The one thing that all people need to have when living in Germany is health insurance. There is no way out of it as it is required by the law and I’m thankful for that. Living in Germany has been an amazing experience and I absolutely love being able to travel to other parts of Europe so easily. However, getting life admin set up can pose its challenges and frustrations.

Health insurance is no different. While you are required to have health insurance in Germany, the different options can be overwhelming at times. The public and private health care systems in Germany are something everyone should understand before moving to Germany. I’ve previously written a post about the differences between German private and public health insurance which is definitely worth the read before reading this post. I’ll focus on my experience with Ottonova, which is my German private insurance company.

Who is Ottonova?

Ottonova is a private health insurance provider in Germany. The company was founded in 2015 and has quickly expanded all over Germany

Ottonova is one of many private healthcare providers in Germany but the company focuses on combining technology with mundane German processes which really simplifies my life. Their app is definitely one of the most revolutionary products in German health insurance and the ability to chat with someone in English on my phone is invaluable.

Ottonova also figured out there is a large expat market in the country that does not speak German. They offer plans and support in English that help simplify your life.

I switched to Ottonova within 4 months of moving to Germany and I wish I had done it before I landed. Those 4 months on the public system are months I won’t get back!

Signing up with Ottonova

Signing up for Ottonova is very easy. You can simply visit their website and register for an initial consultation. Someone from the team will call you to walk you through the steps.

An In home physician check up

While in the process of signing up for Ottonova, the sales rep said that as part of the initial process, they would send someone to my apartment to give me a health check up. This includes a blood test which measures cholesterol, blood pressure checks, and whatever else they wanted.

I had just visited the doctor a few months prior to joining Ottonova when I was still under the public plan. I actually had a blood test done at that point and asked them if I could just send them my blood test result instead of this whole process. They agreed to this and waived the initial check up.

Expat Plans

One of the best parts of Ottonova is their “Expat plan”. This plan is geared specifically towards expats that plan to stay in the country for under 5 years. This is because your German public pension doesn’t start to vest until you stay in the country for over 5 years. For anyone staying in the country for under 5 years, you do not need to pay into long term care insurance (Pflegeversicherung).

Therefore, Ottonova offers you an option to not pay into this which reduces your premiums significantly. If you decide that you do want to stay in Germany after 5 years, you can always go back to a traditional private insurance plan where you do contribute to this.

How much do I pay for German Private Health Insurance Under Ottonova

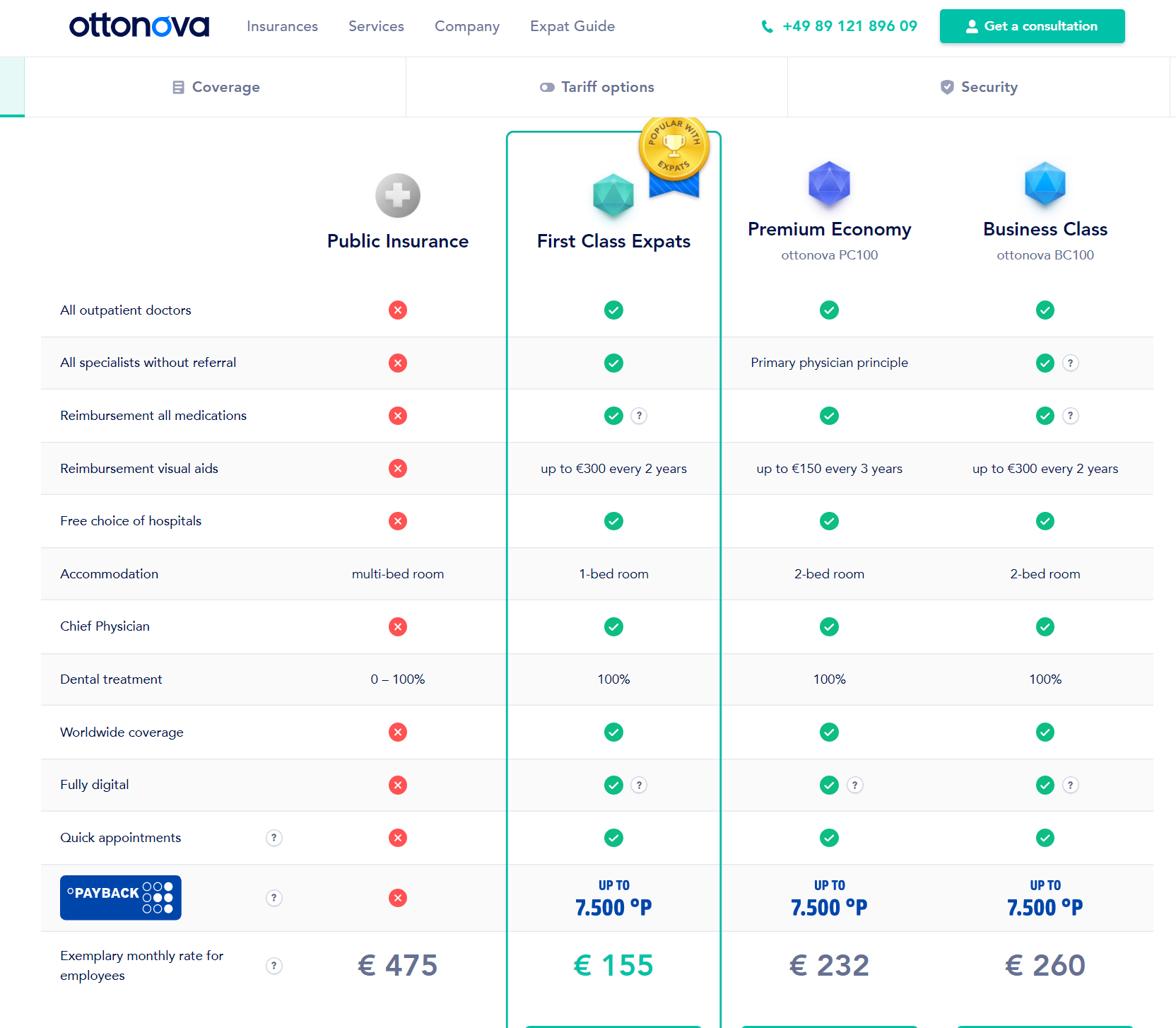

Finally, this is probably what you are really looking for. While the public health insurance system has clearly written out prices based on your income range, private health insurance pricing is totally opaque. There is no price table whatsoever as the price per month is on an individual case.

There are countless factors that go into figuring out your rate that I can’t even begin to pretend like I understand. The most important things I do know from talking to Ottonova is your age, general health, and any pre-existing conditions. Remember, this is a private company insuring you so they need to perform all the due diligence before hand before offering you a quote.

What is my monthly rate under Ottonova

Just a background of myself. I am 33, quite healthy as I work out diligently (somewhat when I’m not getting too drunk at Kleinmarkthalle in Frankfurt), and with no pre-existing conditions.

I took the Ottonova expat plan which doesn’t require me to make any health insurance retirement contributions as I was likely moving out of Germany within 5 years time. This saves a lot of money.

In total, I pay just under €300 a month. This amount is then shared 50/50 with my employer as all private insurance plans are. This means out of pocket, I pay €150 a month. This is less than half the price of what I was paying under the public plan. Again, this is also because I do not contribute to the long term care insurance.

How much does it change?

As a regulated health insurance, Ottonova cannot just increase premiums any time they want. Premiums can increase when actual health costs in general differ more than 5% from what we calculated. This can only happen due to inflation and rising medical costs.

My rate has actually decreased during my second year with Ottonova by €15 or so.

English Concierge Support

One of the most frustrating and complicated things about German health insurance is not being able to communicate with someone to really understand what to do. If you don’t speak German and are using the public insurance, you might encounter many moments where you have no idea what you are saying or doing. Many hospitals and doctors under public insurance are generally not as friendly and don’t speak English which makes the whole experience tough.

Ottonova is geared towards expats in this category and provide a fantastic full English support chat feature within the app. You can chat with a live representative about literally anything related to your health insurance and you’ll receive a response quickly.

I’ve asked Ottonova countless times about whether something is covered under my health insurance plan, forms I need filled out for work or anything else, and even something small like changing my phone number.

It feels like VIP service at times which is a huge step up from what you get on public insurance. Private health insurance in Germany really is miles and miles ahead of the public plan.

Concierge appointment booking service

One of Ottonova’s great features is booking appointments for you.

You can request to have an appointment booked at a doctor of your choice, or have them find a doctor for you. You tell Ottonova what your issue is (GP, Dermatologist, dentist etc.), what your time availability is and they will actually call the doctors on your behalf to book the appointments.

At first, I didn’t bother with this feature because I had no issues just calling doctors on my own. However, I quickly became lazier with the process and found it to be so much easier just to have them do it for me and figure out what the doctor’s availability was.

What is covered in Ottonova?

Under private health insurance in Germany, you’re mostly covered for pretty much every standard thing you can think of. I’m not an expert in healthcare by any means but let’s just say after switching to private health insurance in Germany, I felt like I could do anything. I could see any doctor I wanted, whenever I wanted. I was even paying less money for much better service.

Everyone has different medical needs but I know for sure that Ottonova covers everything from an outpatient perspective and you always have your private room in the hospital incase of serious injuries.

One of the main differences I could see after switching is dental insurance. Under the public system, I had to pay to get my teeth cleaned. It wasn’t much but I still have to pay it nonetheless. Under Ottonova, I get two free teeth cleanings a year.

For a comprehensive list of things that Ottonova covers, please visit their website.

Getting reimbursed for medical expenses with Ottonova

With private health insurance in Germany, you pay the doctor directly and then Ottonova reimburses you for the expenses.

Ottonova makes it very easy to submit expenses and receipts. With their app, you can simply take a picture of your invoice from the doctor. You don’t even need to write any text about your doctor’s visit, the picture receipt is more than enough.

Ottonova reimburses the expenses very quickly. I frequently had invoices paid within 24 hours and it never took more than 72 hours. The money is paid directly to my German bank account.

In Germany, everyone is obsessed with the mail but I would often ask the doctors to just print me the receipt once I was finished so I didn’t have to wait around for the mail.

Would I recommend Ottonova?

I’ve used Ottonova for over two years now. I was on public insurance when I first moved to Germany because I didn’t really understand the differences between the two systems. I don’t visit the doctor for much of anything but from the few experiences I had visiting doctors in Frankfurt, it was enough for me to see how different being on private really was.

Once I switched to Ottonova after 6 months of being on public insurance, it was a revelation. It was as if I finally came into the light. A night and day experience.

Never again do I worry about calling an office and wondering if the person on the other line will speak English or treat me differently because I don’t speak German. I can literally visit any doctor I want now and not have to worry about booking the appointment or how long I have to wait.

The customer service has been great with Ottonova and it’s hard to imagine myself going back to public insurance. All in all, I can definitely recommend Ottonova!

Hello Johnny,

I just tried to send you a message via your contact form. Unfortunately there was a technical error “The form was unable to submit. Please contact the site administrator.”.

You are welcome to write to me at my email address.

Many greetings,

Nils