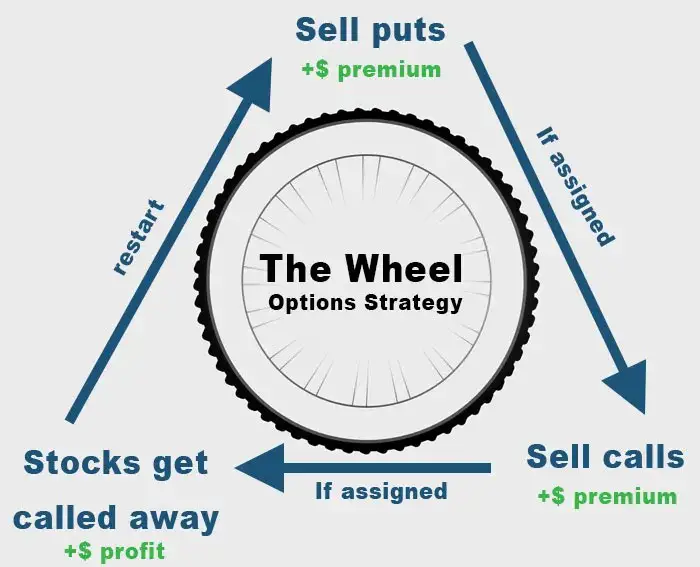

In my previous posts about how to sell covered calls and how to sell cash secured puts, I go over the option theory and the how-tos of this increasingly popular option strategy. Now it’s time to put it all together and show how exactly I sell covered calls to generate income during early retirement. This is one of many passive income streams I employ in addition to writing my blog.

Selling covered calls on an existing portfolio can be a great alternative to traditional dividends and when bond interests are low. In fact, achieving an annual return of 10% or even 15% is feasible without taking on aggressive positions. This is far greater than the typical 3% on a dividend growth ETF or a similar bond fund.

I’ve written covered calls for many years now and regularly execute dozens of trades a year generating a solid $3-5k per month. Before you get too excited, there is of course always risk when it comes to trading options so there is never a free lunch. Nevertheless, the way I sell my options are probably among the lowest risk options trading strategies out there. If you are keen to learn, this post will cover everything you need to know!

What is a covered call?

Before we get started, we need to understand what a covered call is and what selling calls really means.

A covered call is the opposite of the cash secured put. Instead of selling puts, you are selling calls. This means that if the price of the underlying stock goes above your strike price, you will need to sell the stock at the strike price.

It is called covered because you need to already own the underlying shares in order to sell calls. If you didn’t have the 100 shares to begin with, then this is called a naked sell which most brokerages won’t allow you to do because they would essentially just be lending you money (in case the option was called away).

Let’s continue with the below example:

You purchase 100 shares of AAPL at $150 per share (total of $15,000 market value). You then sell a call option expiring at the end of the week with a strike of $155 for a premium of $1 (or $100). Two outcomes can occur:

- The price of AAPL is $154 at the end of the week. Your option expires worthless and you keep the $100 in premiums because the price is under the $155 strike price

- The price of AAPL is $156 at the end of the week. Your option is exercised which means you must sell your 100 shares of AAPL at $155. You also get to keep your premium however as the option has expired. This scenario means your option has been “called away”.

Using the above example, if the price of AAPL was $175 at the end of the week, you would still need to provide the 100 shares of AAPL at $155 which means you’ve locked in a $20 loss per share (Total $2,000). However, since you already own 100 shares, you will never lose money when the price

How do you sell a covered call?

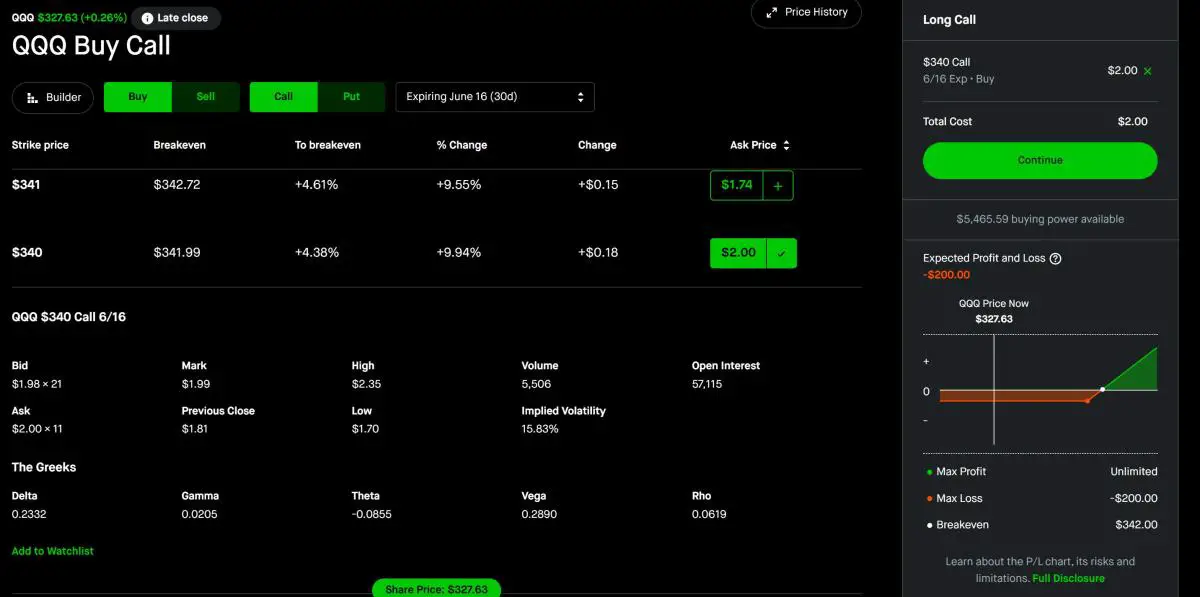

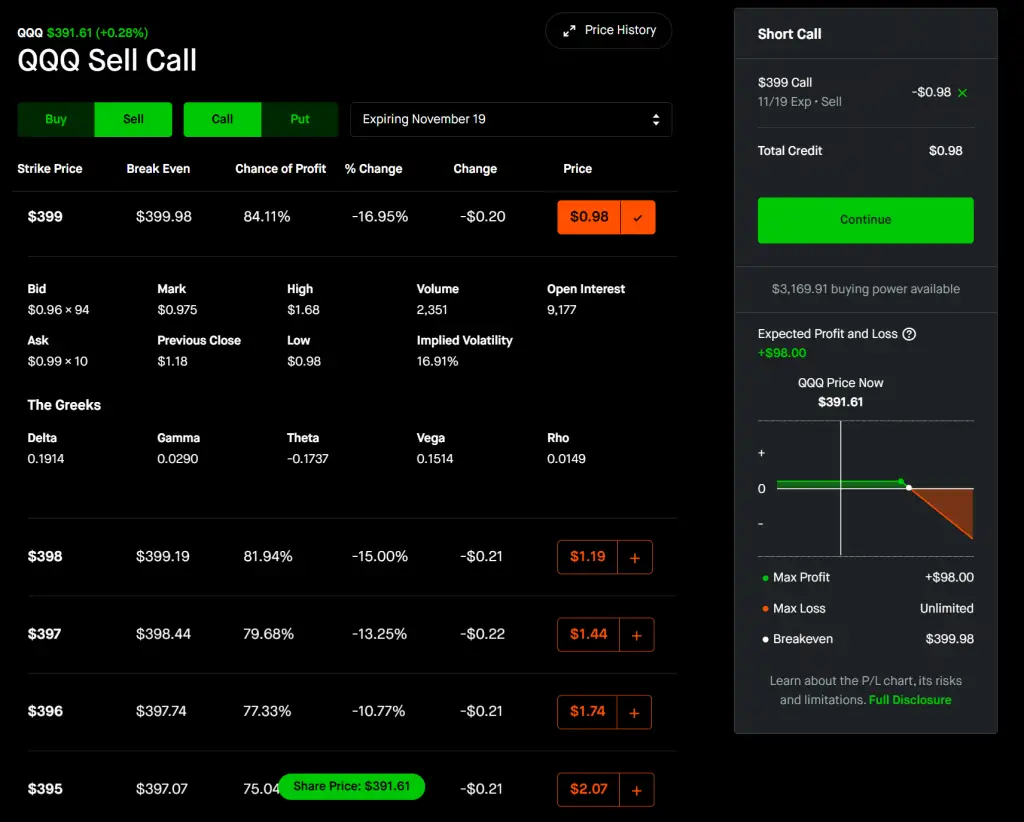

There’s no better way to explain how to sell covered call options than by example. I will use QQQ as my example and then use the option chains in Robinhood to illustrate my point.

I use Robinhood to trade options because it is 100% free. Robinhood, along with Webull and Sofi are some of the absolute free options to trade options. While Chase Youinvest or Etrade allow you to trade vanilla stocks for free, options still carry a price of $0.5-$1 per contract. This adds up quickly and can quickly eat into your profits.

Here is the price history of the QQQ:

As of Nov 12, 2021, it is trading at $391 per share. To sell a covered call, you first need to sell a call on the stock.

I like to use weekly stocks with a delta of 0.2. This reduces the chance of the stock reaching my strike price from my experience allowing me to keep the premium.

Here is a screenshot of selling a call on QQQ. I chose the 399 strike which has a Delta of 0.19 and a chance of profit of 84%. As you can see from the expected profit and loss graph, my max profit on this trade is $98 because when you sell an option, your max profit is capped at the premium you collect.

However, Robinhood will not allow you to sell a naked a call because if the price goes above 399, someone is on the hook to provide the shares at $399 to whomever bought the call (the other side of your trade). This is why you will need 100 shares of the stock in order to sell covered calls.

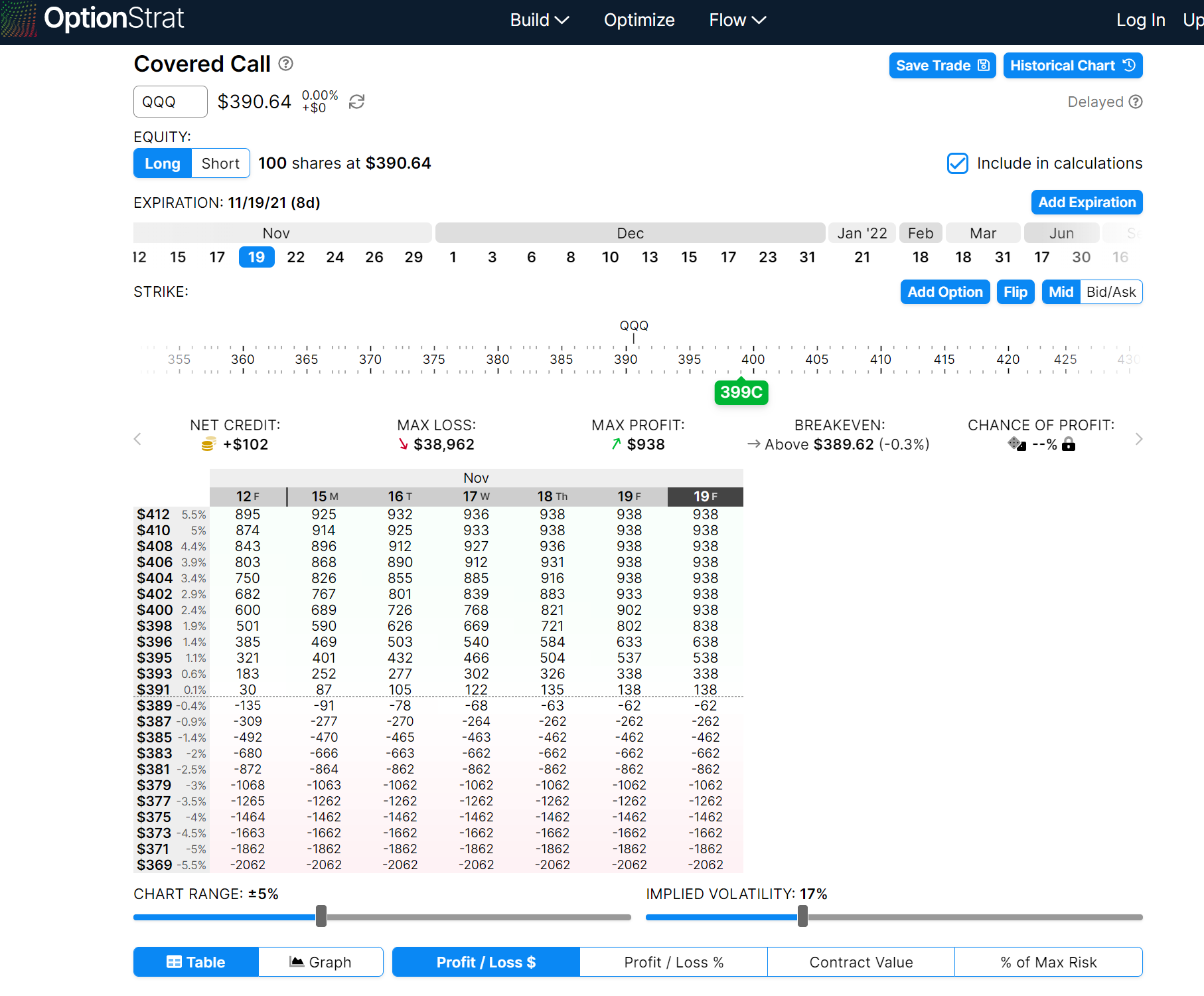

So now I will buy 100 shares of QQQ as well as selling this option and you will get a profit loss graph like the following:

As you can see, OptionStrat.com illustrates this out perfectly. If I sell a 399 strike call against 100 shares, this means I receive a $102 premium. My max profit of $938 according to this chart means if the stock reaches $399, I not only keep the $100 premium, but also realize the gains on the underlying stock. In this case, QQQ reaching 399 from a price of 391 means a profit of $836.

How much money do you need to cover retirement expenses from covered calls?

Now that you have enough knowledge of selling options, how much do money do you really need to generate enough income for retirement?

This of course differs depending on your spending and your requirements for your day to day life. For the purpose of this post, I will keep it at a very easy to digest $50,000 USD. $50k is a lot of money for living almost anywhere in the world. It’s certainly more than enough to live a lavish lifestyle in Bali as I witnessed first hand.

Using the 4% rule of financial independence

For $50,000 per year, using the 4% rule which is the cornerstone of the financial independence movement means I need a portfolio of $1.25m invested. With this amount, I can simply withdraw $50k over a year and my investment will almost always last me until death. However, that is a lot of money to have and now easy for many.

Selling Covered Calls

By selling covered calls, I can feasibly generate 10% to 15% per year. Using the lower end of this range, this means I would need about $500k in order to generate $50k of covered call income. This is less than half the amount of the previous example!

This means if I had a $1.25m portfolio already, I would only need to allocate 40% of the amount to covering my necessary expenses. In addition to this, I could still withdraw per the 4% rule if I needed extra income or if I feel like the market is not in a good state to sell calls.

Selling covered calls on existing positions

Now that you know how much money you need to sell covered calls, let’s put all of this into practice.

Let’s say I need a $500k portfolio to achieve my yearly expenses from selling covered calls. This portfolio consists of a combination of my QQQ stocks. I like to sell my calls with 3-4 weeks to expiry as I generally find that is capturing the most amount of theta decay. I generally also sell my calls with 0.15 Delta (0.2 at the maximum) so the risk of them being called away is lower. This of course can still happen which means you’ll need to roll your options or sell at a loss.

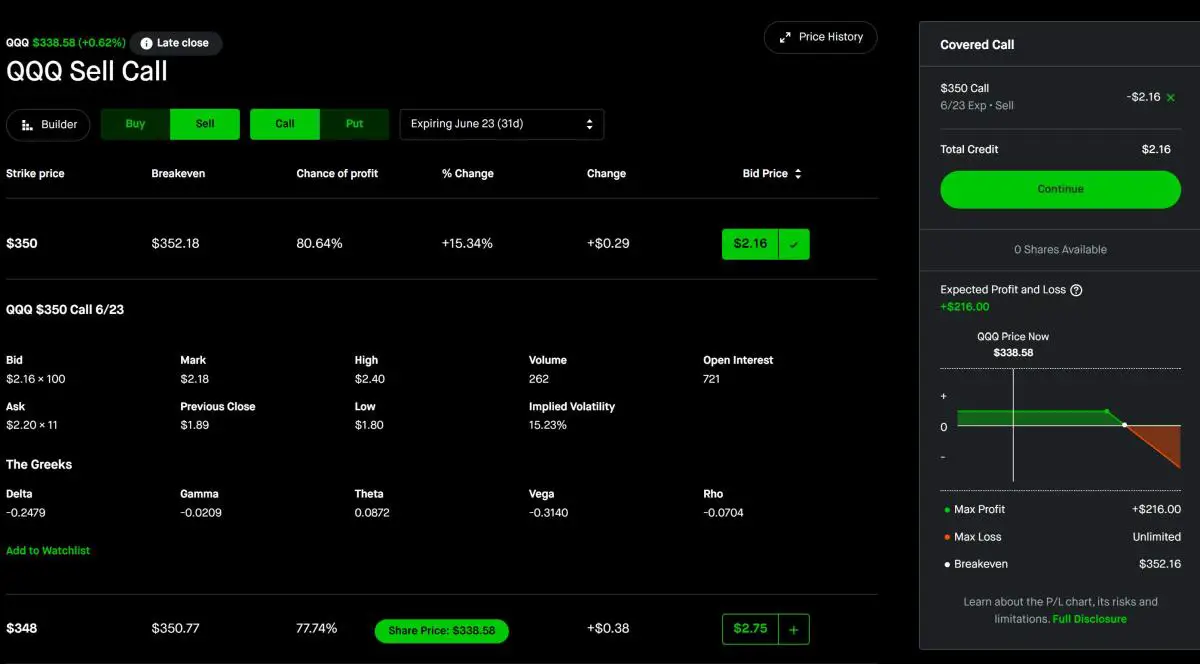

By using QQQ with a current price of $338, we would need roughly 1500 shares of the stock to reach $500k.This means we can sell 15 calls at once. In reality, it’s more likely your stocks will be split between more stocks/ETFs but for the purpose of this example, we will use QQQ.

As you can see from my post about what is in my portfolio, I have outsized positions in a Tech ETF and a broad market (S&P 500) ETF. In fact, I have so many positions, this is how I generate enough passive income to survive on.

As you can see, with a delta of just under 0.25, I can get $2.16 per option contract by selling this specific strike with a 30 day expiration. This means I will generate

15 contracts * $2.16 * 100 = $3,240

I will generate $3.2k over the course of a month. This equates to almost $40k per year which is a yield 8%. While this is not as high as the 10-15% I targeted earlier in this section, it is still much higher than a comparable bond fund would pay.

In this specific example, you can see the Implied Volatility is only 15%. This is very low for the QQQ contract but this was during a period in the markets where VIX was near multi year lows resulting in lower than normal IV. Typically, QQQ trades somewhere in the 20-25% Implied Volatility so premiums could easily be 20-30% higher than in this specific example. Of course, the flipside of increased volatility is the higher chance that the underlying exceeds your strike price!

Don’t get too greedy when selling covered calls on existing positions

My main advice is to not get overly greedy when it come to selling covered calls to generate retirement income. The worst thing that can happen is you sell a call that’s too close to the money and the underlying price moves above the strike at expiration forcing you to sell, or to sell at a loss.

Absolutely stick to a plan and do not deviate even if you are certain the markets can’t go up anymore. There have been many instances in my trading career where after looking at every technical indicator, I was absolutely convinced the markets would not rise much more and I sold a call with a higher delta and pocketed a juicier premium. Sometimes this has worked out for me very well but other times, it’s really backfired.

As a general guideline, if you don’t need the money, why take on the risk? Whether I get $3 or $1.5 on a premium, it won’t move the needle that much. As well, there will always be another opportunity to make money again.

Stick to your strategy and in my case, I take Deltas of 0.15 to 0.25 on all occasions.

Selling covered calls in bear markets

Selling calls during a bear market is a scary and uncertain endeavor. When the market goes down, you are holding onto MTM losses on your underlying positions but are able to still pocket call premiums by selling calls like you normally would.

The problem arises when the market bounces back. Markets don’t go up or down forever or ever in a straight line. Markets crashed a lot in 2022, but it was also met with plenty of relief rallies of 10% or more! If you sell a covered call when the markets are heavily down, you run the risk of a solid relief rally pushing the underlying above the strike price. Depending on how long the relief rally lasts, you could stuck with losses or rolling your contract for a long time.

Don’t take it from me though! One of my readers actually wrote a post about how he scaled through the bear market of 2022 by selling options. He had varying degrees of success managing his cost basis and generating consistent income from options as markets tanked.

What are the risks of selling covered calls?

Like literally every single thing in financial markets, there is no such thing as a free lunch. There is ALWAYS risk associated with a trading strategy no matter how safe it might look. Options in general are just one big dumpster fire of risk. It’s compared to a casino for a reason.

You win big, and you lose even bigger.

Covered calls are no different. There are risk of selling covered calls just like any other strategy out there.

When will you lose money selling calls?

Covered call strategy has two downsides:

- The underlying stock moving down in price

- The underlying stock moving way above your strike price

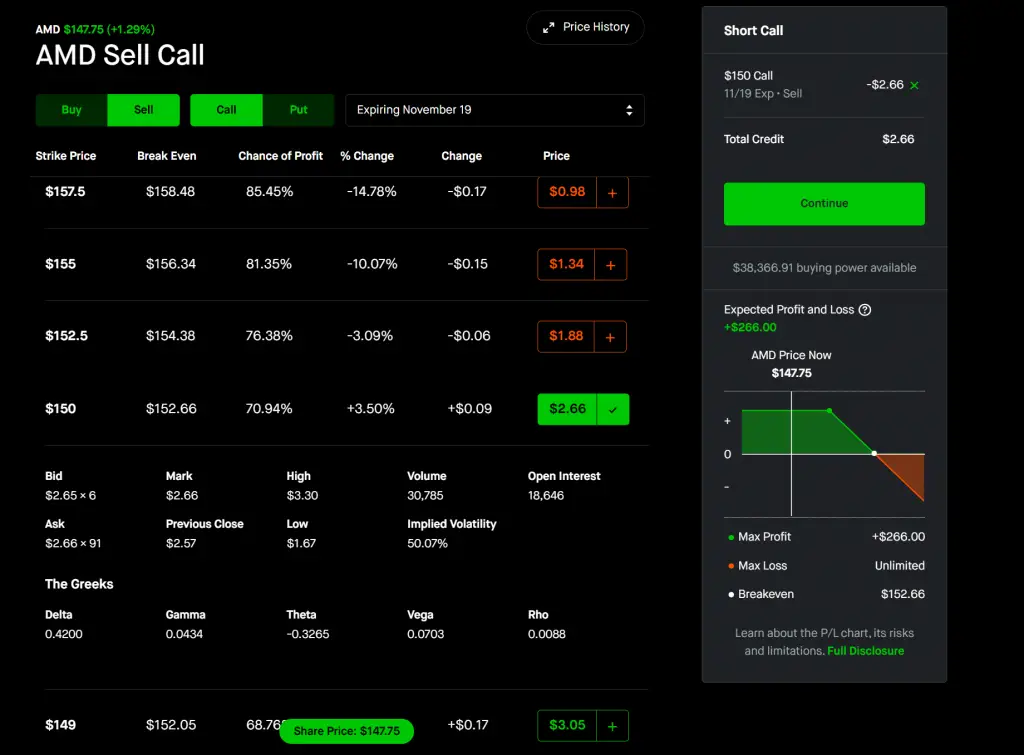

The first option is pretty obvious. If you buy 100 shares of AMD stock at $147.75 and then sell a $150 strike call for the next week expiry, you’ll collect $2.66 (or $266 in premium).

If AMD stock price goes down to $140 the next week, this means you’re now sitting on a loss. This loss is mitigated by the premium you collect however.

On the stock, you’ll have a $147.75 – $140 = $7.75 loss per share

$7.75 – $2.66 (the premium for the call) = $5.09 net loss

This means you will have an unrealized loss of $775 on AMD, but because you sold the option and collected the premium, your net loss is $509. Nevertheless, it is still a loss. However, if you’re selling covered calls on high quality long term stocks like AMD, this isn’t as big of an issue. The stock price will recover at some point in the future. It could be next week, next month, or next year. You might have to hold on longer than you hoped but it will recover eventually.

Opportunity Cost of the underlying going above your strike

The second option is if the price of the underlying goes above your strike price. If AMD stock goes to $155 the next week, this means your gains are capped at $150 since that’s the strike you chose. This means, at the end of the week, you must sell AMD shares at $150.

$150 – $147.75 = $2.25 (This is the profit on your stock)

$2.25 + $2.66 (premium collected on the option) = $4.91 net profit

Had you not sold any call options, you would be sitting on a larger profit ($155 – 147.75 = $7.25).

Because you collected the premium on the option, your net profit will be $491 instead of $225. This is why there is a column in the Robinhood layout for “Break Even”.

Buy stocks you want to hold long term!

Perhaps the most important thing to do to manage risk when trading covered calls or the Options Wheel is to choose stocks you are long term bullish on. These are stocks that you wouldn’t mind holding if the market were to crash because you know it will recover at some point.

This means you should stick to mostly blue chip stocks to reduce risk. Of course, there is never a free lunch and more stable stocks means less volatility which equates to smaller premiums.

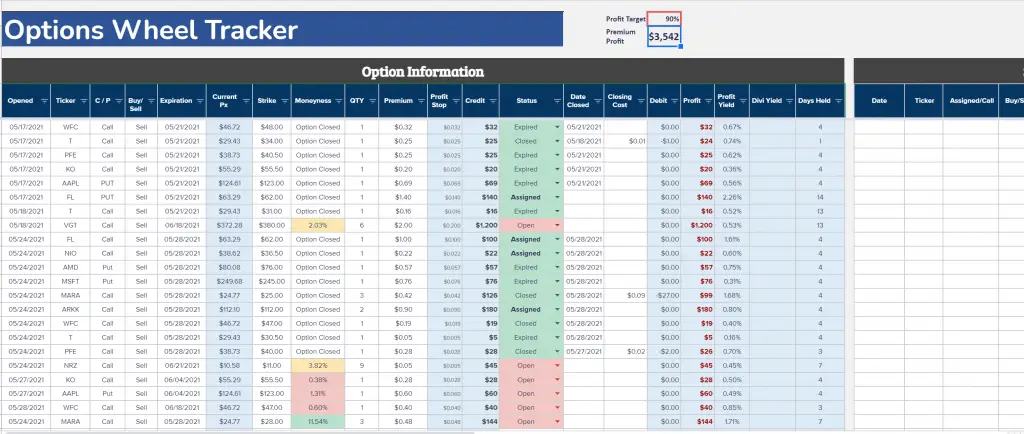

Using a spreadsheet to track Selling covered call options

I’ve been “wheeling” and trading covered calls for awhile now. It’s certainly not the most sexy way of trading and you won’t see anyone from Reddit’s /r/thetagang (Option Wheel afficionados) posting on /r/wallstreetbets anytime soon. Option wheel is about boring but consistent income. It’s not a get rich quick strategy but rather one that offers small gains and doesn’t blow up your account.

Once you start trading, you’ll quickly realize you are executing many trades. If you pick 5-10 stocks like I do to wheel on weekly options, this means you are executing 5-10 trades a week at minimum. Sometimes, you might want to close out of the option or roll it to the next contract which means executing even more trades.

All of this adds up quickly and no brokerage has a good tracking method for keeping tabs on the premiums your collecting and what is getting assigned and what is not. You need to do this on your own which is why I use my personal spreadsheet for this project.

You can access my options trading spreadsheet and use it for yourself to keep track of wheel trades.