2023 is shaping up to be a very fruitful year for credit card bonuses. Banks seemed to cut back on their credit card offerings during the pandemic but the sign on bonuses and rewards have come back in full force. Bonuses have never been bigger until now which means there will be plenty of opportunities to get the best deals in 2023. This is definitely one of the best years for travel hacking.

With my repertoire of points, I’ve managed to travel all over the world in 2022. This includes a multiple month stay in Bali, the islands of the Gods which is my favorite place. In addition, multiple flights back to and around Europe were taken care of thanks to my points like a trip to the south of France, Greece, Turkey, the Caucasus and more.

Summary of the past year’s credit card activity

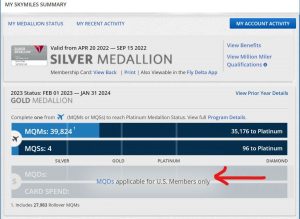

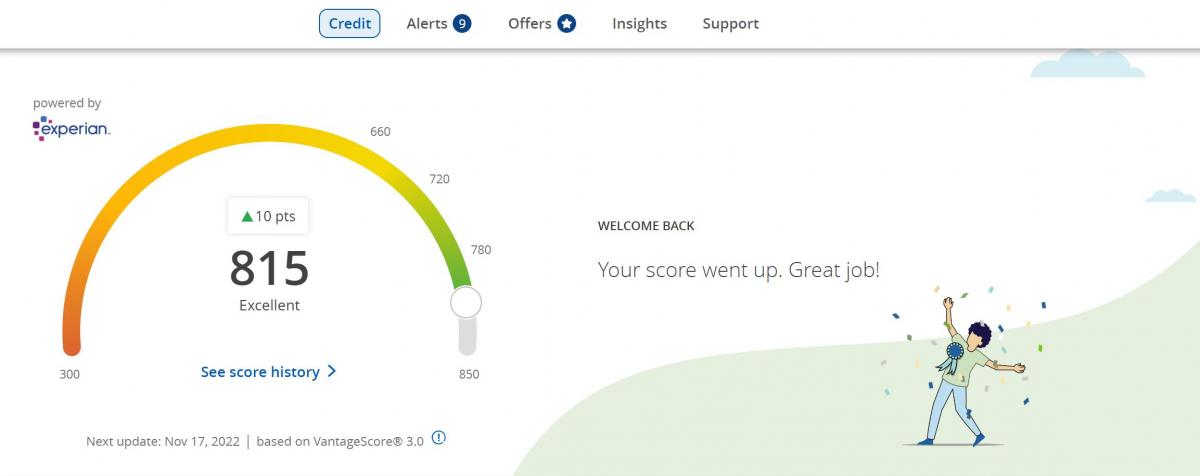

All in all, as of the end of 2022, I have 15 active credit cards. I applied for 5 new credit cards cards in 2022, and have canceled 3. Those not familiar with credit cards might ask, how is my credit score not complete crap at this point? Turns out that opening and closing credit cards does not adversely affect your credit score which I explain in depth.

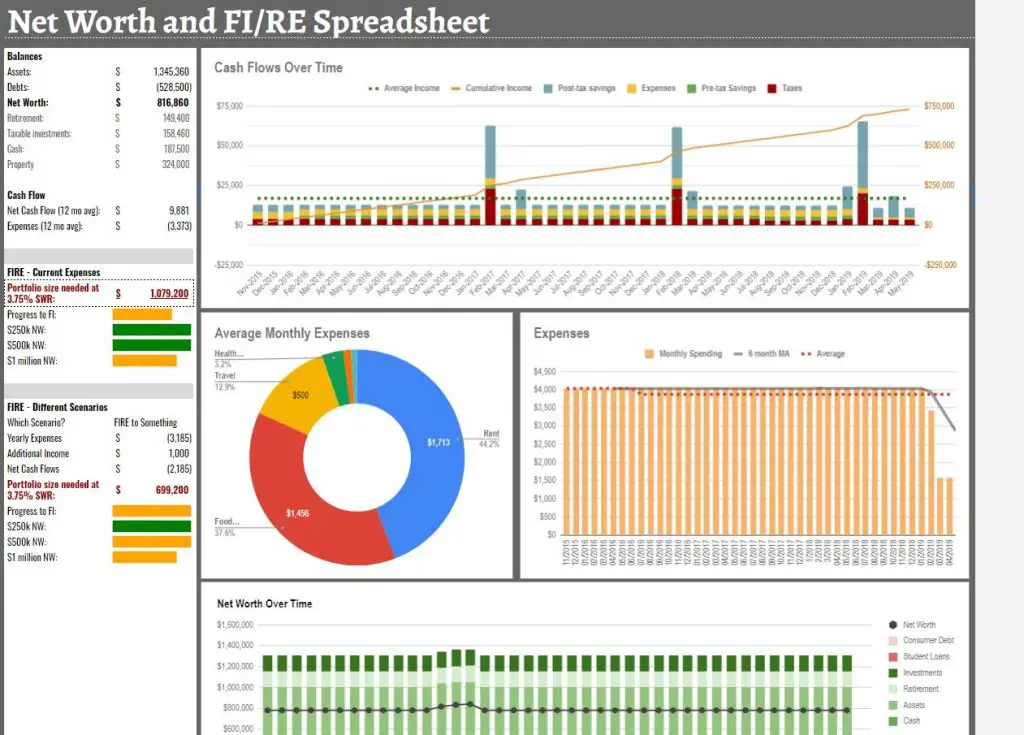

As always, I also use a Google Docs spreadsheet to track all of my credit cards which has really simplified my life. It’s an imperative tool for me to really keep track of so many cards with so many annual fees

Churning credit cards while living abroad

I’ve lived abroad for quite some time now, traveling the world and back. It is more difficult to churn credit cards and optimize sign on bonuses while being abroad. This is primarily due to the fact that most of the world does not accept American Express. AMEX and Chase offer some of the best credit cards in the business after all.

Meeting the MSR (Minimum Spend Requirement) on an AMEX while traveling abroad is difficult if merchants do not accept it. Yes you could use it to book hotels/Airbnbs, flights etc. but it’s unlikely that I could meet my MSRs with these expenses alone. For that fact, I won’t be getting any AMEX cards in the foreseeable future.

With that said, there are plenty of amazing credit cards in 2023 that are Visa and Mastercard, both of which are widely accepted world wide.

Sign on bonuses are the name of the game

As I’ve written in much detail over, sign on bonuses are the name of the game. Yes, having deep knowledge of which credit cards give which points is good but it will never replace just picking up a sign on bonus. For example, the Chase Ink Cash sign on bonus (more on this later in the post) is giving 90k UR points at the moment. Even being able to earn 3x per dollar spent on restaurants & travel, you would have to spend $30k of real money just to get to the same amount as a simple sign on bonus!

Current Credit Card Inventory 2022

Here is an update on my current credit card repetoire:

| Card Name | Annual Fee | Issuer | Keep/Cancel in next year |

| Cash Rewards | $0 | USBank | Keep |

| Spark Cash | $0 | Capital One | Keep |

| Blue Sky | $0 | American Express | Keep |

| Marriott Bonvoy | $95 | American Express | Keep |

| Blue Business Plus | $0 | American Express | Keep |

| Freedom | $0 | Chase | Keep |

| Freedom Unlimited | $0 | Chase | Keep |

| Marriott Bonvoy Boundless | $95 | Chase | Keep |

| Hyatt | $99 | Chase | Keep |

| Sapphire Reserve | $550 | Chase | Keep |

| Ink Preferred #1 | $95 | Chase | Downgrade |

| Ink Preferred #2 | $95 | Chase | Downgrade |

| Ink Cash #1 | $0 | Chase | Keep |

| Ink Unlimited #1 | $0 | Chase | Keep |

Compared to my credit card inventory from previous years, I have very few cards. I’ve gotten rid of most of my American Express cards including the very expensive AMEX Platinum ($695 AF) which really serves me no purpose when living abroad.

The AMEX Platinum is a great card to have in the US especially if you are a Delta flyer. The Delta lounges and Centurion lounges are great to have but they are mostly not available abroad. A few years ago, AMEX was the gold standard when it came to credit card lounge access since they were the only game in town that had their own suite of lounges. Going forward, Chase will release many Sapphire lounges around the world as well as Capital One already going that route.

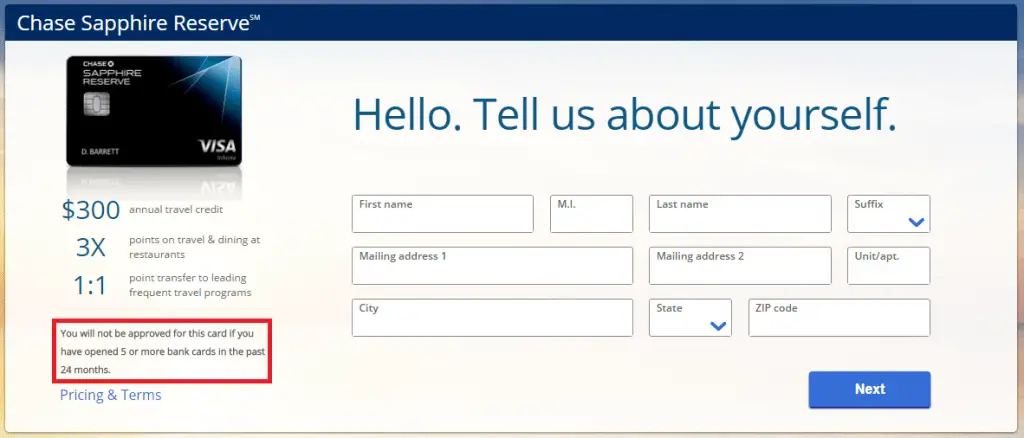

Getting Below Chase 5/24 Rule

What is Chase 5/24? The bane of my existence, that’s what it is. The 5/24 rule is one of the most famous and strongest credit card restriction rules. It merely states that you will automatically be denied Chase credit cards if you have applied for 5 or more personal credit cards from any bank in the last 24 months. For someone like me, I hit this number in a month or two. Sadly, Chase has the best credit cards in the business with the best sign on bonuses to be had.

Business credit cards however, do not count towards this rule meaning every new business card does not add to this 5 card limit. For the last year, I’ve mostly only applied for business credit cards and have slowly watched as I approach 4/24. Once I reach 4/24 (4 cards in the last 24 months), I can apply for new Chase cards, whether they are personal or business. If I apply for Chase business cards however, they do not increase my counter which means I can effectively apply for as many Chase business cards as I can handle without reaching 5/24 and being auto-rejected.

As of end 2022, I am at 4/24 which means I’m just below the threshold. Using my credit card spreadsheet, I can see at which date I will be at 3/24, 2/24 etc. so I know I an apply for new personal credit cards without risking ability to get more chase cards. In another six months around the middle of 2023, I will be 0/24 which means I have plenty of room for new personal cards.

Which credit cards I will target for 2023?

Chase Ink Unlimited #2

Annual Fee: No annual fee

Card Details: 90,000 UR Points sign on bonus after spending $6k in 3 months

The Ink suite of credit cards is a literal points gold mine in 2023. The sign on bonuses for the Ink unlimited and Ink Cash are incredible. At 90,000 UR points, it’s worth at least $1,350 when you transfer the points to the Chase Sapphire Reserve (which I of course have).

As I’ve written in the past about obtaining multiple Chase ink cards, this will be my second iteration of the Chase Ink Unlimited. I already opened this card many years ago but because you are allowed to have multiple copies of this card, there’s no reason not to open a few more to collect the sign on bonuses. In addition, there is no annual fee so it is definitely a no brainer.

Chase Ink Cash #2

Annual Fee: No annual fee

Card Details: 90,000 UR Points sign on bonus after spending $6k in 3 months

In continuation with the previous card, the Ink Cash is another card in the Chase Ink suite that is also offering 90,000 points after spending $6k in 3 months. I also have an Ink cash in my portfolio of credit cards already so this will be #2.

To not trigger any alerts with Chase, I will only apply for this card three months after obtaining the bonus from the previous card. This is known as the Chase 2/60 rule (2 Chase cards in 60 days) and it’s an easy thing to avoid. I’m still debating whether I want to apply for this card with just my SSN or also utilize an EIN to mix it up.

Chase Ink Preferred #3

Annual Fee: $95, Not waived for first year

Card Details: 100,000 UR Points sign on bonus, 3x on travel and various business categories

Probably the single most lucrative sign on bonus in the entire credit card space. The Chase Ink Preferred has had the biggest sign on bonus for Chase in the past many years. This is one of my favorite cards purely for the sign on bonus. The 100k sign on bonus is enormous. It’s worth at minimum $1,500 in cash because I can transfer the points to my Chase Sapphire Reserve which means the points will be worth 50% more when redeeming.

In addition, Chase UR (Ultimate Rewards) points are some of the most valuable in the business. I can transfer them 1:1 (sometimes with a bonus) to numerous airlines and get amazing redemption offers on Business flights.

One of the main things to know about the Ink credit cards is that you are allowed to get multiple copies of the same card. This is a phenomenon I write in detail about how to apply for multiple Chase Ink credit cards. In short, you can apply and hold multiple Ink credit cards simply by using an EIN (or multiple EINs)! I already have two Chase Ink Preferreds now and have collected the 200k sign on bonus between both cards. A third one is something I’m targeting now.

You must spend $15k in 3 months to get this bonus but with one of my favorite manufactured spending techniques, this won’t be a problem.

The Ink cards are all business credit cards so it doesn’t quite work the same when it comes to credit reporting and the Chase 5/24 rules. Wondering how it’s even possible to apply for a “business” credit card without a real business? I answer all of that in my post about business requirements for business cards.

Chase United Mileageplus Explorer

Annual Fee: $95, waived for first year

Card Details: 70,000 United Miles sign on bonus

The Mileageplus Explorer card from Chase is one of the first cards I opened when I entered into the game. I opened this back in 2016 which was a long time ago! Since then, I’ve opened the Business version of this card, as well as the new Chase United Mileageplus Quest which is United’s mid level card that came with a whopping 90,000 miles sign on bonus two years ago.

I am not a big fan of Airline miles because they become less and less useful in recent years with constant devaluation. Nevertheless, I’ve found that I still find decent redemptions on United for international flights and flights within Europe or Asia. For example, my flight from Frankfurt to Kyiv, Ukraine was only 8k miles a few years back.

70k miles without paying any annual fee is a no brainer in my opinion and is one of the easiest bonuses to acquire right now.

Capital One Venture Rewards

Annual Fee: $95, Not waived for first year

Card Details: 75,000 Venture Miles sign on bonus, 2x on any purchase (unlimited)

I’ve been eyeing the Capital One Venture Rewards card for some time. Capital One was one of the first credit cards I ever opened back in my college days and I’ve really opened nothing since. Capital One has always been a B Tier credit card bank without much of anything worth churning.

In recent years, Capital One has entered the credit cards space with the big boys and has really beefed up their credit card portfolio. Capital One calls their rewards system “miles” but it’s not to be confused with airline miles.

However, nowadays, Capital One rewards miles can transfer directly to airlines and hotels like that of Chase, AMEX, and Citi. The have a comprehensive rewards partner list which makes the big 75,000 sign on bonus worth obtaining.

It’s not as lucrative as the Chase Ink cards by any means but it’s an easy card to churn. Capital One has been known to be difficult to get approved for credit so I plan to open a few new bank accounts with them to hopefully make things easier.

Citi Premier

Annual Fee: $95, waived for first year

Card Details: 80,000 Citi ThankYou points after spending $4000 in 3 months, 3x on travel 2x on dining

The Citi Premier card is something I’ve wanted for a long time. In fact, I had this card on my list for many years and I’ve actually tried to apply for it on numerous occasions but was always turned down.

The sign on bonus is a monstrous 80k Citi Thankyou points which at this point are not as valuable as Chase points in my opinion but still a monster sign on bonus nonetheless. In previous attempts, I was always turned down for having applied for too many cards but I hope some time away from applying for personal credit cards (not business cards) will be the magic I need.