In recent years, financial technology has taken some serious strides into the future. Too long have we been shackled by the confines of traditional banking that charges ridiculous fees for no reason. In recent years, there have been numerous companies making serious disruptions to centuries old institutions, and one that I am absolutely obsessed with is Revolut.

Revolut was founded in the UK back in 2015 and their service has really made a huge impact on me as an expat living abroad. It is in my opinion the one must have app for anyone living abroad because you can finally transfer money without having to pay exorbitant bank fees. It has truly revolutionized something I never thought could be revolutionized. This post goes into why you need to have Revolut, which situation to use it, and how to use it.

What is Revolut?

Revolut Ltd is a UK financial technology company that offers banking services including a pre-paid debit card (MasterCard or VISA), currency exchange, cryptocurrency exchange and peer-to-peer payments.The Revolut mobile app supports spending and ATM withdrawals in 120 currencies and sending in 29 currencies directly from the app. It also provides customers access to cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and XRP by exchanging to or from 25 fiat currencies; however, cryptocurrencies remain locked in the app and cannot be moved to another cryptocurrency wallet.

Did you get all that? Yes it’s complicated so I will simplify it for you. Revolut is a bank but also a peer to peer payment system (like Venmo in the United States). On top of this, it is also a way for you to transfer money back and forth in different currencies without having to pay fees.

Is Transferwise the same thing?

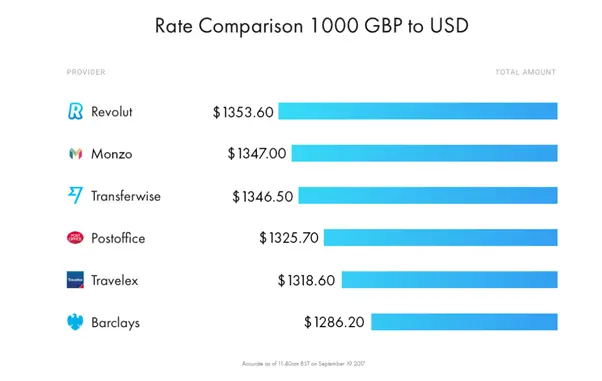

Transferwise is another service that is very popular for sending money in different currencies with minimal fees. Revolut can do what Transferwise (but with 0 fees up to €5,000 a month). However it is also a lot more. It is more of a bank account that you can pay others with. I would say Revolut is a combination of Transferwise, Venmo which is primarily used to pay people, and an online bank.

Revolut Debit Card

Revolut also offers debit cards (prepaid) for their users to pay for in store purchases and online purchases. I don’t have any need for this as I prefer to put all my spending on American credit cards as they give me so many more points. As well, we have many banking products where I come from that allows for no fee ATM withdrawals worldwide and other benefits. If you’re not from the US and don’t have these options, I would highly recommend getting a Revolut debit card.

Multi Currency Wallet

Revolut is like a bank or PayPal account where you can keep money in the account, and use it to pay for purchases or to pay other people. One of the unique features of Revolut is how easy it is to hold multiple currencies in the same account. All you do is add another currency in your wallet. They currently support about different currencies including euros, pounds, US dollars, CAD, AUD, JPY, SGD, and even South African rand. You can add all the currencies to your wallet if you want. Personally, I mainly have USD, EUR, GBP, and ZAR.

You can then transfer between your wallets at any point at the spot FX rate with zero fees. So let’s say you work in Europe earning €s but want to pay someone in Canadian dollars. You can fund your Euro wallet with let’s say €100, and then you can exchange it to your CAD wallet and you will now have CA$150 in your CAD wallet. With this money, you can pay someone that is only accepting CAD.

Using the Revolut debit card

The multi currency credit card really comes in handy when you’re traveling to other countries with currencies that Revolut supports. Essentially, you can load up your wallets with different currencies and when you swipe your debit card in another country, it will automatically use the corresponding wallet. So if you’re visiting South Africa for example, you can top up your Revolut card with R10,000 by transferring euros to rands within the app. Then when you visit Nandos in South Africa, you can swipe your Revolut card and it will deduct from your rand balance.

Personally, this is not that useful of a feature for me because as an American, we have so many credit cards that have zero FX fees and I’d rather get the credit card points. I find this more useful when you need to pay a person in CAD like splitting the costs of a trip to Canada with a Canadian.

Why all expats need to have Revolut

As I live in Frankfurt, Germany, I make a living earning Euros. However, most of my financial situation is still back home in the US so at times I need to pay off dollar denominated obligations. German banking leaves a lot to be desired and making bank wire transfers from my bank in Germany to my bank in the US will incur massive amounts of fees. The bank in Germany will charge me to send money out, and my bank in the US will charge me to receive money. You’re looking at probably 2-5% in fees on any transfer by wire which is just astronomical.

Until Revolut, the best options would be to use PayPal to pay yourself but they also had fees, just much smaller. Transferwise is another great option where you can add your different bank accounts and pay yourself with very small fees.

Revolut will let you transfer money in different currencies for zero fees at the spot rate.

Revolut is like Transferwise and PayPal but with zero fees. Yes, you pay absolutely zero fees and get the spot FX rate at the time of transfer all for free. I don’t know how they make money or how they could provide such a revolutionary feature but this is why it is a must for expats.

FX Rates used in Revolut

I work in Finance so I am very up to date with the FX markets. I have done numerous transfers in Revolut between USD and EUR and can say that they are almost exactly at the spot rate at that moment in time in the real FX market. This means Revolut does not take any extra commission by making the FX fee less favorable.

If you are doing transfers on the weekends, the rates will not be the closing rate on Friday but rather a less favorable rate likely because Revolut needs to hedge itself in anticipation for

Paying people in different currencies

One of my primary uses of Revolut is to easily send money to others. Traditionally, most people in Europe can do bank to bank transfers simply by using their IBAN numbers. The IBAN number is one long number that has the country, bank name, and account number. It is only used in the European Union but it ensures that someone from Spain can pay someone from Germany without issue.

I’ve done many IBAN money transfers with friends already but as the number is so long, most people do not remember it and it can be time consuming to actually make the transfer. Revolut simplifies this because you can just send money to someone else’s Revolut account by just searching for their name in your phone book. This is very similar to Venmo in the US which is incredibly popular now.

As I am a US expat in Germany, German friends will send me money in Euros but I need to pay my bills which are in dollars because I still use my US credit cards to pay for things as I earn many points. Once you receive euros, you can easily convert them to dollars in the Revolut app, and then transfer it to your US bank account all for zero fees. I go into more details about this in the next section.

Transferring money to yourself in different currencies

This is perhaps the most useful aspect of Revolut for the standard expat. If you’re looking to transfer money between your personal bank accounts that are in different countries and different currencies, Revolut is your must have app because you pay no fees for transferring money and you get the spot rate at the time of transfer. No other service that I know of let you transfer money in different currencies with no fees and spot rate.

I’m not sure how Revolut was able to come in and offer something so beneficial for free when no other service could do this before. I will show you exactly how you can transfer money from one account to another. For this demonstration, I will transfer money from € to $USD. My euros will come from my Commerzbank checking account in Germany, and these euros will be exchanged into US Dollars and then transferred to my Chase checking account in the US.

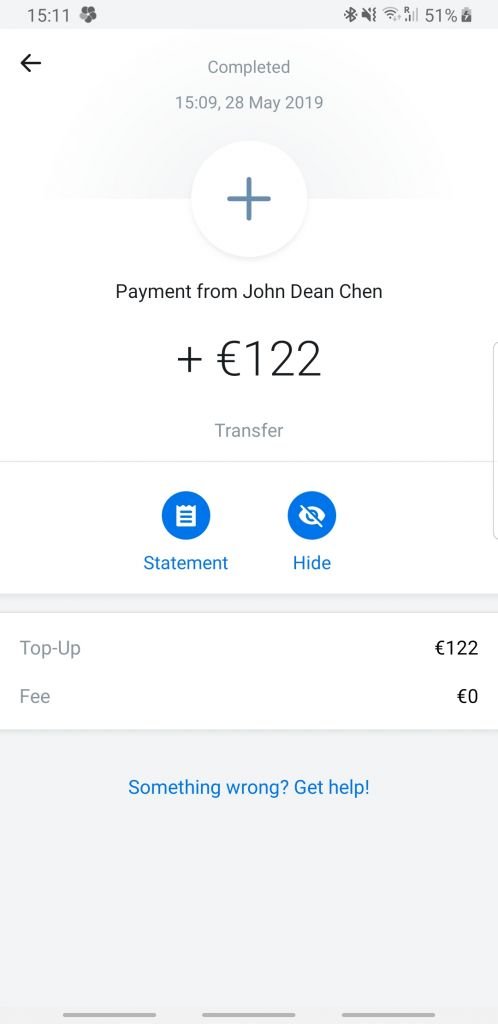

- Transferred €122 from my Commerzbank account to my Revolut account using IBAN

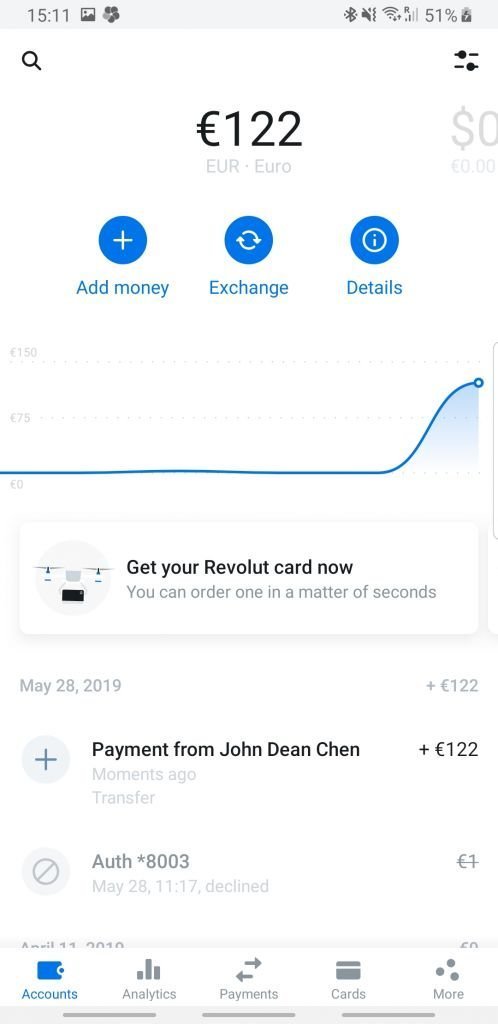

- Now my Revolut account has €122 in euros.

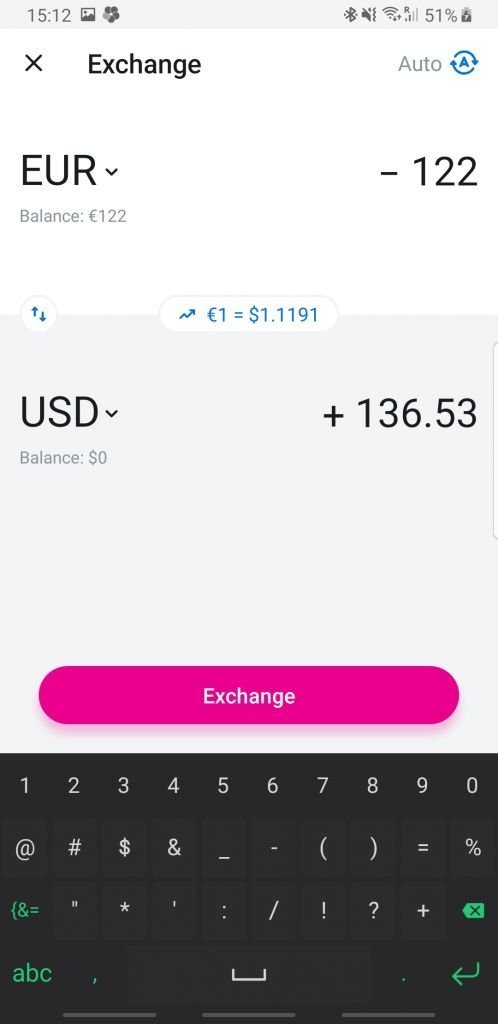

- Click the “Exchange” button to transfer currencies from euro to US Dollars. The rate of 1.1191 was the exact spot rate at the time of taking this screenshot

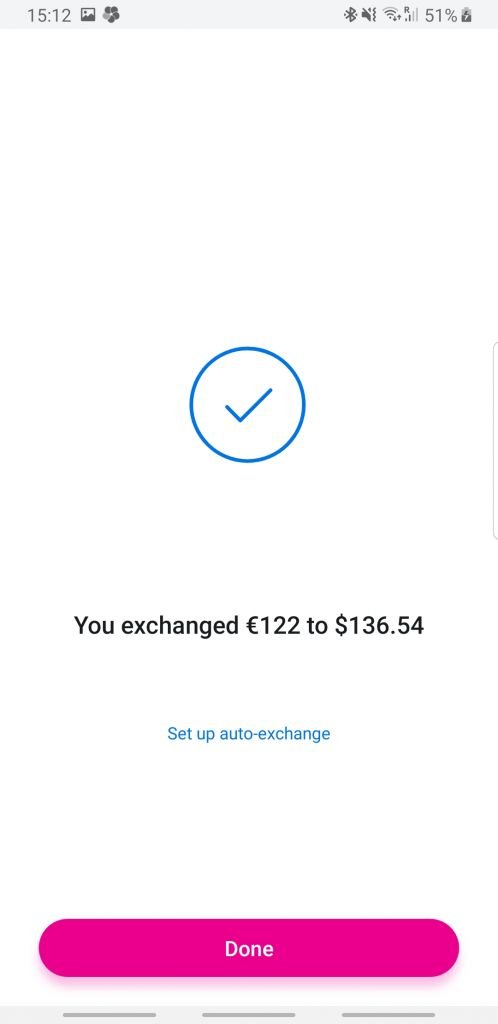

- Confirmation that I’ve exchanged euros to dollars.

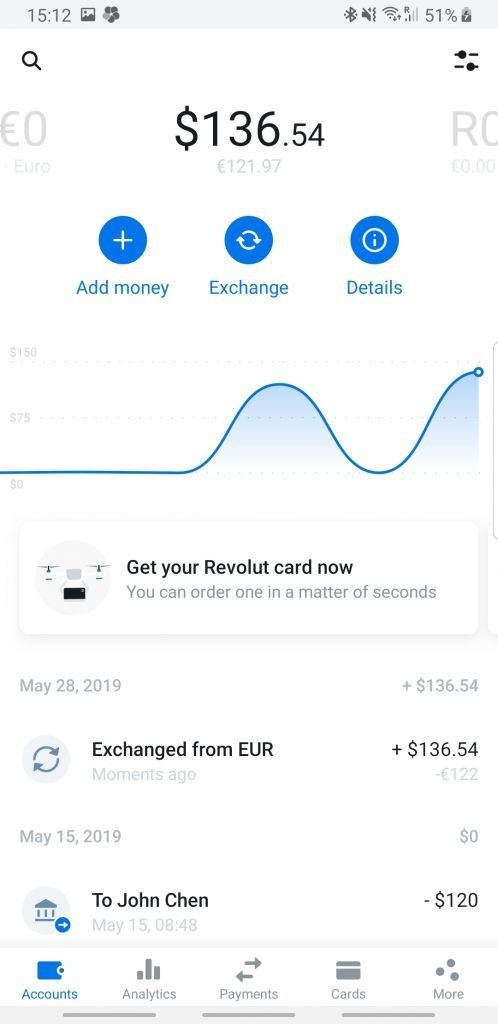

- Now in my accounts page, it shows I have €0 and $136.54 which is expected.

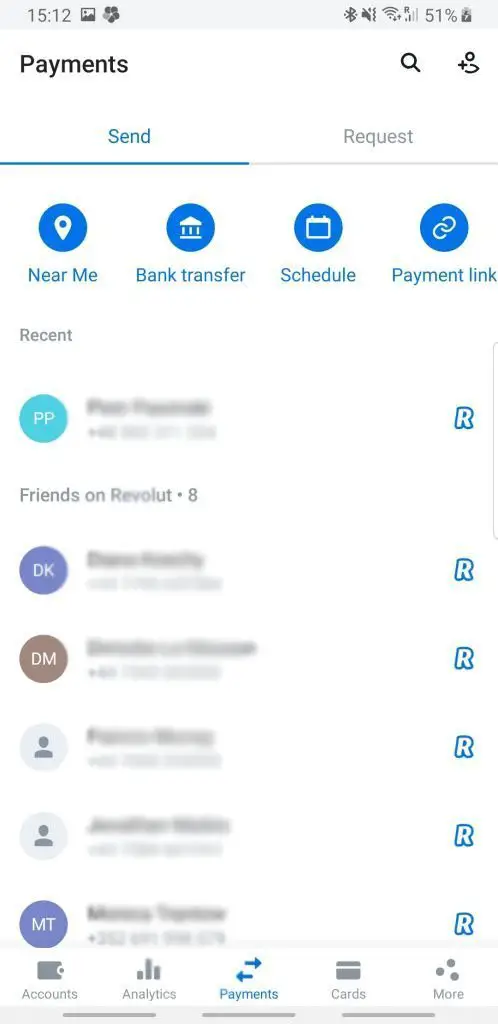

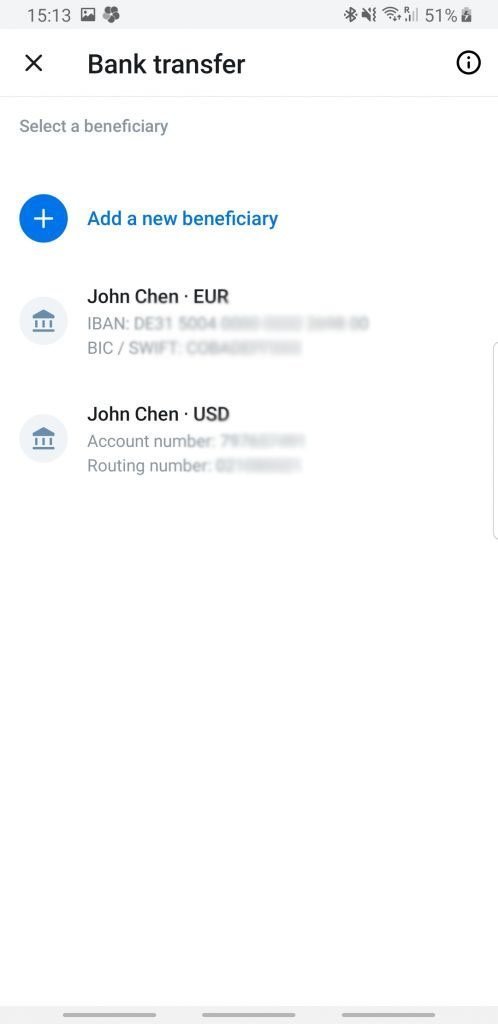

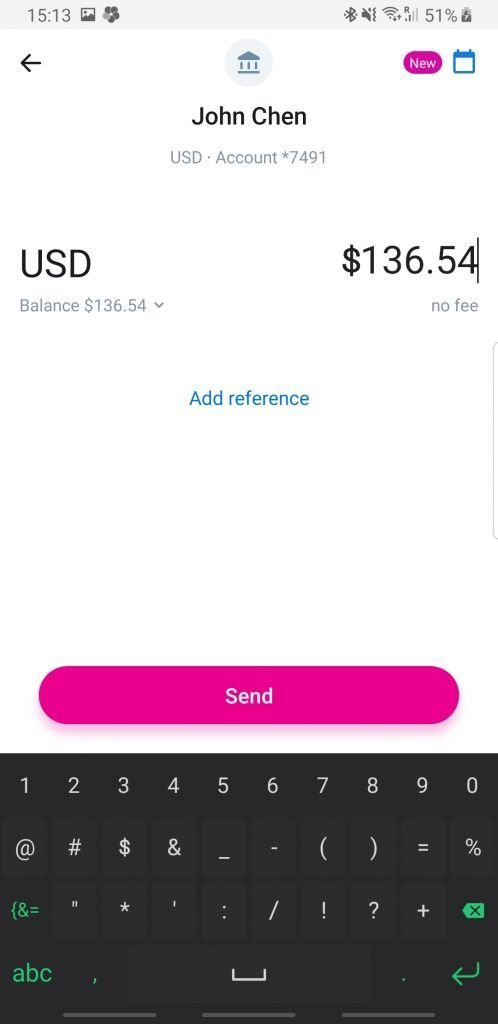

- Next step is to click bank transfer, and you will see a list of your bank accounts. I will select my USD bank account as I want to now transfer my $136.54 balance to my US checking account.

- Select my USD bank account as I am planning on transferring my Revolut balance to my bank in the US

- Confirm my transfer amount

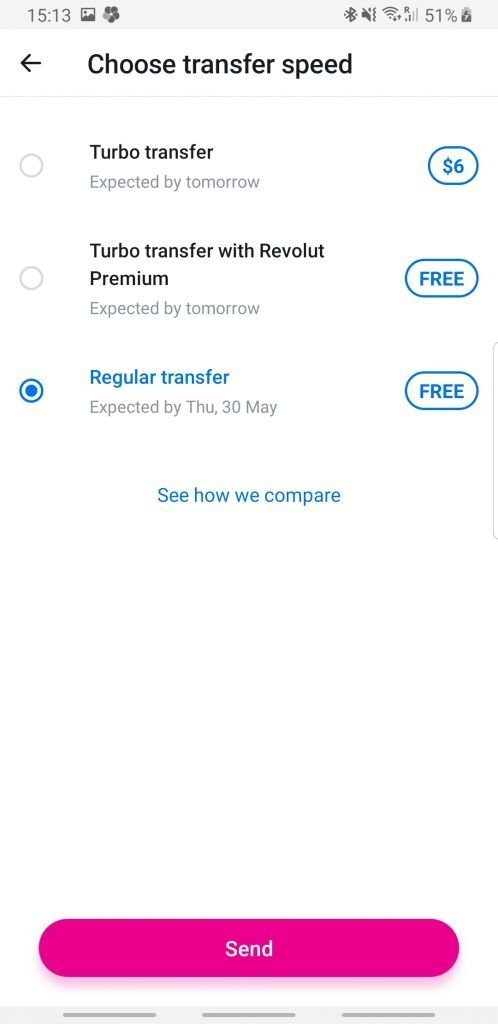

- Choose your speed. I am okay waiting two days so a regular transfer is fine for me.

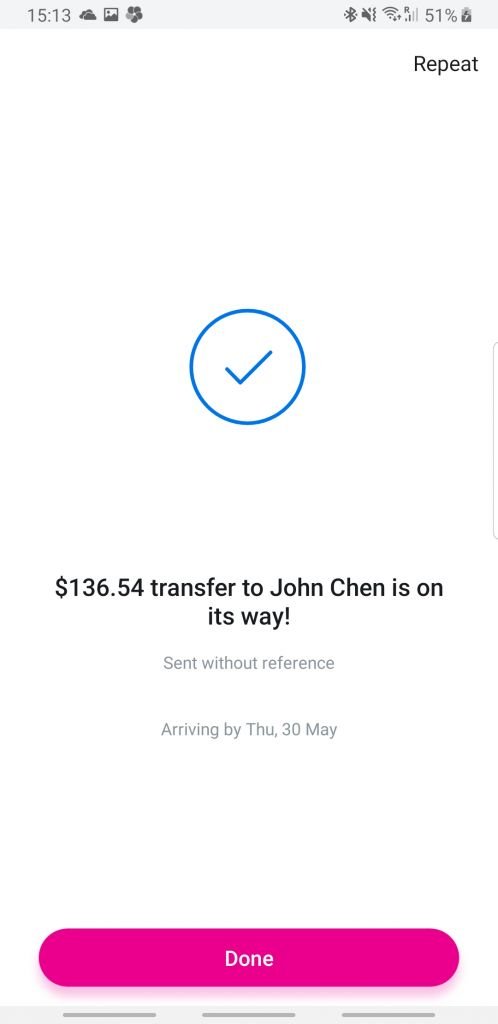

- After clicking send, it is on its way!

I am going to download Revolut because of this article!

I wish I was a European citizen!

How can I get revolut without being a European citizen? It’s not available in the US yet!

Unfortunately it’s only available for eu citizens and eu residents at the moment! Best way would be to get a job in Europe ????. Or just wait until it arrives in the US!

Revolut is now available in the US; https://www.revolut.com/en-US

Indeed it is! I need to create an account myself actually!