There is no question that Chase offers the most lucrative sign on bonuses and the best credit cards in the business. In reality, it really is down to between two companies in 2019-2020, American Express and Chase. My favorite card is still the Chase Sapphire Reserve which I use on a day to day basis.

However, the Business Chase Ink Preferred offers the most lucrative sign on bonus at 100,000 points after spending $8,000 in 3 months. You can combine that with the two other business credit cards in Chase’s Ink portfolio, the Ink Unlimited and Ink Cash which are both offering a whopping 75,000 points sign on bonus. These points are some of the most valuable reward points in the business and you can redeem them for amazing business class flights or an amazing stay at a Maldives overwater villa.

What most people do not know is that you can game the system and actually apply for multiple of the same credit card as one person. Yes, this means you can apply for not one, but two Chase Ink Preferred credit cards and get 160,000 Ultimate Rewards points. Only Chase allows you to do this (AMEX does not).

I’ve used this method of hacking Chase Ink Preferred cards that I’ve obtained well into the millions of points with Chase. Don’t believe me? Check out my proof.

This post will lay out exactly how to go about doing this and proof of me doing so! This is all part of my travel hacking and credit cards guide which is lays out everything involving credit cards.

- For a list of all my credit card and travel hack related posts, click here.

- Also, read my guide on how to get both the Chase Sapphire Reserve and the Chase Sapphire Preferred cards

- If you’re planning to get into the credit card game, make sure to use my detailed credit card spreadsheet to track all of your churning!

- Follow my journey through financial independence as I retired early at 34 to travel the world.

Update Oct 2022: Chase Ink Unlimited and Chase Ink Cash have new and highest ever bonuses! Current bonus is 90,000 points after $6,000 in spend over three months.

Update Mar 2023: The 90,000 point sign on bonus for the Chase Ink Unlimited and the Chase Ink Cash will expire on March 21, 2023.

Update July 2023: The Ink Preferred has now reduced its minimum spend requirement from $15,000 in 3 months to $8,000 over 3 months. This makes it much more attractive and much easier to obtain!

Update Sep 2023: The 90,000 point sign on bonus for the Chase Ink Unlimited and Chase Ink Cash has returned!

Update Jan 2024: The Ink Unlimited and Ink Cash sign on bonus will go back to the 75,000 point mark. Still an amazing bonus for a no annual fee card.

Update June 2024: The Chase Ink Preferred sign on bonus is now a whopping 120,000 points for a limited time! This is a monster bonus and the highest I’ve ever seen. You can still sign up for this bonus using my referral links. Once you get approved, simply message Chase support and ask to be matched to the 120k sign on bonus.

Update September 2024: The Chase Ink Preferred sign on bonus has gone back down to 90k UR points. The Chase Ink Unlimited, however, is still at 90k sign on bonus with no annual fee and a smaller minimum spend making this card the no brainer.

Update January 2025: It is still possible to get many Chase Ink cards. I just applied successfully for my 9th Ink Preferred after canceling a few of the other cards I had. I do think the velocity of applications must decrease however. I would wait at least 4 months (6 months to be safe) in between applications now.

What to know about Business Credit Credit Cards

There are a few noticeable differences between personal credit cards and business credit cards. The primary difference is that the business credit card does not go onto your personal credit report. The impact on your credit score will be very minimal even if you have 5 or 10 business cards. This is especially important when applying for Chase credit cards (both personal and business) because of the Chase 5/24 rule. To better understand this rule and why Chase cards are the best credit cards, read my Chase credit cards guide.

There are many other nuances that can span multiple posts, so luckily I’ve written such a post that goes into detail about business credit cards, do you actually need a business, how it affects your credit score and more. If you have not applied for a business credit card before, make sure to read that post before continuing otherwise this may be confusing.

After reading this post, you’ll be on your way to earning enough points for a once in a lifetime stay at the Ritz Carlton Maldives or the JW Marriott Masai Mara for free!

What are the Chase Ink Business Credit Cards

Okay so now you’re a pro or at least aware of how business credit cards works. For the purpose of this post, it is to maximize taking advantage of Chase business cards so I am only focusing on the following:

- Chase Ink Preferred

- Chase Ink Unlimited

- Chase Ink Cash

- Chase Ink Premier

- Chase Sapphire Reserve for Business

I will not be talking about their personal cards with include

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Freedom

- Chase Freedom Unlimited

What do the Chase Ink cards offer? A LOT of free Ultimate Rewards points. If you’re not familiar with UR points, they are considered the most lucrative points in the game. You can use them to book travel at a discounted rated (1.5 cents per point if you hold the Chase Sapphire Reserve so 80,000 points equates to $1,200 in travel).

You can transfer them to airlines and book business class travel which is a great ROI. Alternatively, you can transfer them to hotel programs like Hyatt and stay at amazing places like the Park Hyatt Hadahaa in the Maldives.

Here are the details of Chase’s Ink portfolio and their respective sign on bonuses.

These bonuses and minimum spend requirements have changed in 2020. I’ve updated them in the below section but for the purpose of the rest of the post, ignore the points examples as they will be outdated. However, the ethos of applying for multiple Ink cards is still the same.

Chase Ink Preferred

Sign on bonus: 90,000 UR points after spending $8,000 in 3 months

Annual Fee: $95, not waived for the first year

Card Details: 3x per $1 spent on the following categories, 1x on everything else

- Travel

- Shipping purchases

- Internet, cable and phone services

- Advertising purchases made with social media sites and search engines

Chase ink Unlimited

Sign on bonus: 90,000 UR points after spending $6,000 in 3 months

Annual Fee: $0

Card Details: 1.5x per $1 spent on everything

Chase Ink Cash

Sign on bonus: 75,000 UR points after spending $9,000 in 3 months (Earn 30k after spending $3k in the first 3 months and 45k after spending additional $6k within 6 months).

Annual Fee: $0

Card Details: 5x back on office supply stores, and internet/cable/phone services, 2x back on gas stations and restaurants, 1x on everything else

Chase Ink Premier

Sign on bonus: $1,000 cash back after spending $10,000 in 3 months

Annual Fee: $195

Card Details: Unlimited 2% cash back on everything. 2.5% cash back on purchases over $5,000

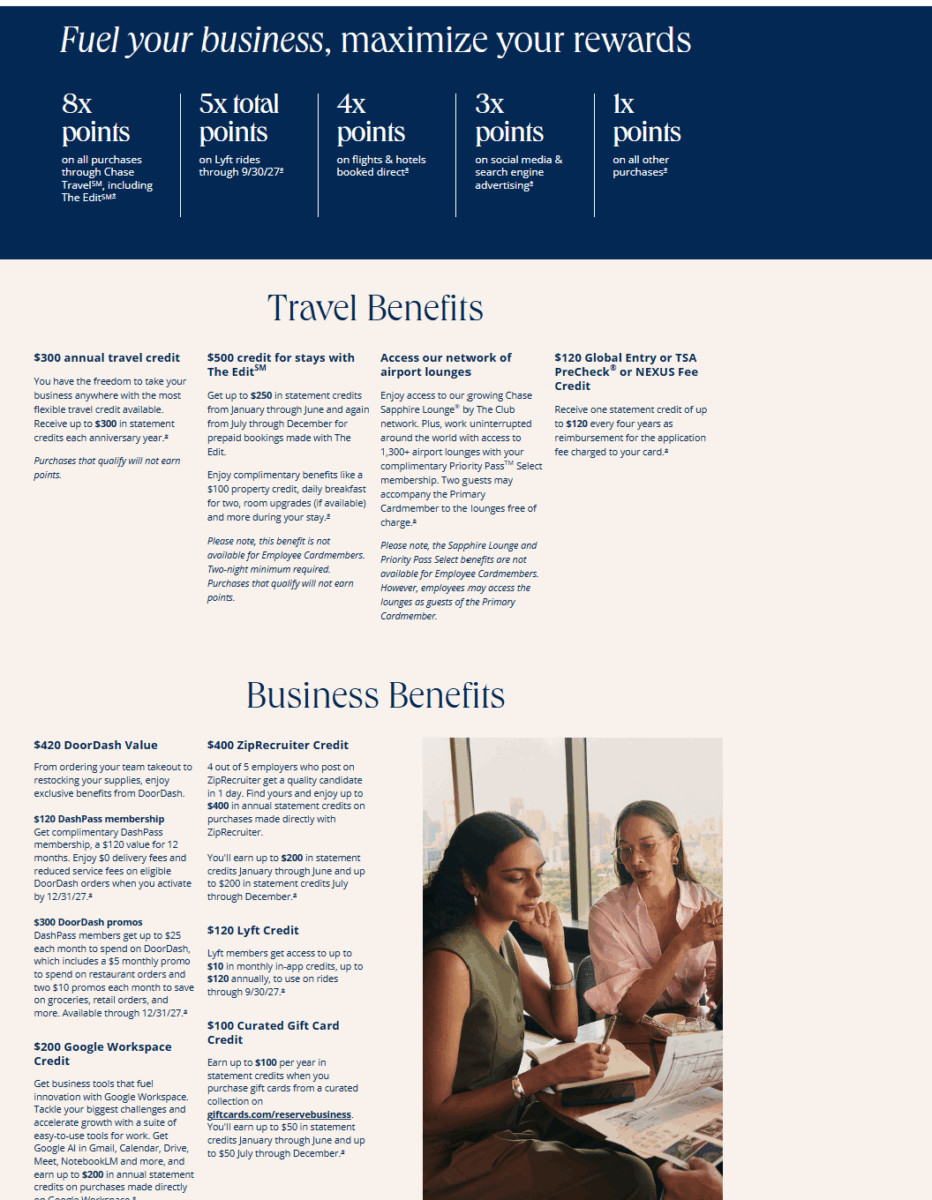

Chase Sapphire Reserve for Business

Sign on bonus: 200,000 points after spending $30k in 6 months

Annual Fee: $795

Card Details: Similar to the refreshed Chase Sapphire Reserve Personal

- 8x points on purchase through Chase Travel

- 5x points on Lyft

- 4x on flights and hotels booked directly with airline/hotel

- 3x on social media and advertising

- 1x on everything else

- $300 annual travel credit

- $500 credit for stays using The Edit hotels by Chase

- Various other coupon style credits

My Analysis of the Chase Ink Cards

The Chase Ink cards have by far the best sign on bonuses in the industry. No other cards or bank provide the same type of value when it comes to the sign on bonus. We all know that the sign on bonus is the key component to the credit card hustling game.

The Chase Ink Preferred, Ink Unlimited, Ink Cash all give UR points which can be transferred to airlines and hotels. The value you can get here can be much higher than the cash value of the points when you book business class flights. For that reason, I almost always prefer to get UR earning cards. The Ink unlimited and Ink Cash are particularly fruitful with 75k or 90k points sign on bonus depending on the time without any annual fee.

Do not be scared of the annual fee on the Ink Preferred however. The additional UR points vs the Ink Unlimited and Ink Cash will more than make up for the $95 annual fee. For example, if the Ink Preferred is offering 100,000 sign on bonus vs the Ink Unlimited at 90,000, the additional 10,000 UR points is worth more than the $95 annual fee you pay. In addition, the Ink Preferred has no FX fees which might make it substantially easier for you to reach your minimum spend requirement.

Chase Ink Premier Card

The Chase Ink Premier is a newer card that only earns cash back and does not earn UR points. The Chase Ink Premier is good if you have a legitimate business and mostly just care about cash back. It’s especially fruitful if you consistently have large expenses since you get 2.5% cash back on purchases above $5k vs 2% cash back on everything else (which is still really good). However, the bonus and the annual fee make this card less appealing to me.

Chase Sapphire Reserve For Business

Chase announced a premium level business credit card (Finally) in 2025 with the Chase Sapphire Reserve for Business. They should have just named this the Chase Ink Reserve to keep it consistent with their Ink business credit card suites.

This card is very similar to the personal Chase Sapphire Reserve that was refreshed in 2025. I wrote about why I will no longer keep the Chase Sapphire Reserve after the updates since the increased AF will be offset by numerous coupon style credits I can’t use given I live abroad.

If you are able to take advantage of these credits, it might be worth getting the premium business card to offset the $795 annual fee. However, I think the sign on bonus of 200,000 points is well worth it if you’re able to meet the minimum spend ($30k in 6 months). Even if you’re not able to maximize the credits, you’re looking at a $495 annual fee card (the $300 travel credit is good as cash).

I also view the $100 gift card credit as almost good as cash. There are enough gift card options which most people can take advantage of, lowering the effective annual fee even lower to $395.

I don’t have the spending power to get $30k done in 6 months, otherwise I would probably apply for this card (and downgrade after the first year).

How to get two chase Ink Preferred business cards

This is where the meat of the post will be so pay attention to this! For the slightly above average Joe that is into credit card churning, it is simple to apply for all three cards in Chase’s business portfolio and get approved. This means you can have all three Ink credit cards (Ink Preferred, Ink Unlimited, Ink Cash) at the same time which means you’ll have garnered a combined 100,000 + 75,000 + 75,000 = 250,000 UR points! When the Ink Unlimited and Cash are at 90,000 points sign on bonus, your total will be 280,000 UR points!

This is a lot of points for anybody.

But what if you want more?

For the pros and the greedy, this is where it gets interesting. By applying for an EIN (Employee Identification number) which is what you’ll need to start a Sole Proprietorship or LLC, you can essentially apply for the same card a second time under a different business name. This means that if you have an EIN, you can apply for the same card again by using your EIN as your Business Tax ID instead of your social security number. Chase sees this as two separate applications, and therefore two credit cards with two sign on bonuses.

Essentially, this means you can apply for two Chase Ink Preferreds for 100,000 x 2 = 200,000 sign on points, or two Chase Ink Unlimited cards for 50,000 x 2 = 100,000 points.

Confused?

Yes it certainly can be and is why I always use a spreadsheet to track all my cards. Step by step it will look like this:

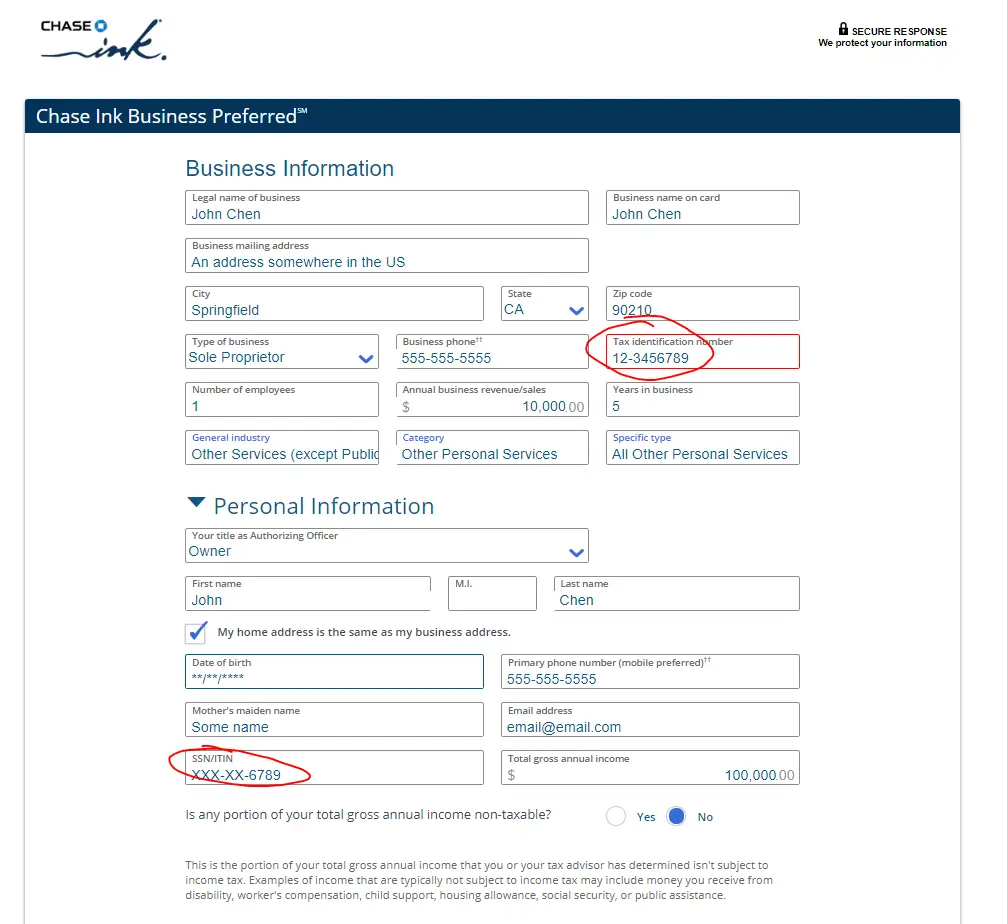

Apply for the first Ink Preferred using your SSN only

When filling out a business card application, Chase breaks the application down into two sections, one for your “business”, and the other for your personal details. On the business section, Chase will ask for your Tax ID number. The tax ID number is your EIN but you are not required to have one if you are a sole proprietorship, which is essentially doing business as yourself (think of doctors or dentists). You can use your SSN in place of your Tax ID instead. As such, for your business name, you can just put your personal name. For more details about how to fill out these applications, make sure to read my business credit card guide.

For your personal section, fill this out with your details and your SSN number as you would any other credit card application. Your business and personal sections will look quite similar in this case. This application is what we like to call the SSN application as you are only using your social security number.

I’ve filled out an application online as the following from Chase:

Apply for the second Ink Preferred using EIN and SSN

After waiting at least two months, you should be safe to apply for your second Chase Ink Preferred card. This time, you are using an actual EIN number (details on how to get one below) instead of your SSN for your business section. Whatever your business name is registered as, make sure to use that in the Business name section. You can still be a “sole proprietorship” even with an EIN so I would continue to select that as your type of business. For your personal section, keep it the same as the first card. This method is called the EIN + SSN method.

The application for the second card will look something like this:

By using your EIN on your second application, you are essentially filing a completely new application under a new business. Your personal section is still used to analyze your credit report (so if you cannot get approved for the first Chase Ink Preferred, then you will not get approved for the second) but using your EIN means you are now applying as a separate business.

Applying for an EIN

Applying for an EIN is very straight forward. Absolutely anyone can apply for an EIN and you don’t even need a real business. Perhaps you are planning to start a business, or perhaps you just think having an EIN sounds cool. Whatever the reason is, it is very easy and quick to get an EIN number from the Government.

When you’re ready, just visit the IRS website for EIN applications to apply for your own number. The application is not very complicated (just select sole proprietorship) and you should be able to get an EIN immediately after applying.

How long to wait between applications of the Chase Ink Cards

So now you’re ready to apply for multiple Chase Ink cards which is great. However, you’ll need to space out your applications because Chase has a concrete anti-churning rule called the 2/30 rule. This states that they will not issue more than 2 cards in a 30 day period. This is any two cards. So at the very minimum, wait 30 days between applications.

However, I like to wait at least 2 months to be on the safe side. This means if I applied for the Chase Ink Preferred on Jun 20, I would only apply for a second Chase Ink Preferred or a Chase Ink Unlimited from August 1 at the very earliest. I mean you’re getting thousands of dollars for free so don’t try and raise any red flags.

The standard Chase 5/24 rule also applies to this card so make sure you are not above the threshold for this rule.

Self Referring yourself to the second Ink Preferred

Currently, and this could change at any minute, you can refer a friend to the Chase Ink Preferred and receive a whopping 20,000 UR sign on bonus.

Note: This method is not advised anymore and people have reported getting accounts shut down because of this.

The pros trick is that you can actually refer yourself if you want to apply for the second Ink Preferred card since technically, you’re two entities. This means you can apply for your first Ink Preferred credit card and get the 80,000 points, refer yourself to get 20k and get another 80,000 on your second Ink Preferred.

- First Ink Preferred Card = 80,000 bonus points

- Referral bonus for referring yourself to the second card = 20,000 points

- Second Ink Preferred card = 80,000 bonus points

_______________________________________________________________ - Total = 180,000 bonus points, or at minimum $2,700 dollars towards travel!

This is exactly what I did and combined with the sign on bonus with the Ink Unlimited (just one card for now), that’s almost 250,000 UR in sign on points within a few months time!

What if I have more than one EIN?

If you already have an EIN through your Sole Proprietorship, you can get a new one through an LLC from the same IRS website. This means yes, you can essentially apply for another Chase Ink Preferred. If you have multiple EINs, technically you can apply for even more of the same cards.

While I’ve not indulged in this, I’ve read cases of people being able to get 4 or 5 Ink Preferreds for one person! This means, assuming they self referred themselves every time, they’re looking at almost a half million UR points!

A study case for another time!

Updated 2022: You can now apply for multiple Chase Ink cards with just your SSN

Yes you heard it right. You can now apply for multiple Chase Ink cards without an EIN. You can literally just use the exact same details as your first application for your second application and be approved for a new Ink card. This works for Ink Preferred, cash, and unlimited cards.

Yes I’m not joking.

I had to do a lot of research on this but plenty of people all over the internet have had success just filling out the exact same application as their first application and you are approved with a new card that has a new card number. This card will of course also be applicable for the sweet sweet sign on bonus that we’re all after.

Just follow the below steps which are the exact same steps I took to opening my third Chase Ink Preferred card.

Once you’ve signed into your existing account, you can choose your existing businesses.

Fill in the application with the same information as before and don’t deviate too much from what you’ve already done.

As you can see, I got my card with instant approval! Make sure of course to follow the guidelines above with being under the 5/24 rule and not having applied for another Chase card for at least two months.

Hi Johnny, appreciate the long post and the fact that you still reply comments! I’ve been dabbling in Chase business CCs for a few years now, and every time I need a refresher on how to do it, I come back to your post. (Also helps that your post is one of the top Google search results, haha)

It’s now December 2025 (almost 2026!) and I have heard that it’s a lot harder to get approved for multiple Chase business CCs. I currently hold a Preferred and an Unlimited, and I also have a Cash that is a downgrade from a previous Preferred (back in 2020). I intend to apply for another Cash since it was a downgrade and I didn’t get the SUB from it.

Do you think it’s still possible to be approved? And what if I wanted to get another Preferred and/or Unlimited, would I still be able to get the SUB? What has your experience been in recent times regarding multiple Ink applications? Appreciate your input as well as this post!

I enjoyed your detailed post, thank you! So nice to see the author replying to posts too!

I’m definitely late to the game when it comes to churning Chase Inks cards.

– When you churn Chase Ink cards, can you do any of the Cash, Unlimited or Preferred?

– Since I havent opened any, should I just do all 3 on my S Corp, spaced out first?

– Do you have to start your first one as a personal one or can start with my S Crop application first? Does it matter?

– Can you keep applying with the same every 3 months meaning with your EIN everytime or have to flip flop?

– Is there a certain income range you recommend putting?

Along with the above questions, also is there a page with all your card referrals to use? Trying to apply tonight

Thank you! You can simply use the existing links in the post under the card you want to apply for.

Hey Shawn, did you end up getting approved??

Hi Shawn!

So I typically apply for the Preferred card because I’m entirely abroad and my charges are all non USD. If I still lived in the USD, I would churn a combination of the three cards. If you haven’t opened any, I would just open one of each for starters to get all the sign on bonuses. Your first card can be SSN or SSN+EIN it doesn’t matter which combination you use. I used to use EIN+SSN but now I only use SSN+SSN. I have put anything from 20k to 80k in my income range but (for now), Chase doesn’t seem to care about or bother to verify.

Johnny, you’re amazing thanks for taking the time out.

Since I have never applied, can I apply to all 3 or maybe 2 back to back to take advantage of the elevated offer right now? is there a 2/30 rule on this or no

Hi Johnny,

When I applied for my first Chase Ink cash and Chase Ink unlimited cards, I used my social security number and my ein. I see now you suggest applying only using your social security number. And applying for the same card a second time, should I apply for a second of each card, but this time just use my social security number? Thanks

Yes you can use SSN for both fields and still get approved. You can also continue using EIN but i find it easier for just using SSN

Hi Johnny, can the points earned on the Chase Ink Premier card be transferred to the Chase Ink Preferred card? I am interested in applying for the Chase Ink Premier card, but I do not know if the points can only be redeemed for cash or statement credits, or if the points on Ink Premier card can be moved to my Chase Ink Preferred card or Sapphire Reserve point for maximum ROI with Chase Travel redemption?

Hi Peter the ink premier card is purely cash back and has no ultimate rewards earning whatsoever. Hope that helps!

I received my first Chase Ink Unlimited Card and Chase Ink Cash Card in 2024 (applied using SSN). Can I now apply and be approved for a 2nd Chase Ink Unlimited in 2025 and get the current 90k bonus offer? Do I need to wait 24 months between when I received the prior sign on bonus in 2024 before being eligible for another sign on bonus?

You can apply now!

Is the approval instant or is it normal for them ‘to get back to you?’

Hi Amy, def not uncommon to not be instant approved. In fact all my applications recently have been pending. Give it a few days to see what the decision is. There’s also a number you can call to manually check

Hey Johnny! My wife cancelled about 4 chase business inks cards – how long should we wait before applying? I’ve heard 3-6 months

Hi CJ, yes I think a minimum of 3 months is good to give your credit history some time to sooth things out. The ink cards are getting ahrder to approve now especially for those that have multiple!

Hi, I got approved for my 1st Chase Ink Business Preferred card last March. I then applied for the Chase Ink Buisness Unlimited in October, 2024 and got approved, and was pre-approved for the Chase Ink Cash in January, 2025 – applied for this one too. Is it ok for me to apply for a second Chase Ink Business Preferred card now? Credit Score is 746 (experian). Applied for Citi Strata and CapitalOne Spark Business in February, 2025 and got approved. Appreciate your help.

Hey Maya, since you got these cards so quickly and your last card in Jan I would wait another month or two for a second ink preferred just to be safe

Thanks for your reply. Makes sense to wait for another month. I am also over the 5/24 limit. I plan on applying with my SSN and exact same details again. Is it still worth a shot?

Yes won’t be an issue as i’ve done this a dozen times now.

[…] Build a strong business credit profile by paying on time and keeping a good credit history8 […]

Thank you for the detailed write up and thorough research.

Digesting information…

So to confirm all 3 ink cards are subject to 5/24 which means you cannot have applied for any personal credit cards anywhere else in 24 months

But…. they will give you “unlimited” bonuses and “unlimited” business cards.

Make it make sense lol

Yes that’s exsctly as it sounds and is exactly true. Many others have asked the same question on these comments 🙂

Hi Johnny do we need to pay off the initial Chase ink business card before getting another? Thank you

What do you mean pay off? Do you mean get the bonus? I would say so yes

Is it better to close old Ink cards that are a few years old before trying to apply for and get a new SUB, to avoid getting denied for low spend activity on the old Ink cards?

I don’t think it matters as long as it is not too recent of an application. If you have like 10 ink cards, then yo ushould definitely close a few but if you only have 3-4, it shouldn;’t be an issue.

A lot of good tips. Thank you! When I need to close Chase Biz cards (4), does it matter if I close them one by one or all at once?

I think one by one is probably better. Maybe wait a week or two between each card to not raise any flags.

Just got rejected because:

– too few personal credit cards (have only 2)

– business too new (created 2months ago)

On the recon line they asked me details about my business. Has to make stuff up but it didn’t work 🥲

Any advice for my next app, hopefully in a few months?

How much revenue and income do you enter ?

Very interesting. Did you use only ssn? And what kind of stuff did they ask you and what kind of things did they want to see as proof?

They just asked me more about my business, they didn’t ask for proofs.

Business was too new… I guess if I say that I have some bank statements to show the activity it could help, but us churners usually don’t have much activity lol, except if you’re into buying groups or tickets reselling

When I send myself a referral do I need to use a new email to create the new account for the new ink card?

do not self refer yourself. That is easy grounds for total shutdown.

Thanks, this is so helpful! I didn’t come across it until after receiving cards with my EIN though. Should it work to go in the opposite direction, and now use just my SS to apply again for the same card?

I’m also gathering that using my SS vs. EIN will have a greater negative impact on my credit score, is that correct?

Thank you so much!

Am I still able to refer myself to get the 40k referral bonus to open my 2nd Biz Ink Preferred card? I opened my first with SSN last year and planning to apply for my second with EIN; therefore, it would be two different business entities. I’ve read some conflicting info online/Reddit that says Chase might block my account and this is no longer allowed post-2019. Let me know if you’ve been able to do this recently and if it still works. Thanks!

Hi Christina I would not refer yourself. That’s like the universal big no no in the churning game. Maybe you might get away with one but is not worth the risk imo.

Just wanted to say thanks for the insights. Got my initial Ink about 1.5 months ago. Already hit $8k for the 120k SUB. Was wondering if I could apply again and found this blog. I’ll try to reapply in 1-2 months or so.

Yes can definitely apply again for the card again. Is also not a bad idea to go for the ink cash and unlimited first as would be even less oversight from chase on those

So what did you do with all the previous Chase Ink cards you had? Did you cancel it right before that 1 year mark to avoid paying $95 for another year?

Hi Tim, I either cancel it or i dwongrade it to a no fee ink card like the ink unlimited or the ink cash. It really just depends on how many total ink cards i have open at the moment!

Hi Johnny, thanks so much for this informative blog! Do you know if this strategy works for business bank accounts as well? Like am I able to get Chase business checking account under my EIN and one under my ssn and get a bank bonus for both accounts? Thanks!

Hi Becca, that’s a great question. I’ve never considered doing this before but it seems like a good idea. I suspect it is possible since you usually get two separate Chase logins for SSN+SSN and SSN+EIN which means there should be space for multiple business checking accounts.

I’ve not heard of others in the churning space doing this either so I suspect it is probably not a thing, otherwise people will have taken advantage of it.

Any insights on the following: Can your friend refer you to a new Ink card you already have Ink cards (2)?

Thanks!

Yes definitely possible

EIN Question-

Got rejected. I currently have 3 INKs for my business all applied for using just my SS# (Sole Prop). One card is about 3 years old but the other 2 I just received in Feb 2024 during the last INK offer. Declined for “You have too many active accounts or too much available credit” and “new business card recently opened”. I called Ink and slashed my available credit from 30K total to 12.5K total. I called Recon. Analyst said “It doesn’t make sense that you decreased your credit and now you want a new card.” I went with the – “I like to use different cards for different expenses” line but he wasn’t buying that: rejected! I have an EIN for my business that I have never used for any CC. Should I reapply using the EIN? Ty.

This has happened to me before. I think teh velocity of cards is an issue and you might just need to wait awhile to re-apply. I had a rejection after applying for a new card 2 months after a previuos card. I waited 3 months after this rejection, closed a few accounts, re-applied and was approved.

However, applying with your EIN might be the solution but I would wait a bit regardless. Prepare to have recon calls with them to explain your EIN however.

Just curious to ask the following-

So I have a chase Biz account and 3 INKs all under just my SS (same biz) – for those of u with an EIN (either same biz or different ) – do your EIN cards appear under the same login account or does chase place these cards in a different (login) account.

[ I want to know if Chase considers the EIN to be a truly separate entity even if all attached to the same SS# ]

TY!

Same thing happened to me (applied for CIP on July 17). I’ve closed some cards across all my card/issuers and lowered credit limits. Will give it 4-6 weeks to flow to credit agencies and will try again with EIN this time. Fingers crossed. I had high velocity with INK cards in 2023 (4 cards) but have been denied every time I applied in 2024 (3 times every 3 months or so). Hoping to get 120k CIP + 4ok P2 referral before it expires on Sep 3.

Is getting a second of the same Ink card on just your SSN, using the same business, still valid in 2024?

yes stll good

What date should I put when applying for EIN? I’ve seen guidance to say business has been doing business for 2 years when applying on Chase.

I usually put like 2014 or so which is when I started the blog.