There is no question that Chase offers the most lucrative sign on bonuses and the best credit cards in the business. In reality, it really is down to between two companies in 2019-2020, American Express and Chase. My favorite card is still the Chase Sapphire Reserve which I use on a day to day basis.

However, the Business Chase Ink Preferred offers the most lucrative sign on bonus at 100,000 points after spending $15,000 in 3 months. You can combine that with the two other business credit cards in Chase’s Ink portfolio, the Ink Unlimited and Ink Cash which are both offering a whopping 75,000 points sign on bonus. These points are some of the most valuable reward points in the business and you can redeem them for amazing business class flights or an amazing stay at a Maldives overwater villa.

What most people do not know is that you can game the system and actually apply for multiple of the same credit card as one person. Yes, this means you can apply for not one, but two Chase Ink Preferred credit cards and get 160,000 Ultimate Rewards points. Only Chase allows you to do this (AMEX does not). This post will lay out exactly how to go about doing this and proof of me doing so! This is all part of my travel hacking and credit cards guide which is lays out everything involving credit cards.

- For a list of all my credit card and travel hack related posts, click here.

- Also, read my guide on how to get both the Chase Sapphire Reserve and the Chase Sapphire Preferred cards

- If you’re planning to get into the credit card game, make sure to use my detailed credit card spreadsheet to track all of your churning!

- Follow my journey through financial independence as I retired early at 34 to travel the world.

Update Oct 2022: Chase Ink Unlimited and Chase Ink Cash have new and highest ever bonuses! Current bonus is 90,000 points after $6,000 in spend over three months.

Update Mar 2023: The 90,000 point sign on bonus for the Chase Ink Unlimited and the Chase Ink Cash will expire on March 21, 2023.

Update July 2023: The Ink Preferred has now reduced its minimum spend requirement from $15,000 in 3 months to $8,000 over 3 months. This makes it much more attractive and much easier to obtain!

Update Sep 2023: The 90,000 point sign on bonus for the Chase Ink Unlimited and Chase Ink Cash has returned!

Update Jan 2024: The Ink Unlimited and Ink Cash sign on bonus will go back to the 75,000 point mark. Still an amazing bonus for a no annual fee card.

What to know about Business Credit Cards

There are a few noticeable differences between personal credit cards and business credit cards. The primary difference is that the business credit card does not go onto your personal credit report. The impact on your credit score will be very minimal even if you have 5 or 10 business cards. This is especially important when applying for Chase credit cards (both personal and business) because of the Chase 5/24 rule. To better understand this rule and why Chase cards are the best credit cards, read my Chase credit cards guide.

There are many other nuances that can span multiple posts, so luckily I’ve written such a post that goes into detail about business credit cards, do you actually need a business, how it affects your credit score and more. If you have not applied for a business credit card before, make sure to read that post before continuing otherwise this may be confusing.

After reading this post, you’ll be on your way to earning enough points for a once in a lifetime stay at the Ritz Carlton Maldives for free!

What are the Chase Ink Business Credit Cards

Okay so now you’re a pro or at least aware of how business credit cards works. For the purpose of this post, it is to maximize taking advantage of Chase business cards so I am only focusing on the following:

- Chase Ink Preferred

- Chase Ink Unlimited

- Chase Ink Cash

- Chase Ink Premier

I will not be talking about their personal cards with include

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Freedom

- Chase Freedom Unlimited

What do the Chase Ink cards offer? A LOT of free Ultimate Rewards points. If you’re not familiar with UR points, they are considered the most lucrative points in the game. You can use them to book travel at a discounted rated (1.5 cents per point if you hold the Chase Sapphire Reserve so 80,000 points equates to $1,200 in travel).

You can transfer them to airlines and book business class travel which is a great ROI. Alternatively, you can transfer them to hotel programs like Hyatt and stay at amazing places like the Park Hyatt Hadahaa in the Maldives.

Here are the details of Chase’s Ink portfolio and their respective sign on bonuses.

These bonuses and minimum spend requirements have changed in 2020. I’ve updated them in the below section but for the purpose of the rest of the post, ignore the points examples as they will be outdated. However, the ethos of applying for multiple Ink cards is still the same.

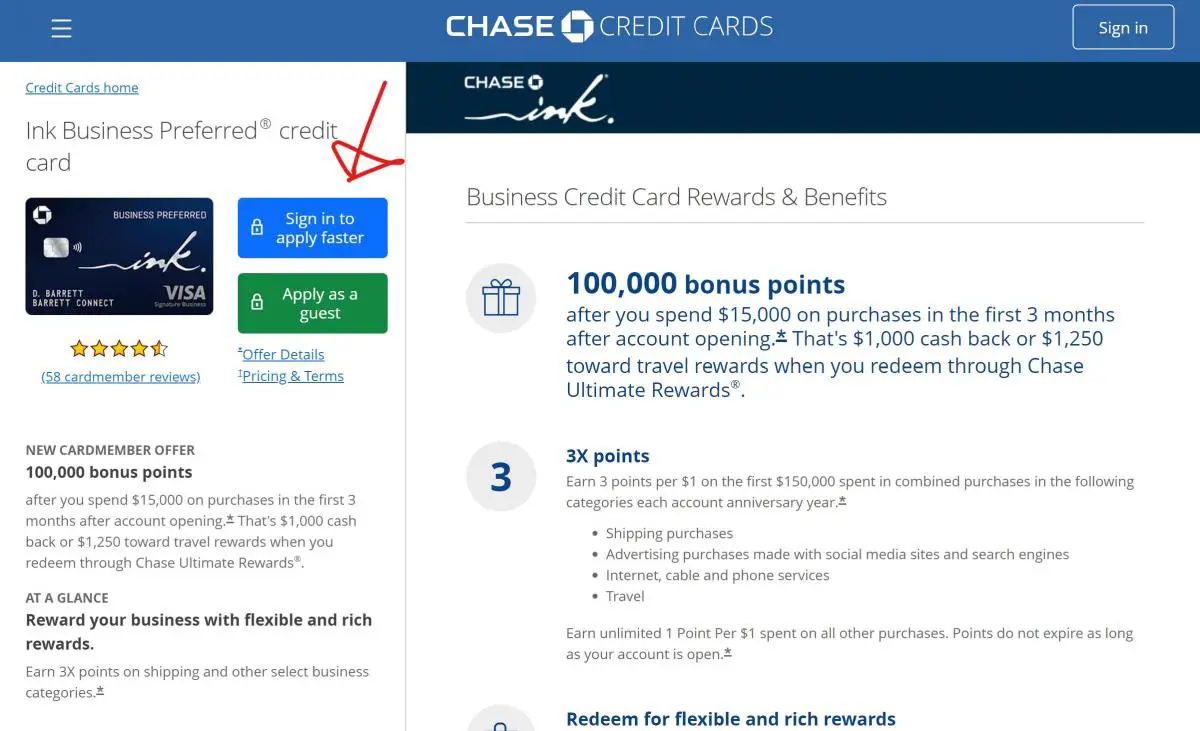

Chase Ink Preferred

Sign on bonus: 100,000 UR points after spending $8,000 in 3 months

Annual Fee: $95, not waived for the first year

Card Details: 3x per $1 spent on the following categories, 1x on everything else

- Travel

- Shipping purchases

- Internet, cable and phone services

- Advertising purchases made with social media sites and search engines

Chase ink Unlimited

Sign on bonus: 90,000 UR points after spending $6,000 in 3 months

Annual Fee: $0

Card Details: 1.5x per $1 spent on everything

Chase Ink Cash

Sign on bonus: 90,000 UR points after spending $6,000 in 3 months

Annual Fee: $0

Card Details: 5x back on office supply stores, and internet/cable/phone services, 2x back on gas stations and restaurants, 1x on everything else

Chase Ink Premier

Sign on bonus: $1,000 cash back after spending $10,000 in 3 months

Annual Fee: $195

Card Details: Unlimited 2% cash back on everything. 2.5% cash back on purchases over $5,000

My Analysis of the Chase Ink Cards

The Chase Ink cards have by far the best sign on bonuses in the industry. No other cards or bank provide the same type of value when it comes to the sign on bonus. We all know that the sign on bonus is the key component to the credit card hustling game.

The Chase Ink Preferred, Ink Unlimited, Ink Cash all give UR points which can be transferred to airlines and hotels. The value you can get here can be much higher than the cash value of the points when you book business class flights. For that reason, I almost always prefer to get UR earning cards. The Ink unlimited and Ink Cash are particularly fruitful with 75k or 90k points sign on bonus depending on the time without any annual fee.

Do not be scared of the annual fee on the Ink Preferred however. The additional UR points vs the Ink Unlimited and Ink Cash will more than make up for the $95 annual fee. For example, if the Ink Preferred is offering 100,000 sign on bonus vs the Ink Unlimited at 90,000, the additional 10,000 UR points is worth more than the $95 annual fee you pay. In addition, the Ink Preferred has no FX fees which might make it substantially easier for you to reach your minimum spend requirement.

The Chase Ink Premier is a newer card that only earns cash back and does not earn UR points. The Chase Ink Premier is good if you have a legitimate business and mostly just care about cash back. It’s especially fruitful if you consistently have large expenses since you get 2.5% cash back on purchases above $5k vs 2% cash back on everything else (which is still really good). However, the bonus and the annual fee make this card less appealing to me.

How to get two chase Ink Preferred business cards

This is where the meat of the post will be so pay attention to this! For the slightly above average Joe that is into credit card churning, it is simple to apply for all three cards in Chase’s business portfolio and get approved. This means you can have all three Ink credit cards (Ink Preferred, Ink Unlimited, Ink Cash) at the same time which means you’ll have garnered a combined 100,000 + 75,000 + 75,000 = 250,000 UR points! When the Ink Unlimited and Cash are at 90,000 points sign on bonus, your total will be 280,000 UR points!

This is a lot of points for anybody.

But what if you want more?

For the pros and the greedy, this is where it gets interesting. By applying for an EIN (Employee Identification number) which is what you’ll need to start a Sole Proprietorship or LLC, you can essentially apply for the same card a second time under a different business name. This means that if you have an EIN, you can apply for the same card again by using your EIN as your Business Tax ID instead of your social security number. Chase sees this as two separate applications, and therefore two credit cards with two sign on bonuses.

Essentially, this means you can apply for two Chase Ink Preferreds for 100,000 x 2 = 200,000 sign on points, or two Chase Ink Unlimited cards for 50,000 x 2 = 100,000 points.

Confused?

Yes it certainly can be and is why I always use a spreadsheet to track all my cards. Step by step it will look like this:

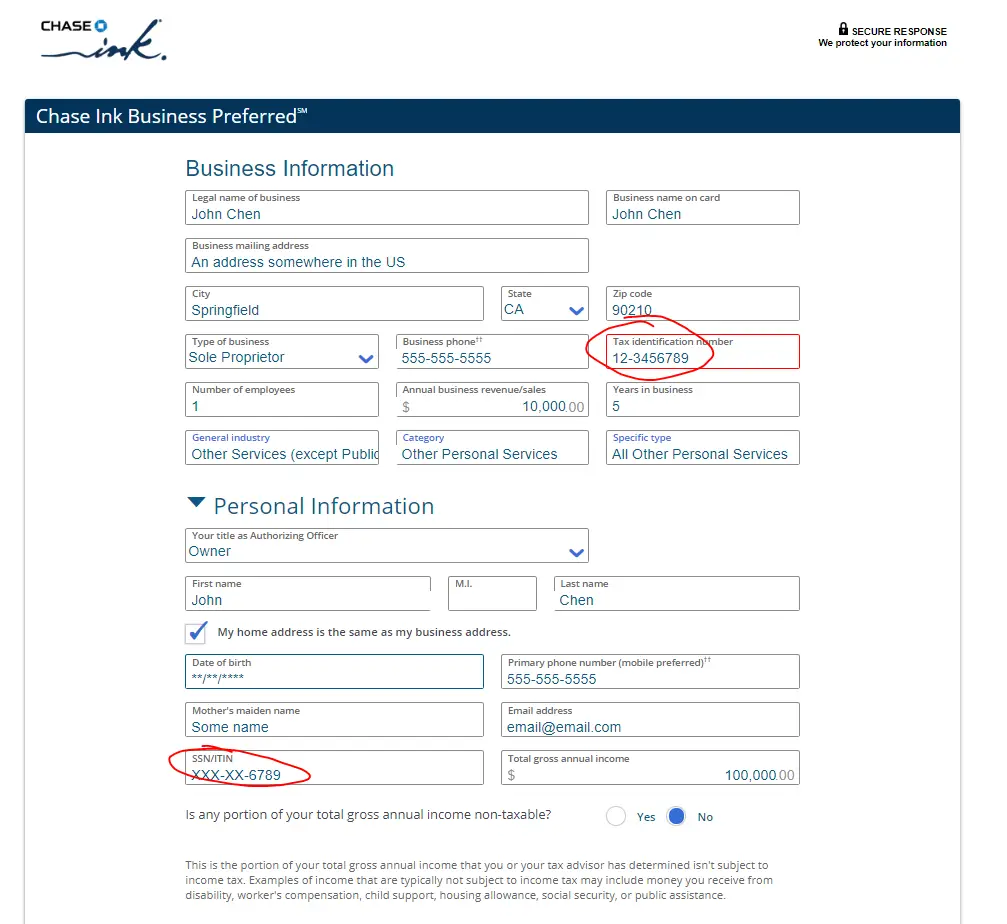

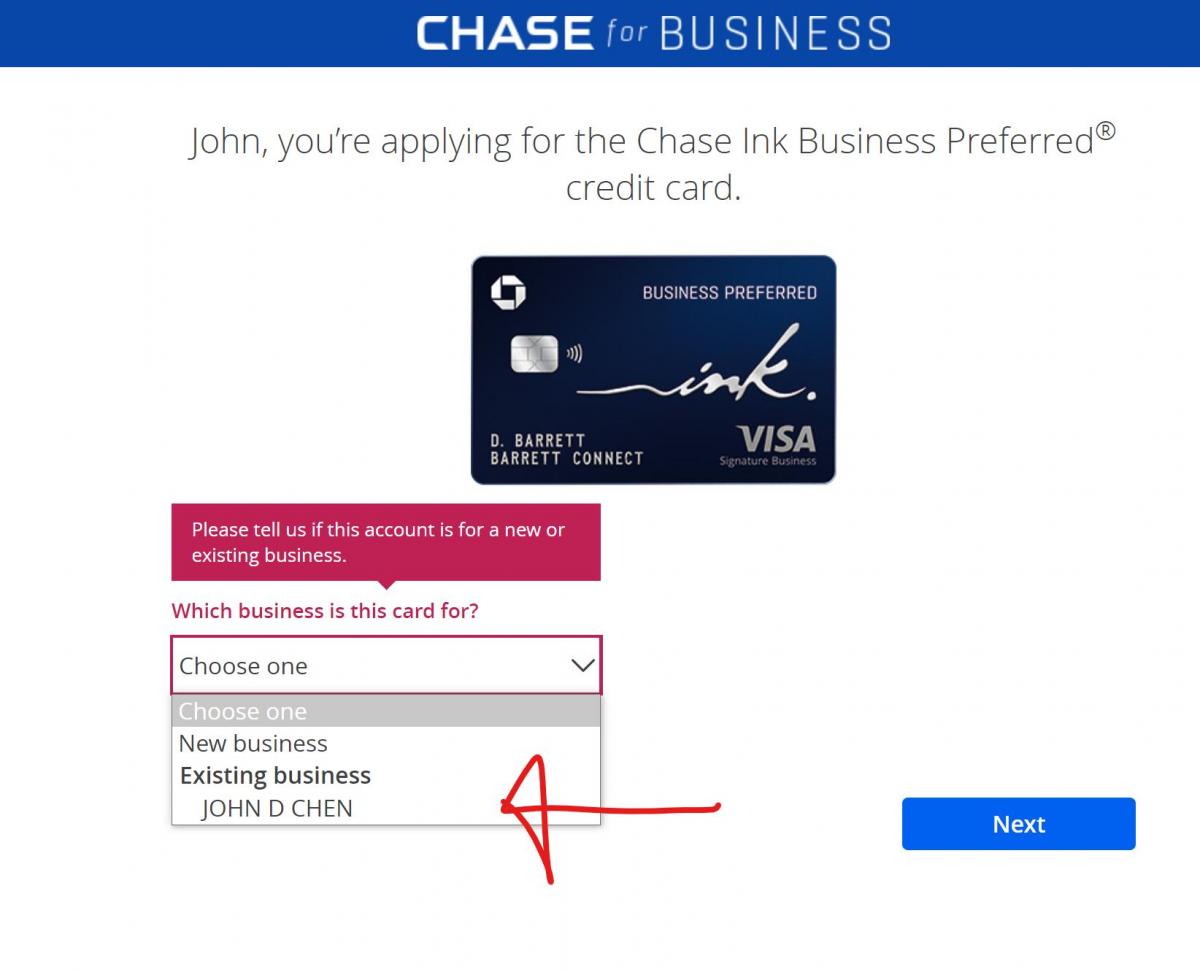

Apply for the first Ink Preferred using your SSN only

When filling out a business card application, Chase breaks the application down into two sections, one for your “business”, and the other for your personal details. On the business section, Chase will ask for your Tax ID number. The tax ID number is your EIN but you are not required to have one if you are a sole proprietorship, which is essentially doing business as yourself (think of doctors or dentists). You can use your SSN in place of your Tax ID instead. As such, for your business name, you can just put your personal name. For more details about how to fill out these applications, make sure to read my business credit card guide.

For your personal section, fill this out with your details and your SSN number as you would any other credit card application. Your business and personal sections will look quite similar in this case. This application is what we like to call the SSN application as you are only using your social security number.

I’ve filled out an application online as the following from Chase:

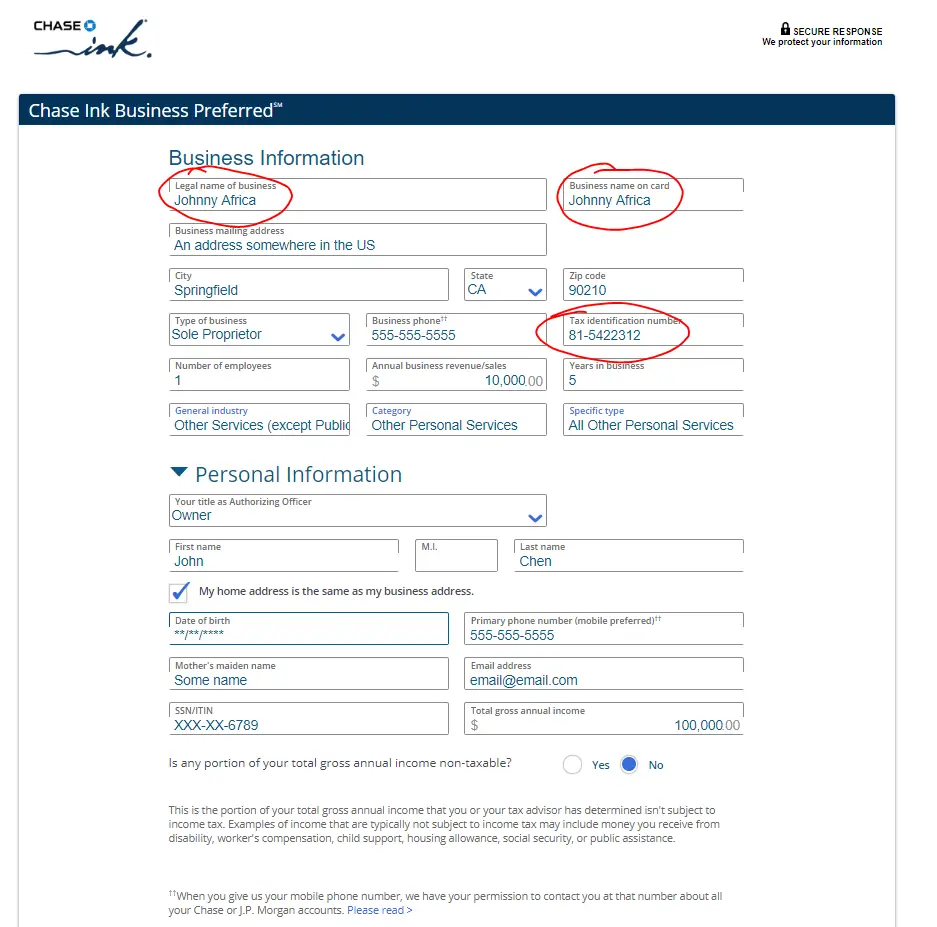

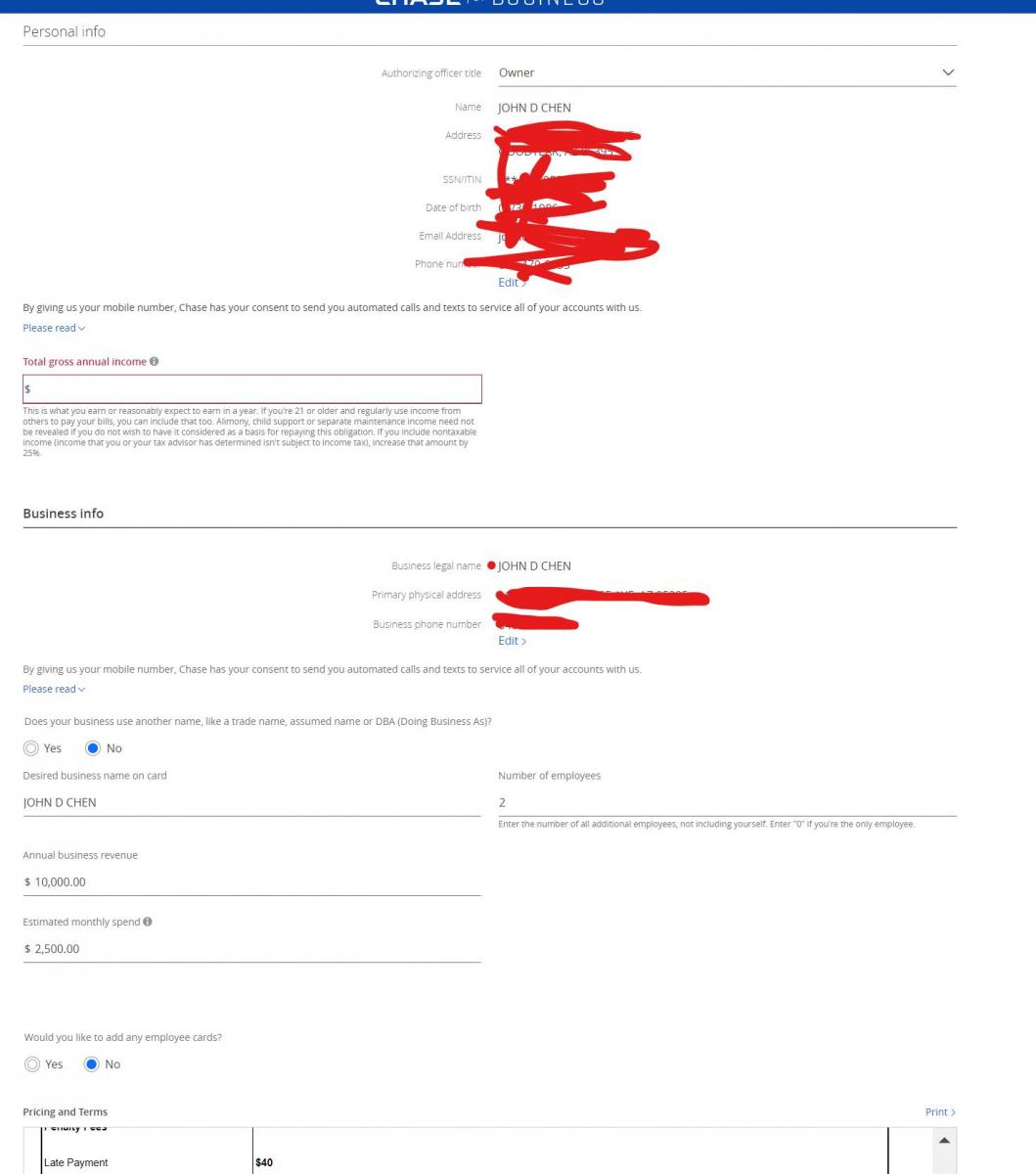

Apply for the second Ink Preferred using EIN and SSN

After waiting at least two months, you should be safe to apply for your second Chase Ink Preferred card. This time, you are using an actual EIN number (details on how to get one below) instead of your SSN for your business section. Whatever your business name is registered as, make sure to use that in the Business name section. You can still be a “sole proprietorship” even with an EIN so I would continue to select that as your type of business. For your personal section, keep it the same as the first card. This method is called the EIN + SSN method.

The application for the second card will look something like this:

By using your EIN on your second application, you are essentially filing a completely new application under a new business. Your personal section is still used to analyze your credit report (so if you cannot get approved for the first Chase Ink Preferred, then you will not get approved for the second) but using your EIN means you are now applying as a separate business.

Applying for an EIN

Applying for an EIN is very straight forward. Absolutely anyone can apply for an EIN and you don’t even need a real business. Perhaps you are planning to start a business, or perhaps you just think having an EIN sounds cool. Whatever the reason is, it is very easy and quick to get an EIN number from the Government.

When you’re ready, just visit the IRS website for EIN applications to apply for your own number. The application is not very complicated (just select sole proprietorship) and you should be able to get an EIN immediately after applying.

How long to wait between applications of the Chase Ink Cards

So now you’re ready to apply for multiple Chase Ink cards which is great. However, you’ll need to space out your applications because Chase has a concrete anti-churning rule called the 2/30 rule. This states that they will not issue more than 2 cards in a 30 day period. This is any two cards. So at the very minimum, wait 30 days between applications.

However, I like to wait at least 2 months to be on the safe side. This means if I applied for the Chase Ink Preferred on Jun 20, I would only apply for a second Chase Ink Preferred or a Chase Ink Unlimited from August 1 at the very earliest. I mean you’re getting thousands of dollars for free so don’t try and raise any red flags.

The standard Chase 5/24 rule also applies to this card so make sure you are not above the threshold for this rule.

Self Referring yourself to the second Ink Preferred

Currently, and this could change at any minute, you can refer a friend to the Chase Ink Preferred and receive a whopping 20,000 UR sign on bonus.

Note: This method is not advised anymore and people have reported getting accounts shut down because of this.

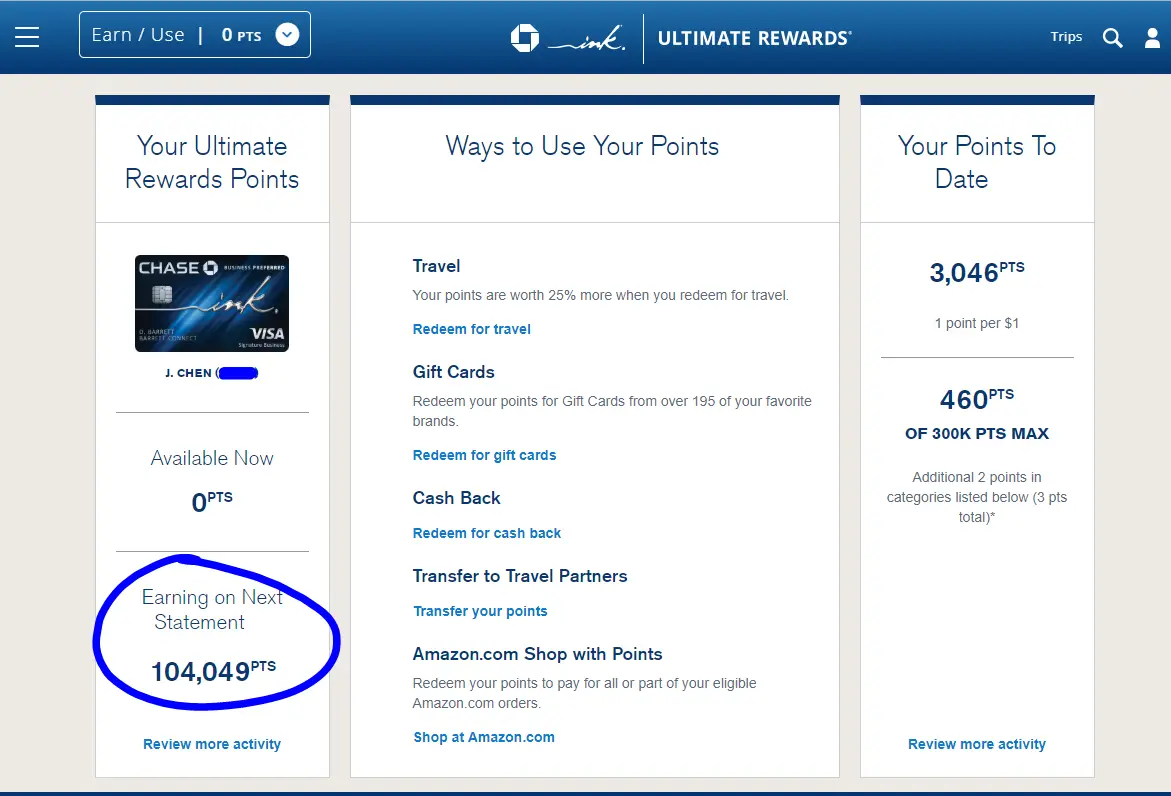

The pros trick is that you can actually refer yourself if you want to apply for the second Ink Preferred card since technically, you’re two entities. This means you can apply for your first Ink Preferred credit card and get the 80,000 points, refer yourself to get 20k and get another 80,000 on your second Ink Preferred.

- First Ink Preferred Card = 80,000 bonus points

- Referral bonus for referring yourself to the second card = 20,000 points

- Second Ink Preferred card = 80,000 bonus points

_______________________________________________________________ - Total = 180,000 bonus points, or at minimum $2,700 dollars towards travel!

This is exactly what I did and combined with the sign on bonus with the Ink Unlimited (just one card for now), that’s almost 250,000 UR in sign on points within a few months time!

What if I have more than one EIN?

If you already have an EIN through your Sole Proprietorship, you can get a new one through an LLC from the same IRS website. This means yes, you can essentially apply for another Chase Ink Preferred. If you have multiple EINs, technically you can apply for even more of the same cards.

While I’ve not indulged in this, I’ve read cases of people being able to get 4 or 5 Ink Preferreds for one person! This means, assuming they self referred themselves every time, they’re looking at almost a half million UR points!

A study case for another time!

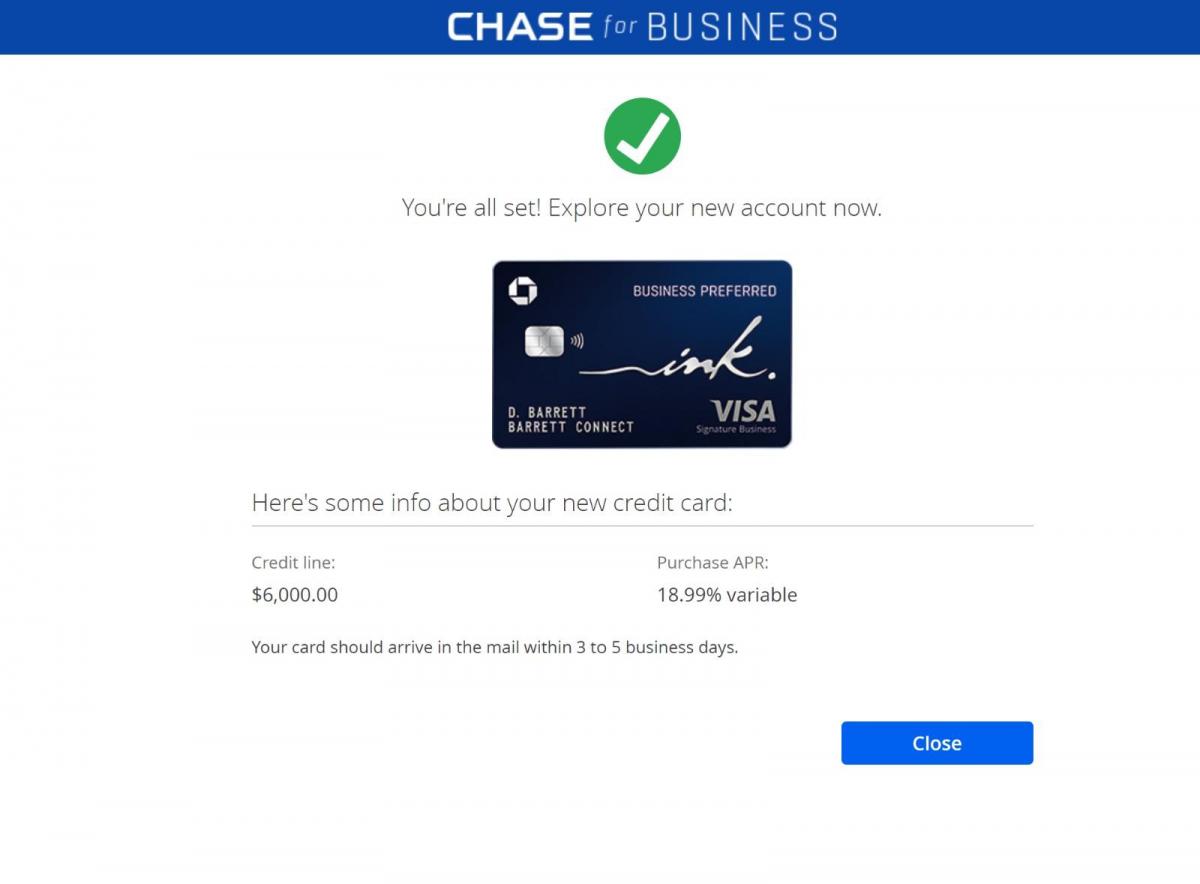

Updated 2022: You can now apply for multiple Chase Ink cards with just your SSN

Yes you heard it right. You can now apply for multiple Chase Ink cards without an EIN. You can literally just use the exact same details as your first application for your second application and be approved for a new Ink card. This works for Ink Preferred, cash, and unlimited cards.

Yes I’m not joking.

I had to do a lot of research on this but plenty of people all over the internet have had success just filling out the exact same application as their first application and you are approved with a new card that has a new card number. This card will of course also be applicable for the sweet sweet sign on bonus that we’re all after.

Just follow the below steps which are the exact same steps I took to opening my third Chase Ink Preferred card.

Once you’ve signed into your existing account, you can choose your existing businesses.

Fill in the application with the same information as before and don’t deviate too much from what you’ve already done.

As you can see, I got my card with instant approval! Make sure of course to follow the guidelines above with being under the 5/24 rule and not having applied for another Chase card for at least two months.

What date should I put when applying for EIN? I’ve seen guidance to say business has been doing business for 2 years when applying on Chase.

I usually put like 2014 or so which is when I started the blog.