Buying a car in Singapore is a very confusing and convoluted process. If you don’t already know, Singapore is the most expensive country in the world to own a car and it’s not even close. That’s because the Government of Singapore imposes steep taxes and fees for the right to own a car that you won’t find anywhere else in the world. As an expat in Singapore, I found the process of buying a car very confusing with so many acronyms and concepts that I could never have imagined.

This post will go into detail on exactly what these confusing concepts mean and how to best understand them. The main things I will discuss on this post are what COE (Certificate of Entitlement) and ARF (Additional Road Fee) mean, as well as why they are more confusing than they appear. Full disclosure, I do not own a car in Singapore as I think it is totally pointless and stupid (more on that later) but that doesn’t mean I am not acutely interested in how things work in my adopted home.

Do you need a car in Singapore?

YOU DO NOT NEED A CAR IN SINGAPORE. There, I said it. You can read a very in depth post about why you don’t need a car in Singapore that I’ve written. This city is not big and the public transportation thoroughly connects the city with very low fares. If you really need to get somewhere fast, a Grab or taxi will do the job and they are much cheaper in comparison to other expensive cities like New York or London. In fact, for the price of owning a basic car, I could take a Grab to the Airport and back TWICE every single day of the month and still pay less than owning a car.

While traffic is almost non-existent in Singapore, driving is a bit of a boring experience. This is because you’re confined to a space as small as Singapore so there really is nowhere to go. If you were thinking of taking beautiful road trips like you can through the German countryside, think again. The only place you can drive to from Singapore is Malaysia. There is nowhere worth going to that is within driving distance in Malaysia.

Sure, you could drive to the 10 hours to a place like Penang but is it really worth it when you could just fly in 1 hour. You are certainly not going to pass through beautiful wine regions like the Mosel Valley, quaint villages like Beaunne in Burgandy, and surely no castles or historical fortresses to look at.

For that fact, there really is no point to own a car in Singapore. Not only is it prohibitively expensive which we will get into later, but there is nothing to actually drive to. If you’re planning to get a nicer car, keep in mind you’ll go no faster than 80-90km/h on average. You might be able to hit 100 km/h during the weekend with no traffic on small stretches of the road.

Singaporeans are obsessed with cars

If you talk to most Singaporeans, they either own a car or have aspirations to own a car. It’s a concept that really befuddles me because I’ve lived in so many different cities of Singapore’s size (and larger) and car ownership was always seen as a detriment and a pointless asset.

Singaporeans are trained from a young age to believe that home ownership and car ownership and some of the fundamental building blocks to a successful life. This is not so unlike many other countries in the world; the only difference is you don’t actually need a car in Singapore.

Public transportation is very comprehensive, cheap, and efficient. Grab taxis are also very cheap in comparison to other rich countries. Distances aren’t very far as the city isn’t that big so walking is also another option. In short, there are plenty of viable and affordable alternatives to owning a car. We won’t even begin to talk about the inconvenience of paying for parking or driving drunk from a night out.

Nevertheless, Singaporeans are all convinced they need to have a car to get around their relatively small city and the other forms of transportation are not enough (they really need to spend a few years in New York to understand what bad transportation is). Therefore, they’ll need to fork out at least $1.5k – $2.5k a month for the privilege of owning a car they will rarely use. More details on that later.

What are the main terms to understand when buying a car in Singapore

There are many different terms to understand when it comes to owning a car in Singapore. I will go into detail about each individual item as well.

OMV: Open Market Value – What the car actually costs at the point of importing into Singapore

COE: Certificate of Entitlement – a certificate that actually allows you to own a car. This is not the same as a drivers license.

ARF: Additional Registration Fee: A tax on the price of the car to be paid in order to purchase a car in Singapore.

In addition to these costs, there are also things like road tax and ERF which are things you must pay for but they are relatively insignificant in costs comaared to the COE and ARF.

What is OMV?

OMV stands for “Open Market Value”. This value is assessed by Singaporean customs and is based on the actual price of the car when it’s sold for export. This is the ACTUAL price of the car and the price you’ll pay in most other parts of the world that don’t have the extra taxes that a place like Singapore does. OMV is an integral concept to understand because it is the basis for the next section, the ARF.

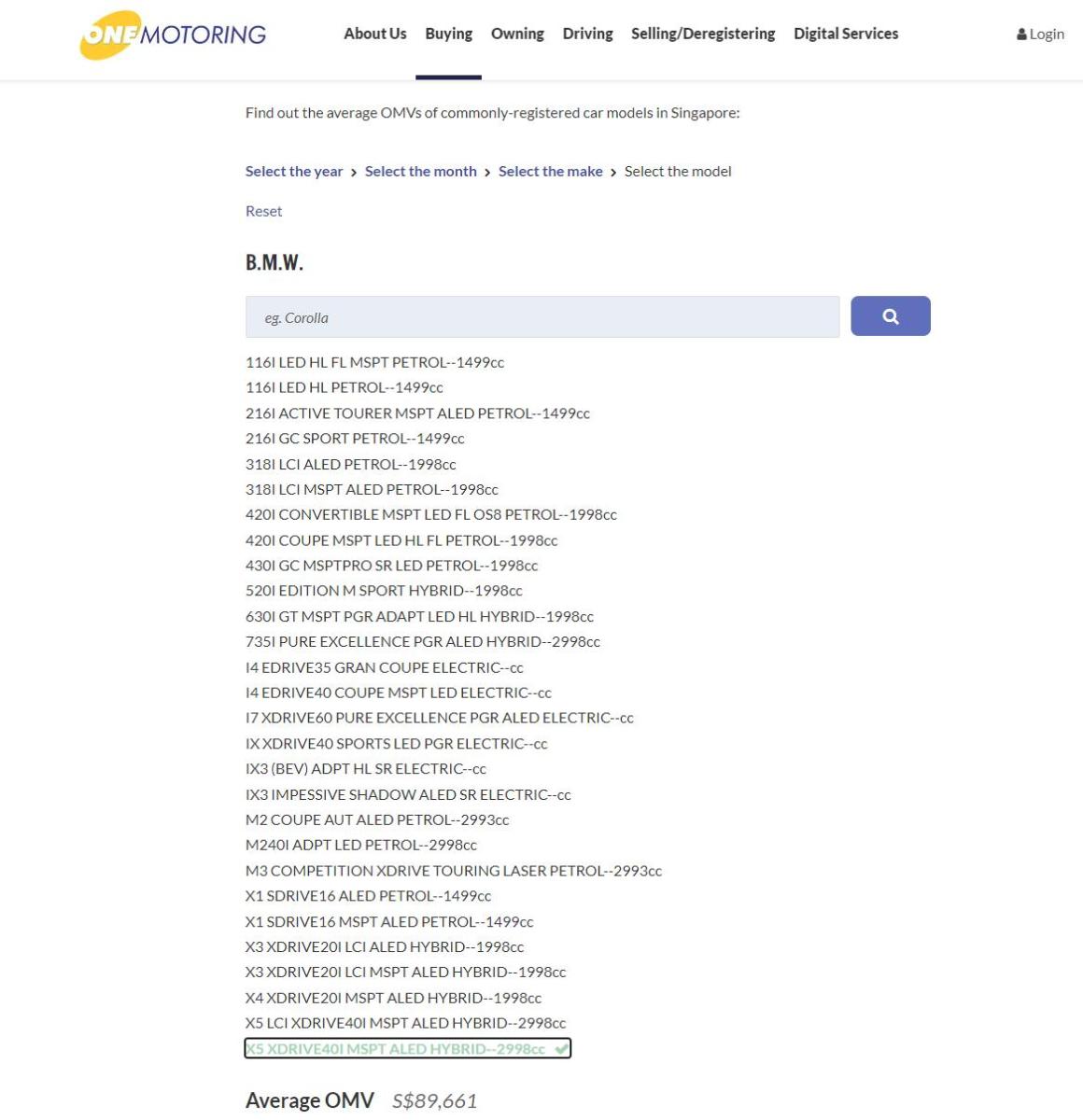

To find the OMV, simply visit the official Singaporean motor website which has the price for all cars based on year and model. As an example, if you want to check the price of a 2023 BMW X5, you can simply navigate using the interface and find your OMV like the screenshot below.

What is COE for Singapore Cars?

COE, which stands for Certificate of Entitlement gives you the legal right to drive in Singapore. The COE was designed in the early 2000s as a way to limit the amount of cars on the road by introducing a cap on the number of “certificates” the Government allows at one time.

These certificates are then auctioned off on the open market based on the prices people are willing to pay. To grossly simplify, the COE is entirely based on supply and demand which is why you’ll see correlation between COE prices and the general state of the economy. Prices post pandemic have skyrocketed to a whopping $140,000 for a category B car in September 2023.

Prices for COE are updated once a month depending on the outcome of the auction. Prices can increase or decrease based on market factors and you can see the trend of the COE prices in the chart below.

Different categories of COE

There are different categories of cars in Singapore and a COE price dependent on this category.

Category A: Cars under 1,600 cc engine

Category B: Cars over 1,600cc

Category C: Goods and services vehicles

Category E: Open category

As you can see, Category A and B have steep price differences which is why many people drive smaller cars with a smaller 1,600cc engine. Many cars that would otherwise be over 1,600cc in the rest of the world have been retrofitted to satisfy Singapore standards so they can be sold with a Cat A COE.

COE is only for 10 years at a time

COE certificates are sold with a 10y life span. At the end of the 10 years, you can either scrap your car (sell it or just tear it down) or buy a new COE at the market rate in 10 years. The COE price is locked in for 10 years at the initial date of purchase. COE is not sold separately and is always sold together with the car as a bundled up package. This means you do not buy a car and then buy a COE separately.

COEs can not be resold on the open market as they are completely tied to the specific car you bought it for.

What is ARF for Singapore cars?

ARF, which stands for Additional Registration Fee is the other most important concept to understand when it comes to owning a car in Singapore. The ARF is essentially a progressive tax based on the OMV (Open market value) of your car. This is not the same as the COE which albeit is an extra cost you must bear, it is not considered as a tax. The ARF is my all intents and purposes a tax.

The ARF has a progressive tax structure based on how expensive your car is. The tax increases the more expensive the car is. As you can see from table below, these are the most recent rates as of 2023 and beyond.

| Vehicle OMV (Open Market Value) | ARF Rate (% of OMV) |

| First $20,000 | 100% |

| Next $20,000 (i.e. $20,001 to $40,000) | 140% |

| Next $20,000 (i.e. $40,001 to $60,000) | 190% |

| Next $20,000 (i.e. $60,001 to $80,000) | 250% |

| Above $80,000 (i.e. $80,001 and above) | 320% |

ARF of a $20,000 car in Singapore

As an example, a $20,000 OMV car will have an ARF of $20,000. This means you must pay the price of the car (the OMV) AND the ARF on top of it which results in a final price of $40,000. Again, this is excluding the COE.

ARF of a $80,000 car in Singapore

If you’re looking at a high end car that costs $80,000 OMV, your ARF will be calculated as the following:

Up to 20,000: $20,000

20,000 to $40,000: $20,000 * 140% = $28,000

40,000 to $60,000: $20,000 * 190% = $38,000

60,000 to $80,000: $20,000 * 250% = $50,000

This means your Total ARF for a $80,000 car is $20,000 + $28000 + 38000 + $50000 = $136,000

Yes this means for a $80,000 car, your additional tax is $136,000 which makes the total price before COE at $216,000! This is almost 3x the original price of your car!

Here are the calculations using the table above to illustrate the process.

| Vehicle OMV (Open Market Value) | ARF Rate (% of OMV) | ARF Amount |

| First $20,000 | 100% | $20,000 |

| Next $20,000 (i.e. $20,001 to $40,000) | 140% | $28,000 |

| Next $20,000 (i.e. $40,001 to $60,000) | 190% | $38,000 |

| Next $20,000 (i.e. $60,001 to $80,000) | 250% | $50,000 |

| Above $80,000 (i.e. $80,001 and above) | 320% | $0 |

| Total ARF | $136,000 |

Why do they have COE and ARF in Singapore?

As an foreigner looking at Singapore’s car market, you might ask yourself why do they make it so prohibitively expensive to buy a car? Surely it can’t make sense to make people pay a price that is 4x what it is in the rest of the world?

Well, you would be surprised but it actually makes a lot of sense. Singapore is a small city state with a finite amount of land. It has only 728 square km of land to call home with 5.5 million people. In addition to places like the port and airport, much of this land is dedicated to life improving things like parks and rainforests. You’re leftover with maybe half of that land for its people. That means you’re looking at a population density of something like 15,000.

Because Singapore has become such a rich country over recent years, everyone now has more than enough money to buy a car at the market rate. However, if everyone started driving in such a confined space like Singapore, the traffic and air pollution of the country would be absolutely abysmal. It would probably be worse than places like Bangkok or Jakarta. The Government knows all of this which is why it forcefully limits the amount of cars on the road with their COE system. Not only does this make driving more pleasant, but also has vast environmental benefits. It essentially forces people with less money out of the car ownership market to limit the amount of cars on the road.

Traffic is almost non-existent in Singapore

That is ultimately why the traffic in Singapore is almost non-existent when it compares to other major cities in the world. The estimated time to destination on Google Maps is actually always the real number. For example, the drive from the CBD to the airport is a brisk 20 minutes at most times of the day. During rush hour, you are looking at 25 or 30 minutes max. Talk about a great standard of life!

A tax on the super rich

Singapore’s ARF and COE are also one of the few methods the Government uses to tax the rich. Because income taxes are so low, the Government uses ARF not only as a way to limit the amount of cars on the road, but to also collect substantial tax revenues.

An example of this are super cars like Lamborghinis. A Lamborghini in Singapore costs roughly $1.5 – $2m SGD to purchase. 80% of this cost is due to COE and ARF which all goes to the Government. The Singaporean Government views these things as luxury and discretionary items that you don’t really need so why not tax it? As long as you don’t call it an income tax, no one will complain.

How much does a car cost in Singapore?

So after putting all these numbers together, how much does buying a car in Singapore actually cost?

Let’s start by breaking out the individual prices and taxes that are invovled with buying a car in Singapore. The basic formula for buying a car in Singapore is the following:

OMV + ARF + COE = Final Singapore Car Price

Let’s take an example of the $20,000 and how much this will cost in Singapore. For this example, we’ll assume the car is below 1,600cc and therefore is eligible for the cheaper category A COE. As we calculated via the ARF table already, a $20,000 OMV car will have an ARF of 100%, which is $20,000. That means the total price is

$20,000 (OMV) + $20,000 (ARF) + $100,000 = $140,000 final price.

This means a very cheap $20,000 car will be at minimum $140,000 in Singapore! That is 7x the price of this car if you bought it in pretty much any other country in the world. If the car is over 1,600 cc, then the COE will be category B and therefore cost $140,000. The price will therefore me

$20,000 (OMV) + $20,000 (ARF) + $140,000 = $180,000 final price.

If your car has an OMV of $80,000, then the calculation is the following. A car of this price will almost always have a category B COE.

$80,000 (OMV) + $136,000 (ARF) + $140,000 (COE) = $356,000 final price!

That means an $80,000 car could buy a very nice villa in Bali!

Finally, just for the hell of it, let’s see what the price would be for a Ferrari F8 Spyder. The OMV is $325,000 per the Singaporean website. Using the ARF table in the previous section, the ARF is around $920,000. Therefore the car price is

$325,000 (OMV) + $920,000 (ARF) + $140,000 (COE) = $1,385,000 final price.

Yes, the final price for a Ferrari in Singapore is $1.4m!! That is over a million US dollars on a single car. It really is that insane in Singapore. For the cost of buying a BMW 3 series in Singapore, you could purchase a Ferrari in any other country for the same price.

Car prices are always quoted as an “all-in” price

When you look for cars to purchase in Singapore whether it’s on Facebook Marketplace, Carousell, or SGCarmart, prices are always quoted in the all-in price. There is no distinction between OMV, ARF, or COE.

If you are financing this car (which most people do because it’s the price of a small apartment), the financing is done on the all in price. A typical loan on a car in Singapore is 30% down and 70% financing. If your all in cost is $150,000, you will need to shell out $45,000 in cash and you can finance the rest. Car loans can go up to 10 years in term length.

Using the example above, a 10y $105,000 loan with a 3% interest rate will mean your monthly payments will be $1,140 per month. You’ll also need to add in other factors like road taxes, ERP, and car insurance which will add up to an additional $300 or so meaning you can expect to pay about $1,500 a month for the cheapest car in Singapore. This is after already forking out $45,000 as a down payment which would already buy you a very nice car in the rest of the world.

Why owning a car is financially very stupid

Well if you can’t see from the above example why owning a car is financially stupid, then you need to go read about how I became financially independent at 34. If you have the cash and an extra $2-3k a month is insignificant, go for it. Otherwise, if you’re stretching yourself and don’t have the spare cash in your budget, know that owning a car is a completely luxury item that is not necessary to survive in this city. You are not in Los Angeles where public tranportation is next to non-existent and distances between everything is super far!