September 2025 showed that the Bull market was eternal with no bears in sight. Even the smallest dip of 1% or was bought up before market close and the month closed with almost no down days for the month. Even a Government shutdown at the end of the month did not deter the market as things were bought up promptly. The Nasdaq is above its 50d moving average for the most amount of days since the COVID recovery

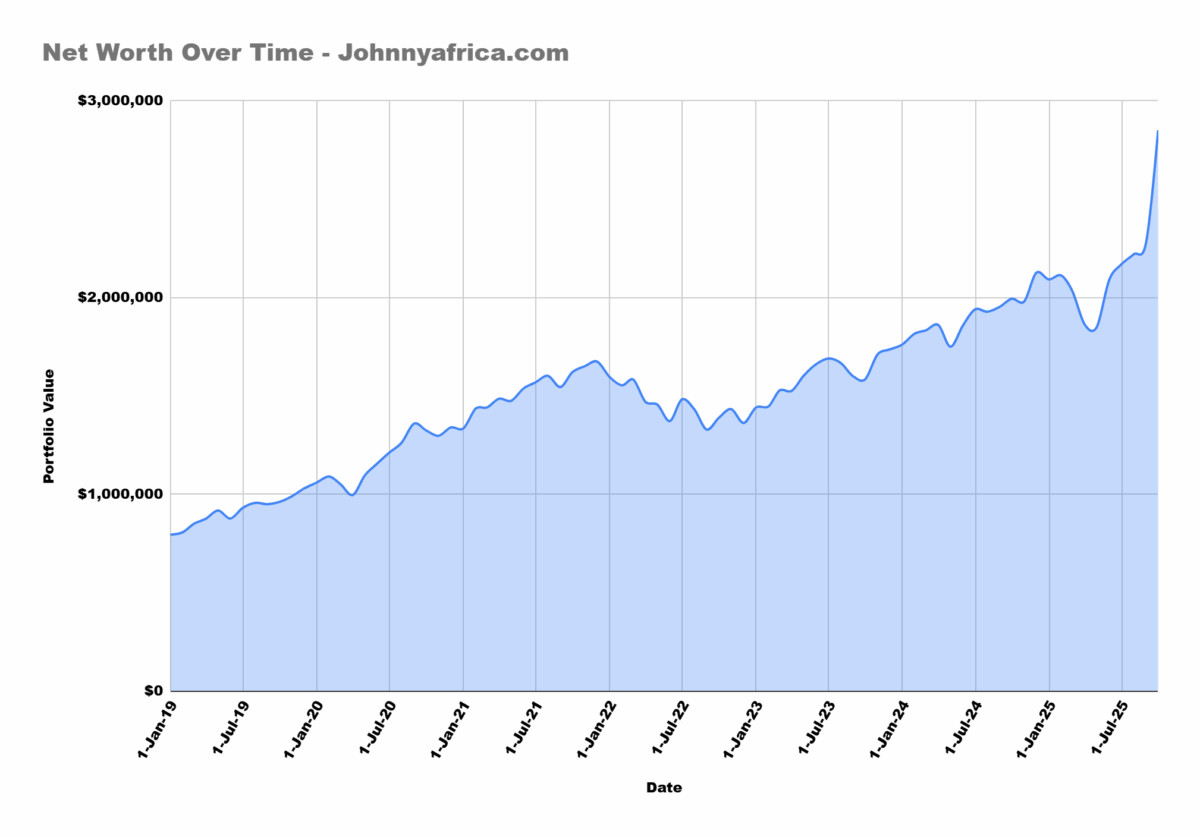

If you haven’t already read my posts before, I achieved Financial independence back in late 2020 early 2021 with a portfolio of roughly $1.3m invested in mainly ETFs. This ballooned to $1.7m during the peak of the markets in early 2022 before coming back down to Earth later in 2022. The portfolio has since regained new all time highs as markets rally beyond the previous highs.

This post will be part of a monthly series of portfolio updates that summarizes how my portfolio performed, what trades I executed, what my monthly expenses were, and my general outlook on the economy/markets. This is by no means financial advice so do not look look at me for sage advice. I make stupid trades and make even worse losses quite frequently.

This is simply the performance of my portfolio and how it has performed on a month to month basis.

Monthly Highlights – September 2025

- Net worth is over $2.4m as of September 2025 Month end

- +$100k for the month

- In September, we stayed and enjoyed life in Bali as this is our new home

- Added in my partner’s portfolio for future FIRE portfolio projections as we are a family (+500kish)

Market Moves

| 9/30/2025 | 8/31/2025 | % Change | |

| Dow Jones | 46,398 | 45,296 | 2.38% |

| S&P 500 | 6,688 | 6,416 | 4.08% |

| Nasdaq | 22,660 | 21,280 | 6.09% |

| Russel 2000 | 2,436 | 2,352 | 3.46% |

What is in my portfolio?

My portfolio is quite simple and straight forward. I have my holdings primarily spread out between a few ETFs, fixed income, and various single name stocks.

ETFs

Again, my primary holdings are in a few ETFs. My primary holdings are in VTI, VGT, and VCR. I’ve always been a big proponent of big tech and have been heavily invested in the Nasdaq for over a decade. This has paid off very well for me given the massive bull market of the 2010s and is essentially what allowed me to FIRE so quickly.

I used to hold more dividend generating stocks as I was really into this type of investing at a period of time. I currently do not have many dividend specific ETFs as I prefer growth more than income. This kind of goes against the ethos of financial independence but I have enough money coming in from other sources that I don’t need to focus so much on consistent income from my investments.

As markets rallied again to all time highs, I didn’t add much to my position like I did in May 2025. I’m comfortable holding a bit more cash than normal and will wait for more opportunities to arise.

Single name stocks

Some of the single name stocks I own are the following

- RDDT

- ANET

- TEM

- NFLX

- RITM

- ASML

- ARES

These single name stocks make up less than 5% of my total portfolio. I tend to not buy much single name stocks anymore as there’s no point to take on unnecessary risks when I’m already so diversified with my ETFs.

Real Estate

I currently own no real estate. I used to own property in the US but have sold it in 2022 before rates started rising. I am not a big fan of real estate. While it definitely can be a good investment, I don’t think it beats investing in the markets. In addition, real estate is highly illiquid with high transaction costs that few people consider.

Finally, as someone that travels around the world and does not like to be tied down to one location, real estate doesn’t make sense as managing it from afar creates a bunch of headaches. I much prefer to have my money liquid and in the stock market.

Fixed Income

I also purchased I-Bonds in 2022 at the height of inflation peak when I-Bonds were paying 9.5%. The rates have come down significantly since then as inflation itself has come down and I no longer bother with I-Bonds.

In the recent high interest rate environment, I had allocated a small portion of my portfolio to fixed income products, specifically purchasing treasury bills with 3-6 month expiry. These were paying out 5.5% which was a great guaranteed income generator. In recent months on the back of anticipated FED rate cuts, this rate was always going to come down which meant stocks should increase.

Well the FED cut rates for the first time since COVID in Sep 2024 which means treasury bill returns will be decreasing for the foreseeable future. My last treasury bill expired in July 2024 and that cash was used to buy the market. I suspect I will not buy any fixed income products for the foreseeable future.

Market Commentary – September 2025

September 2025 will go down as one of those rare months when the stock market seemed to completely defy gravity. Historically, September has a reputation for being one of the weakest months of the year, but this time the opposite happened. Instead of stumbling, equities marched higher in what felt like a straight line, leaving investors wondering if anything at all could derail the rally.

On the surface, the news flow should have given markets plenty of reasons to pause. The labor market, which had been resilient for years, finally showed cracks with private payrolls falling by 32,000 — the first decline in more than two years. Manufacturing readings in the U.S., Europe, and China all pointed toward contraction, underscoring the slowdown in global demand. To top it off, the U.S. government slipped into a partial shutdown, raising uncertainty about when the next round of official economic data would even be available. Forecasts for growth were steadily revised lower, with economists trimming U.S. GDP expectations for late 2025 to the low single digits.

And yet, none of it seemed to matter. The S&P 500 climbed more than 3% in September, its best showing for that month in 15 years. The Nasdaq did even better, surging over 5%, as tech and AI stocks once again carried momentum. Small caps and other lagging corners of the market joined in too, with the Russell 2000 setting new highs. This wasn’t just a handful of mega-caps dragging the market higher — breadth was strong, and almost every dip was bought within hours.

The month was so bullish that there was only 5 down days (vs 15 up days) on the Nasdaq! The Nasdaq is up almost 20% YTD which is on track to reach last year’s return of 28%, an insane statistic.

What explains this seemingly unstoppable move? In large part, it was the return of the “bad news is good news” mentality. Every sign of economic weakness only reinforced the belief that the Federal Reserve would step in with easier policy. The weaker the jobs report, the more convinced investors became that rate cuts were coming. That perception created a feedback loop: bond yields drifted lower, gold rallied as a safe haven, and yet equities — paradoxically — looked stronger than ever. Add in momentum strategies, retail investors chasing performance, and a flood of liquidity that refuses to leave the system, and you had the perfect recipe for a one-way market.

By the end of the month, the tone was unmistakable: this was not a hesitant or choppy advance but a near-relentless grind higher.

Market Value of Portfolio

Here is a history of my portfolio value. As you can see, it’s moved in line with the markets as should be the case since most of my holdings are in ETFs that track the S&P 500 and the Nasdaq.

In Sep 2025, I added my partner’s portfolio to the mix. I’ve avoided doing this for some time as this blog was mainly for my personal purposes but as we are a family now, it’s time to just aggregate everything for the blog purposes.

| Ticker | Quantity | Market Value |

| VGT | 2000 | $1,493,260 |

| VTI | 2500 | $820,425 |

| VCR | 400 | $158,460 |

| VDC | 350 | $74,806 |

| TQQQ | 500 | $51,700 |

| FBGRX | 400 | $78,800 |

| VHT | 250 | $64,900 |

| ARES | 100 | $15,989 |

| RITM | 2500 | $28,475 |

| ANET | 35 | $5,100 |

| RDDT | 100 | $22,999 |

| ASML | 50 | $48,405 |

| Total Stocks | $2,863,318 |

Trades executed for the month of September 2025

September was not an active trading month for me. Although the markets went vertical, I was mostly on the sidelines trying to figure out if market breadth really meant anything. Turns out it didn’t. I sold some puts to collect premiums but turns out I would have been better served just continuing to buy at the continuous all time highs that markets had reached on a daily basis.

While I’m okay having more cash in this market, the feeling of FOMO has definitely set in. This is a textbook time in the market is better than timing the market situation and I’m on the wrong side of that quote. It’s hard to even envision a situation where markets pull back because every bad news has been quickly rinsed away in favor of more bullish action.

Summary of stock and ETF purchases

| Ticker | Transaction | Quantity |

| VGT | Sell Oct $715 Put | 1 |

Portfolio withdrawals and expenses

Withdrawals from my portfolio is an important part of the financial independence ethos. The 4% withdrawal rate rule is one of the main concepts of the FIRE movement which I try to adhere to. Generally, I prefer to sell from my portfolio when markets are near or at all time highs to capture, and only when I actually need the cash.

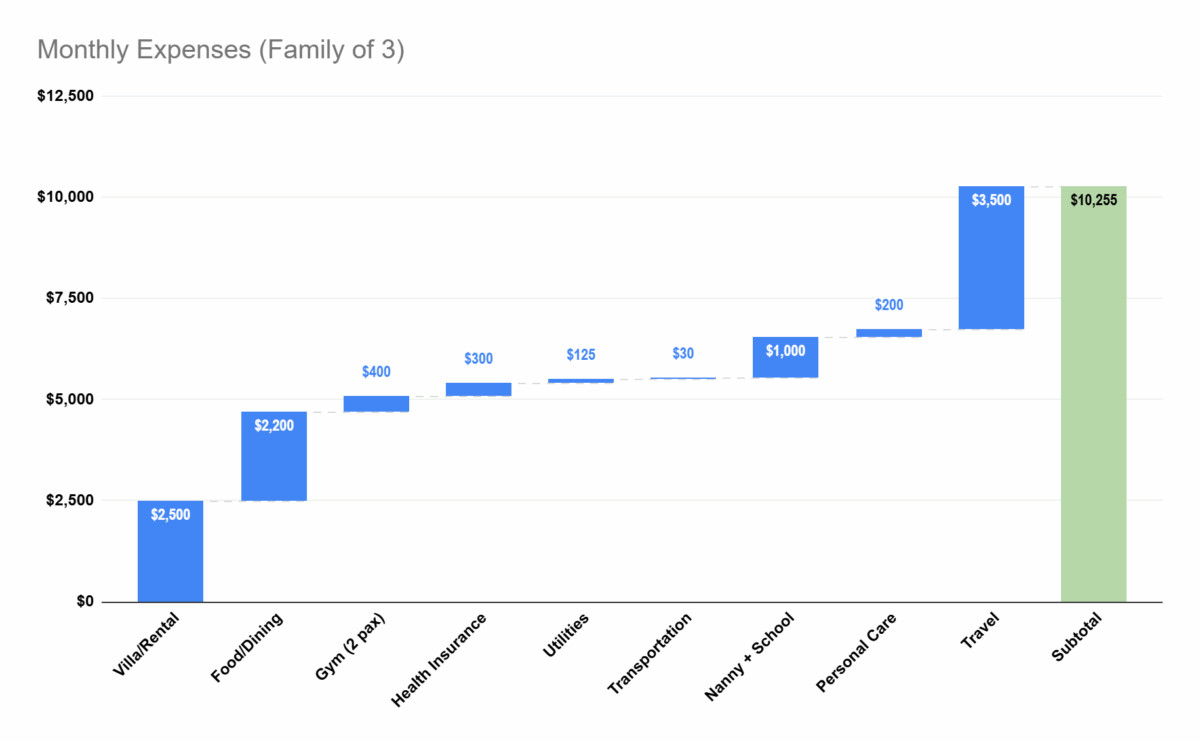

For the month of September 2025, we spent the entire time living the life in Bali. Bali is home and will be for the foreseeable future. It’s a paradise that I have not gotten tired of yet. It’s the perfect place for us to feel at peace, enjoy the healthy lifestyle (some of the nicest gyms you can find), eat amazing food, enjoy sunsets everyday, and raise our child.

We made no withdrawals from the portfolio as we had enough cash coming in from my blog as well as leftover cash from other sources. My blog generates money every month to the tune of $5k or more and I cover exactly how I earn money from blogging in other posts.

Expenses for September 2025

Our expenses for the month were pretty consistent. Living in Bali, we are able to keep our expenses (relatively) low given the lower cost of living. However, we live life to the fullest and do whatever we want, whenever we want. We choose to live in a very nice villa, a super nice gym, and eating out at the nicest restaurants in Bali.

In total, our expenses for the month are as follows in Bali.

In September, we bought a lot of flights for the holidays which is the entirety of the travel budget.

Earnings for the month

While the portfolio is the main source of financial security, we still have income coming from other sources. After all, if you can make money doing something you love, why not?

In our case, we have income coming from my blog which I will detail the numbers in the next section. My partner works part time at a travel related company and also brings in income to help with the monthly expenses.

| ($) | |

| Blog Income | $6,400 |

| P2’s Income | $3,800 |

| Total Income | $10,200 |

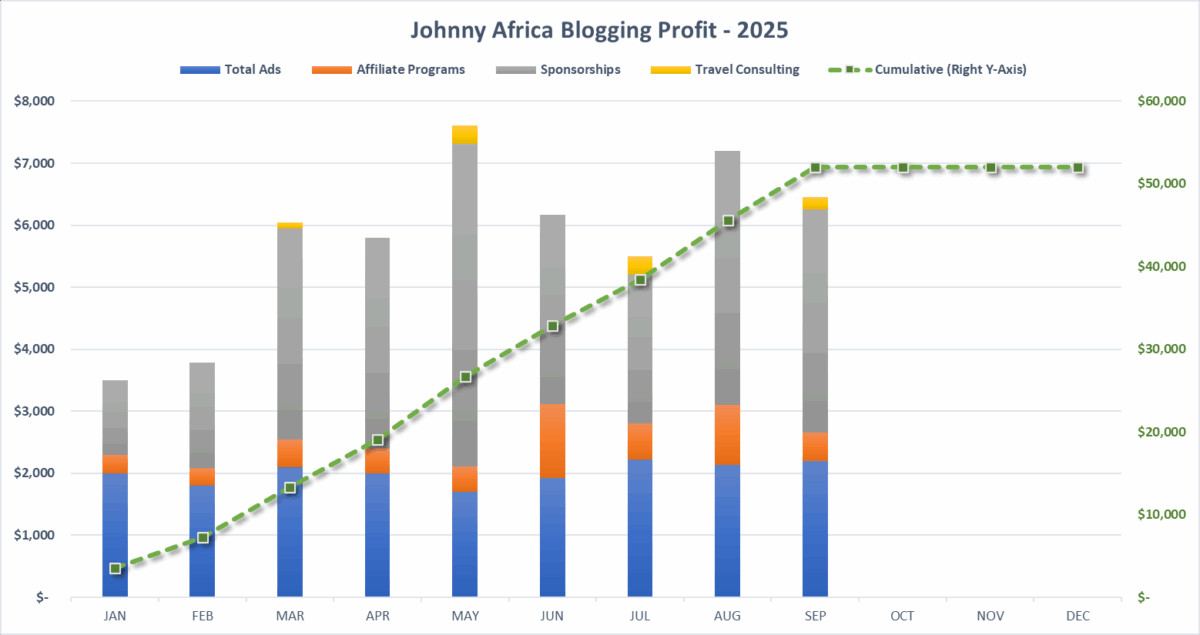

My September 2025 Blog Earnings

I always give a run down on my monthly blogging income on these monthly portfolio reports because this is about my blog after all. My blog generates quite a lot of money from many years of hard work that it is a huge supplement to my FIRE portfolio.

My full 2024 blog earnings report has finally been released via my post in the links above. I made a total of $72k from blogging in 2024 which was an absolute monstrous and record year. 2024 was the last hurrah for traditional blogging and the last of the good days before the major Google algorithm changes.

I earn money from blogging primarily from ads and sponsorships. My ads are managed by Mediavine which I joined in May 2024. In addition to Mediavine advertisements, I also earn money from Affiliate programs, sponsorships, and travel planning. More details on these things in my how to make money blogging posts.

Joining TravelPayouts

I joined TravelPayouts in June 2025 as it’s been majorly hyped by all other bloggers in the travel space. TravelPayouts is a affiliate program aggregator that allows you to combine affiliate programs like Booking.com, GetYourGuide, Trip.com, Rentalcars etc. all in one platform. They also have numerous AI tools that help automate the process of adding affiliate links to your blog.

I’m testing it out for a few months to see if it provides any additional benefit. Most of my affiliate programs in the past have been from Booking.com but travelpayouts will automatically add other affiliate programs to my blog posts in hopes of boosting income

Here is a breakdown of my monthly earnings.

| Category | Amount Earned ($) |

|---|---|

| Mediavine Ads | $2,200 |

| Sponsorships | $3,600 |

| Affiliate Programs | $450 |

| Travel Consulting | $200 |

| Grand Total | $6,400 |

I’m still amazed my blog has held up so strong in the wake of the AI firestorm, Google algorithm changes, and everything going on. My search traffic has stayed very consistent in the last few months and remains elevated compared to other periods. My Mediavine RPMs (Earnings per thousand sessions) has increased slightly due to some tweaks made on Mediavine’s end.

Q4 has always historically been the highest paying months of ad income so let’s see what the rest of the year brings!