Living in Germany has been a great time. Life in Frankfurt has been quite fun and traveling around the country, as well as the greater European continent has just been wonderful.

However, with the good times come the slightly more complicated and annoying things that must be done like taxes. Everyone’s favorite subject. I wasn’t so excited about doing my German taxes after working for a year in the country. German bureaucracy is not the easiest to navigate around and even more difficult if you don’t speak the language.

If you’re working or studying in Germany, there will be a time when you’ll need to fill a German tax return. Don’t worry though, it’s not as bad as it sounds. Here is my guide to get you through it all!

This post is all a part of my guide to living in Frankfurt, Germany where I list out all the things you need to know as an expat in Frankfurt and Germany.

Taxes Overview in Germany

For this post, it will primarily talk about how to actually fill out a German tax return and get your refund (or the amount you owe the Finanzamt).

If you want to learn about German income tax rates, or how to change your German tax class, make sure to read my detailed post about German taxes!

Who needs to file a German tax return?

So this part confused me when I first started doing my taxes in Germany. It turns out, if you are a “regular” employee in the sense that you work a full time job at an office like the rest of us grunts working for the Man, you don’t have to file your taxes. This is because your taxes are already withheld properly from your paycheck because I’m sure you’ll have realized how much lower your net income is than your gross.

The people that are absolutely required to file are those that have made their money as part of a side business or a free lancer. It is compulsory with these conditions:

Income sources

- Additional income (not from salary) superior to 410€.

- Salary replacement income (like unemployment benefits) superior to 410€.

- More than one employer in the year.

- More than 2 salaries (like a full-time job and a minijob).

Family situation

- Married with tax classes 3 and 5, or both 4 “mit Faktor”. More info on tax classes here.

- Divorced and re-married the same year.

So why do your taxes if it’s not required? Because of the money obviously! The average German tax refund is around 1000 euros. Of course this number is probably skewed by a lot of high earners with side businesses and investments that get back heaps of money.

Nevertheless, it’s likely you’ll get some money back even if you do not bother with any meaningful deductions. That is why you should fill out a tax return in Germany because who doesn’t like money? Money that is yours because you overpaid in taxes.

Do you get a tax refund when filing German taxes?

Turns out, the average tax refund is around €1000! This is a hefty sum of money for most people and a good reason to at least fill out the tax return form to see what you get.

Of course, this number is likely skewed higher by high earners getting back multiple thousands. I think on average, however, you do get a positive amount of money back as the German Government holds back taxes conservatively.

When do you need to file German taxes?

Mandatory submissions must be lodged by 31 July of the following year. The tax year runs from Jan 1 to Dec 31 so for the 2019 calendar year (Jan 1, 2019 to Dec 31, 2019), you have up until July 31, 2020 to submit your tax returns.

If you’re voluntarily submitting your declaration, you have up to 4 years to do it.

If you need, you can also apply to your local tax office for an extension, which is usually granted automatically. If you use the services of a tax advisor, the tax office automatically extends the deadline to the end of the following February.

What documents do you need to file German tax returns?

I’m not a German tax expert by any means so if you have a complicated tax situation, then this is probably not for you. However, if you’re like most of us out there with one standard waged job with few deductions, the amount of documentation you’ll need is quite minimal.

Lohnsteuerbescheinigung – This is your annual income statement from employment, you can get this from your employer.

Identifikationsnummer – 11 digit unique identification number. You’ll receive this when you register an address for the first time (anmeldung) and this is your tax ID.

Steuernummer – If you have filed your German tax return previous year, you can find it on your Assessment order (Steuerbescheid)) from the Finanzamt. I was very confused about this number when I was trying to change my tax class earlier in the year but do not worry!

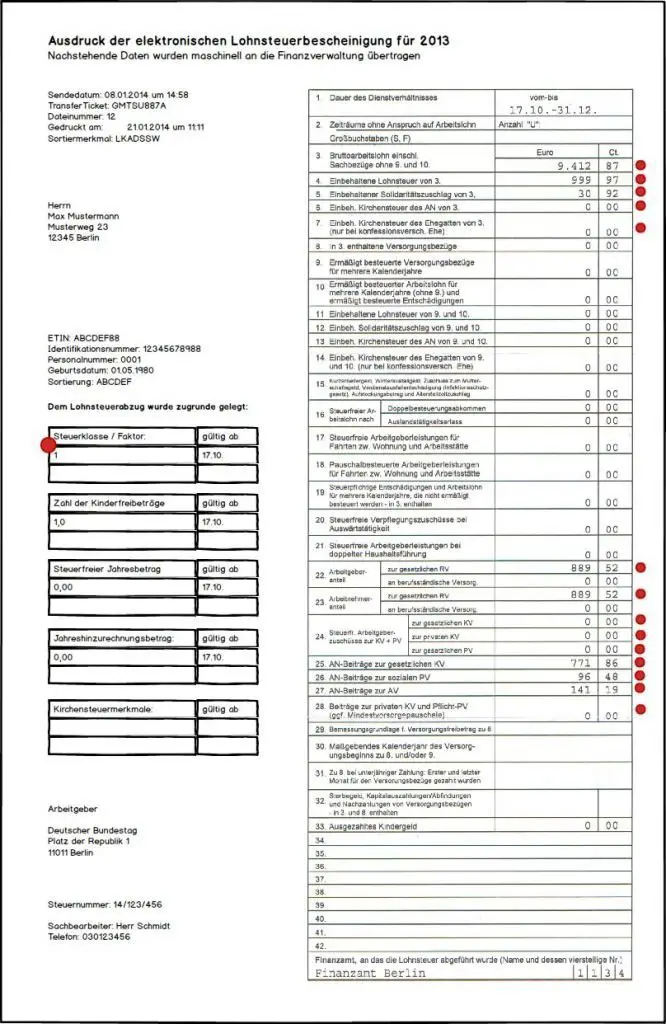

Your Lohnsteuerbescheinigung, or Annual tax statement

Your Lohnsteuerbescheinigung (who comes up with these words??) is the main tax statement you’ll want to look out for.

This is your earnings and taxes paid summary for the year. This is the same as the W2 for those coming from the US. You’ll need this document before you can start your taxes.

This form is provided by your work and can come anytime between the end of December to the end of February. In my situation, it came in mid January.

There are numerous fields to this form but it lays out all the numbers clear cut. For example, your gross salary, total taxes paid, amount paid into the state pension, amount paid for health insurance etc. are all laid out here. Your Lohnsteuerbescheinigung will look something like this:

Once you get this form, you can plug your numbers into a tax prep software like Wundertax and immediately see a rough estimate of what your owed. This is exactly what I did of course!

Filing jointly or separate?

If you’re married, you’ll either be in tax class 3 or 4. If you haven’t changed your tax class, you’ll want to do that right away.

You’ll want to file jointly and you’ll need your spouse’s tax ID number to complete the tax return. If you file jointly, remember that your income brackets will be double what they are for single people.

However, if you are the sole earner, and you are looking to take advantage of tax class 3, you must have changed your tax class during the tax year in order to take advantage of this. What this means is if you are doing taxes in 2020 for tax year 2019, you must have changed your tax class from tax class 4/4 to 3/5 at some point in 2019. If you did not do this, and you are still in tax class 4/4 in 2020, then you cannot claim the tax savings of tax class 3.

If you did change your tax class in say Nov 2019 to tax class 3 and 5, but worked the entirety of 2019 under tax class 1 or tax class 4/4, then you will get a very substantial tax refund back because you will be treated as tax class 3/5 for the entire year.

How to do your taxes in Germany

Having moved to Frankfurt a year ago, I was lucky enough to have my company move here and give me the whole package. This included tax prep services for my German taxes, as well as my US taxes.

After talking to my German tax advisor in early February, they informed me that since they were a professional service preparing my taxes, they could extend the deadline 1.5 years from the standard due date. That means I’d have to wait a year and a half until I get my refund. I found this to be a little ridiculous but I guess this is standard practice. They said they extend every single tax return they do.

Well, time value of money is a thing and I told them to take a hike because I don’t even know if I’ll be here after another year! I wanted my money now.

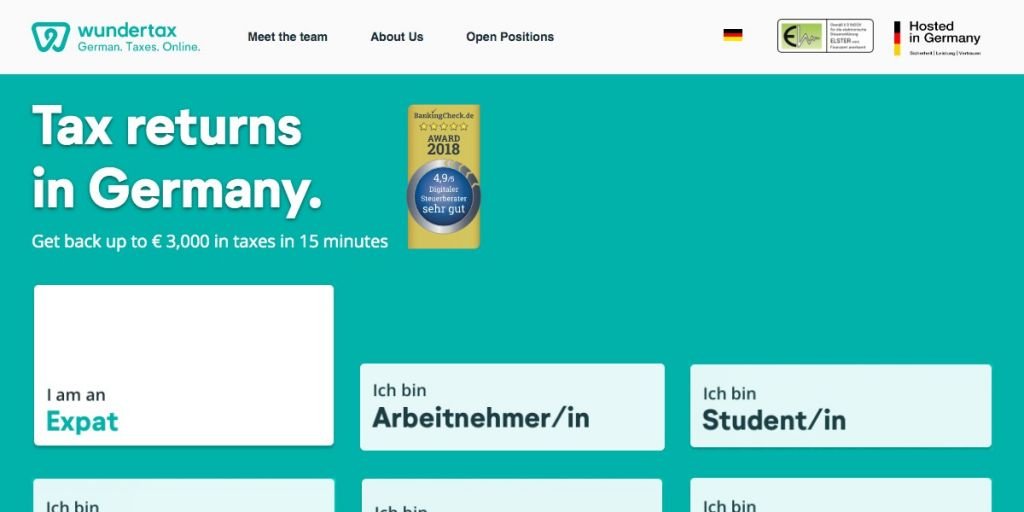

Wundertax and Steuergo

In the US, I always did my own taxes and there are so many tax prep software and services. Turbotax was my go to tax software as it is a program immensely simplifies the tax process in which you don’t have to actually fill out any tax forms. Once you’re done, it calculates an expected refund amount and the program automatically transmits it to the IRS. Few weeks later, the money is in your bank account.

I figured surely there must be something equivalent to Turbotax or H&R Block in Germany. I was right, there are at last two services that I found to be similar in functionality to Turbotax. These are Wundertax and Steuergo.

I played around with both and it seems that they both do the job. They also both have solid reviews from other expats that have used them. I preferred Wundertax because I found the functionality to be much friendlier and aesthetically pleasing. It also explains every little detail in English so you know exactly what you’re inputting. Both services are 100% online and both can transmit the tax returns to the Finanzamt.

Once you’ve transferred your Lohnsteuerbescheinigung information to the Wundertax platform, it will calculate an expected refund for you!

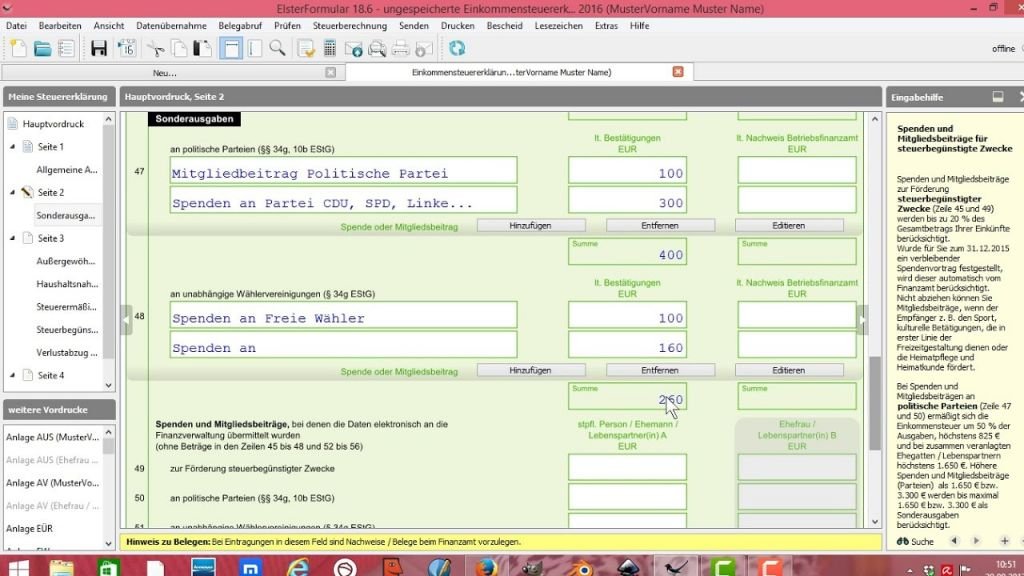

ELSTER

Elster is the free tax preparation tool given out by the Finanzamt. This is probably the quickest way to transmit your tax return documents but there’s just one little problem. It’s entirely in German.

If you’re German is up to snuff, consider using this tax prep tool. Or if you want to slog through it with translations upon translations, use the ToyTown Germany guide which translates everything to English but the software is still very much in German.

It’s not free

These services aren’t free. Wundertax charges about €35 per tax return and Steuergo is a similar price. I’m surprised there are no free services to do such a simple thing but perhaps I’m just not looking hard enough. If anyone knows of any free English based Germany tax programs, please leave a comment!

Filling out the German Tax Return

So now it comes down to the actual knitty gritty of it all, filling out the German tax forms.

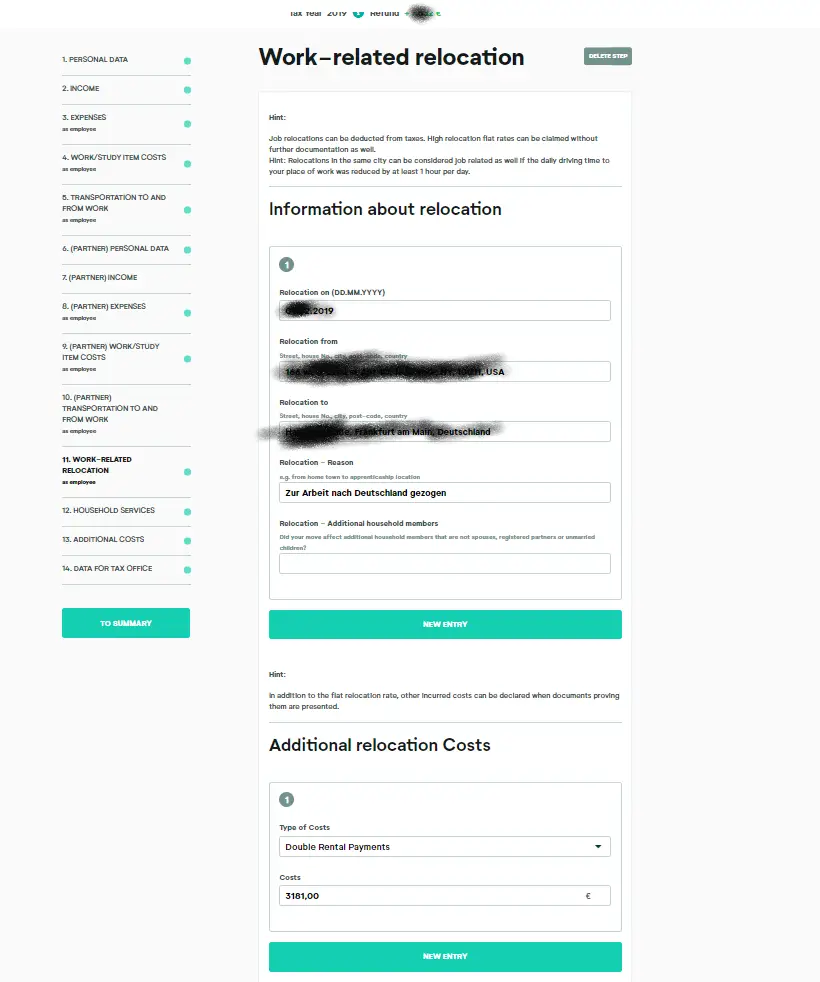

For my purposes, I will use Wundertax as I found their 100% English and friendly interface to be the most helpful. I was able to fill it out quite quickly as my taxes are relatively simple. I didn’t get too fancy with my deductions and stuck with the default numbers. All in all, it took about 1hr to do everything.

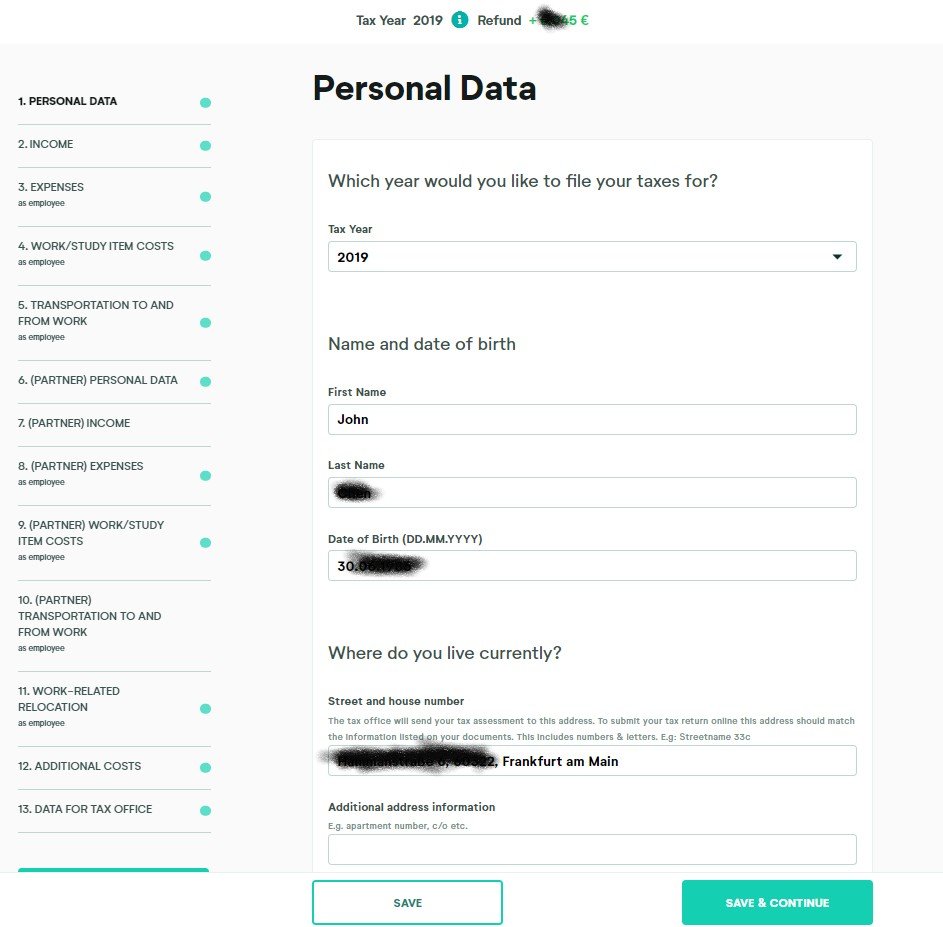

Personal Details on Wundertax

The first step after registering an account (which is a very fast process) is to fill in your personal details. This means your name, birthdate, marriage status, address etc.

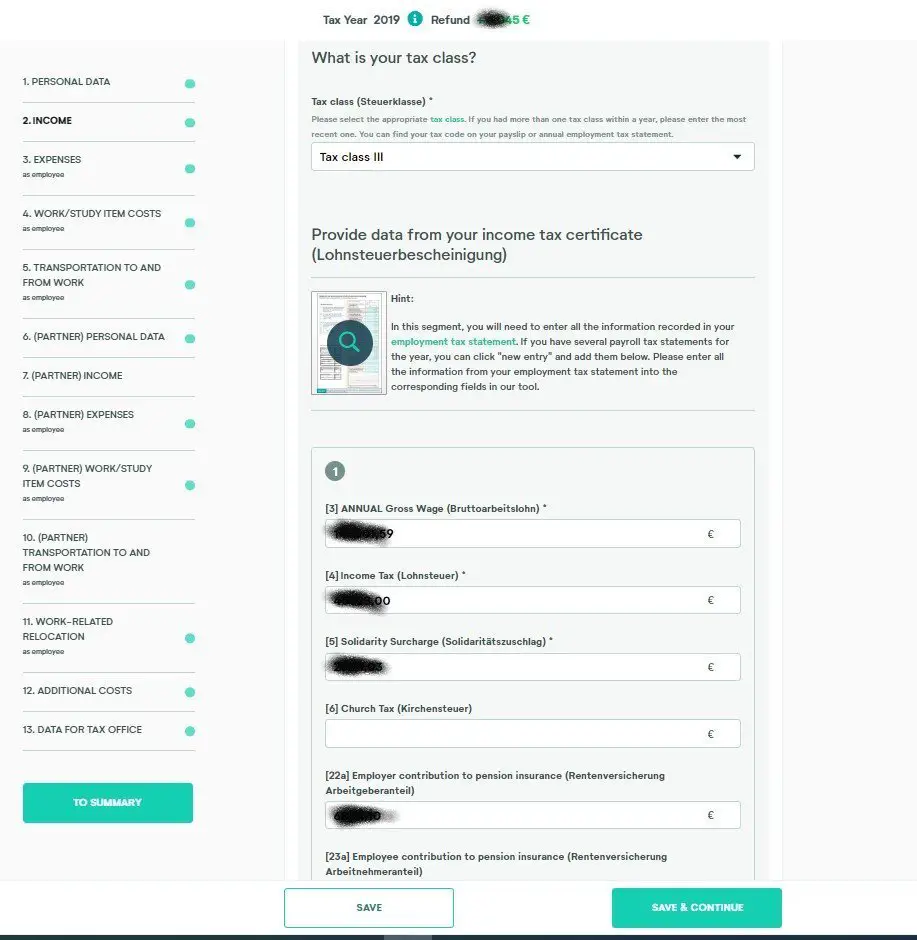

Income Section

The next section is probably the most important section, the income section. It’s here you will select your tax class which I’ve explained in detail in the past what they are and how to change them.

For most people, this just means inputting the numbers from your lohnsteuerbecheinigung. I like Wundertax because it explains what every section of your lohnsteuerbecheinigung means in English, all the while guiding you to the right boxes on your form.

If you’re a freelancer and have self-employment income, there is a section at the bottom of this page where you can input that.

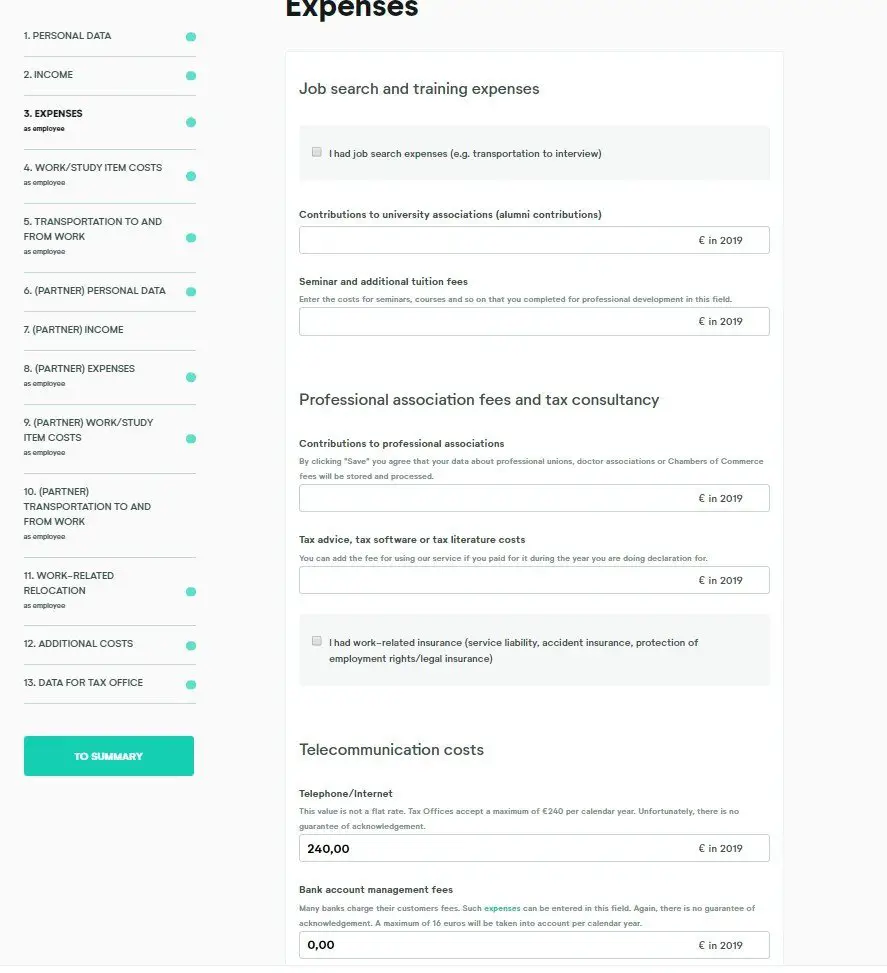

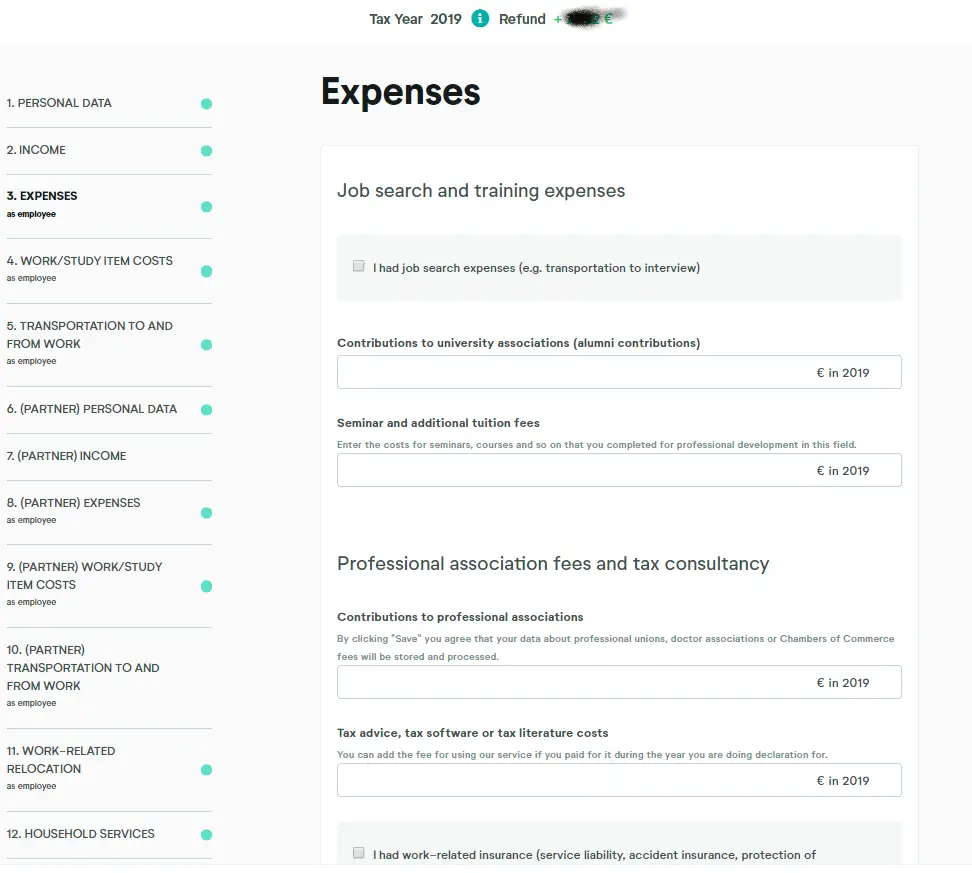

Expenses

The next section focuses on any work related expenses you’ve incurred (more information on that in the next section). I didn’t want to get too fancy with my deductions as I’m just not that familiar with the German system. I also wanted my refund back without any hassle or questions being raised.

I really didn’t have many job related expenses to claim. They recommend taking a flat 240 euro deduction on telecoms and this was actually the default value that wundertax uses. Not sure whether it works or not but I tried it anyhow.

Tax Deductions in Germany

As with any tax filing, deductions play a key role in determining how much money you get back. As a US Citizen, I was very in tuned with claiming deductions back home. It turns out, Germany has a crazy amount of deductions. In fact, I’d say that there are even more generous deductions on offer in Germany than there are in the US! For example, you can deduct the cost of a maid that cleans your primary residence!

If the US had the same amount of generous deductions, I feel like people would abuse it to the moon and beyond but apparently it’s not that big of a thing in Germany. I’m by no means a German tax deductions expert but here are some of the most common deductions to use.

Employment expenses

It is possible to deduct various income-related expenses, as long as they are properly documented and haven’t already been reimbursed by your employer. These deductions are usually capped at 1.000 euros per year. This includes expenses incurred in the following circumstances:

- Moving house for professional reasons, such as relocating to Germany

- Applying to jobs

- Travelling or commuting

- Further training such as work-related literature or training courses

- Equipment such as computers

- Running two households, for instance, if you are a weekend commuter

Insurance contributions deductions

Any contributions you make during the course of the year to compulsory insurance schemes are deductible, up to certain limits:

- Health insurance (both statutory health insurance and private health insurance for primary healthcare are 100% deductible)

- Long-term care insurance contributions (100% deductible)

- Unemployment insurance contributions (up to a maximum of 2.800 euros per year or 1.900 per year for employees and pensioners)

- Pension scheme contributions (up to a maximum of 25.046 euros)

Personal deductions

You can also make deductions for any costs resulting from the following:

- Alimony payments to a divorced partner (up to 13.805 euros per year)

- Charitable contributions to German charities (up to 20% of gross income)

- Interest on a mortgage (on buy-to-let properties, and only deductible against income made from the property)

Child allowances

If you have children, you are entitled to deductions and benefits to mitigate the cost of raising children. This includes:

- Education expenses, if the child is attending a private school in Germany or Europe (30% of tuition fees up to a maximum of 5.000 euros per year per child)

- Child allowance (3.906 euros per child registered in Germany)

- Childcare costs for children under 14 (up to 4.000 euros per year per child)

Be aware that many of these categories have limits and strict rules. If you are unsure, a tax advisor can help you understand how to make use of exemptions, deductions and allowances to reduce your tax bill.

How long does the refund take?

The last but most important question is how long will it take me to get my refund?

The official website says anywhere between 2 to 6 months. This seems like a ridiculous long range of dates but I guess they prefer to be conservative. You’ll receive a Steuerbescheid (tax assessment) letter from the Finanzamt telling you what your refund, or payment owed will be.

I think if you have a less complicated tax return, aka if you are just reporting a lohnsteuerbescheinigung with not so extraordinary deductions and no side hustles, this will be relatively quick. You should receive your tax return in 3-6 weeks time, especially if you filed it online. The money will be direct deposited into your German bank account.

Worth it if you have a more complex situation: a Steuerberater

You can also turn to professional tax advisers in Germany for this. A Steuerberater is a trained agent capable of preparing, processing and submitting your tax declaration in Germany. They are accountants usually experienced into finding particular rules that is relevant to your tax profile to optimize your return. Even if their fees are controlled by certain laws, you usually have to pay a few hundred euros for their services. This is why it’s only relevant if your situation is a bit more complex like

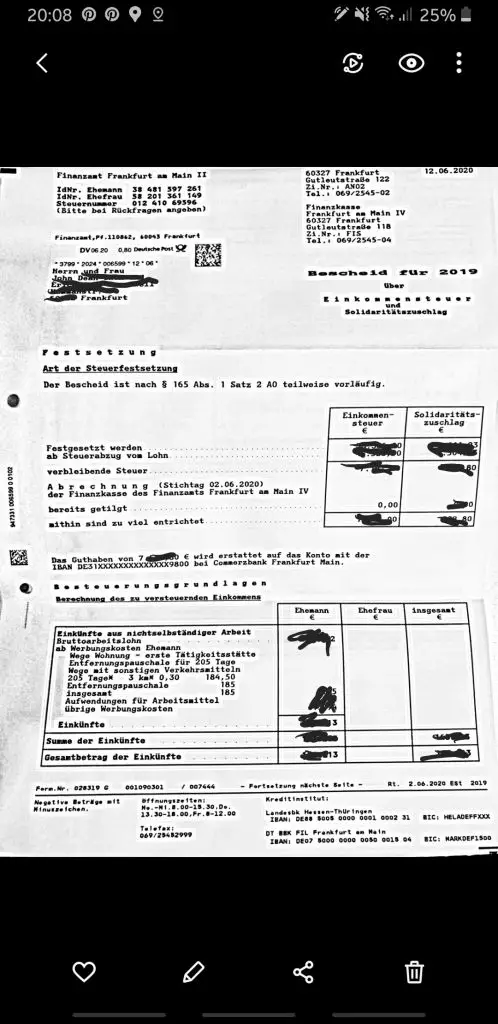

The German Tax Assessment

After roughly 100 days, I finally received my tax assessment from the Finanzamt. I submitted my form on Mar 2 and received my assessment on Jun 16. The refund amount was deposited into my bank account a day later. This form is of course entirely in German and I didn’t understand any of it.

However, the refund amount that I submitted through Wundertax was pretty much exactly the same as what the Finanzamt gave to me. In fact, I received an extra €3!

Here is what the form looks like.

Hi Johnny,

Thank you very much for the very detailed and subsection-wise information on filing tax returns and change of the tax class. My husband moved to Germany this month, and he is unemployed in Germany but was employed before in the country he was residing in. Would I still get a refund for the tax that I paid this year when he was not here in Germany or would I have to pay more tax for those months (as we both were employed)?

Thanks and regards,

Rupali

Hi Rupali, his income in another country does not matter so just make sure to change your tax class and enjoy the cash back