For anyone planning to live in Germany, let me be the first to tell you that having healthcare insurance is the absolute most important thing to do from day one. Germans take their health insurance seriously so prepare to involve yourself in this process either before you arrive in the country, or a few days after you do. It’s ranked as one of the most robust systems in all of Europe and for good reason.

When I first moved to Germany, setting up health insurance was the second thing I did. The first thing was registering an address (anmeldung) at the Burgeramt. Contrary to popular belief, you do not need a residence permit in order to register for the insurance. All I had was my anmeldung, and letter of employment from my company. I registered into the public system with AOK as my provider.

If you plan on living in Germany, there is no situation whatsoever where you can hope to obtain a residence permit, in my case the EU Blue Card, without health insurance!

This post is all a part of my guide to living in Frankfurt, Germany where I list out all the things you need to know as an expat in Frankfurt and Germany.

Public Health Insurance in Germany

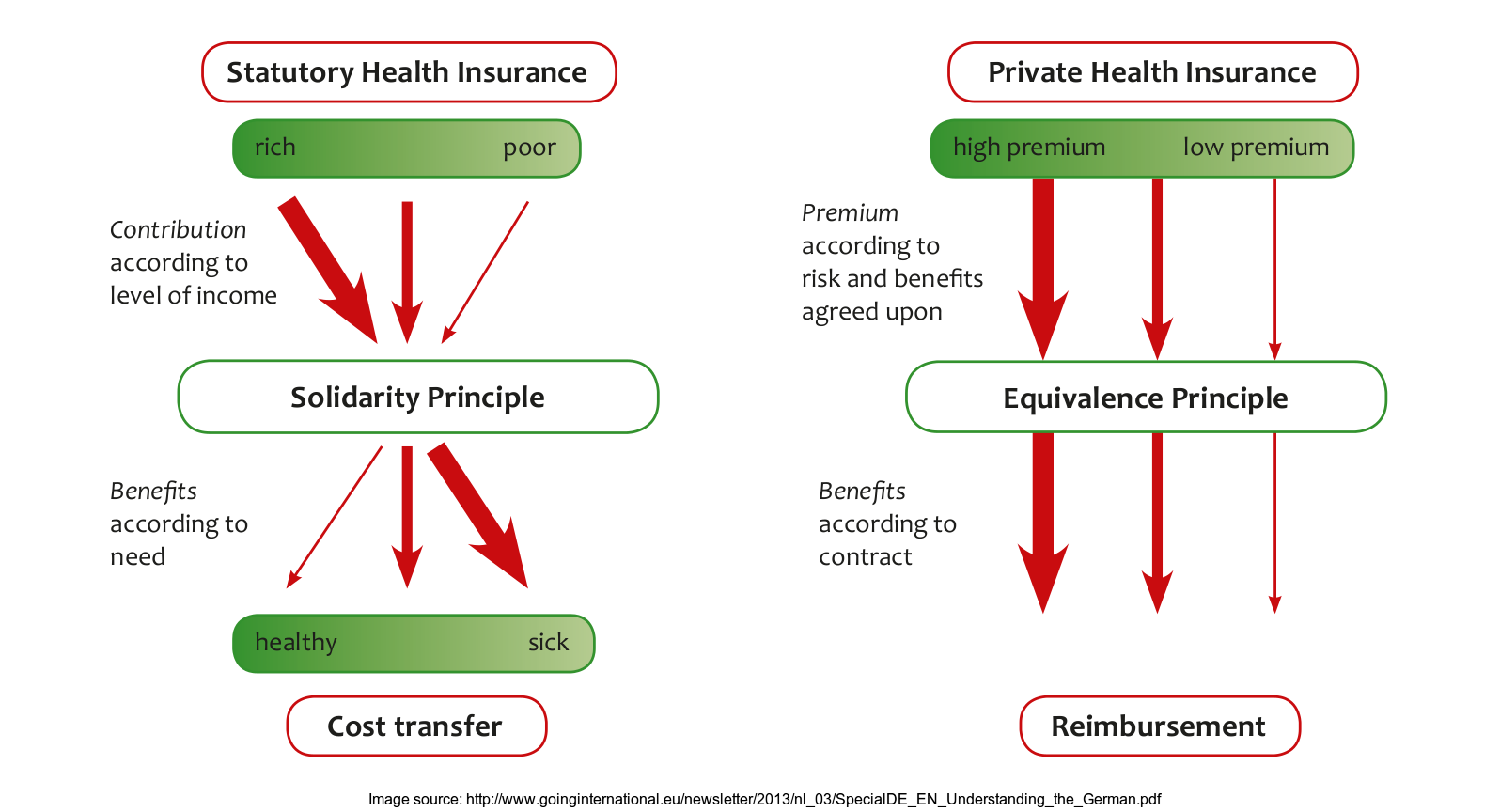

Around 90% of German residents have public health insurance (gesetzliche Krankenversicherung or GKV). It’s also called statutory health insurance. Public insurers are non-profit companies. and are also called sickness funds (Krankenkassen). This is the main statewide health insurance system that Germany is famous for. It covers every citizen in the country and is built on the solidarity principle.

In other words, you contribute based on your income a fixed price. When you’re younger and healthier, you contribute the same amount even if you don’t use it as much as someone older because one day you will be old and be reliant on it.

The public system in Germany is different from the public system in the UK, Canada, Australia, France, Sweden, Norway or Finland. You have more than one health insurance provider option. You can chose any Krankenkasse for your health insurance.

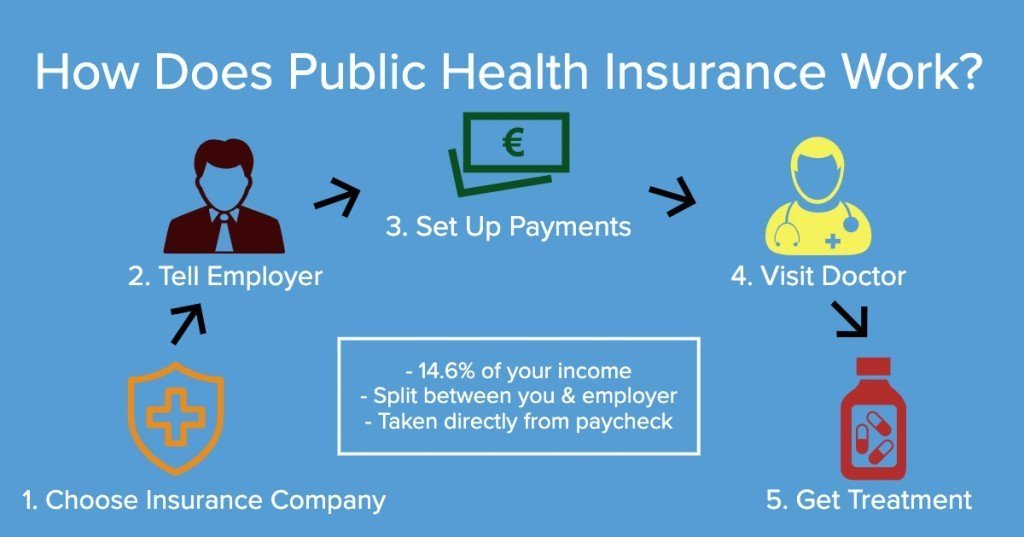

Cost of public health insurance

The cost of public health insurance depends on your income. You pay 14.6% to 15.6% of your income every month. If you make more money, your health insurance becomes more expensive. If you make more than 64,350€ per year (As of 2021), the cost of health insurance stops going up. You just pay the maximum amount. This maximum amount will change every year based on inflation.

The cost as of 2020 is around €850 which is split 50/50 with your employer. This also includes your health insurance (Krankenversicherung), as well as the long term care insurance (Pflegeversicherung).

It covers the entire family

One of the arguments to be made for public health insurance is that you pay a fixed price no matter what. If you are married with 5 kids and your spouse stays at home, you pay the same price as someone that is single.

This is why many people stay on public because it’s a huge savings once you have a family to cover versus the private system.

Benefits of public health insurance

- Public is cheaper when you’re old

Public health insurance is based on your income. If you lose your job or retire, you will pay less for your insurance. When you are old, public health insurance will be much cheaper than private health insurance. If you are over 45 years old, public insurance is almost always the best option. - It covers your dependents for free: Public health insurance covers the whole family. If you have kids or a spouse, you can rest assured that you will pay the same amount no matter what. Even if you decide to have 10 kids, you’ll pay the same price.

- It is income driven: How much you pay is determined by how much money you make. If you don’t make as much, then you won’t pay as much.

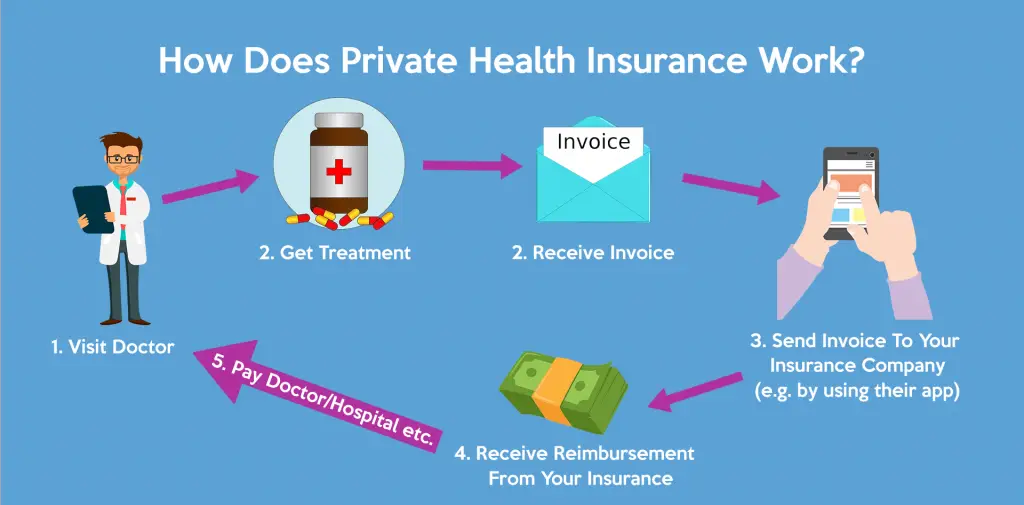

- It requires less paperwork: Public health insurance is simple. The doctors and the insurance companies talk directly to each other, so there is less paperwork to do. This means when you show up, you just need to show your health insurance card and you’re done. When on private insurance, you’ll need to usually pay the bill and get reimbursed by your insurance. This includes submitting receipts and whatnot .

- You don’t pay more for preexisting conditions: If you have pre-existing illnesses, public health insurers can’t refuse to cover you. Even if you have health problems, you will not have to pay more for your insurance.

Disadvantages of public health insurance

- Public is expensive for young professionals

Public insurance is based on your income, and private insurance is based on your health. If you are young, healthy and have a good income, public will be much more expensive than private because it is meant as a one price fits every situation. - You don’t get the best treatment: Living in Frankfurt, it’s clear that the doctors prefer to work with private customers because there’s so many wealthy people here, and hence there is so many people on private insurance. Doctors make more money from working with private insurances so you’ll have the best doctors on the private network. In addition, it’s likely your wait times will be drastically lower on public. You can wait for weeks before seeing a specialist doctor on public, but this would only be a few days when on private.

- Special treatments are not included: If you want special treatments, you will need to pay the extra cost yourself. However, these costs are usually quite reasonable, especially for someone from America.

- It’s not available for everyone: If you are a freelancer who just moved from a non-EU country to Germany, it’s almost impossible get public health insurance. Public insurance companies are not forced to cover freelancers1. Most expat freelancers are forced to choose private health insurance because of this.

Which public health insurance should I choose?

Public health insurance companies (Krankenkassen) have very similar prices and coverage. The biggest difference between companies is customer service.

I chose AOK because that was what my HR department recommended to me. However, their English support is mediocre at best and I would not recommend expats use them after using them for a year. I’ve heard much better things about TK (Techniker Krankenkasse) as they have much more support in English. Settle in Berlin does a good article about using TK as a public health insurance provider.

Although to be fair, I hardly spent any time talking to my health provider itself, as most of the interaction is with the doctor.

My personal experience with German Public Health Insurance

I’ve had German healthcare for over a year now and for the most part, it’s been largely okay. I’m probably not the best person to ask for healthcare related questions because I just don’t go to the doctor. I do my once a year physical to make sure I’m still healthy and that’s usually about it.

I’ve been able to see the doctors I wanted in a time frame that is acceptable, although I am not a frequent customer. The good thing about public health insurance is there’s no added paperwork involved. The doctor’s office simply takes your card, scans it, and that’s it. Your doctor and the health provider will take care of all the billing and you are done.

English speaking medical care

For the most part, doctors are plenty capable of speaking English. The doctors I’ve seen all have perfect English which isn’t really a surprise in a country like Germany.

The frustrating part is the administrative people. The people that schedule your appointments and answer your initial questions either speak no English or refuse to speak it. I’ve encountered quite a few moments where people just kind of scoff at my inability to speak German and make it difficult to get the answers I’m looking for.

I mean I do live in a foreign country where the official language is not English, but I also live in the city of Frankfurt. This is perhaps the most expat heavy city in Germany with more than half of the residents being non-German. I don’t expect to have a full on small talk conversation but I feel like a basic conversation in English is warranted.

Seeing the specialists

Again, I’ve not had any experience seeing specialists but my partner does. On her list to see are gynecologists, dermatologists, physical therapy, radiologists etc.

From the few experiences she has had, she’s found it very difficult to find certain specialists. Particularly gynecologists. In fact, she called at least 15 different gynos before she found one that accepted the public health insurance. Every other doctor only accepted private insurance. The public insurance doctor had a waiting period of about 4 months before they could see her. There were plenty of private OBGYNs that would see her in the same week, some the next day. However, you can still keep the public insurance and just opt to pay in cash to see doctors that only accept private.

How is this possible? I’m not sure because so many people are on public and half of the population are women so where do they all go?

My theory is that there must be many many people in Frankfurt on the private insurance because incomes are much higher in the city. I love living in this city, and don’t particularly find it overly expensive, but there are lots of people making lots of cash.

It was because of this that I decided to switch to private insurance!

Private health insurance is the other beast to consider when looking at German healthcare. Private healthcare is exactly as it sounds, provided to you by a private corporation/provider. I’m not sure if it is also non-profit like the public system but I suspect not.

While the public system is a one price/model fits all, private insurance is an absolute bespoke, tailored to your personal health situation type of coverage. On the public insurance, as I wrote above, you pay a certain fixed price based on your income regardless of how many pre-existing conditions you have, family members, and the like.

Private insurers will conduct a personalized health screening for you to craft a price for you. If you are sick with lots of pre-existing conditions, then obviously the insurer will see you as someone that goes to the doctor often and hence raises your premium.

In return, the coverage is better because more doctors, especially specialists will accept your insurance. I’m still not sure why this is because I’m actually paying less with private insurance than public but I’m sure such a reason exists.

Is Private insurance for you?

I feel like Germans are somewhat apprehensive to public insurance. When I first moved to Germany, I was trying to understand the difference between the two because I just wanted to pay the least amount since I know I never visit the doctor.

I was talking to my German colleagues and most people were on the public system. Even after explaining my situation, it seemed like people automatically assumed I would have kids and stay in Germany forever so why would I bother with private insurance?

The amount you pay for your private health insurance depends on several factors, including:

- Your occupation

- Your age

- Your pre-existing medical conditions (you may have to submit to a medical examination)

- The healthcare plan you choose

- Your voluntary excess (Selbstbeteiligung – see below)

The average premium is around 400-700 euros per month (significantly less for students). If you are employed, 50% of your contributions will be covered by your employer, up to a maximum of 365,63 euros per month plus 59,77 euros per month for long-term care insurance (in 2020). If you are self-employed, you will have to cover the entire premium yourself.

All in all, if you are a young single person with a well paid job, have few health issues, and are not planning to start a family any time soon, then you should absolutely switch to private insurance.

All members of the family are insured separately

One clear distinction is if you have a family. On the public system, you pay one price for everyone no matter what. However on private, you will go through a health screening to determine your rate. However, this rate is just for you. If you have a spouse that does not work, then he/she will have to go through their own health screening and the private insurer will give you a quote for your spouse separately. If you have children, the same process will occur and it’s likely that private insuring a family is much more expensive than using the public insurance.

Switching from public to private health insurance in Germany

I waited about a year before making the switch from public to private insurance in Germany. You can do this as soon as you want. In fact, you don’t even need to sign up for the public insurance before switching to the private. As an expat, you can actually sign up for a private insurer before you arrive in the country. This health insurance will suffice when it comes to obtaining your visa as well, like the EU Blue Card.

Choosing my private insurer

I didn’t do much research to be honest as I found the whole system rather confusing. However, in the year since I moved to Germany, I frequently saw video ads on YouTube for an insurance company called Ottonova. I never really listened to the advertisement but it advertised how as an expat you could save a lot of money by switching to the private system. They also

It kind of stuck to me and it was the first place I went to when I was ready to switch.

Signing up with Ottonova

Ottonova is a private health insurance startup in Germany. I’m a big proponent of startups looking to disrupt antiquated industries and healthcare is definitely one of them. Other startups that I’ve loved using in Germany is N26, a completely online German bank as well as Wundertax, which is an English platform for filing your German tax return.

The process to register is very simple. I scheduled a consultation with Ottonova and someone promptly called me. I had a few questions and the entire thing was done in English. I had plenty of questions for them and they answered them all thoroughly. I was already quite impressed.

Obviously, the main thing for me was going to be the price. In total, they quoted me based on my age a rate of €305 per month (as of 2020). Half of this is always paid by the employer so I’d only be paying around €150. The €305 includes the health insurance as well as the long term care. My partner also got a quote for the same amount. Therefore, between the two of us, our payments are €610 a month which my company paid for half leaving me on the hook for €305 total.

To put it in perspective, I was paying almost €900 a month (€450 from my own pocket) under the public system!

It’s a huge savings. A big part of this is because of being an expat.

Expat advantage for Private Insurance

One of the main reasons expats should consider private insurance is because you can be eligible to pay far less up front. If you’re only planning on staying for under five years, you are able to opt out of paying the altersruckstellungen. This is something you pay into so your private insurance premiums when you’re older do not increase so much. However, if you’re an expat and do not plan on staying forever, there’s no point paying into that fund as you won’t be using it.

Ottonova allows you to not pay into that which saves a lot of money every month. Other insurers likely will also offer this, so it’s best to ask.

Filling out the application

I thought about it for a day or two and was ready to make the switch. The next step was a medical consultation. This includes a phone conversation with someone that will ask you a bunch of questions about your medical history and whether you have any pre-existing conditions.

As well, they will also require a blood test to check your cholesterol and other things. Of course, the more issues that arise from this, the higher your premium will be. I had done a blood test 10 months prior as part of my yearly check up and they accepted this. Otherwise, they said they would send someone to my home to take the blood test. Fantastic.

In the end, they raised my premium another €20 (€10 paid by me) because I have some allergies to pollen. I never thought of this as an issue as so many people have this and it’s easily rectified by over the counter pills but they also said private insurance covers any medication going forward.

Once they created my account, I printed out a few forms that I mailed to AOK (my public insurer) to notify them I wanted to cancel my insurance. I also sent a few documents that Ottonova provided to send to my employer so they know how much my new premiums would be (and how much to pay).

In total, it take three months to make the switch from public to private because German bureaucracy more or less. If you want to make the switch, know that you will need some months before you can use your new insurance!

Switching from private to public health insurance

Switching from private to public health insurance can be extremely hard, and sometimes impossible. If you have serious preconditions, public health insurers are not forced to accept you. That’s one of the reasons many people in Germany tell me not to switch to private. There is valid reason to this too.

If you’re over 55, it’s almost impossible to switch to public insurance. Otherwise, people would do private when they’re younger and cheaper, before switching to public health insurance when they are older. The public system would go bankrupt quickly because the whole system is predicated on the solidarity process.

The one way I’ve heard of this switch being done is to reduce your income. Once your income is below the threshhold of €62,550 in 2020, you are no longer eligible for private insurance so you’ll automatically be switched back to public.