I’ve written in great detail about my options trading strategies in the past. The option wheel is one of my favorites as it is relatively low risk and easy to understand especially for new comers. If you haven’t already read my posts about the option wheel and tracking my options trades then make sure to do so before reading this post!

For this post, one of my readers actually emailed me to tell me about their own options trading experience after discovering my blog. He explained to me how he lost money trading options before but after discovering the wheel strategy, was able to generate consistent passive income and fund his nomadic lifestyle traveling through the USA.

This post is from his own writing and goes over just how he did it!

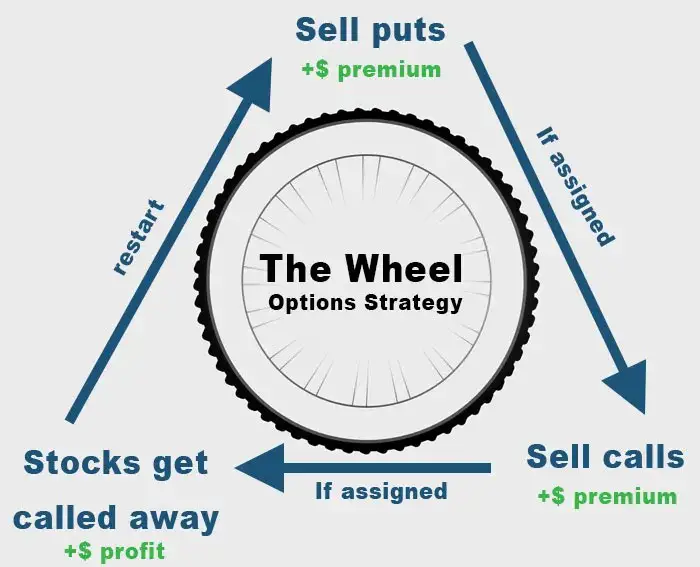

What is the Option Wheel?

Before we go into James’ personal experience with the options wheel, let’s summarize what the option wheel actually is.

The Option Wheel Strategy is a systematic and very powerful way to sell cash secured puts and covered calls as part of a long-term trading strategy. It’s a way to collect consistent option premiums and is one of my favorite passive income methods from trading stocks.

As any option trading strategy carries with it risks, I think the option wheel has one of the lower risk profiles in the options universe. I use the options wheel as a way to generate extra income during early retirement and as a way for me to stay engaged in the markets. It is just one of many passive income strategies I employ so make sure to read up on my other strategies. Using this strategy, I target about $600-$1,000 a week in premiums depending on the state of the market. This strategy is not a replacement for my long term investments, which I’ve written in detail here.

Who is this post on the option wheel for?

If you have no idea what options are, then you should probably read up on basic option theory and understand what you’re getting into before putting your money on the line. However, I think the options wheel strategy is one of the easiest strategies to implement and understand. Therefore, if you have a basic understanding of call and put options, you should be able to get use out of this guide.

As a reference, I had never sold options before getting into this strategy. I used to always buy call and put options, losing more often than not.

If you are looking for a strategy with considerably less risk (and less upside), then make sure to also read my call spread option guide where I go in detail about call spreads and put spreads (bull call, bear call, bull put, bear put spreads).

As I’ve already achieved financial independence, I regularly withdraw from my portfolio of stocks enough to live the life I want. This is something between $30k and $50k a year. I also make sure I pay 0% in income taxes by taking advantage of the long term capital gains rate.

Options are risky

Options are inherently just way riskier than buying standard stocks or bonds. The Wheel strategy is perhaps one of the safest options trading strategies but that’s still not saying much. If you option wheel a meme style growth stock, you are bound to get destroyed when the markets crash.

Make sure to understand the risks of options trading before engaging in it! Otherwise, an alternative you can consider is buying I Bonds (Inflation bonds) which are paying a risk free 9.62% as of 2022!

My Personal Options Trading Experience

In ‘22 I hit bottom trading options, about mid July. I’d been messing around with it for years unsuccessfully, extremely poorly. Still, I was intent on trading with a system that I could rely on. One that could net me 20%+ each year, so I could start earning income, not working my life away.

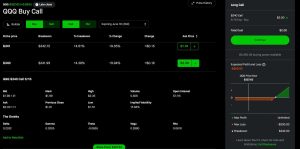

Tl:dr see screenshot below, I found a system and a way to stay accountable and surpassed my goal.

I couldn’t see what set me apart from every other “successful” trader online.

Mid July I’d put another option trade in and sat staring at my phone, realizing I’d just placed a boneheaded trade. I didn’t even know why I did it or what it was, just that I had impulsively traded on a guess. I closed the trade in my small account and wanted to give up.

Discovering the Options Wheel strategy

Then I started to really research. Why were others succeeding while I failed? I started to notice my lack of a system. After a few days of reading, I’d landed here on Johnny Africa about option wheel strategies (link here), but I didn’t know if I trusted it. I went back to him and found a nugget, possibly the most important thing to change my trading – Options Tracking Spreadsheet [link].

Pieces started to come together. Within a few weeks I had completely changed how I traded. In the spreadsheet I knew what I needed to track. I’d found one strategy that I could wrap my brain around and I now had a place for my commitment to be recorded, for good or bad.

My Option Wheel Trade log

So I started hacking away at it, week after week. There’s some psychology behind why this worked, but for me, I think it boiled down to two things. I needed to track my trades to know I was improving and I needed to know what to track. Johnny couldn’t help me put in the reps, but he did help a TON by providing what tracking works for him. As the 2023 started, I am up 26% against my principle of $2500 and I’ve included a screenshot of the trades I took below in his spreadsheet. This year I am up roughly 11% by March.

| Opened | Ticker | C / P | Buy/Sell | Expiration | Strike | QTY | Premium | Status | Date Closed | Closing Cost | Credit | Debit | Profit | Profit Yield |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 06/28/2022 | ARKF | Put | Sell | 07/01/2022 | $17.00 | 1 | $0.30 | Assigned | 07/01/2022 | $0.00 | $30 | $0.00 | $30 | 1.76% |

| 07/05/2022 | ARKF | Call | Sell | 07/15/2022 | $17.50 | 1 | $0.30 | Closed | 07/15/2022 | $0.00 | $30 | $0.00 | $30 | 1.71% |

| 07/18/2022 | ARKF | Call | Sell | 07/29/2022 | $18.00 | 1 | $0.44 | Closed | 07/25/2022 | $0.45 | $44 | -$45.00 | -$1 | 2.44% |

| 07/25/2022 | ARKF | Call | Sell | 08/05/2022 | $19.00 | 1 | $0.35 | Closed | 07/27/2022 | $0.14 | $35 | -$14.00 | $21 | 1.84% |

| 07/27/2022 | ARKF | Call | Sell | 08/05/2022 | $19.00 | 1 | $0.20 | Assigned | 08/05/2022 | $0.00 | $20 | $0.00 | $20 | 1.05% |

| 08/08/2022 | ARKF | Put | Sell | 08/19/2022 | $19.00 | 1 | $0.26 | Closed | 08/10/2022 | $0.20 | $26 | -$20.00 | $6 | 1.37% |

| 08/15/2022 | ARKF | Put | Sell | 09/16/2022 | $19.00 | 1 | $0.25 | Assigned | 08/26/2022 | $0.00 | $25 | $0.00 | $25 | 1.32% |

| 09/07/2022 | ARKF | Call | Sell | 09/23/2022 | $19.00 | 1 | $0.15 | Closed | 09/08/2022 | $0.30 | $15 | -$30.00 | -$15 | 0.79% |

| 09/08/2022 | ARKF | Call | Sell | 09/16/2022 | $19.00 | 1 | $0.10 | Rolled | 09/13/2022 | $0.15 | $10 | -$15.00 | -$5 | 0.53% |

| 09/13/2022 | ARKF | Call | Sell | 09/23/2022 | $19.50 | 1 | $0.20 | Closed | 09/16/2022 | $0.10 | $20 | -$10.00 | $10 | 1.03% |

| 09/16/2022 | ARKF | Call | Sell | 09/23/2022 | $17.00 | 1 | $0.40 | Closed | 09/22/2022 | $0.20 | $40 | -$20.00 | $20 | 2.35% |

| 10/04/2022 | ARKF | Call | Sell | 10/07/2022 | $17.00 | 1 | $0.30 | Closed | 10/04/2022 | $0.45 | $30 | -$45.00 | -$15 | 1.76% |

| 10/04/2022 | ARKF | Call | Sell | 10/14/2022 | $17.00 | 1 | $0.45 | Closed | 10/07/2022 | $0.20 | $45 | -$20.00 | $25 | 2.65% |

| 10/17/2022 | ARKF | Call | Sell | 10/21/2022 | $17.00 | 1 | $0.20 | Closed | 10/20/2022 | $0.08 | $20 | -$8.00 | $12 | 1.18% |

| 11/14/2022 | TQQQ | Put | Sell | 11/18/2022 | $20.00 | 1 | $0.25 | Closed | 11/14/2022 | $0.15 | $25 | -$15.00 | $10 | 1.25% |

| 11/14/2022 | GPRO | Put | Sell | 11/18/2022 | $5.50 | 1 | $0.06 | Closed | 11/15/2022 | $0.04 | $6 | -$4.00 | $2 | 1.09% |

| 11/14/2022 | ARKF | Put | Sell | 11/25/2022 | $15.50 | 1 | $0.20 | Closed | 11/15/2022 | $0.10 | $20 | -$10.00 | $10 | 1.29% |

| 11/15/2022 | TQQQ | Put | Sell | 11/18/2022 | $20.00 | 1 | $0.18 | Closed | 11/15/2022 | $0.23 | $18 | -$23.00 | -$5 | 0.90% |

| 11/15/2022 | TQQQ | Put | Sell | 11/25/2022 | $20.00 | 1 | $0.46 | Closed | 11/17/2022 | $0.36 | $46 | -$36.00 | $10 | 2.30% |

| 11/17/2022 | TQQQ | Put | Sell | 11/25/2022 | $20.00 | 1 | $0.38 | Closed | 11/18/2022 | $0.24 | $38 | -$24.00 | $14 | 1.90% |

| 11/17/2022 | ARKF | Put | Sell | 11/25/2022 | $15.00 | 1 | $0.15 | Closed | 11/23/2022 | $0.05 | $15 | -$5.00 | $10 | 1.00% |

| 11/23/2022 | ARKF | Put | Sell | 11/25/2022 | $15.50 | 1 | $0.37 | Closed | 12/01/2022 | $0.05 | $37 | -$5.00 | $32 | 2.39% |

| 12/01/2022 | ARKF | Put | Sell | 12/16/2022 | $15.50 | 1 | $0.40 | Closed | 12/02/2022 | $0.35 | $40 | -$35.00 | $5 | 2.58% |

| 12/01/2022 | ARKF | Put | Sell | 12/09/2022 | $16.00 | 1 | $0.20 | Assigned | 12/09/2022 | $0.00 | $20 | $0.00 | $20 | 1.25% |

| 12/01/2022 | ARKF | Put | Sell | 12/09/2022 | $15.00 | 1 | $0.20 | Closed | 12/09/2022 | $0.00 | $20 | $0.00 | $20 | 1.33% |

| 12/07/2022 | ARKF | Put | Sell | 12/16/2022 | $15.00 | 1 | $0.60 | Closed | 12/08/2022 | $0.40 | $60 | -$40.00 | $20 | 4.00% |

| 12/09/2022 | ARKF | Put | Sell | 12/16/2022 | $15.50 | 1 | $0.55 | Assigned | 12/16/2022 | $0.00 | $55 | $0.00 | $55 | 3.55% |

| 12/12/2022 | ARKF | Call | Sell | 12/16/2022 | $16.00 | 1 | $0.26 | Closed | 12/14/2022 | $0.29 | $26 | -$29.00 | -$3 | 1.63% |

| 12/22/2022 | ARKF | Put | Sell | 12/23/2022 | $14.00 | 1 | $0.30 | Assigned | 12/23/2022 | $0.00 | $30 | $0.00 | $30 | 2.14% |

| 12/22/2022 | ARKF | Put | Sell | 12/30/2022 | $14.00 | 1 | $0.50 | Closed | 12/30/2022 | $0.00 | $50 | $0.00 | $50 | 3.57% |

| 12/22/2022 | TQQQ | Put | Sell | 12/30/2022 | $17.00 | 1 | $0.81 | Closed | 12/30/2022 | $0.00 | $81 | $0.00 | $81 | 4.76% |

| 12/28/2022 | TQQQ | Put | Sell | 01/06/2023 | $16.50 | 1 | $0.85 | Closed | 01/06/2023 | $0.00 | $85 | $0.00 | $85 | 5.15% |

| 12/29/2022 | ARKF | Call | Sell | 01/13/2023 | $15.00 | 1 | $0.31 | Assigned | 01/13/2023 | $0.00 | $31 | $0.00 | $31 | 2.07% |

| 01/04/2023 | ARKF | Call | Sell | 01/13/2023 | $15.50 | 1 | $0.25 | Assigned | 01/13/2023 | $0.00 | $25 | $0.00 | $25 | 1.61% |

| 01/04/2023 | ARKF | Call | Sell | 01/21/2023 | $16.00 | 1 | $0.20 | Open | $20 | $0.00 | $20 | 1.25% | ||

| 01/18/2023 | ARKF | Put | Sell | 01/21/2023 | $16.00 | 1 | $0.25 | Open | $25 | $0.00 | $25 | 1.56% |

Typical disclaimer! This is my experience, my journey, I’m no expert. I just haven’t seen many articles or videos of people in the thick of starting out, moving into a more intermediate level, so I wanted to share my experiences and the receipts and Johnny was kind enough to let me share some here.

The strategy is simple, based off the option wheel. I sell puts for 1% bi weekly returns (goal) and then repeat after I net about 75% of the trade, or I just let them expire. If I am assigned, I’ll just wait for a rise in the market and exit with a call set at my entry. Sometimes I make more, sometimes less. Sometimes I keep the underlying asset for a few weeks, because the market is staying low (which was the bulk of 2022). But the strategy works.

Originally I started with $1700 and traded it on ARK Fintech Innovation (ARKF) & UltraPro QQQ (TQQQ).

For anyone who is new to option trading, here’s a more detailed look at my mindset:

You can use this on typical stocks, I am not saying I just use Exchange-Traded Funds (ETF). However, the draw back I see in stocks if ETFs are a lot less susceptible to black swan events (like bankruptcy). Worst case for me, I’m stuck with an ETF to hold till I can get my money returned. Even TQQQ is likely to return positive returns with the rise of the QQQ if I was stuck in a trade.

My strategy carries an ownership mindset within it. I am trading to insure other people’s positions with my small account. If I am put (meaning I have to buy the ETF at the end of the contract), I own the shares. And if I’m called (this is the closing position of the strategy) and the market rallies (like this January), then I’ve just lost out on that rally, but still taken profit.

Sounds a bit carefree and cliche, even when I type it, but having lived it, that ownership mindset and lower risk brings a lot of peace of mind. I always have to remind myself, high returns (overall) and minimal risk = a good combo for steady growth. And I’m in this for monthly returns.*

Trading from anywhere

And I get to trade any spot I happen to be traveling! Like finding lake caves in Northeast, PA, eating street tacos in Tucson, AZ, hiking through the Zion National Park, exploring Bartlett Lake, AZ or hiking across Acadia, ME. Now, insert where you’d like to be while you become financially free and use some of the great resources here on this site to make it happen.

To me, I’m running a small time (fun) job that pays me bi-weekly. Treating it like a skill to hone, a means to a financial freedom end has caused me to focus and learn. I’m not there yet, but I hope that this is another proof that you needed to see to know, it can be done, it is being done and it works. Don’t let fear overcome a mindset that puts you in control of another stream of income. Make efforts to learn and if you have questions, you are reading in the right place.

*This version of the option wheel strategy is not tax efficient, I’ll throw that right out there. But with my account size and goals, I’m not concerned about that yet. I should be generating usable cash flow with this strategy and I’ve set aside taxes for that purpose. I might change that when I can later, but that’s an FYI.

**I started tracking my trades in mid July, when the crash was in full swing and prices falling down. Not at the bottom, but closer then the peak. I feel that my returns early this year are showing it’s still a high yielding strategy, but again, that’s something I see as skewing my percentage returns a bit.