For those like me that love to collect credit card rewards and travel everywhere for free, keeping track can become difficult and cumbersome. Among the bonus requirements, reward structures, annual fees, and application deadlines, there are many things to pay attention to.

At any given time, I have about 15-20 active credit cards for just myself. Each year, I will open 5-10 new cards and subsequently also cancel 5-10 credit cards since I do not want to pay the annual fee. This practice is called “churning” and can become stressful and difficult to manage. I’ve created a spreadsheet in Excel that will solve all your problems!

This post is part of my comprehensive guide to travel hacking and credit cards which explains everything you ever needed to know about how to use credit cards to maximize traveling.

- Also, check out my travel itinerary planning spreadsheet which is perfect for organizing and planning your trip!

- As well as my Restaurant List Tracker spreadsheet for keeping track of all the restaurants you have been to in your hometown or abroad.

- To hustle credit cards, you need to have a good grasp of your personal finance situation so make sure to use my net worth and budgeting spreadsheet to keep track of all your financial situations. This is also my spreadsheet which I use to track my net worth on my path to achieving financial independence and retiring early!

- Options trading spreadsheet

- For a list of all my credit card and travel hack related posts, click here.

Why use a spreadsheet to track Credit Cards?

Unless you have a legitimate business, most of us don’t have enough regular day to day spend to acquire any meaningful amount of bonuses.

Even with a lucrative card like the Chase Sapphire where you earn 3x on dining and travel, to get $1,000 worth of rewards, you’d have to spend $25,000. That’s a lot of money for the average person. However, the sign on bonus is a cool 100,000 points which is worth $1,500. The requirement to get these points is to spend only $4,000 within 3 months. A much better return on your money! Of course the Sapphire Reserve has a ton of other benefits as well but for the most part, I sign up for a credit card and will usually discard after I’ve collected the bonus.

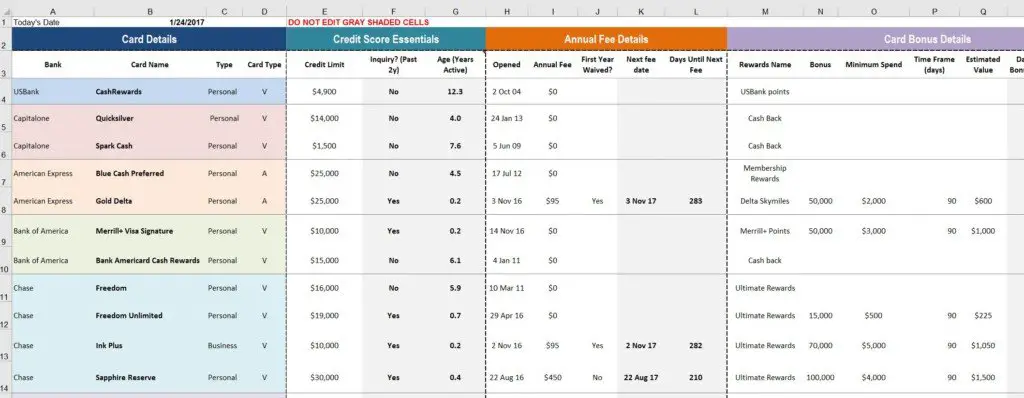

The above example is just 1 credit card. I’m always applying for new credit cards to get the sign on bonus and therefore, my spreadsheet tracks everything from credit limits, credit score impact variables, time to next annual fee, and more.

After churning through dozens of Chase Ink credit cards, my spreadsheet is the template that allowed me to get millions of Chase Ultimate Rewards points and stay in places like the Ritz Carlton Maldives. Make sure to read my review post to see how I was redeemed enough points for a 5 night stay at this amazing resort ($4k a night).

Credit Card Rewards and churning Excel spreadsheet

The spreadsheet I created focuses specifically on credit card bonuses and churning. As I’ve written before, it’s not about spending money on the credit card, as much as it is about pocketing the sign on bonuses when it comes to abundant and free travel.

The spreadsheet is simple, yet effective. It will help you avoid paying excessive annual fees, remind you when your bonus period expires, and track canceled cards. There’s numerous columns in this spreadsheet that captures everything you need to know about you card, as well as conditional formatting to provide alerts. To download it, click the button below!

Note that this spreadsheet is my live, and current credit card inventory. Every card I open and close will be updated in this spreadsheet. Feel free to regularly check on this sheet to see what I’m up to when it comes to churning.

Download Credit Card Spreadsheet

The spreadsheet is in Google Sheets because if I update it in the future, it will be easy to access. It’s easy to download it and use with Microsoft Excel as well.

To download offline, click the red button above, then click file > download as > Microsoft Excel

Using the Credit Card churning spreadsheet

As someone that works with spreadsheets regularly, I’ve included some functionality like conditional formatting and formulas that an Excel novice might not understand. I will explain everything necessary for those wanting to get the full use out of the spreadsheet. For the most part, anyone with any excel experience should just follow my inventory and copy/delete rows accordingly to populate your inventory accordingly.

- Bank: The credit card provider

- Card Name: The name of the credit card

- Type: Whether it is a personal or business card. Business cards do not affect your personal credit report

- Card Type: Visa, Mastercard, American Express, Discover etc.

- Opened: Date card was first opened

- Credit Limit: Credit limit you were approved for. This factors heavily into your total credit limit.

- Inquiry?: Credit inquiries stay on your credit report for two years. This affects your credit score, and business cards are not included

- Uses the Opened Column

- Age: How long you’ve had the credit card for and factors into your credit score’s average age of credit calculation

- Uses the Opened Column

- Annual Fee: The annual fee associated with the credit card. Put $0 if there is no fee

- First year waived?: Many cards waive their first year’s fee but some do not (Chase Sapphire Reserve, Delta AMEX Platinum, Chase Hyatt etc.)

- Next fee date: Uses formulas to calculate when your next fee date is

- Uses the Opened and Annual Fee column

- Days until next fee date: Uses formulas to calculate how many days are left until your next fee

- Uses the Next fee date and Annual Fee columns

- Rewards Name: Name of the card’s rewards network

- Bonus: Sign-on bonus of the card you applied for

- Minimum Spend: How much you must spend to get the bonus above

- Time Frame: How long you have to spend the minimum amount required (in days)

- Estimated Value: This is just an estimated rewards amount I calculated based on how I would use the rewards. Feel free to change

- Days Until Bonus Expires: Uses formulas to computer how many days are left for you to hit your minimum spend

- Uses the bonus and time frame columns

- Bonus Received: When you received your bonus. There is conditional formatting here that will turn the cell green when you input a date.

- FX Fees: Whether the card charges fees when making foreign transactions.

- Rewards Detail: Details of the rewards structure (excluding the bonus)

- Best way to redeem: The most ideal way of using the rewards earned.

- Keep card past 1y: For the credit card churners, this column is a placeholder for you to decide if you want to keep the card after 1y. This is based on whether you think an annual card is worth keeping.

Do NOT edit the cells in gray so to preserve the formula integrity.

What do the other worksheets do?

The main sheet is named “Current Inventory” which is your active inventory of credit cards. I also added a few more worksheets.

Potential Cards:

Anything I plan on getting in the foreseeable future. All fields are the same as the ones in the main sheet.

Canceled Cards:

It’s important to track canceled cards. Not only will this be a good gauge for my credit score, but many credit card bonuses reset after 24 months. That means, I will know when in the future, I can re-apply for the same card and get the bonus again.

Reward Balances:

A way for me to track the points and dollar value of all my points and miles within all the different reward programs

Credit Score:

Straight forward. Track your credit score by using the credit score tools that every bank now provides for free.

Allcards:

A list of all active credit cards out there courtesy of the wonderful people at Reddit.

Track your Chase 5/24 status

To track your Chase 5/24 status and whether you are under the forever problematic Chase rule, simply change the date in cell B1 to a date in the future until the “Total Inquiries for Chase 5/24” cell in column G turns green.

Anti Churning Rules

Different banks have different rules when it comes to opening their credit cards. Chase is by far the most stringiest with their 5/24 rule but AMEX, Citi, Capital One, all have their own set of rules too. I’ve created a box on the “Current Inventory” tab that tracks the most common and concrete rules when it comes to churning. These are all done with formulas and conditional formatting. If something highlights in red, this is something to be cognizant of.

I hope this helps you out as you work your way to endless rewards and free travel! If you have any questions about the spreadsheet, please leave a comment below!

Do you have an updated spreadsheet for 2024?

Thanks for a great spreadsheet!

Betsy

Hi I keep this spreadsheet updated with my own cards so it is always updated for the times!

Hey Johnny,

What is the “All Cards-Reddit” tab used for?

There used to be. Reddit thread where someone updated a list of all cards and SUBs but don’t think this is updated anymore

Thanks for putting this all together and sharing your spreadsheet. I’ve been trying to find a way to see, at a glance, the various pieces of CC info and this should do the trick.

I’d been cancelling cards as you mentioned in your blog, and am now kicking myself for that. Instead, for some of the cards I’m no longer really using, I am now making some easy monthly income on them. I can make some minor updates to your spreadsheet to track that here as well. (And let me know if you want details on how I’m turning unused cards into income).

Glad I stumbled upon your blog. I’ll be sure to go check out some of your other posts. 🙂

Hello Johnny – I chanced upon your site recently and am really enjoying reading your posts.

With regards to the credit card churning strategy, I have a question. As you are doing this with US-issued credit cards, but appears to be living AND spending overseas, is this strategy still worth it for the exchange rate (or fees) you may be paying on the foreign currency denominated transactions?

Also, what are your top credit card recommendations right now? Would appreciate your thoughts. Thanks!

Hey mate, I do churn abroad a lot even while living abroad. I tend to avoid AMEX cards because it’s not accepted in most places but other htan that there’s on reason to not get the free points! Any card with a respectable sign on bonus will have no FX fees so it’s not an issue. I’m actually writing a post as we speak about my credit card action plan for 2023. Stay tuned!

Hi there, Wondering how to get the color coding to work for the card types? Seems like it would be conditional formatting, but I can’t find which cell it’s in. I’m not super experienced with spreadsheets so maybe I’m missing something? Thanks for creating a useful tool!

Hey Alex, the color coding is nothing specific. I just chose different colors for different banks but they are not conditional. Feel free to make them whatever color you choose 🙂

Hi. Love your content and this spreadsheet is WILDLY helpful. Question: Have you ever considered adding a “benefits tracking” sheet? To track things like travel credit, entertainment credit, FHR, etc. With so many cards in my wallet I struggle to keep track of which benefits I need to utilize and when to maximize value. I’ve built a basic one but you’re on another level and I bet yours would be amazing! 🙂

Hey mate, that’s one of the things I’ve thought about for quite some time. How to properly track al the free hyatt and marriott night certificates from my portfolio of cards. I think i’ll make an attempt at it and see what happens!

I get errors whenever opening the spreadsheet. Itll say the workbook contains links to one or more external sources that could be unsafe.I always click the update button. But reopening the file, it asks again. https://i.imgur.com/Dhbn73y.png

Think it’s fine to use mate. Never seen that before (looks like Microsoft excel to be honest)

Other than reddit, are there any websites you use to look for credit card deals? The Points Guy?

Hey Johnny – I can’t find the anti-churning field or column in the Current Inventory sheet you mentioned….which column is it?

Do you mean the 5/24 rule? There is a table at the bottom of the spreadsheet for all of these

Nvmnd – found the churning box. Thx

Can you please explain the reason for iteration column. What is it’s purpose? I am new to churning (Dec 2021), so thank you for the spreadsheet.

I will continue to refer to this thread for additional tips and comments

Johnny,

1. What is the ideal number of credit cards an individual should open up within a 1-3 month time span? What would you recommend for beginners? I’m just starting out.

2. Would it be ok for my wife and I to open up individual accounts at once under the same card company? Trying to find a happy balance without getting overwhelmed and not hurting credit scores. Thanks.

Hi Nick, I think you should open no more than 2 cards in 3 months for a beginner. I always recommend the chase Sapphire reserve to start but if you have no cc at all then start with the chase Sapphire preferred and upgrade to the reserve when you’re ready.

Yes you and your wife are two different people so you can each open your cards no problem. Just make sure you can handle the MSRs on the cards for the bonuses!

Are you going to be updating this?

What do you mean? I update this when I have updates to make on my inventory

For the “Hard Inquiry? (Past 2y)”, how do we determine if we input yes or no?

is it asking whether the credit card does a hard pull? I dont get it?

Hi jun yes that’s what it is for. It’s auto populated so don’t need to touch it.

Hey Johnny,

Do you know anyone doing something similar for Canadian credit cards?

Unfortunately not. But you should be able to just mold the spreadsheet to fit canadian cards accordingly.

Great spreadsheet…makes the church tracking easy for the rest of us. One question, for those credit cards that also include a free hotel stay per year with the annual fee, do you track the expiration of said night on the spreadsheet at all? Given the COVID situation and dates being all over the place, wondered how you are tracking those so they don’t go to waste.

Hey mate, I’ve actually thought about adding something like this but never got around to it! I have so many cards with free nights and have had hard times using the free night certs, especially during covid times. Will think up something for this!

This spreadsheet is limited to 19 credit cards. How’re we able to add more credit cards to the spreadsheet?

Hey Jun, just right click and add another row!

Hey Johnny – Love the detail and customization on the sheet! Has the reddit allcards tab been updated lately? I noticed there are some cards not on the list (new SW cards from Chase). I also tried searching reddit for an updated list but to no avail.

Hi erv, unfortunately I don’t think it’s been updated since about a year ago. If you know of any better sources I’m all ears! Thx

Hey Johnny amazing sheet!

For the “Best way to redeem rewards” column, how do you go about figuring out the best way to redeem the points on the cards? I would love to get a breakdown of the process you use to figure that out.

Thanks!

Grant

Hey Grant, good question 🙂 I’m not sure if there’s any process to it, it is a column open to interpretation I suppose but having churned so many credit cards, you kind of just know how to optimize cards after awhile. it’s all a numbers game.

Largely I value Chase UR points the most and the best card to earn those points is the Chase Sapphire Reserve. So of course all dining and travel expenses go on the CSR because it is 3x. All other expenses go on the CFU for the 1.5x. Of course you also need to maximize the Chase freedom’s 5x quarterly bonus category every quarter. Most other cards I don’t really use much after I get the sign on bonus. All the hotel cards I keep and pay the AF because i find the free night certificate to be worth much more than the annual fee paid (For example, I am going to Rwanda later this year for Gorilla trekking and a night atthe Marriott in Kigali is $230). Hope that helps a bit!

I have more than 20 credit cards and using your spreadsheet. How do I add more credit cards?

Hi Jun, just copy and paste an existing row and then change the details accordingly.

When I did that, the anti churning rules for chase 5/24 became error. It showed no value.

Hey Johnny

I love this spreadsheet but I’m having trouble entering two cards.

I recently upgraded two of my cards to Amex Gold and Capital One Venture. The annual fee has been waived. I’m not sure how to enter these in your spreadsheet. If I enter the original date opened, the annual fee formula isn’t accurate. If I enter the date upgraded, the hard inquiry and age of the card isn’t accurate.

Any advice? Thanks so much!

Hi Kirsten, that is an interesting question! I’ve thought about it and I think the only way to account for this is to insert a new column after the “Opened” column (call it date upgraded) and change the formulas in the Next fee date column to point to the new column instead of the opened column. Let me know if that works for you!

Hi Johnny,

I had a quick question. I was about to open a new Chase card, the Freedom Unlimited, and noticed in your spreadsheet that you opened yours before the Chase Reserve. I know that you are able to transfer the cash-back into points in the Ultimate Rewards but I was wondering if you are able to store up the cash-back/points on the Unlimited and then transfer them to the Reserve card when you open that card up later, say in a few years.

Thanks,

Ian

Hey Ian, yes you can transfer between all the Chase bank issued cards freely (Chase freedom, freedom unlimited, sapphire, ink, etc.). Although it is not beyond the realm of possibility that Chase at some point will get rid of this ability. This is why i alwasy recommend people transfer points from their freedom cards to their reserve as soon as they get them just incase the worst happen!

Hi There! Brand new here…and about to start Chase. I have numerous old accounts I never use. when should I close those out so as not to confuse myself! Also, want to refinance in a few months. Do you think this will pose any issues?

Hi Mary, I would not close out any accounts that have no fees. you’ll want to keep those cards as they really help our credit score. Otherwise if they do have annual fees, I would start closing those out with the ones you use the least. As long as you don’t go overboard with the new cards (more than 5 in a year), you shouldn’t have any problems with refinancing!

Hi, I’m new to this and I have a question. I had my eye on getting a Chase Ink card and then get a Chase Saphire Reserve. Great signup bonuses! It seems like those cards would be best to cancel right after using the reward though since I have to wait so long to re-sign up in the future and earn those bonuses again. I see on your spreadsheet that you keep the Saphire Reserve open past the first year even with the large annual fee. Can you explain why you don’t cancel it and sign up again? Side note, they just made the wait time even longer between signups so this will take even longer :/

Hi Melissa, great questions! While most of my cards are hit and run cards, aka get the bonus, stop using the card, cancel before annual fee hits, the CSR is not one of them. I think with 3x earning on dining and travel, it is the best in class credit card for earning points on day to day expenses (when you’re not trying to meet a MSR on a new card). The annual fee is 450 sure, but it is really only $150 after the travel credit. Plus you get a 50% bonus on your UR points when redeeming for travel, Priority pass, primary car insurance, and a bunch other benefits. I think for $150, it is more than worth it for everything you get. It is the card I use the most especially as I travel so much abroad.

Hey Johnny, love your spreadsheet. Thanks for sharing. Question, is there a slick way to move a card from active to canceled?

Also, so you generally cancel a card right after receiving bonus, or do you wait until a few days before the annual fee is due?

Thanks again!!

Thanks Mike! I normally just move the row from active to canceled, and start it in column E. All the fields should align that way and then you can drag down the formulas in column A-D.

I usually cancel my cards right befor ethe annual fee hits. There is no harm in doing this and think it is just better practice for the banks as they dont’ wan tto see people canceling right after a bonus hits.

This spreadsheet has a lot going on but it’s just what I’m looking for. Thanks for taking the time to create this!

Hi, Johnny! This is my first foray into travel card churning, and I’m really glad to have found your sheet. Could you possibly freeze the header rows of all the longer worksheets, like current inventory and Reddit’s all cards list (View–>Freeze)? It’s tricky to remember what column is what.

Thanks for sharing your tools & experiences!

That’s a great idea Lauren, thanks. Have made the changes!

I’m getting emails about new comments but they are not showing up here in the blog.

Sorry, is fixed now!

Jonny,

I downloaded your list and did not see Capitol One Venture card with 50k miles on current, closed, or potential? Is there a reason why?

Hi Chris, main reason is because I’m trying to get below 5/24. I actually tried applying for the business version of this card but got declined. CapOne is more stringent with their requirements. ALso, cash back cards are lower on my priority list as I get more value from AMEX and Chase points as well as airline miles. $500 for a sign on bonus is very good as a sign on bonus however!

Johnny,

For the Chase 5/24 Rule calculation, I see that you are counting Inquiries and not Issued Cards. What’s the rationale for that? Here’s the common definition I find on many sites: “Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months.” It says nothing about inquiries.

I’d like to find out if you have heard this comment from others and would consider changing the calculation to the commonly-accepted definition.

Thanks again, Geoff

Hi again Geoff, good observation there. You are correct. Inquiries do not affect your chase 5/24 status, only opened personal accounts. The formula i’ve instilled int he spreadsheet actually calculates this correctly so no worries there. I just used the word inquiries without really considering the verbiage. I’ve changed it to accounts! Thanks.

Johnny,

Wonderful tool, great work! My question: Is there any interaction between the separate workbook tabs that would get screwed up if I added a new Current Inventory tab for my wife’s cards? Or should I copy the workbook and maintain one for her and one for me?

Thanks!

Thanks Geoff! There is no problem to copy worksheets to use for your wife as far as formulas go. Alternatively, you can just insert a column at the beginning to denote you or wife if you want to keep everything in one current inventory sheet. You could of course duplicate the workbooks and maintain separate files for the two of you guys as well. I have the GF maintain her own workbook completely separate. Whatever you find the easiest!

Hi! I appreciate your attention to details, planning, and photography. You and I would get along. 🙂

Question: Did you use these chase points for your two week trip to Peru/Bolivia? I am planning an almost identical trip but trying to use my miles from Chase cards to help fund the vacation. If you have any tips to share, I’d appreciate it.

Thanks in advance.

Hi Puja! Yes, since 2015, I’ve prettty much used only points and miles to cover all my flight expenditures for all my travels. The odd Ryanair or Airasia flight that costs under $50, I will pay out of pocket just because.

As for Peru and Bolivia, I would look into fly into Lima and out of La Paz. I would start by searching for a multi leg flight, and then search for two one way flights and see what makes more sense. Normally, I will check first the cost of the flight in dolalrs, and then I will go to the various airlines and see what the cost is in miles. Avianca is the major airline there so I would see how much the flight there is in miles on United, and compare it to the dollar value to see which is more worth it. For example, when I was looking at flights back from La Paz to new York, I found that the one way dollar fare was about $700 (which is a lot!!!). I then searched for United award flights and saw it was 20,000 miles and $75 in fees which is a much better deal. I then transferred 20000 UR points from Chase to united miles, and booked the flight. Hope that helps!

Thanks for the very comprehensive spreadsheet Johnny! One thing I would add to mine is the points expiration date since some of the airline/hotel points have expiration dates and they are hard to track! I’m currently using awardwallet but they’re not the most user-friendly. I randomly discovered your blog when I was looking for credit card tracking spreadsheets and I will definitely be reading more of your articles. I’m also based out of NYC so if you host any reader meetups in the future, I’ll definitely be down!

P.S. I tried to post this comment to the spreadsheet article but it says comments are closed…

Hi Brian! Thanks for pointing out that the comments were closed. I’ve since reopened them and moved your comment (WordPress has a mind of its own sometimes). As for the credit card spreadsheet, I liek your idea! I have edited teh spreadsheet since and added a coumn for that. For the most part, I’m pretty proactive abotu managing my points so this never happens but I totally can relate to it.

Also, it’s great you live in NYC too! I have some friends that have been bugging me about meeting up for a travel hacking session for some time now. If you’d like to come, and have some friends that would too as well, I think I could make it happen! Let me know. Thanks!

What a great spreadsheet – one that has saved me so much work! I love it and thanks so much for sharing it!

Still trying to get my head around it, so may ask questions in the near future.

One question for now – what are the CheckingSaving Bonuses, RewardBalances and TPG worksheet for?

Thanks for the nice words Kav! Great questions as well.

The Checking/Savings Bonuses are the checking and savings account bonuses I’ve signed up for. Like Credit Cards which offer great sign on bonuses, many banks across the USA incentivize people to open accounts by offering free cash. As you can see, I’ve done plenty of those accounts.

Reward Balances: This is to track the points/miles I have across all my reward programs. The TPG worksheet is ThePointsGuy’s valuations of how much each program’s points are worth. This is my very rough way to estimate how much my credit card rewards are worth.

Hope that helps!

Johnny Great Info! I am a married 62 year old veterinary surgeon with excellent credit and FICO score. Recently forced to semi retire from multiple back surgeries and living full time in RV. We want to be able to fly from wherever we are in USA back to Nashville as work comes up. Then back to our rig. Two Quick questions:

1. What is the difference to creditors of FICO score versus Credit Scores from the three agencies. I use Credit Karma for Credit scores and Bank Of America offers free FICO. I also check actual report at AnnualFreeCreditReport or Equifax if something fishy. Any other free sources that do not affect your credit report?

2. When I try to download your spreadsheet for CC tracking on my IPhone 8 it just opens the non-editable sheet without the option to download to MS Excel which is on my phone as well. Please advise.

Hi Paul, I’ll admit I’m not an expert with the rating agencies but I so know that the scores you get from credit karma and Whay you’d get from a credit card provider are the same. For example, credit karma has your transunionn and equifax score. Chase largely uses transunion when they pill your credit score for decision making so they will have a service that tells you your transunion score. All the same stuff. They scores should be very close in number.

As for your iPhone, Im not sure about thay since I don’t use one. Perhaps download the Google sheets app and see if that helps. Otherwise you should be editing this on a computer anyway because editing spreadsheets on a phone is a huge pain. Thanks!

What a great spreadsheet. I love it! … saved a ton or work.

Thanks Jeff! Glad you like it and happy churning!

Johnny, thanks so much for creating such a useful tool and sharing it. This is my first year of collecting credit card bonuses and after a year I am starting to get overwhelmed since between my wife and I we have opened 12 cards this year. I was just getting ready to start creating a spreadsheet but decided to google to see if anyone had a template and found yours as the first result – it looks so comprehensive so I am looking no further! Blessings & Happy Travels!

12 cards already! I like it. Best part of being married is there’s 2 sign on bonuses per card 🙂

Also, glad you like the spreadsheet. Let me know if you have any questions on it!

Hi Johnny, thanks for the blog and the spreadsheet! I’m 23 and just getting into card churning and building my credit, currently have five cards, most recently both Chase Freedom cards. Due to necessary one-time expenses I’m going to be able to hit the minimum spend for both to collect the bonuses. My question is, since I will have little use for the Freedom Unlimited after collecting the bonus (I have the Citi Double Cash card), should I cancel it or product change it to a Slate after about six months? The main reason Im thinking of product changing it is to age the account and not have a <1 year closed account stuck on my report for however long until it falls off. If I product change it, can I apply for another Freedom Unlimited in 2 years and collect the bonus again (with the original F.U., now Slate still open), or do I have to cancel it in order to do this?

Hey Joe, good to hear about your new endeavor!

If you product change to Slate, you should be able to re-acquire the Freedom unlimited bonuses after 2 years. Personally, I wouldn’t bother product changing your non-fee cards. If you really want the Slate card for their 0%APR intro, then just apply for that card as a new card. The bonuses for the Freedom and the Freedom Unlimited aren’t that great to begin with so waiting 2 years just to get the Freedom unlimit’s sign on bonus again seems less fruitful than it’s worth. I also wouldn’t cancel the cards altogether because no fee cards are great to build up your average age of credit which is a key component of your score. If anything, I would wait until you can get the Chase Sapphire Reserve card because that’s where the real rewards start accumulating!

Thanks for the spreadsheet! Great work. One question: My sheet says I have 4 inquiries for Chase 5/24, but I’ve only applied for 2 credit cards in the last year and all my other fields are empty. And when I clear out all the cells, it still has a 2 listed even when I have no data in the worksheet. Just curious. Thanks!

Nevermind. I figured it out.. I didn’t clear out the cancelled cards. Sorry

Glad you figured it out! Happy credit card tracking 🙂

I was just working on something like this for myself but really like the one you have! For the Chase 5/24 piece of this spreadsheet, are you factoring in cards you’ve closed as well as the ones you currently hav eopened?

Hi James, yes it definitely does. It counts the number of personal cards from the “canceled cards” tab that was opened in the last 2 years.

Johnny, where on Reddit do you get the list of active credit cards? Is it regularly updated?

I get it here and I believe it is updated regularly!

https://www.reddit.com/r/churning/comments/4mvgqx/rchurning_spreadsheet

Nice sheet, I’m starting to use it. I fixed the formula for calculation of days until next annual fee so it takes into account the day of year. For cell K4 it should be the following: =IF(I4=0,””,IF(DATE(YEAR($B$1),MONTH(E4),DAY(E4))<$B$1,DATE(YEAR($B$1)+1,MONTH(E4),DAY(E4)),DATE(YEAR($B$1),MONTH(E4),DAY(E4))))

Hi Evan, thanks for the comment. I don’t think the days of the year matter because the formula is just saying if you opened the card this year, the annual fee will hit next year and if you didn’t open the card this year (meaning you opened it years past), the annual fee will hit this year regardless.