2017 has come and passed and 2018 is almost half way done. It’s been quite the year for me in terms of credit card rewards. I like to take inventory of all the cards I have and use. I also have to monitor cards that have upcoming annual fees and decide whether those cards are ultimately worth keeping. There’s been a lot of action in the last year in credit cards. Largely, the big sign on bonuses are still available, but less from Chase and more from American Express.

I still like Chase credit cards the best and think the Ultimate Rewards points system reigns supreme. Overall, I applied for five new cards in the first half of the year. Once I spent enough to collect the sign on bonus, I always went back to my Chase trifecta combo, alternating between the Chase Sapphire Reserve, Freedom Unlimited, and Freedom.

I’ve had to book numerous flights in the past year including another trip to Egypt, New Years in Guatemala, and dive trips to Turks and Caicos and Belize. For the rest of 2018, I’ve booked travel to Europe (because who needs a reason to go to Europe?), a kitesurf trip to the Western Sahara in Morocco, and a big trip to the Maldives. For the Maldives, I will either be redeeming either my Hyatt card’s free nights sign on bonuses for the ultra lux Park Hyatt, or a large chunk of points on the even more luxurious St Regis Maldives. This will be followed by a week long liveaboard dive trip of course.

Summary of the past year’s credit card activity

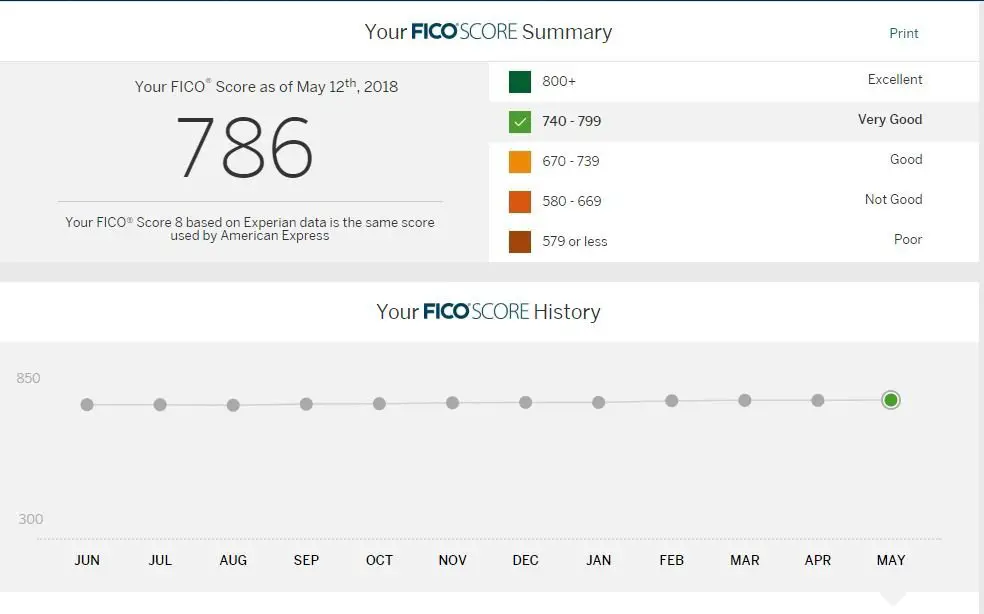

All in all, as of the end of June, I have 19 active credit cards. I applied for 6 new credit cards cards in 2017, and have canceled 5. Those not familiar with credit cards might ask, how is your credit score not a pile of ashes at this point? Read this post for more information, and my credit score is still in the 800 range as evidenced by the below graph! I also use a spreadsheet to track all of my credit cards which has really simplified my life.

I will go into detail on the cards I’ve opened, whether I will keep it long term, and what cards I hope to get in the upcoming months.

Current Inventory

Card Name |

Annual Fee |

Issuer |

Keep/Cancel |

| Cash Rewards | $0 | USBank | Keep |

| Altitude | $450 | USBank | Cancel |

| Quicksilver | $0 | Capital One | Keep |

| Spark Cash | $0 | Capital One | Keep |

| Blue Sky | $0 | American Express | Keep |

| Gold Delta Business | $95 | American Express | Cancel |

| Platinum | $550 | American Express | Keep |

| SPG Personal | $95 | American Express | Keep |

| SPG Business | $95 | American Express | Keep |

| Blue Business Plus | $0 | American Express | Keep |

| Merrill+ Visa Signature | $0 | Bank of America | Keep |

| BankAmericard Cash | $0 | Bank of America | Keep |

| Freedom | $0 | Chase | Keep |

| Freedom Unlimited | $0 | Chase | Keep |

| Hyatt | $95 | Chase | Keep |

| Sapphire Reserve | $450 | Chase | Keep |

| Hyatt Card | $75 | Chase | Keep |

| AAviator Red | $99 | Barclaycard | Cancel |

| Uber Visa | $0 | Barclaycard | Keep |

I track all my credit cards, active and the ones I’ve canceled using my comprehensive spreadsheet. This Google Sheets is managed in real time and is made public for everyone to see.

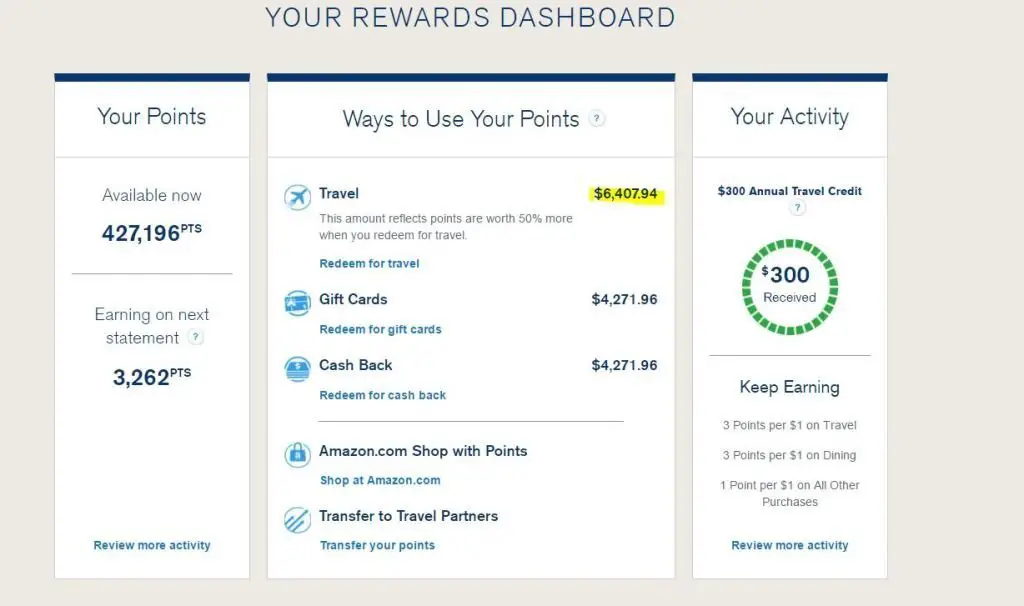

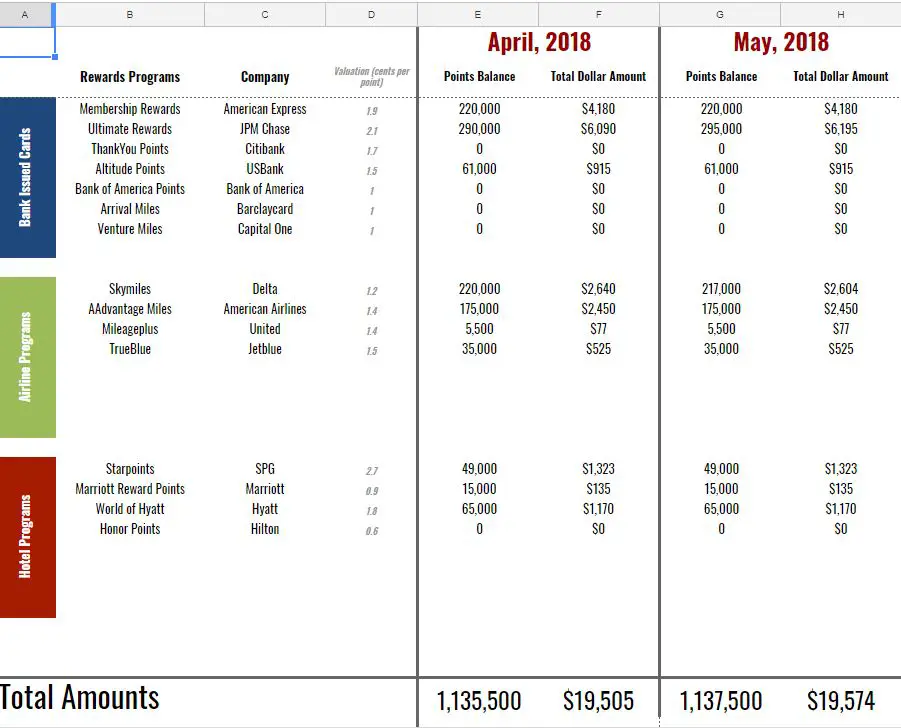

Current Rewards Balances

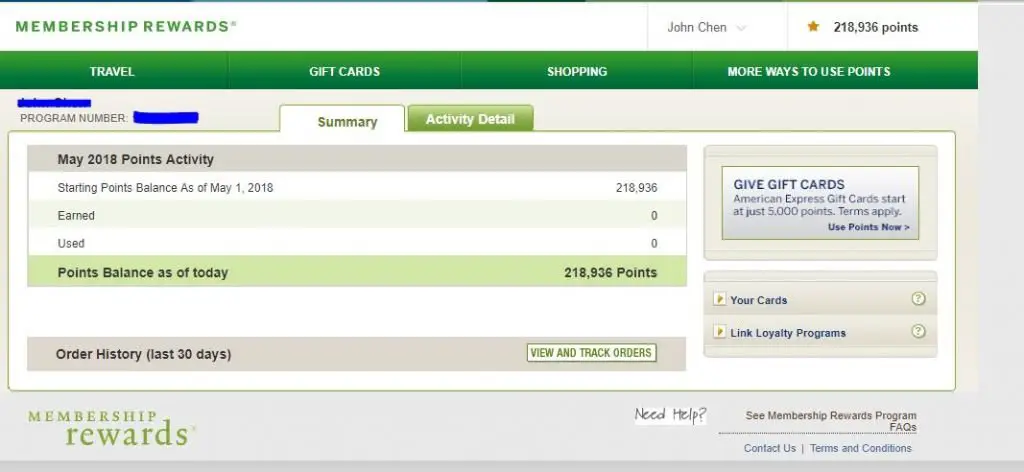

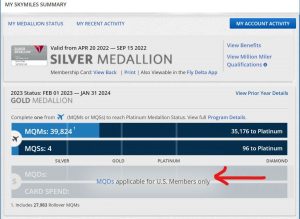

I applied for two new AMEX cards in 2017 which in bonuses alone yielded 150,000 AMEX Membership Reward points. In addition, I continue to add on to my Chase UR points balance as I find those to be the most valuable. Using the valuations system at The Points Guy, I came up with my “estimated” dollar value. Personally, I think his valuations are too high for my purposes. However, if I decided I only ever want to fly Business and First class, his points valuation would be more accurate.

- Chase Ultimate Rewards – 300,000 points (~$6,200)

- AMEX points – 220,000 (~$4,200)

- United Mileageplus- 10,000 (~$140)

- American Aadvantage Miles- 185,000 (~$2,500)

- Delta Skymiles- 220,000 (~$2,600)

- Jetblue Trueplus Points – 35,000 (~$450)

- Starwood/Marriott Points – 280,000 (~2,500)

- Hyatt Points – 80,000 ($1,300)

- USBank Altitude Points – 65,000 ($1,000)

- Total dollar value of my credit cards ~$20,000

Planning my trip to the Maldives

It’s finally getting to that point where I will be visiting the Maldives! It’s been high on my list for awhile and it was just a matter of finding the time. Gearing up for this big trip, I’ve invested a lot of my spend in accumulating SPG and Marriott points to redeem at the super high end hotels there.

Normally, I’m not big into collecting points from the big hotel networks. The type of travel I do takes me to places without chain hotels like Belize, Lake Atitlan, Komodo, Dahab, etc. The times I do find myself in a place with these big chain hotel options, I am usually in a big city where I’m spending most of my time out and about taking in the sights, food, and culture. Wherever I stay is just a place to crash anyway and I could get a bigger space in a better location (as many of the big chain hotels are outside of the central areas) for a cheaper price using Airbnb or booking a boutique hotel.

Chain hotels are good for one night Airport stays, work travel, and experiences like the Maldives. Staying on a private island in an overwater bungalow is incredibly unique and relaxing. Plus in places like these, you are spending the majority of your time enjoying the accommodation you’ve paid for. This is something I would pay for (with points of course).

Park Hyatt Hadahaa vs St Regis Vommuli

For me, it’s a matter of choosing between the Park Hyatt Hadahaa and the St Regis Vommuli. Both hotels are out of this world stunning and both are exorbitantly expensive. That’s why I have been planning this trip for some time and have accumulated a large amount of SPG/Marriott points.

The rooms at these two hotels regularly go for over $1,000 a night with the St Regis regularly going for $2,000+ a night. With all the SPG and Marriott points I’ve acquired, I have close to a half million Marriott points. I could use those points and stay at a regular hotel like the Courtyard Marriott in Bali for two months, or blow it all on an amazing place like the St Regis in the Maldives.

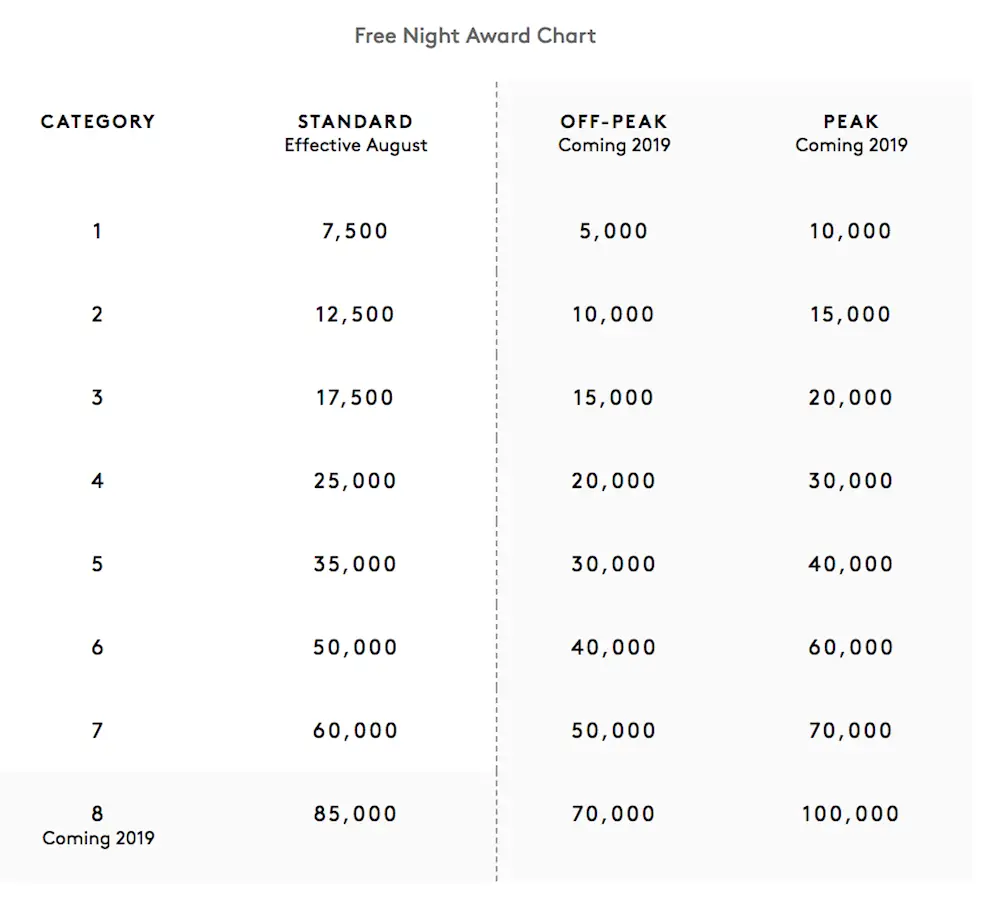

In the past few months, SPG and Marriott finally announced the full details of their merger and what it means for their loyalty programs. Most of the changes are positive, and the thing that sticks out the most is that for just 2018, their highest bracket is category 7 which is only 60,000 points a night. This will change in 2019 as the highest will be category 8 at 85,000 points a night.

This means that the rate at the St Regis Vommuli is a measly 60,000 Marriott points per night. SPG/Marriott also offers the 5th night free when booking reward stays of 4 nights. Therefore, a 5 night stay would cost me 60,000 x 4 = 240,000 points. For 5 nights, that could save me up to $10,000!

In addition, I want to fly first class on Emirates or Etihad with all my American Express MR points but it is becoming more and more difficult to redeem first class flights these days. I will just settle for Business class.

New Credit Cards in 2018

These are all the new cards I’ve applied for since my last post in June 2017. I’ve picked up a bunch of new Business cards as these are easier to get approved for and don’t count as a credit card in the traditional sense since it does not appear on your credit report. I am trying to get below 5/24 (5 cards within past 24 months) so I can apply for Chase cards again, but that seems to be impossible with how much churning I do.

If you’re wondering if you need a business to open a business credit card, read this.

SPG Business and Personal Card

Annual fee: $95 for each, first year waived

Rewards: 35,000 SPG points for the business card after $7,500 spend; 30,000 SPG points for personal card after $3,000 spend

Why I Applied: Starwood points are the most valuable point currency in the world of credit cards. They transfer to many different airlines, and their redemption rate at Starwood hotels is fantastic. Since SPG and Marriott already announced their plans for merging, there’s a chance changes would be made to these cards as well. They have already happened. The bonuses I was able to get for these cards are no longer available.

Keep? Likely will keep both cards as they both offer an annual free night at a Marriott/SPG property that will more than outweigh the $95/night cost.

AAdvantage Platinum Business Card

Annual fee: $95 waived for the first year

Rewards: 60,000 AAdvantage Miles

Why I Applied: I find AA miles to be the most useless among the big 3 US Airlines. However, 60k free points is still a good deal especially with no fee. They have great deals for New Zealand and Australia, two countries I haven’t been to yet, for 80k points round trip. WIth my nearly 200k miles, I can take trips to both countries on separate trips and still have miles left over.

Keep? Cancel before the year is up.

American Express Blue Business Plus

Annual fee: $0

Rewards: 20,000 Membership Reward point sign on bonus

Why I Applied: This card is the biggest no-brainer card available on the market. It is no fee and offers a flat 2x membership reward points per $1 spent on everything. AMEX membership rewards system is the best out there, being even better than Chase’s Ultimate Rewards system. The problem is Chase Sapphire Reserve makes it much easier to earn these valuable points with their 3x on dining/travel than AMEX where the Platinum card only earns 1x points on all purchases except booking flights. This card bridges the gap with 2x on everything. These points will add up nicely for a business or first class flight on Emirates for me.

Keep? It’s a no fee card, so always keep these.

American Express Gold Delta Business

Annual fee: $95, first year waived

Rewards: 60,000 delta miles, 2x delta miles on delta purchases, companion pass after the first year

Why I Applied: I’ve applied for the personal Gold Delta AMEX two years back, collected that bonus, so it’s time to do the same for the business card. In addition, there is no fee for the first year and 60,000 Delta miles is just great to have. Also, AMEX offers 10,000 miles per referral so I have referred 6 people already for an additional 60,000 miles.

Keep? The AMEX Delta card is mostly useless because only earns 2x miles on Delta purchases, and 1x on everything else. Because I have the AMEX Blue Business Plus card that earns 2x Membership rewards points on everything (and these points transfer 1:1 to Delta), this card is totally useless for me. The 1 free checked bag and zone 1 boarding is nice but I never check a bag. I will probably cancel this card, and apply for the AMEX Platinum Delta Business card afterwards to maintain those benefits.

USBank Altitude Card

Annual fee: $400, not waived

Rewards: 50,000 sign on worth $750, 3x on travel and mobile purchases, $325 travel credit

Why I Applied: I only applied for this card because of the sign on bonus. The annual fee of $400 is mitigated because of the $325 travel credit which makes the annual fee $75. The sign on bonus is worth $750 so net net, the card is worth about $700 to me.

Keep? No. This card is just not as good as the Chase Sapphire Reserve so it makes no sense to keep a large fee card.

Canceled Credit Cards in 2017

AMEX Gold Delta

Annual fee: $95, waived for the first year

Rewards: 60,000 sign on miles, 2x miles on delta

These Delta AMEX cards are mostly useless for me. They offer very generous sign on bonuses but after I complete the minimum spend, it’s time to toss out. The earn rate of this card is just not great, and made even more useless with the addition of the AMEX Blue Business Plus card I applied for (see above).

AMEX Platinum Delta

Annual fee: $195, not waived for the first year

Rewards: 70,000 delta miles, 2x delta miles on delta purchases, companion pass after the first year

Why I canceled: Same reason as above

Chase Ink Plus

Annual fee: $95, waived for the first year

Rewards: 70,000 Chase Ultimate Rewards Points

Why I canceled: I got the Ink Plus for the 70,000 point sign on bonus a few years back. It earns 3x on business categories like office stores, internet and phone bills, and other misc business expenses. I just don’t have enough of those expenses to justify the $95 annual fee.

AMEX Business Gold

Annual fee: $175, waived for the first year

Rewards: 75,000 sign on points, 3x points on a category of your choice

Why I canceled: Same as above. This card came with a nice 75,000 MR sign-on bonus but afterwards, it was hard to justify the $175 annual fee as I don’t incur enough business expenses to make it worthwhile.

Barclaycard Jetblue Plus Card

Annual fee: $95, waived for the first year

Rewards: 30,000 sign on points, 3x points on a category of your choice

Why I canceled: I don’t fly Jetblue much but this card is actually quite good for those that fly Jetblue even remotely. I applied to get the 30,000 point sign on bonus which I regret as they offered 50,000 a few months later. Nevertheless, I will likely apply for the Jetblue Business card at some point in the future as it offers another 30,000 point bonus with only $2,000 spend requirement.

Potential future credit cards in 2018 and 2019

- Chase Marriott Business – This card is not subejct to the Chase 5/24 rule which is the bane of my existence. It offers 75,000 Marriott points sign on bonus and with my current inventory of SPG points that will transfer 3:1 to Marriott points later in the year, I’ll have something in the neighborhood of a half million marriott points after this card

- AMEX Delta Platinum Business Card – AMEX offers 4 Delta cards: Personal Gold, Personal Platinum, Business Gold, and Business Platinum. I’ve already had the first three and the sign on bonuses that ranged from 60-70k delta miles. I will get the Business Platinum at some point later in the year for a 70,000 sign on bonus

- Wells Fargo Business Platinum Card – $500 sign on bonus. Nothing fancy but easy money to acquire.

- Barclays Aviator Business card: I already have the AAvaitor red personal card. I got 50k miles that card and the business version is offering another 50k. Barclays and Citi are just throwing miles in my direction.

- Barclays Jetblue Plus Business card: Jetblue is great for flying to the Caribbean and a 30,000 sign on bonus is a no brainer.

Hi! What about AMEX’s once per lifetime rule? After you go through the rest of the AMEX cards, I’m guessing those are out for good?

Hi Monica, yes most of those are out for good but not always. AMEX somewhat regularly releases cards that are not subject to the lifetime rule language. You just hav eto know when and where to look! Regardless, your credit resets every 7 years so i guess it’s not a lifetime rule but rather a once in 7 years rule.

Hey Johnny! Have you ever been approved for a card but denied the sign-on bonus because you’d previously had the card, received the bonus, and then canceled it? I was about to apply for Chase Sapphire card that I had a couple of years ago, but I noticed in the fine print that you had to be 48 months out before you could receive the bonus again. I’d hate to get approved for the card, put several thousand on it, and then miss the bonus due to previous use. Hopefully that makes sense. Just curious as to whether you’ve ever been denied the big initial bonus of miles / cash back / etc. due to having a previous account.

Hi Scott, chase recently changed their rules to 48 months which is unfortunate but they are trying to curb churning. I’ve never been denied the bonus before as I make sure to verify whether I am eligible or not!