Delta introduced the concept of MQDs (Mileage Qualifying Dollars) back in 2016 which shocked the entire world of frequent flyers and travel aficionados. This added a second layer of complexity to obtain frequent flyer status by forcing you spend a certain amount of dollars in addition to flying a certain amount of miles. Gone were the days where one could find the cheapest flights and fly on them purely to earn miles to obtain status!

MQDs are very hard for the average person to meet thereby making earning status much more difficult to obtain. However, there is a way around the MQD requirement; a waiver of sorts, which if used successfully means you will once again only need to worry about distance flown.

Update 2023-2024: Delta recently changed its Elite qualifying criteria by increasing the amount MQDs required. Credit card spending also factors in more significantly to status qualification. Therefore, this method will most likely not work going forward as Delta’s entire Elite qualifying ethos will center around Dollars spent.

What are Delta MQDs?

Prior to this change, Delta along with all the other major airlines in the US (United and American) only had a distance based mileage requirement which made it very easy to obtain status.

Since 2014/2015, Delta introduced the concept of MQDs which means you also must spend a certain amount of money to obtain status. Prior to this, frequent flyer forums were awash with “mileage run” specials where people searched for the cheapest flights possible that covered the most distance in order to obtain status.

I remember seeing crazy routes where people would fly from San Francisco to Boston to Minneapolis to Florida to St Louis, and back to San Francisco for $200 and subsequently obtain elite status because of it. I guess the Airlines took note of this and didn’t want people to abuse the system anymore.

MQDs favor business travelers heavily

In the end, it’s all about the money. Airlines are publicly traded companies and need to make money. Therefore, the introduction of MQDs meant that only people that could spend serious money on flights with Delta could obtain elite status.

For the average person, spending $5k-$10k with one airline in a year is very unlikely. For business travelers, this is much easier. If you’re constantly flying for work, you don’t care about the price of the ticket since the company is paying. In addition, for business travelers that would fly short distances, the concept of MQMs didn’t make sense since you could spend a lot of money but only obtain a few miles since the distances were so short. MQDs solves this problem.

What are the Delta Status Levels and Requirements?

Delta status tiers are the following:

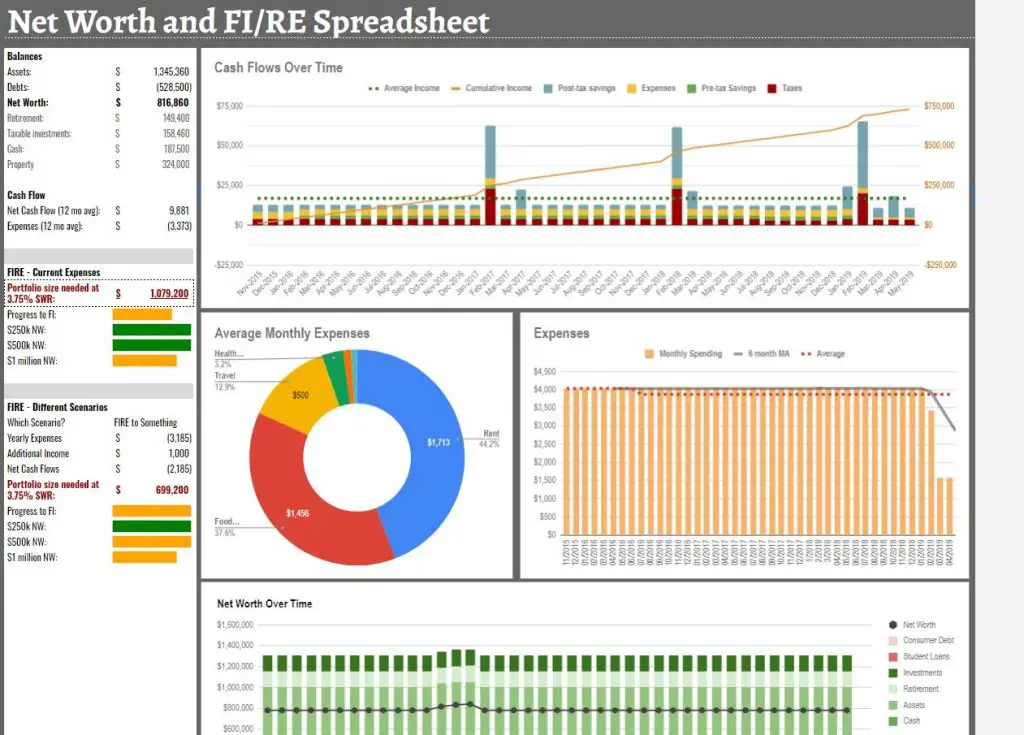

Delta has four status tiers from Silver all the way to Diamond. Silver will require you to spend $3,000 USD with Delta and partner airlines while Diamond will require a whopping $15,000.

I don’t know about you, but spending this much money with one airline is a tall feat if you’re trying to find cheap flights. Silver is doable for the average person but anything Gold and above is pretty ridiculous. This is why the new status system from the airlines heavily favors business travelers.

If you’re company is paying for you to travel, you’re not worried about taking the cheapest flights. If you’re company will pay for you to fly business class, you’ll hit these thresholds in just a handful of flights.

Waive MQDs by using Delta credit cards

The main method to waive MQD requirements is to use the Delta branded credit cards. There are six such credit cards available to travelers from American Express:

- AMEX Delta Skymiles Gold

- AMEX Delta Skymiles Gold Business

- AMEX Delta Skymiles Platinum

- AMEX Delta Skymiles Platinum Business

- AMEX Delta Skymiles Reserve

- AMEX Delta Skymiles Reserve Business

These credit cards always come with large sign on bonuses that fluctuate and are generally pretty useless cards for spending. As part of my travel hacking, I’ve opened these credit cards on numerous occasions just to pocket the sign on bonuses. I won’t go into the churning of these credit cards however but mainly to focus on the MQD waiver.

MQD Waiver on AMEX Delta credit cards

The MQDs requirement can be waived by achieving the MQD Waiver.

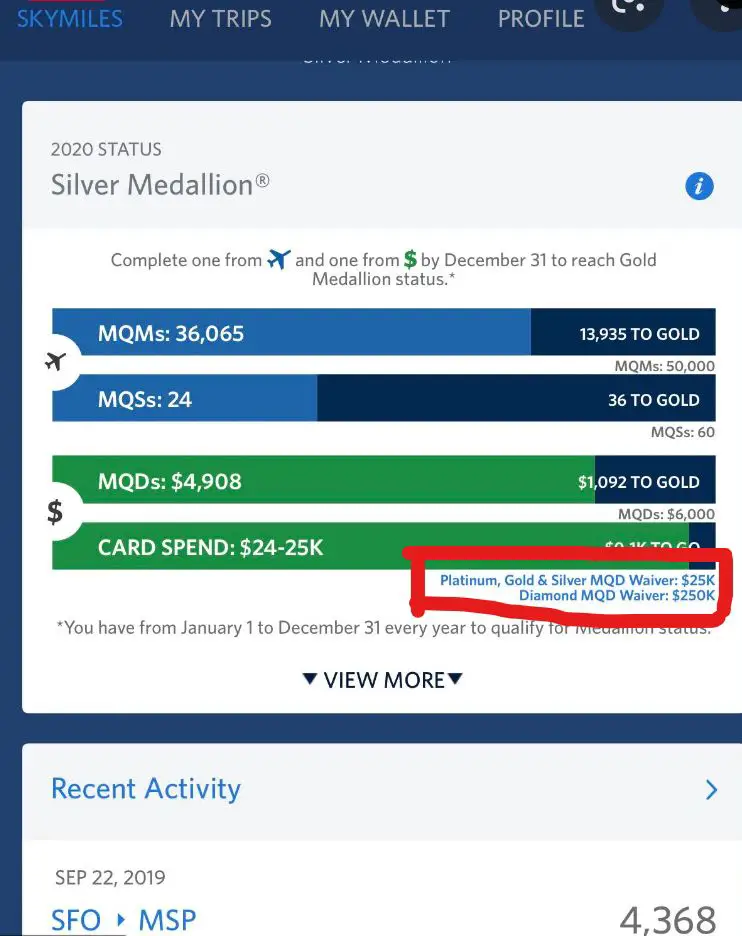

To reach Platinum, Gold or Silver Medallion Status, the MQD Waiver can be achieved by making $25,000 or more in Eligible Purchases during the calendar year with eligible Delta SkyMiles Credit Cards from American Express.

To reach Diamond Medallion Status, the MQD Waiver can be achieved by making $250,000 or more in Eligible Purchases during the calendar year with eligible Delta SkyMiles Credit Cards

Spending $25,000 a year is not super difficult for most people that are trying to obtain status. That’s $2,000 a month which is doable. The MQD waiver for Diamond status used to be $25,000 but they’ve since changed it to $250k because it was making diamond status too easy. With a $250k spend, this weeds out 99% of people trying to use MQD waivers to get Delta’s highest status.

I find the MQD waiver to be useful if you have the spend capability and really want Delta status. However, spending $25k on a Delta credit card means giving up points with other programs. $25k of spend is worth much more if you are spending it on an AMEX (non branded) credit card or a Chase credit card.

25k of Delta miles is worth much less than say 25k Chase Ultimate Rewards points. If you have cards like the Sapphire Reserve, you’re likely to be spending a lot of that money on travel and dining related expenses which earns points at 3 points to $1, which means you’re more likely to end up with something closer to 50-75k Chase UR points.

I find Delta miles to be particularly useless when traveling abroad. Delta eliminated award charts many years ago so you never know how much a ticket is going to cost in terms of miles. Therefore, the MQD waiver only makes sense if you really value Delta status and can’t satisfy the MQD requirement on your own, or have so much spend per year that $25k is not a big deal.

Waive MQDs by living abroad

Finally, we get to the meat of the post. In addition to the credit card waiver system in the above section, there is one much much simpler method to waive the MQDs.

Simply, if you have an international address and can prove you live there, Delta will allow you to waive the MQD requirement no questions asked. Yes, if you live and/or work in another country, you no longer need to worry about MQDs.

This is a typical SkyMiles status window for someone who needs to satisfy MQD and MQMs.

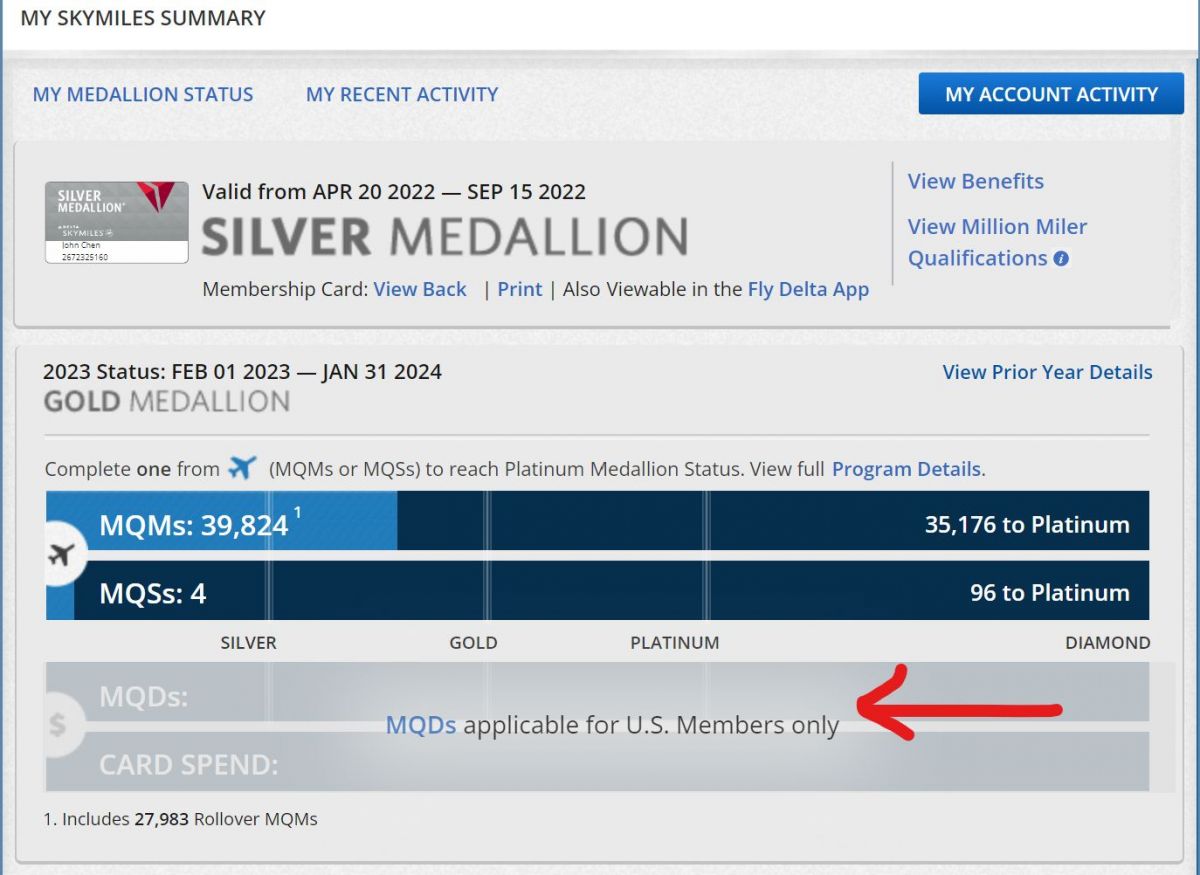

After you perform this trick to waive the MQDs, your status will look something like this.

As you can see, Delta recognizes my account as not being a US member and therefore MQDs are not required.

Why is this you ask?

I don’t have a concrete answer for this. If I had to speculate, I think this is to make it easier for foreigners to earn status where they would probably go to a different frequent flyer program from their home countries. For example, someone in France would almost surely go with Air France as part of SkyTeam and not Delta but perhaps making it easier to get Delta status might convince a tiny percentage of people to switch. Many of the frequent flyer programs out there still don’t have any dollar (or any other currency) spend requirements to achieve status.

At the end of the day, the amount of foreigners looking to obtain Delta status or the amount of Americans living abroad is such a low number that it doesn’t move the needle.

What documents are required?

You will need to show proof of your foreign residence which you can do through the following methods:

- Passport

- ID Card

- Phone Bill

- Utility Bill

- Bank Statements

- Mortgage statement

- Residence Permit/Visa

- The list goes on

Personally, I sent them a bank statement and my EU Blue card which is a residence permit to live and work in Europe. I’m not sure if they actually needed my residence permit but I attached it just in case. Delta is just trying to ascertain that you live outside of the USA.

Step by Step Process

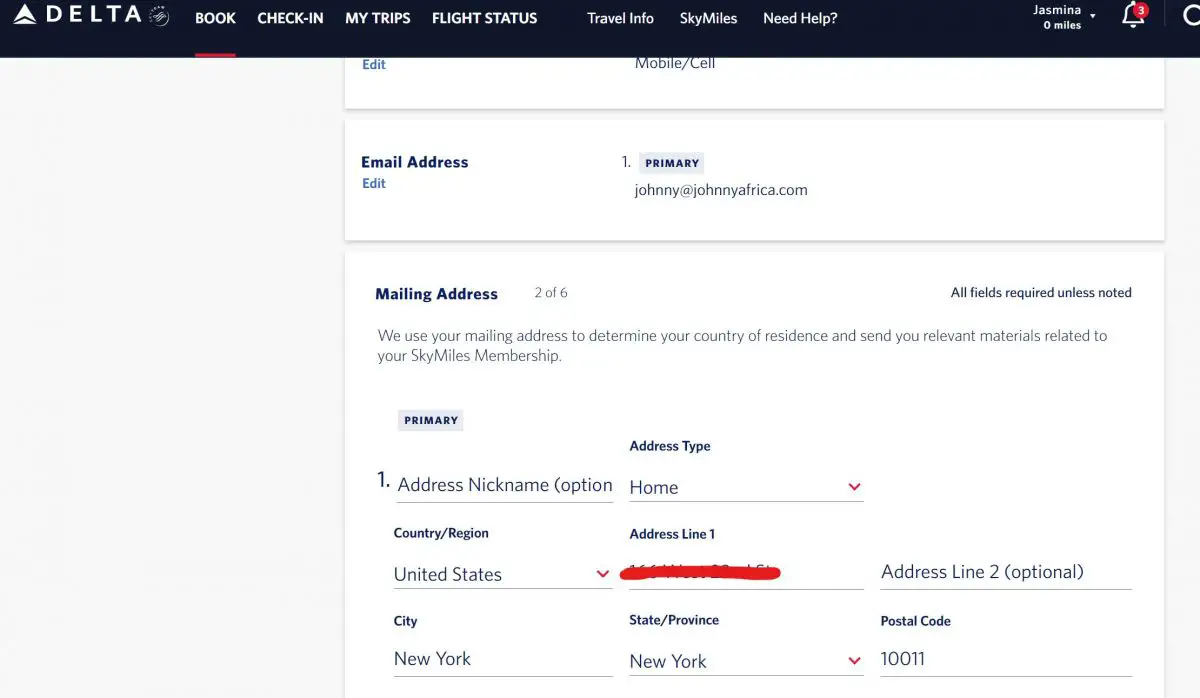

To initiate the change of address process, go to your profile page and edit the mailing address:

You can add a second address so you don’t need to remove your US address. Make sure you select the country outside of the United States.

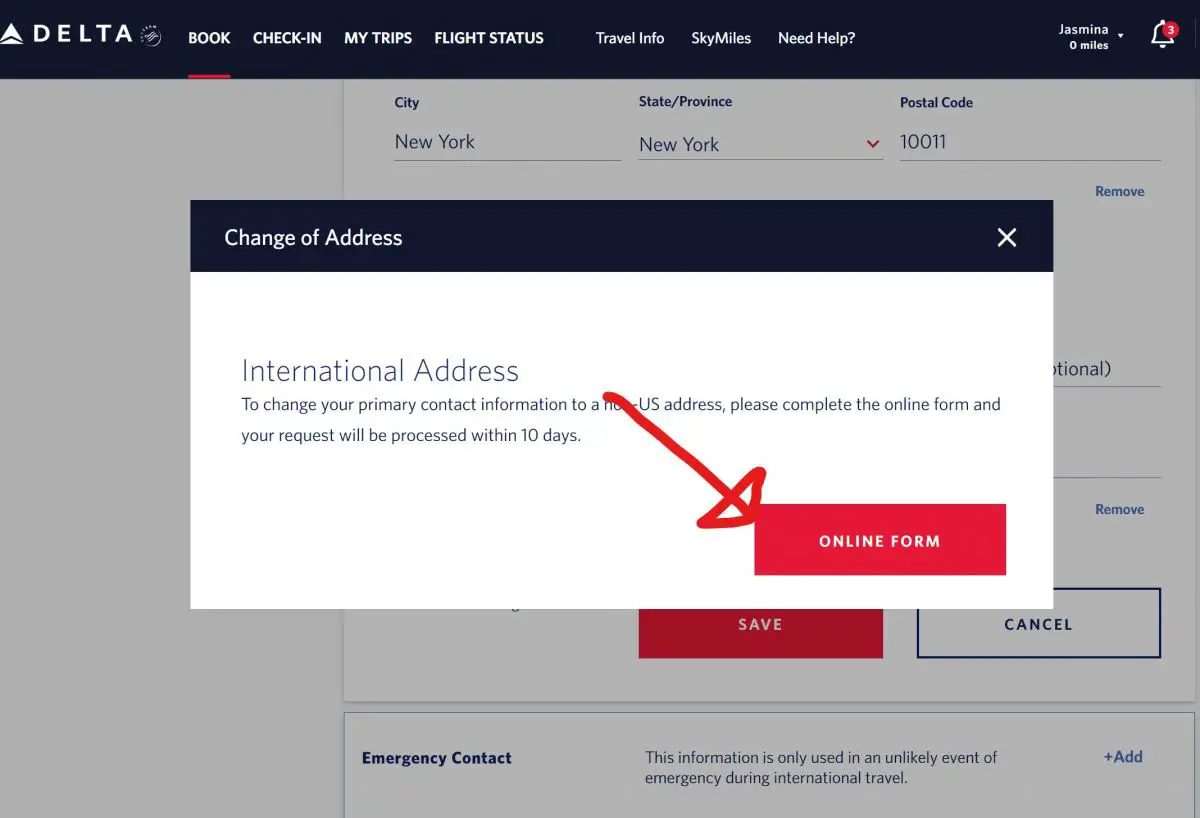

Once you click “Set as Primary”, you will see a window pop up as below:

This is telling you that you will now change your address to an international address on Delta. You will then need to click the online form button.

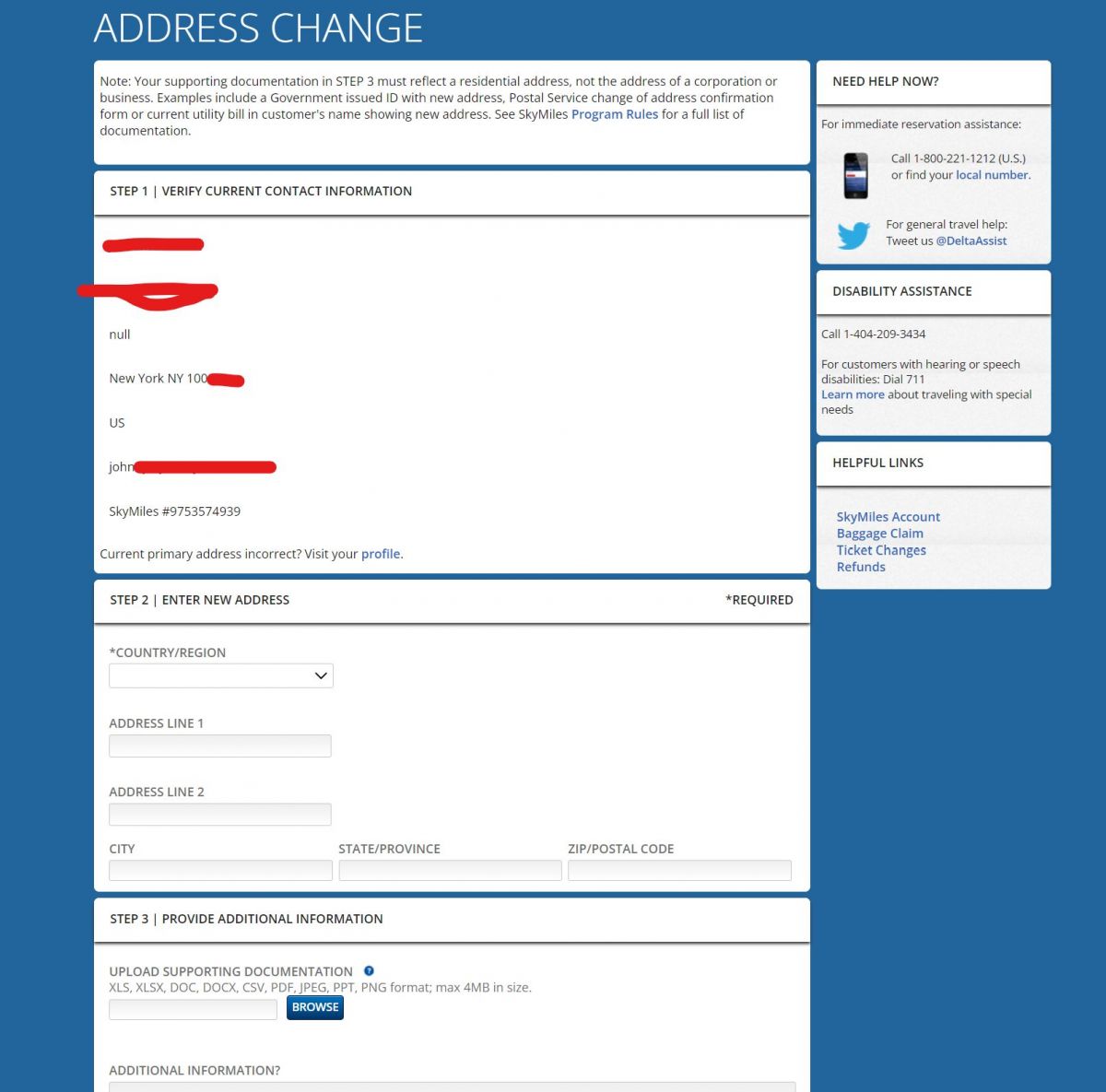

Fill out the online form which is pretty much just inputting your address again like the previous step. You’ll have one area to upload your documentation. You can select only one file so I actually just combined my residence permit and a bank statement into one PDF. I’m not sure what Delta requires exactly but this did the trick!

How long does Delta take to change your address?

Delta claims it takes only 10 days to action the change but it was anything but that. It took my many months to get this changed. I even had to send Delta multiple emails to ask what was going on.

In total, it took me 6 months to get this changed! This could have been because of the post COVID resurgence of travel and Delta being short staffed. Nevertheless, don’t be surprised to wait a long time!

Does Delta track or verify your international address?

Delta will not send any mail to your international address to verify or anything like that. From what I’ve read, they might monitor your account in case you are not truthful of actually living abroad.

The easiest way for them to do this is to look at your flight schedules. If your flights are consistently originating in the US, it would be a red flag to say that you don’t actually live abroad (even if you can prove a foreign address).

Does this work with United or American Airlines?

Does this “hack” work with United Airlines and American airlines? From what I’ve read, United and American do not waive their dollar spend requirements if you are an international resident. Both programs have PQD and EQD waivers if you spend a certain amount of money on their co-branded credit cards but there’s no program like Delta from what I’ve gathered.

This could change in the future but I would be doubtful.