Everyone has different reasons to retire early and everyone has different plans for what they want to do after they’re done working. For some, they simply just want to escape the rat race of the corporate world. Others are keen to spend more time with family. Some might hope for a life of full time travel.

This last part was always my plan when I decided to join the FIRE movement back in 2015. Having saved over $1m USD in my investments meant that it was time to finally pursue those dreams. I had traveled extensively before this so it wasn’t just me jumping into the deep end without a clue. I always knew that I loved to travel and I was acutely aware of how to budget accordingly.

However, I had only traveled for a maximum of a few months at a time, and moreso the traditional two week vacation of the working professional. Having hit FIRE, it was time to travel full time and explore the world at my pace without a concrete day by day plan.

This post will detail exactly where I went in the world in the last year, how much money I spent, and most importantly why the FIRE principals actually work. Following a pre-determined withdrawal rate and diligently following a set budget will ensure that anyone can live out their FIRE dreams.

What is FIRE and withdrawal rates?

For those not familiar with FIRE, I will give a high level summary here. FIRE stands for Financial Independence and Retire Early. It’s a movement that’s really picked up steam in recent years, geared towards people that are unsatisfied and unfulfilled with their “day jobs” that want to be “financial independent” to pursue their real passions and dreams. Traditionally, retirement age was around 65, but people have realized they can retire much earlier as opposed to following the traditional pop-culture vetted approach.

FI is achieved by saving a large percentage of your salary, reducing your spending, and investing those savings in the stock market by way of diversified index funds (S&P 500). Once you’ve saved up enough, aka your net worth is high enough, then you are considered financially independent.

How do you know when you have enough money?

By using the 4% withdrawal rate. This principal states that given the historical average performance of the stock market, you can safely withdraw 4% from your portfolio per year and have enough to last for at least 30 years. For example, if you have estimated you spend $40,000 a year, then you’ll need $1m to be financially independent (4% or $1,000,000 is $40,000).

This is just a very quick summary of the FIRE concept. I’ve written up a much longer post about what FIRE is and exactly how I achieved this status after many years of following the basic principals!

Where I traveled to in the last year

What a year it has been in 2020/2021! Never in my wildest dreams did I think I could travel as much as I did given the Coronavirus pandemic. I was diving in Bonaire when the whole thing kicked off and it felt like the world was ending. My blog’s traffic was plummeting to the abyss because no one was traveling anymore.

Fast forward three months of lockdown and by June 2020, Europe was convinced they had defeated the virus (oh the irony). Everything was open and tourism was back. The best part? Tourism was only allowed for those living in the EU. No external tourists meant that every destination in Europe had the same amount of tourists that they saw in the 1980s. As an expat living in Europe, this was an experience that would not come back around anytime soon.

Summary of my travels for the year

I traveled all over the continent with many months spent in Greece, Italy, and Germany. By October 2020, Europe quickly realized they did not defeat the virus at all and the mother of all second waves was about to come through. I dipped out at the right time and went to Zanzibar for the rest of the year.

Jan to Mar 2021 were dark times and I wasn’t able to travel much (should have just stayed in Zanzibar). The weather was abysmal in most of Europe and many countries were closed down as the second wave came in full force.

My hopes of going to Cape Town were quickly dashed as this was my dream. I had considered spending time in Dahab, Egypt as it was open but having been there numerous times already with the prospect of diving in cold winter water was not appealing. I was resigned to the fact that I would have to spend three months doing nothing.

However, after taking a quick trip back to the US to get my vaccine in April, things were starting to look up. I booked a trip to Albania and explored the South Balkan countries. Things were all opening up at this point, which meant additional travels to Greece, Portugal, Lebanon, Italy. All in all, in the past year, I was able to travel to 12 different countries on three different continents.

July 2020: Greece

August 2020: Greece

September 2020: Greece & Italy

October 2020: Italy & Zanzibar

November 2020: Zanzibar

December 2020: Zanzibar/Pemba and Portugal

January to March 2021: Lockdown #2 in Germany

April 2021: USA (for the vaccine) and Albania, North Macedonia, Kosovo, and Montenegro

May 2021: Northern Greece

June 2021: Lebanon and Portugal

July 2021: Italy

Timeline of events

Here is a timeline I put together to help visualize everywhere that I’ve been in the last year.

What my financial gameplan is

As someone who has hit their early retirement net worth goal, planning for travel expenses is a bit different. There are countless travel blogs out there that detail how someone saved $20,000 for a year of travel. Some of these posts have legitimately useful tips like maintaining savings accounts, grabbing side hustles, controlling your expenses etc. However, this is not something that I really took into consideration.

My net worth goal was already completed which meant I was now financially independent. With a net worth of over $1m, this means according to a 4% withdrawal rate, I could take out $40,000 a year from my portfolio in relatively safe fashion.

For those that are living in expensive cities, this might seem like very little money and for those that are aspiring long term travelers, this might seem like a lot of money. I like to look at it as being somewhere in the middle.

Is $40,000 enough money for one person per year?

How did I arrive at the $40k figure? It’s not just some arbitrary round number that I drew out of a hat. I looked through my expenses for the past many years while traveling, and brainstormed what it would take for me to travel for a year.

I’m not a newcomer to traveling, or even long term traveling. I’ve already been to over 80 countries so I have a slight idea of what I’m doing. I know my travel style and I know most of the tricks to save money. For other budget and long term travelers, you might think $40k for one person is an insane amount of money. For others who are living in NYC or San Francisco, you might think I’m crazy in thinking I can even stay alive on $40k. Everyone has different lifestyles and preferences!

I can’t see the future and who knows, $40k is maybe not enough! I’m not a budget traveler by any means but neither is high end luxury a must. I like eating good food, embracing the things I like to do, and not having to skimp out on much. I’m not 20 years old anymore where I’ve trying to eek out every deal possible.

I have no problems spending money when I feel it is worth it and a good cocktail with the sunset is a must. Perhaps one day I realize that $40k is too little for one person, but I won’t know if that’s true or not if I don’t try it out first!

What’s important to me in traveling?

I think one of the most important things about FIRE and travel is understanding yourself: What you like, what you dislike. What you prioritize, and what is less important.

Having already traveled so much, I knew these things pretty well already which made it easy to budget and do the things I wanted to do. For example:

Things I prioritize

- Good wine

- Good cocktails

- Good food (doesn’t have to be expensive just to be good)

- Grilled Meats: Because smoke, fire, and meat are culturally consistent throughout the world and I love seeing a good BBQ grilling local styled meats

- Meeting interesting people

- Not to travel like a broke backpacker (because I’m not one)

- Do my hobbies and passions (diving, kitesurfing, hiking etc.)

- Warm, sunny weather

Things that are not as important

- Haute cuisine (maybe once a year)

- Staying somewhere very upscale on a frequent basis

- Paying to see every museum and attraction in an European city (because I’ve been to enough)

- Douchy beach clubs

- Big club style parties, music festivals etc.

- Cold climates

$40,000 is REALLY $40,000

What most people fail to understand are taxes for long term capital gains. People see $40,000 and automatically compare it to their own salaries and think it doesn’t add up. The one thing to know about withdrawing from a portfolio of positions held for a long period of time is that there are very low or even no taxes charged on this income. I’ve written a comprehensive guide on how I pay no income taxes.

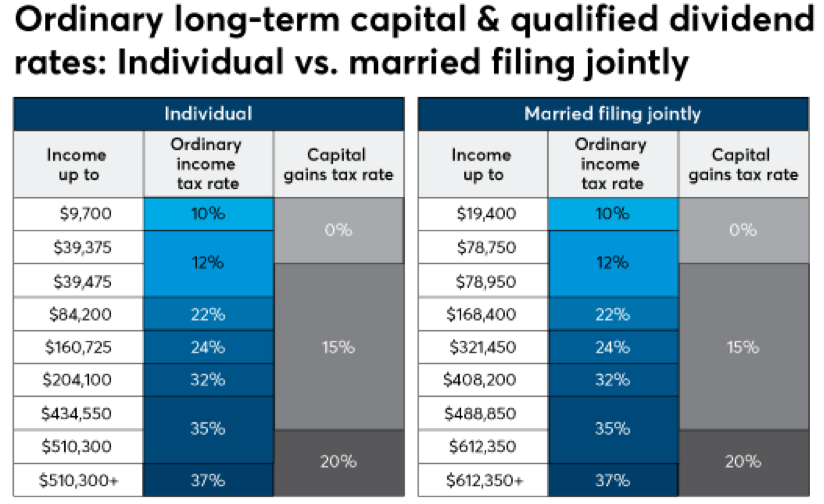

Here is a refresh of what long term capital gains tax rates look like from tax year 2019.

As you can see for single filers, income up to $39,375 is taxed at 10% (anything above this is taxed at 12%). While this is already low, look at the capital gains tax rate. It is 0%!

Yes, you can be a single person with $40,000 and pay NO INCOME TAX. Similarly, if you’re married, you can sell up to $80,000 of long term gains a year and pay NO INCOME TAX.

This is not nonsense, and is absolutely how most people in the FIRE community do it.

In addition, because I am no longer “working and grinding”, I am also not “saving” my money anymore. When I was earning six figures, a portion would go to taxes, and an even bigger portion would go into investment accounts as part of my savings plan.

The $40,000 I’ve allotted myself during early retirement is not only a pure $40,000 cash, but I am using this entirely for expenses.

Withdrawing from my portfolio

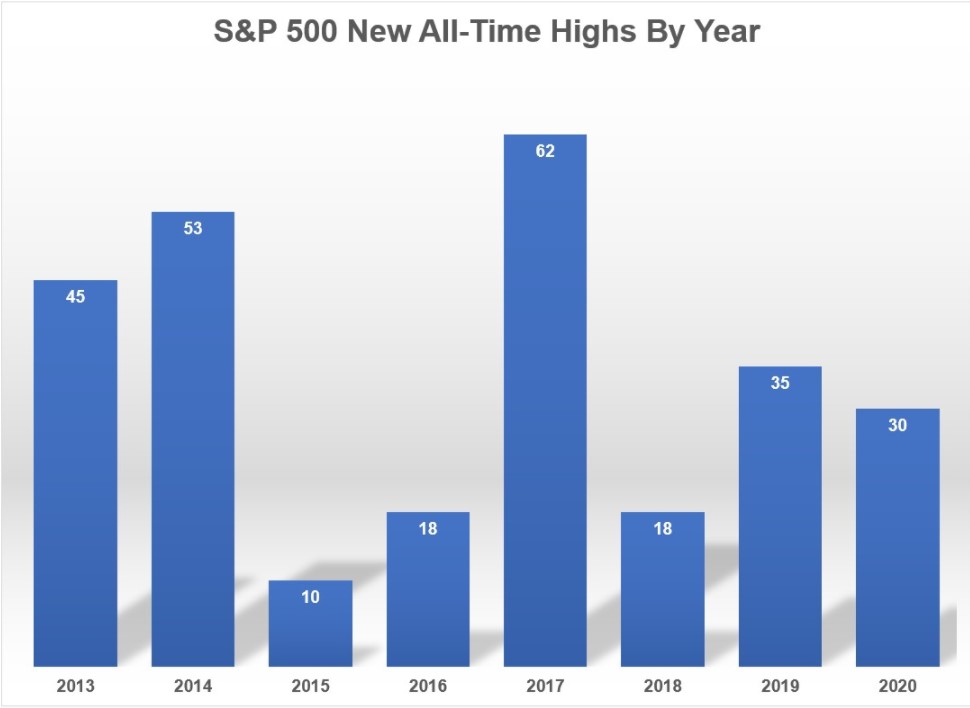

My plan is to withdraw money from my portfolio when I need it. The prevailing consensus if you should try and withdraw from your portfolio at market highs. Of course, you can’t time this and shouldn’t time this. Each year, the market tends to hit numerous all time highs, with some years more than others. It’s impossible to predict how and when this happens, but it’s more of a mental note than anything else.

I like to look at my expenses as monthly. In the end, I try to put as much on my credit cards as possible to score as many credit card points as possible and these cards all have to be paid off monthly.

Dividends

My portfolio of diversified ETFs has a dividend rate of around 1.2%. This means that I received over $10,000 in dividends alone. Before I hit my FIRE number, I would reinvest these dividends automatically. However, now, I keep the cash and either use it to pay for expenses or reinvest in markets if there is a windfall at the end of the month or I see an opportunity.

Additional income

In addition to portfolio withdrawals and dividends, I had income from other sources including

- Blogging (yes you reading this post is helping me live out my FIRE dreams!)

- Selling out of the money options

- Tax refund

I will go into more detail about these additional incomes later in the post.

Expense planning for the past year

I don’t track my expenses meticulously. I don’t believe in accounting for every little transaction you make and balancing it out at the end of the day because it is just too much work.

Nevertheless, I did keep an overall outflow of my bank account and credit card statements during this time to get a big picture of what I was spending.

How much can I spend?

I targeted a 4% withdrawal rate from my portfolio which means I could take $40,000 out a year. As I explained earlier, this is $40,000 in cash, no taxes have to be paid, and none of this money is going into “savings”. This is purely money to spend.

$40,000 a year equates to roughly $110 per day for all expenses. This includes hotels, food, alcohol, transportation, sim cards, gym memberships. Everything.

This doesn’t sound like much for people that travel, and I will admit that it really isn’t. Hotels alone can be well over $100 a day which would just destroy my entire budget. This is very true. I didn’t stay at super fancy hotels except for my wonderful time at the Zawadi Hotel in Zanzibar and the Aiyana resort on Pemba Island.

However, you have to imagine that when you are traveling the “traditional way” where you are taking two weeks off for your vacation, you are trying to fit every little thing in and you’re looking for a more premium experience to detox from every day life.

I engaged in slow traveling which means I am not rushing to see everything. I can wait until I see good deals on accommodations, flights and above all, be extremely flexible. Combine that without the need to stay in nice places or the need to YOLO (because the normal person might not get a vacation until the following year), you find yourself spending far less money than you thought.

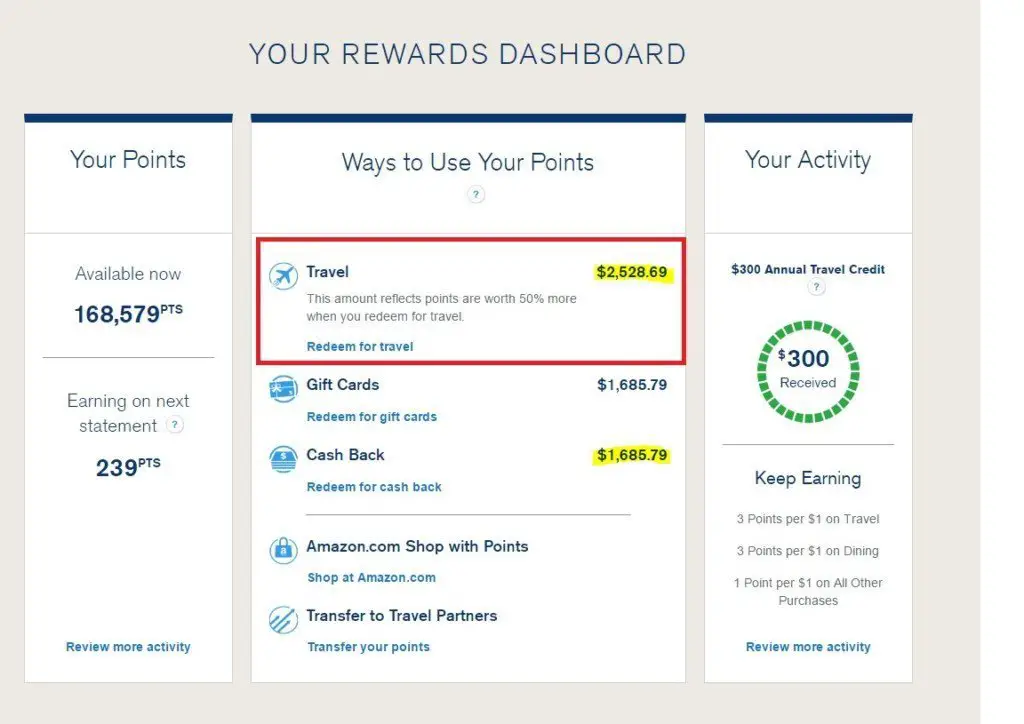

Supplementing my expenses with credit card points

I’ve written numerous times about my love and affinity for credit card points and “gaming the system”. I won’t even beat around the bush. I am a total churner of credit cards in which I open and close credit cards purely to collect the rewards that are offered. I open and close at least 5 cards a year and I’ve amassed hundreds of thousands of points/miles.

These points have helped me offset a lot of costs associated with flights and a few stays at big chain hotels when it makes sense. I didn’t pay for many of my long haul international flights this year but I did spend about 250,000 miles from numerous airlines in the process. I did pay for flights around Europe as these are often times quite cheap and you can’t use points/miles to fly Ryanair anyhow.

How much did I spend during my travels?

Summing it all up, I spent slightly over my budget of $40,000 for the year. I traveled to a lot of different countries all over the world which added to my costs. I also didn’t engage in the more frugal aspects of travel that I have in the past. I didn’t really deny myself many experiences when it comes to eating and drinking at nice places around Europe. I also went diving quite a bit and stayed at rather upscale places in Zanzibar.

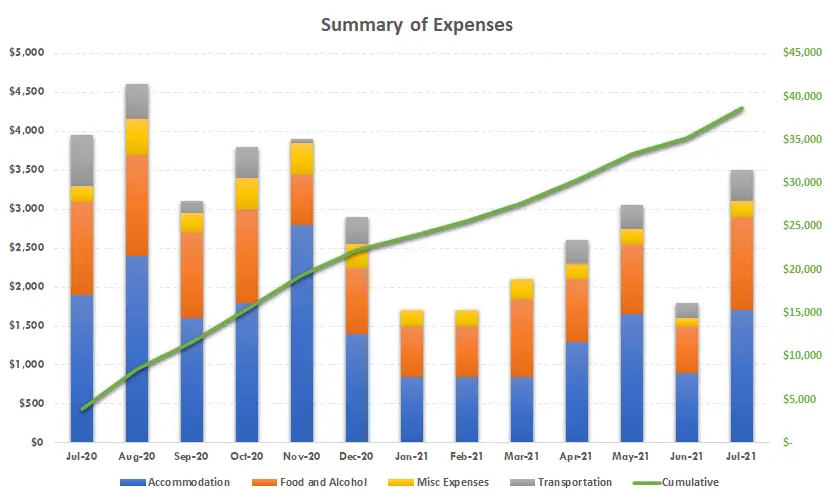

I will break down my expenses and split it by accommodation, transportation, food/alcohol, and misc expenses.

My expenses for 2020-2021

Without further ado, here is a breakdown of all my expenses for the past year. For simplicity, all expenses will be in $USD even though most expenses are in a different currency.

Here is a summary graph of all my expenses for the year. The axis on the right corresponds to the green line which is the cumulative expenses for the year.

As for traveling itself, I spent most of the year on solo travels. Let’s be honest, not everyone can just up and go to wherever they want in the world! I did have a few trips where I shared expenses with one or more people but I won’t bother to get into every little detail.

Accommodation: Easily my biggest spending category. I stayed mostly in Airbnbs especially in European destinations. I had a handful of B&Bs and hotels throughout the trip but I mostly stayed in apartments. I feel too old to stay in a hostel but at times I would stay in one because there was no one else traveling (due to the pandemic) or it was just nice to meet other people.

Food and Alcohol: This is the second biggest category of spend. I love eating good food and exploring the local dishes. I love me some good street food but I am not a broke backpacker that has a $5 a day budget on food. I don’t like fancy tasting style menus however. I’ve done many of those in my life and never feel satisfied especially with the prices. I love wine, good cocktails, and sundowners. All of which are prioritized.

Transportation: Transportation are expenses for flights, car rentals, gas, scooter rentals, taxis, etc. As mentioned earlier, most of my long haul international flights were covered with miles accumulated from hustling credit cards. However, inter Europe flights on Ryanair or Wizzair for example can’t be purchased with points but these flights are quite cheap anyhow.

Misc Expenses: Anything else that doesn’t fall into Accommodation, food, or transportation. This includes things like travel insurance, entrance tickets for museums, sim cards, gym memberships, electronics etc. This also includes hobbies of mine like scuba diving or kitesurfing. I was thinking of creating another category named “activities” but realized that it didn’t make sense as I only do these things in certain parts of the world. I’m not paying to go diving in Italy for example.

July 2020

This was the beginning of my travels and I spent most of the month traveling through Greece. This was absolutely amazing seeing the Cyclades islands without the typical summer crowds due to COVID-19. Athens was also a highlight of my trip and easily one of my favorite cities in Europe.

While Athens is quite cheap to visit, the islands are expensive because this is the prime vacation destination for much of Europe. I definitely spent more than average while here because the Greek islands during the peak summer months will just cost you money.

Accommodation: $1,700

Food/Alcohol: $1,200

Transportation: $650

Misc Expenses: $200

August 2020

August was spent almost entirely in Greece. I visited so many Cyclades islands including Paros, Naxos, Milos, Santorini, etc. The budget in August was probably the highest of my entire year because anytime you throw in Santorini to the mix, you will need to spend the money. Santorini was probably my least favorite island in the Cyclades but when you’re already in that part of the world, why not?

While on the islands, I would normally elect to get around by scooter or by ATV. These would run roughly €15-30 per day depending on the island but it is definitely the best way to get around and see everything.

Accommodation: $2,200

Food/Alcohol: $1,300

Transportation: $450

Diving in Folegandros: $120

Various Excursions in Santorini: $250

Misc Expenses: $100

September 2020

September was spent in combination with Greece and Italy. In Italy, I spent some time in Naples and the Amalfi Coast. In Naples, I spent quite a bit of time there just eating Napoli style pizzas and soaking in the history of that beautifully grimey city. Naples is probably one of the cheapest cities in the country so I really didn’t have to spend much money here.

Accommodation: $1,300

Food/Alcohol: $1,100

Transportation: $150

Misc Expenses: $250

October 2020

The first half of the October was spent traveling through the Amalfi Coast and Capri. This is easily one of the most beautiful parts of Italy and Europe. It’s not surprising that this area attracts the amount of the tourists it does. It was a place for the wealthy back in the old days and it’s definitely not for the budget conscious in the modern times. Capri especially is probably the most expensive area in Italy that I’ve been to. I was quickly missing the cheap prices of drinks and pizza in Naples.

The second half of October was the start of my multiple month adventure in Zanzibar, Mafia Island, and Pemba Island. Most of Europe was closing down due to the second wave of COVID so I decided to fly to the only country in the world that just flat out refused to believe COVID was real.

A bit concerning at first. I saw no masks anywhere in the country, not even the airport. In fact, they even told people arriving to the airport that there is no COVID here, so you are free to take off your masks. Ironically, their COVID denying president ended up getting COVID and died. The new president is the complete opposite.

Anyway, traveling around Mafia Island, Zanzibar, and Pemba was my schedule for the next two months. I had been to Zanzibar once before many years ago and remembered that it was not a cheap place to visit. In fact, not places in Africa are really that cheap to visit except for South Africa. However, due to COVID, the tourism industry was completely decimated so I quickly realized I could negotiate bargain rates for accommodations.

I ended up staying in some very nice places I would never have considered staying in if it were normal times as those prices would quickly decimate my $40k/yr budget.

Accommodation: $1,600

Food/Alcohol: $1,200

Scuba Diving in Mafia Island: $400

Transportation (taxis): $150

Flights (between islands): $250

Misc Expenses: $250

November 2020

November was entirely spent in Zanzibar. I visited numerous different areas of Zanzibar including Matemwe, Nungwi, Paje, Michamvi, Stone Town etc.

Again, due to COVID, I ended up YOLOing a little bit and spending a lot of money on nicer places that I would never have been able to afford otherwise. Safe to say, my budget was completely blown up this month due to my YOLOing but what’s life if you can’t do that every now and then? You can’t stay at places like the Zawadi Hotel while on a budget!

The food and alcohol budget is lower because some of the places I stayed in had food included as part of the stay.

Accommodation (Matemwe): $400 for 6 nights

Accommodation in Nungwi: $350 for 7 nights

Accommodation at Zawadi Hotel: $700 for 3 nights

Accommodation in Paje: $300 for 5 nights

Accommodation in Michamvi: $400 for 3 nights

Accommodation in Stone Town: Free thanks to Hyatt free night certificates

Food/Alcohol: $650

Scuba Diving: $300

Transportation (taxis): $50

Misc Expenses: $100

December 2020

December was split between Zanzibar and Pemba Island. I only stayed on Pemba for one week or so before flying back to Europe and visiting some friends for Christmas in Portugal. Overall, I did not spend as much in December since I had accommodation provided for a chunk of the time.

Nevertheless, in Pemba, I did another YOLO experience staying at the Aiyana Hotel which is definitely another place I would never consider staying in while traveling full time. The normal rates around north of $600 a night in normal times but due to COVID, this place was only $200 a night and I was provided a room upgrade! I stayed here for a few nights while staying the majority of the nights at an eco lodge not too far away. I spent most of my time diving and just relaxing.

Accommodation – Pemba Eco Lodge: $300 for 6 nights

Accommodation in Aiyana: $600 for 3 nights

Accommodation in Portugal: $500

Food/Alcohol: $850

Scuba Diving: $300

Transportation (taxis): $150

Flights (between islands): $200

Misc Expenses: $250

January 2021

January was the start of the 3rd wave in Europe and the beginning of some very dark and depressing times. Everything was closed for months on end without much possibility of opening. I had planned to spend the winter months in Cape Town because there really is no place better than a stay in Cape Town! Sadly, they also went into another lockdown so those plans were quickly foiled.

January to March were quite depressing and I did not do much at all. It just felt like most of the world was shut down and traveling seemed like the wrong thing to do at that time. I could have went back to Zanzibar but I didn’t feel as interested. I ended up saving a lot of money in the next three months just hanging out in Germany, while at the same time focusing on honing my options selling skills.

Accommodation: $850

Food/Alcohol: $600

Misc Expenses: $200

February 2021

Nothing changed in February.

Accommodation: $850

Food/Alcohol: $600

Misc Expenses: $200

March 2021

Same as above. Near the end of the month, I did fly to the US to get my COVID-19 vaccine which I won’t really classify as a trip and the expenses were higher but nothing out of the ordinary.

Accommodation: $850

Food/Alcohol: $900

Misc Expenses: $350

April 2021

After three long months of lockdown, I had to go somewhere come April. Many countries were coming out of hard lockdowns and after doing a lot of research, I settled on the South Balkans starting with Albania. I ended up also going to Macedonia, Kosovo, and Montenegro in addition to these places.

April is an amazing time to visit these places as the weather is warm but not overly hot and the tourists are nowhere to be seen yet. Traveling in the Balkans is among the cheapest traveling you can do in the world actually. The prices for food and alcohol are as cheap as it gets for some incredibly tasty food.

Accommodation: $1,300

Food/Alcohol: $800

Transportation (car rental): $300

Misc Expenses: $200

May 2021

May was spent mostly traveling through Northern Greece. I spent a few weeks road tripping through Northern Greece visiting Thessaloniki (amazing city), Meteora, the Zagori Mountain range, and the beautiful island of Lefkada.

Greece is just my favorite place in Europe because of its incredible landscapes, the best of the best food, and very friendly people. Greece is also one of the cheaper countries to visit, especially if you are avoiding places like Mykonos and Santorini (which I went to the year before).

Accommodation: $1,650

Food/Alcohol: $900

Transportation (Car Rental and gas): $300

Misc Expenses: $200

June 2021

In June, I spent most of my time in Lebanon traveling around the country. Lebanon was always high on my list and it was a country that was completely open for tourists. Cost of traveling in 2021 is among the cheapest countries in the world because of their massive economic crisis and currency devaluation.

I spared no expense while traveling around Lebanon. I ate at the nicest restaurants, drank at the nicest bars, took Ubers everywhere, and did every single thing I wanted to without much compromise.

Accommodation: $800

Food/Alcohol: $500

Transportation: $200

Misc Expenses: $100

July 2021

Finally, July 2021 was spent in Portugal and Italy. After my trip to Porto and the Douro Valley of Portugal, I went to Italy to visit the Tuscan wine region. I spent almost two weeks traveling between Rome and Florence, ultimately having to call it a trip because I was overloaded on pasta and pizza. I guess there are worse things that can happen!

Accommodation: $1,700

Food/Alcohol: $1200

Transportation/Flights: $400

Misc Expenses: $200

Totals for traveling for a year

In total, I spent just shy of $40,000 for the year. Again, these are not exact figures because I did not keep track of every little transaction I made but rather just good estimates. Given that I did not do much for three months due to COVID-19 lockdowns, I would have probably spent closer to $45,000 or $50,000 if I had done what I wanted to during those months which was to spend time in South Africa.

| Accom. | Food and Alcohol | Transport / Flights | Misc. Expenses | Total | |

| Jul-20 | $1,900 | $1,200 | $650 | $200 | $3,950 |

| Aug-20 | $2,400 | $1,300 | $450 | $450 | $4,600 |

| Sep-20 | $1,600 | $1,100 | $150 | $250 | $3,100 |

| Oct-20 | $1,800 | $1,200 | $400 | $600 | $4,000 |

| Nov-20 | $2,800 | $650 | $50 | $700 | $4,200 |

| Dec-20 | $1,400 | $850 | $350 | $300 | $2,900 |

| Jan-21 | $850 | $650 | $0 | $200 | $1,700 |

| Feb-21 | $850 | $650 | $0 | $200 | $1,700 |

| Mar-21 | $850 | $1,000 | $0 | $250 | $2,100 |

| Apr-21 | $1,300 | $800 | $300 | $200 | $2,600 |

| May-21 | $1,650 | $900 | $300 | $200 | $3,050 |

| Jun-21 | $900 | $600 | $200 | $100 | $1,800 |

| Jul-21 | $1,700 | $1,200 | $400 | $200 | $3,500 |

Withdrawals from Portfolio

Withdrawing from your portfolio is one of the main principals of Early retirement. I’ve talked about the 4% withdrawal rate already which has been backtested through extensive historical market performance and deemed to be “safe”.

Of course the 4% is just an overall guideline. You don’t need to hit that exact amount every year just because. It’s up to you to manage your finances according to what you are planning to spend and what life throws at you. Everyone has their own bespoke situation. I know some people that sell stocks on a fixed date every month without any changes. I know others that sell stock once a quarter and others that only sell when they need it.

I am of the latter preference. Because I have a few other income sources and my expenses are generally not the exact same month to month, it doesn’t make sense to sell down stocks consistently every month. Some months I spent much more than my “monthly expense” figure, and others where I fell way below. I just had to come up with my own gameplan as the year went along. That’s kind of the expectation when you’re traveling around the world full time during COVID-19!

Withdrawals I made from my Portfolio

I made six withdrawals from my investment account to the tune of about $25,000. I sold mostly equal parts of the ETFs that I owned. Most withdrawals were between $4,000 to $5,000 and I tried to sell my stock when the market was near all time highs.

The market took a pronounced dip in February 2021 especially with tech. I had a feeling it was overdone and resisted selling any stock until it recovered only a few weeks later. Of course, it’s not good and sustainable to try and time these things long term but I will take the little wins where I can get them!

Incomes from other sources

Just because you’ve stopped working and have “retired” does not mean you will never do anything that generates money ever again in your life. I actually believe that if you just stop working and do nothing, you will surely get bored out of your mind and seek out your old job. You need a game plan and often times, a game plan could involve you pursuing things that may generate money. Money of course is not a requirement or the purpose because your costs are already covered by your investments.

Blogging as a passion project

This blog has always been a passion project of mine and I find it somewhat therapeutic to write down my thoughts after a big trip. I like taking nice photos and writing about my experiences so other people can hopefully create their own.

It also turns out that blogging is also quite easy to monetize. By easy I mean, it is easy to throw some ads up and generate money. It is not so easy however to actually make a lot of money. I’ve written in detail about how I much money I make as a travel blogger. I have multiple avenues that I generate income from blogging listed on this post.

I never factored in blogging income to my FIRE plans however. Blogging income, while nice, is volatile as hell and certainly not something you can consistently rely upon. Any changes like, oh I don’t know, a worldwide pandemic can severely impact your earnings! Coming into 2020, I was at an all time high as far as traffic and blogging income goes. I was on track to clear $20,000 in income for 2020. This would have been almost half of my yearly budged expenses!

Fast forward to March 2020. The pandemic hit and everyone stopped traveling. My traffic and revenues went to 1/3 of its pre-pandemic highs.

In addition, you are playing the Google Search game because that is how the majority of your traffic will be obtained. The engineers at Google are constantly tweaking their algos and you have no idea what comes next. At any point, they could make a negative tweak that destroys your traffic.

Writing this in mid 2021, traffic has recovered and is now about 2/3 of what it was pre pandemic. Let’s see what becomes of it in the future!

Income from blogging

My total income from blogging during this past year of travel amounted to roughly $8,000. This includes Ad revenues, sponsored posts, affiliate links, and my travel planning program where I help people plan honeymoons to Africa.

As I write this in August 2021, the blog is generating over $1,000 a month again which means this will help supplement the FI/RE lifestyle a bit further.

Tax refund

I received a tax refund in March 2021 of almost $5,000! This is because I only worked part of the year in 2020 and was taxed at a higher rate through those working months. Of course, I don’t expect this to continue on for future years but it’s a nice to have!

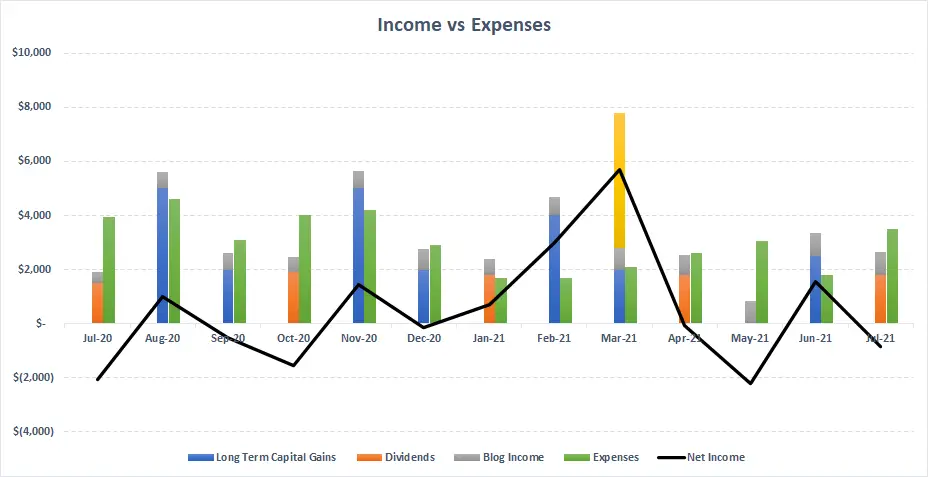

Putting it all together – Income vs Expenses

Now that you know how much money I spent in the year, and how much money I brought in (from various sources), it’s time to put it all together in another pretty graph.

This graph shows just how much I spent every month, and how much money I brought in my portfolio, blogging, etc.

*the yellow bar is my one time tax refund

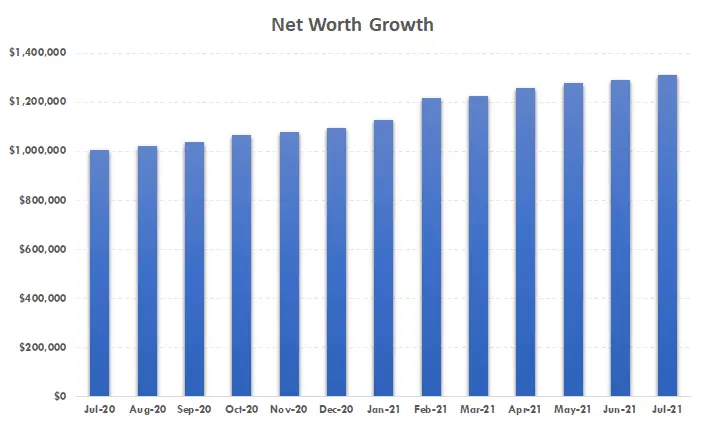

How my net worth changed over the last year

If you pay attention to financial markets, you will know that the market has enjoyed an exceptionally long and fruitful bull market run. The period after the March 2020 Pandemic crash has been exceptionally fruitful even in comparison to years past.

My portfolio consists of almost entirely of Index ETFs that track the entire market, as well as tech ETFs which I have always been bullish on. In general, my portfolio composition is something of the following:

- 50% in total return ETF (VTI, SPY)

- 40% in Tech ETFs (VGT, VCR, QQQ)

- 10% single name stocks and cyrpto (TSLA, NVDA, etc)

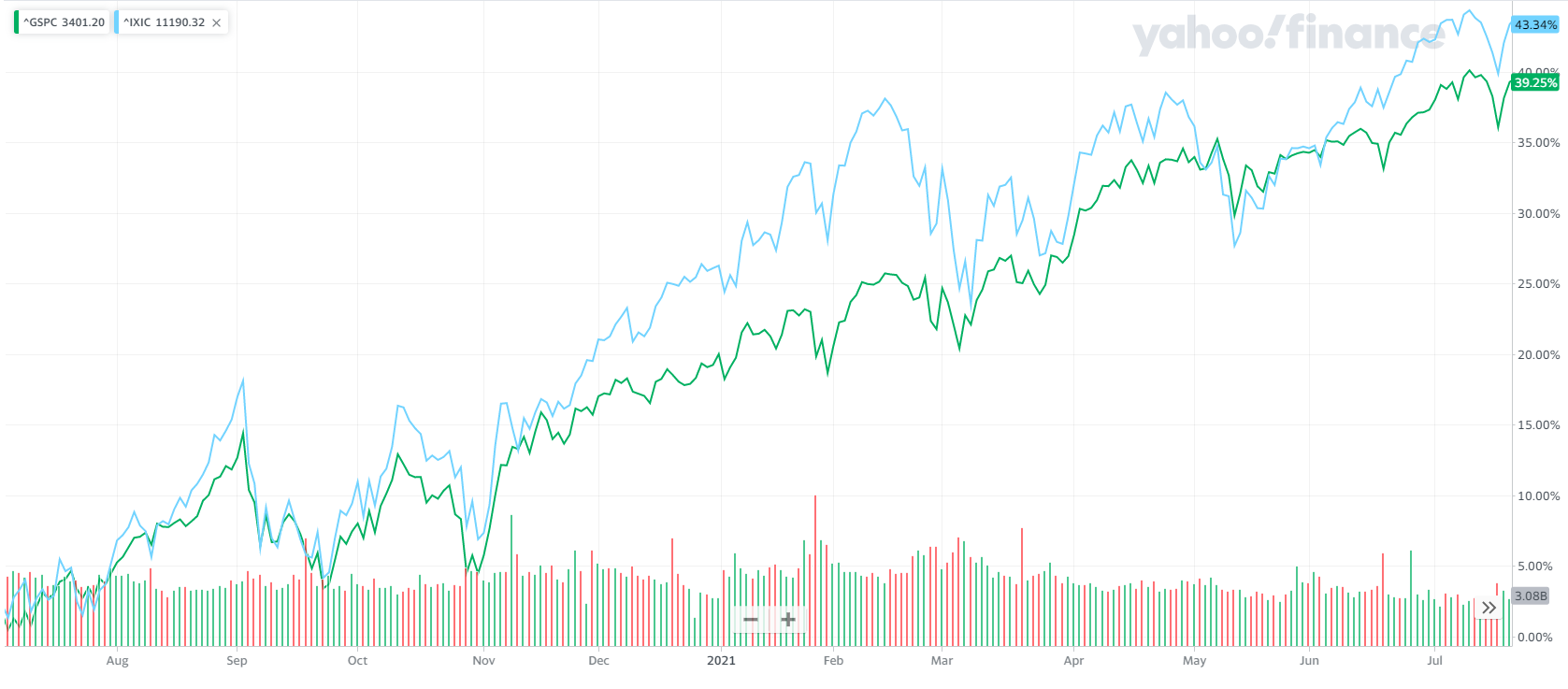

Performance of the S&P and Nasdaq

The performance of the S&P should always be your benchmark when comparing market returns. In the year that I’ve traveled, from July 2020 to July 2021, the S&P has increased from around 3,200 in July 2020, to almost 4,400 in July of 2021. This is a massive 35% increase in the markets. Absolutely monstrous. Compared to the annualized return of around 8% for the S&P for the last 30 years, the period I chose to go traveling has been an absolute outlier.

Similarly, the Nasdaq has also increased from 10,550 to 14,600 in the same time period for an almost 40% increase. As I have much of my portfolio in tech centric names, this benchmark is also quite important for me.

Because of the huge gains in the stock market, I would naturally expect my portfolio to increase significantly in value as well. Of course, it did.

My Portfolio growth

I started my trip with a total net worth of just over $1m in investments. As I write this in August of 2021, my net worth is sitting just north of $1.3m. It’s grown in line with the market return for the period as well with the help of selling covered calls on my existing holdings and a few bespoke trades I made in January 2021.

I really only withdrew about $23,000 from the portfolio throughout the year so as you can see, this really did not do much in really lowering my net worth.

Summing it up

I hope you enjoyed the read! I know there was an insane amount of information laid out on this post to process. To summarize everything, this post essentially touched on two main things:

- Traveling the world and the expenses associated with undertaking such an endeavor

- Retiring Early (FIRE) and the mechanics of how to manage your finances and portfolio once you are no longer working

The title of the post is aptly named how I traveled the world and increased my net worth. It’s just to punch home the point that you can travel the world without breaking the bank and that the safe withdrawal rates really do work. I ended the year with significantly more money to my name because the markets returned a ridiculous 30-40%.

Of course I know this is not going to happen every year. I’m not stupid or naive. It would be ridiculous to assume markets return even half of that in a year. 2020-2021 was just a very special one off year for the markets that was juiced up by central bank stimulus and a shift in post-pandemic businesses.

Nevertheless, what this does show is that if you stay within the safe withdrawal rate as proposed by the FIRE community (<4%), then over the long haul based on historic average returns on the markets (8-9%), then you will be okay. A market crash is not a matter of if, but a matter of when. It’s all but inevitable we will see another one. Over the long term, however, markets will continue to rise and sticking to a plan is the most important thing you can do.

What’s next?

After a year of mostly traveling full time, I suspect I will continue on with this lifestyle for a bit longer. Eventually, I would prefer to spend my time slow traveling only a handful of destinations a year. I think the perfect combination would be to live somewhere different every 4-6 months as this will really allow you to get familiar with a place. There are so many amazing places in the world that the possibilities are endless!

So you just didn’t care about COVID at all?

I followed all the covid protocols of the countries I visited closely and got vaccinated as soon I could get it so yes I would say I did care.

thanks for the inspiring read!

im actually really bad at investing and been learning it.

so im curious, when you put your money into spy, do u just leave it there all the way, or would there be times when you sell some at the ceiling and then buy again when it reaches support?

Thanks and glad you like the blog! I generally don’t sell my holdings as they are elong term but I will buy up more shares on a dip when I think the technicals are good. Generally when I need to make a withdrawal to fund my day to day expenses I try to sell when markets are near to all time highs, which in 2022 didn’t work out so well, but 2023 has been good for that