There is no question that Chase offers the most lucrative sign on bonuses and the best credit cards in the business. In reality, it really is down to between two companies in 2019-2020, American Express and Chase. My favorite card is still the Chase Sapphire Reserve which I use on a day to day basis.

However, the Business Chase Ink Preferred offers the most lucrative sign on bonus at 100,000 points after spending $15,000 in 3 months. You can combine that with the two other business credit cards in Chase’s Ink portfolio, the Ink Unlimited and Ink Cash which are both offering a whopping 75,000 points sign on bonus. These points are some of the most valuable reward points in the business and you can redeem them for amazing business class flights or an amazing stay at a Maldives overwater villa.

What most people do not know is that you can game the system and actually apply for multiple of the same credit card as one person. Yes, this means you can apply for not one, but two Chase Ink Preferred credit cards and get 160,000 Ultimate Rewards points. Only Chase allows you to do this (AMEX does not). This post will lay out exactly how to go about doing this and proof of me doing so! This is all part of my travel hacking and credit cards guide which is lays out everything involving credit cards.

- For a list of all my credit card and travel hack related posts, click here.

- Also, read my guide on how to get both the Chase Sapphire Reserve and the Chase Sapphire Preferred cards

- If you’re planning to get into the credit card game, make sure to use my detailed credit card spreadsheet to track all of your churning!

- Follow my journey through financial independence as I retired early at 34 to travel the world.

Update Oct 2022: Chase Ink Unlimited and Chase Ink Cash have new and highest ever bonuses! Current bonus is 90,000 points after $6,000 in spend over three months.

Update Mar 2023: The 90,000 point sign on bonus for the Chase Ink Unlimited and the Chase Ink Cash will expire on March 21, 2023.

Update July 2023: The Ink Preferred has now reduced its minimum spend requirement from $15,000 in 3 months to $8,000 over 3 months. This makes it much more attractive and much easier to obtain!

Update Sep 2023: The 90,000 point sign on bonus for the Chase Ink Unlimited and Chase Ink Cash has returned!

Update Jan 2024: The Ink Unlimited and Ink Cash sign on bonus will go back to the 75,000 point mark. Still an amazing bonus for a no annual fee card.

What to know about Business Credit Cards

There are a few noticeable differences between personal credit cards and business credit cards. The primary difference is that the business credit card does not go onto your personal credit report. The impact on your credit score will be very minimal even if you have 5 or 10 business cards. This is especially important when applying for Chase credit cards (both personal and business) because of the Chase 5/24 rule. To better understand this rule and why Chase cards are the best credit cards, read my Chase credit cards guide.

There are many other nuances that can span multiple posts, so luckily I’ve written such a post that goes into detail about business credit cards, do you actually need a business, how it affects your credit score and more. If you have not applied for a business credit card before, make sure to read that post before continuing otherwise this may be confusing.

After reading this post, you’ll be on your way to earning enough points for a once in a lifetime stay at the Ritz Carlton Maldives for free!

What are the Chase Ink Business Credit Cards

Okay so now you’re a pro or at least aware of how business credit cards works. For the purpose of this post, it is to maximize taking advantage of Chase business cards so I am only focusing on the following:

- Chase Ink Preferred

- Chase Ink Unlimited

- Chase Ink Cash

- Chase Ink Premier

I will not be talking about their personal cards with include

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Freedom

- Chase Freedom Unlimited

What do the Chase Ink cards offer? A LOT of free Ultimate Rewards points. If you’re not familiar with UR points, they are considered the most lucrative points in the game. You can use them to book travel at a discounted rated (1.5 cents per point if you hold the Chase Sapphire Reserve so 80,000 points equates to $1,200 in travel).

You can transfer them to airlines and book business class travel which is a great ROI. Alternatively, you can transfer them to hotel programs like Hyatt and stay at amazing places like the Park Hyatt Hadahaa in the Maldives.

Here are the details of Chase’s Ink portfolio and their respective sign on bonuses.

These bonuses and minimum spend requirements have changed in 2020. I’ve updated them in the below section but for the purpose of the rest of the post, ignore the points examples as they will be outdated. However, the ethos of applying for multiple Ink cards is still the same.

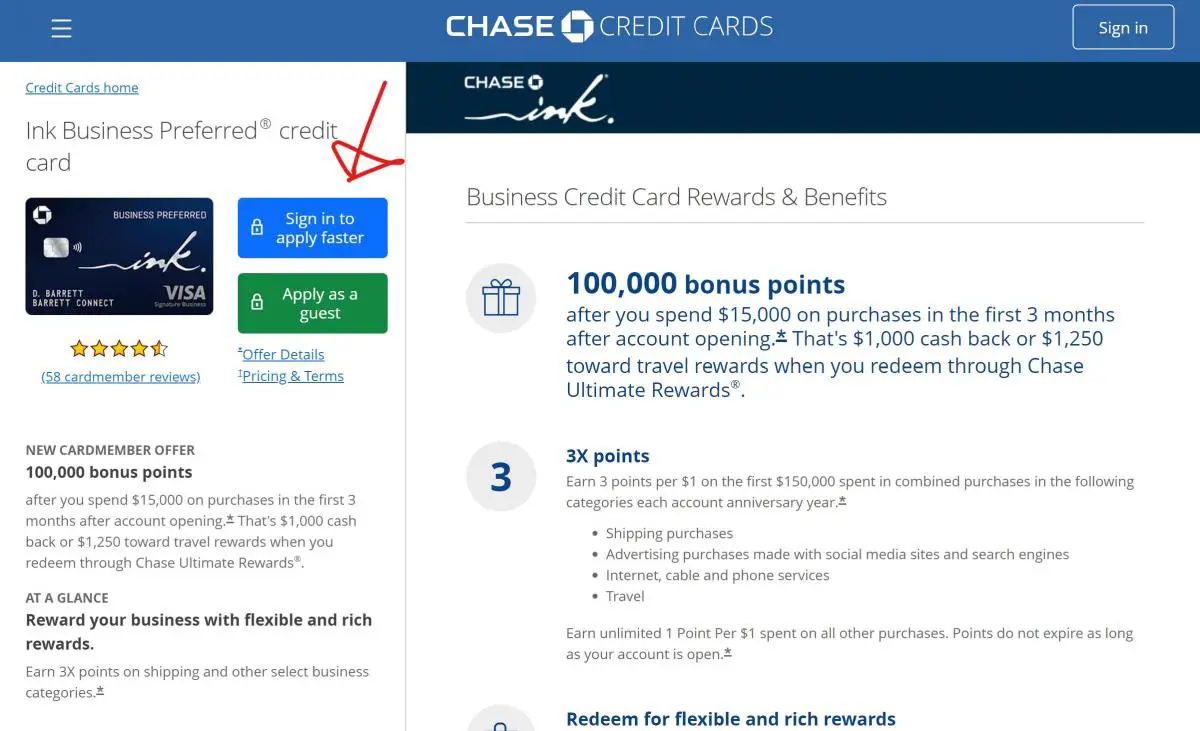

Chase Ink Preferred

Sign on bonus: 100,000 UR points after spending $8,000 in 3 months

Annual Fee: $95, not waived for the first year

Card Details: 3x per $1 spent on the following categories, 1x on everything else

- Travel

- Shipping purchases

- Internet, cable and phone services

- Advertising purchases made with social media sites and search engines

Chase ink Unlimited

Sign on bonus: 90,000 UR points after spending $6,000 in 3 months

Annual Fee: $0

Card Details: 1.5x per $1 spent on everything

Chase Ink Cash

Sign on bonus: 90,000 UR points after spending $6,000 in 3 months

Annual Fee: $0

Card Details: 5x back on office supply stores, and internet/cable/phone services, 2x back on gas stations and restaurants, 1x on everything else

Chase Ink Premier

Sign on bonus: $1,000 cash back after spending $10,000 in 3 months

Annual Fee: $195

Card Details: Unlimited 2% cash back on everything. 2.5% cash back on purchases over $5,000

My Analysis of the Chase Ink Cards

The Chase Ink cards have by far the best sign on bonuses in the industry. No other cards or bank provide the same type of value when it comes to the sign on bonus. We all know that the sign on bonus is the key component to the credit card hustling game.

The Chase Ink Preferred, Ink Unlimited, Ink Cash all give UR points which can be transferred to airlines and hotels. The value you can get here can be much higher than the cash value of the points when you book business class flights. For that reason, I almost always prefer to get UR earning cards. The Ink unlimited and Ink Cash are particularly fruitful with 75k or 90k points sign on bonus depending on the time without any annual fee.

Do not be scared of the annual fee on the Ink Preferred however. The additional UR points vs the Ink Unlimited and Ink Cash will more than make up for the $95 annual fee. For example, if the Ink Preferred is offering 100,000 sign on bonus vs the Ink Unlimited at 90,000, the additional 10,000 UR points is worth more than the $95 annual fee you pay. In addition, the Ink Preferred has no FX fees which might make it substantially easier for you to reach your minimum spend requirement.

The Chase Ink Premier is a newer card that only earns cash back and does not earn UR points. The Chase Ink Premier is good if you have a legitimate business and mostly just care about cash back. It’s especially fruitful if you consistently have large expenses since you get 2.5% cash back on purchases above $5k vs 2% cash back on everything else (which is still really good). However, the bonus and the annual fee make this card less appealing to me.

How to get two chase Ink Preferred business cards

This is where the meat of the post will be so pay attention to this! For the slightly above average Joe that is into credit card churning, it is simple to apply for all three cards in Chase’s business portfolio and get approved. This means you can have all three Ink credit cards (Ink Preferred, Ink Unlimited, Ink Cash) at the same time which means you’ll have garnered a combined 100,000 + 75,000 + 75,000 = 250,000 UR points! When the Ink Unlimited and Cash are at 90,000 points sign on bonus, your total will be 280,000 UR points!

This is a lot of points for anybody.

But what if you want more?

For the pros and the greedy, this is where it gets interesting. By applying for an EIN (Employee Identification number) which is what you’ll need to start a Sole Proprietorship or LLC, you can essentially apply for the same card a second time under a different business name. This means that if you have an EIN, you can apply for the same card again by using your EIN as your Business Tax ID instead of your social security number. Chase sees this as two separate applications, and therefore two credit cards with two sign on bonuses.

Essentially, this means you can apply for two Chase Ink Preferreds for 100,000 x 2 = 200,000 sign on points, or two Chase Ink Unlimited cards for 50,000 x 2 = 100,000 points.

Confused?

Yes it certainly can be and is why I always use a spreadsheet to track all my cards. Step by step it will look like this:

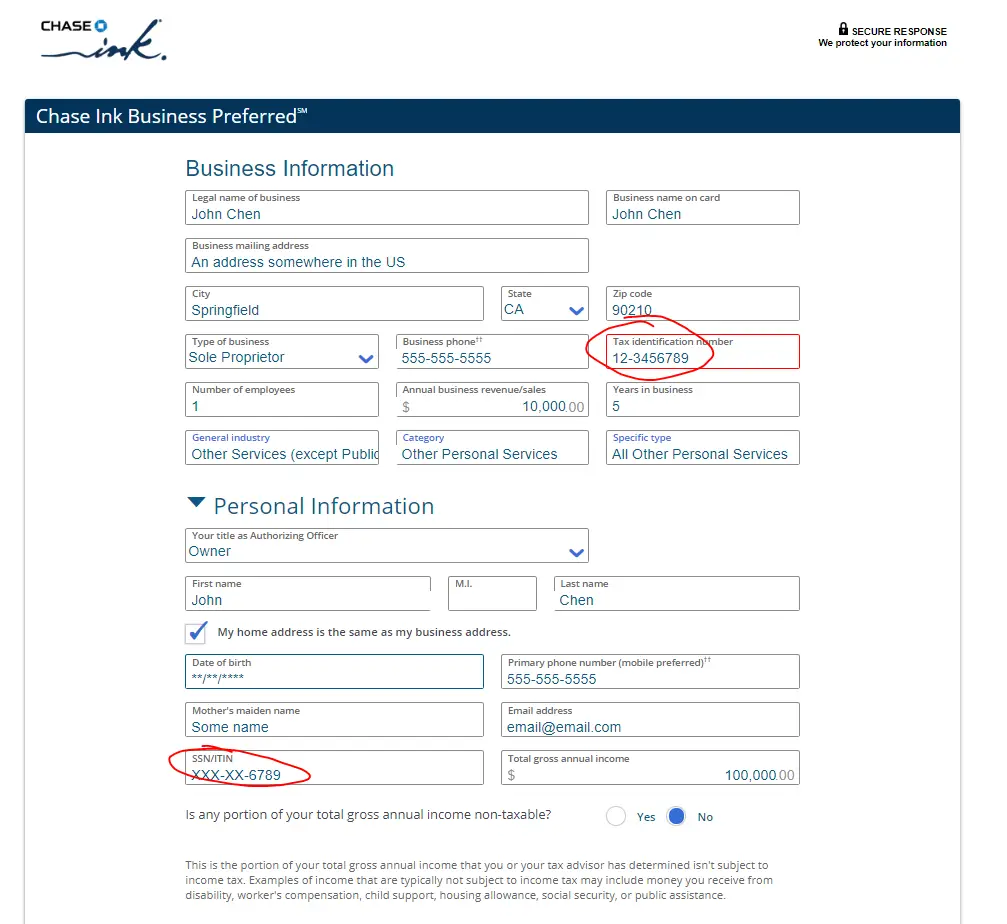

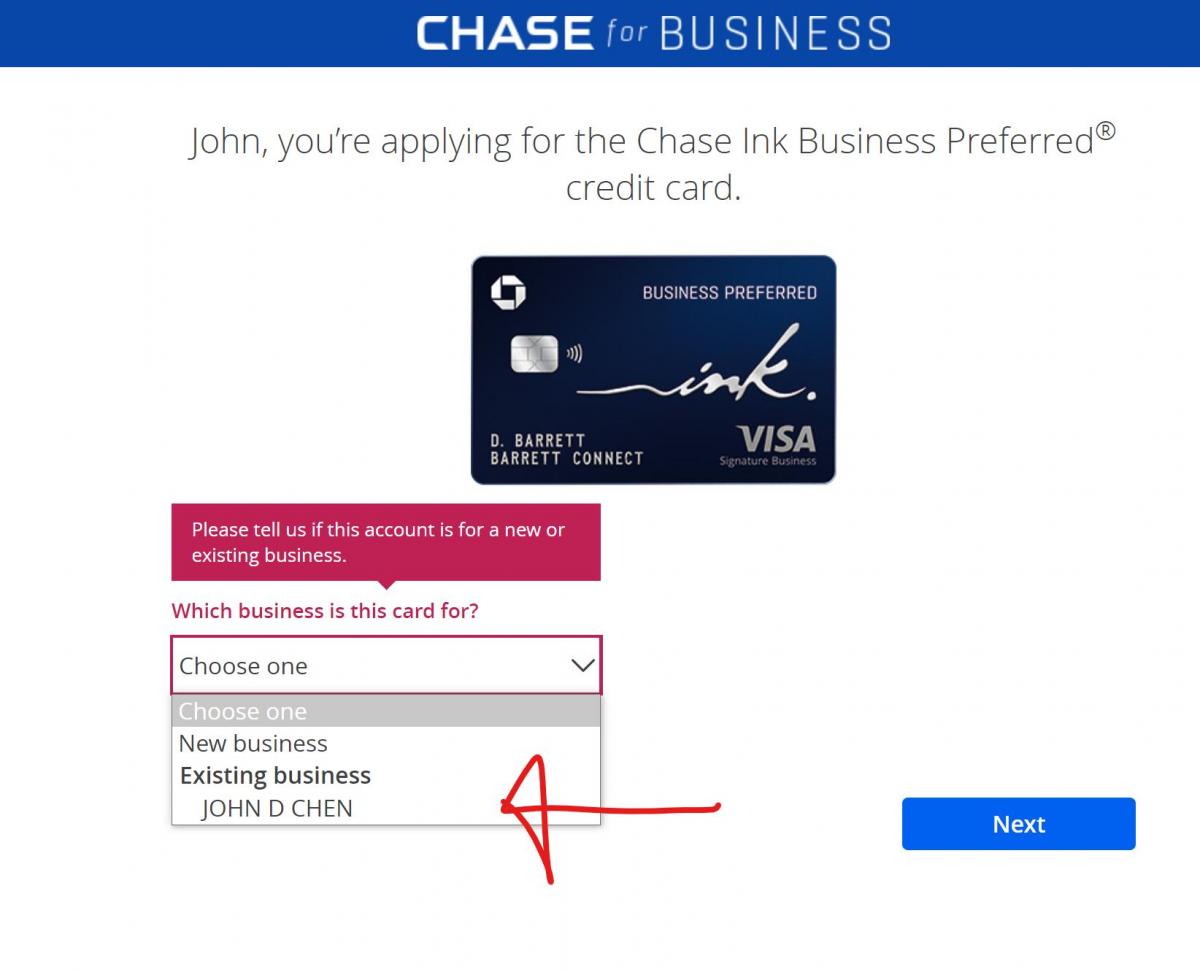

Apply for the first Ink Preferred using your SSN only

When filling out a business card application, Chase breaks the application down into two sections, one for your “business”, and the other for your personal details. On the business section, Chase will ask for your Tax ID number. The tax ID number is your EIN but you are not required to have one if you are a sole proprietorship, which is essentially doing business as yourself (think of doctors or dentists). You can use your SSN in place of your Tax ID instead. As such, for your business name, you can just put your personal name. For more details about how to fill out these applications, make sure to read my business credit card guide.

For your personal section, fill this out with your details and your SSN number as you would any other credit card application. Your business and personal sections will look quite similar in this case. This application is what we like to call the SSN application as you are only using your social security number.

I’ve filled out an application online as the following from Chase:

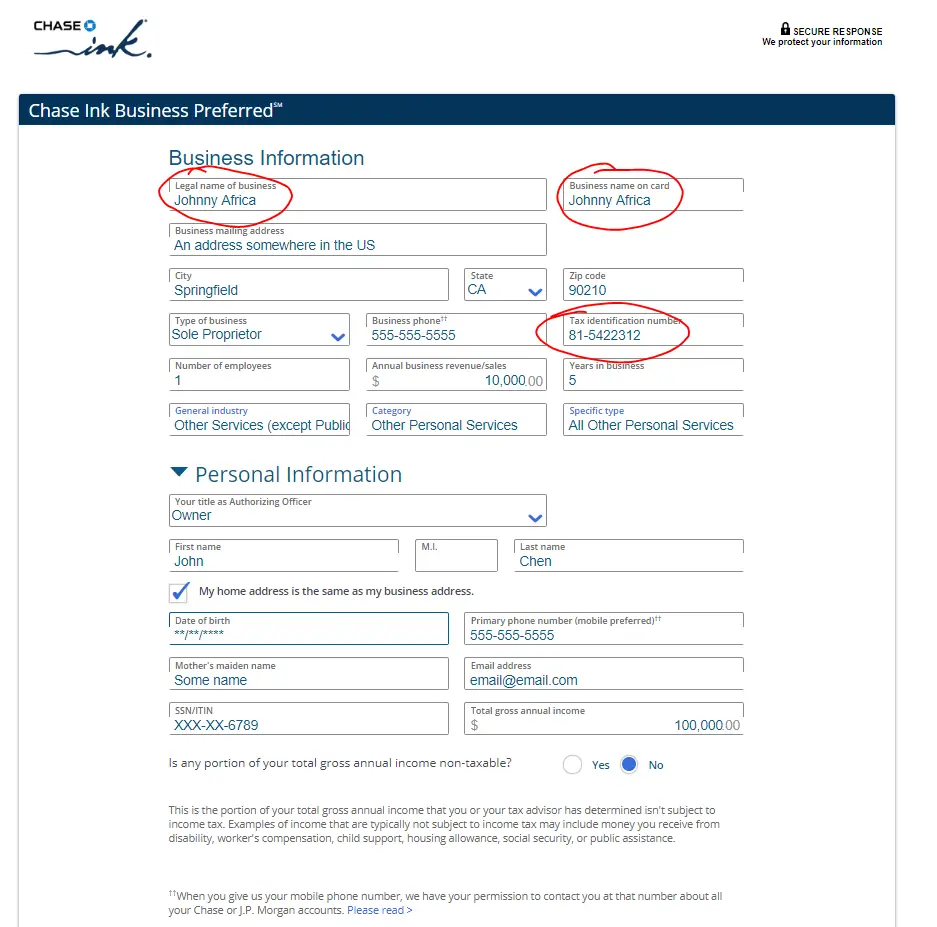

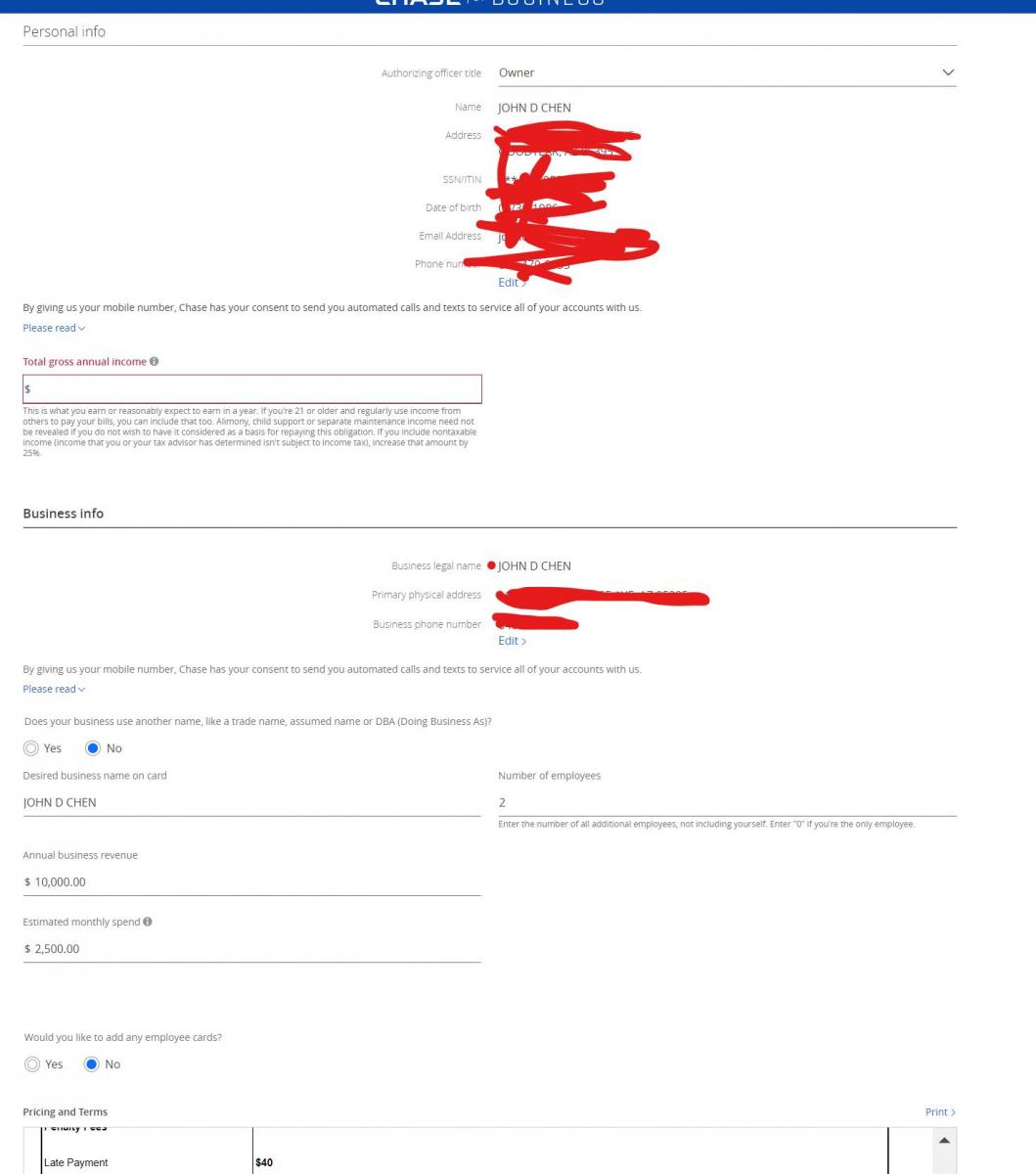

Apply for the second Ink Preferred using EIN and SSN

After waiting at least two months, you should be safe to apply for your second Chase Ink Preferred card. This time, you are using an actual EIN number (details on how to get one below) instead of your SSN for your business section. Whatever your business name is registered as, make sure to use that in the Business name section. You can still be a “sole proprietorship” even with an EIN so I would continue to select that as your type of business. For your personal section, keep it the same as the first card. This method is called the EIN + SSN method.

The application for the second card will look something like this:

By using your EIN on your second application, you are essentially filing a completely new application under a new business. Your personal section is still used to analyze your credit report (so if you cannot get approved for the first Chase Ink Preferred, then you will not get approved for the second) but using your EIN means you are now applying as a separate business.

Applying for an EIN

Applying for an EIN is very straight forward. Absolutely anyone can apply for an EIN and you don’t even need a real business. Perhaps you are planning to start a business, or perhaps you just think having an EIN sounds cool. Whatever the reason is, it is very easy and quick to get an EIN number from the Government.

When you’re ready, just visit the IRS website for EIN applications to apply for your own number. The application is not very complicated (just select sole proprietorship) and you should be able to get an EIN immediately after applying.

How long to wait between applications of the Chase Ink Cards

So now you’re ready to apply for multiple Chase Ink cards which is great. However, you’ll need to space out your applications because Chase has a concrete anti-churning rule called the 2/30 rule. This states that they will not issue more than 2 cards in a 30 day period. This is any two cards. So at the very minimum, wait 30 days between applications.

However, I like to wait at least 2 months to be on the safe side. This means if I applied for the Chase Ink Preferred on Jun 20, I would only apply for a second Chase Ink Preferred or a Chase Ink Unlimited from August 1 at the very earliest. I mean you’re getting thousands of dollars for free so don’t try and raise any red flags.

The standard Chase 5/24 rule also applies to this card so make sure you are not above the threshold for this rule.

Self Referring yourself to the second Ink Preferred

Currently, and this could change at any minute, you can refer a friend to the Chase Ink Preferred and receive a whopping 20,000 UR sign on bonus.

Note: This method is not advised anymore and people have reported getting accounts shut down because of this.

The pros trick is that you can actually refer yourself if you want to apply for the second Ink Preferred card since technically, you’re two entities. This means you can apply for your first Ink Preferred credit card and get the 80,000 points, refer yourself to get 20k and get another 80,000 on your second Ink Preferred.

- First Ink Preferred Card = 80,000 bonus points

- Referral bonus for referring yourself to the second card = 20,000 points

- Second Ink Preferred card = 80,000 bonus points

_______________________________________________________________ - Total = 180,000 bonus points, or at minimum $2,700 dollars towards travel!

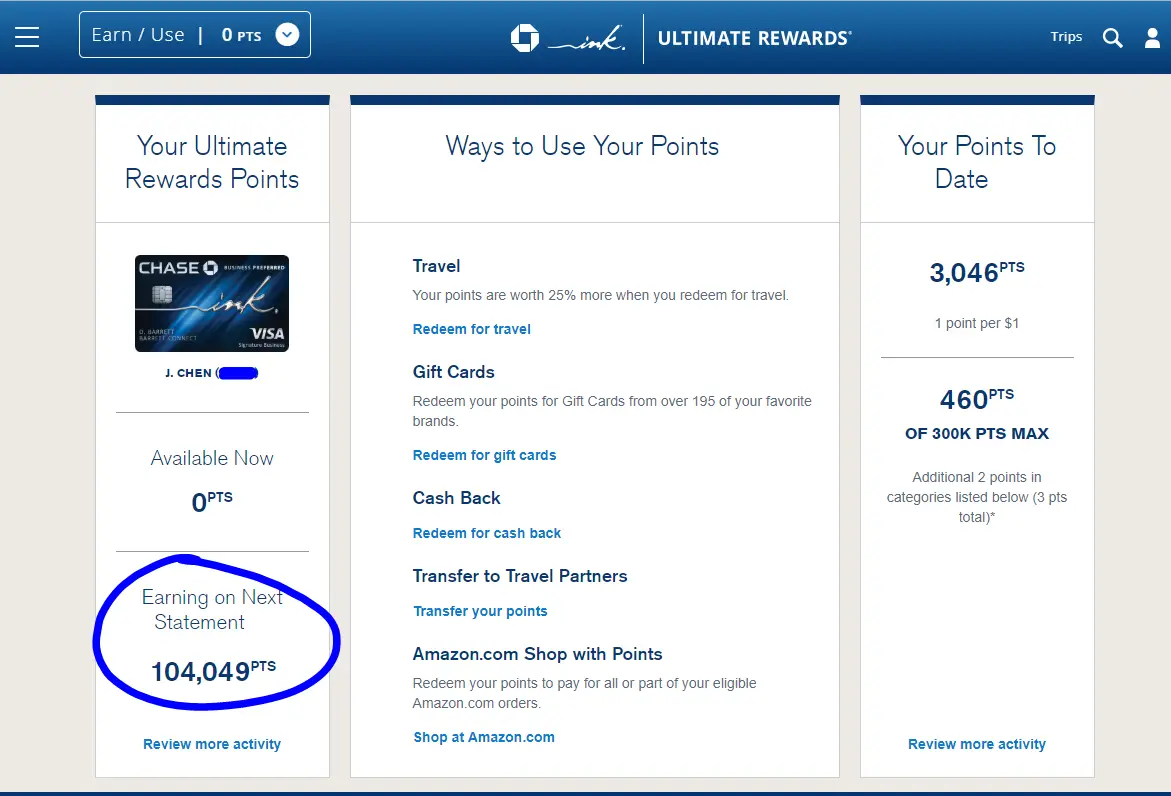

This is exactly what I did and combined with the sign on bonus with the Ink Unlimited (just one card for now), that’s almost 250,000 UR in sign on points within a few months time!

What if I have more than one EIN?

If you already have an EIN through your Sole Proprietorship, you can get a new one through an LLC from the same IRS website. This means yes, you can essentially apply for another Chase Ink Preferred. If you have multiple EINs, technically you can apply for even more of the same cards.

While I’ve not indulged in this, I’ve read cases of people being able to get 4 or 5 Ink Preferreds for one person! This means, assuming they self referred themselves every time, they’re looking at almost a half million UR points!

A study case for another time!

Updated 2022: You can now apply for multiple Chase Ink cards with just your SSN

Yes you heard it right. You can now apply for multiple Chase Ink cards without an EIN. You can literally just use the exact same details as your first application for your second application and be approved for a new Ink card. This works for Ink Preferred, cash, and unlimited cards.

Yes I’m not joking.

I had to do a lot of research on this but plenty of people all over the internet have had success just filling out the exact same application as their first application and you are approved with a new card that has a new card number. This card will of course also be applicable for the sweet sweet sign on bonus that we’re all after.

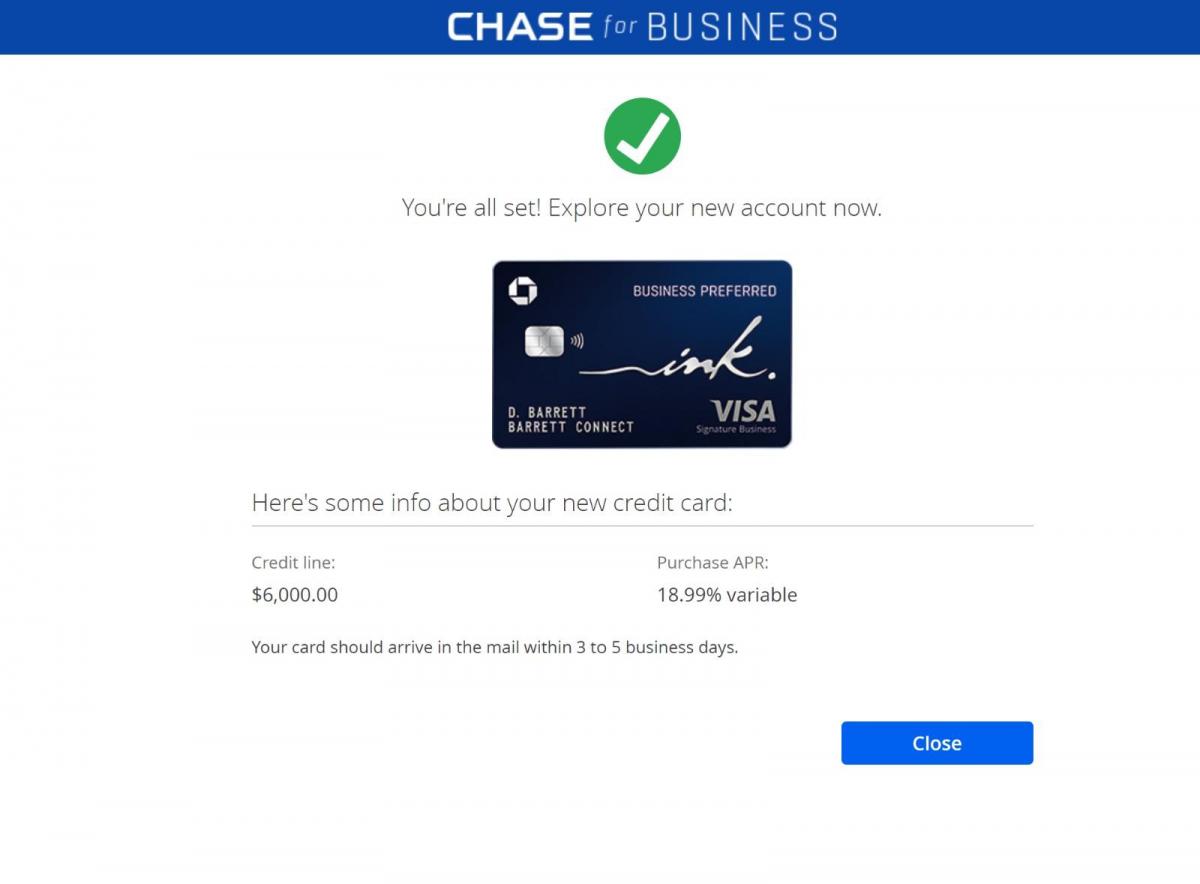

Just follow the below steps which are the exact same steps I took to opening my third Chase Ink Preferred card.

Once you’ve signed into your existing account, you can choose your existing businesses.

Fill in the application with the same information as before and don’t deviate too much from what you’ve already done.

As you can see, I got my card with instant approval! Make sure of course to follow the guidelines above with being under the 5/24 rule and not having applied for another Chase card for at least two months.

Hi Johnny,

When you say you can now apply for multiple ink cards, can I apply while having for example the ink preferred open with my SSN? Or do I need to close that account first and then apply?

Thanks.

Yes you can apply multiple times and do not need to close any of the accounts.

New post —- can you reply???

Already replied?

The first card i got for my LLC was the CIU, whose SUB I am close to completing. Of course I will eventually get a CIC and CIP as well. I’m thinking of spacing them out every four months. Is the following reasonable or is it just going to get me shut down?

At month twelve apply for a second CIU, month sixteen a second CIC, and month twenty cancel/replace CIP, which I don’t see as a keeper because it has no organic spending value for my business. I like the 3x travel but none of it would be for business, so primary CDW wouldn’t apply, and only getting 2x travel from a CSP would be basically irrelevant given the proposed annual SUB earnings and the CSP’s own SUB.

At month twenty four close second CIU and reapply for another, at month twenty eight close second CIC and reapply for another, and so on. I am of course assuming Chase will approve me for five simultaneous Inks.

The idea is I would have a constantly rotating trio of Ink SUB cards (at moderate velocity by aggressive churner standards) while keeping my original CIU and CIC for organic spending. I keep each card in the trio a year before cancel and replace, with the idea being that it mollifies the algorithm and Chase underwriters. I’ve read DPs about underwriters not liking it when you quickly cancel to free up credit line space, and then replace, even if total velocity is otherwise acceptable.

Hey James, that’s a good strategy. I usually wait 3 months for my applications so 4 months is extra conservative. I don’t think you need to cancel your CIU or CICs however. I have 3 CIU and 3 CIC all under just my sole prop. Most of these were downgraded CIPs. I try to not close cards because I think chase views that negatively (but not 100% sure).

Sorry…..Can you delete my post….I see a reply now from you.

Ok, thanks for the encouragement. I was originally thinking 4 months because the CIP can’t be downgraded until after the annual fee posts, and 4 months for 3 cards keeps an annual cycle going for all the cards including the CIP, and lets you restart a new 0% offer cycle for each card. Too conservative?

Were you churning CIPs quarterly and downgrading each after a year, rather than churning CIC/CIU directly? What was the reasoning for that? A lot of annual fees, not to mention the extra MSR involved.

At some point, obviously, Chase is going to start rejecting applications, presumably because of total credit extended. Is the right move then to call recon and if total credit is the issue, see if stealing credit lines from other cards will mollify them? That will keep the old line active, albeit with a trivial credit line. I’ve heard they can do that. Do their business cards need you to put a charge every six months or a year on them to keep them open?

Hey mate, I use CIP because I live and travel abroad exclusively. Most of my expenses are Non USD so using CIC and CIU means I am paying 3% on FX fees. 3% on the $6k MSR is $180 in fx fees which eats into the sign on bonus. Also for the CIP, the larger SUB more than makes up for the AF in my opinion. Of course you do need to have the capability to spend $8k in 3 months.

I generally reduce my credit limits on my cards when they are getting to be too much or too high. I call in and just tell them to reduce my credit limit on whatever cards I choose to $1k or $2k. This way, my total CL with Chase will remain below a certain threshold. I don’t think you need to make any charges to keep these cards open.

Hi Johnny,

I Understand that

1. You can keep applying for the same card every 2 to 3 months

2. When you apply under EIN can you refer yourself if you already have the same card under SSN and Vice Versa. How often can you keep doing that.

3. When do you start closing the cards

4. Best ways to match the spend limit.

Hi Snehal,

1. Yes exactly

2. Would not self refer whatsoever

3. I product change the CIPs to CIU or CIC. I will close the latter 2 once I get more than like 10 cards just to keep things in check.

4. Hard to say depending on what kinda lifestyle you life. the CIPs are easier to spend for my purposes as they have no FX fees. I prepay purchases sometimes. For example, my hosting for this blog charges me month to month but I can preload $1000 and it will pay for the next few years.

Chase denial of INK due to TOO MUCH RISK.

All apps SSN/SP/ same legal name.

5/24 w/ Chase biz cards. 1/24 with personal(non-chase cc).

In fact all biz cards were 5/12 months waiting 2 months between apps.

Chase has interpreted this as a single business since same SSN/Name……wrong.

Each Chase biz CC I picked a different category of business but Chase lending says it does not care about category.

So what is the solution? 5/24 rule for biz only has never been enforced to my knowledge.

DO I apply with an EIN(which I have) , new biz name with no tax documents to back to sine I was legit using my SSN Or do I not apply for long time maybe 1 year?

Cash lending refused to allow me to switch CL, reduce CL, cancel INK card(1 has been over 1 year). would not answer if I apply EIN & diff biz…and same revenue/spend if that would be ok refused any comment. I have over $45,000 CL available to move between biz cards. I have over $30,000 CL to move with Chase 2 personal cards I have(IHG, Freedom)

Very confusing as Chase lending is so uncooperative and limited competency other than too much risk…which means too many cards under one business name….when it’s NOT one business and Chase disrespects teh category option I select own application.

No clarity if 5/24 is blocking me only on biz side….

Is this method still working in 2023/2024? Have an ink preferred but would be amazing to get another of the same card for that bonus.

Thanks for the great info, Johnny! I was just approved for my first Ink Cash card in September using my SSN. Am I right to understand that I can apply for another Ink Cash card using my SSN?

Does Chase have any rules re how often applicants can get a SUB on the same card assuming using SSN? I read somewhere that it is 24 months.

Lastly, how long do you suggest holding on to business cards if one is interested in churning? On the personal card side consensus seems to be at least a year.

Yes that’s right. Wait about 2 months in between applications. 24month rule does not apply to this strategy if you read the post closely

Hi Johnny, so it is the case that you can get multiple bonuses on same ink card with either the same EIN or SSN? I applied for and got approved for CIC and CIU earlier this year with SSN and want to apply for another with the 90k offer. Can I apply for another with SSN and get approved? Thank you!

Yes that’s exactly how it works. As an example, i’ve opened 4x CIP on my SSN in the last 2 years. I’ve downgraded them all to CIU or CIC when the 2nd AF was about to hit. Currently have 2 CIPs open.

FYI, referral links are at 75k SUB but you can easily secure message chase to match to the 90k offer

Great info on your page Johnny! I have a CIP, CIU, CIC all under my EIN (I have an s-corp but cannot remember if I applied with S-Corp or Sole-Prop?). All SUBs were met and the cards are over 24 months old. I would like to open a CIC or CIU under my SSN for another sole-prop business. Can I refer myself and get the referral bonus from the CIC under my EIN? Or should I have my husband refer me and he can get the referral bonus? Or should I just cancel the EIN cards and apply again on my husband’s referral with my SSN? I am 4/24. I am also considering getting the Marriot Bonvoy Boundless with the 5 night cert bonus….and not sure which to do first. Thanks!

Hey Lisa, so not refer yourself as that is asking for shutdowns. No need to cancel your existing cards either. I would get the biz first otherwise I’d you do the Marriott you’ll be at 5/24 and then can’t get any inks until you’re back below

Johnny,

How often can you apply for these Chase Biz cards and not get nuked by Chase? Is it a new card every month, 2 months, 3 or something else?

Hey mate there’s no hard science to it but generally the rule is no more than 2 cards with chase every 2 months but I keep it at 3 months

Hi Johnny,

I really like this blog, lots of interesting content.

Wonder why you don’t get the Ink Business Premier? Annual fee/min spend too high?

Thanks a lot!

Hey mate, ya the annual fee is double the AF of the ink preferred and it only gives you cash as opposed to ur points which are more valuable. I think the only reason to get the ink premier is if you have a method to constantly spend $5k transactions

The ink preferred just had its MSR dropped for $8000 btw. Makes it much easier for the average joe to get!

Thank you for this post! This has been super helpful!

I have a question for you maybe you might have some insight on.

So I have a business ink unlimited, which I got for one of my SP’s and applied using the respective EIN. Could I refer my other business (also an SP under my name) to get the current 40k point referral bonus + SUB? or could that potentially get my accounts shut down?

also, your post recommended applying first as SSN and then EIN, but does it matter that I would be going from EIN to SSN? The second SP doesn’t have an EIN.

Thank you for the help! I’m at 4/24 and in the market for some more Chase business cards while the referrals are high but I’m not sure if I can refer myself still even though they are separate businesses 🙂

You would think this to be a no brainer but I’veknown instances of shutdowns happening because of this. Dunno what the situation is nowadays but I would not risk it. If you do decide to risk it, please let us all know 🙂

BOA Alaska Business card – DENIED

3/24, 810+, 3 INK approvals in 5 month.

BOA could not or would not tell reason for rejection. I requested reconsideration and again rejected.

Called again and the supervisor asked my tax returns….I asked why valuation are you looking on my taxes?

BoA could not or world not answer so I assume I’m not eligible at this bank?

BoA seems very hostile compared to Chase.

So with 4 inquiries in past 4 (ie BOA biz)……. how much longer should I wait to apply at Chase for either IHG biz or CIU biz? MY last Chase approval CC was a CIC biz so thought I’d alternate.

BOA Is notorioufor being impossible. I’ve tried also multiple times in the past without much luck for their Alaska card. For chase, 2 cards every 60 days is the golden rule but I like to give it at least 90 days to not raise any flags.

Approved for 2nd Chase Business Ink Cash under same EIN. When it took me to my auto approval screen after applying, it said congrats, then it said I had a 12,000 credit limit on it, and then it said Purchase APR of 17.99% variable… Curious if this is a mistake or am I really not getting the 12 months 0% APR on intro purchases? I will probably know more next week when I get the card, but bummer if so

Good data point thanks! Maybe good to call in once you get the card to confirm from customer service

Thanks—BOA shattered my EGO……first time ever denied credit and refuse to tell me reason why. I suspect my last CIC inquiry was Mar 19…then I applied BOA As CC Apr 2….. 2 weeks separation. Otherwise not sure why they dislike me.

Onto to Chase lol

Haha good luck

I closed my chase ink cash today and I applied for Ink Cash and was approved. I want to re-apply for Ink Cash (had it for more than 24 months) when should I apply for it again? should I wait 30 days? or I can apply tomorrow?!

I closed my chase ink cash today and I applied for Ink Cash and was approved. I want to re-apply for Ink Cash (had it for more than 24 months) when should I apply for it again? should I wait 30 days? or I can apply tomorrow??

Shouldn’t apply for more than 2 chase cards in 60 days (I do 90 days to be safe). But otherwise, apply for ink unlimited instead of cash to mix it up

I just got approved for my 2nd Ink Unlimited using EIN SSN method. First time applying using EIN; however, the new card is not showing in my Chase account. Is this because it’s linked to EIN instead of SSN? Do I have to call Customer Support to add it manually? Thanks.

Hey Mate, EIN only will be a different login than EIN+SSN from my experience. Call CS and see what they suggest?

Hi Johnny,

I want to express my gratitude for the valuable insights from your blog. It was incredibly helpful in guiding me through the process of applying for and obtaining multiple Chase Ink cards.

To give you an overview, I currently hold four Chase Ink cards – two obtained using EIN (CIU #1 in Sept ’22 with CL $35K & CIC #1 in Dec ’22 with CL $23K) and two obtained as a Sole Proprietor without using the EIN (CIU #2 in Jan ’23 with CL of $16K & CIC #2 in Mar ’23 with CL of $10K).

I wanted to share with you that CIU #2 was instantly approved. However, CIC #2 was not approved instantly. Chase called me within 48 hours of my application and asked several questions about the business and why I needed four Ink cards within six months despite having a credit limit of over $70K. I explained that I wanted to optimize my operational cash flows and that I did not want to max out my existing cards. Interestingly, the representative was aware of all four of my business cards, even though they were issued to two different businesses.

My plan is to apply for two more Chase Ink cards at the end of 2023.

Do you suggest closing any of my existing four Chase Ink cards before I apply?

Furthermore, I obtained a CIP in Jan ’23 through a product change from CIU #1. The reason for this change was because the CIU/CIC SUB (90K with MS of $6k, a 15x return) is more attractive than CIP’s (SUB 100K with MS of $15K, a 6.6x return). Also, I needed CIP immediately to transfer Chase Ultimate Rewards to travel partners.

My question for you is, would I be eligible to receive the SUB of 100K if I apply for CIP using the same EIN that I used to apply for the initial CIU #1 that was eventually converted to a CIP?

Thank you again for your help and insights.

Best regards,

Teck

Yes I’ve heard of many people that have applied for a 2nd CIP and have gotten it approved with the SUB. I’ve had 2x CIP open at the same time on my SSN only so have 2x CIP on EIN should also work. Hope that helps!

3/24, 800 Fico. 2 Chase INK CIC-Dec 22′, CIU-Jan 23′ (41 days apart)

Balances on CIC=$6k/CL=$10k; CIU=$6.7k/CL=$10k

Three personal cards in past 2 years: CSP, IHG, C1 Venture X. CSP drops off 3/24 Jun 23′

1. Does having Not paid off the balances on 0% 12 mo cc impact getting a new Chase biz card?

2.If I wanted 2nd CIC how long must I wait? 2nd CIU after the CIC?

3. Would a IHG biz be more easily approved ?

4. Would getting C1 Venture–goi to 3/24 drops back to 3/23(July 23′) if I get a new personal card. Or would be be smarter going outside Chase to C1 Venture 75kSUB than staying with Chase?

I like UR points more than C1 better transfer. I have C1 Venture X

Have two large payments I want to compete before APR 20……would like new credit card SUB so $6k SUBS are ok to meet.

|SO concerned about the velocity, cadence, and the balance when applying for more Ink cards/

I think carrying balances is fine as long as your payment history is on time. High balances with your biz cards does not affect your personal credit score as business cards don’t factor into your credit utilization ratio

Thanks. For example $5700 balance on CIC the minimum payment was only $57 .00

that February 2023. Have made (x2 ) $2000 payment on CIC to show ability to make payments.

I also have a $6700.00 balance on CIU and only $15.41 is due Mar 1.

Each card CIU, CIC has a CL=$10k

I was thinking when I apply for CIC in April—both CIC & CIU will be reduce to $3k balances.

Chase Ink cadence was CIC-12/22′, CIu 1/23—-SUBS met and posted by Jan 10 and Mar 5(CIU).

Appreciate you feedback and the wonderful ideas on travel destinations. If only the airlines would cooperate.

BTW- What do you think of Bask Bank 2 AA miles for average balance ? Seems pretty weak since AA award travel has gotten so depressing for 2023.

I was about to apply for a second Chase Ink business unlimited, but before I hit submit, one of the conditions says “10) The new Cardmember bonus offer is only available if I do not have this card and have not received a new Cardmember bonus for this card in the past 24 months.”

Did that say that when you applied for multiple of the same card?

Yes it says that for me too and has not been a problem before. Maybe to stay safe, just open a ink cash instead of unlimited as it is same thing.

What if you have this cadence as I apply SSN, SP every time real name? I’m 3/24(personal)

Are now counting INK apps as part of 5/24 rule?

1. CIC – NOV 22′ – balance $6k

2. CIU – Jan 23′ 0 balance owed $6.7k

Does holding an INK card balance impact approval? It’s a benefit go INKS’ 0%, 12 mo.

Do you wait 2 months for 2nd CIC or move a 3rd different biz card? I can’t do CIP($15k) thinking of

IHG biz. Then in 5 months re-start CIC/CIU fame as new spending starts.

want some clarity on what are criteria for getting bonus on different inks cards or on same card. my understanding is I can get all 3 bonuses using just SSN and then can apply again for each of 3 with each EIN I have. is there something new that would allow me to get multiple bonuses with a new application and thus 2 of same card with different card numbers only using SSN? Thank you!

There’s no special criteria, it is just how the system works at the moment.

Hey Johnny,

Thanks for the excellent article! It really helped us.

I have one biz card with the EIN, a personal card, and an incoming biz card created w my SSN. Would the new card made with me SSN be the same login as the biz card with my EIN? Or will I now have 3 logins total?

Thank you!

Hi Mary, I have all my SSN in one account. EIN is with another login but I’ve heard of other people that have them all in one account.

Thank you! (:

Are you saying we could

1) Apply for Ink Cash, say in Dec 2022, using SSN

2) Meet the SUB requirements and pocket the SUB

3) Apply for a second Ink Cash in Feb/Mar 2023 using SSN and still get the SUB ?

Assume EIN doesn’t exist and only SSN is available.

Hey Simon, yes that is exactly what I mean! I just did it with the CIP for the second time int he last year. That’s 200k of sweet chase points in a year!

So I have one of each ink cards all with Just my SSN. Are you saying I can apply for second, third, however many I want with Just my SSN? If so, what allows me to do this (gap between applications, etc.) and what do I need to change on each application? Thank you!!

Hello, Johnny.

I used your link to apply for a Chase Ink Cash using my EIN for a sole proprietorship. Chase called me and needed additional documentation to prove the existence of my business. Is this typical? I don’t have documentation.

Thanks,

Ed

Hey mate, usually not typical but anything goes. What did they ask for specifically?

Hello, Johnny.

Hmmm. For some reason each time I have visited this site in the last 3 weeks, your reply wasn’t visible but it was today.

Anyway, Chase asked for a document (such as a utility bill) that shows the business name I put on my application and something else (I don’t recall what it was because I know I don’t have it 😉 )

I see the ‘new’ method that you wrote about regarding just applying for a second Ink using social security number. So your second Ink application can have the exact same information as the first Ink application? No need to change names, numbers, addresses?

Thanks

Hey Ed, yes exactly you can use SSN for both applcaitions now without any issue. No need to change a single thing. I literally had the exact same applications for both cards (3 months apart) and now I have two CIPs with different numbers and the like.

As for a utility bill, I suspect you don’t nee dto provide this because that would mean you have a large enough business where you rent your own facilities for this business. I would be curious if you told them no my business is not one that requires me to rent a physical facility.

Don’t use a made up business name (Doing Business As, aka DBA) unless it is a registered DBA with your public entity (county) or Chase and other credit card issuers will ask you for proof of the business name. In my county in California, this is called a fictitious business name filing (paperwork and fee, plus newspaper publishing who is doing business as XX) and is done with the county.

All valid points. THanks Dana!

Hi Johny, I have a question for ya.

So I got 2 ink card this year. April 2022 CIC and July 2022 CIU both under my SSN.

Today apply again via SSN + EIN and was approved for another CIC. However when log into account not seeing the meter for the SUB. Did they change it to 24month per sub. Thanks

Hey mate, that is strange as should be working. Maybe wait a few days and if it hasn’t shown up maybe call chase to verify?

For repeating Ink apps under SSN, I’ve always “known” you had to wait 24 months from your prior bonus to be eligible. Is that no longer necessary?

No that hasn’t been the case for some time. Bonuses are possible as it’s a completely separate card in this case. It’s a bit crazy I know but for now that’s how it is!

Do you babe any DP on shutdowns by Chase? I’ve seen a few comments other places of shutdowns and maybe many don;t report the negatives of churning.

I READ YOUR UPDATE ON THIS POST ABOUT GETTING MORE THAN 1 OF THE SAME CARD SIMPLY W UR SSN: Hey Johnny, how r u doing? I have 4 ink cards open at the moment: 2 cash (ssn n ein) & 2 unlimited (ssn n ein), what do you think I should do to get more UR points? should I close on before applying or I can get my 5th ink? of course I was thinking on decreasing the limit of a couple of them to the min which I think its 500usd. Cheers n thx

Hey mate, how about opening the same cards with just your SSN and no EIN. Alternatively, open up a CIP if you can meet the $15k MSR.

Johnny, appreciate the article!

Does the personal name/business name matter as much as the EIN/SSN?

For example, on the first card I applied for I used the business name in the business category and then my SSN, instead of personal name and SSN. Can I apply for another one using the business name again with the EIN?

All these business cards count towards the 5/24 rule because they are tied to your personal info/SSN correct?

Hey Chris, yes you can apply with EIN and personal name. I’m surprised Chase didn’t ask you for anything when you applied with SSN and not your personal name. DId you select Sole Prop?

Great article! Question… does the order of applications have to be SSN first, then EIN second? I already applied for chase business ink unlimited using EIN. Can I go apply again using SSN this time?

Hi Johnny,

Do you think it is time I do a CIP SSN+FullName? Been 2 months since the last application. Here is my DP:

1/1/2016 CIP EIN1+TradeName cancelled

11/2019 CIP EIN1+TradeName cancelled

11/2019 CIP EIN2+TradeName cancelled

6/22/2019 CIP SSN+FullName cancelled

4/2021 CIP EIN3+TradeName

Hey KJ, yes seems liek yo uwill be eligible now for a second CIP/SSN. Maybe wait another month just to be extra safe since you canceled your card end of june two years ago.

Hi Johnny,

I want to thank you for this article. After posting the comment yesterday I went ahead and applied and was approved for a second CIP/SSN.

My spouse has the following spreadsheet. She applied for her second CIP/SSN and got in review status.

5/29/2017 CIP SSN+FullName Product change to CIC

6/20/2019 CIP SSN+FullName cancelled

10/31/2019 CIP EIN4+TradeName cancelled

4/24/2021 CIP EIN5+TradeName

Ah that’s great news! Enjoy the extra UR AND Let’s hope p2 can get approved too!

Hi Johnny,

How are you doing? Well, it’s a year later and I want to travel overseas again using Chase points. So far I’ve applied for Chase Ink Unlimited cards as follows:

P1

5/25/2022 CIC EIN 1 + TradeName (approved)

5/26/2022 CIC EIN 2 + TradeName (denied)

5/26/2022 CIC EIN 3 + TradeName (approved)

P2

5/26/2022 CIC EIN 5 + TradeName (approved)

5/26/2022 CIC SSN + Fullname (denied)

I am trying to figure out when I should I apply again using EIN 2,4. And SSN for p1,p2?

Hey mate, i think for P1 you haven’t sued SSN for awhile so start there for the EIN+SSN. Let me know how it goes though as I am also looking to apply for some extra CIPs and CIUs coming up.

Do I need to cancel any of my inks to get more UR points? I have had 4 in total and I have them all open at the moment, look:

1- Approved for CIU 2019 SSN (Full Name) …got the points

2- Approved for CIC 2020 SSN (Full Name) …got the points

3- Approved for CIU mid 2021 EIN (biz name) …got the points

4- Approved for CIC jan 2022 EIN (biz name) …got the points

Do I need to cancel any of my inks to get more UR points? I have had 4 in total and I have them all open at the moment, look:

1- Approved for CIU 2019 SSN (Full Name) …got the points

2- Approved for CIC 2020 SSN (Full Name) …got the points

3- Approved for CIU mid 2021 EIN (biz name) …got the points

4- Approved for CIC jan 2022 EIN (biz name) …got the points

What should be my next steps? I can always start another EIN right? just changing a bit the scheme of my current business will easily lemme do so, I do ecommerce in different platforms and shipping methods so I am planing to break it down anyways to even digest my data easier and strategize other things as marketing and of course my credit card benefits as earning UR points…

Does anyone know the rules for the INK cards? How often can one cancel and get the same card and bonus?

I just got the INK preferred (had one a few years ago) and the INK unlimited. I still have an old INK Cash card, I’m wondering if I can cancel it and reapply for a new INK Cash card to get the 75k bonus (or do I have to wait some period of time since HAVING it or since EARNING the Bonus)?

Thanks so much!

The rules are generally 24 months after canceling the card before you’re eligible for a new bonus. So if you re\ceived the bonus 2 years ago but still have the card, cancel said card, and reapply for the card a month later, you won’t be eligible.

Would the 24 month rule (after cancelling, cannot open new card and collect new bonus unless 24 months have passed) apply interchangeably for both saphhire preferred and reserve? Meaning, if I cancel my reserve card, do I need to wait 24 months to sign up for preferred? Or can I apply for preferred right away since it has been over 48 months since I got the original sapphire bonus?

Hey! If I’m currently under 5/24, am I able to apply for any of the Chase SMB cards?

Yes for sure!

Does chase treat the two different businesses (EIN & SSN) as each having its own separate 5/24 limit?

Hi there, I think it is still based on your SSN so wouldn’t imagine it would have its own 5/24.

Johnny thanks for such a well written article! Hoping to get your advice on 2 questions:

1. When applying with EIN, have you encountered any issues with your “Legal Name Of Business” not matching your first and last name? I applied using a legitimate legal name of biz as e.g. “John Art” + EIN, but Chase is giving me a hard time, asking for a DBA or Fictitious Business Name (FBN).

I’ve seen some threads on Reddit that the legal name of business should exactly match the first & last name, even if applying via EIN. Not sure if Chase has changed their policy since you wrote this post? (This is the first time I’m applying using a biz name other than my first/last name)

2. Have you seen anyone able to apply for multiple cards using EIN and the same first/last name? I.e. submitting the exact same application over a few years to get the signup bonus as a sole prop.

Thank you for the great content!

Hi there! Interested in this topic too… I understand the name doesn’t matter any longer, also some people have gotten approved applying twice w exact same names and also using only SSN in both applications (alough the EIN + SSN sounds more convincing and it is what I d do) I also understand to approve you for a 2nd card of a card that you already have active in your pocket the bank wont auto approve u n most of the times needs to receive a call from you, I have earned the bonuses of CIU CIC in the previous few months and I m applying for any of those 2 again in the coming weeks, if u want we can keep in touch to share the DP… Cheers…

Hi Will, yes that would be great to get some DPs. I’ve not heard of people getting approved with solely SSN 2x which would be very interesting! Yes a ot of times ti will require a call into the Chase recon line but I’ve dialed in there many times and people are quite reasonable. You just need to sound convincing with your argument about multiple businesses, revenue, etc.

Hi Johnathan,

1. I normally always apply with my name as my business, even if I am using EIN. If you don’t use your full name, you will need to provide them with your EIN documentation that you filed with the state. I’ve gotten one of these in the past and it’s pretty straight forward. However, if I just use my full name as the business name, i usually don’t need to provide this.

2. yes, I’ve heard of people getitng 2, 3 or even 4x the same card with different EIN numbers but using the same name. Pretty crazy some of the churners out there!

Where are finding other spots on turn like reddit?

Link?

I’m seeing a few comments on chase shutdowns on INKs….think its was 10xtravel/

Great article… I recently made up for the bonuses on Ink cash and unlimited, in both I think I applied w my EIN with SSN, can I apply then in each w my SSN only? I ask this cuz they way u explained was first SSN only and then SSN Ein n IDK if the order was important…

Hi will the order shouldn’t matter!

Thanks for the comment Johnny, I have been an entrepreneur expat digital nomad in the last 7 years and I try to travel w points, BUT, and this is a big but, the problem is that my bases are in areas not very well researched for miles people so the info is hard to find, my bases are: Eastern Europe (Ukraine, Georgia, soon Russia if possible), SEAsia (Vietnam, Thailand, Cambodia), South America (Argentina, possibly soon Guatemala and or Mexico).. I have a few sweetspots I have discovered but again, its hard to find the info online cuz most of the sweetspots discovered always envolved USA and I usually dont touch USA… any clue? some people told me I should find kinda of a TPG that lives in Europe, the same for and Asian kinda TPG and South America to start unwrapping the info, one major thing is that there are not SouthAmerica Asian direct flighs whatsoever n most of the time it ll be over 2 stops to get to SEA and that means it wont show up in awardhacker and some programs r possible only ma 1 stop… any idea?

Hey Will,

1. Similar travel locations as me. Mostly Germany/Prague/Poland/Gungary numerous times.

SEAsia (Vietnam, Thailand, Cambodia), Central America(Panama, Nicaragua, Costa Rica).

2. Into the Chase Inks—like to make contact with exchange travel ink ideas.

I’m only using SSN, SP as I do have rental property as a side business and don;t want EIN..

3. Have CIC, CIU – 2.5 mo period. Wants 2nd CIC but may have to rotate a IHG biz anbs I cant do CIP for 6 months due to spending issue.

Now debating how I do new app but concerned I’m carrying large bonus on the ICI & CIU $6500 each. Not sure of impact of a balance on biz cards that’s 0% int 12 mo allowed?

4. I’m based n SEA and award travel is terrible to find unless 6-12 mo out in biz to EU only SEA on ANA seem s open.

I have been able to apply for Ink preferred cards under the same EIN for years. So far I have 7 cards in the past 3 years and just got 2 more ink cards in the last two weeks. I was talking to the rep helping me, he tells me there’s no set maximum on the card and told me I can just keep on applying. Please keep in mind I spend a lot with my business and I charge at least 150k per year on each card and always paid off immediately.

I just tried to apply for another card and was on the phone with the rep. This time I was not immediately approved. Will call them back next week to see if it gets approved.

Thanks for sharing, Paul. That’s pretty amazing. Would you mind sharing a few more DPs please 🙂

Did you apply for 7 cards with the same EIN and business legal name? And was it a sole prop. or LLC / Corporation? And would you mind sharing what cards you got?

The reason I ask is because I’ve tried to do something similar, but just barely got started. I’ve have/had a total of 4 Chase cards, all as sole props:

2018 CIP SSN+FullName

2019 CIC SSN+FullName

2020 CIP EIN+FullName

2021 CIP EIN+TradeName

(FullName is where my biz name matches my SSN; trade name is my DBA for my sole prop – I had to submit documents to Chase verifying my DBA)

Just want to report back that while I was not able to get the card approved over the phone I was indeed approved today for another one which showed up in my chase account online today. This is the 3rd card approved since March and 8th with same EIN/company info. Keep in mind I’ve charged at least $150k on each one of the cards with real advertising charges that were paid off immediately during the current anniversary year so I think Chase knows I am not trying to just game the system for the bonus sign up points. I usually go for American Express Business Gold as I could get 4x on advertising spend but Amex would not issue me any more cards even after I cancelled some of the cards to go back down below the 10 charge card limit. I have 15 American Business Gold cards and the way I got around the limit was I would cancel a American business gold cards in order to get a new one but end of last year Amex wouldn’t issue me any more cards even though I had less than 10 cards. Luckily I was able to reactivate the cancelled cards from last year(within 2( or 3 I forgot) months of cancellation and use them for this year. I plan to keep on applying for new CIP cards once every 10 days and we will see if they keep on issuing new cards to me. I am not really sure how Chase makes it’s approval decisions but I think perhaps at some point they might extend too much credit to me and stop issuing any more cards to me. I know my situation is rather different than other people but I thought I share this in case someone is in similar situation as me and wondering how man cards Chase would issue to someone.

This is quite interesting, thanks for the DP. How much total credit do you ahve among your Chase personal and biz cards? Am surprised you can get so many cards approved as they generally have a total CL limit they will extend. I just opened the chase united quest card but had to take some credit limit from anothe rcard in order to get it approved.

Johnny I didn’t answer the part about credit limit. I think total I have over 100k on 8 cards for business and maybe another 25k for the personal.

Hi there,

Does the EIN and SSN trick (counting as two separate businesses) work for other issuers, in particular Amex and Barclays?

Thanks!

Hi Alexa, it doesn’t work for the othe r issues to my knowledge!

Hi! Wow thanks so much for the speedy reply! You’re as awesome as your blog! I confirmed with friends that work at Barclays/Amex that it won’t work with them.

I just applied for my first chase business card (the ink, I have other cards with chase, just not business) and was approved after calling in for a measly $3K. Doesn’t make a lot of sense given my credit score (800), personal income (well into the 6 figures), business income ($80K in revenues; remainder of personal income is from my full time job), and spend/history on my other chase cards (~$50K a year on my reserve and freedom), plus I’m only at 3/24…I also bank with Chase (e.g., my savings are all in Chase). I don’t know if this is typical for a first round business card application, but figured I’d share for other readers because I was quite surprised.

Anyway, question for you. Since my credit limit is so low, and I actually need more than that for some upcoming expenses, I was thinking to apply for a second business card (the united card). I was thinking to do it after midnight tonight since I read that as long as you apply within 24 hours but on different days, the bureau will combine reports – have you seen this happen? I dont really care if I get denied as long as it isn’t a second hard inquiry, I figure it’s worth the try.

Thanks for the insight here and will keep ya’ll posted on how it goes.

I have 8 CIP cards, 1 Amazon, and 1 CSR card. I was pretty surprised too that they are approving so many cards since going by everything I see online there’s a limit. I do tell them all I need is the minimum credit limit whatever that may be. The 7th CIP card I got only had $5k in credit limit but the 8th CIP I got had $15k limit. One of the reps did mention perhaps at some point I might have too much credit and that might be a problem. Like you I just move the credit limit around so it’s not an issue as most of the cards I basically won’t use after I hit the $150k limit. I just requested another card and will call them next week to see if they will approve another card for me. I tell each rep that I am ok if I don’t receive the sign on bonus as I am not gaming the system to get that.

Thanks for sharing, Paul. May I know if you have a banking relationship (personal and/or biz) with Chase? I might try to do the same b/c it’s a pretty awesome DP!

I’d like to add a DP — Chase is totally fine with shifting CL on-the-fly between business cards – the minimum CL on a card must be $500. I currently have a CIU ($3K CL) and CIP ($5K CL) and plan to move most of the CL to CIP (8500) so that I can meet the minimum spend in 2 charges; then do the same for the CIU.

Cheers!

I don’t have a banking relationship but I am thinking about opening an account with them to see if it would make it easier for me to obtain CIP cards through a banker. It’s kind of a pain to have to explain the same thing every single time.

I applied and earned the Ink Business Preferred bonus in Dec 2019, but honestly do not remember if I included my EIN. I applied again today for the 100k bonus and was approved using my EIN immediately. Because I was approved, does that mean I’m good now (assuming I meet min spend) as I presume they would have denied me if I wasn’t eligible for the bonus offer. Thx!

Hi Josh, yes I think you would be eligible for your bonus! You shouhld also be able to check the bonus progress status in the chase portal as well now. Let me know what you see I’d be curious too.

Wow…that worked. I just checked my account and it says “Spend $15,000.00 by 04/24/21 to earn your bonus”. Appreciate the heads up!

Ah amazing! Glad to see EIN+SSN is working properly. Enjoy the points!

Do you know if Chase still considers two EINs as separate applications and you remain eligible for the bonus to bypass the 24 month waiting period for a second card bonus?

Yes am pretty sure two separate EINs mean you can get two different cards!

Do all cards show up under the same account, or do you have different accounts with different usernames for each?

If you’re doing one card on your SSN, and another card using in EIN, then theese will be on different accounts. I’ve not successfully been able to call them and convince them to combine both accounts.

Thanks for this writeup!

I’ve been seeing a lot of people with solid credit and good standing with Chase get denied for the business preferred for not having sufficient funds in a checking or investment account with Chase. I previously had a business checking in good standing then closed it, and kept my 2 business Chase CC’s. Am eligible for the Chase Business Preferred 100k bonus now that it has been 26 months from receiving, and was wondering what your thoughts were on applying without having an active Chase Business Checking Account.

Hey Kevin, I think during normal times, you’d have been approved without much issue. HOwever, due to the pandemic, Chase and every othe rlender has really tightened up their lending standards. I think they will only give credit cards out to people they have strong relationships with now so having a business checking account will certainly “show them” you have more of a relationship. However, I think you have a pretty long history with them so I’d give it a shot but just keep in mind it’s not as autopilot as it has been during normal times.

Hey Johnny, Great post! One question. What if I already have 4 other chase business cards and need to call to shift credit to get approved for the second bus preferred. Would the agent then see that I already have one and deny me because of that? Thanks.

Hi peter, if you just call to shift your credit limit, i don’t think the agent will know your intentions (not that they’d probably care). Also, you can change your credit limit by secure message as well

I just got my second card using the EIN and SSN approach. I assume there is no good reason to keep the original card and pay the annual fee so is the recommendation just to cancel the original card when the AF is due?

Hey Bill, yes definitely no need to keep the other ink preferred. I think from best practices pov, it is advisable to downgrade the card to the no fee Ink Cash isntead of straight up canceling it. You want to have vgood standing with Chase and canceling their cards too quickly may put you in bad standing for future endeavors. This is not a fact per se, but they definitely keep track of everything. Hope that helps!

Hi Johnny,

I have a question regarding the Ink business preferred. So I got the first card using a sole proprietorship so I didn’t have a separate EIN and used my SSN. Can I send myself a referral link from the first one and apply on the second application with the same business name and just my SSN or do I need a separate EIN in order to apply again and/or get the referral bonus on the first card.

Thank you!

Hey Grant, I would not try self-referring yourself anymore. Chase is on to that now and it will probably be flagged now! This changed recently so wouldn’t try to test it.

HI Johnny,

great post! will this also work for Southwest biz cards to qualify fo CP?

also, if your tracking spreadsheet able to be saved on iphone? thanks in advance!

Hey Gie, it will not work Co branded cards unfortunately (southwest, United, Marriott etc). Only works on chase Bank specific cards (ink preferred, unlimited, cash etc).!

Also, my spreadsheet will save onto your Google docs so that can be accessed by any device

thanks! I already applied for the 2nd SW biz card and it says under review :(.. does that mean it will get denied? will it be a red flag if I apply again using my EIN for another CIBP? thanks for your input.

I think it would have to be rejected unfortunately! If you do get it approved, Lmk because that would be a huge win ha!

Johnny, can I still apply for another ink preferred on my same SSN and business name as long as I don’t refer myself? If so, could the person who referred me the first time refer me again, and could I refer a different person who I already referred from the first card?

Hey Grant, yes you can have the same person refer you it shouldn’t be problem. For the second card you need to use an EIN+SSN combo if you the first card you did was just only a SSN

Ok makes sense, is that also the case for the ink cash and unlimited? so i can basically have 1 of each of the 3 cards on just SSN and then for the second use EIN and new business name, and if i want a third pick a new business name with the existing EIN? Also, I simply used my name when I applied for the first card. if I get an EIN and use that, what is a good basic business name to use since I have already used just my full name? Thank you for all the help Johnny!

I applied for a 2nd CIP using my EIN on Dec. 12th, 2019 and activated the card on June 2nd. I self referred using the CIP I opened in September 2019. However, my referral bonus has not posted to my first CIP. It’s been two statement cycles — the 2nd statement just posted Feb 26th — and 10 weeks. Does this mean I didn’t get the self referral bonus? or is it taking its own sweet time to post?

Hi Dorothy, do you mean you activated on Jan 2? Referrals should post within 1 statement I think, at least that’s what happened for me. I think the self referral party has left the building unfortunately. I need to update the article.

Hi Johnny,

Thanks for the tip. I heard there’s some terminology that your are not eligible for the bonus offer if you’ve opened up a card in the past 24 months. Is this true? I opened up my last chase ink preferred about a year ago and wanted to get a 2nd using EIN.

Thanks

Hi Freddie, this is true. However, if you are applying with EIN+SSN on the second one, it’s considered a separate account/card so for bonus reasons, you are good to go.

Does this method only work for the Ink Preferred? Not able to get two Ink Cash or Ink Unlimited?

Hi Mateo, that’s a good question. I believe you can also do the same for all chase ink cards, just not on their cobranded biz cards like the United business or Marriott business cards.

Hi Johnny,

Thanks for the post. So I just applied for my first ever Chase Ink Card before reading this post and did get approved for it. My question is since I did use my EIN and my SSN for this first application, If I apply for the same next Chase Ink card using only SSN, do you think I can double dip the bonus like the method you mentioned?

Thanks,

Hey Andy, yes that’s exactly how to do it and you’ll be able to double dip thereafter! I’m not sure if you can still self refer though, I’ve read they are cracking down on that!

Thanks for this tip – I just got my second Ink Business Preferred card!

I do have a question. My existing Ink card is linked to my Chase login so I can transfer points from my Ink card to my Sapphire Reserve card. Can I also link my second Ink card to the same account and also transfer those points to the Sapphire Reserve?

Hi James, yes definitely should be possible to link those accoutns. If not, I would just call the customer service line and have them all connected to each other. Hope that helps!