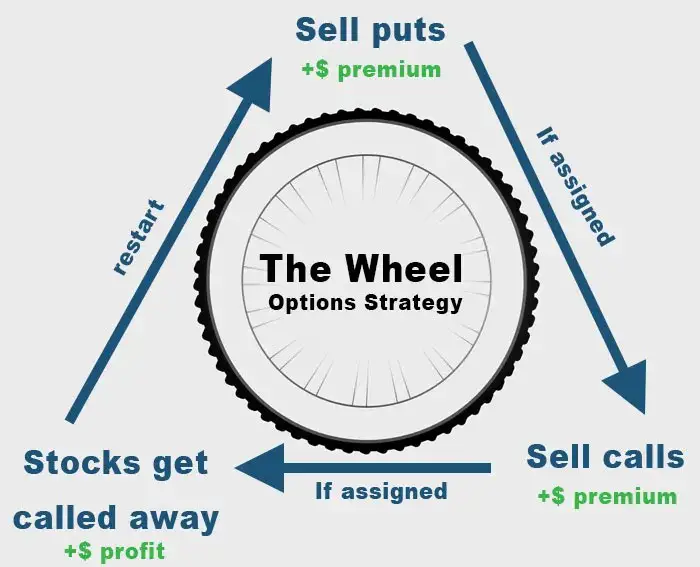

I recently wrote about how I employ the option wheel strategy to earn a consistent income from selling options. This involves selling puts and calls repetitively. This method allows you to collect a consistent premium on your stocks of choice with much lower risk than buying naked options.

This guide will go into detail about the cash secured puts part of the strategy. Selling puts is the opposite of selling a covered call which I cover in detail. Selling puts is a a very powerful way of building income and buying into a stock at a lower price, which is something I’ve regularly deployed in my journey to FIRE (Financial independence).

This guide will show you everything you need to know about the cash secured put strategy and hopefully answer all the questions you had!

Who is this post for?

If you have no idea what options are, then you should probably read up on basic option theory and understand what you’re getting into before putting your money on the line. However, I think the selling puts and calls are one of the easiest strategies to implement and understand. Therefore, if you have a basic understanding of call and put options, you should be able to get use out of this guide.

As a reference, I had never sold options before getting into this strategy. I used to always buy call and put options, losing more often than not.

What is a cash secured put?

A cash secured put is the opposite of selling a covered call. Instead of selling calls, you are selling puts. This means that if the price of the underlying stock goes below your strike price, you will need to buy the stock at the strike price.

It is called cash secured because you need to have the cash on hand ready to go in order to buy the underlying shares in case the price moves below your strike price. In this case, you’ll need enough cash to purchase 100 shares of the underlying stock as that is the standard option size. If you didn’t have the cash for 100 shares to begin with, then this is called a naked sell which most brokerages won’t allow you to do because they would essentially just be lending you money (in case the option was called away).

Let’s continue with the below example:

You sell a put on AAPL with a $150 strike price. You will collect a premium for doing this because you are giving someone else the right to purchase a put at that same strike price. If the price of AAPL moves below $150 at the time of expiry, then I will need to purchase 100 shares at $150 for a total of $15,000. Two scenarios can essentially come out of this.

- The price of AAPL is $155 at the time of expiry. This means the price did not go below the strike price I purchased it at, and I will keep the full premium.

- The price of AAPL is $148. Because it is below my strike price, I will now be “assigned” the stock which means I must purchase the 100 shares of AAPL at $150. Because the market price is now at $148, I will have a $2 unrealized loss.

How do I choose the strike prices of my options?

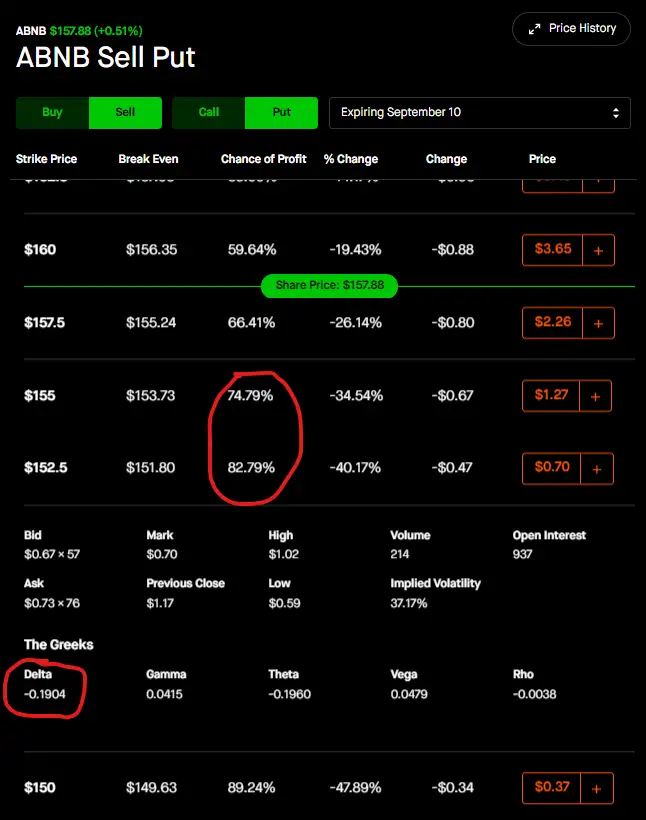

There are probably much more sophisticated ways to do this but I usually just target a delta value above below 0.25 and call it good. Robinhood lays it out quite nicely and even has a “Chance of Profit” column which is not the same thing as the Delta value but derives its probability from the delta.

For example, the stock below is Airbnb. The current price is $157.88 so I would sell a put below the current price. I choose my price based on delta values and how I feel about the stock.

If I think the stock has momentum to go higher, I will sell the $155 put and collect $1.27 (or $127) of premium. If I’m not feeling passionate about the stock and am indifferent, I will go with the lower strike and sell the $152.5 strike and collect a $0.7 ($70) premium.

Theta is your best friend

Theta is the Option Greek for time decay. When you are buying an option, time decay eats at your premium and is one of the main reasons you always end up losing money. When you are option wheeling, you are continually selling options so theta becomes your best friend.

Every day that you near expiry, theta helps you with your trade just a little bit more.

Implied Volatility (IV) Crush

Otherwise known as IV Crush. IV Crush is probably the single best thing to happen to option sellers and executors of the Option Wheel. When a stock experiences a huge run up, implied volatility increases drastically which will also increase the value of the premium.

Many people like to buy a call or put option when they see a huge move in the price because they want to get in on the action. The problem is, the option is so expensive at this point because of the implied volatility has skyrocketed. For option sellers, this means you can collect a huge premium.

More times than not, a stock that’s doubled in price overnight will likely not experience the same move the next day. The price could move say 10%-20% in either direction but it is still a far cry from 100%. This means implied volatility could collapse rather quickly which means the value of the option could move quickly as well. This is referred to as IV Crush.

For example, when AMC was having its big run in q2 of 2021, IV went up to 600% at one point! This is absolutely insane. If you bought a put thinking the price would go down, then you would have been right. The stock promptly went from its highs in the $60s down to the $50s in one days. You would think that owning a put would mean you earned money. However, because the price movement downward was much slower than the previous days, the implied volatility went down to something like 300% (which is still insanely high). This meant that even though you were betting the right price movement, the implied volatility move meant your option actually lost value!

How much money do you need?

Nothing is free in this world. You need money to make money. Selling a covered call means you need to have enough money to own 100 shares of the stock outright. Depending on the stock you are trading, this can mean anything from $1000 to $100,000.

For example, let’s say you want to option wheel AMD stock. The current price of the stock is around $100. Since all options are 100 shares per contract, this means you need $100 x 100 = $10,000 to sell 1 put contract. From my experience selling weekly options, I’ve been able to collect about $100 on average per week doing this as AMD has a higher than average Implied Volatility.

That means $100*4 = $400 per month, or about $5,000 per year in premiums. This translates to roughly a 50% annualized return by selling AMD puts which is not YOLO wallstreetbets type of returns, but will more than suffice for my purpose!

Trading puts around earnings

Trading around earnings as a whole is risky because volatility is at its highest point during these weeks. If you actually look at the implied volatility for a stock around earnings season, you can see that it always goes up.

Even if the price of the stock doesn’t move much, the implied volatility can be much higher than expected because it’s what the market is anticipating. This means calculating IV using Black Scholes vs what you see in the market can vary drastically during earnings season. You can have a stock move sideways 1% leading up to an earnings release, and then have it go up or down 10% in the next day.

This additional IV means juicier premiums around this time. Your premiums will be elevated which means your “breakeven price” will be higher. However, you are of course running the risk that the company blows out earnings and your stock goes to the moon or vice versa.

In addition, IV Crush is a concept that all option traders (buyers and sellers) should be familiar with. When you’re trading around an earnings release, Implied Volatility will almost always be higher than previous days. This is because traders are anticipating a volatile event around earnings. When earnings are released, IV will decrease substantially even if you see a big multi percentage move. If the stock doesn’t move much after earnings, you can expect IV to fall off a cliff. For example, as an option seller, you could see a move lower after earnings in the price of a stock but not a rise in the price of your option because of IV Crush.

IV Crush is an option sellers best friend. Selling around earnings means you can collect much larger premiums and IV crush is in your favor. Of course, all is good in the world until you get it really wrong!

Examples of selling cash secured puts

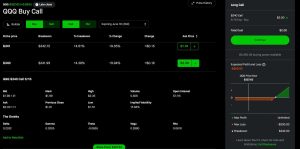

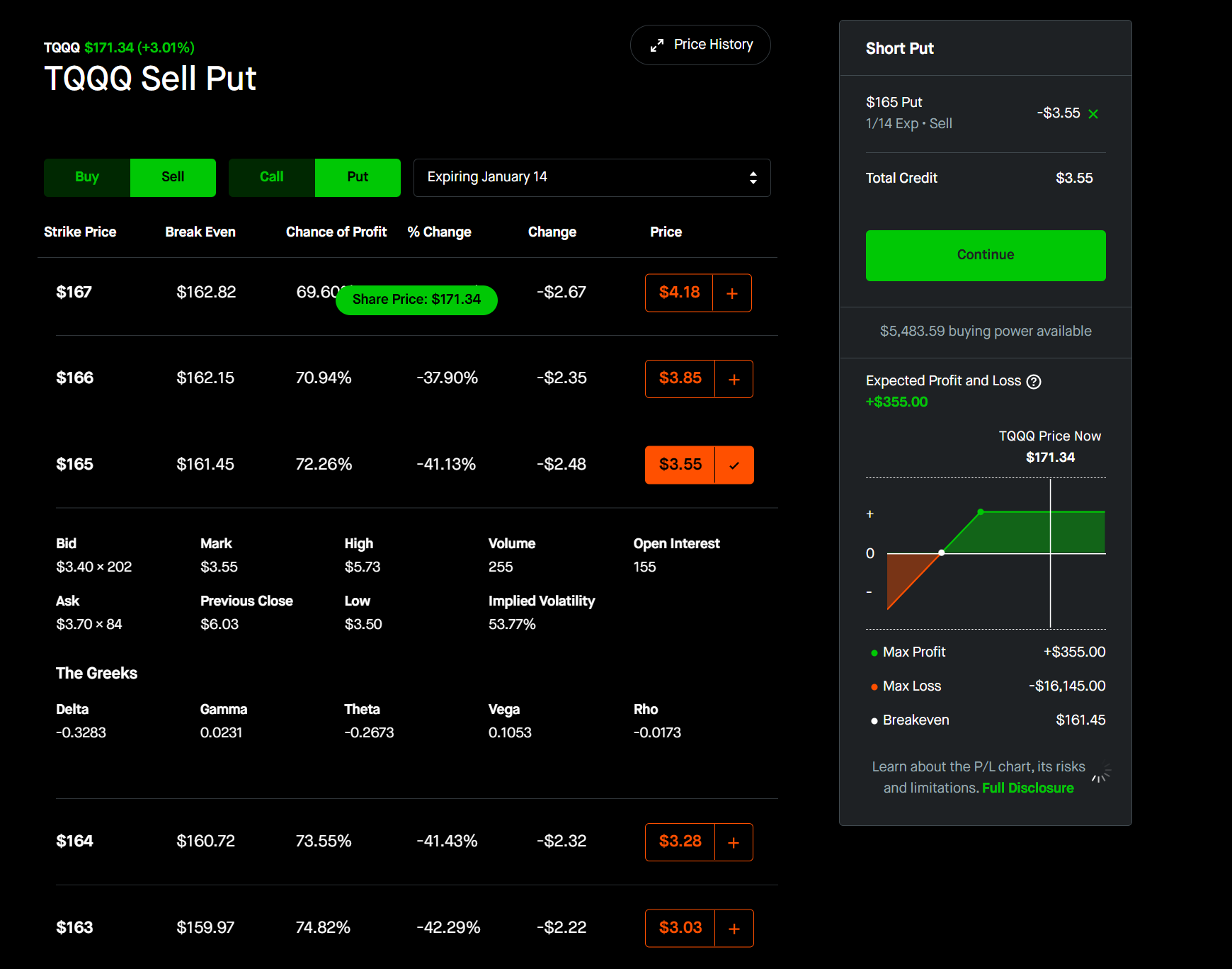

There’s no better way to explain how to sell covered call options than by example. I will use TQQQ as my example and then use the option chains in Robinhood to illustrate my point. TQQQ is one of my holdings in my portfolio that has helped me retire early.

I use Robinhood to trade options because it is 100% free. Robinhood, along with Webull and Sofi are some of the absolute free options to trade options. While Chase Youinvest or Etrade allow you to trade vanilla stocks for free, options still carry a price of $0.5-$1 per contract. This adds up quickly and can quickly eat into your profits.

Here is the price history of the TQQQ:

As of Jan 3, 2022, it is trading at $171 per share. To sell a cash secured put, you’ll do the following.

I like to use weekly stocks with a delta of 0.3. This reduces the chance of the stock reaching my strike price from my experience allowing me to keep the premium.

Here is a screenshot of selling a put on TQQQ. I chose the 165 strike with 11 days until expiry which has a Delta of 0.33 and a chance of profit of 72%. As you can see from the expected profit and loss graph, my max profit on this trade is $355 because when you sell an option, your max profit is capped at the premium you collect.

However, Robinhood will not allow you to sell a naked put because if the price goes below $165, someone is on the hook to provide the shares at $165to whomever bought the call (the other side of your trade). This is why you need to have cash available as collateral, in this case you’ll need $16,500 (165* 100) to sell this put.

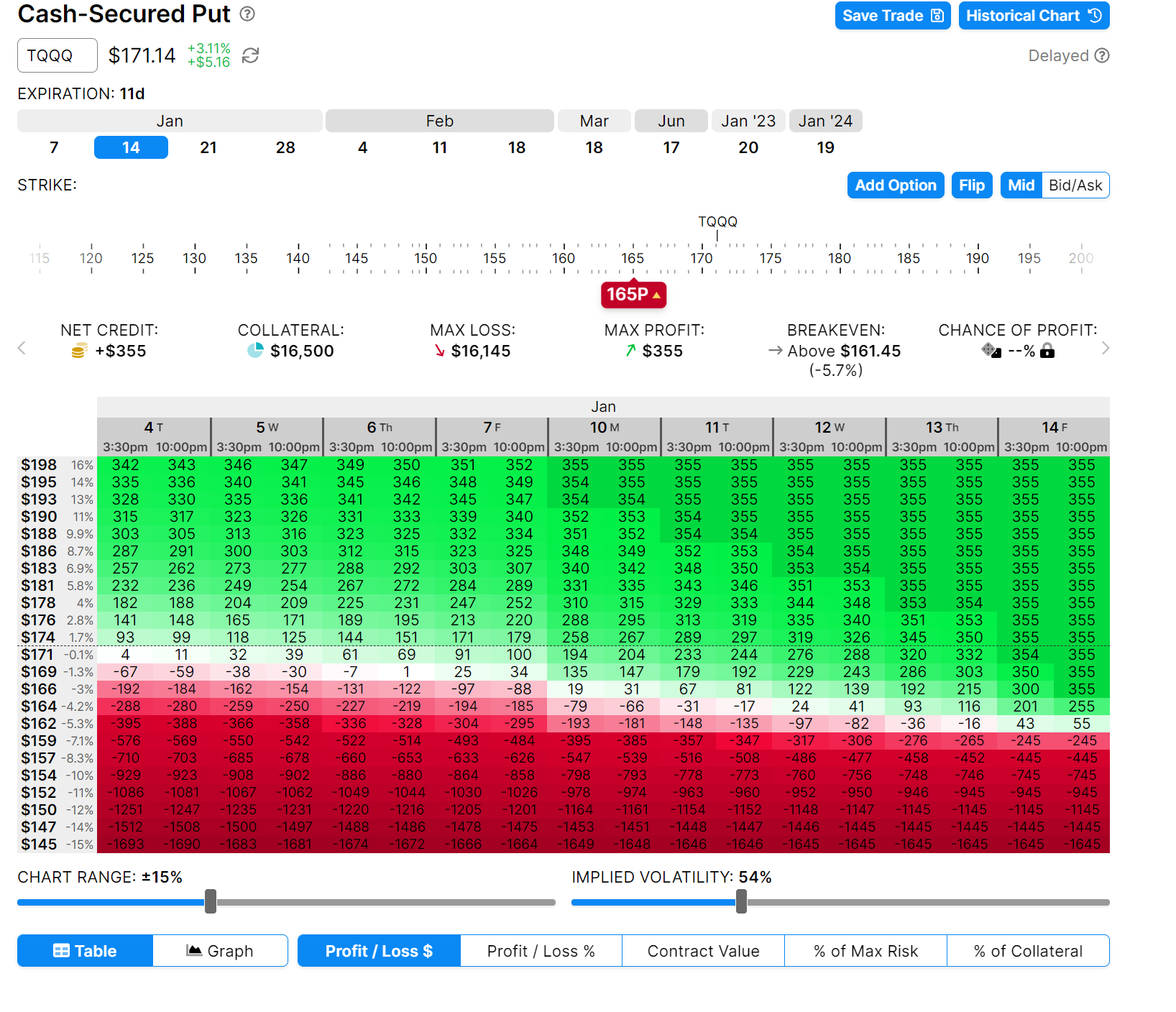

So now I will sell a cash secured put on TQQ at this $165 strike with 11 days until expiry and you can see what the profit loss graph will look like the following:

As you can see, OptionStrat.com illustrates this out perfectly. If I sell a $165 put, this means I receive a $355 premium. My max profit of $355 is the maximum amount of profit I can make on this stock. This is different from a covered call because I would not benefit at all by any movement in the underlying stock. Whereas in a covered call, I would benefit from appreciation in the underlying when the price moves towards my strike, selling a put merely gives me the right to purchase something at a lower price.

If the stock moves to $165 by expiration date, this means I will keep the $355 and then be able to purchase the stock at $165 (for a total of $16,500). If the stock moves to $160 at expiration

Rolling the cash secured put to a later date

Now we are on to more advanced topics. If the price of your stock reaches the strike price of your cash secured put, you will be forced to buy the stock at the strike price. You might not want to do this because you think the market will keep going lower.

What you do in this case is either:

- Close the position for a loss (you can’t win every time right?)

- Roll the option to the next week, next month etc.

In the second example, what does that mean to roll the option? Simply it means to sell your current option and buy another option one week (or two week, or one month etc) out. You’re simply rolling the obligation of the option further down the line. Essentially, you are just extending the time you have to get the result you are hoping for.

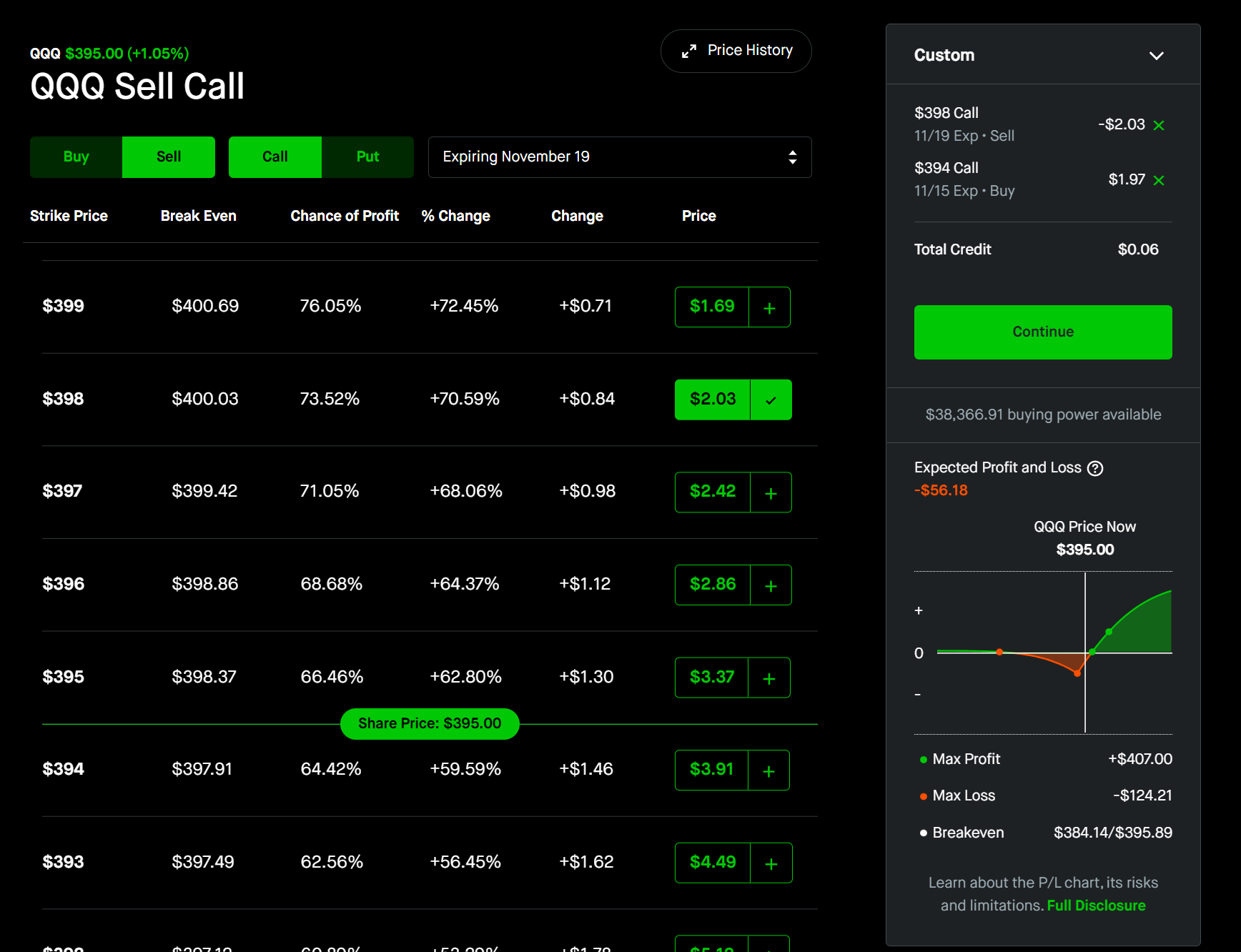

If your short put is in the money meaning you will have to buy 100 shares of the stock and this is something you don’t want, rolling your option is definitely one way to accomplish this. Let’s use this example below:

Let’s say I sold a cash secured put on TQQQ at the $ shares of QQQ and I sold a covered call with a $394 strike expiring Nov 15. It is Nov 15 now and the price looks like it will be above 394 at the end of trading day on Nov 15. I don’t want my shares to be exercised so I want to “roll the option”.

This means I’d have to “buy back” my original option for $1.97 which will most likely mean a loss from the original premium I collected. However, I can now look at the Nov 19 expiration date 4 days out and see that I can sell another covered call at the 398 price and collect a $2.03 premium. This means I have extended my option out 4 days and increased my price target to $398. I even collected a net $0.06 in premium.

Of course the price of QQQ can easily go past $398 by Nov 19 close but you can continually do this until you reach your desired result. Unfortunately, this means if you are looking to achieve consistent premiums weekly, you are not collecting premiums anymore as you’re constantly rolling out the option.

Why selling covered calls beats selling cash secured puts

Selling covered calls means you purchase 100 shares of a stock, as well as selling an option with 0.2-0.25 delta. This means you collect a premium, as well as realizing any MTM gains on the stock up to the strike price of your short call.

High quality name stocks in the long term are generally bullish which means you want to have a long term bullish outlook on your stocks. If you look at a graph of AAPL for example, it has its fair share of dips but the stock has been rising consistently for the past few decades. Anyone who is a permanent bear on Apple surely has accrued no money in their portfolios.

For both strategies, you need enough money for 100 shares of the stock. For covered calls, you need to outright own 100 shares. For cash secured puts, you need enough cash collateral for 100 shares. Therefore, the upfront capital is not different for both strategies.

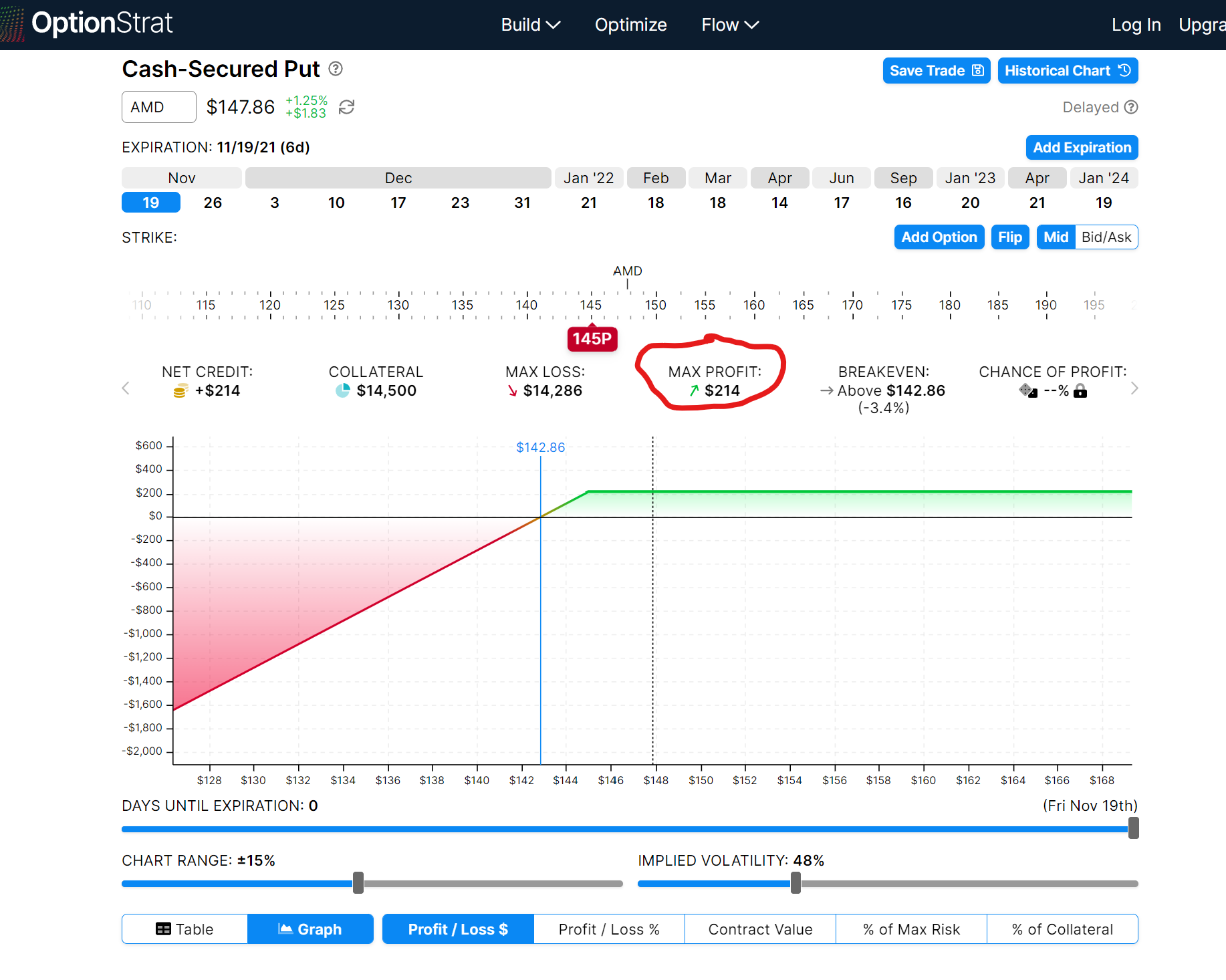

However, for cash secured puts, you only get the premium on the stock. If I sell a $145 put on AMD stock, I collect $2.14 in premiums. This means my maximum profit is $214 on this trade. If the stock moves to $145 upon expiration, this only allows me to buy the stock at $145 and that’s it. You can see this from the Optionstrat screenshot below

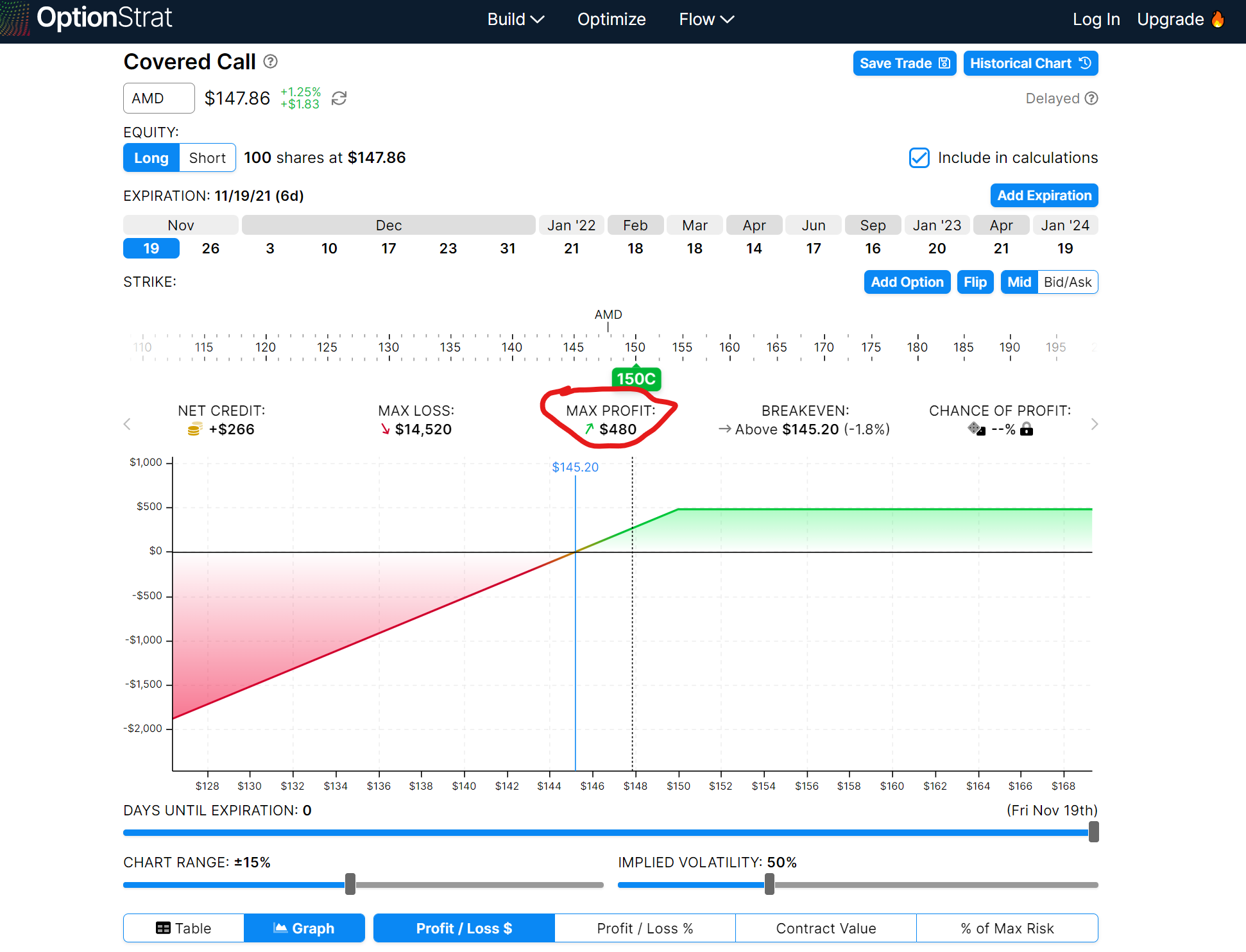

For a covered call, let’s say I sell the $150 strike on AMD, my maximum profit is therefor $480 because of the premium and the stock appreciation.

Again this is because I need to have 100 shares of the stock in order to get into a covered call. I’m not saying that a covered call is always better than a cash secured put. If you anticipate the stock going down in price, then a CSP is advisable.

However, over the long run, I just find with high quality names, a covered call strategy consistently beats selling puts.

Selling a put to buy into a stock you like

Selling a put can be advisable if you want to be assigned. This means, you want to buy into a stock at a lower price than what it is currently trading at. This is because you can collect a premium, and then buy the price at a lower price. Of course, in any market correction, the price of the stock can quickly dip below the strike price you sold the put at. However, you wanted to buy the stock anyways, so it doesn’t matter. You can’t time things perfectly after all.

Example of selling a put on NVDA to buy into the stock

The risk with this strategy is that you miss out actually buying the stock because the price goes up. Let’s say you are looking to buy into a stock like NVDA. This is a strong semi-conductor name that has been appreciating heavily over the last few years. All fundamentals point to continued strong growth as the world can’t satisfy its appetite for semi conductors.

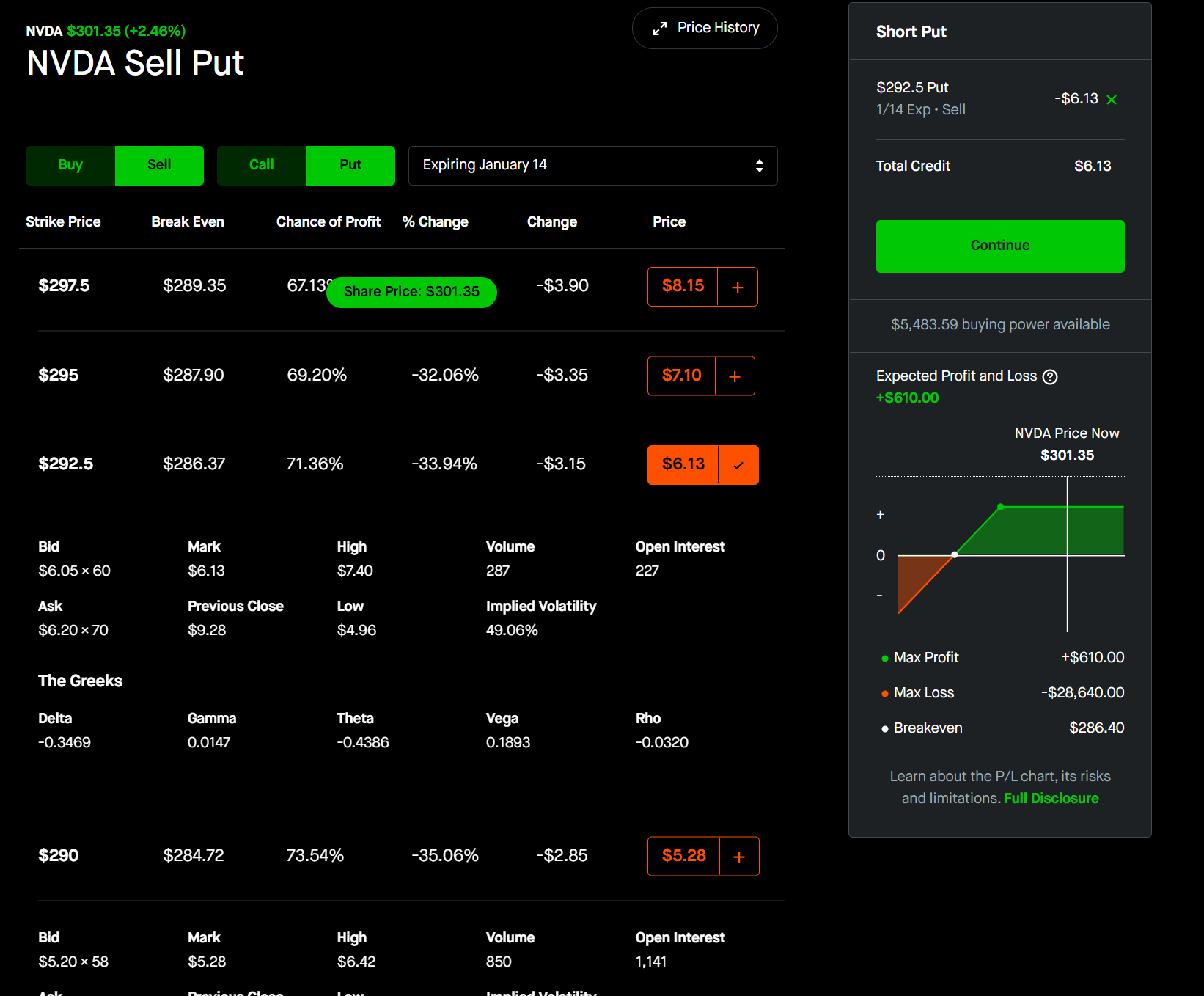

The stock is currently trading around $301 but I want to hold it long term. However, I do feel like it is due for a short term dip (not saying this will actually happen but just purely hypothetical for this example) but I want to own it regardless because I think it is a solid long term hold. Therefore, I’ll sell a cash secured put at $292.50 for expiry in 1.5 weeks.

This means that I’m anticipating the stock to go down about 3% in the next week and I’m totally comfortable buying it at that price. For this obligation, I am rewarded handsomely to the tune of $601 because of the premium.

The perfect case would be if NVDA goes down to $292.50 exactly which means I would keep the whole premium, and then purchase the shares at this price. The following week, NVDA rallies to $310 and I’m sitting on $17.50 of price appreciation in addition to the premium I collected on my put.

Of course, selling a put on NVDA means you’ll need $292.50 * 100 = $29,500 in cash lying around. If $30k is a significant portion of your portfolio, then it might not be advisable to be allocated 100 shares of NVDA for the sake of diversification.

What if the price never goes down towards your strike?

If the price of NVDA goes up and stays up, then you’ve essentially only collected the premium on selling your put. If you had just purchased the shares outright without waiting, you would have made significantly more money. This is one of the main reasons many people advise against using a cash secured put as a way of buying into a stock.

You’re essentially timing the market on a market dip. You might get lucky and time it right, but you could just be completely wrong and miss out on the capital gains.

If a market correction has already occurred but you think there might be a small chance of the market dipping further but you want to buy the stock nonetheless, then consider selling an at the money put or slightly in the money put. This way, you’ll collect a much larger premium .

What are the risks of selling cash secured puts?

Like literally every single thing in financial markets, there is no such thing as a free lunch. There is ALWAYS risk associated with a trading strategy no matter how safe it might look. Options in general are just one big dumpster fire of risk. It’s compared to a casino for a reason.

You win big, and you lose even bigger.

Selling puts are no different. There are risk of selling cash secured puts just like any other strategy out there.

When will you lose money selling puts?

Selling puts strategy has two downsides:

- The stock moving way below your strike price where you are in unrealized loss territory

- The underlying stock moves way above your strike price and then you miss out on potential gains

Let’s continue with the example of NVDA from above.

If NVDA stock price goes down to $280 by the following week, this means you’re now sitting on a loss. This loss is mitigated by the premium you collect however.

Because you sold a strike at $292.50, you’ll have to purchase $100 shares at $292.50 which means you’re sitting on an unrealized loss of $292.50 – $280 = $12.50

$12.50 – $6.13 (the premium for the call) = $6.37 net loss

This means you will have an unrealized loss of $1,250 on NVDA, but because you sold the option and collected the premium, your net loss is $637. Nevertheless, it is still a loss. However, if you’re selling covered calls on high quality long term stocks like NVDA, this isn’t as big of an issue. The stock price will recover at some point in the future. It could be next week, next month, or next year. You might have to hold on longer than you hoped but it will recover eventually.

Buy stocks you want to hold long term!

Perhaps the most important thing to do to manage risk when trading covered calls, cash secured puts, or the Options Wheel is to choose stocks you are long term bullish on. These are stocks that you wouldn’t mind holding if the market were to crash because you know it will recover at some point.

This means you should stick to mostly blue chip stocks to reduce risk. Of course, there is never a free lunch and more stable stocks means less volatility which equates to smaller premiums.

Using a spreadsheet to track Options Wheel

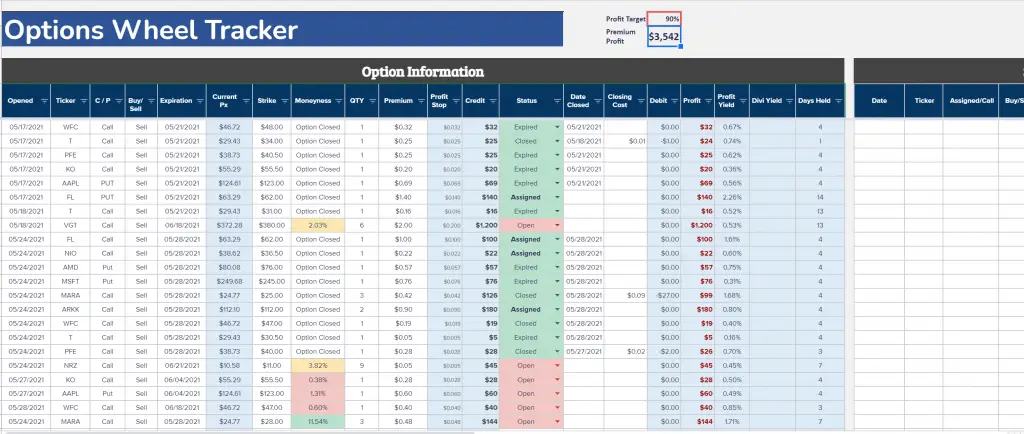

I’ve been “wheeling” and trading cash secured puts for awhile now. It’s certainly not the most sexy way of trading and you won’t see anyone from Reddit’s /r/thetagang (Option Wheel afficionados) posting on /r/wallstreetbets anytime soon. Option wheel is about boring but consistent income. It’s not a get rich quick strategy but rather one that offers small gains and doesn’t blow up your account.

Once you start trading, you’ll quickly realize you are executing many trades. If you pick 5-10 stocks like I do to wheel on weekly options, this means you are executing 5-10 trades a week at minimum. Sometimes, you might want to close out of the option or roll it to the next contract which means executing even more trades.

All of this adds up quickly and no brokerage has a good tracking method for keeping tabs on the premiums your collecting and what is getting assigned and what is not. You need to do this on your own which is why I use my personal spreadsheet for this project.

You can access my options trading spreadsheet and use it for yourself to keep track of wheel trades.