Germany has a distinct set of tax categories depending on your status in life (married, single, etc). This class will determine exactly how much taxes you pay to the Government and changing it could result in a much larger paycheck. This post will explain the difference between the different tax categories and how to change them accordingly. There’s a chance you could save a lot of euros changing your tax class and put that towards visiting some of this beautiful country. In addition, your tax class will be absolutely key when it comes time to file a German tax return, which I go into great detail in my post about filing my own German tax return as well as determining how much unemployment money you’ll receive if you lose your job.

For those planning or thinking of moving to Frankfurt, make sure to also read why I absolutely love living in the financial capital of Germany!

If you are planning or are moving to Germany, make sure to also read about my experiences living in the country. This post is also a part of my guide to living in Frankfurt, Germany where I list out all the things you need to know as an expat in Frankfurt and Germany.

Tax Categories in Germany

Below you will find a description/criteria of the different tax categories:

| Tax Class | Description |

|---|---|

| I | Those single or separated, but not falling into either categories II or III |

| II | Single and separated, with a child, entitling them to a child’s allowance. |

| III | Married employee. |

| IV | Married employees if both of them receive wage. |

| V | Married persons who would normally fall into class IV, but whose spouse is in tax class III (more on this later) |

| VI | Employees who receive income from other employment on other, or several different tax cards (Lohnsteuerkarte). |

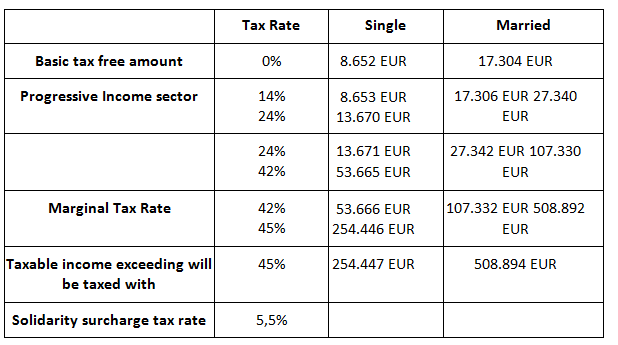

As an expat, when you initially register yourself with the anmeldung which is a whole process on its own, you’ll automatically be placed into tax category 1 (single) or tax category 4 (if you’re married). If you’re married and your spouse is not in Germany, you will be put into tax class 1. Here is a breakdown of the tax brackets in Germany for single and married.

Tax class 1

Tax class I is what many expats will fall into by default. If you’re a single person, you will automatically be put into class 1. However, there are some complexities as well for those that are moving to Germany but leaving their families behind in their home countries.

Single people

If you’re single and working in Germany, you will automatically be put into tax class I. There is no way to change this and there is no reason to change it because this is exactly what Tax class 1 is for. Tax class 1 has the highest tax rate as you would expect since you are only responsible for one person, yourself.

Families that are living together in Germany

If you’re married, but you moved to Germany on your own leaving behind your spouse in their home country, then you will also be put into class 1. This is because Germany only recognizes married tax status if you’re spouse is also living in Germany with you. For as long as you’re living in Germany on your own, you will be put into class 1 and pay the higher tax rates. There’s no way to change this unless your spouse moves to the country.

However, if your spouse is an EU citizen living in Europe, Germany does recognize this as a marriage. Assuming she has no job, or is at a much lower paid job, then you could potentially change your tax class to 3 which has a significantly reduced tax rate.

Tax class 3

Tax class 3 is what many married expats will want to change their categories to. This means that one person is making significantly more money (how much is significant I’m not sure) than the other spouse. The same applies if you are the sole earner, and your significant other does not work at all. Your significant other will then be assigned tax class 5.

Being classified in Tax class 3 will mean you save a significant amount on your taxes. I’m not an expert on the numbers but I’d estimate it to be somewhere between 10% of your paycheck that you’ll be getting back. This makes sense as the Government is taking less of your paycheck as you now need to support two people instead of one.

Tax class 4

By default, when you are register in Germany as a married couple, both you and your spouse will automatically be put into class 4. class 4 is assuming both parties are working similarly paid jobs and therefore, your tax obligation will be similar to tax class 1, which is the highest tax obligation. I’ve played around with the BBX calculator and even if you make the same salaries, it’s almost always better to change to tax class 3/5 because on a combined tax rate, it is still better than having both parties in class 4.

If you both move to Germany at the same time, you will be put into class 4. If your spouse moved to Germany after you did, once you register them you will go from class 1 to class 4. If your spouse is not working, then it behooves you to change to class 3 and 5 as soon as possible as you are paying more taxes than required. The rest of this post will go into detail about how to accomplish this.

Tax class 5

Tax class 5 is the counterpart of the spouse that is in class 3. One person will always be one or the other. Being in tax class 5 means you either do not work, or are earning significantly less than you spouse who is in tax class 3.

The tax rates are actually the highest in tax class 5, even higher than tax class 1. Why would anyone want to end up in tax class 5 then? Because the alternative is both parties being in class 4 which is taxed the same as class 1. Essentially, if you’re not working, it is a no brainer because your spouse who is in class 3 will save a lot of money. However if you are working, but earn significantly less than your spouse, your tax will be a bit higher than if you were single (class 1), but your spouse will be significantly lower (class 3).

If you did not make the change and both stayed in class 4, then overall you as a couple will be paying more tax.

Difference in tax rates

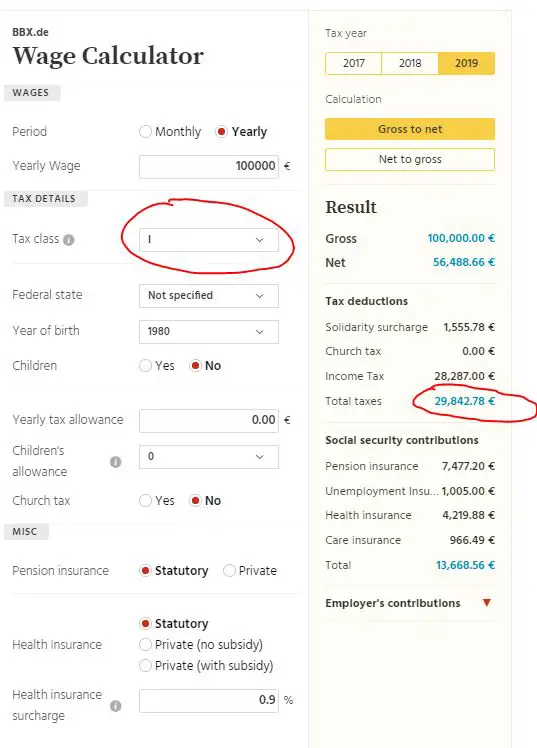

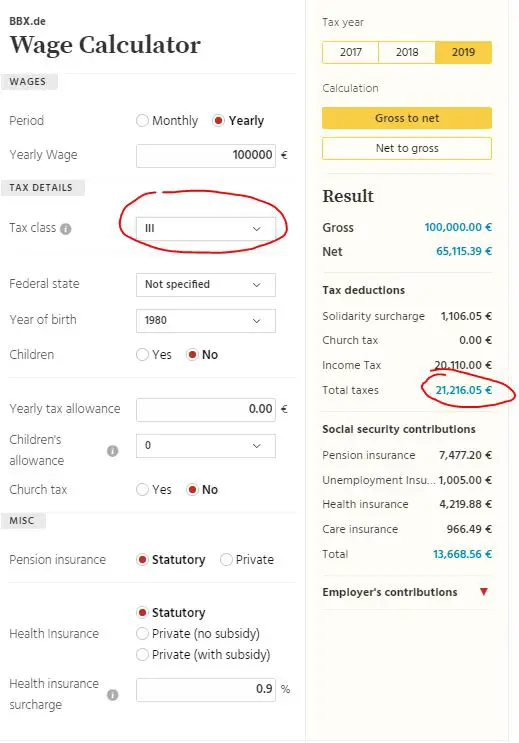

Wondering how much money you’ll save if you go from tax class 1 to tax class 3? A damn lot of money it would appear. The tax rate comes down significantly when you’re in tax class 3. I used the income tax calculator at bbx.de to illustrate my example.

Assuming I earn €100,000 a year, this is what my tax picture looks like in class 1. My total taxes amounts to €29,843 or about 30%

If I change it to tax category 3, then I am only paying €21,216 a year or about 21%.

That’s a difference of €29,842 – €21,216 = €8,626. This means I am saving almost €9,000 a year or about 9% of my paycheck! This will go a long way in helping out with the cost of living in Frankfurt where I’m living and really helped me save more money to allow me to retire early at 34 having achieved financial independence.

Changing tax class in Germany

Anything to do with taxes and Finance in Germany is done through the Finanzamt, the finance authority of Germany. They review and process your end of year tax returns along with any refunds associated with it. They also control which tax class you are in. This information is then fed to your employer which take care of how much taxes are withheld from your paycheck. In order for you to change your tax class, you must change it with the Finanzamt. Simply telling your HR department you got married will do nothing because they have no control over which tax class you are and how much to withhold.

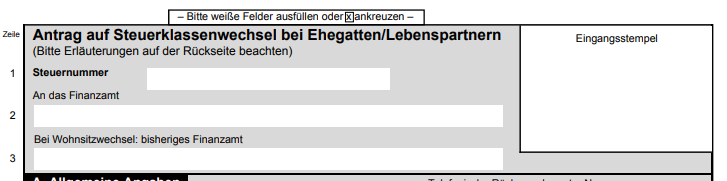

You will need to fill out a tax class change form called the “Steuerklassenwechsel” in order to go from class 4/4 to class 3/5. This form can be obtained at your local finanzamt or you can simply download it online from this link. It is two pages and there are no English translations. I’ve broken down the form to help you fill it out!

Part 1 – Steuernummer

- This is the Steuernummer which is different than your tax Identifikationsnummer. The latter is sent to you via mail and it is your permanent tax filing number for as long as you live in Germany. The Steuernummer is a unique tax filing number that the Finanzamt of your local jurisdiction gives you after you file your first tax return. If you move to another city in Germany, you will be under a different Finanzamt which will give you a different number. You can obtain this by simply going to the Finanzamt office and requesting it.

- An das Finanzamt: The location of your Finanzamt office

- Bei Wohnsitzwechsel: bisheriges Finanzamt: If you’ve moved before, the previous Finanzamt.

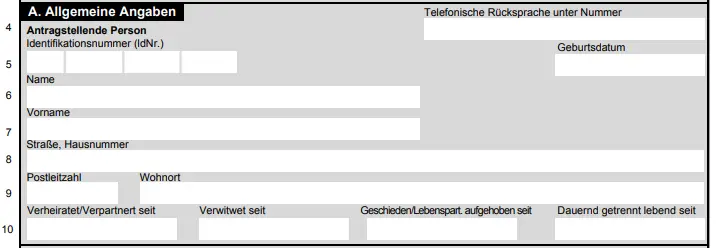

Part 2 – Personal Information

This part deals with the personal information of the first spousal member.

- Antragstellende Person: This is the personal tax ID number sent to you by mail from the Finanzamt and is a 11 digit number.

6: Name: Last name

7: Vorname: Firstname

- Strasse, Hausnummer: Your address

-

Postleitzahl: Postal Code | Wohnort: City

-

Verheiratet/Verpartnertseit: Date you got married | Verwitweet seit: Date you became a widow | Geschieden…: Date you divorced | Dauernd getrennt…: Date formally separated

Fill in only one of these boxes. If you’re recently married and want to switch to tax class 3/5, then fill in just the first box with your marriage date. Should match your marriage certificate

11 to 15 are for your spouse. He/She will also have an identifikationsnummer which you’ll need to put here. You don’t need to fill in 14 or 15 if you live at the same address.

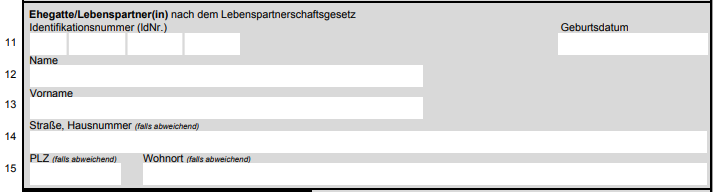

Part 3 – Tax change

This is probably the most important part of the form. This part is where you choose which tax category you want to belong to, which is the whole purpose of this exercise.

- This is your previous tax class. If you’re recently married or you’re an expat and your spouse has recently joined you, you will be put into vier/vier which means four / four. This is expected because when you’re first married, you’re automatically put into 4 / 4.

-

This is your desired tax class. In this case, I want to be tax class 3 and my spouse to be tax class 5 so I select drei/funf or three/five. The first number corresponds to the person in lines 4 to 10, and the second number corresponds to the second part of the table (lines 11-15).

19 and 20. This is if you want to apply the changes in the current month or from the following month. Not sure why I’d wait so I select the first box.

21 to 28: Technically you’re only allowed to change your tax class once a year. This section is for if you have to change it again during the year because your spouse resumed work or something. Most of the time this is unnecessary.

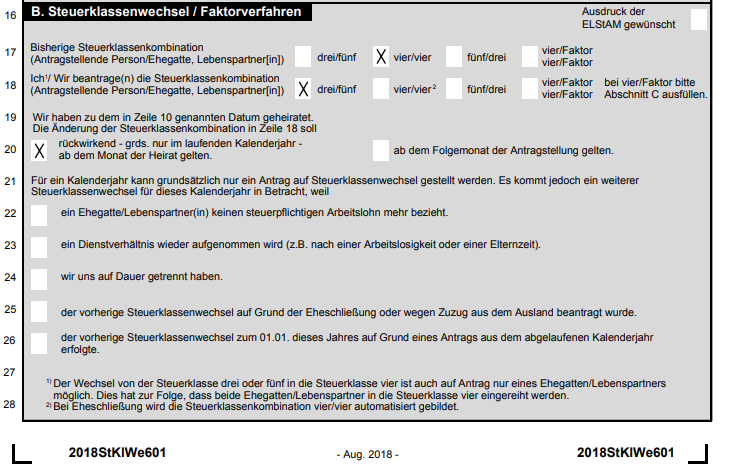

Part 4 – For tax class 4 with factor

The last part on the second page is to only with changing to tax class 4 with factor. I’m not even sure what tax class 4 with a factor is so I’d think almost all expats would not use this.

- This is your income. The left column corresponds to the first spouse, and the right column is the second spouse. Put 0 if your spouse has no income.

33 and 37: This part will be blank for most people because it has to do with receiving pension income.

- This is asking you are you participating in the state pension program. If you select no, you are probably a free lancer or contractor of some sort. Everyone else is supposed to pay ino this

-

This is asking if you are enrolled into the state health insurance program

-

Monthly contributions to a private health insurance program. Only if you’re enrolled in private health insurance

Make sure to have both parties sign and date in box 43 and you’re done!

Going to the Finanzamt

Once you’re done filling this form out, you’ll need to visit the Finanzamt office in your local jurisdiction. Yes you have to go in person to change your tax withholdings in Germany which for me is a bit crazy. In the US, you just tell your HR department you got married and change some options online and that is usually the end of it. Very rarely do they request you provide a marriage certificate. But Germany is a bit more rigid so you’ll have to make time for this.

In Frankfurt, the Finanzamt is in the Banhofsviertel. No appointment scheduling is required; just show up in person during their business hours. Make sure to bring the following with you:

- Passports

- Anmeldung (address registration)

- Marriage Certificate (with apostille)

- Completed Steuerklassenwechsel form

The Finanzamt in Frankfurt is at Gutleutstrasse 114 near the Bahnhofsviertel. There are multiple buildings belonging to the Finanzamt but the one where you make changes to your tax class is the building furthest east. If you get lost, just ask someone and they will point you in the right direction.

When I arrived, I got a number for my case. I waited about 10 minutes before a tax officer saw me. I handed her my filled out form and she made the changes in 5 minutes. She did not even ask me for a passport or marriage certificate!

How long do the changes take to materialize?

The Finanzamt makes the changes and it is communicated to your employer within the first 5 days of the month. Most people get paid on the 15th of the month in Germany so as long as you submit your changes before the end of the month, you’ll see it for the next month’s paycheck.

For example, if I submitted my change on July 25, the Finanzamt will communicate the changes by Aug 5 to my employer, and they will make sure it is reflected on my Aug 15 paycheck.

That’s it. Quite a painless process I must say!

Getting a tax refund for being in Tax Class 3

Let’s say you moved to Germany in February of 2019 by yourself. You’ll automatically be put into tax class 1 and taxed accordingly at those rates. Your spouse then moved to Germany in August, and you filled out the change form to change your tax class to tax class 3. From September onwards, you are in tax class 3 and paying lower taxes.

Because you changed your tax class in 2019, you are entitled to pay only tax class 3 tax rates on your income for the entire year!

However, you will not be reimbursed for this until you file your German tax return in the first half of 2020. So in this example, you’ll have paid tax class 1 rates from February to August, but tax class 3 rates from September to December.

This means that when you file your German tax return, you will receive a refund that is the difference between tax class 3 and tax class 1 for the months of February to August. This could amount to thousands of euros!

Hi, My wife will be moving to Berlin shortly (I am already here). You mentioned that for tax class change, marriage certificate with apostille is needed. Is this needed even if it is in English? And can it be done after moving to Germany?

Hey mate, I don’t believe you need an apostille anymore for these documents but best to double check with the Burgeramt.

Hi Johnny,

I came to Germany on June 1st 2022, my family is coming to Germany on December 6th,

now i am under tax class 5 now, to change it to tax class 3 it will take 1 month,

My question is , when i file tax in 2023, for these month (june to Dec ) am i considered under tax class 3 or 5 for getting some tax returns back?

Best Regards,

Somesh

Hey mate, how are you in Tax class 5 if none of your family is in the country? You should be in tax class 1 until you have a spouse registered in the country. I think as long as you change your tax class to 3 before the end of the year you should be good to go. Perhaps call up the finanzamt just to verify this. They are pretty responsive.

Hi Johnny, I moved with my kid to join my husband in Germany April of this year and started working in June. I am recently separated from husband and we had the tax class of 3/5 because he earns higher than myself. How do I go about changing my tax class since we are separated, would I be able to get some refund from the previous months taxes and finally when is the deadline to have the tax class changed and to what class would I be picking?

Hi Joy, I think the deadline is sometime in November. I would think you would get a refund of sorts since 3/5 pays more than just being on tax class 1. If your child is with you then you will be tax class 2 so for sure you would get money back. I would just ask the finanzamt however as I’m not an expert with these classes unfortunately!

Hi Johny,

Which form do I need if I need to change from IV to I as my partner is leaving Germany for good? I have been searching online but I cant seem to find it. Thank you!

Hello Johnny,

I am living in Germany with my spouse and child. I am on tax class 3 and my spouse and child are moving back to India in November and will not return. They will deregister/abmeldung before leaving.

Do I need to change the tax class from 3 to tax class 1 immediately?

Is it true that because my spouse was with me in 2021, I will taxed under tax class 3 even though they are leaving Germany for the last 2 months of this year?

Thanks.

Hi Raj, if you deregister them from Germany, then yes you are supposed to change back to tax class 1. I’m not sure if that means your whole 2021 will be treated as such however. I’m pretty sure you will still be treated as tax class 3 and maybe they prorate the tax class 1 for the alst two months. I think best to speak with the finanzamt.

Thanks. I am assuming either last 2 months will be prorated for tax class 1 or the full year will be considered tax class 3 because my family was here for majority portion in Germany. I will confirm with Finanzamt.

Yep that would be my guess. Let me know what happens. I would be curious and am sure others would be too.

Hi Johnny! What you wrote was so helpful. My husband and children arrived here in Germany from the Philippines last August. The examples that you wrote actually corresponds to the months that they arrived. ???? Thank you so much for enlightening us about the tax class in Germany. It is indeed a great help. The next step for us is to find a job for my husband. It is quite difficult because we are living in Offenburg.???? one step at a time, and I know it will be good. Thank you.

Hi Laraine, glad you found the post helpful and welcome to Germany!

Hi johnny,

Thanks for the useful information.

I have a question let’s say if I got married in May’21 and my spouse moved into Germany in September’21 and my tax class is changed from October’21 to tax class 3.

So now when I file my returns next year will I get tax difference from May to September or January to September.

Thanks 🙂

Hey Aaron, you get the tax difference for the year so jan to sep you’ll get the difference between tax 3 and tax 1.

Thanks for your post

I need to ask, if my wife left germany for long vacation, shall i nform them to change my class to 1?

I mean is she planning to never come back? If so she needs to deregister with the burgeramt before you can change back to class 1

Hi johnny

Thanks for such a great post. I tried to reach Finanzamt Frankfurt. But they are not answering. Do you know if there is any other way to get appointment?

Hi mate, I think they might be closed right now for the holidays? I would try again in the new year.

Thank you very much.

Hi Johnny,

Thanks a lot for this detailed blog.

I changed my tax class last week and it was a breeze, thanks to your blog.

Please keep writing and wish you the very best!

Glad to hear that Aravind! Did you have to make an appointment during covid times?

Hi,

I would like to know the process of getting tax class changed during COVID in Frankfurt. I went to the Finanzamt office however it is closed. I don’t know how do i get my and my wife’s tax class changed.

Thanks for your help!

Hey Anubhav, my friend just tried doing nit and apparently you need to make appointments now due to COVID which is not surprising. Hope that helps!

Thanks a lot Jonny for the prompt response. May i know the process of getting an appointment. I tried calling them unfortunately it starts an automated call in German and i barely speak German.

COuld you please share a contact numbers where i can call and book appointment. Just an FYI, i dropped them an email at poststelle@fa-ff4.hessen.de. However, didn’t hear back yet.

Hey anubhav, unfortunately I don’t know what the process is since I’ve not done anything during covid times. Perhaps ask a German coworker to help?

Dear Johnny,

Thank you for the detailed information. It is very useful. I have a question regarding tax class change.

My tax class was 3 and my wife had a tax class of 5 in January 2019. But in July, my wife got job and we moved to a tax class of 4/4 in November 2019 (effective from December). Now my question is how the Finanzamt calculate my and my wife`s tax? Should I pay the tax amount equivalent to class 4 from January to December? This means should I pay back to Finanzamt?

My wife was unemployed until June and she got job in July only. Between July and November she paid tax in class 5, and since December she is paying tax in class 4.

Safe regards,

Jijeesh

Hello Jonny, I am married and have 2 children. My husband and children don’t live in Germany with me but stayed in our home country. I am tax class 1. As I have children can I apply for tax 2 if they don”t live in Germany? My understanding is that as long as my husband don’t live with me in Germany it is not possible to change any tax class?

Hi Sandra, yes your spouse must live with you to change to tax class 3 (assuming he’s not working). Im not familiar with tax class 2 unfortunately!

Hi Johny, thanks for the detailed information, I have a question regarding tax class change, I got married in November 2019,my wife joined me here in Germany in Mid of February, when I visited burgeramt to change my maritial status, they have asked me to bring the translated copy of marriage certificate. By the next time I visited them the burgeramt is closed since then due to corona pandemic. I can visit finanzamt only I update the maritial status at burgeramt. Do you have any recommendation to update the tax class.

Hey Arjun, can’t really help you here but I think the Burgeramt will reopen eventally. It for sure will reopen by this year so in the end, you’ll get that money back when you file your tax return.

Hi Johny

First of all let me thank you again for this blog post.

I have a request for you, if possible can you please make a blog post on how to read Tax Notice given by finance department for both the scenarios where we get money back and where we need to pay extra.

Recently I got the notice but there are just so many numbers there.

Hey Vikram, I’m still waiting on my tax Notice so once I get it, will add it and disect it, will to my exisitsng post about how to do a tax return!

Hi Johnny, thanks for the full explanation!

I’m married and I arrived in Germany May/2019, since then, I’ve been working.

In all my payslips, I received the salary from May to Dec in the tax class 3 which was perfect because my wife is not working but I never changed from tax class 4 to tax class 3.

In January/2020, the HR of my company asked my to provide them my tax ID which I never gave them. I went to Finanzamt because I didn’t know my tax-ID. I provided for the HR my tax ID and then, in February/2020 I received my salary in tax class 4. Then I went again to Finanzamt and changed from tax class 4 for tax class 3.

The problem is, I’m really really afraid of my tax class during all the 2019 was 4 and not 3. And if it’s true, maybe I need to pay more taxes instead of receiving money back from tax return. I’m also really upset with my company that never asked me this tax ID in 2019.

If my tax class was 4 instead of 3 during 2019, is that any solution that I can do?

Hi Luis, that is a very interesting situation that I’ve not heard before. I think legally, you’re supposed to change everything with the finanzamt. in fact, your HR is supposed to have some sort of connection into the Finanzamt which tells HR what tax class you are, and how much to withold accordingly. That’s what my HR told me at least. Also, my HR said they wouldn’t even pay me until I provided them my tax ID (I got my first paycheck without the tax ID because I was waiting for it in the mail and HR did a one off favor for me).

I’m not a tax expert by any means so I can’t provide any sort of expert advice. I’d probably go to HR and explain to them the problem and see what they say as it really was their fault. It’s likely they will be pretty useless so perhaps a tax professional would be best. Otherwise, you’re technically not even required to file a tax return at the end of the year in Germany unless you have self employment income.

Thank you so much for the answer!

The point is that I already did my tax return using wundertax website and I’m waiting the results. I did it before this situation and as I filled as tax class 3, I was suppose to receive a very good money back, because I only worked from May to December, so my annual salary was way less and then I should pay less.

But if I was tax class 4, then I’ll probably have to pay them back, unfortunately.

I talked to HR today and they told me my tax class changed and their system from 02.2020 but they don’t know if my tax class was always 4, they recommended me to contact the tax authorities.

By the way, thanks for the help and as you’re curious about it, I’ll let you know as soon as I receive the answer from the tax authorities about my tax return.

Hi luis, yes please let me know the outcome of your tax return! I’d be very curious to know as well. Also if you could let me know how long it took from submitting on wundertax to getting your letter from the finanzamt, that would be great as well as I also submitted my return on wundertax recently!

Hey Johnny, as I promised to update you:

I just received today the letter from finanzamt and I’ll receive my tax return correctly! Thanks god! haha

I don’t know what really happened but what I suppose is: No matter how did you receive your salary, how was your tax class but, if you do a Joint declaration you can provide the tax class as you wish.

If during the year was 4-4 (me and my wife) but we realized that we can benefit from 3-5, we can do a joint tax declaration with 3-5 . I don’t know, this is just a guess! Because that’s what I did, I put 3 for me and 5 for my wife in the joint declaration of wundertax and it worked.

Regarding the time last from submitting and receiving the letter: I submitted on 14. February and received today, 02. April. But, in the meantime I received another letter asking me more information about income abroad, as I arrived in Germany in the middle of the year. I took almost 2 weeks to sent back them this requested information. So I believe you already received, right?

Thank you for your patience 🙂

Hey Luis, this is very helpful thanks! So as long as you fill out your tax return as 3-5 that’s as ll that matters? I submitted mine on Mar 2 so hopefully get it in the next two weeks.

I have not received any mail asking me for more information on income abroad. When did you get this letter? I arrived in Feb so almost my entire year was in Germany so perhaps that might be why I don’t have anything

That’s what I think but it’s only a guess.

Regarding the letter I receive it in my letterbox at home the end of february giving me more or less 20 days to answer.

That was the form which I received at home: https://www.finanzamt.bayern.de/Informationen/Formulare/fms.php?n=034138_19

Ah thanks for the heads up. Will keep an eye out for this but I think either I lived abroad only 1 month so it’s not necessary or because I am a US citizen and US and Germany have a tax reciprocity agreement with each other.

Hi Johnny,

thanks for your detailed info.

But what if I need to change from class 1? The form doesn’t have this choice at the point 17.

Any suggestions?

Thanks in advance

Hey Davide, how it works is once you’re married and you’ve registered you and your spouse as married, you will automaticalcly be changed from class 1 to class 4. Your spouse will be automatically in class 4. So this form is to change your tax class from tax class 4/4 to tax class 3/5. Hope that helps!

Hello Johnny,

thanks for your reply.

You mean I have to go first to the Bürgeramt to register my spouse and I as married. The Bürgeramt will communicate automatically to the Finanzamt our new class which will be 4. If I want to change in 3/5 I should use the form we are talking about. Is this the process?

Thanks in advance,

Davide

Yes that is correct. Generally, before you do anything administrative at all in Germany, you need to register and get the anmeldung done first.

Hi Johny,

It was indeed very helpful post.

I have recently moved into Hannover Germany, my wife and daughter is in home country and will be here with me once I get blue card and house.

At the moment my city registration is done and I will get my Tax ID on coming Monday. My colleague went today to their office and enquired them about tax class and asked them to change his tax class as he is married (his family is also in his home country and not yet arrived or registered in Germany). The lady at the office told him that we don’t have any info of your family, so bring originals of marriage certificate and birth certificate in German language and we will update your tax class, though the lady officer knows that his family is in home country.

As per your blog family have to be registered first in Germany then we will be able to request for class change, whereas my friend was told differently by the officers.

Now I’m very confused what to do. Secondly I don’t have originals, and I will have to get then through DHL and later send then back to Pakistan because these originals are required there as well for Visa Application.

Please advise me what should I do?

Regards,

Osama

Hi Osama, from my experience, I needed to register my +1 at the Rathaus with my official marriage docs. Then I brought these to the finanzamt, filled out the form to change my tax class and it was done. The Finanzamt didnt’ even look at my marriage certificate, they were able to see that my spoues was already registered in their systems and just automatically changed my tax class that way.

Hello Osama,

Shall i know what happened further.

Is that possible to change the tax class from 1 to 3 even our family is in our home country.

Regards,

Kishore

Hi Johnny,

First of all thanks a lot for providing this info.

I am married since 2016 and working here in Berlin since March 2019. and My wife came here in Oct 2019 and got register in Oct 2019. currently, my Tax class is 1 and planning to change into class 4.

I just wanted to know can change my tax class retrospective in my case like from March 2019 also can apply for a tax refund for paid extra tax

Any suggestions/help would be much appreciated.

Thanks in advance

Hi anish, do you mean changing to tax class 3? If so I think you need to do this before 2019 ended to get the full refund for 2019. That’s why most people make their tax class changes before the end of the year

Hi Johny,

changing tax classes are also possible for married students? Or, is it only for full-time employees?

Hi Arup, I don’t see why it wouldn’t be? But do you guys have salaried jobs? It might not make much difference if you’re not earnign above a certain amount of money.

Hii Johny ,I would like to know that my wife is coming in December .And she will register here in germany in December 2019 itself .In that case, Will i get the money fro whole year of 2019 ?

Hi Akhil, I think you need to do the switch before Nov 30 as this is the last day to change your tax class before the end of the year. However, I think as long as you do it in 2019 (dec), you can apply it retroactively but you may need to do some extra paperwork filings. I’m not entirely positive however. Let me know what happens as I would be very interested in the answer!

Hello Johnny,

Thank You for detailed info regarding tax class change in Germany.

I need a small information. I came recently to Germany and I am married and under tax class 1 now.

I am planning to bring my wife to Germany on 30th Nov,2019.

Can I apply for tax class change before 05th Dec,2019 so that it will be updated for December Pay cheque?

Is there any last date in a particular year to apply for tax class change?

Your response is highly appreciated.

Thank You,

Regards

Balaji M

Hi Balaji, I would apply for the tax change as soon as she moves here and gets registered (would do this asap). As long as you change your tax class before the end of the year, you will get a tax refund for the entire year as if you were tax class 3. You probably won’t see your paycheck change until Jan or even Feb paycheck but don’t woryr, all of the money you made in 2019 will be tax class 3 as long as you change it before the end of the year.

Hi Johnny

First of all thanks a lot for providing this info.

I am a married person with a child. While registering ourselves in Hamburg we were registered as a family still I got tax class 1. I am not able to understand why it happened.

Secondly, the form does not have a previous tax class as 1 under part 3.

Any suggestions/help would be much appreciated.

Thanks in advance

Hi Vikram, that is strange indeed but also sometimes it takes one or two billing cycles for it to reflect correctly. Talk to your HR and they should be able to inform you if it’s been changed. Otherwise, I think you should just go to the Finanzamt with this form completed, copy of you and your wife’s address registration and just get it taken care of. Tell them you registered as a family and should tax class 3 but you were not. Sometimes they make mistakes and it’s best to take action into your own hands instead of waiting for them to hopefully catch their error is my opinion.

Thanks, Johnny went to the Finanzamt and got the tax class changed. It was a smooth experience all in all took 10 mins. 🙂

Awesome! So glad to hear that and you’ll feel good after the next paycheck!

Hi Johnny, you have a great blog going here! My wife and I used many of your suggestions when touring the Southwest!

You tax guide is quite comprehensive, and will help any expat to cut through the red tape and fill out those awful sheets.

But I have to clarify one point: Tax classes don’t change the amount of income taxe due! The income tax for married couples is usually calculated by adding up the taxable income of both partners, halving it and having each pay half. If both earn the same amount they don’t benefit from this “splitting”, but if one earns 100.000 and the other 0, they will both be taxed as if they had earned 50.000 each. This saves them about 9000€ in taxes due to the lower marginal tax rate.

The tax class mainly governs your monthly installments deducted from your salary. Instead of waiting until the end of the year to get back those beforementioned 9000€ you have to pay less each month. If you don’t switch tax class you end up paying 9000€ too much as a couple and getting reimbursed afterwards. 3/5 is a good combination if you don’t want to wait a year until you get your money back and one partner earns at least 60% of the total income. 4/4 with factor turns it into a basically stepless system for all those couples in between.

As the tax class influences the monthly net income, you can use it to game the system. Benefits like unemployment benefits or paid parental leave are based on the net income. So if you know your work contract is expiring next year and you don’t know if you’ll find another job immediately or if you plan on taking a parental leave, it might be smart to switch into class 3 to be eligible for higher benefits, even if you’re not the main earner.

I hope this clears it up a little.

BTW, 07/31 is the last day to file your taxes for 2018.

Also, I would recommend a day trip to Wiesbaden. Formerly one of the most important spas in Europe, it retains a lot of its old splendor and is nowadays the capital of Hesse (not Frankfurt, as many think). It’s 40min by train.

Keep up the good work!

Hi Patrick, yes you’re definitely right. Goign to tax class 3/5 is merely just playing time value of money, aka getting your money sooner so you can do something with it (although negative rates in the EU maybe means something different vs in the US) as opposed to waiting for your tax refund. It’s a very interesting point you made on your last paragraph though. I did not know about the benefits calculation being based on net income!

I’ve also heard the same things about Wiesbaden! Planning to bike there from Frankfurt when I finally buy a bike!