It’s 2021. I’m 34. I’m retired.

My blog was always started as a way to write about my experiences traveling the world. Occasionally, I would write about credit card related things because this enabled me to travel the world so much more cheaply. However, it’s time to come out of the dark and also write about my love for personal finance.

Specifically, this post is my detailed post of how I was able to achieve financial independence in my early 30s even while traveling as much as I did. There’s a lot of financial terms in this post so if you have any questions, please leave a comment at the end! I’ve also updated these posts with a monthly portfolio summary where I discuss the current value of my portfolio, the trades I’ve performed, withdrawals, and more.

As the second part of this FIRE series, I traveled the world for a year upon reaching financial independence and increased my net worth. This post goes into detail about how I managed my portfolio withdrawals, expenses, and where I traveled to. I also have written a detailed post of exactly what is in my portfolio if you want to know exactly what I’m invested in as well as how I pay zero in income taxes from withdrawing my portfolio.

Finally, I started writing monthly portfolio updates on my blog. These updates include the value of my portfolio, what I am currently holding, the trades I’ve executed, and any other interesting things I see happening in the markets.

What is FIRE (Financial Independence Retire Early)?

FIRE stands for Financial Independence Retire Early. The concept has been around for awhile but it gained mainstream traction in the last 10-15 years when people discovered they could essentially live frugally, save the majority of their money, invest it into broad market index funds, and use that portfolio to stop working.

What do I need to know about FIRE?

Personal finance can be scary to some, and a passion project for others. I’ve always been comfortable with my finances and investing was always something I gravitated towards. If you are one of those that make a good salary but are clueless to semi-clueless about investing, the concept of FIRE will probably be a bit of a “wtf is this?”

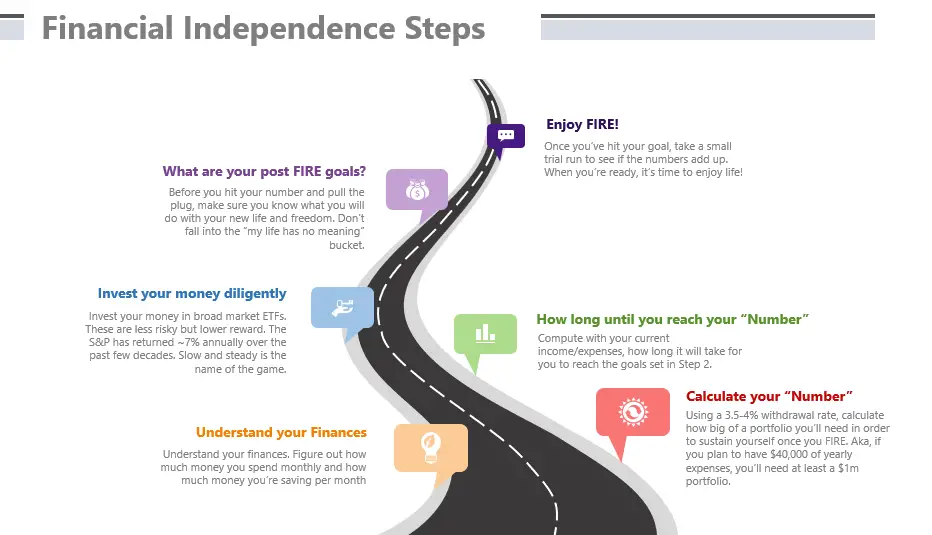

I’m not here to tell you it is simple, because it’s not. However, I think the concept of FIRE is quite simple. It goes a little something like this:

- Realize you don’t want to work until 65: The whole point of retiring early is it not?

- Calculate how much money you plan to spend a year in “early retirement”

- Assuming a 4% withdrawal rate (details on this below), multiply that number by 25. This is how much money you need in a diversified portfolio of stocks.

- How do you get there? By saving and investing a lot, and watching compound interest do its thing.

What is the 4% Withdrawal Rate?

The 4% Rule is known as the “safe withdrawal rate,” or the amount of expenses you should be able to withdraw from your savings each year when you retire without touching the principal. (This number is based on a study from Trinity University.)

Finding out your safe withdrawal rate is the first step to learning how to become financially independent.

So how do you find out how much you need to save? Do two things:

- Find out how much you spend yearly. This includes everything that you might possibly spend in a year including rent, utilities, groceries, gas, etc.

- Multiply it by 25. Or however many years you aim to retire for.

This will give you enough expenses to withdraw 4% for years and years to come.

Here’s a handy chart to show you how much you’ll need to save based on possible yearly expenses.

| ANNUAL EXPENSES | Financial Independence Goal |

| $20,000 | $500,000 |

| $30,000 | $750,000 |

| $40,000 | $1,000,000 |

| $50,000 | $1,250,000 |

| $60,000 | $1,500,000 |

| $70,000 | $1,750,000 |

| $80,000 | $2,000,000 |

Is the 4% safe Withdrawal rule really legit?

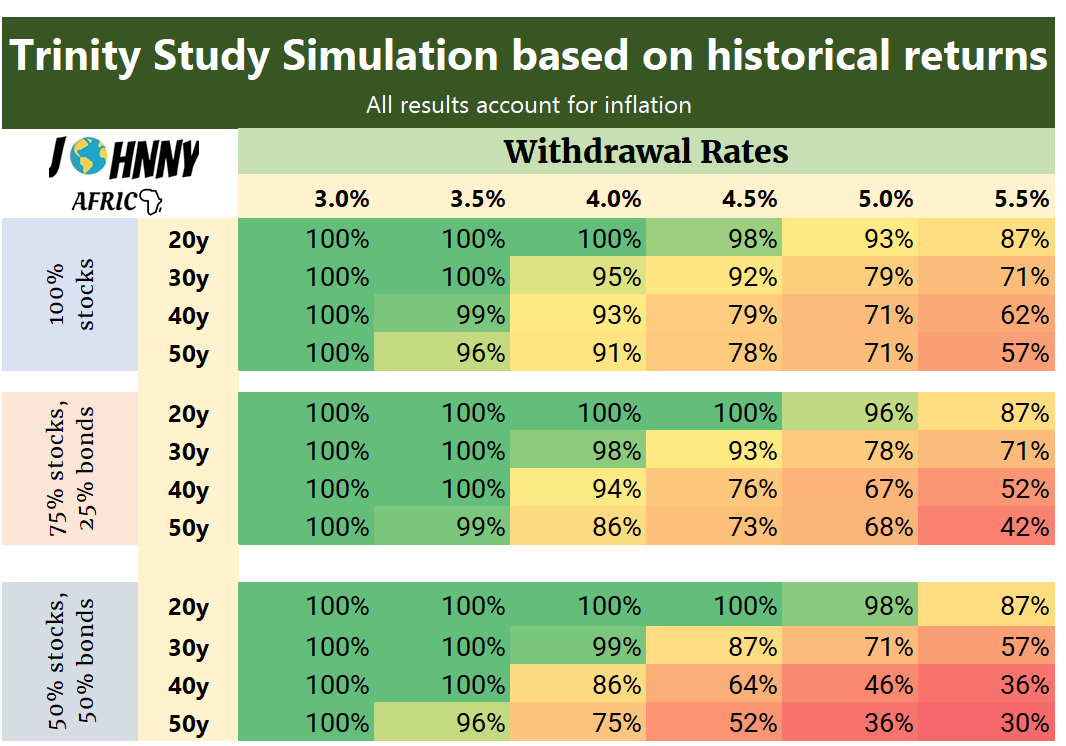

You might be asking is it really as simple as just looking at 4% of your portfolio and calling it a day? There must be other risks out there. The answer is there probably is but the point of the Trinity study is that they backtested data over the last 100 years and given the market moves from the last 100 years, a 4% withdrawal rate on a portfolio invested in a broad basket of stocks meant you will have enough money to retire on.

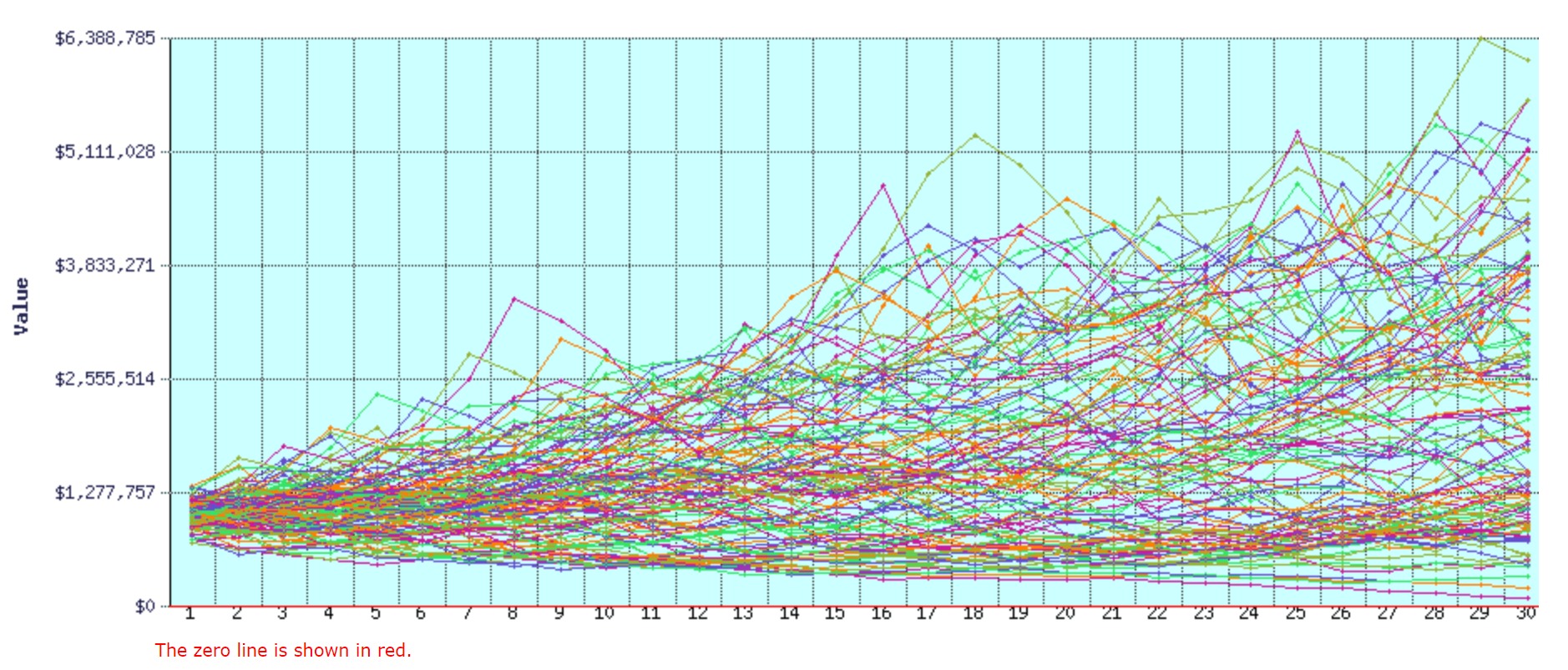

This means, if you have $1m invested in a S&P ETF like SPY, or VTI, or VTSAX, you can withdraw $40,000 a year and it will last for at least 30 years. The S&P has returned something like 7-8% over the last 30 years so if you’re only withdrawing 4% a year, then you are net still increasing your portfolio. Even with market crashes like the Dot-Com and Financial Crisis, the math still works out.

The withdrawal rate also takes into account inflation which will increase every year. Normally, during periods of high inflation, markets tend to underperform but it comes back in line with the mean as inflation cools. This is because during periods of high inflation, companies will increase their prices which in theory will generate higher profits and therefore, higher share prices. Everything moves in tandem over the long run and the withdrawal rate takes this into account.

Of course the next 30 years could be the financial reckoning and apocalypse that we’ve never seen in the last 100 years. There is always a chance the mother of all crashes happens. However, even with the many recessions the economy has seen over the past many decades, this study still holds true.

Thankfully, I’ve done extensive research and modeling into the 4% withdrawal rate which I explain in my detailed post about the 4% rule and the Trinity study.

How I discovered FIRE?

I think the first time I really discovered FIRE was reading another blog. I was sitting there at my desk and like every other FIRE enthusiast, I kept wondering to myself, is this really the meaning of life?

“Am I really supposed to just do this for the next 40 years?”

“Just because someone somewhere said this is just how life is supposed to be?”

I know many people that derive their meaning and self worth from their jobs and careers. Early on, I was one of these people. However, the more I traveled, the more I realized it wasn’t so important.

After living in Europe, I look back on my 22 year old self and wonder how did we ever think that was a normal way to live!

I think the big aha moment was when I thought to myself, “If I do this for another 40 years, and accumulate $__ more millions, does it make me that much happier?” The answer was a firm no.

What I did for a living before FIRE

I worked for the majority of my career for large fortune 500 type companies in the financial services sector. I started working at the age of 22 which is very typical for someone from the USA.

We don’t have gap years here like in Europe because the system likes to herd their young cattle into the workforce to contribute to the social security system as early as possible. Okay maybe it’s not this grim, but I do remember as a kid thinking how strange it was to see that one student taking a year off to travel after college.

I spent twelve years working in the Financial Services sector starting out in the Big Apple (where everyone else starts). I took an international assignment in South Africa five years into my career. My love for travel really came out during this time and is how this whole blog started.

I then took another international assignment in Europe which has allowed me to see almost every European country.

How did I travel so much and still manage to FIRE?

Before I stopped working, I had already been to almost 80 countries in the world. I spent all my vacation time while working actively traveling and seeing the world.

Through a combination of travel hacking and a generally frugal mindset, I was able to see much of the world. This included a sophisticated system of credit card churning which allowed me to essentially always fly for free.

Travel is also my biggest hobby, and the only thing I care to spend money on. I was always good at controlling my expenses at home so I could continue to do the things I wanted.

Lastly, travel is not expensive. Rather, it does not have to be expensive. Living in New York, my expenses were probably as high as it gets in any part of the world. When I traveled abroad, it was almost as if it were cheaper than just living my normal life.

My Stocks Portfolio Over the Years

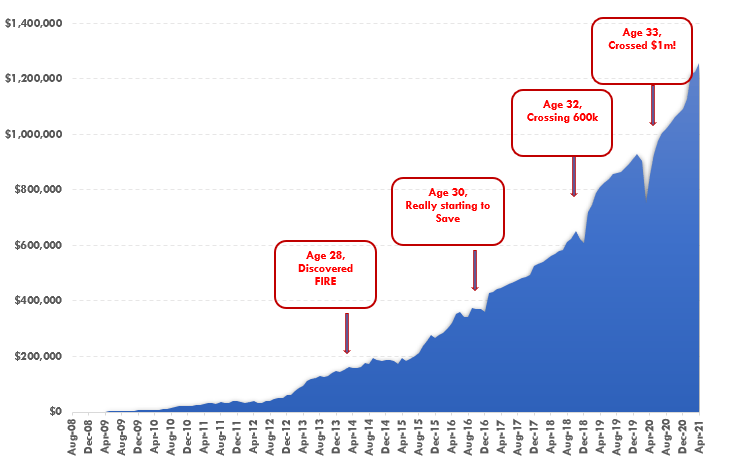

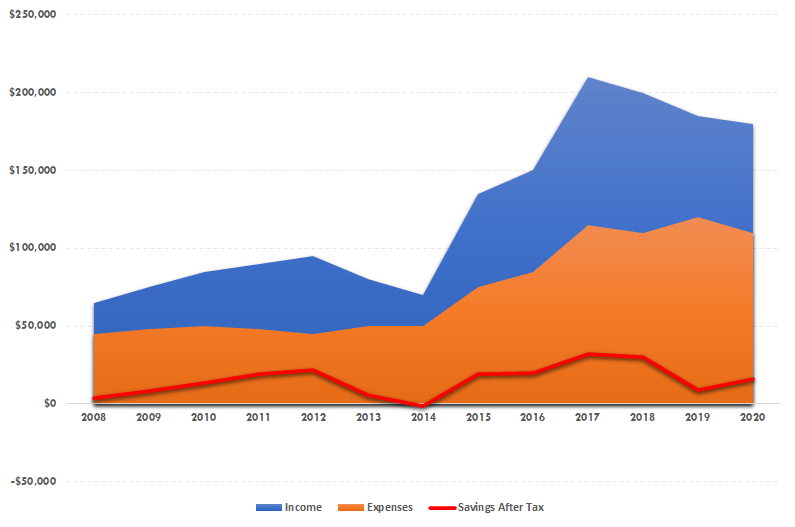

Now to the numbers and pretty charts. I think the best way to visualize just how someone can retire early is to watch compound interest do its thing.

FIRE is not a fancy or complex system. It’s literally taking the century old retirement trajectory and amending it to retiring earlier than the typical 65-67 age.

The name of the game is to maximize your savings, and minimize your expenses. Easier said than done of course and I won’t go into how to save money in this post because there are entire books and websites dedicated to this.

Without further ado, here is the evolution of my net worth since starting in the work force. I use this net worth spreadsheet that I created to track my figures.

As you can imagine, the road to financial independence is not a straight one. There were bumps along the way but in the end, investing is about the long term horizon. As you can see, the overall trajectory is a solid upwards line.

Portfolio Summary

I write a monthly portfolio update where I summarize what’s happened to my portfolio, the total value, trades I’ve undertaken, withdrawals I’ve made, and much more. Make sure to sign up for the newsletter to get updates when these posts drop!

What is in my portfolio?

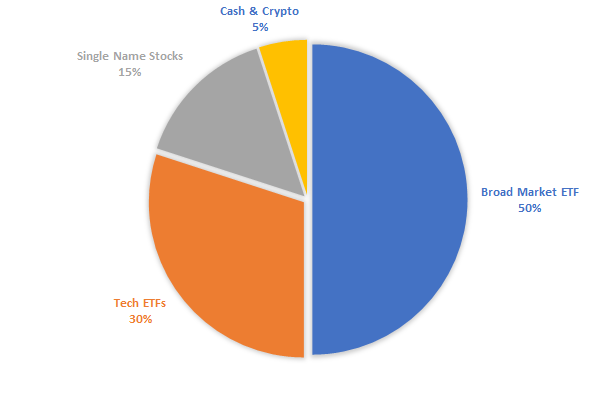

My portfolio is relatively boring, consisting of broad market ETFs and Tech ETFs. The prevailing sentiment for FIRE is to put nearly 100% of your portfolio in an S&P fund and leave it be. However, I have always been bullish Tech and continue to be. I am comfortable with my exposure to it.

I put about 1% of my money into cryptocurrencies and this has since ballooned to about 5% of my overall net worth. I am not going to pretend like I am some expert in crypto but I do believe in its uses for the future and am comfortable with the exposure.

In addition, I like to also trade and sell far out of the money options on my existing portfolio as a way to generate a small amount of extra income. I don’t really need to this money but I find it to be generally low risk and something to keep me occupied while focusing on the markets.

Starting out in 2008

I started investing after 2008 as I entered the work force during the financial crisis. It was a crazy time during those first few months in New York. I was watching stock markets go to the center of the Earth and workers with their brown crates saying goodbye to their offices.

As an irresponsible 22 year old that didn’t understand basic budgets, investing, FIRE, or having the foresight to buy stocks at their lowest point, I missed out on many opportunities early on. Even if you don’t know anything about FIRE, you’ve probably heard of compound interest and how it is always prudent to start as early on in life as possible.

As a 22 to 25 year old, I had different priorities which were to go out to nice restaurants, party a lot, buy nice clothes, and really anything else you could think of that would crush your ability to save. I was living the young adult life in NYC. Nothing wrong with that of course.

My lowest point in 2009

I had accumulated a ton of credit card debt in University from largely irresponsible spending. I even had a job making $18/hr making websites (which was a lot of money in the mid 2000s for a college kid!) but somehow through years of buying who knows what, I had accumulated almost $10k of credit card debt.

Living in NYC and trying to live this lavish “New York” centric lifestyle on an entry level salary meant I had no money left at the end of the month. In fact, I was losing money every month.

In March 2009, I hit my lowest point. I had no money in my checking account, all my credit cards were maxed out, and I couldn’t apply for new credit since I had missed payments in the past. I had one more day until pay day. It was at this point that I realized, I might not be able to eat until tomorrow.

In a stroke of desperation, I called a friend up for dinner that evening. I feigned stupidity and told him I forgot my wallet and asked if he could cover my dinner. Of course he obliged and I was able to fight another day. It was at this point, that I knew I had to do something.

2009 to 2013

After this revelation, I swore that I would do everything possible to not repeat that experience. Luckily, a tax refund, year end bonus and a few paychecks later, I was able to pay off the majority of my credit card debt in one swoop.

I understand how unlikely this scenario is for the vast majority of people in debt but I do consider myself extraordinarily lucky and fortunate for a much of my circumstances.

For the next four years, I was much more diligently about my budgeting. I never experienced a moment where I didn’t have money again. I received numerous pay raises and established a few side hustles during this time to really increase the amount of money I made and saved.

However, I was not really doing much with my money like investing at the start of the biggest Bull market of all time. I had my 401k which I did not max out and a brokerage account where I bought various stocks with a small portion of my paycheck.

2014 – Let there be FIRE!

Near the end of 2014, I had accumulated roughly $200k in net worth at this point which of course is no slouch. It was one random eventful day that I discovered a blog called Mr Money Moustache which is perhaps one of the pioneers of the movement and how many others discovered the concept.

After doing ample reading and crunching the numbers (which I always had an interest in doing), I figured I might as well give this a shot. It was also at this point that I really started traveling the world and realized that working forever at a big company was not the meaning of life.

At this point, I decided I would give it a shot!

2015 – 2020

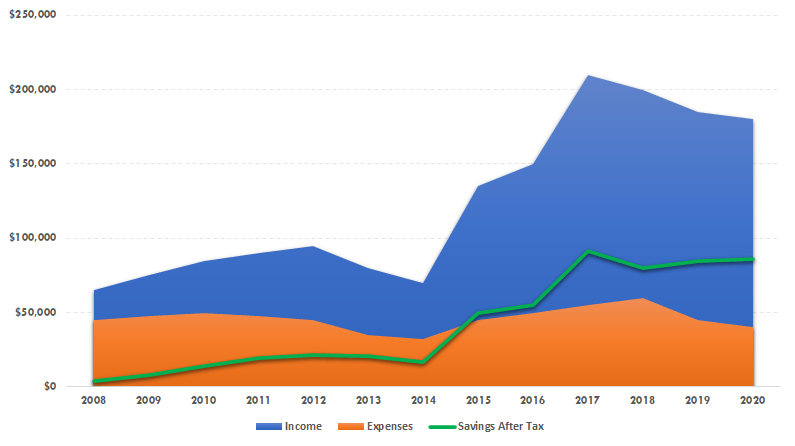

For the next five years, I was fully dedicated to FIRE. I started to max out my 401k and along with the company contribution, I was adding $30k a year into the 401k. I was also saving roughly 40-50% of my paycheck after tax.

The craziest thing at this point was that I was making two to three times more money than I was as a fresh graduate. However, my expenses were even lower than it was during my early years.

With the amount of money I was saving, coupled with the continued Bull Market of the 2010s, I saw my net worth start to move exponentially.

2015 saw my net worth increase $100k, and 2016 saw my net worth increase $150k, and so forth.

During this entire time, I felt incredibly comfortable with my finances. My life choices fundamentally changed as I never felt like I needed to spend money on accumulating “things” but rather my only desire was to invest in life experiences. This meant continuing my travels around the world, diving around the world, and staying in shape. Coupled with an acute dedication to credit card churning which allowed me to fly everywhere for free, it was an easy time in my life.

Being in NYC, I was surrounded by more successful and higher earners than myself. However, I knew deep down that I didn’t need the validation of a bigger paycheck to make me more happy because I was already doing the things I loved which was more than many others could say.

The COVID Pandemic in 2020 was a scary moment for the world and was a scary moment for everyone’s portfolio. However, for better or for worse, trillions of dollars later of stimulus meant that markets rallied to all time highs and then some. I was diligently buying up depressed tech ETFs and was rewarded for it later.

In mid 2020, I had finally hit the $1m threshold.

Reflections on hitting $1m

The day I saw my accounts hit $1m was a bit of a revelation. I thought I would have mental confetti raining down. Instead, it was just any other day. I was traveling through Greece realizing that I was already doing what I was already so passionate about doing.

There were no immaculate parties or celebrations. I ate two gyros instead of one gyro for lunch, did a short workout, and went to the beach.

What if I worked until the traditional retirement age?

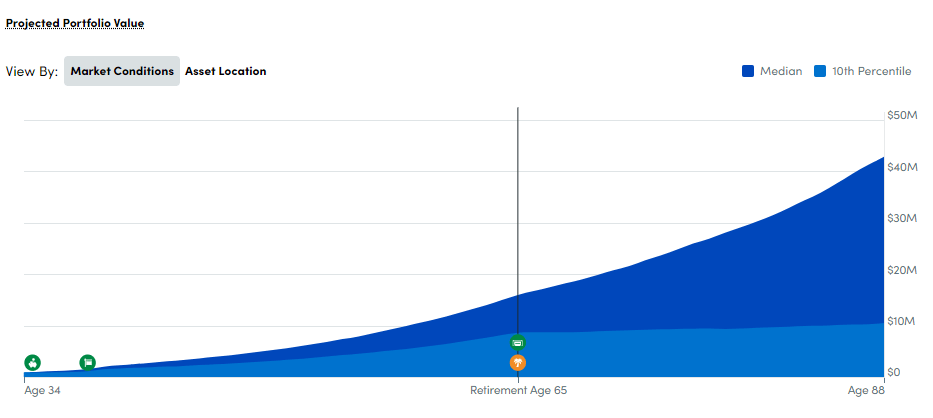

If I never discovered FIRE, I would probably just have kept working away climbing the corporate ladder. Personal Capital has a great retirement planning tool with numerous inputs you can play with.

If I just kept working to the “typical” age of 65, assuming only a 5% pay increase yearly for the next 30 years or so, with an average 8-10% returns on investment, I would have something like $15m by the time I hit 65.

Of course, in my profession, the more senior you get the more non-linear your pay raises become. The pay and bonuses can increase very fast which means the 5% pay increase over 30 years is extremely conservative. Conversely, I probably would have increased my expenses substantially without discovering FIRE.

How long does $1m+ last?

How long does a million dollars last? Well of course it depends. Everyone’s plans are different and unique. Everyone has a lifestyle they are used to and a lifestyle they feel they need to uphold.

Financial experts say you need $3m. Using the conservative 4% withdrawal rule (which I write in detail about), this means you will have $120,000 a year to spend. If you spend $10,000 a month then for sure this is how much you need. If you are withdrawing $120,000 a year with a portfolio of $1,000,000 you will go bankrupt very quickly.

However, even while living in NYC, I realized my expenses were shy of $60,000 a year. I always knew that I would not stay in NYC long term for a variety of reasons. Living in Europe, my expenses were much lower at around $40,000 a year and I was living quite the high life.

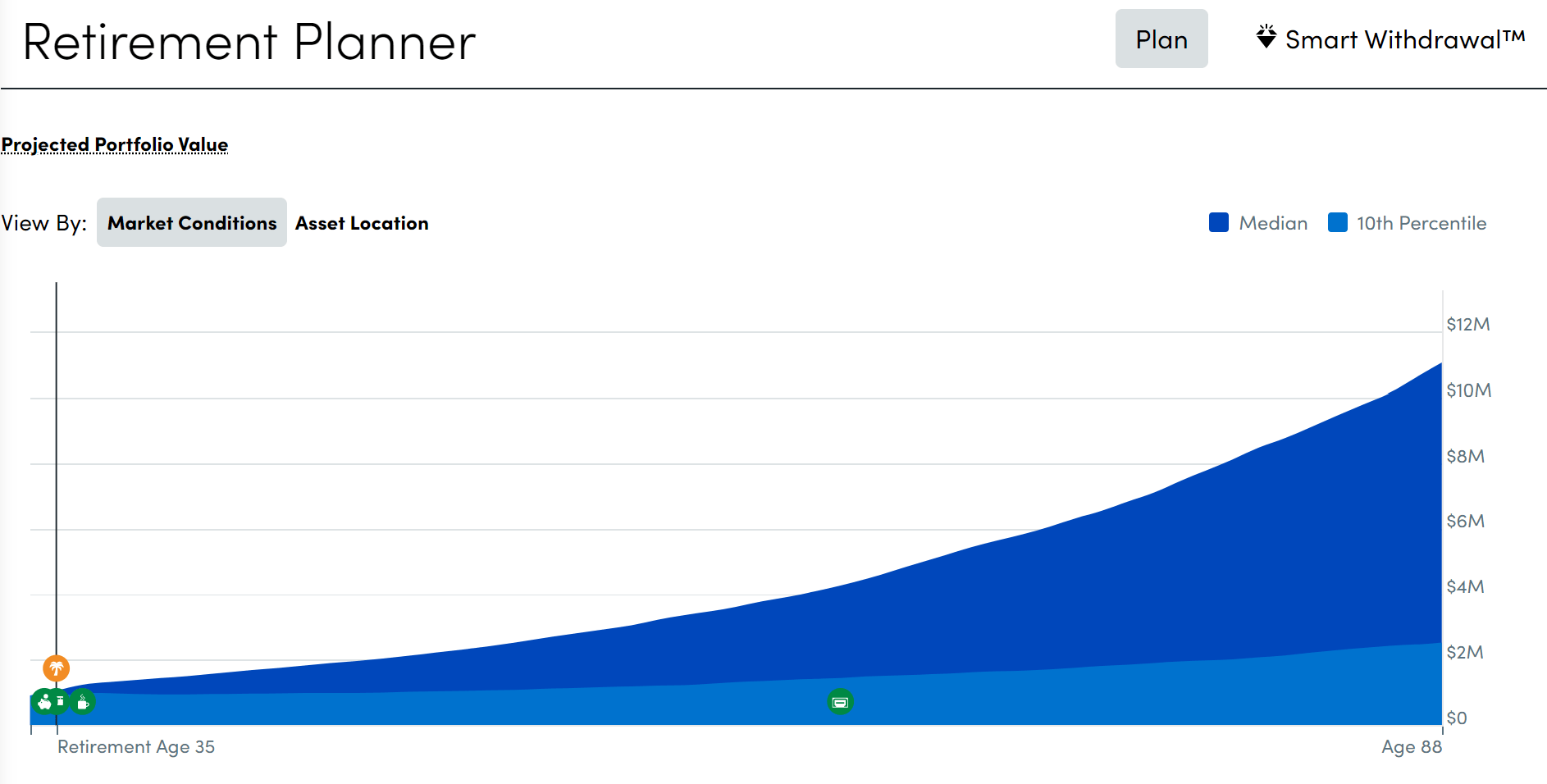

As the old saying goes, a million dollars ain’t what it used to be. I would definitely agree with that. This is especially true in 2023 after having a few years of the craziest inflation of my generation and seeing prices go up everywhere. However, it is still a substantial amount of money and depending on your yearly expenses, it can still last a very long time. Using the retirement planner in Personal Capital, I can plot out my current scenario out and see that my portfolio will more than suffice.

Using the FIRECALC website, you can input your yearly withdrawal rate, total portfolio size, and total years. The website runs a series of hypothetical scenarios using data from the last 100 years. I have a near 100% chance that the portfolio is not depleted before I die.

Of course there are many assumptions here:

- My expenses won’t go up significantly: Who knows what life brings right?

- Social Security benefits can start at 65

- No additional income comes in: Well I’m already earning extra money on the side thanks to the income from my blog!

Takeaways from reaching FIRE

I took no shortcuts to reaching FIRE. I didn’t start a company, I didn’t work for a startup that made it big, I didn’t buy Ethereum at $50 (although I did buy a bit Bitcoin when it was in the low four digits), and I certainly did not work for a big FAANG company in the early years with stock options.

I simply had an above average salary, learned to control my expenses, and invested more diligently.

Leaving money on the table if I kept working

The precipice of FIRE is that during the accumulation phase, you dump all your savings into the stock markets by buying a diversified broad market ETF like VTI or SPY. Every month, take your savings and dump it into the markets. Rinse and repeat.

I did this diligently, but I did not put all my money into it. I always kept a large holding of cash. My early years when I had accumulated so much debt led me to be extra risk adverse which was just stupid in hindsight.

Time in the market is ALWAYS better than timing the market.

I was constantly waiting for a big market pullback which of course, like EVERY prevailing market theory tells you to do, never happened. Time in the market is ALWAYS better than timing the market. I knew this and fully grasped what this concept meant. Nevertheless, I didn’t listen to my own advice and kept a large portion of money in cash. It wasn’t until early 2019 after the market sell off in Dec 2018 that I decided it was time to just put everything into the markets. To never look back and go all in.

Had I invested near 100% of my salary when I discovered FIRE like I should have, I probably could have hit $1m much earlier in my life. I would be closer to $2m net worth in fact as I write this article instead of $1.3m.

Hindsight and FOMO have never done anyone any good when it comes to investing so I can’t be bothered by this! It is what it is as they say, and life goes on.

Having a higher income helps FIRE tremendously

I think a lot of the FIRE blogs out there are trying to create this lifestyle following where they constantly advertise “Hey this is how I did it and you can do it too!” Hope is the greatest equalizer and probably one of the best profit generators on the internet.

Nowhere in this post or on my blog will I tell you “hey look how easy this is, you can do it too”. Yes the math is relatively simple but if life was as simple as 15 rows in Excel, then I think we could solve world peace and climate change tomorrow.

Much of what I attribute to my FIRE journey ending so early was because of my high income. I didn’t really start the FIRE journey full on until 2015 or so. Given that this is only six years, it’s nearly impossible to achieve such a portfolio size without having a high income. In the end, you can only cut your expenses so much.

Increasing your income whether that’s through finding a new job or creating new side hustles is easier said than done. I’m not here to sell you courses about how to earn money being an Amazon affiliate or something. I’m just here to say that retiring early works much faster when you are earning more.

Avoid Lifestyle Creep like the Plague

Controlling your expenses is one of the paramount principles of reaching FIRE. This is easier said than done. As you make more money, your first inclination is to reward yourself for your hard work and buy something (that you probably don’t need).

You see your friends doing the same thing and feel the FOMO urge to reciprocate. This is literally just one of the phases of life and everyone succumbs to it. Some might say well what is the point of making more money if you can’t live a little? The difference is everyone’s definition of “living a little” is different. Mine just happened to not require me to have to spend more money. All the while, I was fast building up my net worth through my investments.

Over the years, I completely avoided lifestyle creep because I just focused on what makes me happy, travel. I already knew how to travel frugally and along with my credit card points, I never really spent that much money. As my income increased, my expenses stayed the same if not slightly less. This helped me tremendously.

Here is a breakdown of my expense and income over the years.

Here is a hypothetical scenario of my income but embracing lifestyle creep. The scary thing is most people have no idea that it’s happening to them because it just feels like the “normal” path.

And in the end, this is the difference:

Don’t compare yourself to others

Living in New York, you’re constantly thinking about money and seeing what other people are doing. Keeping up with your friends and doing what society “thinks” you should be doing is one of the worst things you can do. The worst part is most of the time you are doing this unconsciously and don’t even know.

Comparison is the thief of joy

-Someone wise

You quickly learn that there is someone always richer and doing better than you.

Literally always.

The question is what do you do with this information? Comparison and competition are not bad things inherently. It’s the basis of how society has innovated and progressed throughout the centuries. The problem arises when as an individual, you compare yourself to someone else and feel that you can only be happy once you have what the other person has.

One of my favorite quotes is “Comparison is the thief of joy” which I really relate to. You can spend your whole life comparing yourself to others and you’ll never be satisfied or happy.

The secret to FIRE is understanding your own plan and being happy with what you have in life. You don’t need a new car just because your friend got one. If you know buying a new car is everything you want in life and the only way to making you happy, then go ahead and do it if finances allow. Otherwise, what’s the point?

If, however, you know that you are only doing it because you feel like you’re not successful otherwise, then you need to just re-evaluate priorities!

FIRE Advice and Tips

For those looking to go on their own journey to Financial independence, here is the advice I would impart

- The earlier you start saving and investing the better. Compounding is a time game and the longer you have the better.

- You don’t need a financial advisor to help you. Simply auto buy diversified index funds when you get your paycheck.

- Track your spending, investments, and net worth.

- Don’t be scared of bear markets. When prices fall hard, this is the best time to buy.

- Do not engage in lifestyle creep.

- Don’t be discouraged. Even if you don’t have $1m in ten years, I can guarantee you will have more money than if you did not save and invest.

Am I crazy to leave and not continue getting paid?

I think 99% of people out there would say to me are you crazy to turn down that kind of money or stop working? Or perhaps something along the lines of $1m+ is nothing and not nearly enough! You need to work and earn another million.

Don’t worry, you aren’t the only one. I’ve thought of this constantly as well. It’s ingrained into me to think about money and whether if enough is really enough. I’m still not sure I have the answer. However, I do know that life is much better without working at a job that you don’t find much meaning in. That much is for sure.

Sure there is always the “just one more year” plan but I’ve seen this quickly turn into ten more years.

Life is like a long call option

Cue the inner finance nerd for this section. If you don’t understand basic financial derivatives, this will sound really strange to you. A guy’s gotta geek out sometimes.

Life is a long call option after all. Once you “have enough”, you’re essentially holding an in the money option. The longer you hold onto this option, the greater the chance that you might be even more “in the money” and achieve something great. Conversely, there is always a chance your life goes downhill like an unlucky health issue or some other unexpected crisis.

What is absolutely certain and can’t be avoided in theta decay. Theta decay is time decay meaning every day you don’t exercise your option, it is worth less and less. Time decay is inevitable and at some point your option just expires worthless.

The takeaway? Money isn’t easy to make, but there is always the opportunity to make more. Time is finite, and your time left on Earth is decreasing by the day. What’s most valuable is having the freedom to decide how to use that time.

My expenses during FIRE

The prevailing sentiment for traditional financial planners is that your expenses will be highest once you stop working. This is because most people traditionally work their whole lives and wait until retirement to do the things on their bucket lists.

I don’t subscribe to that train of thought. My expenses will be lower, even with all the traveling I am doing.

In the end, my FIRE number has always been right around $40,000 a year. Withdrawing from a portfolio of long term capital gains will ensure that I pay zero taxes. In addition, just because you are no longer working for your familiar job does not mean money will never flow in again. Just selling far out of the money calls on my existing portfolio will guarantee small income every month.

“Retiring” early doesn’t mean you are no longer allowed to do something that happens to bring in money. There are various things that I am doing on the side that just happen to generate small bits of income. Small passion projects if you will. If it’s something you enjoy doing, then that’s what it’s all about. This blog brings in a five digit sum of money every year which you can read about in my blog income report.

My Passive Income sources

Over the years, I’ve developed a number of different passive income streams that will and have helped tremendously once cutting ties with the traditional job. I will summarize what they are and roughly how much money I make from each one with a link to posts where I delve into deeper detail.

Note that these income sources are in addition to what I can safely withdraw from my portfolio (the whole premise of FIRE after all).

My Blogging Income

This should be no surprise. I’ve spent many years blogging and started my travel blog back in 2014. I really had no idea what I was doing; writing just for the hell of it. It wasn’t until 2017 when I really started to focus on SEO keyword optimization and affiliate programs that I was able to generate my first $5,000.

Fast forward to 2022, my blog is consistently generates money for me passively. Of course, I spend a lot of time writing new articles and posting about them. This has always been a passion of mine however so for me it is not considered work at all.

The money I generate from blogging is a combination of advertisements, affiliate marketing, and personal travel planning that I do. In fact, you reading this post is in fact generating income for me!

I made about $3,000 a month from blogging in 2022 which I write in detail about how I actually make this much in my “how much do travel bloggers make” post.

Selling options to generate passive income

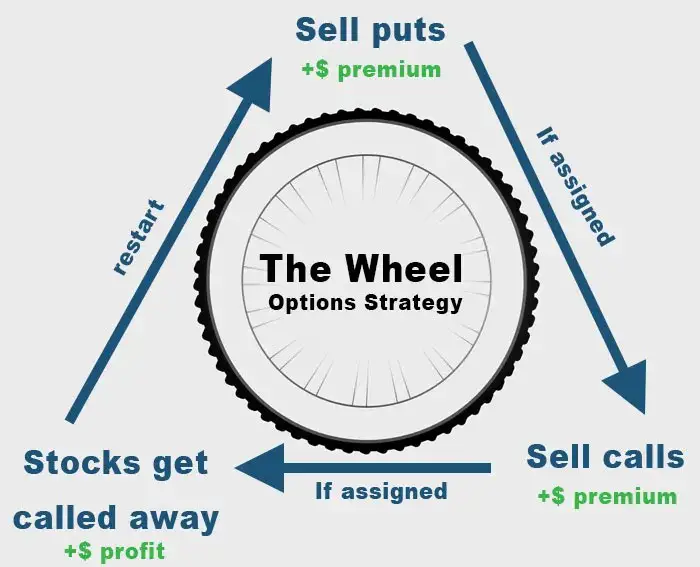

Trading is a great way to generate passive income. I’ve been using numerous strategies like selling calls/puts, aka the option wheel strategy for years now. I’ve also done numerous trades involving put and call spreads which are more complex.

Trading is not without its risks so by no means is this income source guaranteed or without its issues. It also requires time to research and understand what you’re actually trading otherwise you’re doomed to lose money. With the cash in my portfolio, I often times will run option wheel on certain stocks that I think are ripe for the picking.

In addition, I sell far out of the money call options on my existing holdings. I tend to target 0.1 to 0.15 delta call options which I find to be safer from being called away. The premiums generated from 0.1 delta options is low but because I have so much stock in positions, the small amounts add up quickly.

In total, these strategies net me $1.5k a month averaged out over the year (some months I take a loss) depending on how much opportunity I take.

Credit card hacking to travel the world

Finally, because I travel so much, I’ve long been a (self-proclaimed) master at hacking credit cards. This is only something that is fruitful in the US as the credit card offerings in other countries are mediocre at best.

I’ve written in great length about how I travel hack and open numerous new credit cards a year to pocket the sign on bonuses. These points and miles allow me to book free flights and free hotels in fancy places in the Maldives. In general, this is much money per month but it for how little work it is, it feels good!

It’s hard to quantify this amount in dollar terms but let’s just say it’s about $500 a month.

Continue to travel the world

I think there is a big misconception outside of people that retire early in that most people ask well what are you going to do? If you are “retired”, then you will just spend the rest of your time doing nothing?

This is of course a natural reaction to uncommon concepts. The truth of the matter is, just because you stop working doesn’t mean you are chained to your couch for the rest of your life. Life is about the possibilities and to do what makes you happy. I was just convinced that working in a cubicle for the rest of my days was not that path.

Sure I could have “retired” at the traditional age with at least $10-15m in the bank. But the question I asked myself is simply, “What can I do with $15m at 65, that I can’t already do at 35 with 10% of that amount?”

If you have no good answer for that question, then it is time to really think about. Or just pull the trigger and FIRE!

Thank you for your knowledge!

Glad you enjoyed it!

Fantastic post, 80 countries before 35 is insane! One thing I didn’t see mentioned (maybe I missed it) was at what point in your journey did you choose to quit your job, when you hit $1M?

Hey Ruchi, thanks for the kind words! It’s easier to up the country count when you live in Europe :). By the time I left, the portfolio was already around $1.3m but it was at the 1m mark that I finally thought htis is possible!

On the ‘Net Worth data’ tab in your spreadsheet columns BS to BW all have the same month/year of 12/2015. Maybe all the dates to current are just off.

Should have seen this when I was 24! Will definitely tell my son about it.

Good job!

Haha anytime is a good time to start!

Are you still living in Europe? Thought you were living in Germany in 2020, not NYC.

Yes still in Europe!

Hey Johnny,

Great post, and even better execution of the FIRE plan. Bravo and congrats!

Obviously, you are a really smart guy who does not need unsolicited advice, but what the heck –

People who retire early tend to do it when the S&P 500 is near all-time highs, not bottoms. But shit happens – dot.com bust, Great Recession – and going through them, watching those beautiful wealth charts turn down, and drop quarter after quarter, is not fun. Been there, done that.

Thanks Tony! yes you’re definitely right that people pull the plug when riding market highs. 2020 was scary but the FED learned from 2008 that if you just juice the economy enough (for better or for worse), it will snap back. Of course, past successes never guarantee future returns so there is always the tail event of all tail events that is possible int he future. And everyone has a “I will do xyz” plan when the market crashes but when it really does happen, rarely does it go to plan. However, there’s no point to wait around for that next tail event to happen. I feel like my withdrawal rate is quite small anyhow and is quite easy to reduce it if I must so I am comfortable with that.

Hi Johnny, I really enjoyed this read. Was not expecting to read this when I first stumbled on your site but this was very interesting and different than other travel blogs out there! Can I asked what you did for a living where you earned as much money as you did?

Hi Jordan, thanks for the kind words! I was living in New York City working in their biggest sector (so probably doesn’t leave much to the imagination). I won’t get too much into the details. However, I can assure you that the money I made, while good by most standards, is in fact extremely average or even below average.