I’ve been actively churning credit card points for the better part of a decade now and I’ve learned so many things along the way. One of those things is how to obtain an insane amount of credit card points quickly. I was recently able to amass over a million Chase Ultimate Reward points simply by churning Chase Ink cards over and over.

You might be skeptical, and you wouldn’t be the first, but this post will detail exactly how I was able to amass so many points. A million Chase UR points is worth at a minimum $10,000 in cash, and $15,000 in travel bookings if you use the Chase travel portal (Assuming you have the Sapphire Reserve which I of course do). Better yet, a million points can be used much more lucratively to book super luxury hotels or business class flights, which I did.

If you haven’t read my other posts about travel hacking, make sure to browse my posts to enhance your knowledge!

Chase Ink Business Credit Cards

For starters, let’s go over my favorite Chase cards which are from its business suite. I have the Chase personal cards as well including the Chase Sapphire Reserve, Freedom Cash Flex, and Freedom Unlimited. However, I obtained these cards many years ago however, so earnings points quickly from sign on bonuses is no longer an option since I’ve already done it.

For the purpose of this post, it is to maximize taking advantage of Chase business cards so I am only focusing on the following:

- Chase Ink Preferred

- Chase Ink Unlimited

- Chase Ink Cash

- Chase Ink Premier

I will not be talking about their personal cards with include

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Freedom

- Chase Freedom Unlimited

What do the Chase Ink cards offer? A LOT of free Ultimate Rewards points. If you’re not familiar with UR points, they are considered the most lucrative points in the game. You can use them to book travel at a discounted rated (1.5 cents per point if you hold the Chase Sapphire Reserve so 80,000 points equates to $1,200 in travel).

You can transfer them to airlines and book business class travel which is a great ROI. Alternatively, you can transfer them to hotel programs like Hyatt and stay at amazing places like the Park Hyatt Hadahaa in the Maldives.

Here are the details of Chase’s Ink portfolio and their respective sign on bonuses.

Chase Ink Preferred

Sign on bonus: 90,000 UR points after spending $8,000 in 3 months

Annual Fee: $95, not waived for the first year

Card Details: 3x per $1 spent on the following categories, 1x on everything else

- Travel

- Shipping purchases

- Internet, cable and phone services

- Advertising purchases made with social media sites and search engines

Chase ink Unlimited

Sign on bonus: 90,000 UR points after spending $6,000 in 3 months

Annual Fee: $0

Card Details: 1.5x per $1 spent on everything

Chase Ink Cash

Sign on bonus: 75,000 UR points after spending $9,000 in 3 months (Earn 30k after spending $3k in the first 3 months and 45k after spending additional $6k within 6 months).

Annual Fee: $0

Card Details: 5x back on office supply stores, and internet/cable/phone services, 2x back on gas stations and restaurants, 1x on everything else

Chase Ink Premier

Sign on bonus: $1,000 cash back after spending $10,000 in 3 months

Annual Fee: $195

Card Details: Unlimited 2% cash back on everything. 2.5% cash back on purchases over $5,000

What Do You Need To Replicate My Million point strategy?

I hate selling pipe dreams and saying that anyone can get a million Chase UR points easily. It takes a bit of work and time so if you think it’s too much of a hassle to get credit card points, this is not for you. However, if you’ve read this far, you’re probably keen to know if you could pull it off.

There are a few things you’ll need to get a million Chase UR points.

- Excellent Credit Score – You’ll need at least a 740 credit score to safely open Chase Ink cards

- Spending power – You need to be able to spend at least $8,000 within 3 months as that is the requirement to get the sign on bonus for the Chase Ink Preferred. This shouldn’t be so hard in today’s inflation driven world

- Patience – You can’t get a million points quickly. This is not a get rich quick scheme. However, I managed to do it in about 1.5y which I think is quite reasonable for so many points!

- A partner in crime – Your journey to a million Chase points will be sped up if you have a partner who will also join in on the fun with you. Chase has a referral program where you can earn 20,000 (40,000 in 2024) points when you refer someone else to the Chase business cards. More details on how to game this in the sections below.

- 5/24 rule: You’ll need to satisfy the Chase 5/24 rule which states that you have not applied for 5 or more personal credit cards within the last 24 months. The Chase Ink credit cards do not count to towards this as they are business cards.

If you have these things satisfied, you are in a good position to obtaining a million Chase points yourself.

Why are Chase Ultimate Reward points so valuable?

Chase Ultimate Reward points (UR points) are in my opinion the best credit card points system around. The value and versatility you get from UR points is unmatched versus AMEX, Citi, and Capitalone in my opinion. Of course, there are certain transfer partners that other banks have that Chase does not, so your own experiences will vary depending on which airline/hotel you value the most. However, in the broader picture, I think Chase points are the best.

Using Chase UR points

Chase UR points can be used in a variety of ways.

- Redeem for cash

- Redeem for travel with a 50% bonus

- Transfer to airlines and hotel programs

For starters, the worst redemption for UR points is to cash them out. You will get a 1c to 1 point redemption value. 10,000 UR points would be $100 USD.

This is alright if you need cold hard cash, but there are better uses of the points.

The 2nd most useful redemption is to redeem UR points for travel on the Chase Travel Portal. In this travel engine, you can search for flights, hotels, car rentals etc. using Chase’s travel agent, Expedia. The prices on this search engine aren’t often the best you’ll find on the internet but you are able to use your UR points at a 50% premium when redeeming. That means a $1,000 flight on the Chase travel portal will be 66k UR points as opposed to 100k UR points if you redeemed it for cash.

Finally, the most optimal way of redeeming Chase points is by transferring to its partners. Chase has many airlines and hotels that it partners with and you can transfer Chase UR points at a 1:1 ratio for many of the programs. This means with 10,000 UR points, you can get 10,000 Singapore miles, or United Miles, etc.

Often times, Chase will even run a transfer bonus to programs like Marriott where you can get a 50% bonus. This has come in really handy for when I want to book a stay at the Ritz Carlton Maldive

The list of Chase transfer partners is ample and you can get some very good redemptions with these travel programs when you want to fly business class.

How I obtained a million Chase UR points

Now onto the good stuff!

I was able to obtain a million Chase UR points over the course of a few years by simply churning Chase Ink credit cards.

The secret is that you can obtain multiple Chase ink credit cards using the same business information without issue as I’ve written in great detail about. Yes, this is exactly what it means. You can apply for multiple Chase Ink Preferred cards using your social security number without issue. I’ve applied for 6 Ink Preferreds over the past few years and have been approved!s

Don’t believe me? Look at my Chase Banking App and see how many Ink cards I have.

For the purpose of this blog post, I’ll walk through exactly the timeline of how I obtained so many points.

This table starts from January 2023 and ends in May of 2025. As a caveat, I already have the Chase Sapphire Reserve, Freedom Flex, and Freedom Unlimited personal cards. Even before I started hustling Chase Ink cards, I already had hundreds of thousands of points from previous hustles.

| Date | Card | Strategy | Bonus Pts. Earned | Regular Pts Earned | Total Pts |

|---|---|---|---|---|---|

| Jan 2023 | Ink Preferred | #1 | 100,000 | 25,000 | 125,000 |

| Mar 2023 | Ink Unlimited | #1 | 90,000 | 10,000 | 225,000 |

| Jun 2023 | Ink Cash | #1 | 75,000 | 7,000 | 307,000 |

| Jul 2023 | CC Referral | #1 | 40,000 | 347,000 | |

| August 2023 | CC Referral | #2 | 40,000 | 387,000 | |

| Jun to Dec 2023 | Regular Spend | 30,000 | 417,000 | ||

| Dec 2023 | Ink Preferred | #2 | 100,000 | 20,000 | 537,000 |

| Dec 2023 | CC Referral | #3 | 40,000 | 577,000 | |

| Apr 2024 | Ink Preferred | #3 | 100,000 | 20,000 | 697,000 |

| May 2024 | CC Referral | #4 | 40,000 | 737,000 | |

| Aug 2024 | Ink Preferred | #4 | 100,000 | 20,000 | 857,000 |

| Nov 24 – Feb 25 | Regular Spend | 25,000 | 882,000 | ||

| Mar 2025 | Ink Preferred | #5 | 100,000 | 20,000 | 1,020,000 |

In order to interpret this table, let me explain what’s going on. Over the course of 2 years, I opened multiple Chase ink cards and I pocketed the sign on bonus each time. Because you can open multiple chase ink cards, this accumulation can snowball quickly.

I organized this table to reflect the exact timeline of when and which card I accumulated. The “Bonus points earned” column is the sign on bonus for that card. For example, the Chase Ink Preferred was offering 100,000 UR points for all of 2022-2024 while the Chase Ink Unlimited was offering 90k for some time.

The “Regular Spend” column is the points accumulated from just spending normally. In order to get the sign on bonus for a card like the Ink Preferred, I needed to spend $8,000 within three months. As the Ink card earned 3x on travel, I was often times able to collect around 20,000 UR points just on my way to satisfying the minimum spend requirement.

I would simply repeat this process every 3-4 months with opening a new card. For me to spend $8,000, it would often times take me 2-3 months. There were a few periods where I did not have any new cards opened and had no sign on bonuses I was chasing. During these times, I would simply spend on my Chase Sapphire Reserve for my day to day expenses and I would accumulate something like 5-10k points a month.

Chase Ink Referral Bonuses

For all of 2023 and 2024, Chase was offering a 40,000 points referral bonus on Chase Ink Cards. I take full advantage of this and referred as many people as I could. As a caveat, I will say that I earned quite a few sign on bonuses because I put the referral link on my blog and many people used it to sign up for cards.

Most people do not have this luxury of a highly functional travel blog to juice up their points earning. The next best thing is simply to use your partner. If you have a wife, husband, boyfriend, or girlfriend, this is the perfect way to earn more points simply by referring them.

If you refer your partner to the Ink Preferred, they would earn a 100,000 sign on bonus and you would pocket the 40,000. A few months later, they could refer you to another Ink card and they’ll earn 40,000 points while you earn the 100,000 sign on bonus. This snowballs very quickly if you have the right setup. I made sure to refer my family and friends on multiple occasions. This helped me earn something like almost 10 sign on bonuses just from people I knew.

Sadly in 2025, this referral bonus went back to its usual 20,000. This is still quite a large referral bonus however and certainly worth referring partners and friends.

How I spent my 1 million miles?

Amassing credit card points is a game in and of itself but what fun is just accumulating points without reaping the benefits?

A million Chase UR points is a treasure trove of possibilities and I know exactly how I would take advantage. While I’ve not used all my million points, I’ve certainly used quite a few of them already.

Business class flights

I’m a big fan of flying long haul business class because it is just uncomparable to a coach experience, especially on the right airlines.

On our recent trip to Australia and New Zealand’s South Island, we flew business class for the whole family on Singapore Airlines. SQ Business is one of the best in the world and it’s easy to see why. From the comfortable seats, to the amazing food, to the wonderful stewardesses that took care of our baby while we enjoyed our champagne, it was unmatched.

From Singapore to Sydney, we found flights for 55k SQ miles one way on business class for a total of 110k miles for two. As we had an infant, we were able to easily add her to the booking by calling their customer service line. We paid 10% of the base fare (about $250).

From Auckland, we flew to Cape Town which was one of the best use of miles out there. For 75k miles per person, we had a 10h flight from Auckland to Singapore and another 12h flight to Cape Town. This was an absolute game changer when traveling with a baby!

Total Chase points spent:

Singapore to Sydney Business class: 55,000 x 2 = 110,000

Auckland to Cape Town Business class: 75,000 x 2 = 150,000

Total: 260,000 pts

High End Hotel Redemptions

My favorite use of Chase UR points is to redeem it at ultra luxury properties on Hyatt and Marriott.

Chase UR transfers 1 to 1 with Hyatt as well as Marriott. Chase runs multiple times a year a 50% bonus transfer to Marriott so you can get 1 UR to 1.5 Marriott points. When you redeem points for Marriott, you get the 5th night free if you book 4 nights which makes it even more valuable.

I redeem these points exclusively on stays in the Maldives as I find the points to return the most value when paying for the hotels there.

As an example, the Ritz Carlton Maldives is probably the most beautiful hotel I’ve ever stayed in. It generally costs somewhere around $3,000 USD a night and something like 125,000 Bonvoy points.

However, if you book 4 nights, you get the 5th night free so it works out to be about 100,000 Bonvoy points for a $3,000 a night hotel. This comes out to be about 3 cents per Bonvoy point which is very good in my opinion. If you transferred Chase UR points with the 50% bonus, you’ll essentially get 4.5 cents per 1 UR point which is ridiculous.

I recently went to the Ritz Maldives for a second time which was still the most beautiful property I’ve seen. I booked two rooms for us and my inlaws as it’s something they’ve never experienced before. I transferred Chase UR points to Marriott when Chase was running a 50% transfer bonus and ended up transferring 600,000 UR points. This netted me 900,000 Marriott points which was enough to book 2 rooms for 5 nights (total value of around $30,000).

What about other points programs?

I’ve written exclusively about the Chase points ecosystem and how I was able to get so many points from purely opening new credit cards.

What about the other banks out there? American Express, Citibank, CapitalOne, Wells Fargo, and USBank all have credit cards that they offer with solid points potential.

AMEX points transfer to even more partners than Chase and CapitalOne has a very solid portfolio of transfer partners as well. Earning points from regular spend is not as easy as with Chase (the 3x travel/restaurants on the Sapphire Reserve really is a game changer) but you can still get points quickly if you have the right combination of cards.

Nothing as lucrative as the Chase Ink

The problem with AMEX, CapitalOne, and Citibank cards is that you are not able to open multiple cards of the same card. AMEX has great sign on bonuses with their business cards like the AMEX Gold Business and AMEX Platinum Business. The problem is that you are not able to open multiple iterations of these cards like you can with the Chase Ink.

It’s simply one and done.

I’ve earned 150,000 AMEX MR points on the Gold Business card before but I have no way of earning more cards from a sign on bonus. I could open the Platinum Business but for a $695 annual fee, I don’t really find it worthwhile to chase the sign on bonus when the annual fee is that high.

Hi, is the churning Chase Ink business cards strategy now over? I saw the added a new bonus restriction? I was going to apply but not curious. Please let me know!

Great post.

What requirements are there re: having a business? What would have to be provided to Chase in order to apply for a business credit card?

Thanks!!

There really are no requirements! They don’t ask you for anything as far as proving your business exists or any tax documents. They just ask you how much revenue you make bring in per year and your monthly estimated expenses.

So, can you explain how you get the same card over and over? You get an Ink Preferred in Jan 2023, Dec 2023, April 2024 and Aug 2024? Are you saying you used the same SS# each time? (“You can apply for multiple Chase Ink Preferred cards using your social security number without issue. I’ve applied for 6 Ink Preferreds”) Do you cancel the cards? Are you using/claiming multiple businesses? What do your numbered Strategies mean?

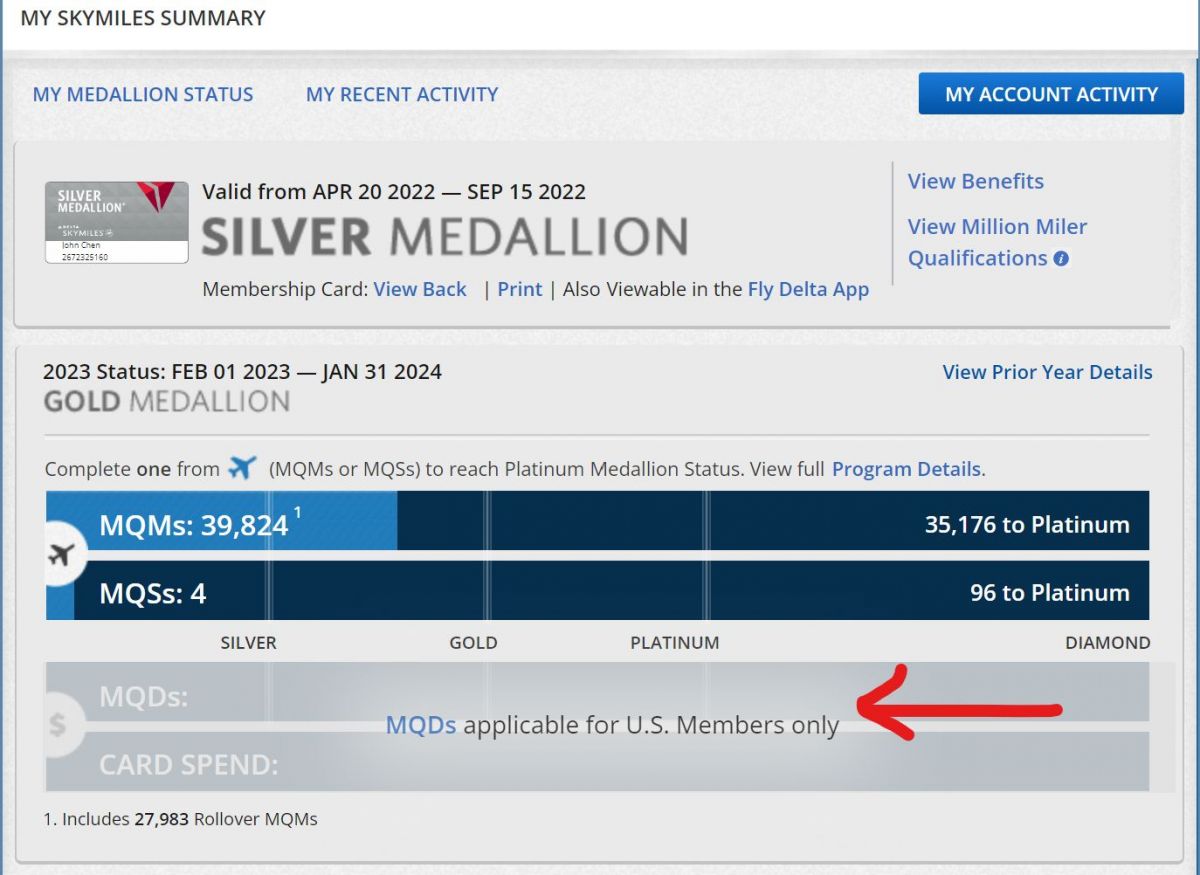

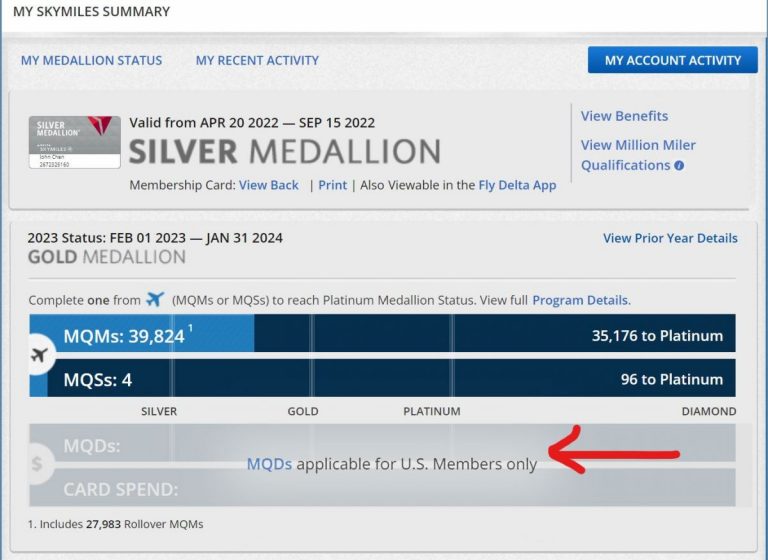

No you can literally open the same card multiple times. There’s nothing fancy about it. It’s just how it is. Look at the screenshot of my chase bank account for proof