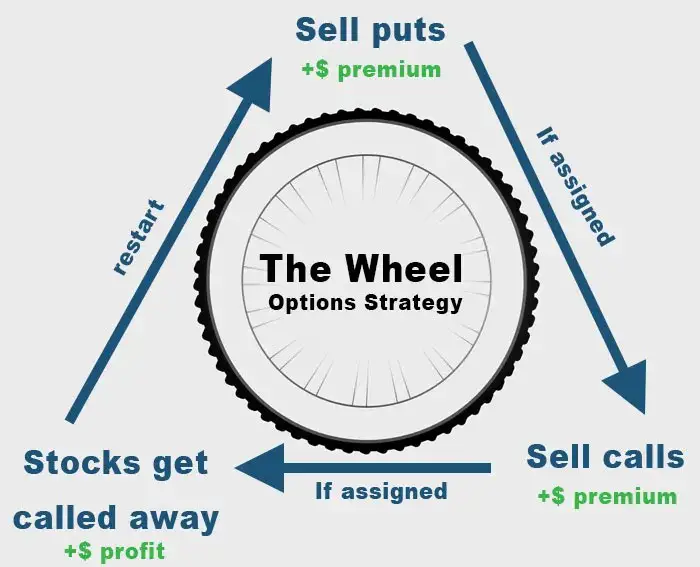

I recently wrote about how I employ the option wheel strategy to earn a consistent income from selling options. This involves selling puts and calls repetitively. This method allows you to collect a consistent premium on your stocks of choice with much lower risk than buying naked options.

This guide will go into detail a more advanced strategy called the call spread (as well as the put spread). While the option wheel, covered call, or cash secured put strategies only involve buying/selling one option at a time, the call spread is more advanced in that you will need to execute two option trades at the same time, similar to that of calendar spread options.

This guide will show you everything you need to know about the call spread strategy and hopefully answer all the questions you had!

As I’ve already achieved financial independence, I regularly withdraw from my portfolio of stocks enough to live the life I want. This is something between $30k and $50k a year. I also make sure I pay 0% in income taxes by taking advantage of the long term capital gains rate. I use these option strategies to generate a little side income.

Who is this post for?

If you have no idea what options are, then you should probably read up on basic option theory and understand what you’re getting into before putting your money on the line. I think the call spread strategy is quite easy to understand once you get the hang of it. However, I think it is definitely more complicated than a vanilla strategy like covered call writing or selling cash secured puts.

The good part of a call spread strategy is that the downside risk is mitigated. You can and will lose money, but you can rest assured that this won’t destroy your account.

As a reference, I had never sold options before getting into this strategy. I used to always buy call and put options, losing more often than not.

What is a call spread?

A call spread or bull call spread, long call spread, or vertical bull call spread is an options strategy that involves buying a call and simultaneously selling a call. This strategy is meant for those that want to capture gains in a stock that is trending upwards but not rapidly ascending upwards.

The call spread limits the amount of money you can make on the upside, but also limits the amount of losses on the downside. This is a very important difference to something like the covered call strategy which I will go into later.

Bull call spread

In the case of a bull call spread, you want the price of the underlying stock to go up (hence the bull part of the strategy). This means you will buy an ITM call with a strike price below the current price and sell an OTM call above the current price of the stock.

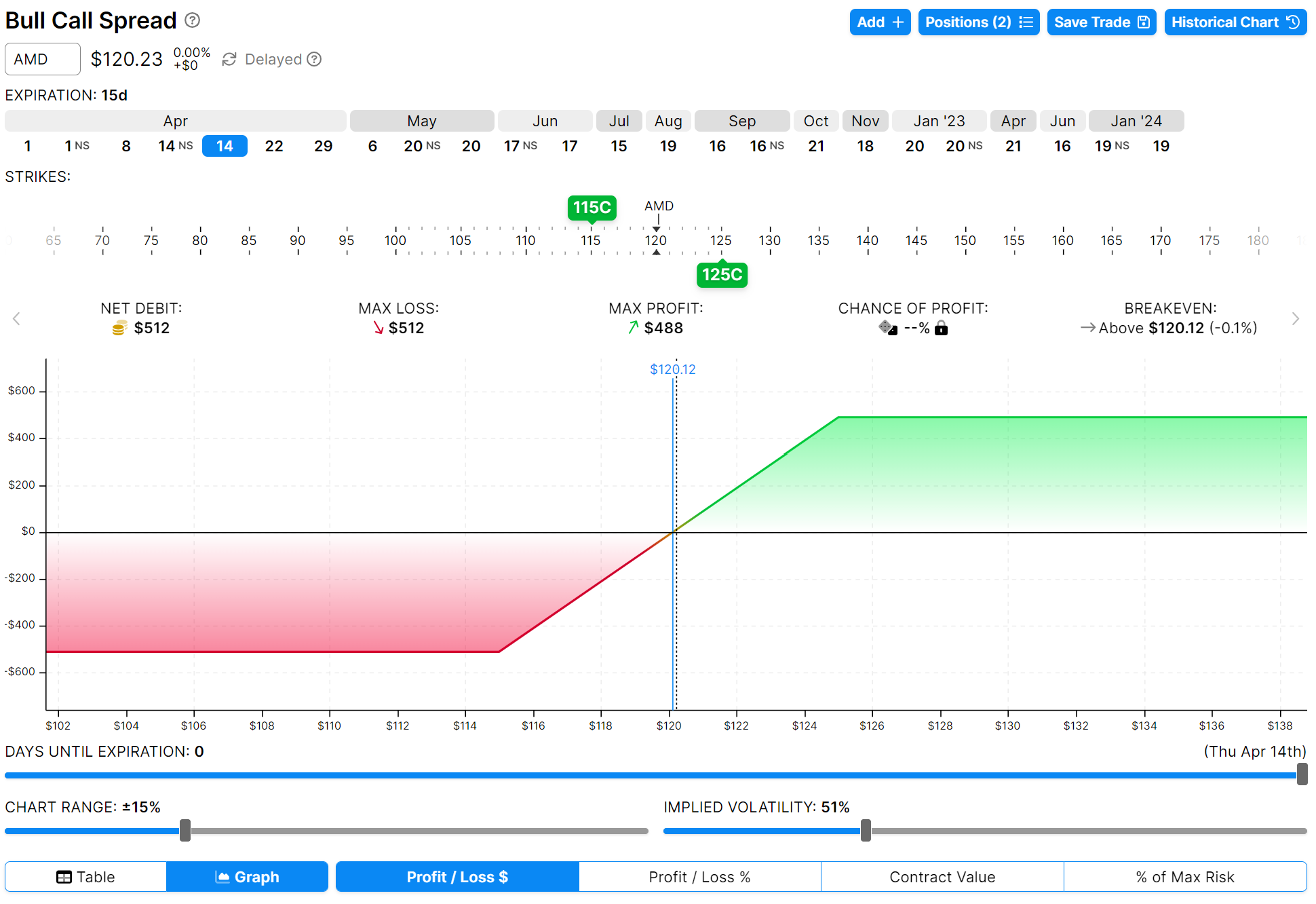

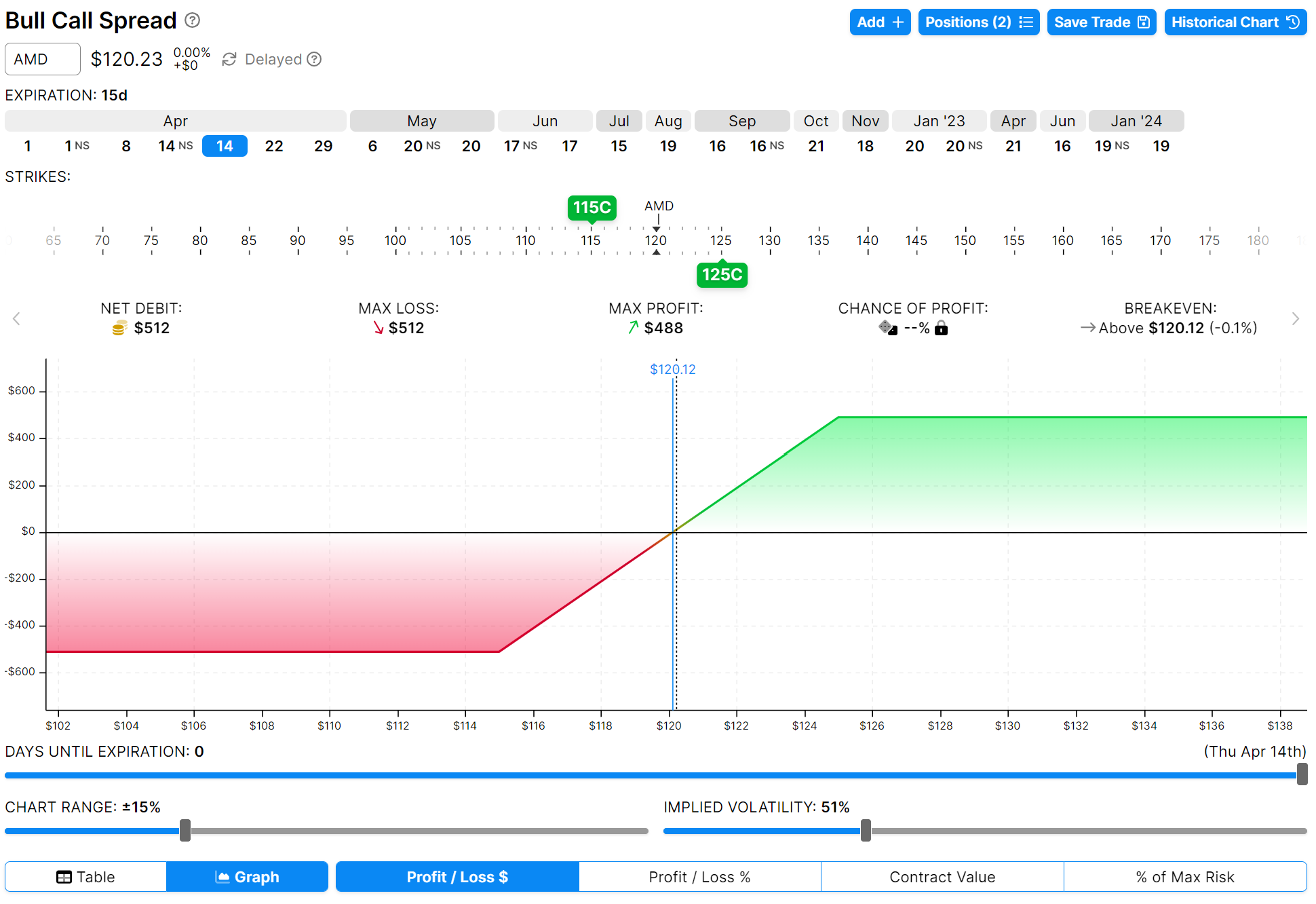

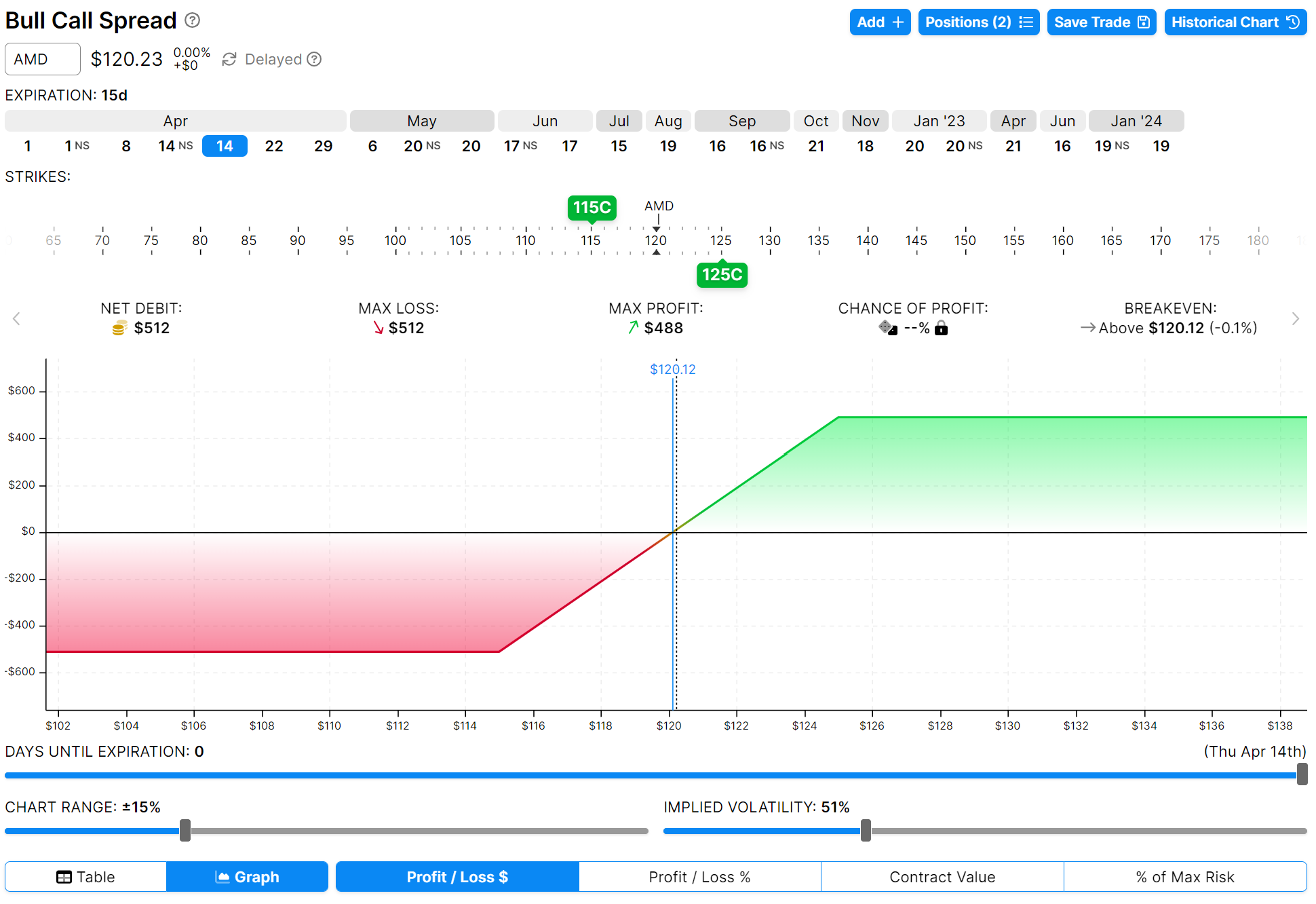

Let’s continue with the below example:

You want to purchase a bull call spread on AMD because you think the underlying stock will rally (but not significantly). You want to capture some profit on the way up but want to minimize your risk if AMD went down in price.

- The current price of AMD is $120

- Purchase a $115 call option for $8.25, sell a $125 call option for $3.13 credit. Therefore you have a net credit you must pay of $8.25 – $3.13 = $5.12 Same expiration dates on both options.

- The price of AMD moves to $125 at expiration, you collect a profit on long call option and a loss on the short call option. Your net profit is $488.

- The price of AMD moves to $115 at expiration, your long call option expires worthless and you keep the premium on the short call. Therefore, you lose all of the money you paid up front of $5.12 (or $512)

Bear Call Spread

A bear call spread is the opposite of a bull call spread in that you are looking for the price to go down. Therefore, you will reverse your option structure by selling a lower strike call and buying a higher price call as per the diagram below:

This strategy receives a net credit which means you get premiums up front. When the price goes down,

What is a put spread?

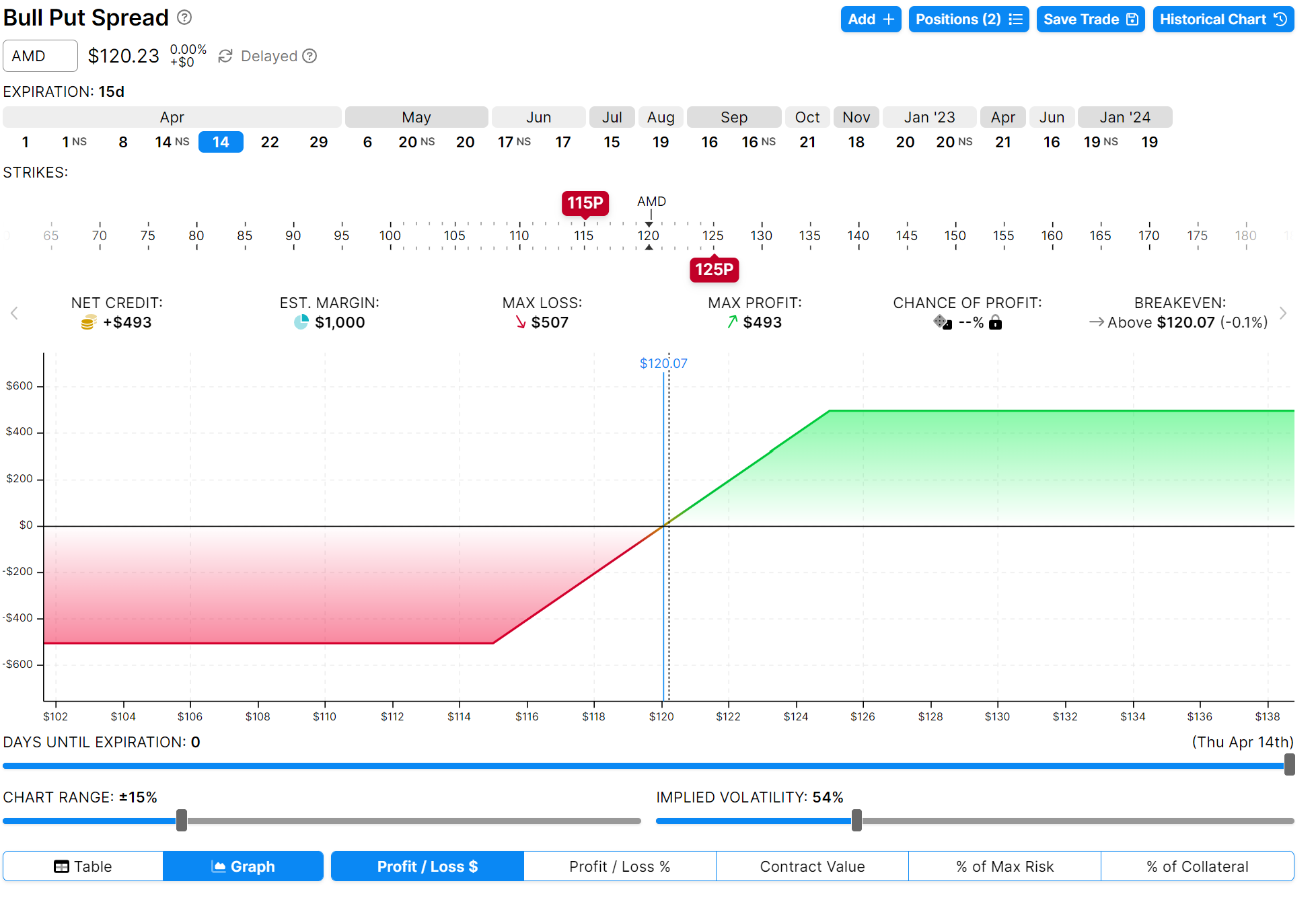

A put spread is the same strategy as the call spread but employs using puts instead of calls to create the strategy. For example, a bull call spread means you’ll buy a call and sell a call simultaneously with the strike of the long call below that of the short call. A bull put spread is the same thing. Instead of using calls, you will use puts instead to formulate the strategy.

Using the same example as above on AMD stock, we have the following payoff diagram.

Therefore a bull put spread means you will buy a put at a lower strike price and sell a put at a higher strike price. This strategy is a net credit meaning you will receive premium and be long theta.

Why use a bull put spread instead of a bull call spread?

If you look at the payoff diagrams between the bull call and the bull put spread strategies, you’ll notice that they are essentially the same. The main difference is the bull call is a debit strategy and the bull put is a credit strategy. This means you must pay money to enter the bull call spread but you will receive a net credit (premium) in the bull put strategy.

Both strategies benefit from the price of a stock moving up, but what is required from each strategy is different. Unlike the bull call spread, the bull put spread doesn’t need the underlying security to decline in order to show a profit. In fact, the underlying security can oftentimes trade flat and still leave the bull put spread profitable. Further, the underlying asset can actually decline in price at times and still leave the the bull put spread profitable.

This is probably the biggest difference when deciding which strategy you want to use.

Different names and type of call spreads and put spreads?

There are numerous names for a call spread that all mean the same thing. This really confused me in the beginning so let’s use this section to clear out the terminology. A traditional call spread is simply selling an option at one strike and buying an option at another strike. How you structure these buys and sells determine the name of your call spread.

For a traditional call spread where you are selling an ITM call and buying an OTM call option, this can also be called

- bull call spread

- vertical bull call spread

- long call spread

- debit call spread

Similarly, if you are taking the opposite view hoping for a fall in the price of a stock, you will want to use bear call spreads. These are the other names for bear spreads:

- bear call spread

- vertical bear call spread

- short call spread

- credit call spread

This is of course not the same as similar spreads used with puts. For the purpose of this post, I focus on call spreads. However, if you are planning on using puts, here are the terms to be familiar with.

- Long Put spread

- short put spread

- vertical bear put spread

- vertical bull put spread

- Bull put spread

- bear put spread

- credit put spread

- debit put spread

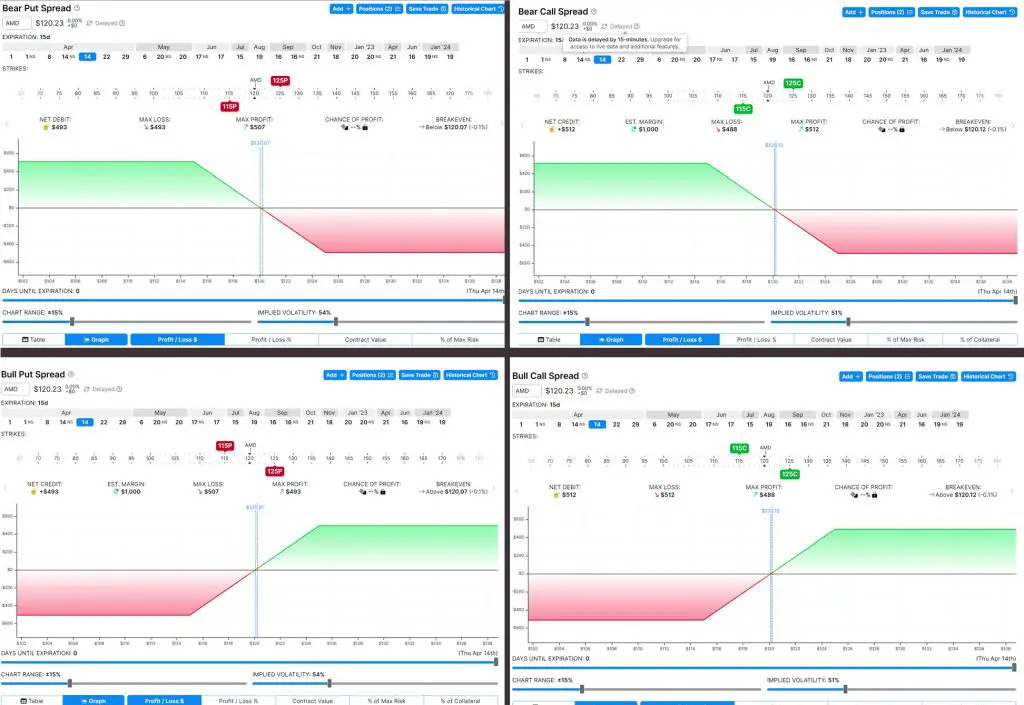

This photo summarizes the differences between all 4 strategies with a side by side comparison of their payoff diagrams.

As you can see, the bear put and bear call spreads have the same payoff diagram. The bull put and bull call spread also share the same payoff diagrams.

The only difference is that the bear put and bull call are net debit strategies, and the bull put and bear call are net credit strategies.

Table summarizing the different option spread strategies

For the option spread strategies, there are essentially four different strategies. It can get very confusing what the differences are between them so this table summarizes it all for you.

| Spread | Strategy | Strike Prices | Debit / Credit | Max. Gain | Max. Loss | Break-Even |

| Bull Call | Buy Call C1 Write Call C2 | Strike price of C2 > C1 | Debit | (C2 − C1) − Premium paid | Premium paid | C1 + Premium |

| Bear Call | Write Call C1 Buy Call C2 | Strike price of C2 > C1 | Credit | Premium received | (C2 − C1) − Premium received | C1 + Premium |

| Bull Put | Write Put P1 Buy Put P2 | Strike price of P1 > P2 | Credit | Premium received | (P1 − P2) − Premium received | P1 − Premium |

| Bear Put | Buy Put P1 Write Put P2 | Strike price of P1 > P2 | Debit | (P1 − P2) − Premium paid | Premium paid | P1 − Premium |

My experience is that until you actually use these strategies in real life, it’s almost impossible to really get a firm grasp on them. You can look at my payoff charts and read my blog all you want, but it won’t be until you actively trade these strategies that you really understand them.

How do I choose the strike prices of my call spread and put spread?

Choosing your strike prices for your call and put spread option strategies is very important. The strikes you choose for the two option contracts for your strategy will determine how much risk reward you take on. I’ll explain this as best as I can with the examples I’ve already used with AMD.

Let’s stick with the bull call spread and see what happens when we change the strike prices we use.

The original example I used was long call @ $115 and short call @ $125. AMD’s current price is $120. Your payoff diagram is like the below.

As you can see from this photo, the red (losses) and green (gains) are essentially mirroring each other. You have an equal chance of making money as you do losing money. This is because the two strikes I chose are equidistant from the current price of the stock.

Let’s see what happens if I choose strike prices above the current price of AMD. For this example, I will

- Buy (long) call @ $125

- Sell (short) call @ $130

This generates the following payoff diagram.

As you can see, the green and red regions of the graph shift drastically in favor of the gains. You are risking $136 for a potential profit of $364. On paper, this seems like a much better bet than the previous example which was risking $512 to earn $$486.

Not so fast.

This new call spread, while costing less, means the stock has to rise significantly more than the previous call spread. The first example, you need AMD to rally $5 to $125 and you’d claim the full profit amount of $486. In the second example, you would need AMD to rally $10 to earn a $364 profit. That’s an almost 8% rally which is much more significant. In fact, if the price of AMD only rallies to $125, you lose the full amount! You essentially need AMD to move much more significantly for this strategy to play out.

Theta is your best friend for bear calls and bull put strategies

Theta is the Option Greek for time decay. When you are buying an option, time decay eats at your premium and is one of the main reasons you always end up losing money. When you use the bear call and bull put strategies, you are receiving a net credit (premium) so theta becomes your best friend. This is why these two strategies are called credit spreads.

Every day that you near expiry, theta helps you with your trade just a little bit more.

When would I use a call spread option strategy?

I’m not an options trading expert by any means. I mostly trade covered calls to generate extra income and they are the easiest options to understand. However, I will dabble in call spreads and put spreads every now and then.

I like to trade call and put spreads around earnings season. I don’t have the risk appetite to trade naked calls and puts which are essentially YOLO gambling style trades. When you get it right, you can make multiple times your initial investment but when you get it wrong, you can just lose everything. I prefer more risk management on my end.

Bull put spread option when I think the stock is going up

If I think a stock is going up around earnings, I like to trade bull put spreads to capture the elevated premiums from the rise in Implied Volatility. I collect a net premium on this trade but my downside and upsides are both limited which I am okay with because I am betting on an earnings beat.

Implied Volatility Crush (IV Crush)

This additional IV means juicier premiums around this time. Option spreads are one of my favorite ways to trade earnings. It’s a much less risky way of trading earnings as the downside risk is mitigated. You won’t see the monster gains that could come your way if you buy a naked call or put, but if it goes the other way you lose everything in an instant. Pure gambling really.

In addition, IV crush is a real thing around earnings and this only benefits a put credit option because it reduces the value of the options. I could be dead wrong on the direction of the stock but still make a decent profit from the drop in Implied Volatility. I’ve seen this happen to me before on Tesla earnings.

Tesla usually has massive spikes in volatility around earnings and in this one particular trade, I had a bull put spread open and the stock did nothing the next day. I bought back my put spread the next day for a nice profit as the premiums had fallen so much.

Call spreads vs selling covered call

Selling covered calls means you purchase 100 shares of a stock, as well as selling an out of the money call option. This means you collect a premium, as well as realizing any MTM gains on the stock up to the strike price of your short call. This can be illustrated by the below payoff diagram.

As you can see with a covered call, your downside is unlimited. If the price goes down 10% you essentially will have an unrealized MTM loss of 10% less any premiums you collect. If the stock moves down 10%, the small premium you collect will not offset your loss. This becomes very risky if you are using the covered call strategy on a riskier stock with high volatility.

Minimizing risk on the downside with call spreads

As you can see from the above charts. A covered call has unlimited downside risk in case the price of the stock tanks. Yes you collect the small premium but this for sure will not negate the loss you’ll incur if the stock were to go down 10-15%.

That is where the call spread differs. Because you buy the call option at a lower strike, this ensures you minimize your downside risk. The call spread is perfect when you want to collect a premium on a riskier stock or when trading stocks around earnings to capture heightened volatility.

With the call spread, your downside is limited but your upside is also more limited as you are not purchasing 100 shares of the stock outright.

Both the covered call and the call spread strategies are best when you are trading a stock that you think will go up slightly (not a lot). A call spread just has less risk.

With a covered call, you’ll need to have enough cash on hand to purchase 100 shares of a stock, aka collateral. This is something you do not need with a call spread.

Example of a covered call vs call spread

Let’s run the numbers and see the difference between what is required to enter into a call spread vs a covered call on AMD stock.

| Strategy | Upfront Investment | Stock Price on Expiration Date | |||

| Below $115 | $115 | $120 | $125 | ||

| Bull Call Spread | $512 | -$512 | -$512 | +$0 | +$488 |

| Covered Call | $12,023 | Unlimited | -$205 | +$313 | +$790 |

What about a call spread vs covered calls on a high quality stock?

I mostly trade covered calls with high quality stocks that I am comfortable holding for the long term. This way I can generate consistent premiums during normal market conditions. I’m talking about stocks like AAPL, MSFT, AMD etc which I am comfortable holding for the long term even if the markets take a crash.

In this case, there isn’t much of advantage to using a call or put spread vs just using traditional covered calls.

How to buy or sell vertical option spreads?

As already discussed above, you can buy call spreads by simply buying and selling options on the same stock at the same expiration date. However, not all brokerages are created equally. You’ll want to trade option spreads using a more advanced brokerage like Robinhood, Schwab, TD Ameritrade etc. This is because their apps are much more sophisticated where you can buy multiple options at once.

If you use a basic brokerage account like Chase YouInvest, you can only buy/sell one option contract at once. This means, if you have a call spread you’re looking to execute, you can’t actually buy them at the same time. Let’s say you have a call option you’ve sold, by the time you’ve clicked through the buttons to buy the corresponding call option, the Greeks have already changed and your original call spread will be slightly different.

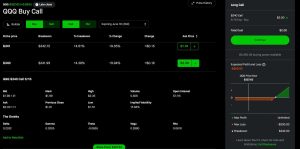

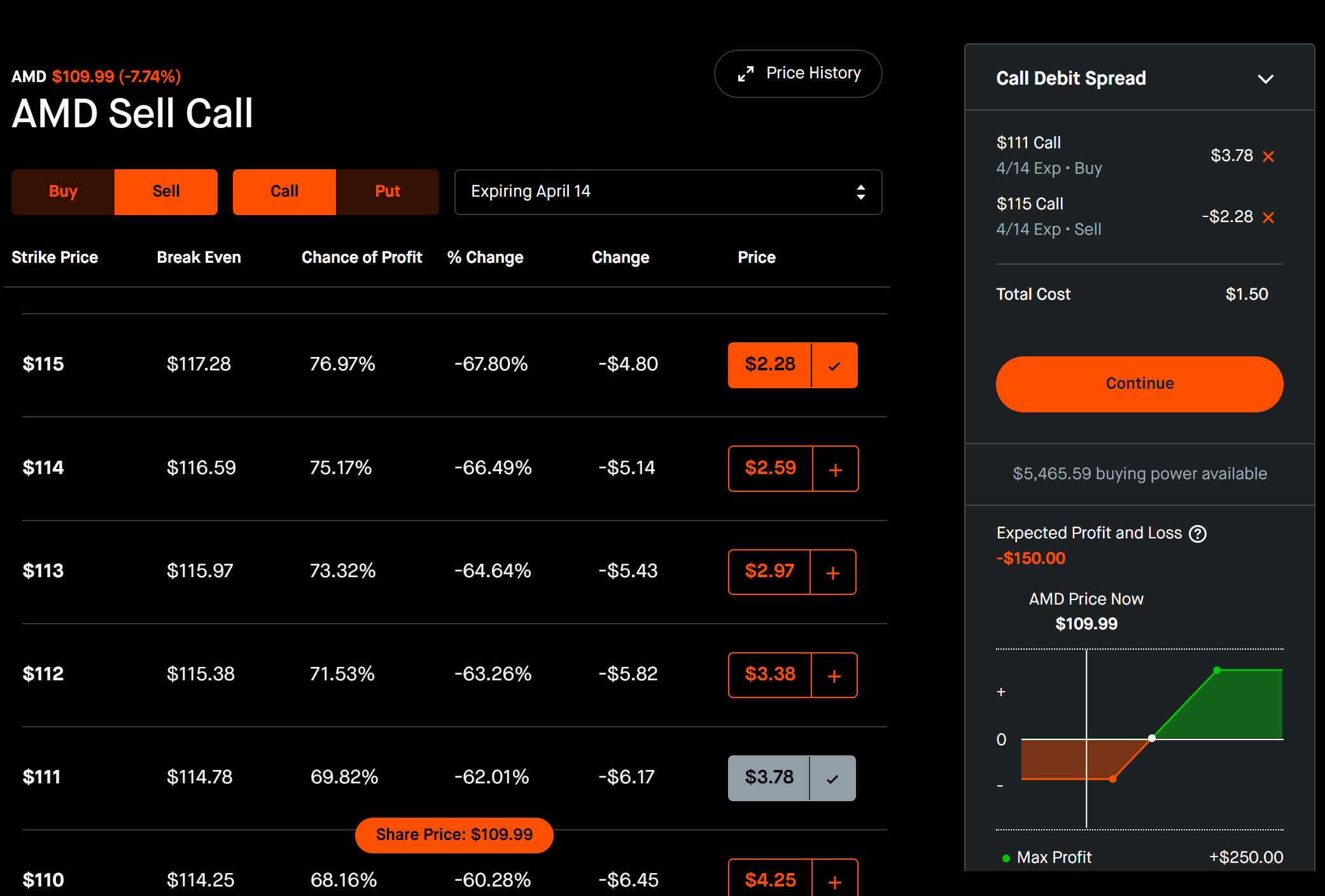

Using Robinhood to buy call spreads

Robinhood is my preferred brokerage to use when buying option spreads. This is because you can select the two option contracts you want to build your call spread and you can see the information in real time. The Robinhood screen will even update to show that you are now buying a “debit call spread” or “credit call spread” depending on how you’re structuring your trade. A great way to make sure you aren’t messing up your strategy!

As you can see in this example, I am buying a bull call spread (also called a call debit spread on Robinhood) on AMD. The current price is $110 and I am trading the $111/$115 spread which means I am buying the $111 call and selling the $115 call. I must pay $150 to enter this option (hence the name debit spread). The breakeven price is at $112.50 which means if AMD stock closes between $110 and $112.50 at expiration, I lose anything between $0 and up to the full $150 premium I paid.

If the stock moves up past $112.50 and even to $115, I can realize the full profit potential of $250.

What are the risks of call spreads?

Like literally every single thing in financial markets, there is no such thing as a free lunch. There is ALWAYS risk associated with a trading strategy no matter how safe it might look. Options in general are just one big dumpster fire of risk. It’s compared to a casino for a reason.

You win big, and you lose even bigger.

Call and put spreads are no different. You’re risking something in hopes of winning something else. You can’t have profits without risk in the world of options trading.

There are no big risks with call spreads

There are no unlimited risks when it comes to spreads. You know exactly how much you can you lose and how much you can win. There are no opportunity costs either as your option will expire when it expires, and you’ll know exactly the final result of your trade.

Unlike covered calls which have large opportunity costs when the underlying stock goes above the strike price of your short call, you are not buying any shares outright in spread strategies so you are not tying up much capital.

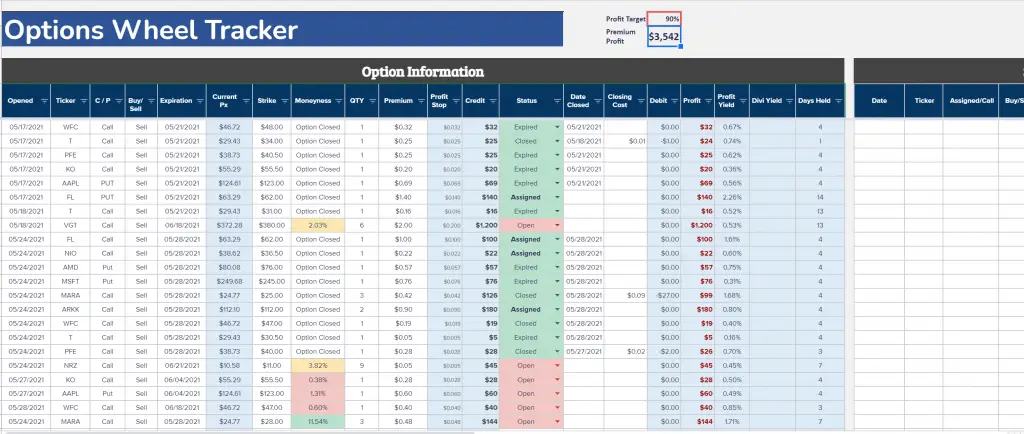

Using a spreadsheet to track call spreads

I’ve used my options trading spreadsheet to track my options wheel strategy for some time. When it comes to selling options consistently, you really need to have a spreadsheet to keep track of everything you’ve done otherwise you’ll get confused quickly.

All of this adds up quickly and no brokerage has a good tracking method for keeping tabs on the premiums your collecting and what is getting assigned and what is not. You need to do this on your own which is why I use my personal spreadsheet for this project.

You can access my options trading spreadsheet and use it for yourself to keep track of all your call spread and put spread trades.