing those savings into general market tracking ETFs, stop working at a younger age (hence the retire early piece) while living off your investments and adhering to the 4% withdrawal principal. It has really taken off and has received countless media coverage.

My spreadsheet has a tool to calculate exactly how much you’ll need to retire early on the main page. I won’t go into too many details as I could go on for thousands of words on this topic. I reckon most people using this will have a general understanding of what FIRE is but make sure you leave a comment if you want further clarification.

Note that this doesn’t have any fields to add additional income while you are FIRE’d. For example, making money blogging like yours truly!

FIRE with current expenses

I break down the calculation into two tables. One is assuming you will FIRE with your current expenses. This is good if you don’t plan on changing your current lifestyle too much (like moving to Southeast Asia or something) and want to ensure that your living standards stay the same. This will be the first FIRE table on the left. I choose to use a 3.75% withdrawal rate which is lower than the standard 4% withdrawal rate used in the Trinity study. Many folks go even lower than this because the 4% withdrawal rate is a traditional retirement age metric and assumes you only need your investments to last 25 – 30 years. Feel free to change this to 3.5% or even 3% for the ultra conservative.

FIRE with different expenses

The second table for FIRE is if you plan on changing your spending habits once you pull the trigger. This could mean you move to another town with cheaper cost of living, or maybe you want to move to another country with much cheaper cost of living while also having passive income from let’s say blogging :). Any situation you can think of, the spreadsheet will allow you to do and it will spit out how much money you need to have in accordance to the withdrawal rate that you set.

Hi Johnny, I tried downloading save a copy off google sheets but when opening it says excel tried to repair as much as it could. Some formulas broke and formatting lost. Do you have the original excel file and what version are you using? Help me out with this and I can share some templates I’ve also built in the past to give you more ideas (gym/workout tracker, job search tracker, reservations tracker, etc).

Hey Geoffrey, this spreadsheet is designed in Google sheets and not excel so it will never have 100% portability if you export it to a .xls

This is a great post! I’m a recent college graduate and I’m struggling to figure out how to save money and invest for the future. This post has really helped me to understand how to do it.

HI Johnny, your blog and this spreadsheet are of great inspiration.

I’m using your spreadsheet as a reference for mine taking into account all italian peculiarities.

The only thing unclear to me is the couple property/mortgage. You are considering the house as an asset even though there is still a mortgage hanging over it. Isn’t this method misleading for the calculation of net worth?

Hey Lorenzo, yes for sure this is the case. The house is an asset but if there is a mortgage then there is of course a debt associated with it. If you look at the liabilities section you’ll see a row for mortgage that evens yourself out.

Awesome sheet Johnny. Thanks so much. It has really motivated me to stick with the FIRE journey.

I’ve made a few minor changes to the sheet (e.g. amended SWR to 4%), but the changes that I would like to add are beyond my expertise.

On the Dashboard (which is excellent), i’d like to add a chart/graphic that shows the change in net worth – ideally over different time periods such as portfolio change since previous month and over past year in dollar and percentage terms. Would you know how to do this?

Perhaps another addition to the Dashboard could be a pie chart showing the dollar value and percentage of each asset and liability.

Thanks so much for sharing this sheet. You are an inspiration!

Hey Gav, glad you like the spreadsheet! I was also thinking of doing something simliar to this in previous years. It will take some time coding it together with my limited Google Sheets knowledge! But I think it is a good idea! Good luck on your FIRE journey!

Hi,

Downloaded your Options document. Its really awesome. Just wanted to clarify few things.

>>Which column i should put in STRIKE PRICE?

>>Where should i put the price the day i bought the options?

thanks

meenu

Hi Meenu, i think you posted this comment on the wrong post?

Hi Johnny – this is a really helpful spreadsheet! Thank you so much for efforts creating it. I’m not following the formula on the Cash Flows Sheet line 41 checking/savings. Looking at C41 as an example (=C35-C38-C39-C40-C43), why is C42 (taxable account) not included in this formula?

Thank you!

Hello,

I just started using the net worth worksheet and I’m trying to figure out what goes in the cash – credit card row for the net worth tab. Is it the amount of credit you have available or the cash advance amount? Thanks!

Hi Leslie! The credit card amount is just the amount of credit you’ve used that month. It will be a negative amount to your total net worth.

Oh! That makes so much sense, lol. Thanks Johnny!

Johnny,

This spreadsheet is everything I have been looking for!! It took me a while at first to adjust the timeline/dates, but your responses to other readers’ comments helped me figure it out! Thank you!

Hi Cheyenne glad it helped and happy tracking!

Hi Johnny!

I’m looking at your “Net Worth data” sheet and I’m confused about why your 401k and Roth IRA balance can go down. I thought you can’t extract money from these accounts until retirement, without a penalty. With the exception of certain situations like 1st purchase of a home.

Hi! Love the excel but I am having trouble with the first tab, dashboard, as the date starts in Oct 2015. Could it be updated to January 2020?

Yes of course, you can rework the dates to whatever you want. Delete columns you don’t need and start accordingly!

Hi Johnny

Your website is awesome. I especially like your spreadsheet for tracking spend, assets and FIRE.

I made a copy of the spreadsheet, but i’ve been having trouble using it. Every time i add/delete colums in order to enter my own data or chnge dates, it messes up other parts of the spreadsheet, such as the graphics dashboard.

I’m basically wanting to start recording my cashflow and assets from July 2019 and track going forwards.

Any help would be thoroughly appreciated.

many thanks

Hi Lee! Glad you like the sheet. Can you try deleting all the columns except for the fist column in the trends sheet and then replace the date (first row) with July 2019? That you should work. Thx

Hi Johnny

Thanks for the swift reply.

I’d previously tried deleting the columns and then amending the dates. But doing so, then messes up some of the other formulas – particularly those used in the Raw data.

After a few tweaks (using trial and error), I have managed to get nearly everything working. The only thing that I cannot get to automatically update is ‘Property’ – row 11 on the Dashboard.

many thanks!

Ah yes thanks for the comment, you are right! I had forgotten to update the formula but it is fixed now. Thanks for the catch!

Hi Johnny!

Your spreadsheet looks fantastic. I saved a copy of the spreadsheet but I too was having trouble using it in order to record my own data (I was planning on using it for recording everything from January 19 or so).

What can I do in order to make it work for me? 🙂

Thank you so much!

David

Hey David, you should be able to just delete everything in all the sheets until Jan 2019. Just highlight all the columns, right click, delete column should do it.