Traveling the world is tops of many people’s bucket list, mine included. However, lost among the over photographed Instagram accounts and “I quit my job and now I magically travel the world” blogs, is the cost of traveling. I often get asked how I can afford to travel so much? There are plenty of ways to save on travel. Entire books have been written on this topic.

One of the biggest expenses for traveling is flying. International flights can easily top $1,000 round-trip and be the roadblock for many people to achieving their wanderlust dreams. In the past two years, I’ve successfully paid next to nothing and essential fly for free. Whether it be domestic flights around the USA, or internationally to Europe or Asia, I have saved something between $5,000-$7,000 on flights.

It’s really not that hard for people to fly for free like me, or at least save significant amounts of money.

This post is part of my comprehensive guide to travel hacking where I go into detail about how I fly for free, book the cheapest flights, and how to be an overall better traveler!

How to Fly For Free

The secret to flying for free, is credit card bonuses. This may not be much of a secret, but knowing how to exploit the system can mean the difference between one free flight and ten free flights. While using the right credit card is very important to maximizing rewards, it is the sign-on bonus that is offered by the dozens of large credit card companies out there that can be worth thousands of dollars in combination.

For the purpose of this post, I will focus on sign on bonuses to illustrate how I travel for free using credit cards. As a disclaimer, I do NOT travel for work, and do NOT have significant business expenses. I’ve read numerous bloggers boasting about how they traveled first class around the world with their credit cards but they also own legitimate businesses and rack up tens of thousands of dollars in expenses. The average person, myself included, does NOT have the spending power, and hence rely on credit card bonuses, as opposed to the credit card itself to fund free travel!

Credit Card Sign Up Bonuses

Credit cards have largely a negative reputation as a mechanism to destroy people’s finances. This is certainly true for those that cannot handle their finances. For those that can however, there are so many benefits including rewards, trip insurance, purchase protection, and concierge service. Credit cards offer different reward incentives for their use.

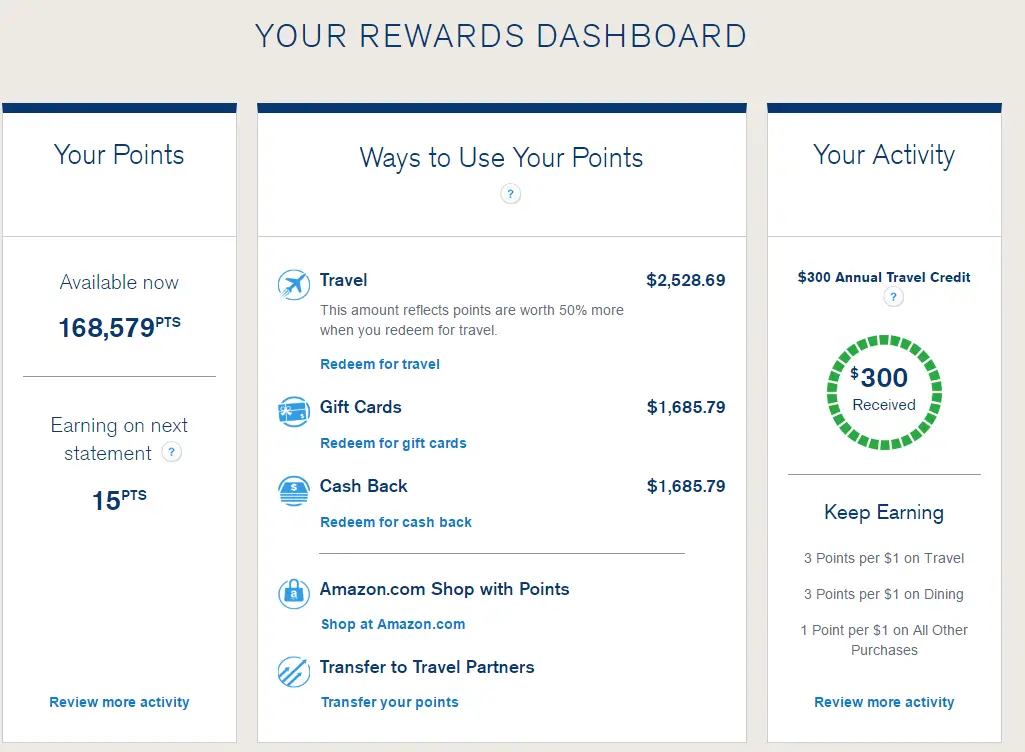

For example, the Chase Sapphire Reserve offers 3x points per dollar spent on dining and travel, so if you plan on spending a lot of money in this category, you will accumulate a fortuitous amount. For the purpose of this post, I will focus primarily on the most lucrative part of the rewards, the sign-on bonus.

To travel for free, the secret is to pocket as many of these sign on bonuses as you need to fund your travel lifestyle. These sign on bonuses can range from $150-1,500 depending on the terms and conditions of the card. All credit cards require you to hit a minimum spend amount within a certain time frame. This can be anywhere from $500 to $5,000 within the first three months. Once you’ve satisfied this, the free money is all yours, and you’re free to do whatever you want with it.

Churning Credit Cards

This practice is known as “Churning”. There are numerous blogs, podcasts, and even books dedicated to the art of “churning” credit cards. This post is nothing revolutionary to what is already available on the internet. Rather, I am trying to sum up everything I’ve learned from churning credit cards in this one concise post.

How many credit cards is enough?

I’ve signed up for a dozen new credit cards in the past two years and have pocketed all the sign-on bonuses they have to offer. There is no right number of credit cards to have. Depending on how much you want to travel and spending power (ability to hit the spending requirements), 20 or even 30 credit cards is not a crazy proposition!

How can credit cards be so lucrative?

For my foreign readers, this will come as a bit of a shock, In America, our credit cards offer insane reward programs. I’m talking about sign-on bonuses that can be worth well over $1000. Yes, over a thousand bucks to sign up for a credit card!

This is a phenomenon I’ve only witnessed in the US. Living in South Africa, credit cards had minuscule reward earning potential, and a sign-on bonus was almost unheard of.

There’s no definitive theory as to why America has the most lucrative credit card rewards. My theory is that America is the land of debt, and we as a country love to buy stuff we don’t need, and subsequently rack up thousands of dollars in debt in which we pay atrociously high interest rates on. So while the rest of the world uses credit cards as a more convenient method of cash payment, we in America use credit cards to fund lifestyles we can’t actually afford, and end up paying for it for years.

The banks don’t make money of people like me pocketing the sign on bonuses, but rather the people that spent too much and now pay 15% in interest every month. It’s those people that I have to thank for my free travel.

My Credit Card Inventory

Over the past two years, I’ve signed up for the following credit cards. This is in addition to a few credit cards I’ve already had for many years that are no fee (Capital One, Chase Freedom etc.)

Credit Card |

Issuer |

Annual Fee |

Sign on bonus |

Minimum Spend |

Cash value of Bonus |

| Chase Sapphire Preferred | Chase | $95, waived for first year | 55,000 points | $4,000 within 3mo | $700-800 |

| United Mileageplus Explorer | Chase | $95, waived for first year | 55,000 United Miles | $2,000 within 3mo | $500-750 |

| Chase Freedom Unlimited | Chase | No Fee | 15,000 Chase Points | $500, within 3mo | $225 |

| American Airlines AAdvantage | Citi | $95, waived for first year | 50,000 American Miles | $3,000, within 3mo | $500-$700 |

| Citi Prestige | Citi | $450, NOT waived | 50,000 Thankyou Points | $3000, within 3mo | $625-800 |

| Chase Sapphire Reserve | Chase | $450, NOT waived | 100,000 Ultimate Rewards Points | $4000, within 3mo | $1,500 |

| Delta Gold | Amex | $95, waived for first year | 50,000 Delta miles | $2000, within 3mo | $500-700 |

| Chase Ink Plus Business | Chase | $95, waived for first year | 70,000 Ultimate Rewards Points | $5000, within 3mo | $1,050 |

| Merrill+ Signature | Bank of America | No Fee | 50,000 Points | $3000, within 3mo | $650-1000 |

Total Cash Value: |

$6,250 – $7,525 |

I’ve focused the majority of my credit cards on travel-centric cards. I’ve used the various reward points on all my credit cards solely on redeeming flights. Flights, at least for me, are a big part of my travel spending, and also the most lucrative redemption category for many of the cards I’ve signed up for.

There are so many more cards I can and may sign up for the in the future like the various hotel credit cards (Marriott, Hilton, etc.) that I can seemingly have enough credit card points to sustain my flight expenses for the foreseeable future.

Why Annual Fee credit cards are important

The secret is to pick the cards with annual fees as they give the best rewards. Many are turned off to the idea of paying a “fee” for a credit card, but I would tell those people they are leaving a lot of money on the table. Most of these cards waive the fee for the first year, allowing me to cancel the cards before I actually have to pay anything.

For example, the Chase Sapphire Preferred has an annual fee of $95 (waived for the first year), and a 55,000 point sign-on bonus worth $700-800 depending on how you spend it. The Chase Freedom, a no annual fee option from Chase, has a sign on bonus of $150. The Sapphire Preferred bonus has a cash value almost 5 times that of the Chase Freedom, This isn’t even factoring in the actual benefits and point earning potential of the Sapphire Preferred, which I will touch on in future posts.

Bottom line, the best cards with the best bonuses almost always have an annual fee.

A $450 annual fee is way too high?!

These cards for the newcomers undoubtedly have a big sticker shock. These fees are usually not waived for the first year so before you’ve even swiped it once, you’re already paying $450 out of pocket. However, these cards are in fact the most lucrative. The Chase Sapphire Reserve for example has the following benefits:

- $300 annual travel credit

- 100,000 point sign on bonus worth $1,500 towards travel

- 3x points on dining and travel related expenses

- Points are worth 50% more when redeemed on Chase travel portal

- Free Priority Pass Select (absolute must when traveling internationally!)

- Free Global Entry ($100 credit)

Just using the first bullet, the annual fee actually becomes $450-300 = $150. A $300 annual travel credit is essentially cash. This applies to any travel expense: taxis, hotels, airfare, tours etc. Anyone that isn’t able to spend $300 a year on travel related expenses should not be churning credit cards!

Too many credit cards hurts my credit score?

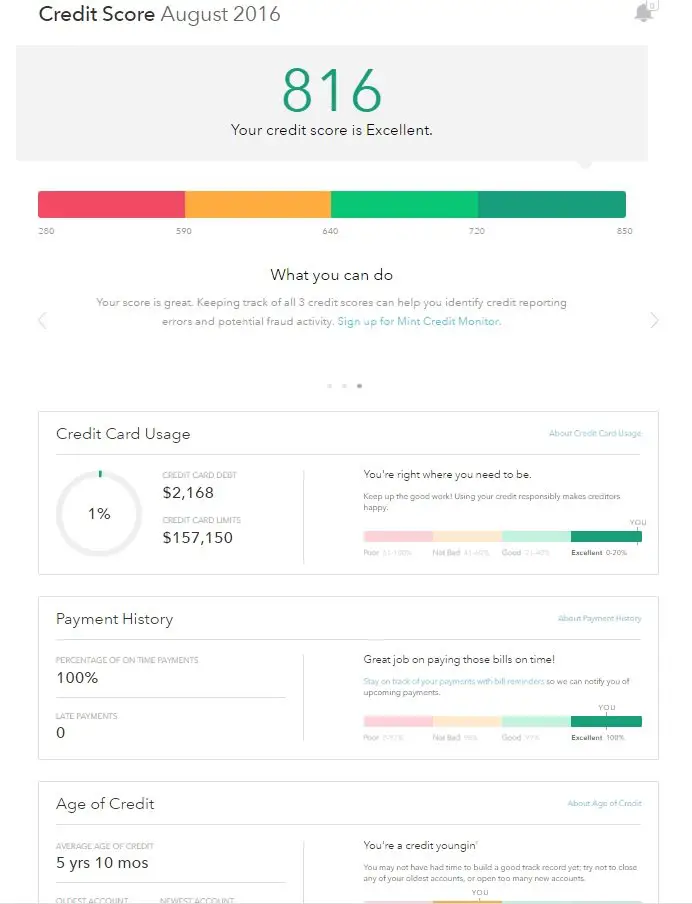

The age old question that I always get asked, “Does opening too many credit cards hurt my credit score?”

The short answer to this is no. (Read More: Why Opening and Closing Multiple Credit Cards Doesn’t Kill Your Credit Score)

Your credit score is NOT determined by how many credit cards you open and close, but rather mainly by the following:

- Payment History – If you do not pay on time, this will absolutely hurt credit scores the most.

- Credit Utilization – Your total monthly debt / total credit availability. Ex: If your credit cards total $20,000 credit limit, and your monthly bill is $2,000, your credit utilization is %10

- Length of credit history – The total history of your credit is an important determinant for credit scores. The longer you’ve had a credit card, the better. The secret here is to keep your cards that do not have annual fees and never close those out so to satisfy this requirement. I have credit cards from college from a decade ago that I never use, and I choose to keep them open for this purpose.

Closing credit cards hurts my credit score?

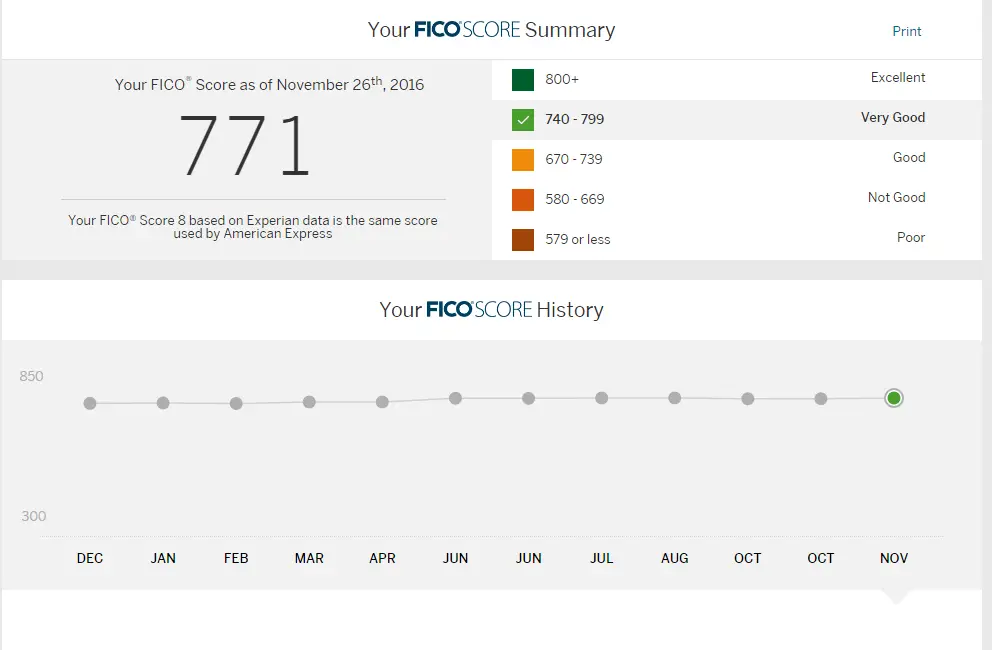

Opening and closing credit cards may cause your score to fluctuate ever so slightly, but it is negligible. I’ve opened at least a dozen credit cards in the last two years, and my credit score has actually gone up. Why? Because my credit utilization rate is very low.

Because I have so many credit cards, my total credit availability is something in the $200,000-$300,000 range. If I spent $2,000 a month, my credit utilization is a mere 1%. This makes me MORE credit worthy in the credit bureaus eyes as it looks like I am so frugal with my credit usages. Food for thought.

How do I start flying for free?

Now that you know that credit cards can provide a

- Good to Excellent Credit Score: This is obviously the most important factor. You need to have high credit scores to get the best cards. 700 is a good score for most, and 740 is the cut off to be automatically approved for most of the higher end cards.

- Spending Power of at least $1,000/mo: Looking at my credit card inventory above, all these credit cards require a “minimum spend” within a certain time frame (usually 3 months). The standard is usually $3,000 in 3 months. Living in New York, this is not a problem (sadly), but for those that can’t spend this much, consider paying your rent using a third-party credit card service and eat the fee (usually 3%) as a way to quickly reach your spending requirement

- Ability to Pay on time: This isn’t a MUST, but your reward ratio goes down significantly as soon as you pay interest to the credit card companies.

- Organization: If you’re going after multiple credit card bonuses at once, like I do, it is imperative to organize your credit cards so you know exactly how much you’ve spent on which card. There’s nothing worse than thinking you’ve hit the requirements to get the bonus but did not spend enough. Credit Card companies will rarely give you the benefit of the doubt if you “forgot” to spend enough.

Hi,

assuming I have 3 credit cards with some sign on bonus that I already received. So I have miles split on three credit cards now. Is there a way to use those miles to buy an expensive flight? Or is that only possible if all cards are from the same bank?

I am just asking in general as I have not started with buying credit cards yet. But that question seems pretty important to me.

Also, what if I have 50.000 miles and use 45.000 miles for a flight, are the rest 5000 miles useless or can I transfer it to another card where I have more miles in order to get a higher total number of miles?

Hi Cartman, if you have airline miles from three different credit cards, as long as the credit cards belong to the same airline, then the miles wll be combined. But if you have a Delta credit card and an United credit card, then of course you can’t use those in conjunction with each other.

Also, any leftover miles you can save for future flights or if you don’t plan on getting more miles, then it will probably be pretty useless with a balance cof 5k.

Do you know good cards for Germany or the UK?

As a South African living in South Africa .. what’s the best credit card I can apply for in terms of travel rewards ?

Very informative, thanks.

Thanks!

Would love to know the answer to this too

Murica is bankrupt though…brown stuff could hit the fan any minute now…then what…

Good luck Johnny! I remember you telling me you were going to do just this! All the best buddy…hugs.

I wonder if one gets the points if the balance from your old card gets transferred on to the newly opened card, for example “Chase Sapphire Preferred”.

ha! i like your way of thinking. Unfortunately, the credit card companies are smarter than that and balance transfers are a specific type of transaction that will certainly not trigger any reward points. Otherwise I would just rack up 20k of expenses and transfer them back and forth between two cards until I have a million points!

Hey great write up! Such a useful post, especially about the credit score part.

I saw from your inventory that you don’t have the AMEX platinum? Is that one of your older cards or is there a reason you don’t have it?

Yes, I am indeed missing the AMEX platinum. I’m not a big fan of AMEX point earning structure to be honest. It’s usualy 1x point per $1 spent which lags far behind that of Chase and Citi. Also, the current bonus for the AMEX Plat is 40k which is hardly worth it with the annual fee being $450. I’ve heard rumors that AMEX is completely redoing their personal platinum card and will release a new version of it next year to compete with the sapphire reserve. I will definitely get it if I can get 100k points as a sign on bonus.

Hey cool, I actually know someone in real life who also knows about credit card churning! I don’t have as many cards as you, but my wife and I have both gotten the Chase Southwest Premier and have flown SJCPDX on points for the past year and a half or so. Interesting to see that your credit score is up in the 800s. I’d like to see a follow-up post in 2 years when you start canceling your cards. 🙂

Actually, I’ve already canceled three cards in the past year and my score’s in tact. I will continue to cancel them early next year. Again, canceling and opening credit cards aren’t the main factors in your credit score!