November 2025 was finally the straw that broke the camel’s back. A pullback finally appeared, albeit not as extreme as many hoped. Cracks in the AI trade, BTC crashing, FED hesitation on a rate cut, and general risk off sentiment led to the first meaningful pullback in the markets since April. I wrote in my previous month’s update that I felt like October was peak FOMO in that it didn’t seem like anything could break the market’s resolve. Usually when these types of readings happen, it means the market is

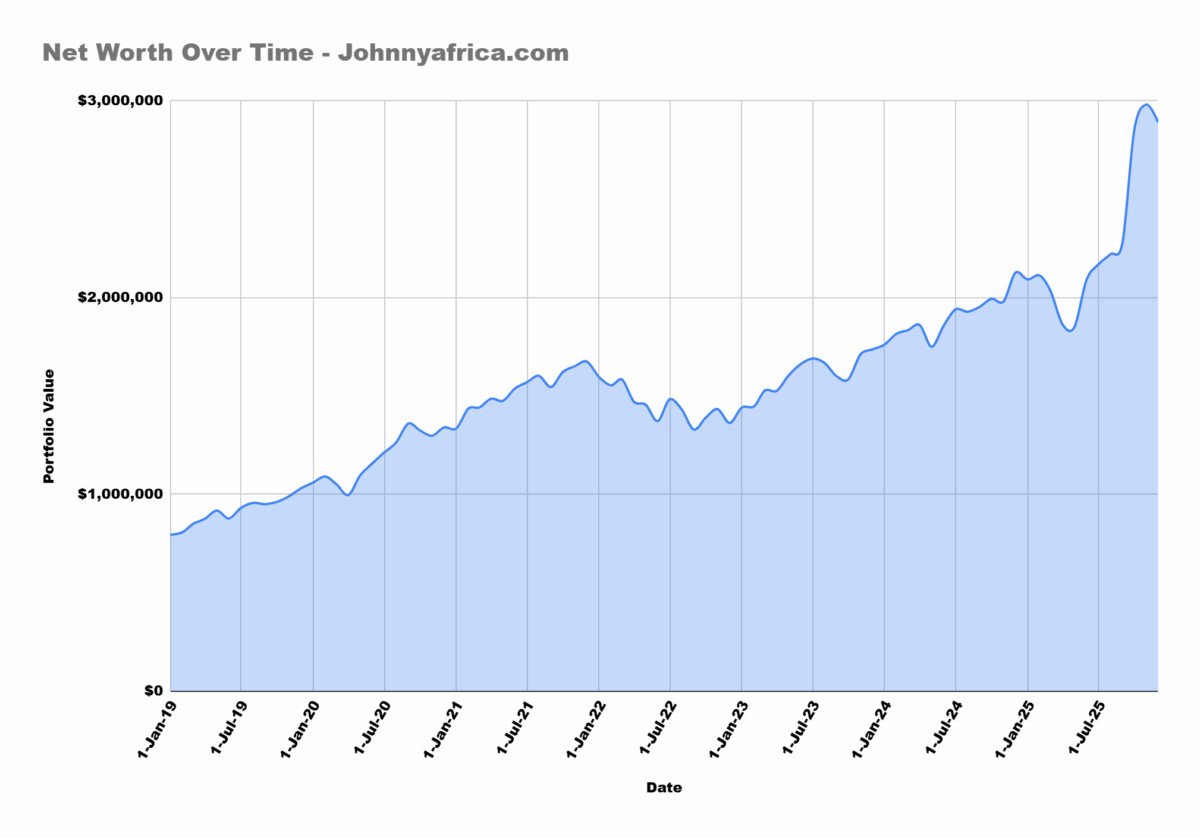

If you haven’t already read my posts before, I achieved Financial independence back in late 2020 early 2021 with a portfolio of roughly $1.3m invested in mainly ETFs. This ballooned to $1.7m during the peak of the markets in early 2022 before coming back down to Earth later in 2022. The portfolio has since regained new all time highs as markets rally beyond the previous highs.

This post will be part of a monthly series of portfolio updates that summarizes how my portfolio performed, what trades I executed, what my monthly expenses were, and my general outlook on the economy/markets. This is by no means financial advice so do not look look at me for sage advice. I make stupid trades and make even worse losses quite frequently.

This is simply the performance of my portfolio and how it has performed on a month to month basis.

Monthly Highlights – November 2025

- Net worth is at $2.7m as of November 2025 Month end

- -$90k for the month

- In November, we stayed and enjoyed life in Bali as this is our new home

Market Moves

| 10/31/2025 | 9/30/2025 | % Change | |

| Dow Jones | 47,563 | 46,398 | 2.45% |

| S&P 500 | 6,840 | 6,688 | 2.22% |

| Nasdaq | 23,725 | 22,660 | 4.49% |

| Russel 2000 | 2,479 | 2,436 | 1.73% |

What is in my portfolio?

My portfolio is quite simple and straight forward. I have my holdings primarily spread out between a few ETFs, fixed income, and various single name stocks.

ETFs

Again, my primary holdings are in a few ETFs. My primary holdings are in VTI, VGT, and VCR. I’ve always been a big proponent of big tech and have been heavily invested in the Nasdaq for over a decade. This has paid off very well for me given the massive bull market of the 2010s and is essentially what allowed me to FIRE so quickly.

I used to hold more dividend generating stocks as I was really into this type of investing at a period of time. I currently do not have many dividend specific ETFs as I prefer growth more than income. This kind of goes against the ethos of financial independence but I have enough money coming in from other sources that I don’t need to focus so much on consistent income from my investments.

As markets rallied again to all time highs, I didn’t add much to my position like I did in May 2025. I’m comfortable holding a bit more cash than normal and will wait for more opportunities to arise.

Single name stocks

Some of the single name stocks I own are the following

- RDDT

- ANET

- TEM

- NFLX

- RITM

- ASML

- ARES

These single name stocks make up less than 5% of my total portfolio. I tend to not buy much single name stocks anymore as there’s no point to take on unnecessary risks when I’m already so diversified with my ETFs.

Real Estate

I currently own no real estate. I used to own property in the US but have sold it in 2022 before rates started rising. I am not a big fan of real estate. While it definitely can be a good investment, I don’t think it beats investing in the markets. In addition, real estate is highly illiquid with high transaction costs that few people consider.

Finally, as someone that travels around the world and does not like to be tied down to one location, real estate doesn’t make sense as managing it from afar creates a bunch of headaches. I much prefer to have my money liquid and in the stock market.

Fixed Income

I also purchased I-Bonds in 2022 at the height of inflation peak when I-Bonds were paying 9.5%. The rates have come down significantly since then as inflation itself has come down and I no longer bother with I-Bonds.

In the recent high interest rate environment, I had allocated a small portion of my portfolio to fixed income products, specifically purchasing treasury bills with 3-6 month expiry. These were paying out 5.5% which was a great guaranteed income generator. In recent months on the back of anticipated FED rate cuts, this rate was always going to come down which meant stocks should increase.

Well the FED cut rates for the first time since COVID in Sep 2024 which means treasury bill returns will be decreasing for the foreseeable future. My last treasury bill expired in July 2024 and that cash was used to buy the market. I suspect I will not buy any fixed income products for the foreseeable future.

Market Commentary – November 2025

November 2025 was the pullback that we were all looking for. The markets had been rallying for 6 months straight after the April crash and November finally saw a little bit of a pullback. S&P was down 5% and the Nasdaq went down 9% to early September levels. A minor correction at best but one that was much needed to flush out the excess in the market.

Much of this pullback came after NVDA’s earnings report. While they crushed expectations, markets ultimately were too overbought leading to the sell off. Everyone piled onto the AI bubble talk abut I don’t think that narrative carries much weight. People love comparing any overbought condition in tech to the 2000 tech crash but they really share no commonalities besides just having the “tech” theme associated with it.

The pullback lasted a week before market participants went back into the market to buy the dip. Google led the way and the rest of the tech sector slowly followed suit. NVDA is still down 20% from its all time highs and I suspect they will have a decent rally back to its highs in December.

The November market pullback sets up nicely for a year end Santa rally. A lot of fund investors are trailing the average and I suspect some FOMO buying will occur into year end.

Market Value of Portfolio

Here is a history of my portfolio value. As you can see, it’s moved in line with the markets as should be the case since most of my holdings are in ETFs that track the S&P 500 and the Nasdaq.

In Sep 2025, I added my partner’s portfolio to the mix. I’ve avoided doing this for some time as this blog was mainly for my personal purposes but as we are a family now, it’s time to just aggregate everything for the blog purposes.

| Ticker | Quantity | Market Value |

| VGT | 2100 | $1,579,620 |

| VTI | 2500 | $840,775 |

| VCR | 400 | $156,284 |

| VDC | 350 | $75,614 |

| TQQQ | 500 | $27,270 |

| VHT | 250 | $73,633 |

| ARES | 100 | $15,685 |

| RITM | 2500 | $28,725 |

| ANET | 35 | $4,574 |

| RDDT | 100 | $21,647 |

| ASML | 50 | $53,000 |

| Total Stocks | $2,876,826 |

Trades executed for the month of November 2025

November was an active month of trading for me. As markets pulled back, I executed numerous trades to take advantage of the pullback. Some worked out and some didn’t.

I exited out of many of my AI and nuclear stocks that were very high risk. I bought them in October during the initial crazy run up. I should have sold them sooner but ultimately did not make as much money as I had hoped on them. These include stocks like OKLO, NBIS, and CRWV.

As markets dipped, I was DCA’ing the entire way down by purchasing shares of VGT and selling puts. While I collected some meaty premiums on puts, the markets declined below the strikes of the puts I sold which made me buy VGT at a price of $740 on Nov 21, 2025. Markets have since already rallied past that price so I’m sitting pretty.

All the cash I’ve accumulated over the last year waiting for the dip I’ve mostly spent during this pullback. I suspect the dip won’t keep dipping and this will be the last dip before something big happens next year.

Summary of stock and ETF purchases

| Ticker | Transaction | Quantity | Premium |

| VGT | Buy | 200 | |

| OKLO | Sell | 100 | |

| CRWV | Sell | 100 |

Portfolio withdrawals and expenses

Withdrawals from my portfolio is an important part of the financial independence ethos. The 4% withdrawal rate rule is one of the main concepts of the FIRE movement which I try to adhere to. Generally, I prefer to sell from my portfolio when markets are near or at all time highs to capture, and only when I actually need the cash.

For the month of November 2025, we spent the entire time living the life in Bali. Bali is home and will be for the foreseeable future. It’s a paradise that I have not gotten tired of yet. It’s the perfect place for us to feel at peace, enjoy the healthy lifestyle (some of the nicest gyms you can find), eat amazing food, enjoy sunsets everyday, and raise our child.

We made no withdrawals from the portfolio as we had enough cash coming in from my blog as well as leftover cash from other sources. My blog generates money every month to the tune of $5k or more and I cover exactly how I earn money from blogging in other posts.

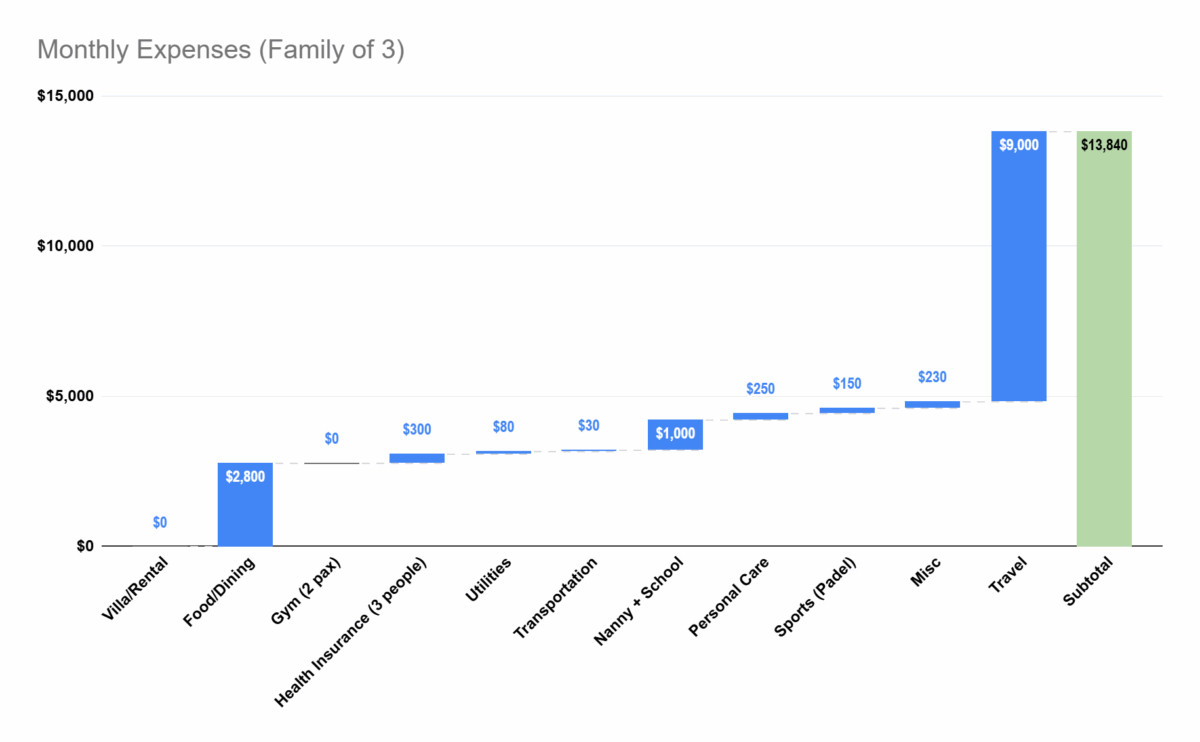

Expenses for November 2025

Our expenses for the month were pretty consistent. Living in Bali, we are able to keep our expenses (relatively) low given the lower cost of living. However, we live life to the fullest and do whatever we want, whenever we want. We choose to live in a very nice villa, a super nice gym, and eating out at the nicest restaurants in Bali.

Historically, I was accrual accounting our expenses but I’ve decided going forward I will cash account all our expenses which is much more realistic as far actual financial management goes. A lot of our expenses in Bali are paid for upfront for multiple months. Things like rent are paid upfront as well as the gym (discount for paying multiple months upfront).

In total, our expenses for the month are as follows in Bali.

This month we paid an insane amount of money for travel as we booked a trip to Saudi Arabia (staying at the Banyan tree hotel) for new years. We also booked flights for the Maldives which we will visit for the 5th time to a few standout resorts!

Earnings for the month

While the portfolio is the main source of financial security, we still have income coming from other sources. After all, if you can make money doing something you love, why not?

In our case, we have income coming from my blog which I will detail the numbers in the next section. My partner works part time at a travel related company and also brings in income to help with the monthly expenses.

| ($) | |

| Blog Income | $7,900 |

| P2’s Income | $3,800 |

| Total Income | $11,700 |

My November 2025 Blog Earnings

I always give a run down on my monthly blogging income on these monthly portfolio reports because this is about my blog after all. My blog generates quite a lot of money from many years of hard work that it is a huge supplement to my FIRE portfolio.

My full 2024 blog earnings report has finally been released via my post in the links above. I made a total of $72k from blogging in 2024 which was an absolute monstrous and record year. 2024 was the last hurrah for traditional blogging and the last of the good days before the major Google algorithm changes.

I earn money from blogging primarily from ads and sponsorships. My ads are managed by Mediavine which I joined in May 2024. In addition to Mediavine advertisements, I also earn money from Affiliate programs, sponsorships, and travel planning. More details on these things in my how to make money blogging posts.

Joining TravelPayouts

I joined TravelPayouts in June 2025 as it’s been majorly hyped by all other bloggers in the travel space. TravelPayouts is a affiliate program aggregator that allows you to combine affiliate programs like Booking.com, GetYourGuide, Trip.com, Rentalcars etc. all in one platform. They also have numerous AI tools that help automate the process of adding affiliate links to your blog.

I’m testing it out for a few months to see if it provides any additional benefit. Most of my affiliate programs in the past have been from Booking.com but travelpayouts will automatically add other affiliate programs to my blog posts in hopes of boosting income.

In November 2025, TravelPayouts paid me almost $700 which is better than what I earned using only Booking.com’s affiliate program.

Here is a breakdown of my monthly earnings.

| Category | Amount Earned ($) |

|---|---|

| Mediavine Ads | $2,000 |

| Sponsorships | $4,500 |

| Affiliate Programs | $1,100 |

| Travel Consulting | $300 |

| Grand Total | $7,900 |

I’m still amazed my blog has held up so strong in the wake of the AI firestorm, Google algorithm changes, and everything going on. My search traffic has stayed very consistent in the last few months and remains elevated compared to other periods. My Mediavine RPMs (Earnings per thousand sessions) has increased slightly due to some tweaks made on Mediavine’s end.

Q4 has always historically been the highest paying months of ad income so let’s see what the rest of the year brings!

Hi Johnny,

Really enjoy and think about your Financial BlogPosts, Fire is the ultimate aim.

Also I have made my biggest gains using a small handful of Vanguard ETF’s. Speaking for myself, it enables wealth without the stress of understanding the whole financial Stock Market and high level investing. Low fees etc. VUG has made 60% of the portfolio and VOO the reset. I’ve reset the risk lately, as November was Sooo painful, uncertainty with the market, whether it would continue to slide further. Still Vanguard, but moved to several of the other ETF’s, Emerging Markets, Europe, Australia Financial etc as well as keeping the VUG and VOO and Vanguard Overseas Shares. Plus some individual Growth stocks with potential. I’d be keen to see you do Fortnightly posts, on Market Incidators and swings as you understand them.

Cheers and thanks