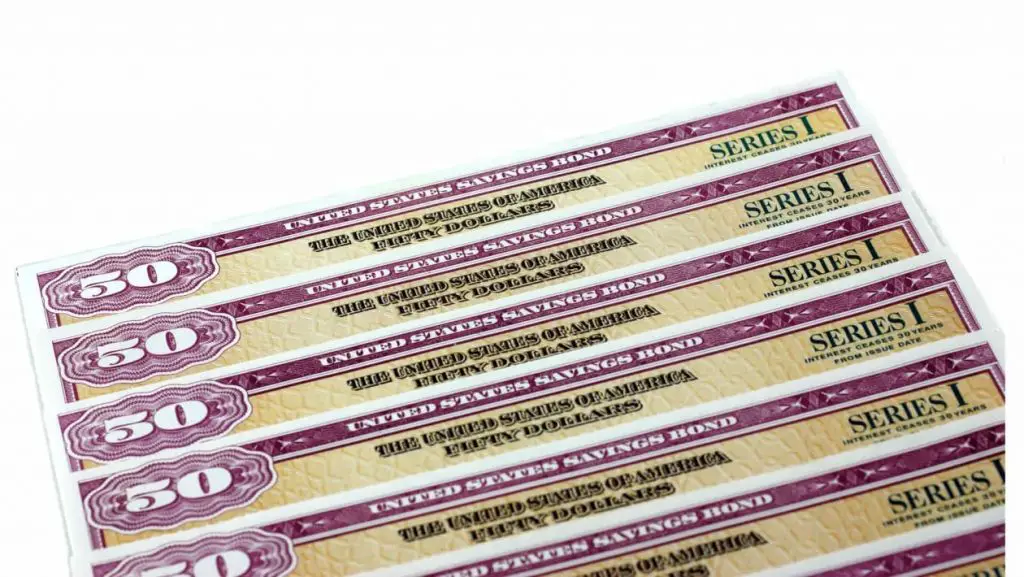

I Bonds, or Inflation Bonds, or Series I Savings Bonds are one of the best fixed income investments that you can find. This bond specifically tracks the inflation level of the United States and pays interest based on this level. This bond was first introduced in the late 90s and has been an absolutely essential part of anyone looking to invest in risk free assets.

While inflation has been low in the last decade or two, this bond has largely paid above the FED funds rate which means it has historically outpaced returns from a traditional savings account or CDs. I’ve only been purchased these bonds in the last year since inflation has been steadily rising. As of mid 2022, inflation bonds are paying a monstrous 9.62% which is 100% guaranteed by the US Government so this is ask risk free as it gets. I’ve owned inflation bonds recently as part of my Financial Independence lifestyle and portfolio.

Yes, really. You can get 9.62% in guaranteed income as of mid 2022.

Of course, all good things come with complexities and things to understand. This guide will go into detail about what inflation bonds are and how you can purchase them!

What is inflation?

Inflation is a general increase in the price of goods and services. It is caused when money supply increases faster than economic output.

Inflation can be good or bad for you, depending on how much you have saved up and how much your living expenses are. If you have a lot of savings, then inflation is good for you, because it will help your money grow faster. On the other hand, if you have a lot of debt, then inflation is bad for you because it will make all the interest rates higher and make it harder for you to pay off your debt quickly.

Inflation is also bad for savers because when inflation goes up, so does their cost of living (because they need more money to buy things they used to be able to buy with less). And this makes it harder for them to save up more money in order to retire early or do other things that require lots of savings (such as buying a house).

The good news is that there are ways to protect yourself from inflation: investing in certain types of bonds (such as I Bonds) or stocks in companies that pay dividends (like utilities).

What are I bonds?

I Bonds are short for Series I Savings Bonds. They are bonds issued by the U.S. government directly to retail investors. Currently, I Bonds carry favorable interest rates over other CDs and bonds to the low interest rate environment. I Bonds have been around since 1998 and have generally always paid above the risk free rates. This makes I Bonds the best bonds you can buy at the moment.

Not a traditional bond

I Bonds are not traditional “bonds”. They can’t be resold or traded in the secondary market. I would view an Inflation bond as a variable rate CD. Like a CD, you don’t have to worry about the value of the bond going down. It is 100% backed by the US Government and you can withdraw at any point (after 1 year) at 100% of the value.

A typical CD has a fixed interest rate depending on the current fed funds rate but the I Bond has a variable rate as the interest rate changes semi-annually depending on the level of inflation the US is currently experiencing. When inflation goes up, you can expect the interest on the I Bond to go up, and vice versa. This rate is locked in for 6 months and then adjusts accordingly thereafter. As long as you hold the bond, you will receive whatever the new rate is.

Why should you buy I-Bonds?

I Bonds are not like other savings bonds. They are not a good place to put your money for a short time, and they don’t allow you to get the best interest rate.

I Bonds are inflation-indexed bonds that provide a guaranteed return that increases with inflation. They’re designed to help protect your purchasing power against inflation and they’re backed by the US government.

Because of these unique features, I Bonds are primarily intended as long-term investments. If you want to buy savings bonds for short periods of time, consider Series EE Bonds instead (see our guide).

What is the interest rate of i-bonds

An I bond earns interest monthly from the first day of the month in the issue date. The interest accrues (is added to the bond) until the bond reaches 30 years or you cash the bond, whichever comes first.

- The interest is compounded semiannually. Every six months from the bond’s issue date, interest the bond earned in the six previous months is added to the bond’s principal value, creating a new principal value. Interest is then earned on the new principal.

- You can cash the bond after 12 months. However, if you cash the bond before it is five years old, you lose the last three months of interest. For example, if you purchase an I Bond on May 2022, you can’t withdraw your principal or interest until May 2023. If you do withdraw the balance of your bond on May 2023, you will only receive 9 months of interest (12 months – 3 months = 9 months).

How often does the rate of I-Bonds change?

Inflation bonds interest rate is reset every 6 months in the months of May and November. The rate changes based on the level of inflation the US is currently experiencing. The CPI (Consumer Purchasing Index) is the Golden standard for determining the inflation rate that the Government uses. This report is released monthly and has a huge effect on financial markets.

As the CPI increases, you can expect the rate of Inflation bonds to also increase and vice versa. This rate is fixed for 6 months however so if the CPI continues to increase throughout the 6 months, you won’t see additional benefit until the rate is reset at the end of that 6 month period.

What are the interest rates for I Bonds?

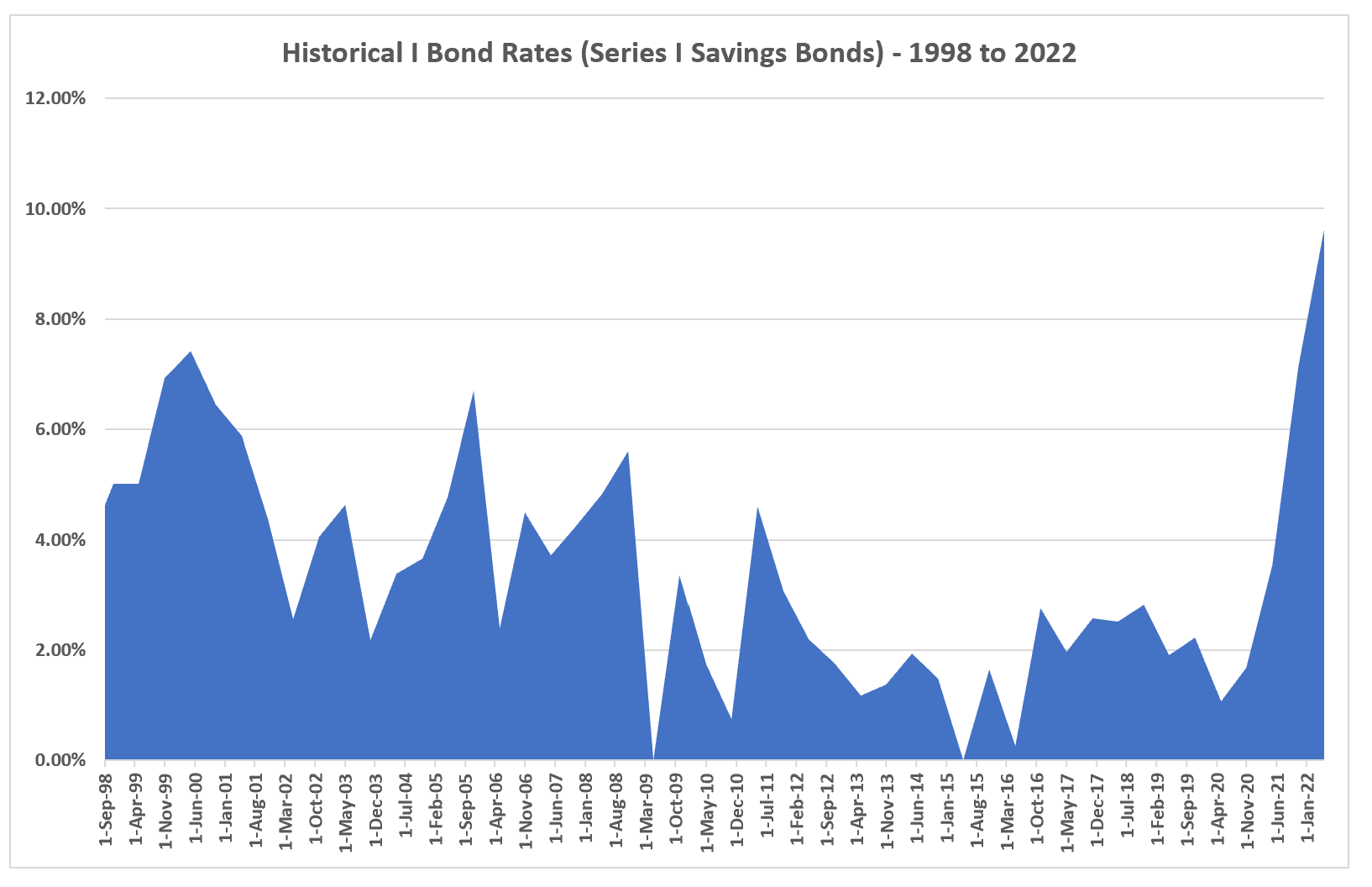

The interest rate on I bonds change every 6 months depending on the level of inflation the country is experiencing. As I write this in 2022, the rate has hit a whopping 9.6% given how rampant inflation is.

This means with a $10k investment, you can expect to earn $985 a year in interest since it compounds semi-annually. Prior to 2022, the peak in I Bond interest was 3.6% 20 years prior. I Bonds were never a really attractive investment until 2022 which they’ve become the best way to weather the financial bear market storm.

Here is a historical chart of how I Bonds have paid out

Are I Bond interest payments automatically invested

Yes, the interest you receive on I-Bonds are automatically reinvested into your principal portfolio until you decide to withdraw. This compounding is done semi-annually on the dates of your personal bond issuance date. This is a form of tax deferral essentially as you never realize these profits unless you withdraw.

I Bonds are a great way to diversify your portfolio

Inflation bonds are a great way to diversify your portfolio. While most of my portfolio is in stocks, I Bonds are a great way to have a risk free cash generating investment. I Bonds can pretty much double as a savings account. It’s a great place to park your cash and because of how liquid it is, you can withdraw it whenever you want.

Below is a chart of how much money you would have if you invested in I-Bonds from when they were first created (in 1998).

For this chart, I assumed a $10,000 yearly contribution (max contribution per year).

As you can see, an investment of roughly $240k over 22 years would yield a portfolio of $580,000 as of mid 2022. This is an almost 250% return which is obviously less than the returns of the S&P 500 over the same period but given that it is risk free, this is a great way for those that have lower risk tolerances.

How to buy I-Bonds?

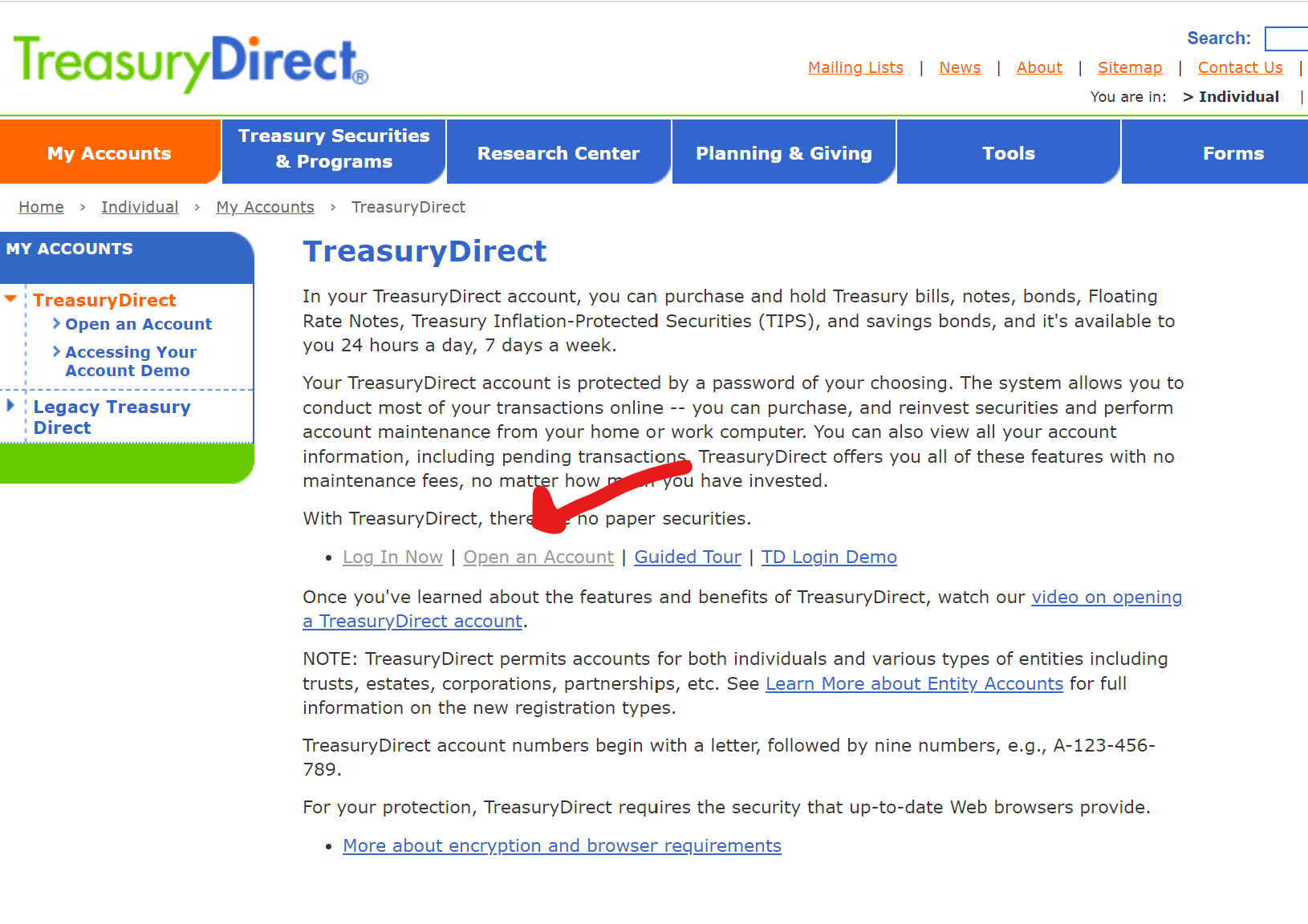

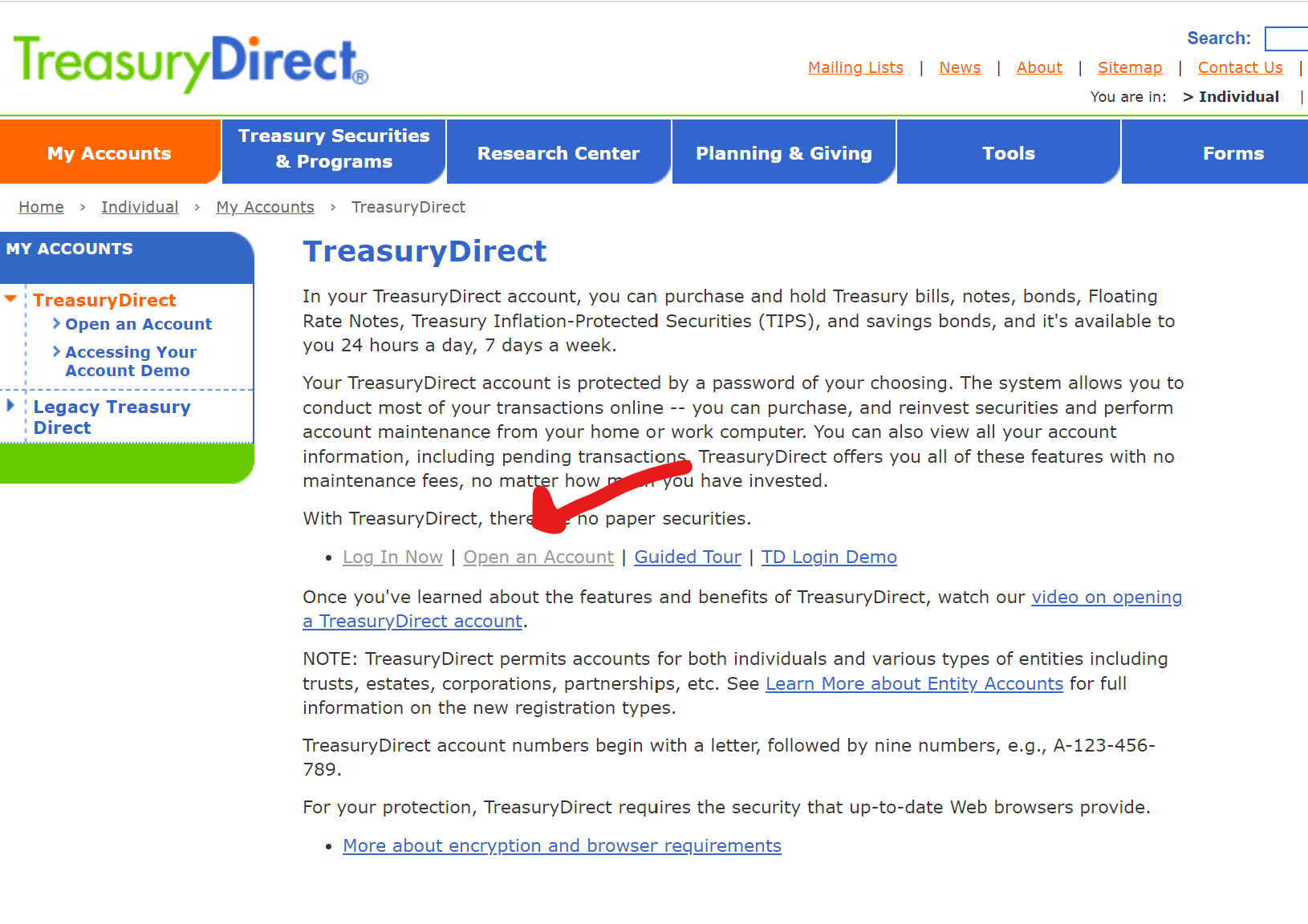

Use TreasuryDirect which is a website straight from the US Government that facilitates the sale of bonds to the regular consumer. TreasuryDirect is NOT a brokerage account and you can’t do anything with one of these accounts besides buying US Government bonds (which Inflation linked bonds are one of).

The Treasury Direct website looks like it is straight out of the early 2000s. The interface is old school and at times I had to double check to make sure it wasn’t a bogus website. In the end, any website ending in a .gov URL is trustworthy because you can’t be any person off the street and get a .gov URL.

The interface is basic but it is very easy to use. In the end, you aren’t trading stocks or options with this interface. It’s just purely to buy and hold bonds.

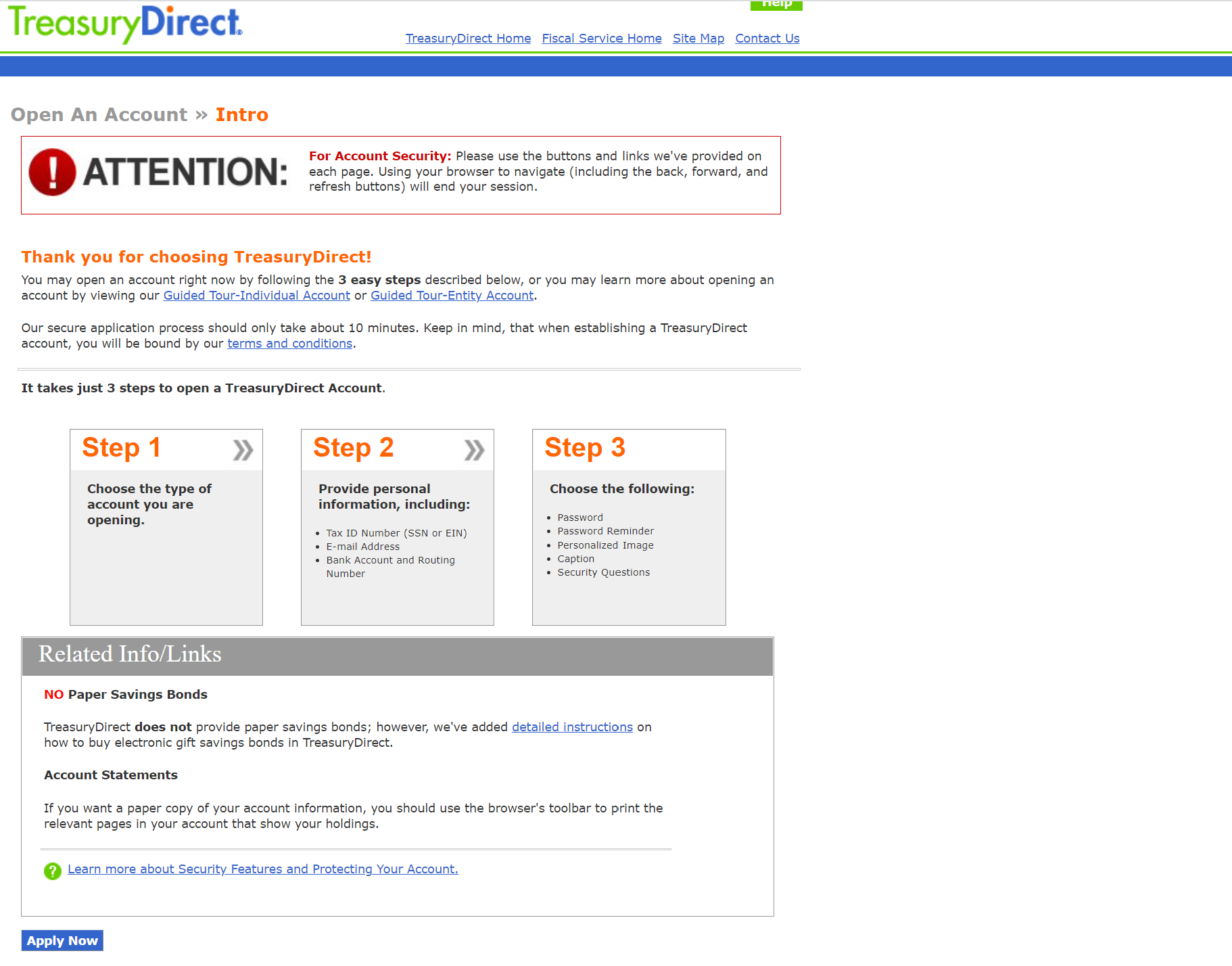

Step 1: Visit the Treasury Direct webpage

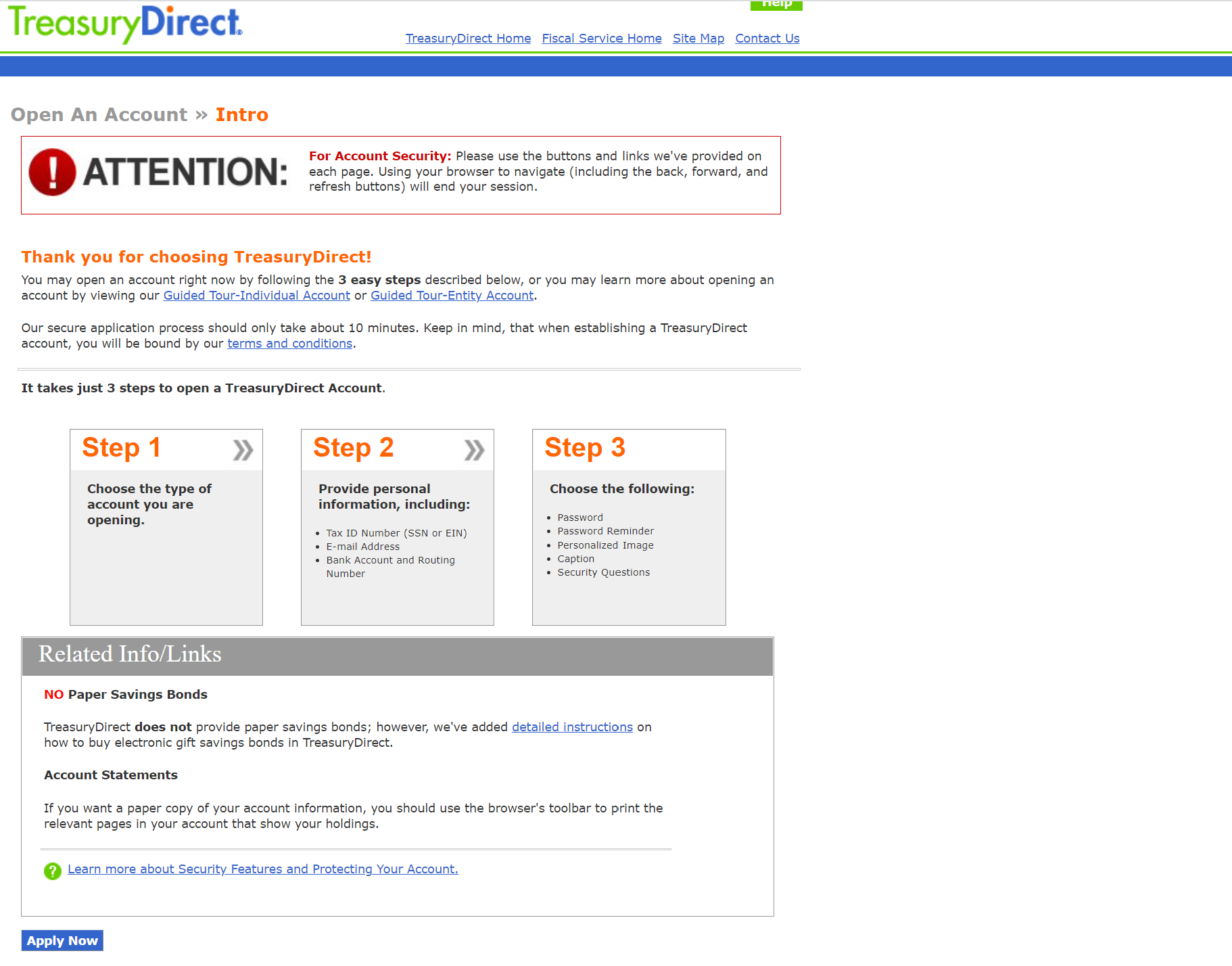

First step is to open the TreasuryDirect’s website for opening new accounts.

Step 2:

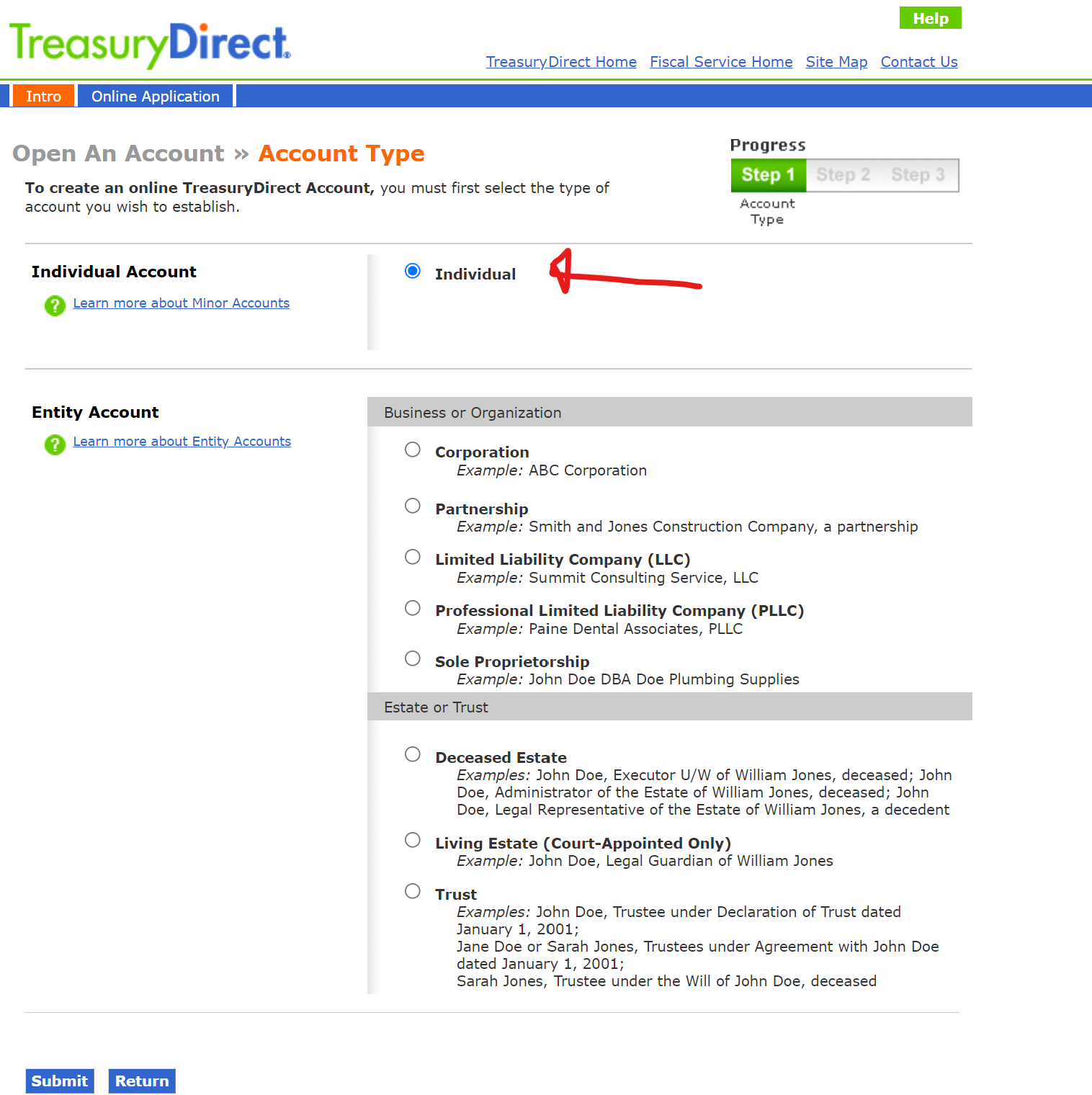

Step 3: Choose Individual

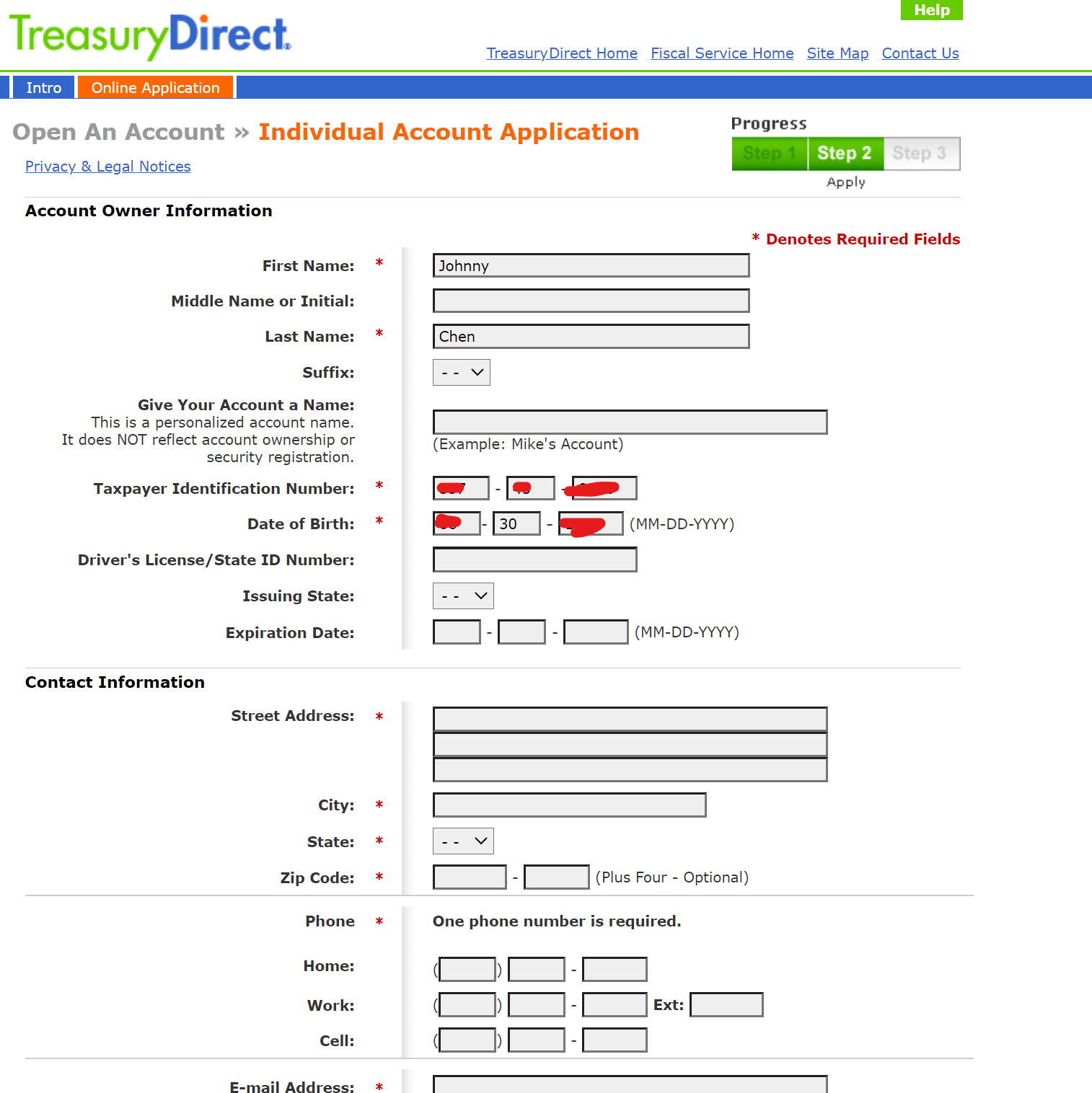

Step 4: Fill out the form

You’ll fill out the form similar to filling it out for the personal account. You’ll need your SSN, residential address, phone number, email etc. There’s nothing here that is out of the ordinary.

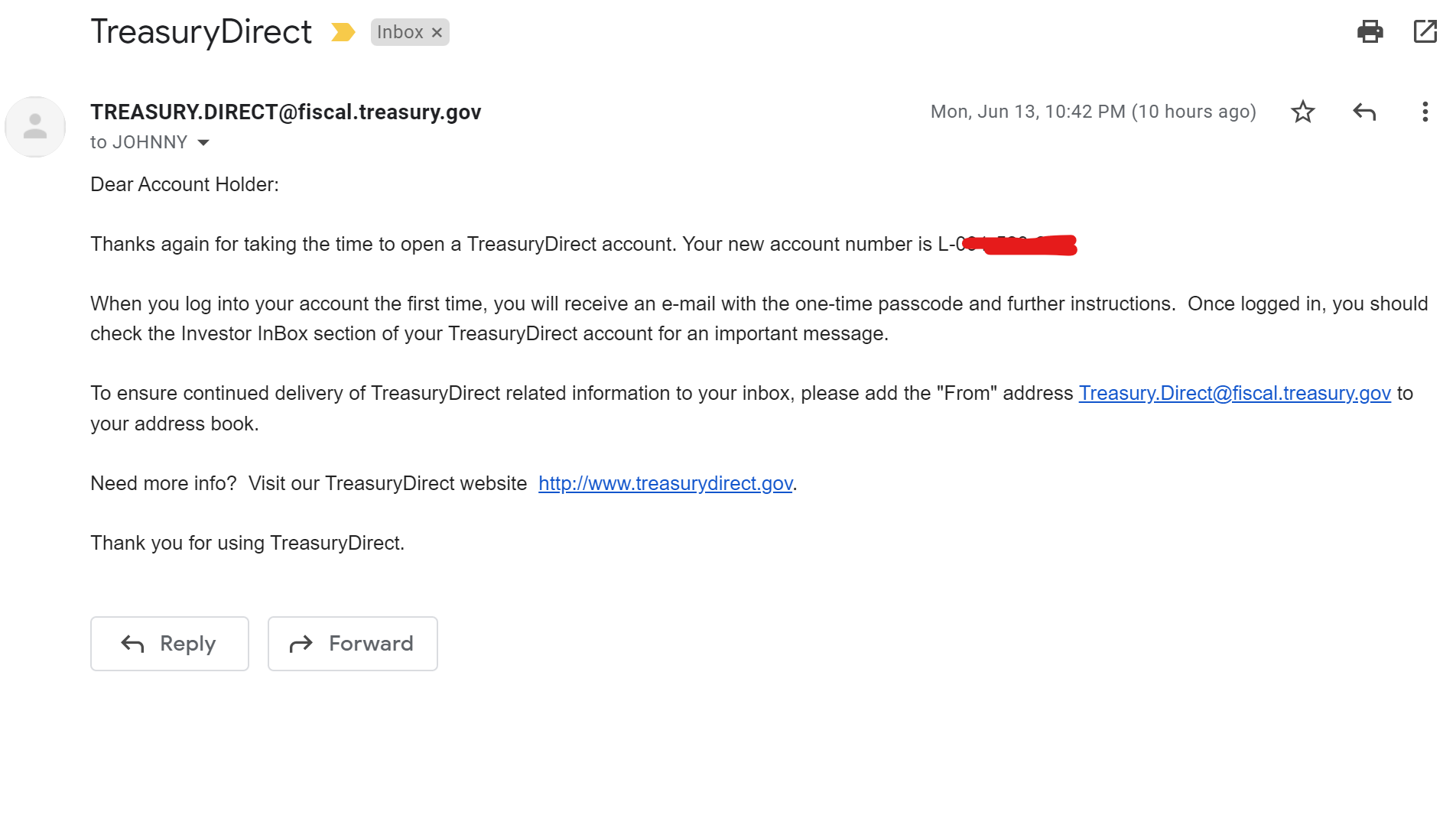

Step 4b: Verify your account via email

Once you finish your application, you’ll receive an email from TreasuryDirect which includes your account number. This will be the number you use to login to your account. Save this!

Step 5: Buy I Bonds

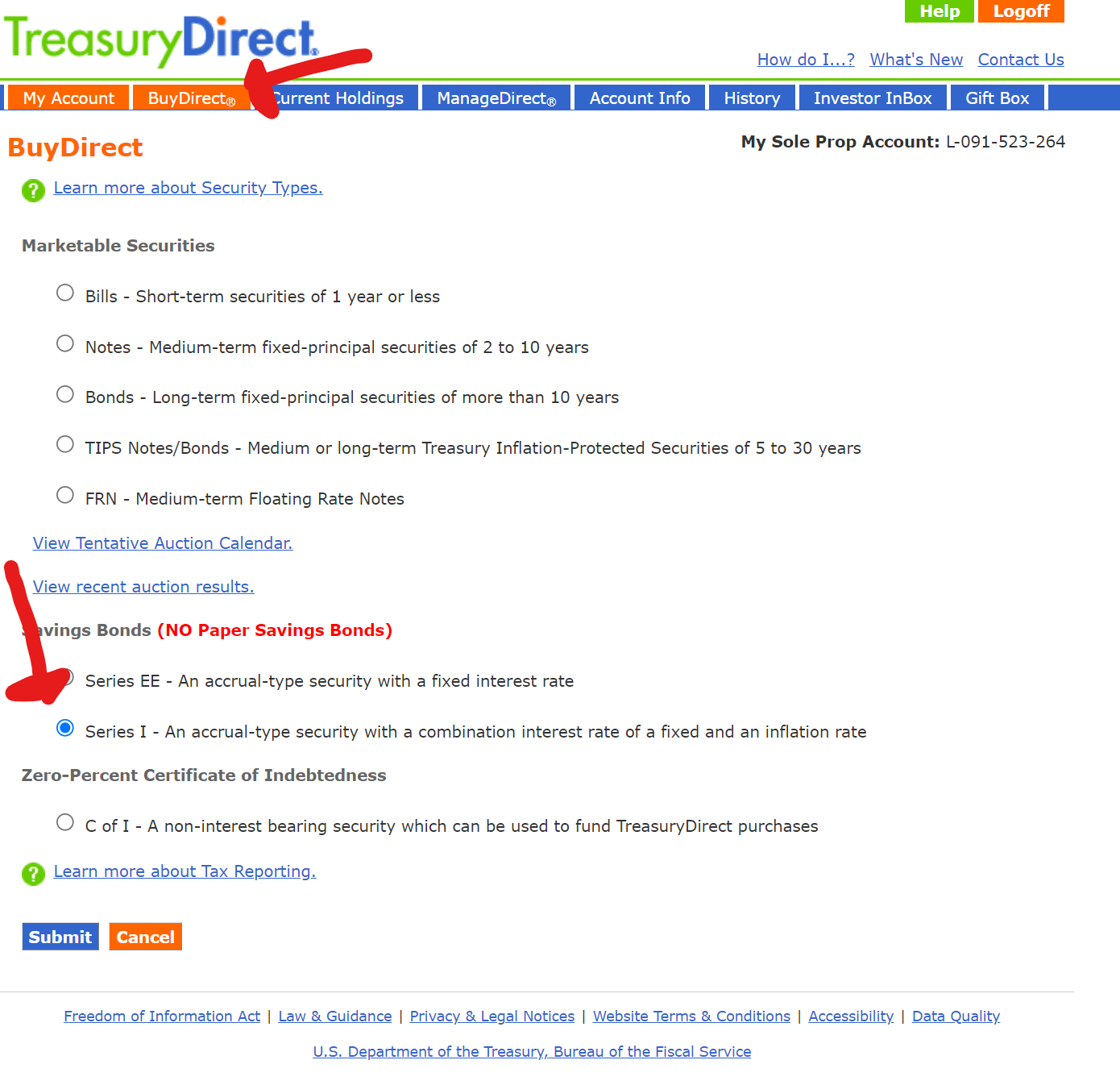

Once complete, you can submit the application and you’ll receive an email from Treasury Direct with your login details. You can proceed to the purchasing page of the treasury bonds and select the following:

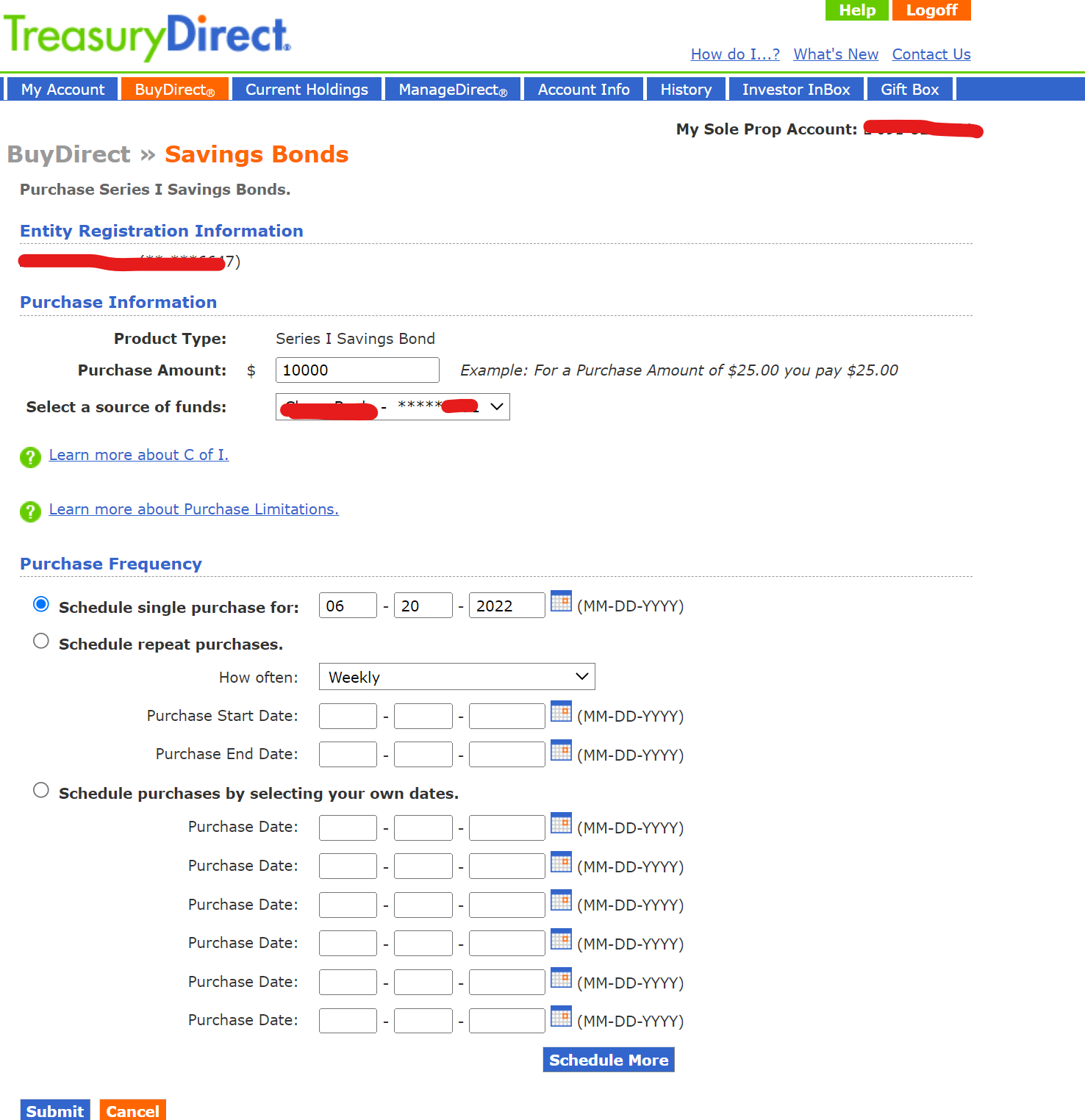

Finally, complete your purchase on the following page. You can choose to schedule recurring payments or just make one lump sum payment

Use a VPN if you’re outside of the US

If you’re an expat like myself living in Germany, Bali, and South Africa or anywhere in between, you’ll likely need a VPN in order to access this website. I use ExpressVPN and set my region to the United States in order to access this website.

You cannot buy i-bonds from a brokerage

As mentioned above, I-Bonds can only be purchaesd straight from the US Treasury. This means you cannot purchase I-Bonds using a brokerage account like Chase YouInvest, Fidelity, Robinhood, TDAmeritrade etc. You can buy all sorts of corporate bonds from these brokerages but not Inflation linked bonds specifically.

Why does the Government offer Inflation linked bonds?

Link your “Main” bank account

As already discussed before, TreasuryDirect’s website, interface, and technology is old school. Make sure to link a bank account you plan to use for the long haul. Changing the bank account information after registration is a bit of a pain. You need to submit paperwork and wait. It’s not worth the trouble.

In addition, make sure to triple check your account and routing numbers. TreasuryDirect’s website does not do any sort of verification on your bank account so if you have the wrong number, it won’t work.

Save your account numbers and password questions

When you open an account, you’ll be assigned an account number by Treasury Direct which you will receive by email communication. Make sure to save this email and number as it will be very hard to obtain later on if you need it.

The password you use is not case sensitive and when you login, you’ll have to use their strange on screen keyword which you can only input with your mouse (and not a keyword)

What are the purchasing limits for Inflation linked bonds?

Like all good things in life, there’s a limit to what you can obtain. That’s no different for I-Bonds. There is a limit per individual of $10,000 per year that can be put into Inflation bonds. If you’re married, that number doubles to $20,000 (which is still just $10,000 per person).

A bond that pays 9.6% as of 2022 with zero risk as it’s backed by the US Treasury is completely unheard of. This type of rate would likely far outpace returns in bonds or equities during a high inflationary period where rates are constantly rising.

People with a lot of money or high net worth could put hundreds of thousands of dollars into these bonds and earn almost 10% which just doesn’t make sense for the Government or society. It just further exacerbates income inequality and additionally provides a huge bill for the US Government.

The limit is $10,000 per year which you can deposit all at once or throughout the year with each paycheck .

How to purchase more than $10,000 in i-bonds?

You’re probably thinking, how can I get more of this sweet sweet yield? At 10% guaranteed (as of 2022), this rate is incredible and almost unheard of. It’s paying more than some Emerging market bonds so it makes sense to get as much as you can of it. Thankfully there are ways to purchase more I-bonds than the traditional $10k limit.

- Buy I Bonds for your business: S-Corp, LLC, Sole Proprietorship

- Gift bonds to your children under 18 years old

- Buy I Bonds in a living trust

All methods above have a limit of $10k per method. If you’re married, this can be $20k. For example, a married couple with two kids can in essence buy a total of $80k of I-Bonds per year:

- Purchase $10k per spouse on personal SSN = $20k total

- Purchase $10k per spouse on a sole proprietorship – $20k total

- Purchase $10k per spouse for your revocable living trust – $20k total

- Gift $10k per child (2 kids) – $20k total

- Total: $80k

Keep in mind that TreasuryDirect does not do joint accounts. If you and your spouse both want to purchase $10k per person, you’ll need to both open separate accounts. In the end, each account on TreasuryDirect is linked to a single SSN, or EIN. Therefore, being married doesn’t matter because you still have two individual Social security numbers.

If you’re a single person, unfortunately the maximum you can purchase is $20k unless you are able to create a living trust without a spouse.

Create your own Sole Proprietorship by opening an EIN

You’ve already bought $10k worth of I bonds through your personal account and now you want to purchase an additional $10k through a business but you don’t have a business. You’ve come to the right place.

You can open an EIN (Employer Identification Number) which is what you use as a Sole Proprietor. You don’t need to have a full fledged “business” in order to have one. This is simply a way to separate your finances and taxes between your business and personal income. Plenty of people with side hustles like driving for Uber, blogging like yours truly, selling clothes on eBay, or anything in between can apply for an EIN and thereby file a schedule C during tax season.

I frequently use my EIN to apply for multiple business credit cards to get the sign on bonuses. This has become incredibly lucrative but also this is a great way to increase my allocation to inflation bonds.

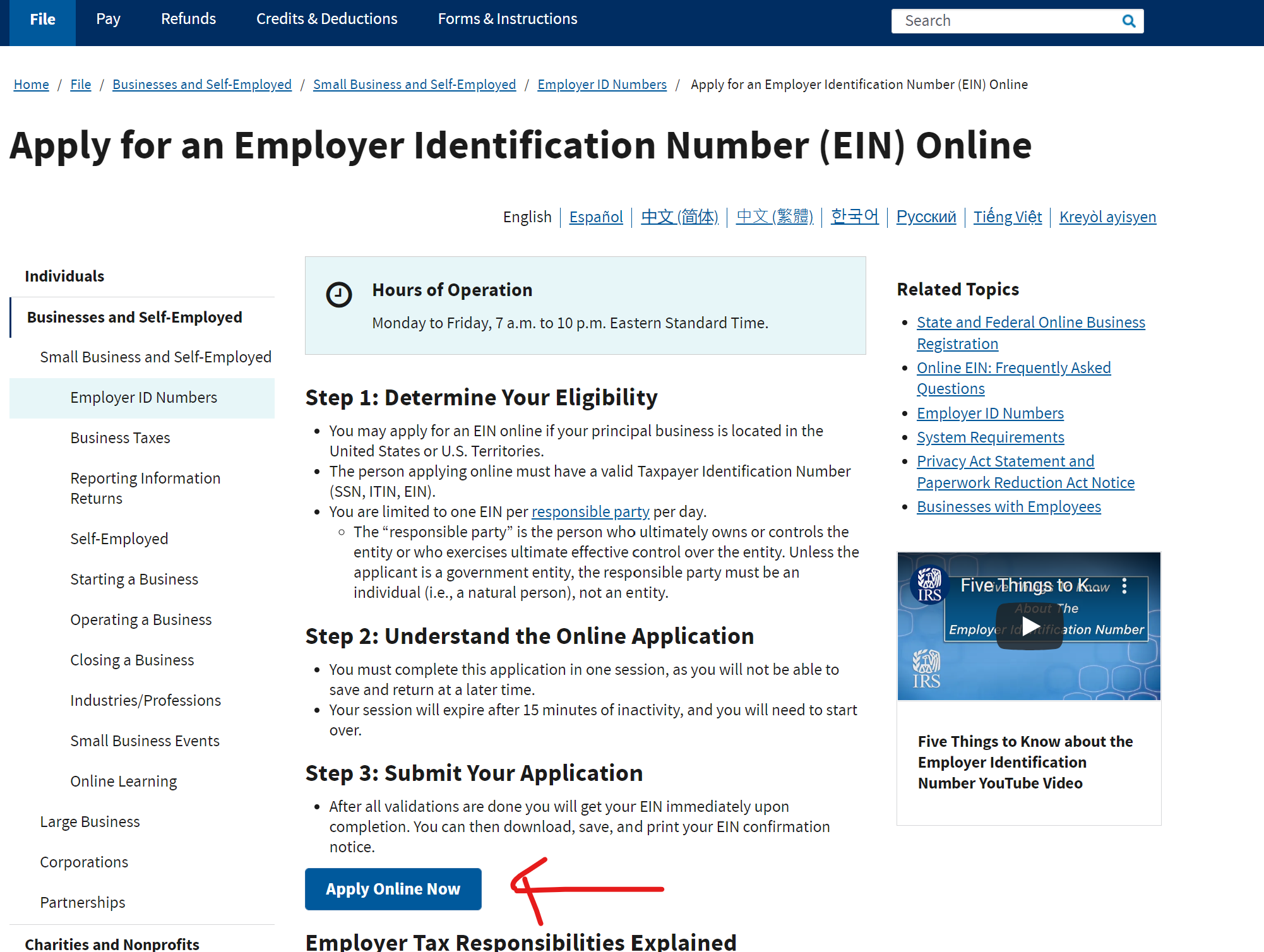

How to get an EIN number

Applying for an EIN is incredibly simple. Simply visit the official IRS website to apply for an EIN number.

How to buy I Bonds through your business: Sole Proprietorship, LLC, S-Corp etc.

Once you have your EIN number, you can apply for a brand new account on Treasury Direct separate from your personal account. You will have two account numbers and just two completely separate accounts you’ll have to manage.

Step1: Visit the Treasury Direct webpage

First step is to open the TreasuryDirect’s website for opening new accounts.

Step 2:

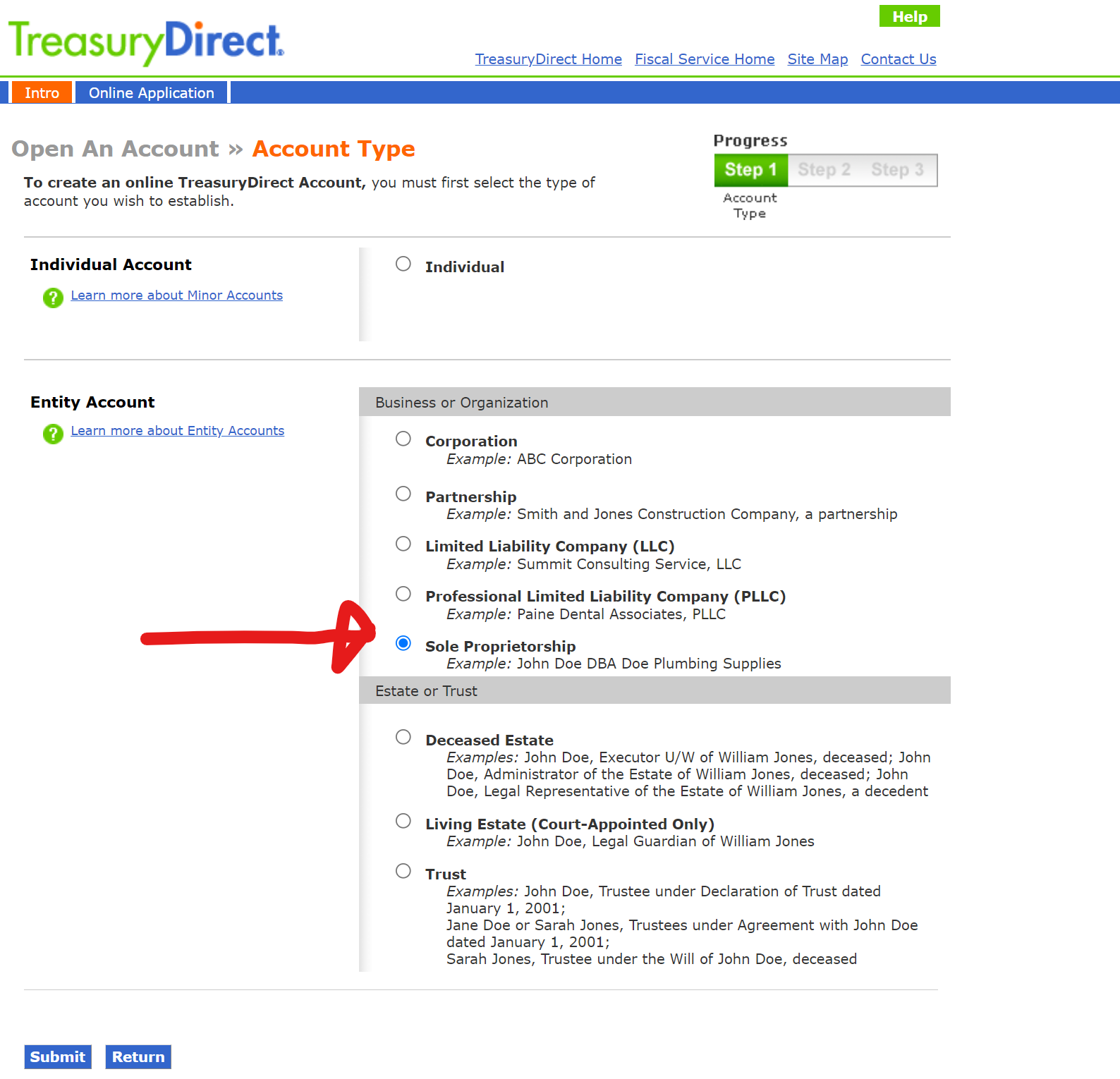

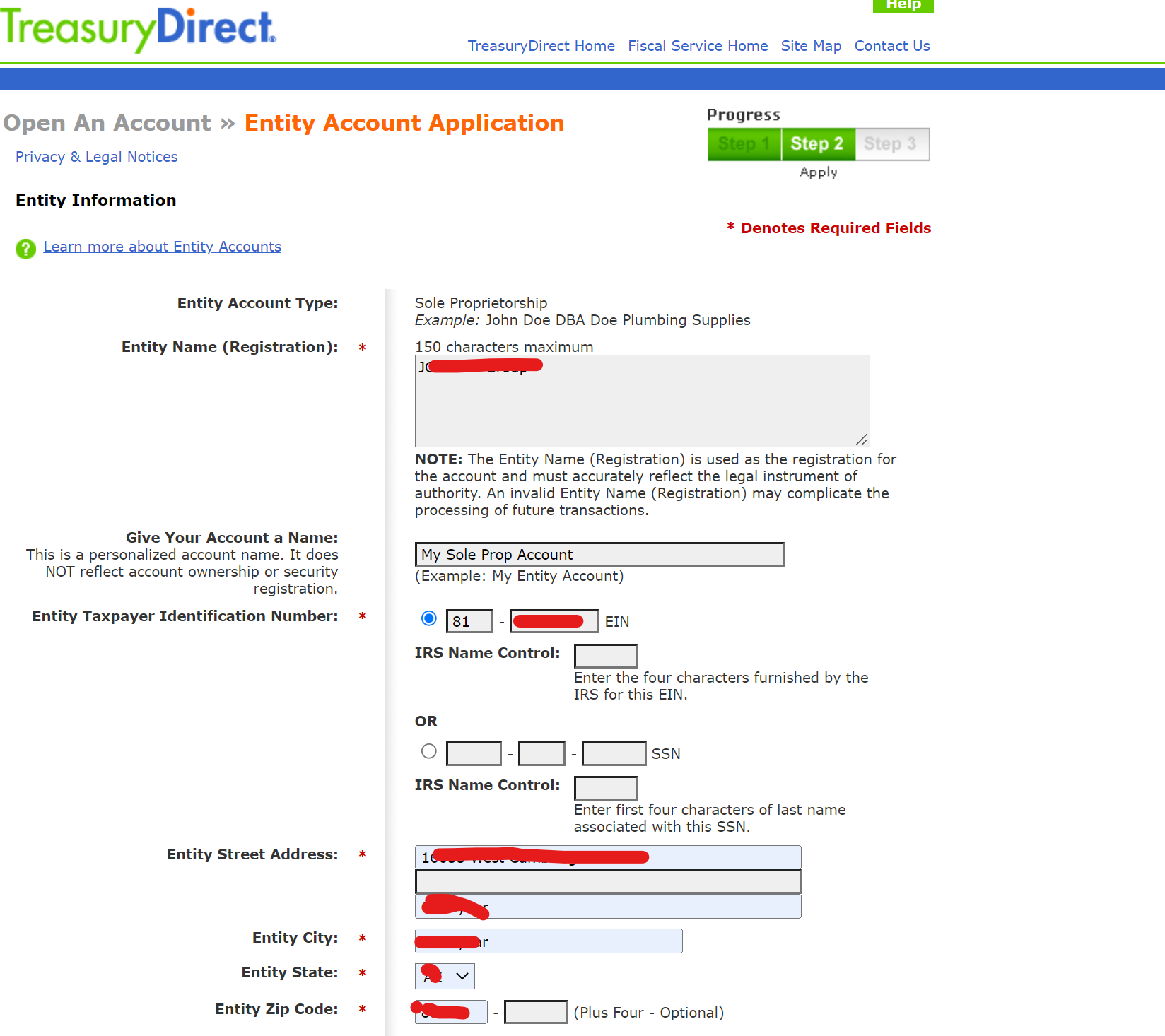

Step 3: Choose Sole Proprietorship

Step 4: Fill out the form

You’ll fill out the form similar to filling it out for the personal account. However, you’ll want to use your EIN number in the Entity Taxpayer Identification Number area. The rest of the fields like address, drivers license, phone number etc can all be the same. The bank you use to transfer money to TreasuryDirect can also be the same. You don’t need to use a Business checking account or anything along those lines.

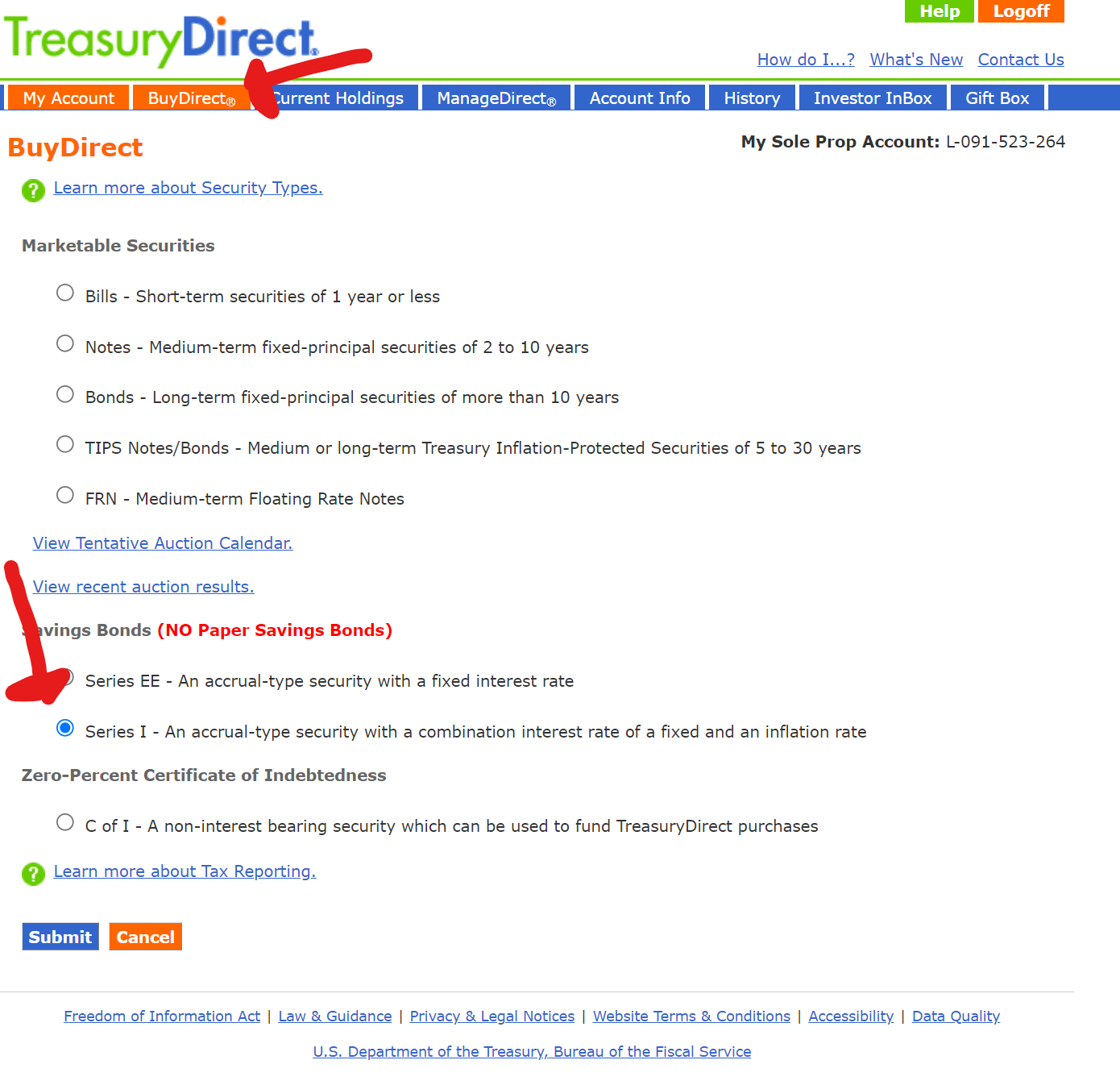

Step 5: Buy I Bonds

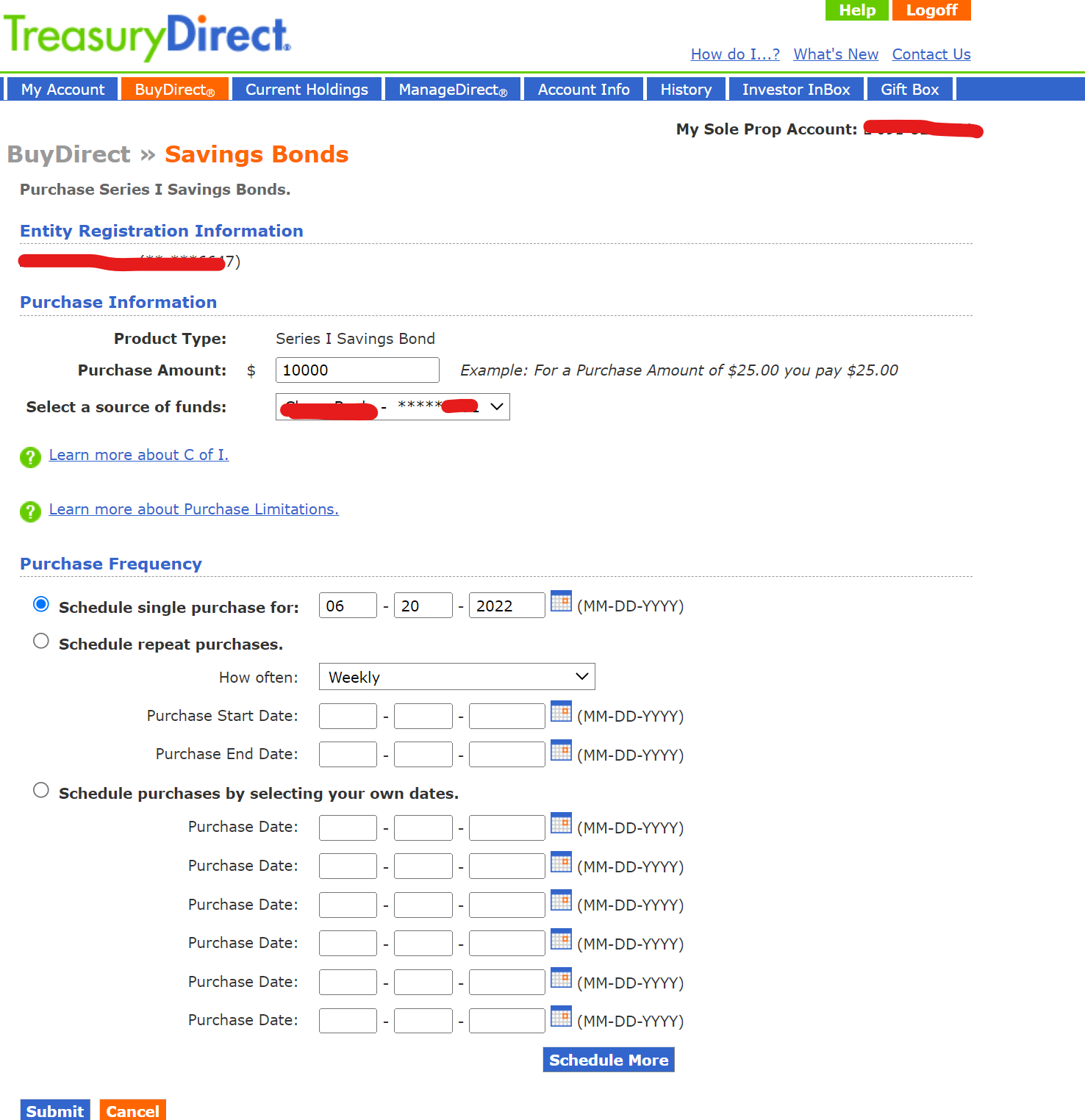

Once complete, you can submit the application and you’ll receive an email from Treasury Direct with your login details. You can proceed to the purchasing page of the treasury bonds and select the following:

Finally, complete your purchase on the following page. You can choose to schedule recurring payments or just make one lump sum payment

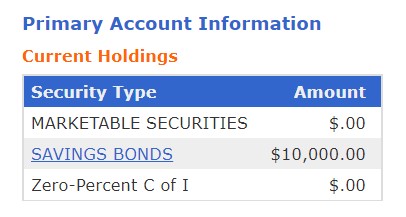

How to check the balance of your i bonds?

TreasuryDirect does not send out any account statements (which is great actually). You can check the value of your account by

You’ll see a list broken down by the Issue Date when you click on the Savings Bonds link.

Three-Month Lag in Current Value

If your bonds are still within five years from the Issue Date, the Current Value automatically excludes interest earned in the last three months. If you cash out today, you’ll receive the Current Value. That’s why you won’t see any interest in the current value during the first four months. You will start seeing a higher value in the fifth month.

Interest Rate Lag

The interest rate on your bonds doesn’t necessarily change right away when a new rate is announced. Each bond stays on the previous rate for the full six months before it moves on to the next rate for another six months. The rates change in different months depending on when your bonds were originally issued.

Don’t worry when you see your older bonds are earning a different interest rate than your newer bonds. When those older bonds “serve out” the previous rate for the full six months, they will move on to the newer rate for six months. All bonds eventually go through all rate cycles.

How to cash out your investment

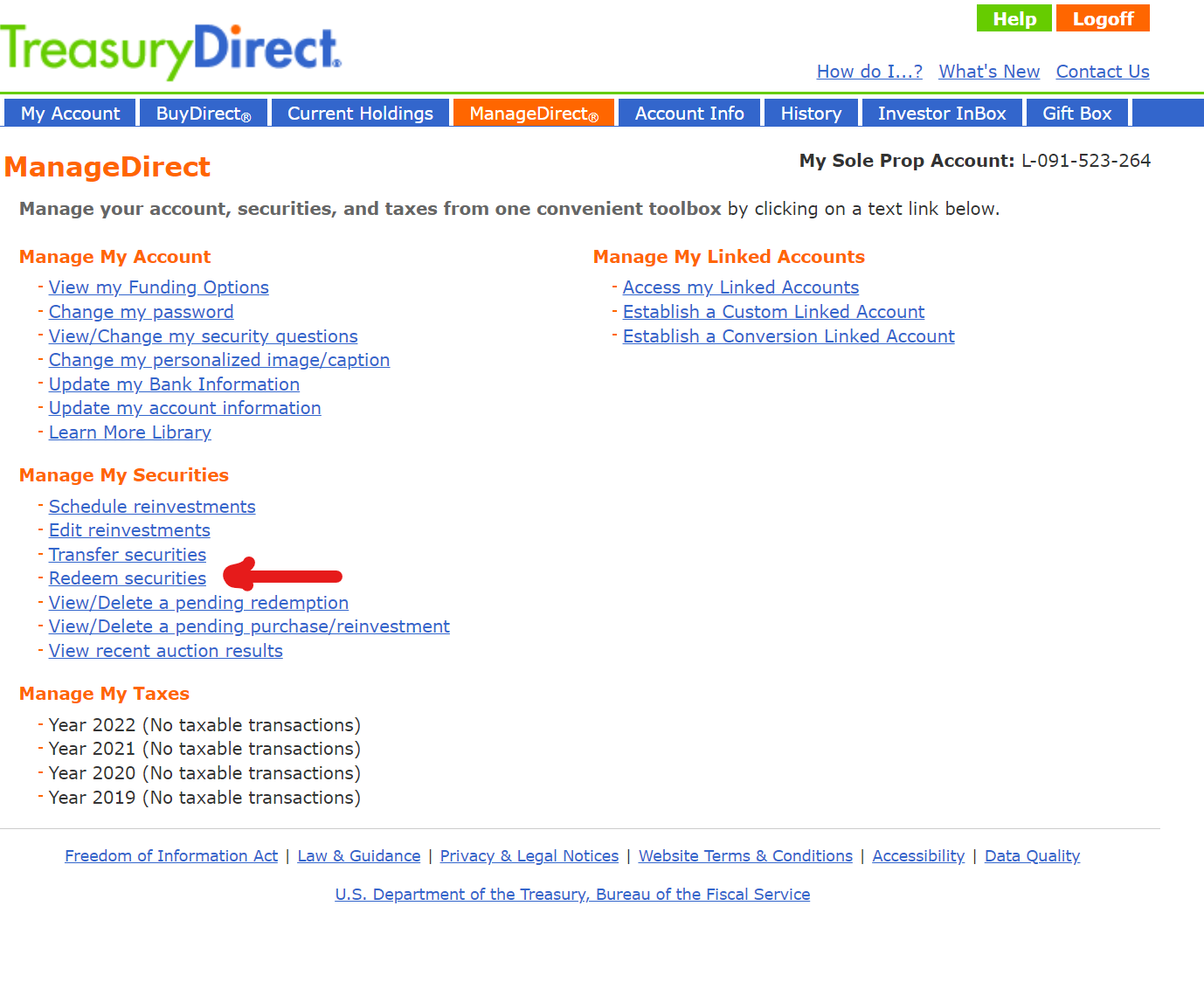

If and when you want to withdraw from your I bonds, you can simply go to the ManageDirect page and go to the Redeem securities link. Follow the prompts on this screen and you can withdraw either as much or as little as you want ($25 minimum). This can be on interest you’ve already earned or part of your principal.

Keep in mind that if you’re withdrawing before 5 years, you will forfeit the last 3 months of interest.

How are I Bonds taxed?

I Bonds enjoy a very favorable tax regime. As they are savings bonds, they are only taxed when you withdraw/redeem your investments. Unlike normal cash investments (CDs, savings accounts etc.), you pay taxes whether you use that money or not.

For I bonds, the account can grow for years without having any tax implications. When you are ready to withdraw, the amount is taxed as a 1099-INT which is just regular income (sorry, no cap gains rates here).

TreasuryDirect will generate tax forms for you to use for your tax returns if you do withdraw any money throughout the year.

Customer Service

If still have questions or if you run into any problems, you can contact TreasuryDirect:

- Send an inquiry via their contact form.

- Send an email to Treasury.Direct AT fiscal.treasury.gov.

- Call 844-284-2676 during business hours.

Thankfully, I’ve not had to call them to assist with anything yet. Given how ancient their website is, I don’t have much hope for customer support. I could be wrong though!

Selling and redeeming your I-Bonds

All good things come to an end and the same can be said about I-Bonds. At some point, the rates of I-bonds might not be favorable compared to other risk free assets and you might want to sell them out. This was the case from 2022 to 2023 when all time high rates of 9.5% in mid 2022 were met by a rate of 3.4% 1.5 years later when inflation came down.

I bought my I-bonds in September 2022 and promptly sold them in December 2023. I earned 8.2% over a 15 month period. You forfeit three months of interest if you sell within 5 years as we already discussed above. To redeem the bonds, simply follow these easy steps. In your TreasuryDirect portal, navigate to the Current Holdings section:

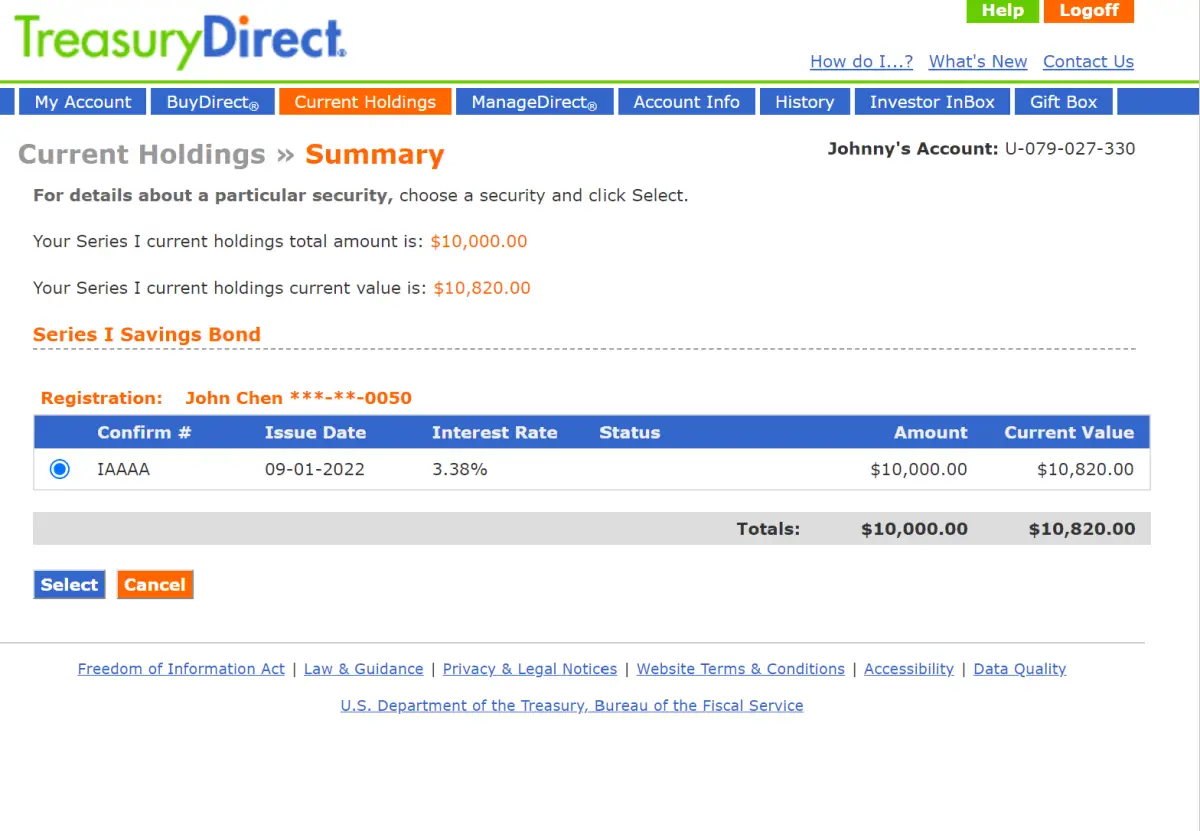

Select your bond. In my case, I only have the one bond

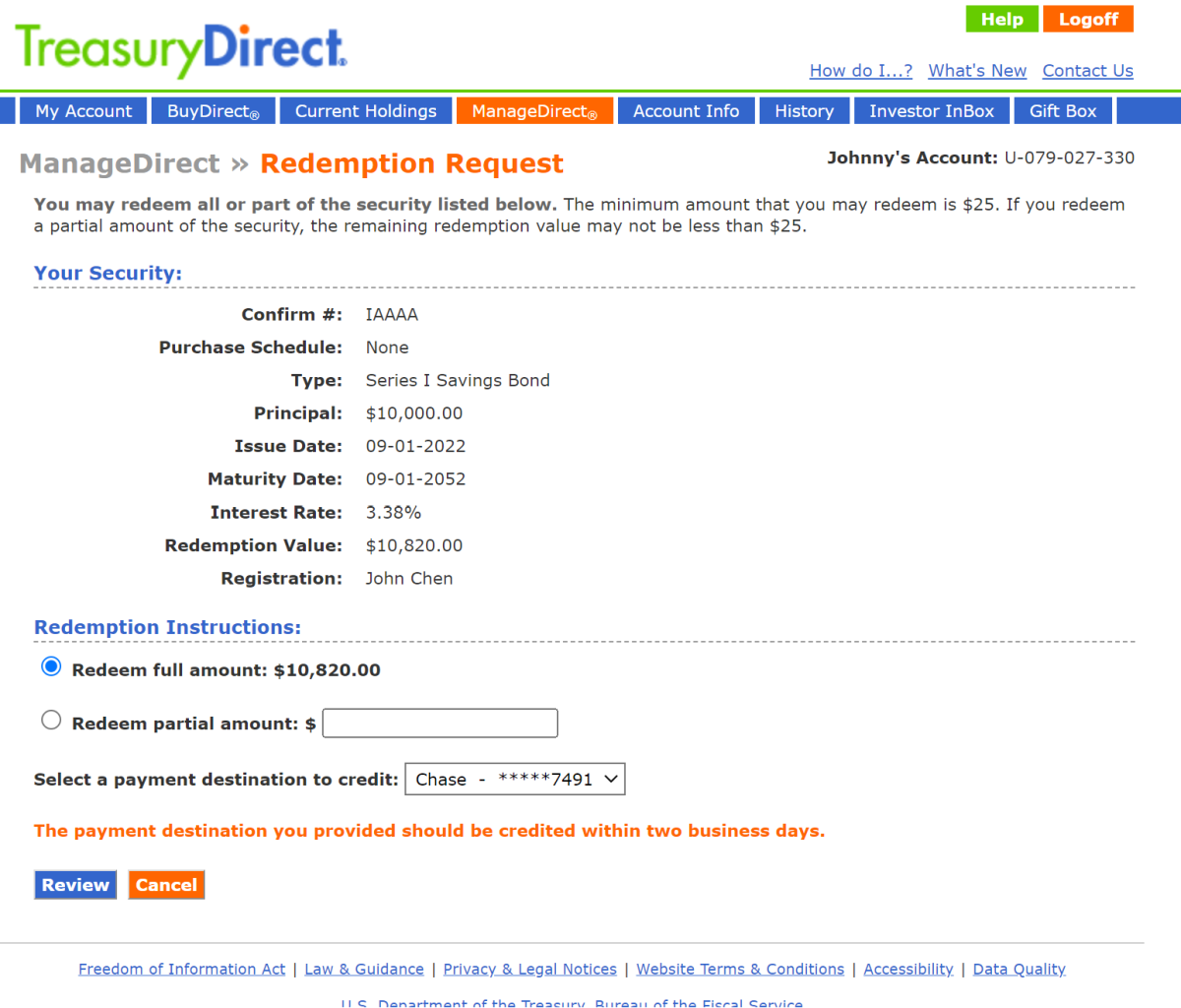

Hit the redeem button:

I hit redeem for the full amount which brings you to the next and final page.

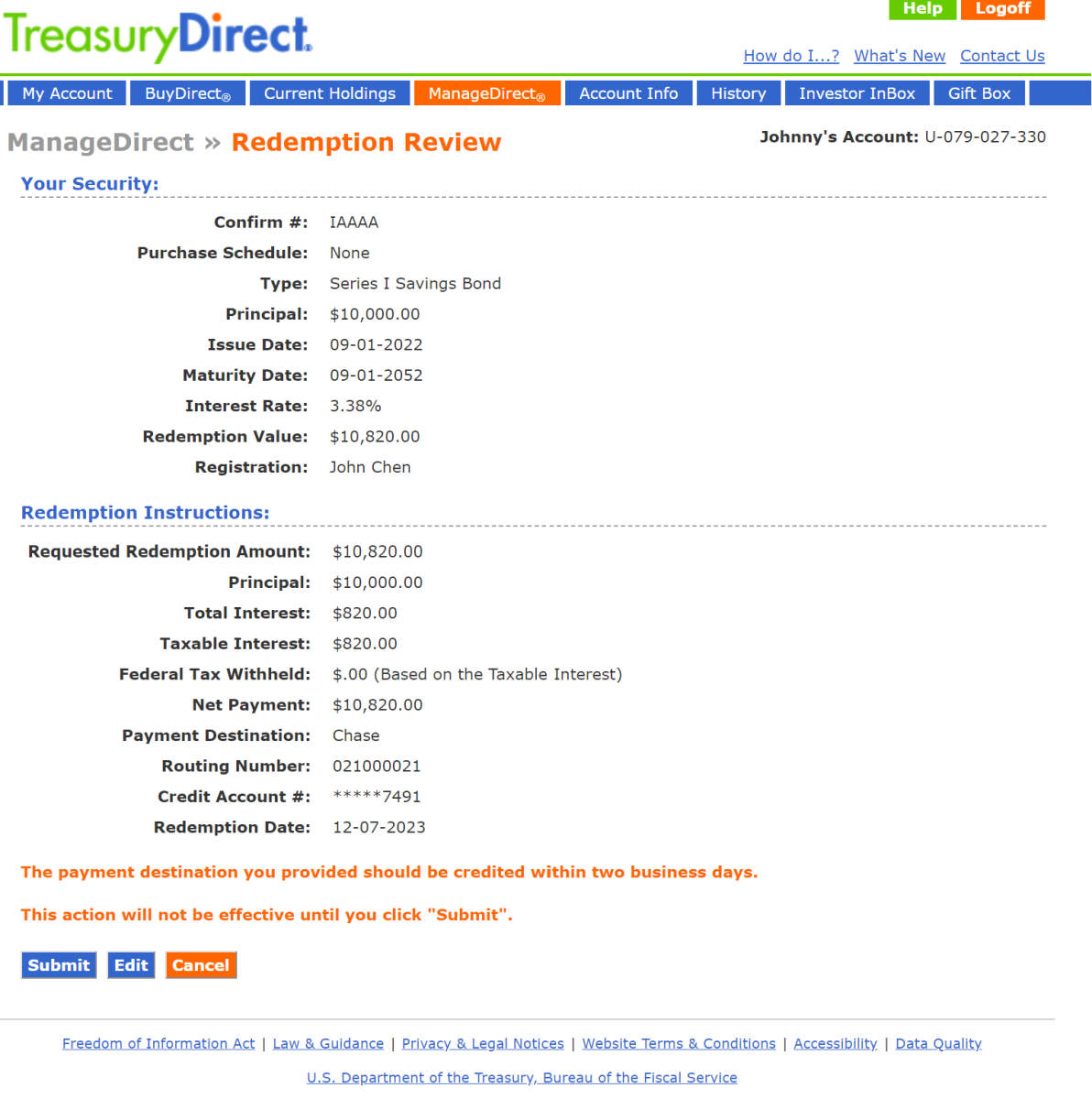

After completing the process, you’ll receive an email confirming your selection.

The money takes 2-3 business days to reach your bank account and once you initiate the process, it can’t be reversed!