One of the most important things in the financial independence space is the concept of the 4% Safe Withdrawal Rate, or the 4% rule, or simply, “The SWR”. This concept essentially kicked off the FIRE movement when certain people realized they could just withdraw a certain amount per year from a portfolio of diversified stocks/bonds and not go broke.

The 4% rule has plenty of controversy surrounding it with supporters and detractors all abound. Nevertheless, it is a sound investment strategy that many people (including myself) swear by. In order to understand financial dependence, a firm standing of what the SWR is (and is not) is absolutely imperative.

I will go into detail in this post of what the 4% rule is, what its limitations are, and if it really is the holy grail of personal finance!

Note that the Trinity study and the 4% SWR was performed on US market history (investment in the S&P 500) the principals apply to other nations as well.

What is the 4% safe withdrawal rate?

If you’re new to the concept of financial independence and retiring early (FIRE movement), make sure to read my post about how I achieved financial independence at 34.

Safe Withdrawal Rate: The Maximum rate at which you can withdraw from your investment portfolio without running out of money

How do you determine your safe withdrawal rate?

This is the million dollar question (no pun intended). Figuring how much money you need per year when you retire is the most important step. But how do you know how much you need?

Depending on who you ask, the answers will vary wildly.

The Financial Independence noob

A newby to the FIRE movement might say you need $5m or $50m just because they never thought of this question before. My favorite example of this is when I asked one of my colleagues from one of my previous jobs what her “number” would be.

She promptly replied that she would need $50m to stop working now. I was completely dumbfounded as I knew exactly what she did, how much money she made, and what kind of growth trajectory she was on.

Working in the financial services industry meant above average income but in no world would she ever make $50m in her entire lifetime. I asked her how she could pick such a number when she had no prospects to make such an amount, thereby never being able to retire. She just responded that it would be a number she was comfortable with. I even asked her if she was planning to become the CEO to which she said no chance.

Some people just don’t know what they are talking about!

The Financial advisor

A financial advisor might tell you that you should look at your pre-retirement spending and budget accordingly for that which will land somewhere between $2m to $5m. They’ll warn you that $1m is not enough these days because you just need more money for whatever. The problem is financial advisors don’t understand the early retirement movement and would rather not encourage it as it runs counter-intuitive to their business model.

Often times, they suggest you need a lot more money than you actually need so to keep you working longer and thereby paying their fees for longer.

Your friends who spend way too much

A credible source may be asking the friends in your social circle how much they think they need. No I’m just joking as this is often times a horrible way to go.

I worked my whole life in the financial services industry and it wasn’t uncommon for young people to earn a half million dollars a year. On average, people would earn at least $150k-$200k which might seem like a lot of money, but this doesn’t go far in New York. Many of my friends also had no grasp on personal finance and would spend money faster than it came in.

Therefore, the amount of money they needed was far more than the average person, myself included. Some of them couldn’t even fathom the idea of retiring early because they were in no position to even though they made $200k a year. Because the only life they knew was one of excess spending, their “number” was far higher. I mean if you think you need need at least $200k a year in spend, then you’ll need a minimum of $5m to retire.

Thankfully, that’s not the life I ever lived or cared to emulate. Traveling the world and living the good life places like Bali or Cape Town does not require so much money in the end.

The Financial independence enthusiast

The conventional approach from the FIRE community is such that you should take your yearly spend and multiple it by 25, thereby arriving at the coveted 4% withdrawal rate. If you plan to spend $40k a year, then you should have $40k x 25 = $1,000,000 in your investment portfolio.

In the end, $1m is your retirement number and 4% is your withdrawal rate, which I think is a very reasonable number.

$40k might be your pre retirement spending number or it may not be. $40k could also be what your yearly spend will be after you retire because you plan to do change your entire life and moving

You can’t predict the future, and shouldn’t try

You never know what the future holds but if the past is any indicators, you can be certain you will be taken for the ride of all rides from an economic perspective. Bear markets, financial crises, and everything in between are not an if, but when. Nevertheless, you have to pick a number at the end of the day because living in a world where you are planning for the apocalypse is just not a life that is worth living.

I decided that $40k a year is more than enough as I always knew I would leave the US which is one of the most expensive places in the world. FIRE’ing while traveling and living abroad is not only cheaper but much more exciting.

Why does the 4% actually work? Cue the Trinity Study

So you’re asking why does the 4% actually work? How did someone come up with this number and why does it have so much acceptance in the FIRE community?

In the simplest form, you can think of it as having a portfolio of diversified stocks (and or bonds) in your portfolio that pays dividends and appreciates at an average rate of 8-9% per year before adjusting for inflation. Let’s say inflation is 3% on average over the past century or so, which leaves you with 5-6% rate of appreciation in real dollars. If you’re spending 4% a year, then you will always have a surplus of 1-2% at the end of the year which means you should be able to live off this portfolio forever.

If a historical portfolio can survive multiple wars, recessions, hyper inflation & more, then perhaps it can survive the next 30-50 years

-Trinity Study basics

What is the Trinity Study?

The “Trinity Study” is a paper and analysis of this topic entitled “Retirement Spending: Choosing a Sustainable Withdrawal Rate,” by Philip L. Cooley, Carl M. Hubbard, and Daniel T. Walz, three professors at Trinity University.

This study is a backtesting simulation that uses historical data to see if a retirement plan (i.e. a withdrawal rate) would have survived under past economic conditions.

Put simply, the professors were asking, “If we had retired at any point during the last century, how much could I spend over the duration of 30 years without running out of money”.

What were their conclusions?

With a portfolio of at least 50% stocks (diversified ETFs like VTI) and the rest in bonds, you can safely spend 4% of your initial portfolio value adjusted for inflation and have a high degree of confidence that your portfolio will survive 30 years, and likely much longer.

This study was first run in the late 90s but has since been updated officially by its authors to include the financial crisis and the same conclusions hold.

This study is of course not meant to predict the future because no one knows what the next 50 years holds. However, if we can simulate historical conditions which include things like world war, hyper inflation, financial crises, recessions, and everything in between, perhaps this is somewhat reliable for planning for the future.

Personally, I think we live in a period of accelerated change. Things have always changed and evolved throughout the ages but due to the advancement of technology, the rate of change for the next 50 years will be much greater than the previous 50 years. What that means for financial markets, economic stability, and the Trinity study is anyone’s guess however!

How successful is the Trinity study?

So is the trinity study actually legit? Aside from the actual simulations run by the creator of the Trinity study, there have been countless studies and simulations run by people all over the internet (thank goodness).

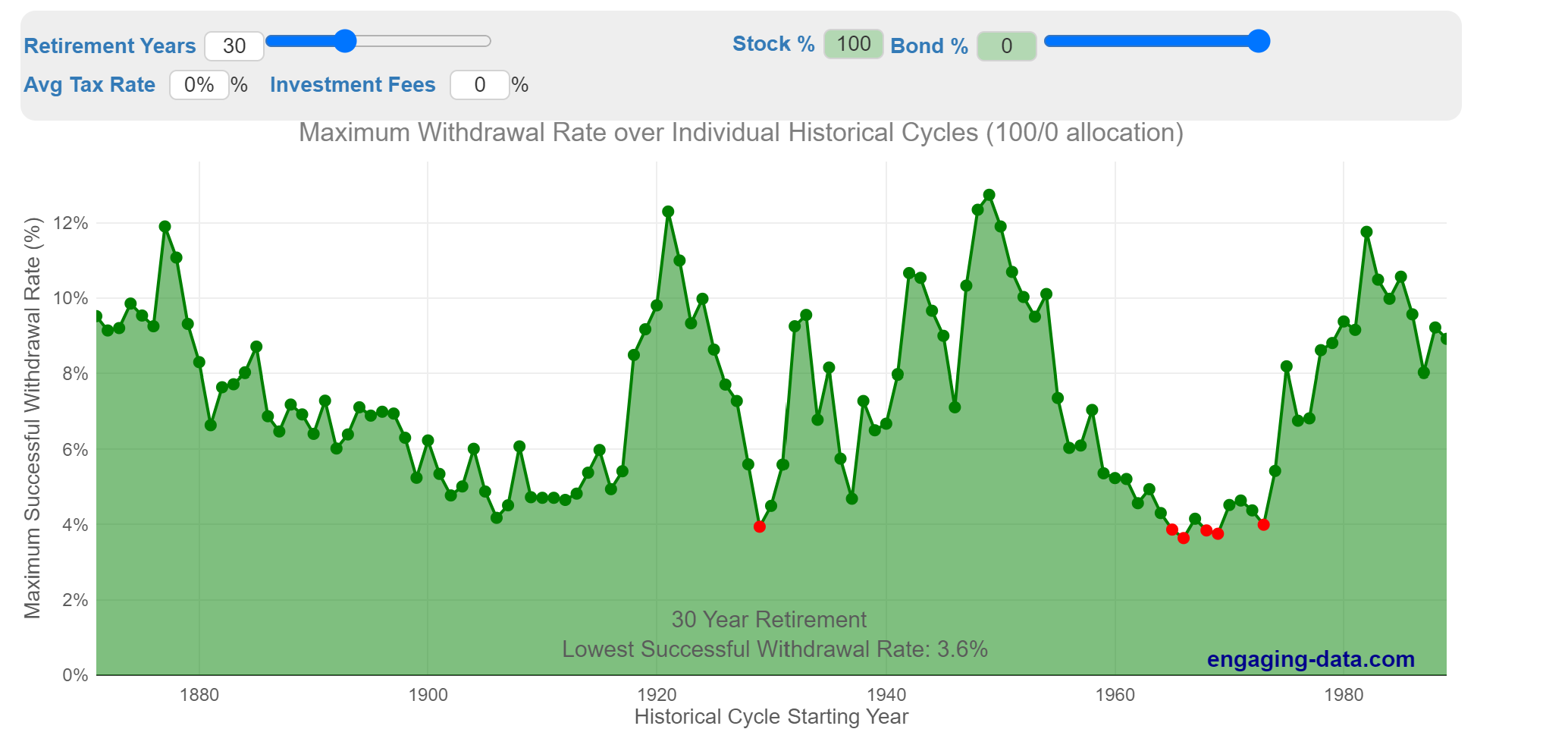

I’ve used the calculator at Engaging Data to simulate numerous scenarios depending on withdrawal rates, the duration of your retirement, and the allocation of the portfolio. The calculator then simulates a hypothetical retirement based on the market returns throughout history. The calculator has historical market data from 1871 to 2019. It is using real world historical data to see how much money you would leftover. For example, if you have a 30y retirement horizon, you would have retired in 1989 and the calculator uses the historical returns from 1989 to 2019 to compute its results.

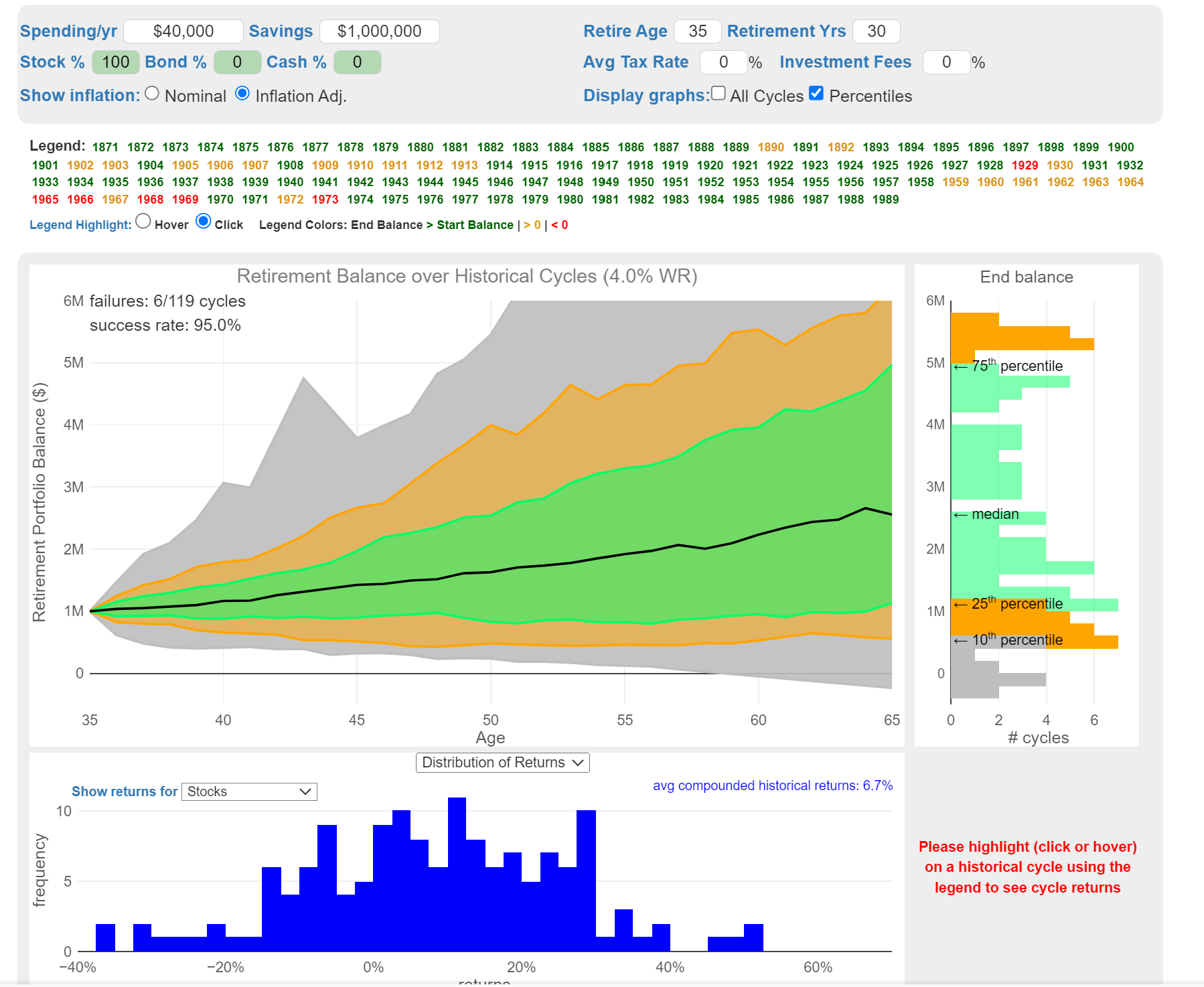

I ran the below calculator 100 times or so with different variables. As from this screenshot, you can see that this specific run is assuming a 4% withdrawal on a 30y retirement on a portfolio of 100% stocks which emulates my personal portfolio. I chose the results to be inflation adjusted because this is important, an average tax rate of 0% because I don’t plan to pay any taxes thanks to generous long term capital gains tax rates, and 0% investment fees because no brokers charge for trading anymore.

As you can see, a 4% withdrawal rate means that a portfolio of $1m in 1989 would mean I would have a $2.5m portfolio value at the end of the 30y period which means that it’s more than likely I would have more than enough money to survive retirement. The “success rate” is 95% which means the 4% safe withdrawal rate is very robust.

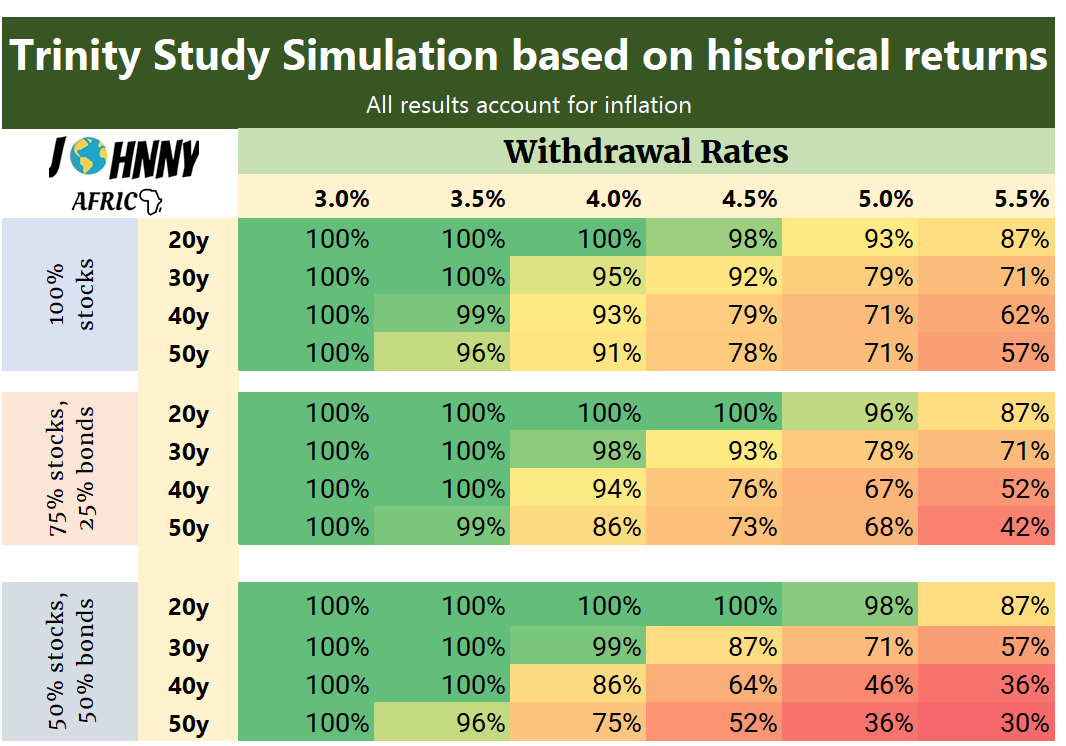

The below table is running this calculator with various withdraw rates and retirement durations. Someone like me will most definitely require more than 30 years in retirement. I am 35 after all. With average live expectations rising due to medical advancements, someone like me should be planning for a 50-60y retirement (hopefully).

As you can see, the 4% withdraw rate is very effective assuming a portfolio of mostly diversified stocks. With a portfolio of 100% stocks, I have a 91% chance of making it through a 50y retirement. I didn’t include anything over 50 years into this table because the results for a 60y, 70, 80y retirement were quite similar to 50 years.

A lower withdraw rate of 3.5% essentially meant you always succeeded according to the Trinity rule.

A higher allocation to bonds was generally less successful than higher equity portfolios likely because bonds have drastically underperformed in recent times. While generally, the common thought process is more bonds as you get older to minimize volatility but I’m not sure this is a prudent move as it was in the past.

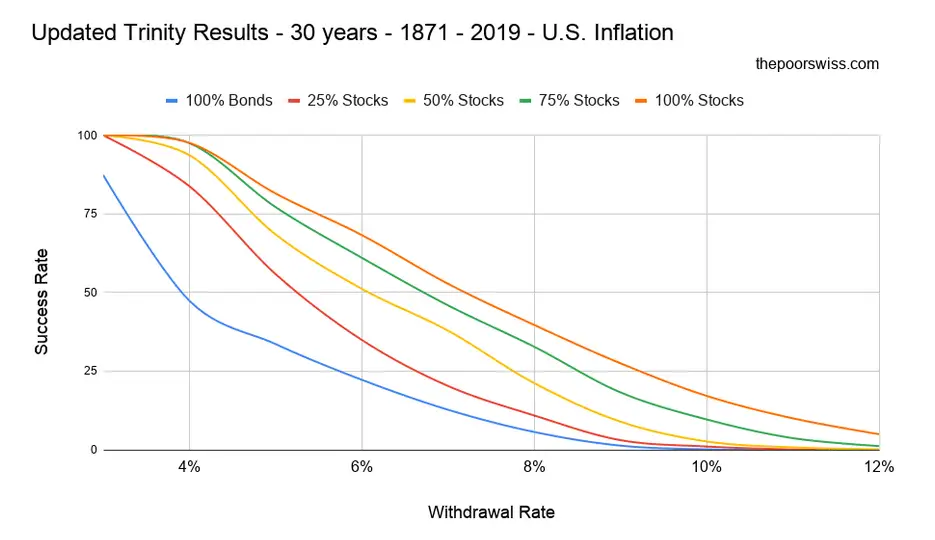

The Poor Swiss has a very nice chart summarizing the above based on different withdrawal rates and portfolio allocations.

What withdrawal rates work?

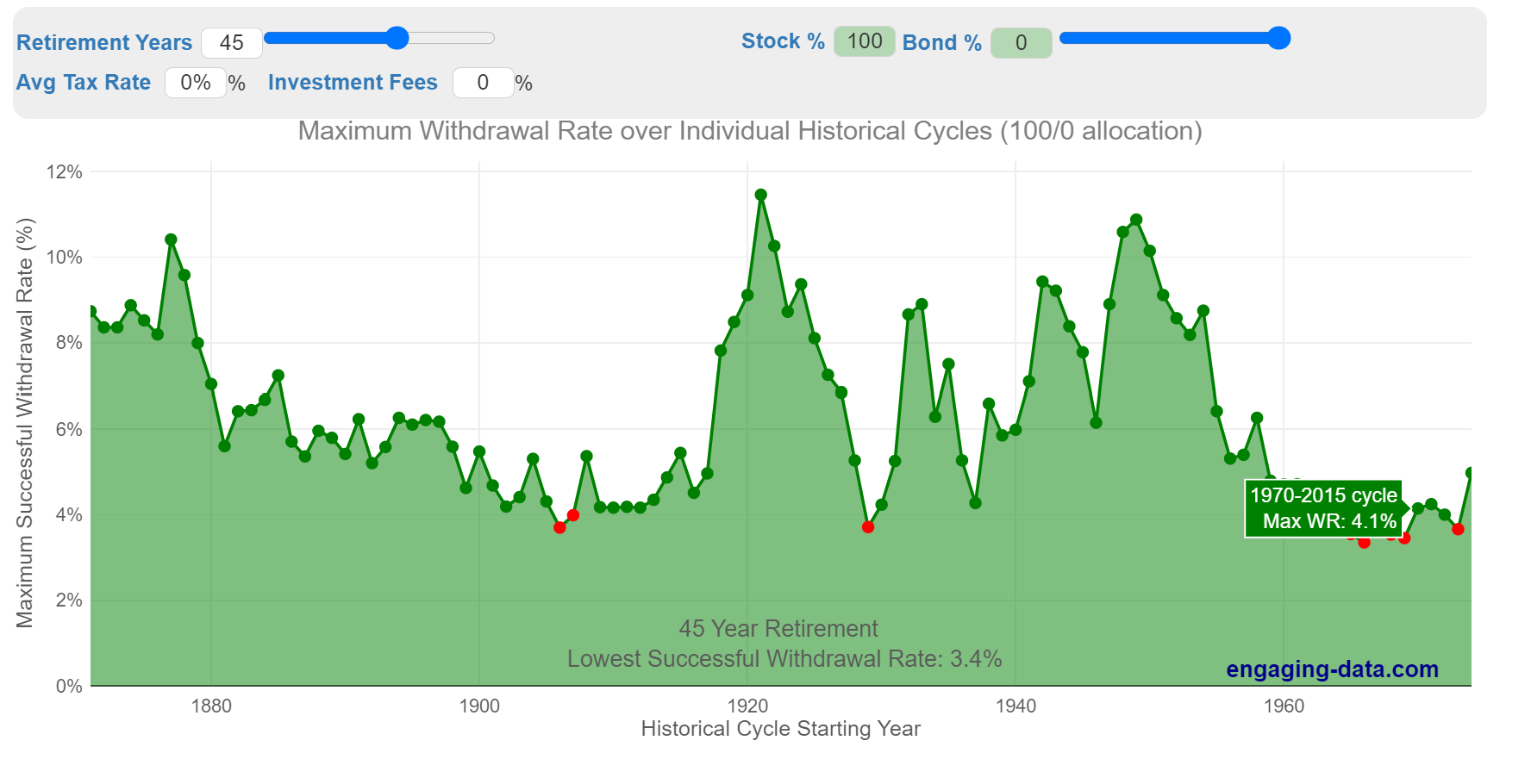

To further stress the Trinity study, Engaged Data has another calculator that let’s you play with what SWR would have worked depending on the year you retired.

I chose an example with a 45 year retirement and a 100% allocation to stocks as I plan to mostly be in stocks throughout my life. As you can see, the 4% withdraw rate has been almost always successful.

If you had a 45 year retirement starting in the late 1960s, you would have ended in the early 2010s which would have meant you went through the Tech bust of the 2000s and the great recession. Therefore, a withdraw rate of 3.4% would have been required to survive that scenario.

Does the SWR account for inflation?

Stocks in theory outperform other investments when inflation rises. This might not be the case in the beginning when inflation first starts increasing due to fear in the markets, but over the long run, stocks perform well. This is because if a big corporation increases prices while overall salaries increase, then overall profits should therefore increase leading to a larger share price.

The common practice for using the SWR is to increase your yearly withdrawal by the inflation amount. For example, if the CPI (inflation) is 5% in a year and your safe withdrawal amount is $40k, the next year you can withdraw $40k + $2k = $42k and your portfolio will be in tact.

In reality, your real inflation figures will be different than the official CPI report released by the Government. A lot of these numbers are impacted by housing and energy costs which might not directly affect you as it might others. Conversely, you might see that you need more money than what the CPI is because you spend more money on food and going out for example.

Adjusting your SWR by inflation is merely a guideline, a way of saying that the study works and accounts for the inflation.

Retiring right before a huge market crash

If you happened to retire in 2000 at the height of the Tech bubble, you would have seen an immediate crash in the value of your portfolio to the tune of 35%. The portfolio recovered over the years but then you were hit with the Great recession which wiped out 50% of the value of stocks. It wasn’t until 2011 that the losses from 2008 were recovered.

Sequence of Returns Risk

In this case, you would have had a lost decade and your returns would have been muted. Withdrawing from your portfolio when the market is at the lows will severely impact how much money you have in the future. In other words, when you retire is actually very important.

This is called the sequencing of return risk, aka the risk of retiring in the wrong sequence of events. You want to most ideally time your retirement (When you stop working) to not coincide with market highs because you have a higher chance of markets dropping and taking your retirement portfolio with you.

Retiring in 2000

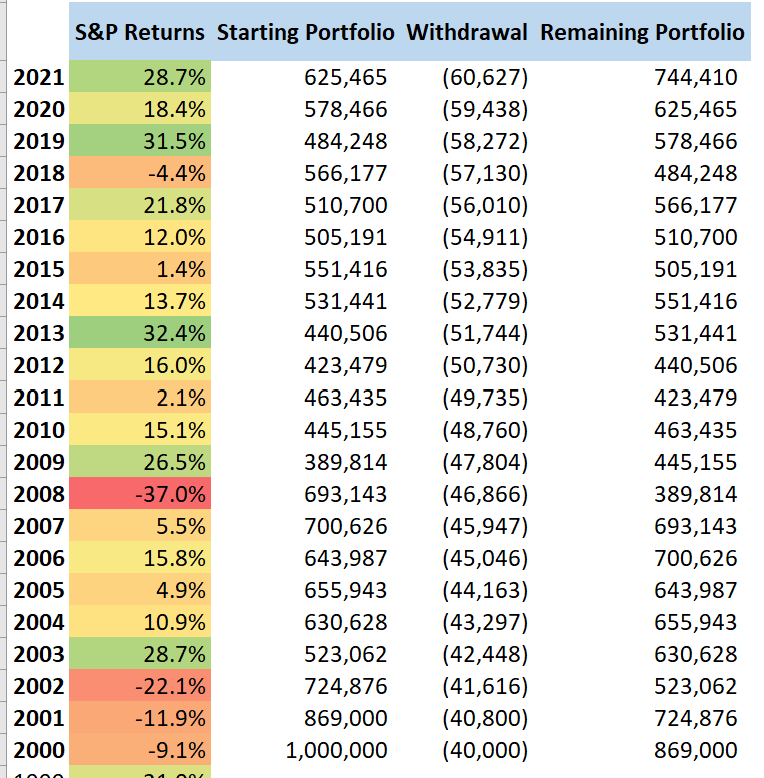

Here is a table that shows the historical returns on the S&P 500 on a starting portfolio of $1m, and a 4% withdrawal rate that increases by inflation every year (assumed 2%).

As you can see, the early 2000s were not kind to investors. If you had $1m invested in 2000, it would be worth just over half of that 3 years later assuming a $40k yearly withdrawal. Because of how much you lost from the beginning, the portfolio never really recovers even 20+ years later!

Remember: The Trinity study is not a flat 4% withdrawal every year depending on your portfolio balance but simply 4% of your starting retirement balance.

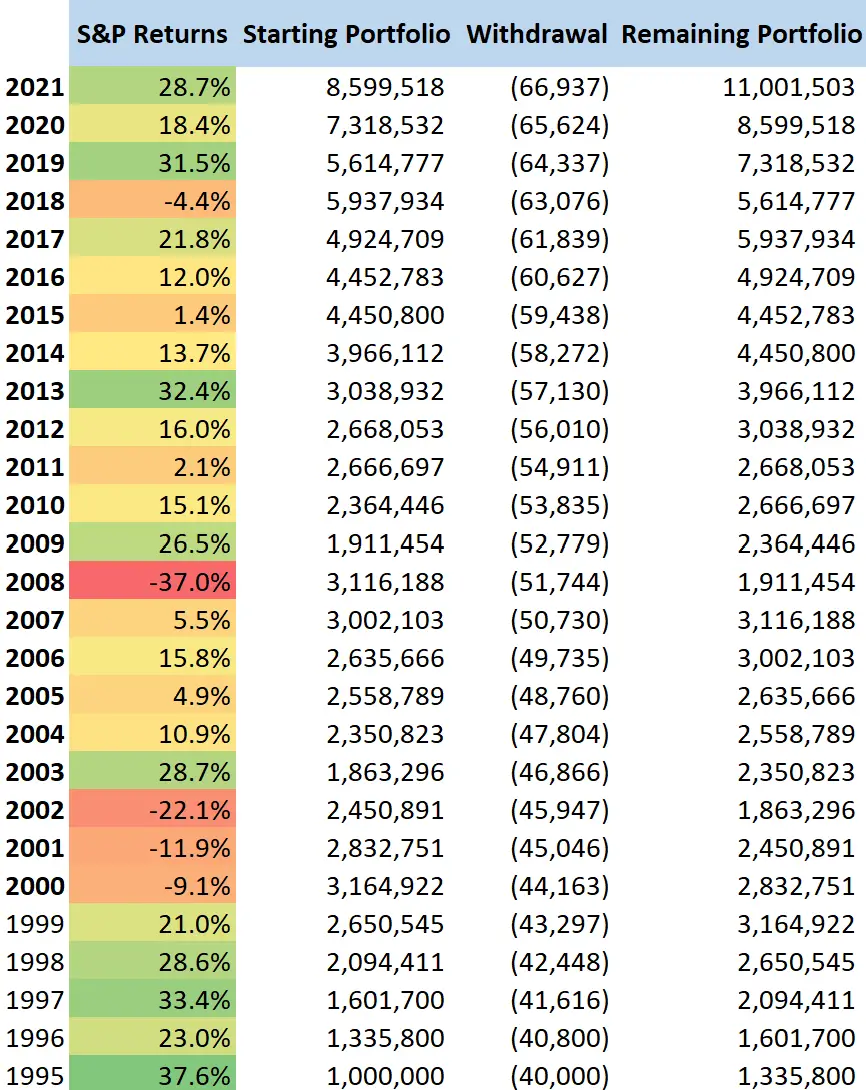

Retiring in 1995, totally different

If you retired 5 years earlier with $1m in the bank, you would have had a much different scenario. The mid 90s were very strong for the markets and you would have almost doubled your money before entering the tech bust.

As you can see, this picture is extremely different. Yes you would have still lost a lot of money during the tech bust and the Great Recession as you can see from the declines in 2002 and 2008. However, because the value of your portfolio is already so high, withdrawing $40k to $50k is a substantially smaller percentage of your overall portfolio than the sequence of risk returns from the first example.

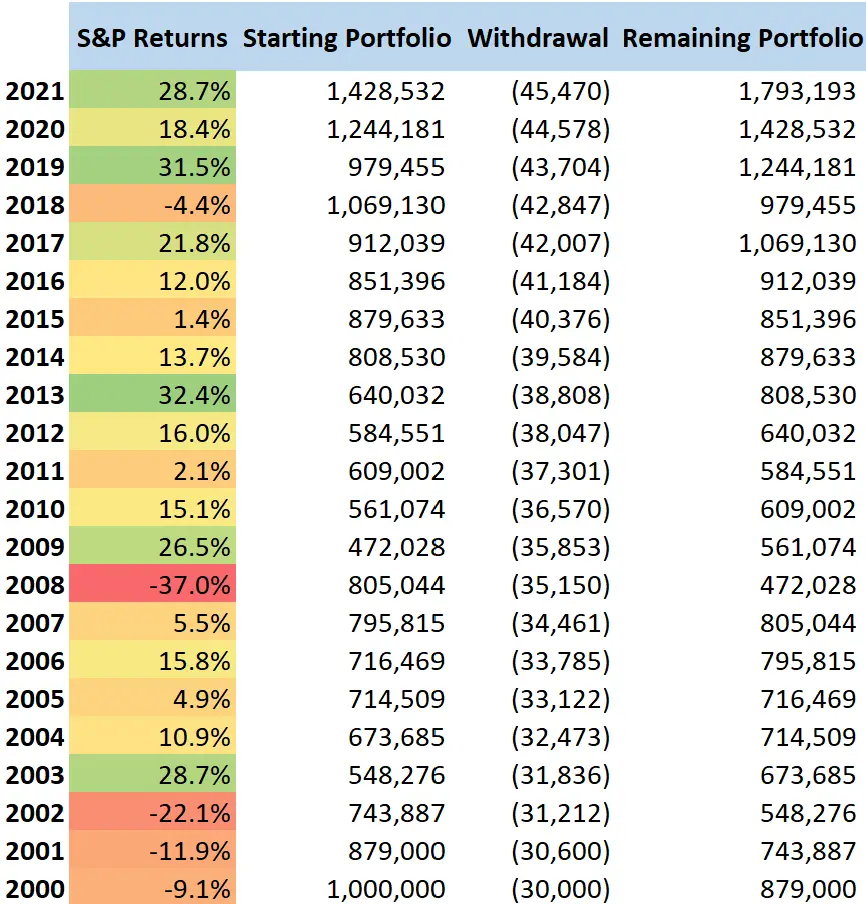

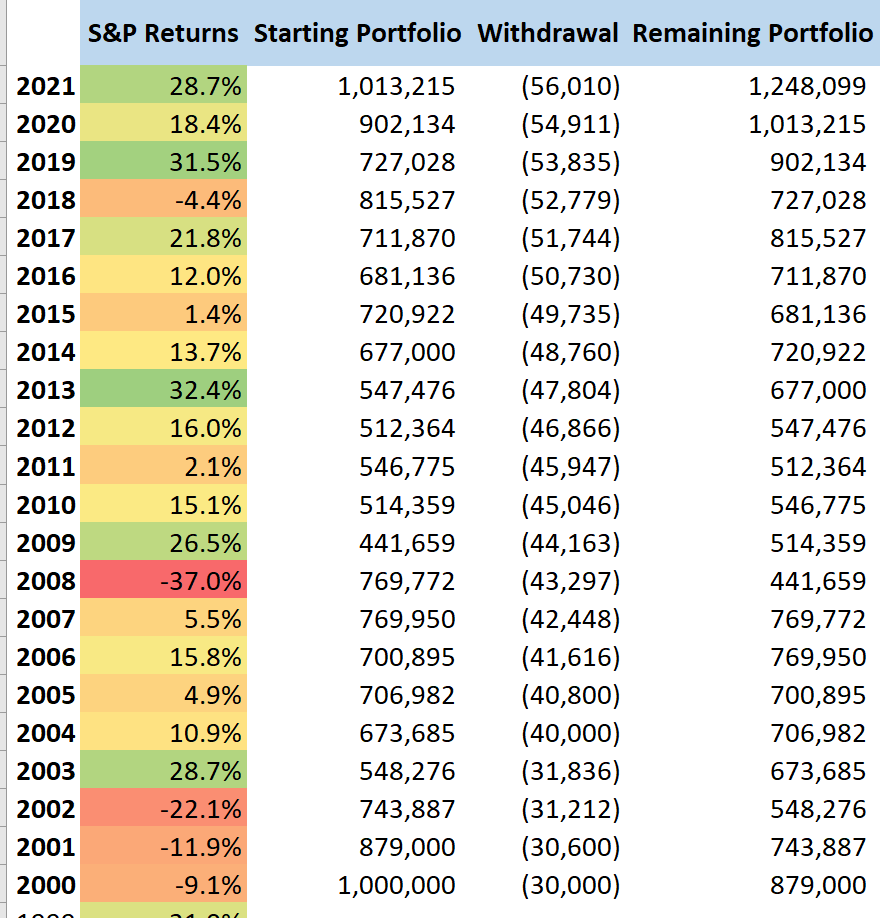

Retiring in 2000 but with a 3% withdrawal rate

If you retired in 2000 with a 4% withdrawal rate, it would have been scary to watch your portfolio crumble. However, if you switched this to a 3% withdrawal rate, you can see how quickly this changes the equation.

Simply reducing your spending will drastically improve your chances of success (which was already proven in the table from the section above). As you can see, if I changed to a 3% withdrawal rate, then I would have almost $2m in my portfolio as of 2021. This is a huge difference vs retiring in 1995 but it still beats the original scenario!

Of course, this defeats the purpose of a 4% withdrawal rate so let’s see what it would look like if I started with a 3% withdrawal rate in 2000, and switched to a 4% withdrawal rate in 2003 once I saw the market was improving.

You end up with a smaller portfolio as you’d expect but you are still above your initial investment.

How to minimize the sequence of returns risk?

In the end, it’s impossible to predict what will happen with markets. You might be one of the very unlucky few that pulls the trigger right before a bear market. This might seem scary but in the end, you have to pull the trigger at some point, otherwise you’ll just never end up doing it out of fear.

There’s no fool proof way to minimize the sequence of returns risk but here are some of the strategies I employ.

- Employ a bond tent: Allocate more to bonds in the beginning years but switch to equities after the first few years.

- Build in a sufficient cushion: Instead of retiring right when you hit your “number, consider working a few more months to pad your portfolio

- Lower your withdrawals during bear markets: It’s unlikely you need to spend exactly 4% a year. If there’s a protracted bear market, lower your withdrawal rate to 3% and wait it out.

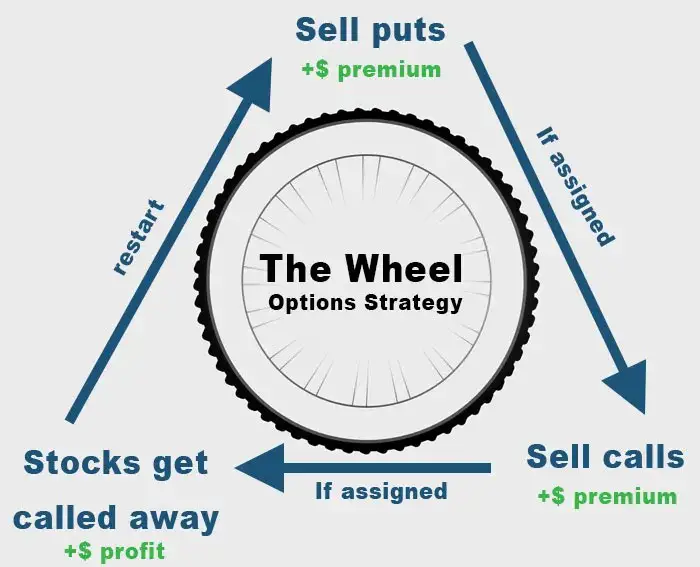

- Withdrawing only at the market highs: I only withdraw when the markets at or are near their highs. I have sufficient side income to cover my day to day expenses as well as other activities like selling options to generate passive income.

- Side or part time income: In protracted bear markets, there’s no shame in trying to find an extra source of income whether that’s going back to work or doing a side hustle.

Is a 90% SWR success rate good enough?

As you can see from all the above analyses, the 4% SWR is actually somewhat of a very conservative scenario. Yes there are instances where the 4% fail but in general, it is quite a robust calculation.

In many of the examples, even withdrawing 5% a year yielded unfounded success with portfolio value rising substantially.

Trinity study is more than just 30 years

The Trinity study was done on a 30y time frame. For early retirees, it’s likely you’ll need a lot more than 30 years. 50-60 years is the more adequate time frame especially as medical advances mean we will all live longer.

But as you’ve seen in the previous examples, the SWR is quite robust for retirement periods longer than 30 years, much longer in fact.

In summary, the 4% withdrawal rate will get you well past a 90% success rate. Success is defined as not running out money, or having an account value above 0 when the retirement period is over.

But is it really this easy? Can you really sleep sound at night just setting this type of advice on autopilot?

Here are some common complaints about the Trinity rule and here are my comments

- The time period the Trinity study was conducted in was in a time of prosperity and growth; this won’t be the case in the future

- Yes, the study was conducted during times of growth. However, this growth was also met with multiple wars, recessions, hyper inflation, multiple financial crashes and more. Not saying that times in the future won’t be different of course, but who can predict this?

- Inflation will outpace any gains and wipe out my portfolio. Costs like healthcare, housing, food etc. have all outpaced CPI

- Costs for healthcare and housing have definitely outpaced the inflation rate, this is without a doubt. However, the return of the S&P takes this into account and with rising costs, markets will rise as well. That is what the Trinity study is based off of. Worst case, just move out of the US to a country with first world healthcare 🙂

- The 4% withdrawal rate has failure and you run the risk of still going broke

- This is not untrue, but will you live your life based on something that has a very small chance of happening? If so, when will you ever actually retire because you’ll always be scared of running out of money?

Trinity study does not account for any extra income made during retirement

The Trinity study is based on the fact that you will never work or earn another dollar again or change their retirement strategies like the below:

- Never earn another dime, whether it’s through side income like blogging or taking on some part time job

- No additional income from social security or recurring pensions

- Never adjusting your withdrawal rates: This is important because as mentioned above, I would absolutely lower my spending if markets were to materially decline

- Never spend less as you age (which is common)

The 4% safe withdrawal rate is merely a study that uses fixed assumptions. It really is more of a guideline, a general overview of how to FIRE for dummies. In practice, it’s unlikely you’ll spend exactly the 4% withdrawal rate every year, and it’s unlikely that you’ll be a lifeless robot following the directions of some financial paper.

If you’re financially savvy enough to obtain a portfolio of $1m+, it’s likely you factored in a significant cushion, even though the 4% rule says you don’t need one. It’s also likely that during a period of financial stress, you will also adjust your lifestyle accordingly to plan for the worst.

When does the Trinity study not work?

Here are the instances where the Trinity study is no longer valid and really there’s only one.

You materially change your retirement plan

Perhaps you decide to have children which of course will drastically increase your spending.

Maybe you decide that you want to be a baller and want to buy fancy cars. Surely a $40k withdrawal rate will not be enough.

Or you want to start a new business and require some initial capital outlay. If this is a significant endeavor, then you aren’t really retired anymore?

The 4% Withdrawal rate is good enough

So while there will always be detractors for the 4% rule, I think it is actually quite dependable. In the end, this study and strategy is just a guideline. Your real world situation will always differ and you’re human meaning you will adjust with the times. No one knows how much healthcare will cost in the future, but no one can predict what kind of technological revolutions come along with it.

The world will change and you will change with it too.

Personally, I hardly ever withdraw 4% because I know I can make up for withdrawals with my passive income from blogging as well as trading. Of course, we can’t forget about all my credit card travel hacking which allows me to fly for free.

In the years since achieving FIRE, I’ve traveled the world only to see my net worth increase and I’ve only really withdrawn something like 1.5% or 2%. The 4% rule is there for me to understand that in the worse case where I choose to do absolutely nothing, my portfolio will be enough to withstand the test of time.

The 4% rule is here to stay and I can recommend for you to use this calculation as well!