The Foreign Earned Income Exclusion, or FEIE, is one of the most valuable and most lucrative tax breaks out there. If you’re an expat or world traveler from the USA, it’s very likely you’ve heard of this deduction or have even applied it to your taxes. There are countless articles about what the FEIE is and if you qualify for it for those working abroad. However, what is incredibly misunderstood about the FEIE Is that it also applies to those that are working for US companies but simply just living abroad.

With the COVID-19 pandemic, remote working has become a way of life and so many people have embraced being location independent. Not only does this open the door to living in beautiful places like Bali, Portugal, or Greece, but it allows you to save on cost of living which will surely be much lower than living in the US. What most people forget to consider is you can use the FEIE to also deduct over $100k of your income simply because you are residing abroad!

Yes, no joke, if you make $100k or less, you can essentially pay zero income taxes simply by moving abroad. If you have a normal salaried job where tax is automatically withheld from your paycheck, you can easily get up to $20k back in your taxes! This blog post will go into detail on exactly how you can do this and what steps you need to take using TurboTax.

Disclaimer: I’m not a tax professional or tax accountant so do not take this blog post as the holy grail of information. Contact your accountants accordingly.

Who is this post for?

This post is for US citizens currently working or planning to work abroad. Everyone’s tax situation is different so you’ll just have to read this post and determine if it is the right situation for yourself.

- US Citizen or US Tax Resident

- Working a traditional salaried job (not a must)

- Planning to stay at least 330 days outside of the US

- Working at a job that allows remote working (YMMV)

What is the Foreign Earned Income Exclusion (FEIE)?

The Foreign Earned Income Exclusion is a deduction created by the IRS to reduce the tax obligation for those working abroad. Remember that as a US citizen, you are obligated to pay taxes on all your income worldwide. No matter where you work or live. Using this deduction, you can exclude over $100k straight up from your tax obligation no matter what.

However, the US has foreign tax credits which ensures that you do not pay additional taxes if your foreign taxes paid are higher than what you would pay otherwise in the US (whole different topic that we won’t discuss here).

Example 1: Joe works and and lives in Dubai earning a salary of 400,000 UAE Dirhams (roughly $110k USD),. Joe pays 0% taxes to Dubai because the tax rate there is 0%. With the FEIE, Joe can exclude up to $112k of income a year from foreign earned taxes. Therefore, Joe also owes nothing to the IRS

Example 2: Using the same example as above, let’s say Joe earns 800,000 UAE Dirhams a year ($220k USD). Joe still pays 0% in taxes to the Dubai Government because there are no income taxes. However, with the FEIE, Joe can only exclude $110k in income a year so Joe is left with $110k in income he must pay US taxes on. This is quite the headache for many highly paid Americans working abroad and is one of the reasons many have given up their citizenships.

Example 3: Jane lives and works in Germany earning 150,000 Euros (~$170k USD). Using the FEIE, this means Jane can exclude $110k of income and therefore only be left with about $60k in tax obligations. However, the tax rate in Germany is higher than in the US so she can actually use the Foreign Tax Credit to offset any taxes (won’t go into this credit here).

Example 4: Jacob works for a tech startup in San Francisco and earns $110k a year. The tech startup is very forward thinking and with COVID reshaping the world, they allow Jacob to work anywhere he wants. Jacob decides to travel the world and live in different places as a digital nomad. He is gone for most of the year and only returns to the US for two weeks to visit family. Jacob’s job is a traditional salaried job meaning his startup withholds taxes from his paychecks and he ends up paying about $20k in taxes a year. Using the FEIE, Jacob can deduct his entire salary from his taxes and essentially gets a refund of the entire amount in taxes he paid.

If example 4 sounds like something that you can relate to, that’s great because example 4 is what this post will mostly touch on!

How much is the Foreign earned income exclusion (FEIE)

Every year the FEIE is adjusted for inflation. As I write this post in 2022, the limit is set at $112,000 USD. This amount is doubled if you are married filing jointly. As you can see from the historical table, the amount has increased steadily over time and I expect this to always continue in the future.

| Tax Year | FEIE Amount |

| 2022 (filed in 2023) | $112,000 |

| 2021 (filed in 2022) | $108,700 |

| 2020 (filed in 2021) | $107,600 |

| 2019 (filed in 2020) | $105,900 |

| 2018 (filed in 2019) | $103,900 |

| 2017 (filed in 2018) | $102,100 |

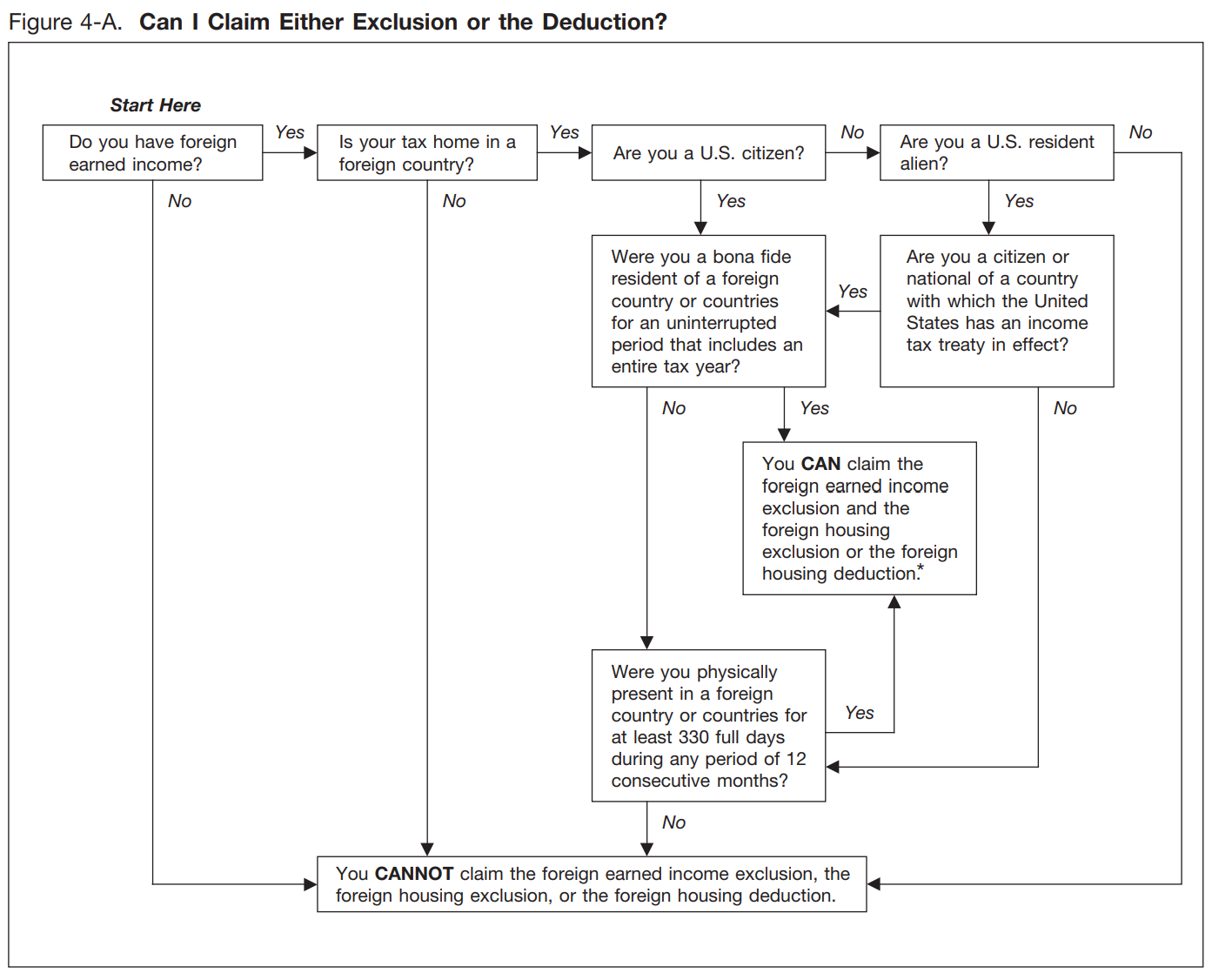

How to qualify for the FEIE?

There are two ways to be eligible for the FEIE:

- Physical Presence Test: Be physically present in another country for at least 330 days during any 12 month period

- Bonafide resident of a foreign country for an entire tax year

Physical Presence Test

The physical presence test is probably the easiest way to qualify for the FEIE as a digital nomad. For the purpose of this post, I will mostly focus on this method as it gets more complicated when you use the bonafide resident method.

In order to pass this test, you must have:

- Foreign Earned Income. This includes salaries, wages, commissions, contracting work etc. Earned Income is the key phrase here, aka money you actually earn from actively working in a job. Interest, dividends, and capital gains do not count as earned income.

- A “Tax Home” outside of the US: In order to claim the PPT (Physical Presence Test), you must not maintain a primary residence in the US. If you own a house, it’s best to just rent it out, or leave it empty but not claim this as your primary home. Does this mean you have to have an actual home in a different country for the entire year? No. You simply need to not have your home base in the US. If you plan to live in multiple countries that is okay for this requirement. You can view the full language on the IRS website.

- Been Physically Present in a Foreign Country for the Necessary Time frame. This time frame is 330 days out of a 365-day period. This does not have to be on a calendar-year basis, and can be adjusted over a two-year span as needed to qualify. An important thing to note is that you must spend 330 full days in the foreign country, as partial days and time spent traveling do not count. It’s critical that you track travel days carefully if planning to use the PPT, as you’ll need to be able to show details to the IRS if requested.

What is foreign earned income?

Now that you know what the deduction is, how does the IRS classify income that is foreign earned?

Generally, the IRS classifies income based on where it is earned. In the traditional sense, this means if you are living in South Africa for example, earning South Africa Rands, this means you are earning foreign income. Therefore, the above limits would apply for any income earned in South Africa.

Digital Nomad in South Africa: Earning US dollars living in Cape Town

Finally, if you’re a full time digital nomad, meaning you live more than 330 days of the year outside of the US (in this case let’s use Cape Town), any money earned while living in Cape Town counts as foreign income because it was earned in a foreign place.

This means you can have a traditional salaried W2 job from the US where your salary is paid in USD and claim this deduction. As long as you satisfy the requirements (physical prescence test or bona fide resident) for the Foreign earned income exclusion, you can claim this deduction regardless of where your money is made.

Working in France at a French company earning Euros

If you are living in Paris, France working for L’Oreal or something earning a euro based traditional salary, then this constitutes “earned income”. It is foreign earned income because it’s in a different currency and you are living in a different country.

Trading stocks while in Mexico

If you are a digital nomad/early retiree and all you’re doing is selling options to generate income to fund your lifestyle, this is not earned income. Capital gains and trading stocks is not considered earned income. Therefore, the FEIE does not apply to you. Aka, you cannot make a very successful trade with a $100k profit and deduct all your gains.

What about paying taxes in the country I’m living in?

Depending on the country that you live in, you may be obligated to owe taxes to that country’s Government, even if you are not working at a local job in that country. Every country has different rules so you just need to be aware of them.

However, most countries do not require you to pay any taxes or have any tax obligation if you stay in the country for under 6 months per year. In reality, most countries won’t even let you stay there on a tourist visa that long anyhow. Whether they actually monitor and check your situation is an entirely different question.

The best way to avoid even breaching this subject is simply to live in multiple places a year. In this case, you could live in Cape Town for 4 months of the year, spend 4 months somewhere in Europe for the summer months, and then live in Bali for another 4 months. If Bali’s time zone is too much for you, then move to Mexico or somewhere else in Central America. Problem solved.

Why should I care about the FEIE?

Now that you understand what the FEIE is and if you are actually eligible, what does that actually mean for you as far as money and taxes go?

This post is most useful for those working for a US company on a W2 contract (full time salaried employee, not contracting) earning USD. This is because when you are on a normal salary in the US, taxes are automatically withheld with each paycheck. If you are earning up to the FEIE limit, you can essentially get all of those taxes back in cold hard cash when you file your taxes at the beginning of the following year.

Get a large tax refund

In 2022, this means if you earned $112k, you would pay roughly $18k in federal income taxes. With this deduction, you could get the entirety of that $18000 back as your tax refund. That’s enough to live for a year in many places around the world or a nice chunk of change for you to invest towards financial independence! I could easily live on this in Bali.

If you are a digital nomad or 1099 employee, your taxes are not withheld but you will owe money at the end of the year based on your tax bracket. This deduction will clear you of any taxes owed up to $112k!

How to claim the FEIE deduction, step by step

Now that you understand what FEIE means as a digital nomad, the next step is to actually demonstrate this deduction in practice just so you can see that it’s not fake news.

Form 2555

The form that you’ll need to familiarize yourself with is Form 2555-EZ which is the Foreign earned Income Exclusion. I’ve never done taxes by actually filling out the forms as I prefer to use software to simplify the process.

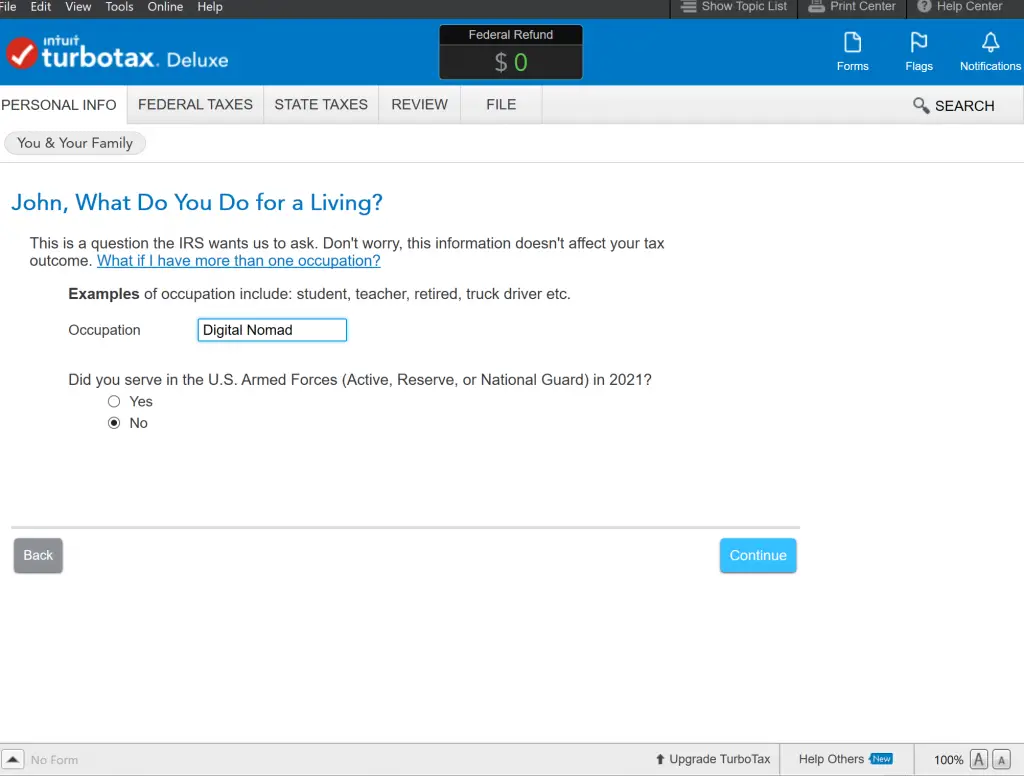

I use Turbotax for my tax filing and have done so for many years. I’ve just become accustomed to the layout and it’s stored my information for so many years that it’s hard to break away. Almost like being sucked into the Apple ecosystem. You can you use another Tax preparation software and do the same thing because all good tools will include the Foreign earned income exclusion.

Let’s get started!

Set up Turbotax

First step is to set up Turbotax. I won’t take a screenshot of each picture because it would just be too many pictures.

Here you can put your name, occupation, married status, and various other admin related details.

Add your W2 information

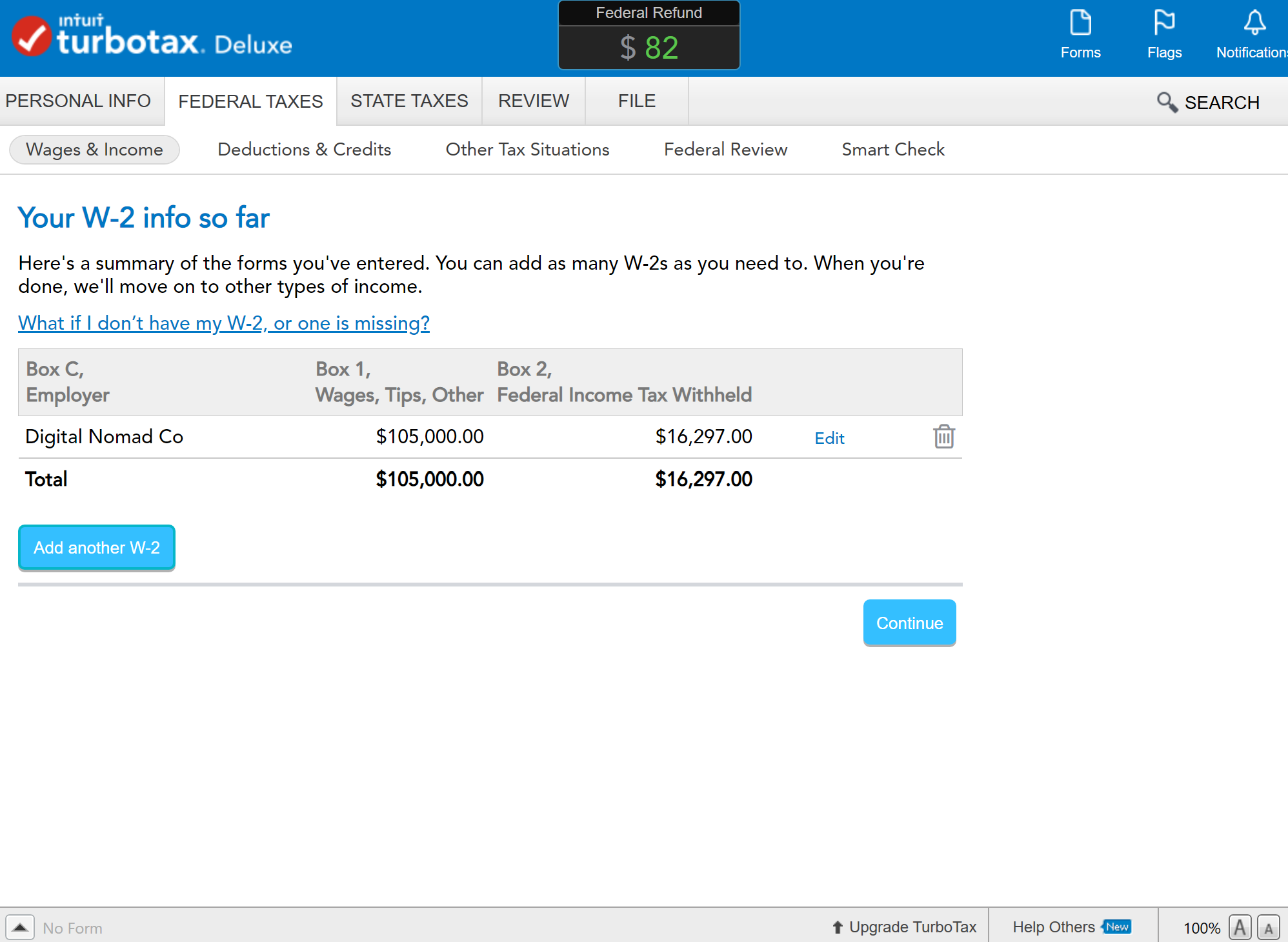

The next step is to add your W2 information. For the purpose of this demonstration, I will not use an actual W2 that I’ve received but merely create numbers that make this example meaningful.

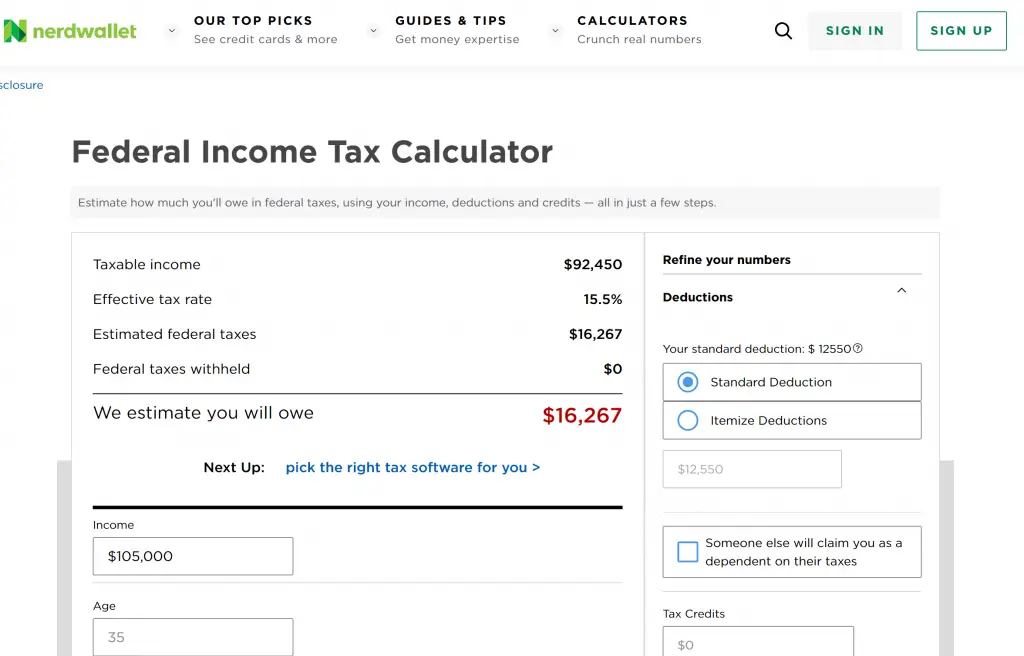

For the purpose of the demonstration, I will report an annual income of $105,000 which is well below the FEIE threshold. From this quick calculator on Nerdwallet, you can see that a $105k income means you must pay $16k in taxes after the standard deduction.

Now I will add this information into my W2 in Turbotax and you get this result.

As you can see, the number at the top center shows your federal refund/owed amount. Plugging in these details means you pretty much are owed nothing. This is as expected given the tax calculator from Nerdwallet. The $82 refund amount is simply because this Turbotax software is doing 2021 taxes and I looked at 2022 tax brackets. A minor detail.

After you’ve finished adding your income, proceed to the next step.

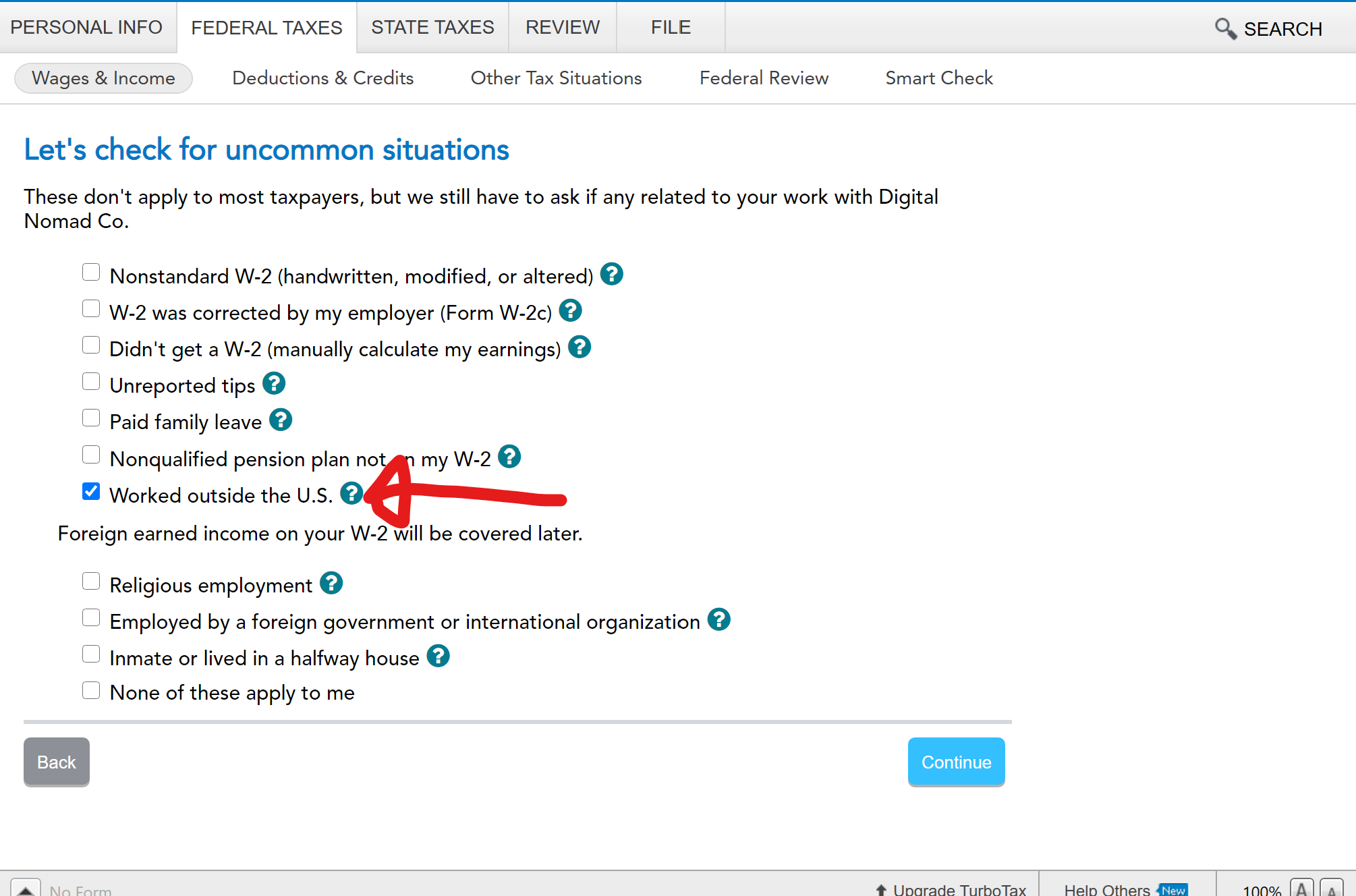

Here you must select the “Worked outside the U.S” box which will set you up for what you need to do next.

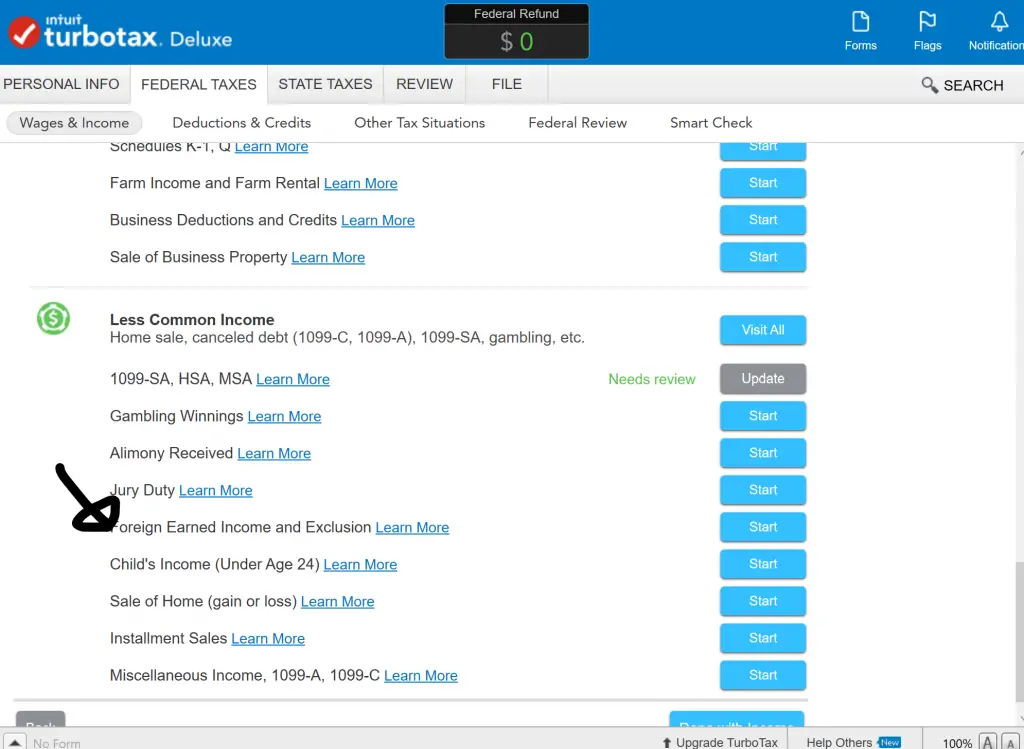

Claim the Foreign Earned Income and Exclusion

Once you’re back to the wages and income page, scroll to the bottom and start the section highlighted below.

You would think the FEIE would be under the Deductions and credits section of Turbotax but it is not.

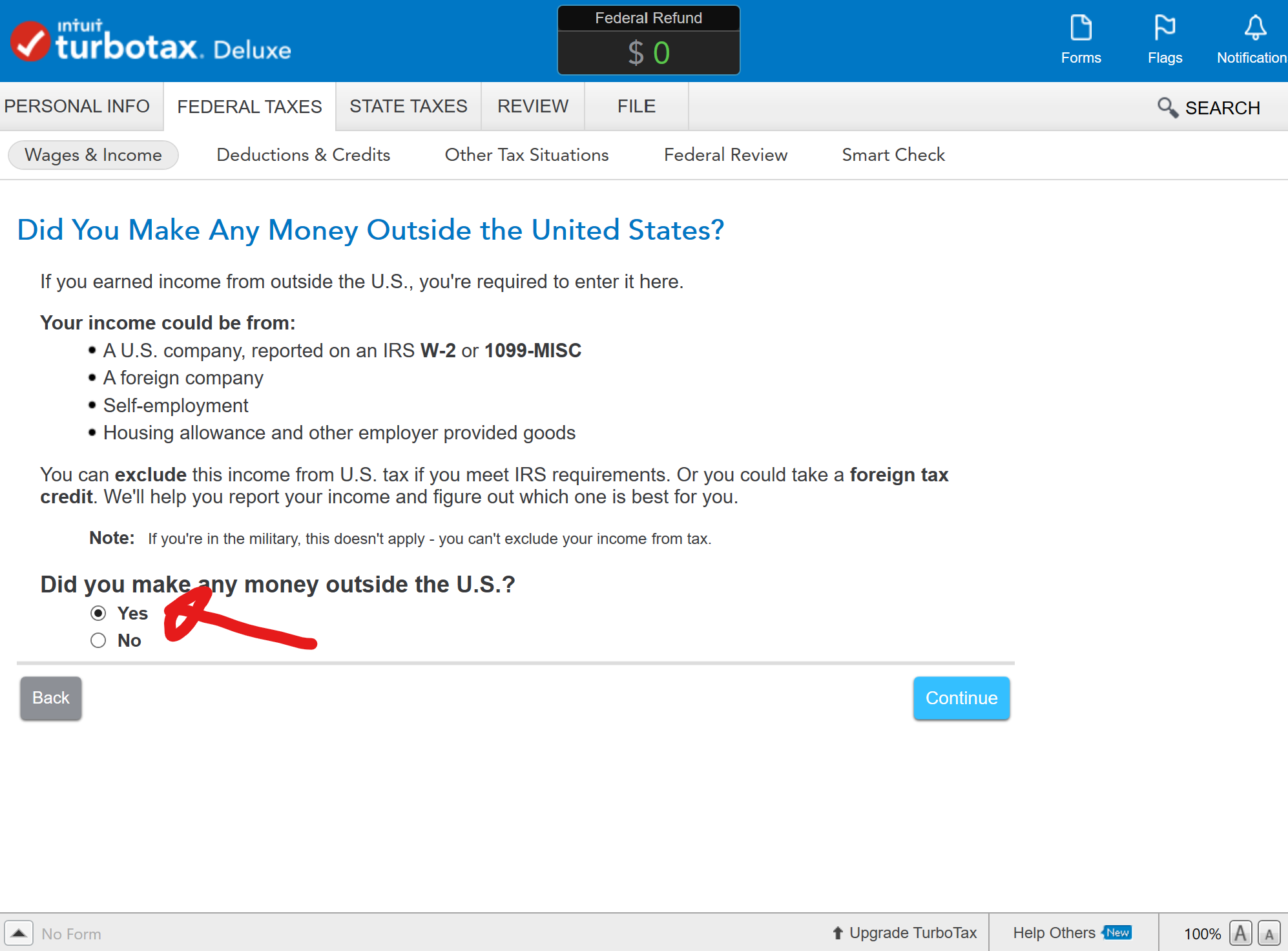

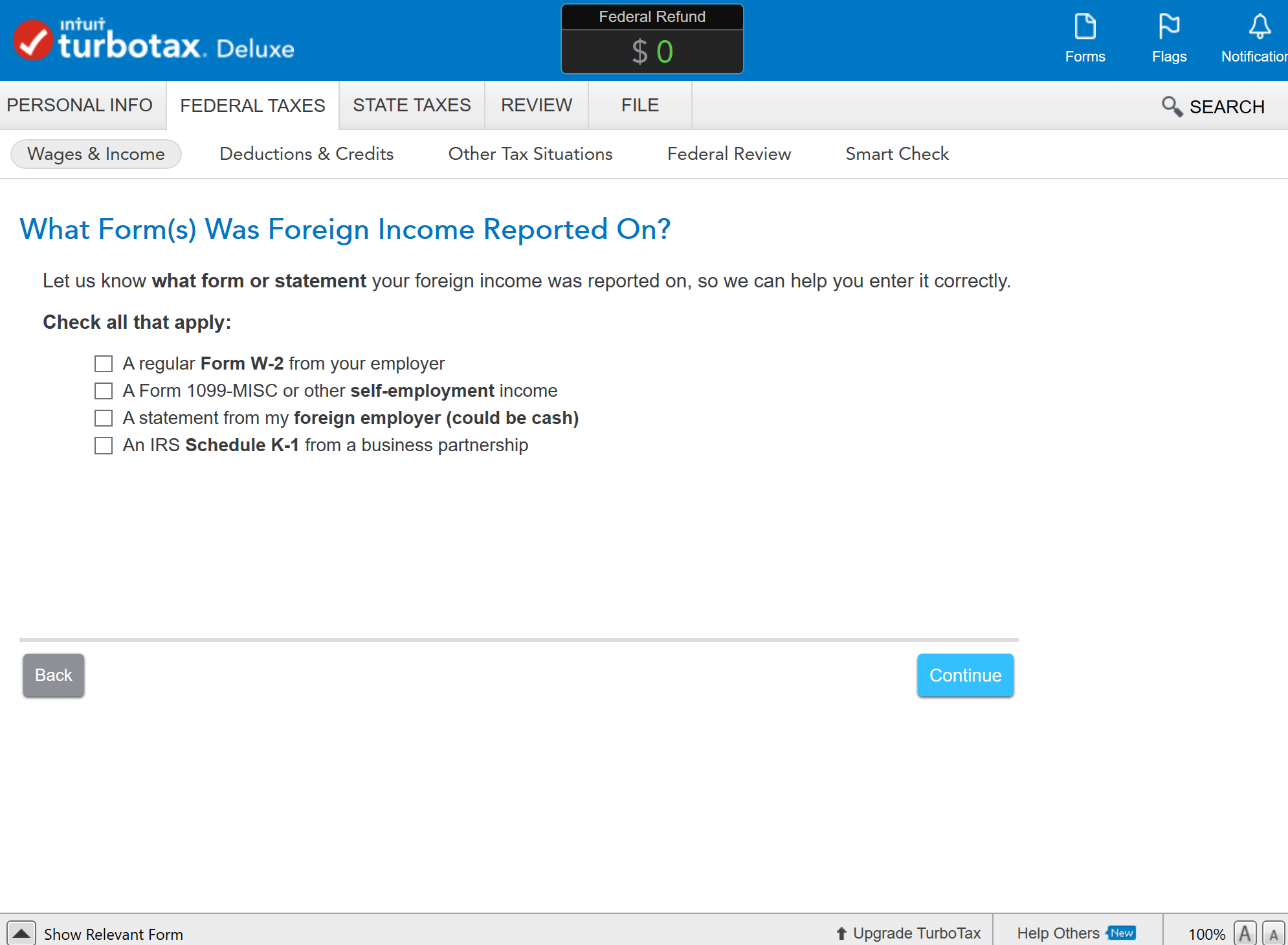

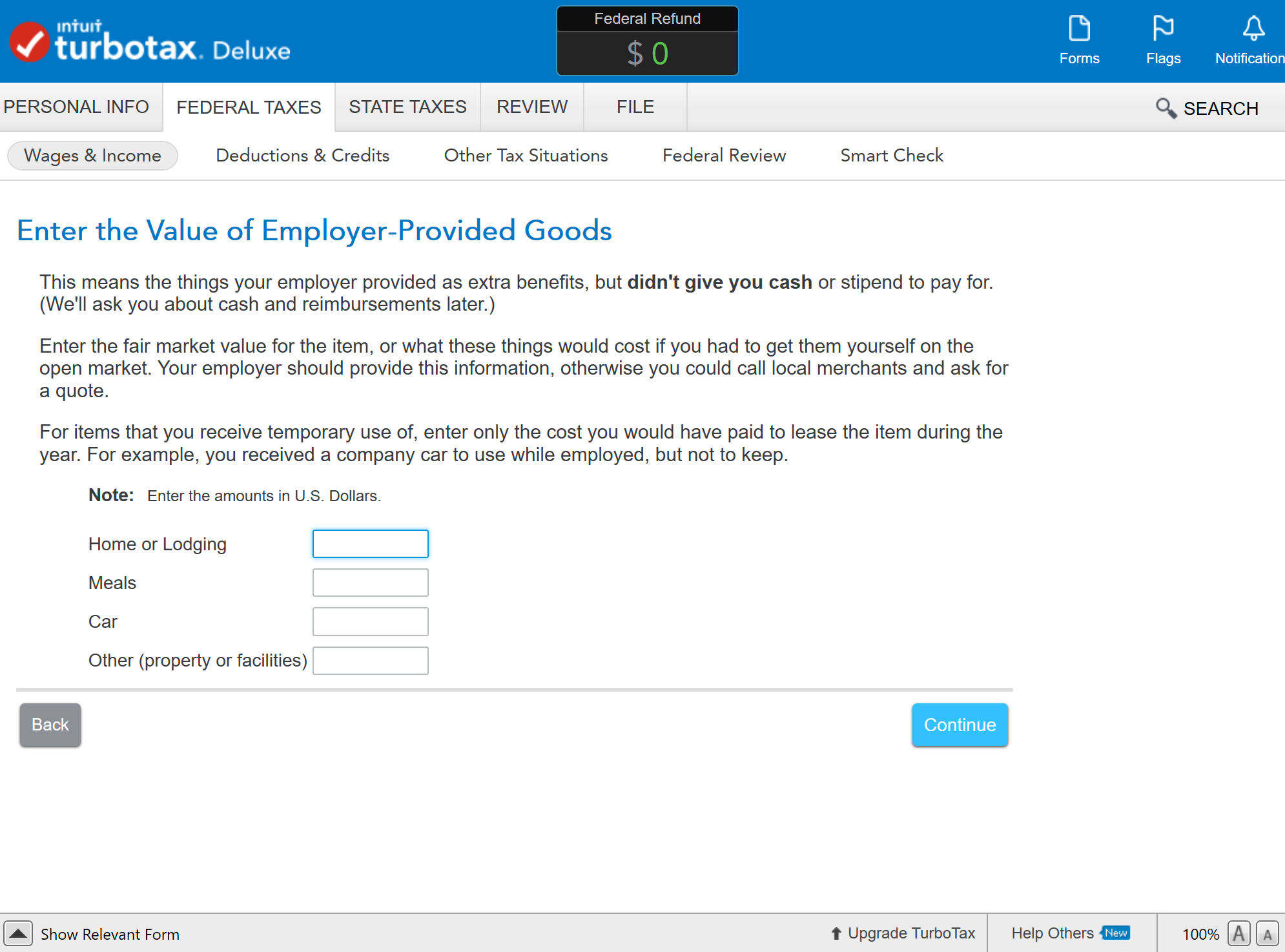

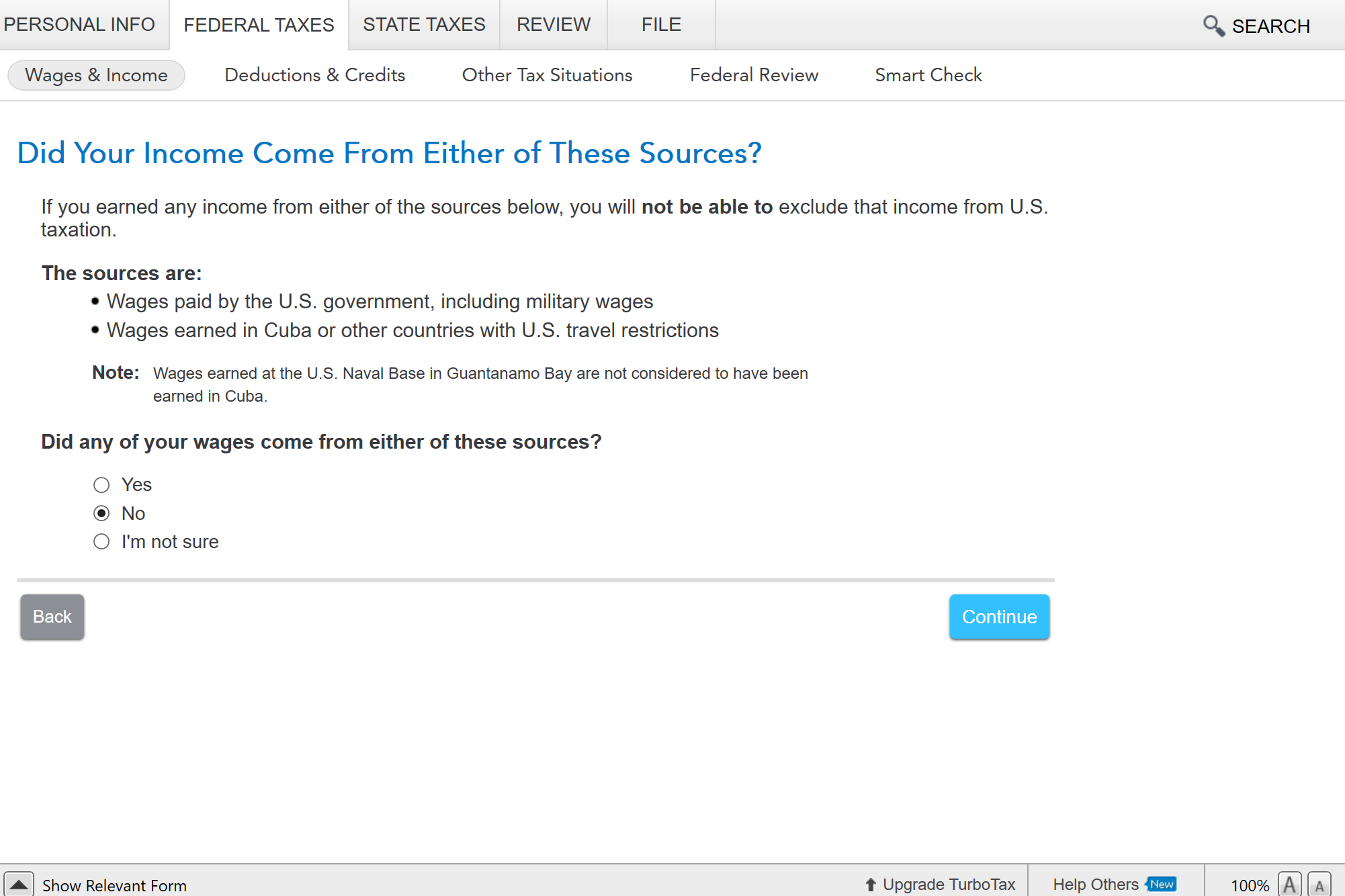

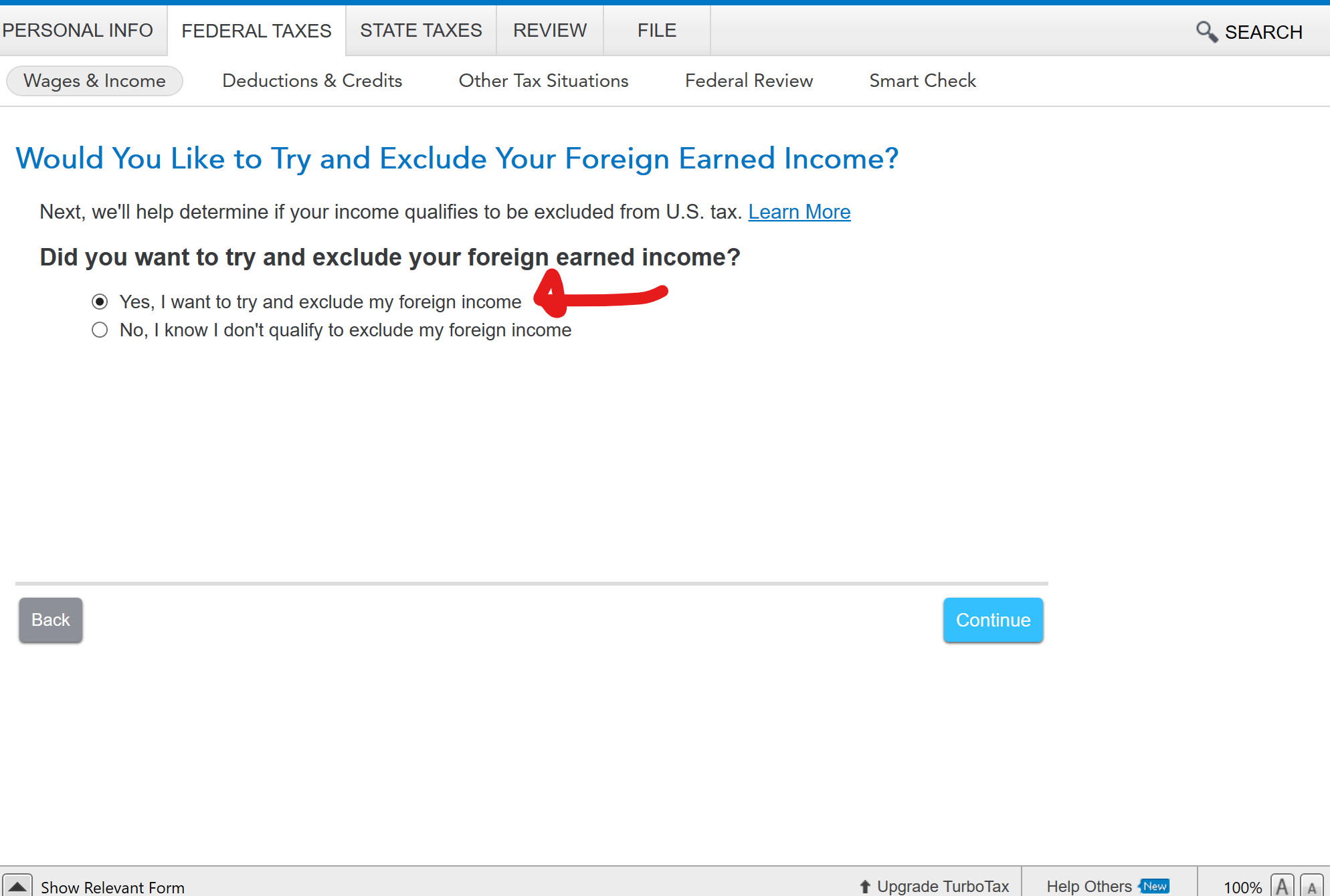

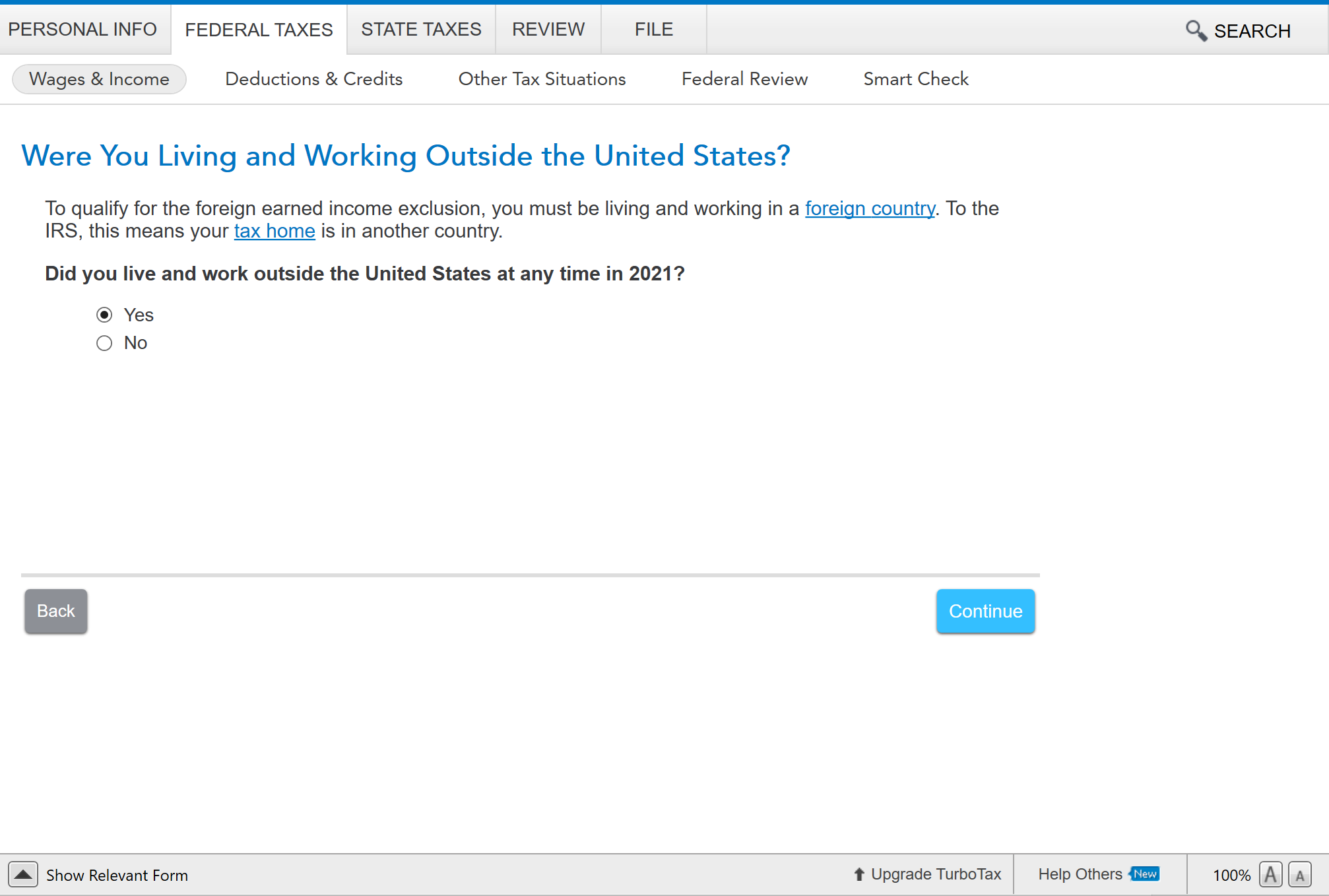

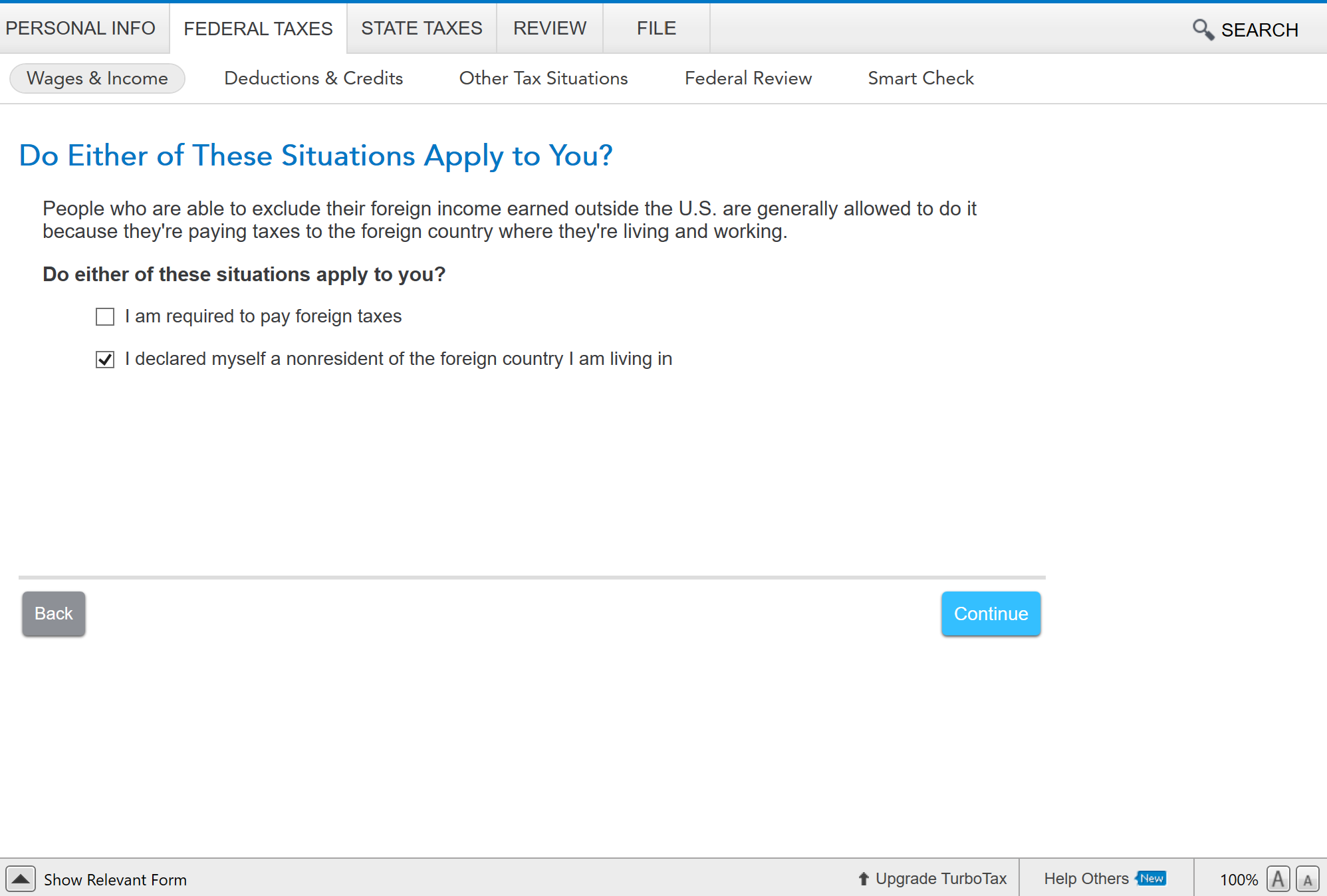

You will go through numerous pages next so just make sure to select the right options:

Do not select anything here.

If you’re a digital nomad, it’s unlikely that these things will be paid for. If they are, you can enter the amounts here now but for simplicity sake I left these all blank.

Select no for this.

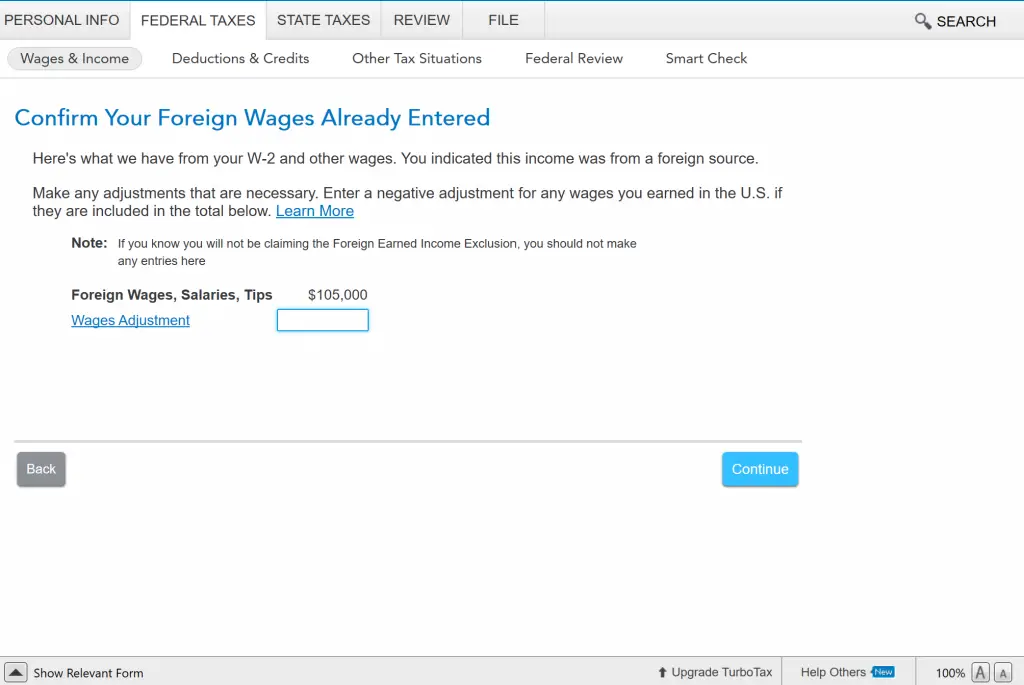

This wage adjustment is rarely ever used so just leave this blank

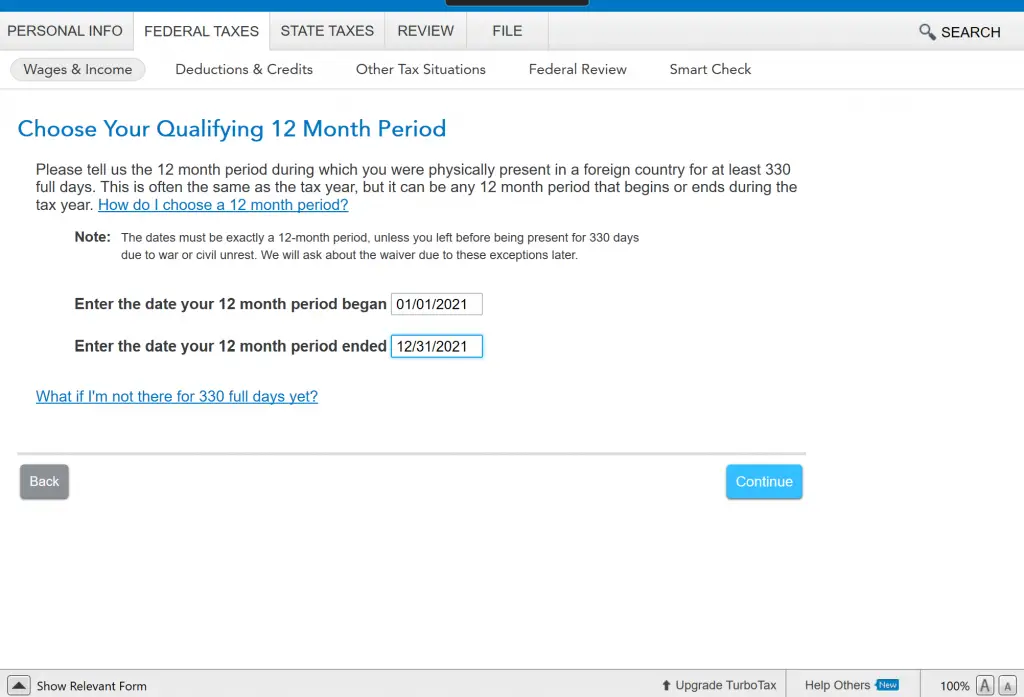

This page can be a bit confusing but it is essentially Turbotax testing the Physical presence piece of the FEIE. Remember that you need to be away for 330 days of the year to qualify for this deduction.

The result of the FEIE

After the previous picture, you will see the FEIE go through and the federal refund counter skyrocket up. You’ve officially claimed the FEIE and now you can claim back $16k in taxes that you’ve paid! Enjoy the cash and travel accordingly.

What about state taxes and the FEIE?

State taxes are another thing that you can benefit from using the FEIE. Only 9 states have no state income taxes: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

If you don’t live in one of these states, you’ll have state taxes withheld every paycheck. With the FEIE, this will also deduct your income from state tax obligations. However, it might be more difficult to prove that you are not a resident in some states versus others. You’ll have to do research on your own.

The FEIE is particularly useful for those that have jobs based in NYC or California due to the high state and local taxes.

What are the audit risks for using the FEIE?

The FEIE has come under higher scrutiny over recent years because more and more people are taking advantage of it. It’s one of the least complicated deductions you can make and one of the most lucrative.

If you do come under audit, it’s not difficult to prove your deduction by keeping good records of your flights, hotel bookings, etc. If you own a house in the US, show that it’s been rented out.

Remember, you need to prove to them that you do not have a primary home in the US.

Does your company know you are living this lifestyle?

The main question that everyone wants to know but doesn’t want to ask is whether your employer is keen for you to do this lifestyle. I know many digital nomads that just up and move to another country without telling their employers. They use VPNs to hide their movements but in the end, they are doing everything on the down low.

Most US employers I’ve read about to will allow their employees to now work anywhere in the US. Moving out of the country is an entirely different question. Most companies don’t want to be on the hook for the numerous tax implications of their employee working in a foreign country. In addition, security, compliance, and confidentiality are all issues that become more complicated when you move abroad.

If you plan to take this deduction without your company knowing about your whereabouts, then you are running the risk of just losing your job straight up.

However, I do not think this is something that will get you in trouble with the IRS. To them, you are claiming the FEIE because you moved out of the country. Whether your company is happy about it or not is a different question.

Summary of the Foreign earned income exclusion

Hopefully this guide gives you the understanding you need to apply the FEIE for your tax situation.

Remember that this deduction does not include income made from capital gains (long term or short term). It is simply for earned income. I have another post about how I pay 0% in taxes by taking advantage of the long term capital gains rates.

If you’re planning to live a nomadic life, make sure to absolutely understand this deduction and research whether this applies to your situation. It is a lot of money in the end and can totally change your life!