Opening a bank account is one of the first things you must do when living in Singapore. Not only will you need it to get your paycheck but you’ll also need it to pay things like rent and utilities. Singapore is also one of the most digitally advanced nations in the world when it comes to payments and you’ll want a local bank account to digitally pay merchants without using a credit card.

Opening a bank account is a relatively simple process for a foreigner but as always, be prepared for a less than smooth process. As with anything, when you’re a foreigner, nothing goes as planned. This blog post will be for expats moving to Singapore on an employment pass or study pass and what you’ll need to get the ball rolling.

Why you need a bank account in Singapore ASAP

As with anything involving moving to a foreign country, a bank account is among the most important things to consider. If you’re moving to Singapore for work, the first few weeks are of the utmost importance because you’ll need to find an apartment, get paid, set up all your phone contracts, etc. To do any of these things, you’ll want a bank account pronto.

Singapore in particular is very digitally saavy when it comes to their banks unlike Germany and their banking system. People use their phones to pay at almost every merchant in the city. From street food to fine dining, everything is done by phone.

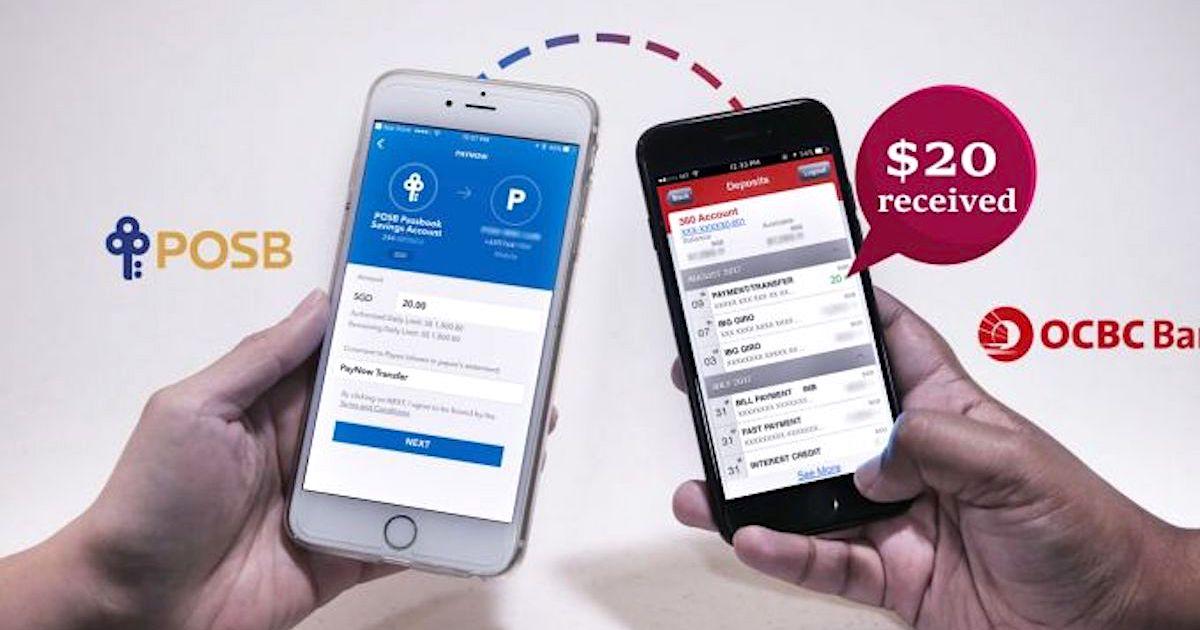

Singapore also has a system called PayNow which is how you can make P2P payments easily, as well as paying merchants. Hawker stands for example used to be cash only until PayNow was introduced. Nowadays, they will have their PayNow QR code in front of their stands which you can scan and pay accordingly. It speeds up the process drastically and a cashless society is possible. In fact, I think the only reason to carry a wallet is if your phone has bad battery life!

Best Banks in Singapore to open an account

Singapore has one of the best banking systems in the world. It is the financial center of Asia after all, especially as Hong Kong’s influence continue to wane after COVID. Singapore has a very robust financial system with banks that are very well capitalized, financially stable, and reliable. Singapore as a whole is seen as a country of stability, little to no corruption, and home to banking regulators that don’t mess around.

Singapore is home to a plethora of local banks as well as multinational banks that have set up their SE Asian offices in Singapore. You are spoilt for choice when it comes to opening bank accounts in Singapore. For the purpose of this post, I will focus primarily on basic consumer accounts like checking/savings accounts and save credit cards for a later post.

Each bank on this list is very reputable and trustworthy. Some banks have accounts with no maintenance fees and others only have them based on minimum balances you keep.

DBS Bank

DBS Bank is one of the largest banks in Singapore and offers bank accounts for expats. It’s also ranked as the safest bank in all of Asia for what it’s worth. It was the bank that many of my friends used and consistently the one that was most recommended. They offer very expat friendly bank accounts like the DBS Multiplier account that allows you to transact in SGD and 12 additional currencies from the same account.

With the Multiplier account, you can exchange between currencies at a rate that is very near to the spot rate. It’s not as good as say Revolut, but it offers better exchange rates than TransferWise from my experience. Finally, you can transfer foreign currency to foreign bank accounts without additional fees. This is extremely valuable if you’re an expat that wants to send money home on a regular basis and want to avoid crazy wire fees.

UOB

UOB, or United Overseas Bank, is the third largest bank in Singapore by deposits. It has the most locations of any bank in Singapore for ATMs which makes it great if you transact in cash. The branches are also much more appealing and modern looking than the archaic branches of DBS and OCBC.

UOB also has expat friendly accounts with multi currency accounts on offer. Since I don’t have an account with them, I can’t comment on the FX rates they provide.

OCBC

Among the largest banks in the Asia-Pacific region, Oversea-Chinese Banking Corporation (OCBC) allows non-residents and expats in Singapore to open savings, chequing, and foreign currency bank accounts. The minimum initial deposit for most OCBC bank account is S$1,000.00. For some OCBC bank accounts, yearly account fees are waived for the first year. Account applications can be started online.

Citibank

Citi is one of the largest banks in the US. They have a retail banking business in Singapore and is a popular choice for expats. If you’re American and already have an exiting Citi account in the US, you should be able to open an account in Singapore relatively easily. Citibank offers various checking and savings accounts as well as multi currency accounts.

Citibank has probably some of the best credit cards you can find in Singapore with decent sign on bonuses and rewards structures. Of course, credit card rewards in Singapore are nowhere close to the fruitfulness you find in the US but it is better than most other countries in the world.

ATM fees in Singapore

ATM fees are notorious for being high and unreasonable in Singapore. If you take cash from a bank ATM that is not your own bank, be prepared to pay some hefty fees. For example, the DBS ATMs charge $5 SGD per transaction and the OCBD ATM charges $7 SGD! That is a lot of money!

If cash is of importance to you, then I would stay with opening an account from a local bank because they have more ATM locations. UOB has the most ATM locations in the country followed by OCBC and DBS Bank.

Thankfully, most things are cashless in Singapore nowadays with the exception of a few hawker stalls. PayNow has essentially reduced the need for cash and your phone is the most valuable ATM these days.

Documents Required For Opening a bank account in Singapore

For the purpose of this post, I will focus on the documents necessary to open a bank account if you’re a resident foreigner. This means you are on a work pass or study pass of some sort (EP holders).

If you’re a non resident foreigner that is just looking to open a bank account in Singapore to transfer funds into, you’ll need to go a different route. There are many banks in Singapore that will open accounts for you but you’ll need few more documents. It’s not a difficult process however because let’s be honest, Singapore is the Switzerland of SE Asia and they have no issues taking your money if you want to give it to them.

Regardless of which bank you choose, the following documents will be mandatory for opening an account:

- Your passport;

- Your work permit in Singapore (for employees);

- Your study permit in Singapore (for students).

In addition to these documents, most banks will require the following:

- Proof of residence (in Singapore);

It’s not overly complex to open a bank account in Singapore and the documents you need are in line with any other country I’ve lived in.

Opening up a bank account at DBS experience

Now on to the real stuff. How easy is it to actually open a bank account in Singapore? The answer is, not so easy. I had already heard about various horror experiences from friends but I must say that the experience at DBS was not great.

To open a bank account at DBS, you’ll need to download their DBS Digibank app. You can apply for a new account as a foreigner using the prompts in the app. The app will ask you for the following things:

- Work or Study Permit: EP, SP etc. If you are not in Singapore yet and do not have your EP, then you can use your preliminary IPA approval letter from the MoM. Similarly, if you’re studying in Singapore, you can use your study visa.

- Proof of Residence: You need to provide your utilities statement, rental contract, or something else to prove your residence. If you are not in Singapore yet, you can simply use your IPA again. If you’re staying at a corporate apartment temporarily, they can sometimes provide you a document for this.

- Passport: Self explanatory.

You’ll need to upload these documents to the app and then you’ll spend a few days waiting for approval. I found that this step is slow and unreliable. It’s best to just visit the branch and have them complete the process.

DBS Branch is a disaster

The DBS Branch in Singapore is a completely disaster. I’ve never seen such a terrible in person branch banking experience. It was so crowded and so chaotic is such a small space that I felt like I was in the ER room of a hospital and a car accident had just occurred. You’ll need to queue up when you enter and you’ll get a number texted to your phone. Depending on the amount of people, it could take you up to 1 hour to actually talk to someone. The whole process was absolute madness and not something you would expect from a bank in Singapore in the 21st century.

Thankfully, most of the staff are helpful and friendly but that doesn’t excuse the very archaic and slow process of opening an account. Once you open the bank account, everything is very simple and straight forward.

Use Singpass if you’re already settled in the country

If you’re already int he country for some time and have your Singpass app set up, you can simply use your Singpass to import all the required documents into DBS Digibank. This will save you a lot of time and will generally expedite the process. Although, the hard part of banking in Singapore is getting a bank account before you get all these visas set up so you can get paid by your work!

Use PayNow in Singapore

Once you do get your bank account open, make sure to have them set up your mobile banking which is the most important thing you’ll have in Singapore. Everything payment related is done digitally nowadays with your phone.

PayNow is one of the payment systems within DBS and it is the most used payment method in Singapore. You can use PayNow to pay your friends if you’re splitting a bill when going out. You also use PayNow to pay merchants directly. Hawker markets and restaurants will have the PayNow QR code ready for you to scan. This will automatically open the DBS Digibank app and their bank information will already be pre-populated.

I am a huge fan of PayNow and think the entire world should be adopting similar payment methods. Of course, PayNow is exclusively linked to your checking/savings accounts. You cannot use credit cards in conjunction with PayNow so no points will be had.

Can DP Holders open a bank account in Singapore?

Can DPs (Dependent Pass) holders open a bank account with one of the Singaporean banks?

The answer is a resounding yes.

Anyone who tells you that a DP must open a joint account with the EP holder is wrong. A DP can absolutely open their own bank accounts separate from the EP holder. You’ll be able to use PayNow or PayLah on your own without having to share an account with the EP holder. However, you will need the EP holder to accompany you to the bank and sign off on a few documents. This is because while the bank account is under your name (the DP holder), it is still connected to the EP holder’s account. Some banks might not allow this but DBS Bank for sure does.

Opening a credit card is a different question however. A bank is probably not going to lend credit to a DP holder as easily as the EP holder since this carries a lot of risk. A bank account (checking or savings) is just a place to park cash so a bank won’t have much issue with this. Giving money on credit is another story.

Open a joint account if you can’t open your own account

If your bank won’t allow a DP their own bank account, every bank will allow the EP holder to create a joint account which is an extension of the EP holder’s account. This account will have its own account number and the DP could theoretically just use this account exclusively and thereby use services like PayNow.