One of the first things you’ll want to do when moving to Germany is to open a bank account at one of the numerous German commercial banks in the country, especially if you’re coming from outside of the EU. Many bills that you’ll have to pay in Germany can only be done by bank transfer so you’ll want a German bank account with an IBAN number to facilitate payments. This post goes in depth about how to open bank accounts in Frankfurt, as well as a summary of the credit card situation in the country, as I am a huge advocate of credit cards back home in the US.

This post is all a part of my guide to living in Frankfurt, Germany where I list out all the things you need to know as an expat in Frankfurt and Germany.

German banking is a decade behind the times

Maybe even two decades? Part of that is probably due to the cash culture of the country. Of all developed countries, I think Germany is by far the most anti-credit card. Even many developing countries like South Africa for example are light years ahead of Germany when it comes to discarding cash.

Part of the German cash culture stems from the cultural desire to not live off of debt. I suppose the old adage of if you don’t have the money, you can’t spend it holds very strongly in Germany.

Banking operations and payment options in Germany

German banks mostly resemble the typical UK/US high-street banks in terms of banking operations and payment options, although cash is still popular.

ATMs (Geldautomat) can be found at bank branches as well as other locations such as supermarkets, shopping centres, train stations and main streets. Use of ATMs is free but there can be a charge of up to €5–10 if you use an ATM at a different German bank, especially if you are on the basic checking plans.

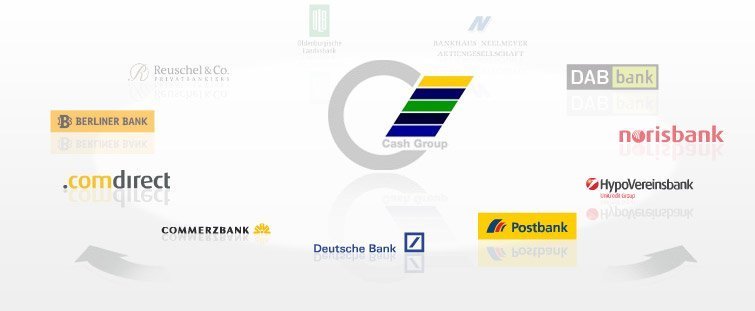

The four largest banks in Germany: Deutsche Bank, Commerzbank, Postbank, and HypoVereinsbank form the Cash Group which waive all ATM fees when you use within this group. So if you bank with Commerzbank, you can use any Deutsche Bank ATM around the county and vice versa.

Bank Accounts in Germany

There are many banks and credit unions in Germany. However, I will narrow down the list to just the banks that offer English support and an English online banking interface. These will mostly be the large German consumer banks, and various Fintech startups. Many Germans bank with local credit unions like Frankfurter Volksbank, Sparkasse etc. but as they do not offer English support, I won’t put it on the list.

- Commerzbank

- Deutsche Bank

- N26

- Bunq

- Targobank

Up until recent years, many banks charged small fees to use their services. It seems like this is still the case with many banks. Most of the accounts I looked at at some sort of fee from €3-10 a month for basic accounts.

English Support with no bank fees

It seems like this is the holy grail for expats living in Germany. Which banks offer English support and interfaces, as well as no fees. If you’re here short term, it’s likely you’ll need nothing more than a place to park cash and pay bills. In essence, the only banks I’ve found that offer totally free accounts with a free debit card, as well as English support are Commerzbank and N26.

Deutsche Bank has English support and they may have a completely free option but this was not the case when I was on the search.

For Commerzbank, their website is in English but many of their features are not available if you select English. However, all their correspondence and mail is done in German. I had to use the Google Translate camera feature to make sense of the documents they sent me initially.

N26 is the only bank that is done completely in English. Horray Fintech startups in Germany! For those that don’t want the hassle of archaic German bureaucracy, I would open an N26 account.

Types of bank account in Germany

There are two main types of bank accounts in Germany.

Current account (Girokonto)

Current accounts are the standard type of bank account in Germany, which can be used for receiving salary in Germany and paying bills. Current accounts are like checking accounts in the US. Banks in Germany generally require that you be a German resident in order to open one. This means you could be a student, or on a Blue card like myself. You’ll want a checking account so you can withdraw cash, pay your bills like your apartment rent, or paying another person.

Savings account

These can be either instant access (Tagesgeldkonto) for saving money for things such as holidays, or fixed deposit (Festgeldkonto) which is a higher interest account with a minimum deposit and a fixed period that the money has to stay in the account, used more for investment banking purposes.

Current accounts are generally only available to German residents, as you typically need to have a permanent address in Germany to open an account, although some online German banks offer current accounts to non-residents. Savings accounts are offered to both residents and non-residents and can be opened from abroad with many German banks.

As you’ve probably already found out, interest rates in Germany are negative so you will earn absolutely nothing keeping your money in cash. I’m not sure what the purpose of a savings account is in this situation but Germans are obsessed with saving cash in zero-yielding accounts. Definitely the anti-FIRE method for those looking to retire early.

Banking with Commerzbank

I started banking with Commerzbank because they, along with Deutsche Bank and few select others offer English interface and support. This means they have Online Banking and a website in English. For expats, this is quite essential so you will be limited to the banks you can choose. I found the checking account opening process to be lengthy but standard. They requested my passport, residence permit, and employment contract and that was it. I received the Maestro Debit card in the mail a week later, along with numerous other documents to set up online banking (which was not easy to do).

All in all, banking with Commerzbank has been acceptable, but nothing I would write home about. I once used the debit card while in Paris at a BNP Paribas ATM and was charged €6 for an ATM fee which is outrageous. Also, their mobile App as of Q2 2019 STILL does not offer English support but this should be changing in Q3 (fingers crossed).

Cash Group

Cash Group is an alliance formed by Germany’s biggest banks (Deutsche Bank, Commerzbank, Postbank, Hypovereinsbank) and its subsidiaries. It pretty much means if you bank with them, you can use any of their ATMs in the country which should help with ATM fees. Otherwise, you can expect to pay some pretty hefty ATM fees if you use an ATM outside of the network.

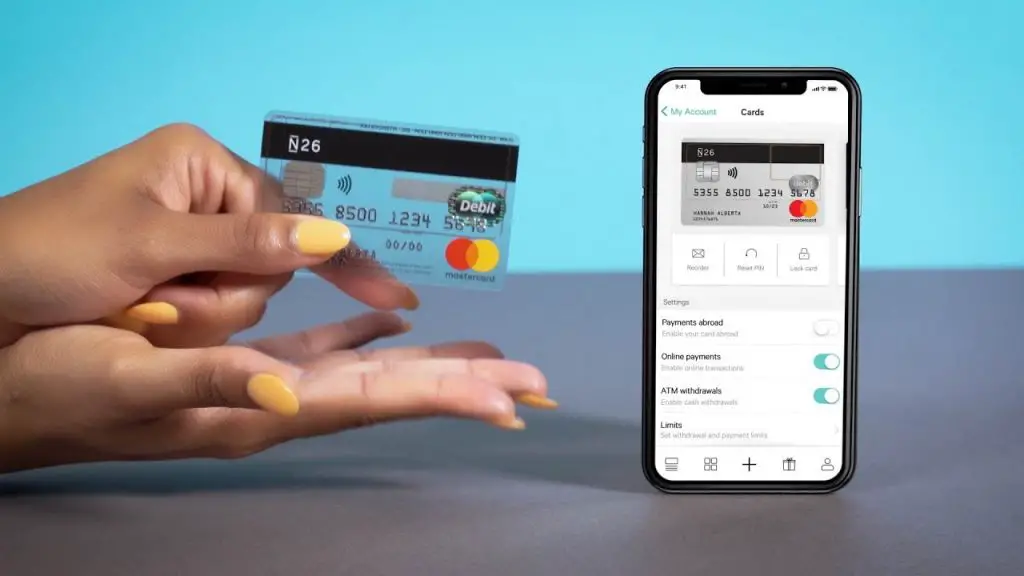

Banking with N26

I had read about N26 on some other blogs before arriving in Germany. This is a fintech startup based in Berlin that offers a mobile only checking account. The best part is you can make 5 ATM withdrawals a month without any fees. They are also much easier to open but you will need to verify your information via video call where they will guide you to take pictures of your passport. I’m much more satisfied with N26 just purely because I don’t have to pay ATM fees when traveling around Europe.

I haven’t had too much hands on experience with N26 yet but Settle in Berlin has a very good writeup on his experience using N26 which I can recommend if you are interested in going this route.

The IBAN

If you’re already European, you’ll know fully well what the IBAN is. For non Europeans, this will be new. The IBAN is essentially a one stop shop account number that you can use to receive and send money throughout the European Union. In the US, you need an account number and a routing number but in Europe, the IBAN is just one number that has all the details you need.

The IBAN is always located on your bank’s debit card and is something like this: DE89 3704 0044 0532 0130 00. The DE means Germany, the next 8 digits is for the bank, and the last 10 is your account number. Quite convenient in my opinion.

Using Revolut: an Absolute game changer

Revolut is a game changing Fintech startup in my opinion that should be the future of banking. It combines into one the ability to pay people very quickly without needing to know someone’s bank account number (like Venmo in the US), transferring money between different currencies without any transaction fees, and traditional banking like paying for goods at a store using their debit card or paying bills with an IBAN.

Revolut is completely in English and although I’m not sure if it can completely replace a conventional bank account in Germany, it is definitely a must have supplement. Read my detailed writeup of Revolut for those interested!

Credit cards in Germany

Back home in America, I was something of an obsessive and master user of credit cards. To keep it short, I amassed dozens of credit cards in the US and earned millions of free points and miles which help fuel a lot of my travel like my stay at the Park Hyatt Maldives. I still have many US credit cards while living in Germany because the credit card offerings in Germany are, how should I put it? Completely useless. This whole section will be written from the perspective of an avid user and hustler of American credit cards. If you’re not from the US, please ignore any references! If you are interested in just how lucrative credit cards can be in the US, read my travel hacking guide.

Firstly, German’s are not really into using credit cards. They are definitely not into using credit cards to finance a life they know they can’t afford, unlike my compatriots in America. This means banks don’t earn much interest, which means less profits, and less benefits to the consumer. Also, interchange fees are significantly lower in Europe which means banks don’t earn as much when the consumer swipes.

SCHUFA SCORE

In Germany, your creditworthiness is most likely tracked and recorded by Schufa Holding AG, Germany’s biggest credit agency. Schufa is the shorthand abbreviation of Schutzgemeinschaft für allgemeine Kreditsicherung which means nothing to me so Schufa it is. This is similar to credit rating agencies in the US such as Experian, Transunion, and Equifax. As Germany doesn’t engage in credit cards as vigorously, the main attributes of this score (out of 100) is whether you pay your bills on time and that is about it.

You can order a PDF copy of your report for €30 by using this link directly from meineSCHUFA.de. From my research, there is no quick way to check this online for free. This report is also used for renting apartments as a way for landlords to see if you have paid your liabilities.

If you’re just interested in applying for a credit card, you don’t need to request a copy of this as the bank will do the check for you.

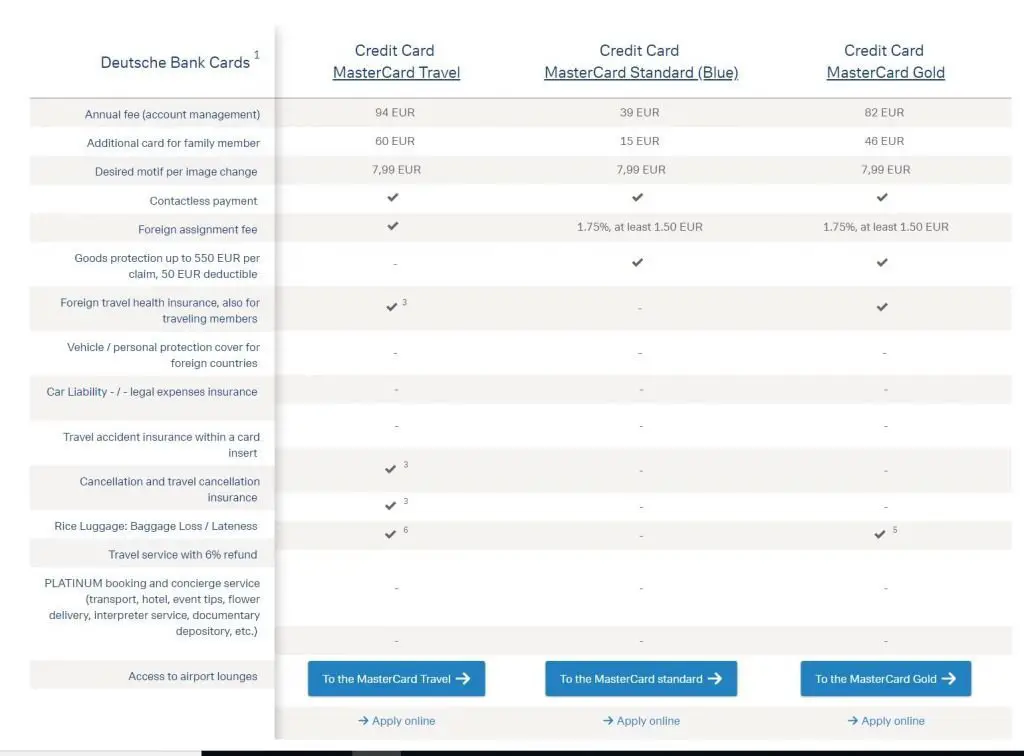

Credit cards offered by banks

In general, the credit cards offered by commercial banks in Germany are mostly charge cards. This means, you pay the remaining balance at the end of the month without any interest possibilities. Most banks do also offer a premium level credit card product. These are hardly “premium” from what I’m used to. There’s no points earning system in Germany, nor is cash back a thing. A sign on bonus is absolutely not a thing.

The premium cards in Germany advertise primarily travel insurance, no FX fees, and sometimes Priority Pass access. Of course you can expect a fee of roughly 100 euros a year. Some cards do not even have the no FX fees benefit which makes it only a worthwhile card to have if you only plan on traveling within the EU.

Are there any good German credit cards at all?

In Germany, there are very few credit card offerings and none that I would consider “good”. There are no sign on bonuses to speak of that are worthwhile, and few cards with very little reward earning potential. Therefore, if you have a credit card from home that does not charge FX fees, and offers your standard travel protection, I’d recommend staying away from the credit cards here with annual fees altogether. It just doesn’t make sense.

No fee Credit Cards in Germany

However, if you must have a credit card here, then I’d recommend going for some no fee offerings.

- Barclaycard Visa: This is perhaps the only card I’d consider getting if I wanted to have a credit card for the sake of having one. It offers no annual fees, no FX fees.

- Santander 1 Plus Visa

The Barclaycard is the only credit card that is useful in my opinion. But if there a reason to have a credit card if it doesn’t earn points, and you aren’t carrying a balance month to month? In the US, the answer would be to build credit history but the same does not apply in Germany. \The only reason to have a credit card in my opinion is if you plan to do all your banking and finances from Germany, and need a credit card without FX fees for traveling outside of the EU. Other than this, I don’t think there is any reason at all.

Credit Cards with annual fees in Germany

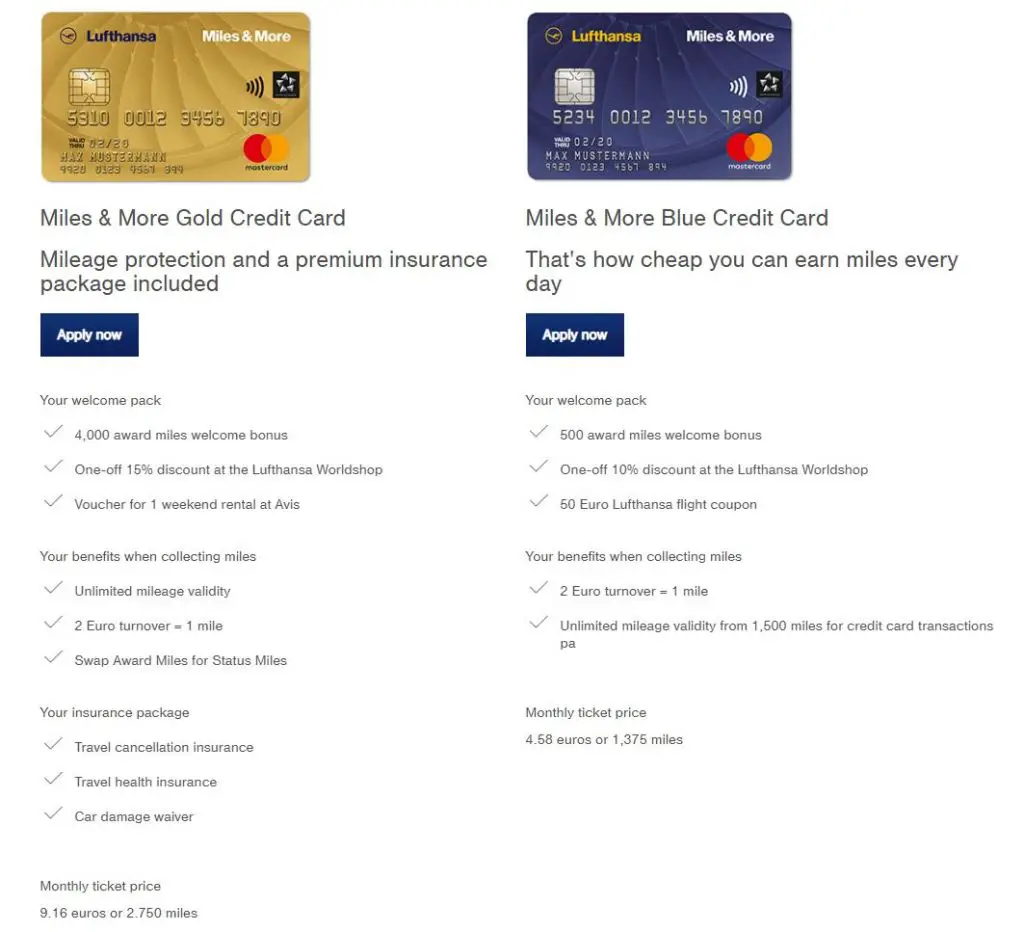

If you must have a car that earns some sort of rewards, the only credit card I can find with some sort of rewards earning structure is the Lufthansa Miles and More card by DKB (Deutsche Kreditbank AG). You can see from the below screenshot that the premium gold credit card for Lufthansa offers 4,000 bonus miles which won’t even get you a one way flight within Germany.

Additionally, earning Lufthansa miles is a €2 to 1 mile ratio. Yes, TWO euros have to be spent to earn one mile. Compare that to the US where you can earn 2 or even 3x miles per ONE dollar. The UK, Canada, Australia, and Mexico even offers cards that have at least a 1 to 1 earn rate.

Have you ever considered converting your current plastic credit card with a custom luxury metal credit card?

I found out there is german company called cardrare which can do that without to create a new bank account. I’m really interested in such things. How about you? This sounds very interesting to me.

I think Revolut already offers metal cards for a small fee. But otherwise, I don’t think it’s much use besides just looking cool? Most times I just use mobile pay anyhow.