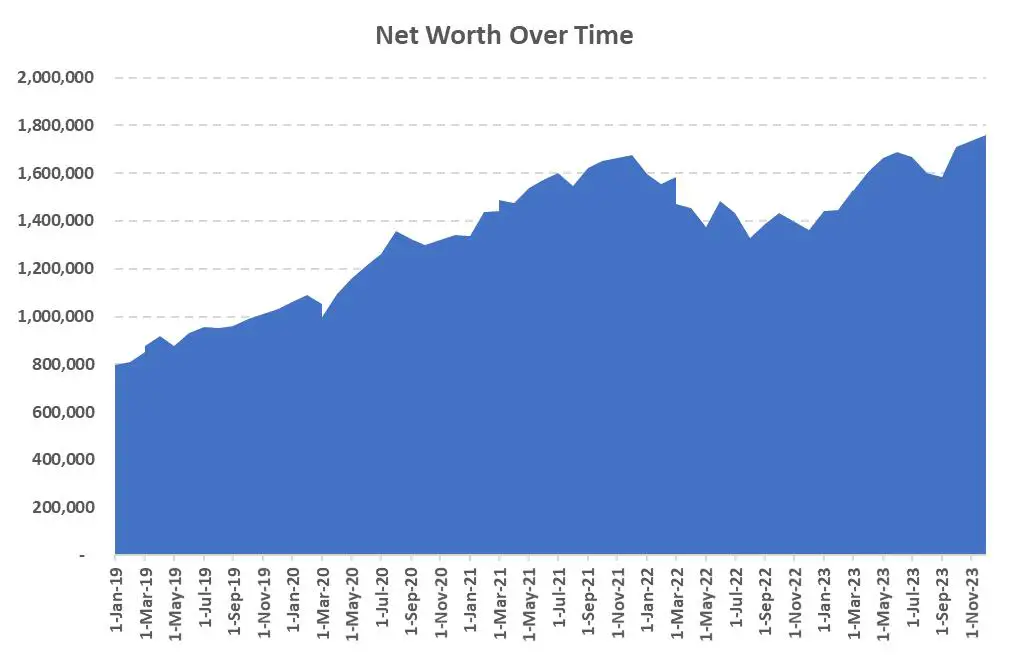

December 2023 was another month for the ages. After starting off my inaugural portfolio update post last month for November 2023, December was simply a continuation of the unstoppable market run of 2023. If you haven’t already read my posts before, I achieved Financial independence back in late 2020 early 2021 with a portfolio of roughly $1.3m invested in mainly ETFs. This ballooned to $1.7m during the peak of the markets in early 2022 before coming back down to Earth later in 2022.

This post will be part of a monthly series of portfolio updates that summarizes how my portfolio performed, what trades I executed, what my monthly expenses were, and my general outlook on the economy/markets. This is by no means financial advice so do not look look at me for sage advice. I make stupid trades and make even worse losses quite frequently.

This is simply the performance of my portfolio and how it has performed on a month to month basis.

Monthly Highlights – December 2023

- Net worth is near $1.75m m as of December 2023 Month end

- +$50k for the month

- Went back to Cape Town for the first time in years which was always an amazing time.

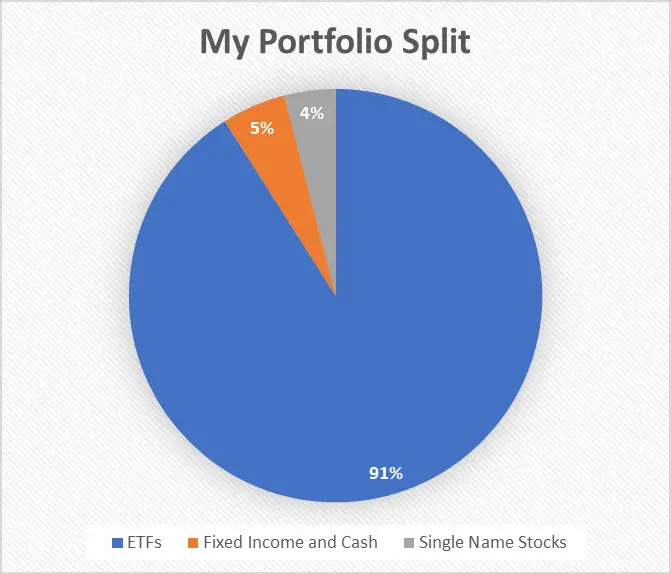

What is in my portfolio?

My portfolio is quite simple and straight forward. I have my holdings primarily spread out between a few ETFs, fixed income, and various single name stocks.

Fixed Income

Due to rising rates, I’ve also allocated a small part of my portfolio (<5%) to fixed income products. I’ve been purchasing 5.5% yielding treasury bills with a 3-6 month expiry. I currently have about ~$60k invested in a 3-mo T-Bill that will expire in Dec ME. I plan to buy another 3 month T-Bill upon maturity.

This is guaranteed money with zero risk which I decided to take advantage of while waiting for better entry points. However, it seems like this money probably would have been better used just buying the market but this is opportunity cost I’m willing to sacrifice.

I also purchased I-Bonds in 2022 at the height of inflation peak when I-Bonds were paying 9.5%. The rates have come down significantly since then as inflation itself has come down. The optimal time for me to sell these bonds were on Dec 1, 2023 as that would have been the last month I was eligible for the higher rate of 6.4% (still higher than what treasuries paid). As you must forfeit three months of interest upon withdrawal before 5 years, in total my blended rate of return was around 8% for 15 months which is definitely something I can live with.

ETFs

Again, my primary holdings are in a few ETFs. My primary holdings are in VTI, VGT, and VCR. I’ve always been a big proponent of big tech and have been heavily invested in the Nasdaq for over a decade. This has paid off very well for me given the massive bull market of the 2010s.

I used to hold more dividend generating stocks as I was really into this type of investing at a period of time. I currently do not have many dividend specific ETFs as I prefer growth more than income. This kind of goes against the ethos of financial independence but I have enough money coming in from other sources that I don’t need to focus so much on income.

I added to my ETF positions in December but not so much as I typically do not like buying more stocks at all time highs. Often times this is not good market advice as the prevailing sentiment has always been “time in the markets trumps timing the markets”. Nevertheless, I like to think I know a thing or two more.

Single name stocks

Some of the single name stocks I own are the following

- Tesla

- BRK.B

- Netflix

- RITM

These single name stocks make up less than 10% of my total portfolio. I tend to not buy much single name stocks anymore as there’s no point to take on unnecessary risks when I’m already so diversified with my ETFs.

Real Estate

I currently own no real estate. I used to own property in the US but have sold it in 2022 before rates started rising. I am not a big fan of real estate. While it definitely can be a good investment, I don’t think it beats investing in the markets. In addition, real estate is highly illiquid with high transaction costs that few people consider.

Finally, as someone that travels around the world and does not like to be tied down to one location, real estate doesn’t make sense as managing it from afar creates a bunch of headaches. I much prefer to have my money liquid and in the stock market.

Market Commentary – Dec 2023

December 2023 was a month for the ages. The November inflation report was mild and the FED signaled that it would start cutting rates in 2024. Markets rejoiced at the thought of inflation ending and the massive bull run of November continued into December with another rally for the ages.

Markets rallied to all time highs in the DOW, S&P, and the Nasdaq to levels last seen in late 2021/early 2022. The Nasdaq 100 index rebounded 54% this year alone which is crazy, and was the biggest rally since 1999.

My main ETF holding of VGT already hit all time highs in November 2023, and it continued to rally to new levels in December. It seemed nothing could affect the markets and all news was good news. The VIX also traded at multi-year lows around 12 which meant that all fear was more or less out of the market.

I was hoping for a few market pull backs but this never really materialized so I continued to buy stocks at/near all time highs. I suspect 2024 will continue the market trend of 2023 barring a resurgence of inflation.

Market Value of Portfolio

Here is a history of my portfolio value. As you can see, it’s moved in line with the markets as should be the case since most of my holdings are in ETFs that track the S&P 500 and the Nasdaq.

In total, my portfolio is sitting somewhere around $1.75m but this probably would have been closer to $1.8m if it weren’t for my covered call MTM losses.

Here is a summary of my stock holdings as of December ME. As you can see, most of my holdings have ventured deeply into tech which has been the main driver of my returns this year.

| Ticker | Quantity | Market Value |

| VGT | 1450 | $701,800 |

| VTI | 2080 | $493,418 |

| VCR | 400 | $121,820 |

| VDC | 300 | $57,288 |

| TSLA | 200 | $49,696 |

| TQQQ | 1000 | $50,700 |

| FBGRX | 400 | $69,308 |

| VHT | 250 | $62,675 |

| RITM | 2500 | $26,700 |

| ASML | 50 | $37,846 |

Trades executed for the month

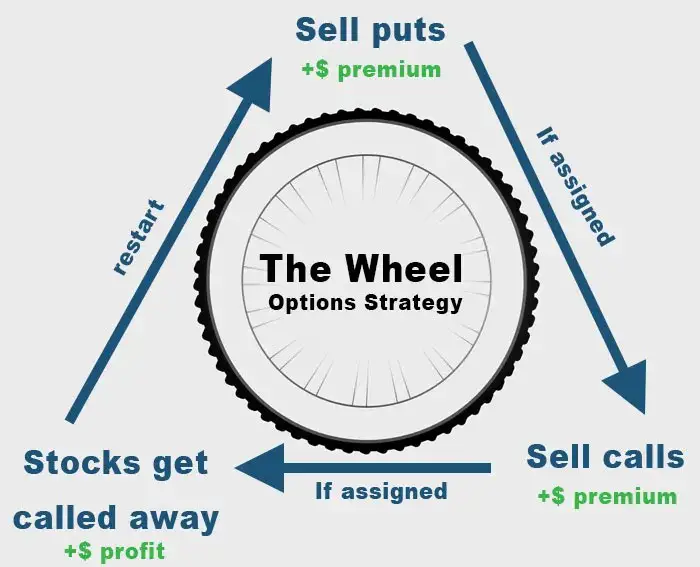

December was a bit of a disaster for my trading regime. I sold covered calls on my holdings of VGT, VCR, and VTI in early November as the rally was getting heated. I had no idea that rally would essentially rocket to the moon and eclipse not only 2023 highs but all time highs as well. I sold calls that quickly went into the money.

These calls had a Dec 15 expiry and by the time it came close to expiry, I had to roll out the contracts 2-3 months in order to not lose any money. The underlying was already about 5% in the money which means delta really messes you up. I was not even able to roll the strikes up to the current underlying price unless I wanted to roll the contracts out 5 months!

I don’t like my theta to be that long dated as you just never know what can happen in a half year. I suspect we will see pullbacks because markets never go up in a straight line (and it already has been so for 2 months). With the rolling of all my contracts, I made no money this month on my options selling and have essentially limited my passive income for the next three months since I rolled out my contracts for that long. This is the major risk of selling covered calls is that your contracts go so deep in the money that you have to roll it many months out and limiting your potential gains.

I also purchased more stock in my existing holdings (VGT, VTI, VCR, VDC, VHT). I also rolled out my one t-bill of $60,000 for another 3 months as the yield of 5.5% was just too tempting. I will continue to buy dips in 2024 like I did all throughout 2023 as I believe the rate cut euphoria will continue into the new year and beyond.

Summary of my option trades for the month

| Ticker | Quantity | Buy/Sell | Expiry | Contract (Options Only) |

| VGT | 10 | Buy to Close | Dec 15, 2023 | 450 Call |

| VGT | 10 | Sell to Open | Mar 15, 2024 | 475 Call |

| VGT | 2 | Buy to Close | Dec 15, 2023 | 465 Call |

| VGT | 2 | Sell to Open | Mar 15, 2024 | 480 Call |

| VTI | 15 | Buy to Close | Dec 15, 2023 | 230 Call |

| VTI | 15 | Sell to Open | Mar 15, 2024 | 240 Call |

| VCR | 5 | Buy to Close | Dec 15, 2023 | 285 Call |

| VCR | 5 | Sell to Open | Mar 15, 2024 | 305 Call |

| TQQQ | 10 | Buy to Close | Dec 15, 2023 | 43 Call |

| TQQQ | 10 | Sell to Open | Mar 15, 2024 | 47 Call |

Summary of stock and ETF purchases

| Ticker | Buy/Sell | Quantity |

| VGT | Buy | 5 |

| VTI | Buy | 10 |

Portfolio withdrawals and expenses

Withdrawals from my portfolio is an important part of the financial independence ethos. The 4% withdrawal rate rule is one of the main concepts of the FIRE movement which I try to adhere to. Generally, I prefer to sell from my portfolio when markets are near or at all time highs to capture, and only when I actually need the cash.

For the month of December 2023, I traveled to Cape Town, South Africa which if you don’t already know, is one of my favorite places in the world.

I made no withdrawals from the portfolio as I had enough cash coming in from my blog as well as leftover cash from other sources. My blog generates money every month to the tune of ~$3k and I cover exactly how I earn money from blogging in other posts.

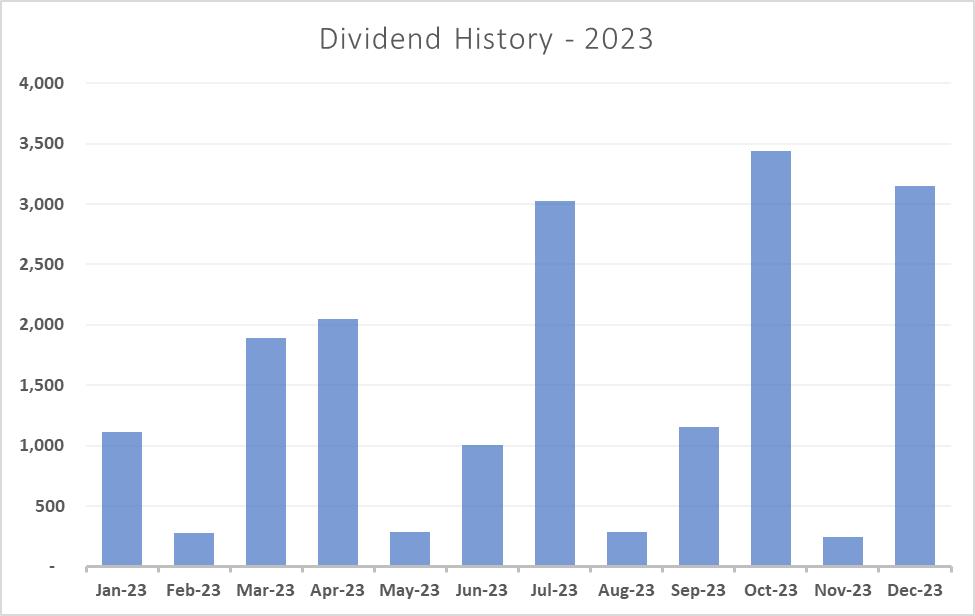

Dividend Income

For December, I collected a total of $3.2k in dividends. I typically reinvest my dividends which has served me well during the market downturn of the last year or two. I think I will probably stop reinvesting dividends in the near term as I like to keep a cash pile while stocks are at all time highs to reinvest when markets eventually dip.

Congratulations Johnny, onwards and upwards!

THank you Justin! That is the plan!