Without a doubt, one of the first things a person goes through when moving abroad is fretting about the unknown. I didn’t know much about the country of South Africa but if I was to move my life to another country, I wanted to know as much as I could. I went on sites like Numbeo to gauge what my expenses would be like, how it compared to my expenses in NYC, and how it compared to the salary I was getting paid in the US.

Obviously NYC is one of the most expensive cities in the world and South Africa can’t touch that cost of living, so taking a pay cut seemed natural, but how much is right? It’s been almost a half a year since I’ve lived here now! Time flies for sure, but I’ve also pretty much settled into my new life and have cost of living figured out. This post is all part of my Ultimate guide to living in Johannesburg.

For a cost of living for Cape Town, click here.

In recent years, I’ve also moved to Germany so if you want to compare, here is my breakdown of the cost of living in Frankfurt, Germany.

Update 2019: South Africa has a high rate of inflation and this article has been updated with fresh 2019 numbers! Please leave a comment if you have something to add or disagree with something. Note that this is just simply my cost of living, and not representative of everyone else.

South African Economy

South Africa, has a GDP Per Capita as of 2014 of around $6,500, meaning the average person earning something around that a year. This is significantly lower than first world nations but is considerably higher than the rest of Sub-Saharan Africa with the exception of The Seychelles. Sandton, the wealthy suburb of Johannesburg, is likely the richest area in all of South Africa. It is in this suburb that I’ve lived at for almost half a year that I’ve deduced how ridiculous the income standard deviation of this country really is.

Sandton is incredibly first world, and would be nicer than most parts of America if put to the test. The GDP Per Capita of Sandton is perhaps 10x higher than the rest of the country and I wouldn’t be surprised. Right next door in the township of Alexandra however, it could have something 1/10th the average and I would not be surprised either. Living in Sandton is not as cheap as I thought it would be. It is not overly expensive either.

If you’re planning on moving to Sandton, realize that you’ll be living in the wealthiest area of the country and people here certainly do not live remotely resembling of the country’s GDP.

Taxation

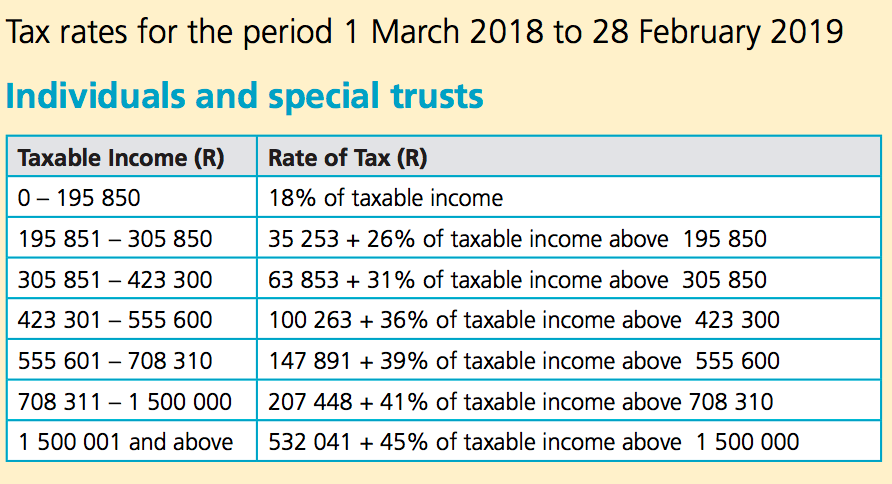

Taxes in SA is similar to the US in that it is a tiered tax structure. The highest tax bracket is 40% and this starts at something like R620k/year. However, only income earned above 620k will be taxed at that rate. Everything below that is taxed at its respective level. I’m not an expert on taxes but I am an expert on seeing my paycheck diminish from taxes and getting owned by the government. An interesting fact I’ve learned about SA is that because of the huge income disparity, only about 10% of the population pay taxes that makes up for the other 90% of the population. It’s always a topic of discomfort but after living here for awhile, I can totally see it being true.

Updated as of 2018/2019: South Africa has raised the taxes on most brackets and has introduced a new high end bracket for those earning more than R1.5m a year of 45%. The previous highest tax bracket of 40% has been raised 1% to 41%. These numbers have changed significantly since I first moved to South Africa in 2013, showcasing the volatility of the local economy.

Here is a breakdown of my monthly expenses. Note that this is really only helpful for someone in a similar position to me in that you’re not married, do not have any dependents, and living the bachelor’s life.

If you have kids, this guide is not for you! However, there are plenty of Joburg blogs out there started by people with kids like JoburgExpat that will be more helpful.

Rent – 13,000R

Without a doubt any New Yorker’s biggest expense. I remember living in NYC and it would not be uncommon to see someone spend 50% of their take home pay on rent! Renting an apartment, like one of my previous blog posts will go into detail, is cheap compared to New York, but really not as cheap as you’d think. If you’re willing to live OUTSIDE the main city area, like Fourways and Sunninghill, it is cheap. Otherwise, you’ll be quite surprised at just how expensive a 2 bedroom apartment is in Sandton.

Yet, if you are not from around here, and hence do not know many people, living on your own in the booneys just to save money is unappealing as well. Sandton is a farcry from a big urban center, but it is about as close as it gets for expats in Joburg and probably where most ex-pats will want to live. It’s like moving to NYC for the first time, and living in Queens. Plenty of people do this because it’s so expensive, and nothing against Queens, but it’s no Manhattan. Because there are so many expats who likely don’t have any possessions to their name, furnished apartments are in high demand and do not come cheap.

An average furnished 1 bedroom in the Sandton/Morningside/Rosebank area runs something around 12,000R. This won’t get you anything spectacular either; just your basic slightly above average apartment. If you want something with style, add another R3,000 onto that price tag. If you can find a roommate however, a 2 bedroom apartment becomes significantly cheaper in proportion to the 1 beds. I’m fortunate enough to be one of those people and the apartment I have now, in the Sandhurst Towers, is amazing.

Certainly something I would never be able to live in in NYC. At 10,000R (20k split two ways) a month, most South Africans would never want to pay this, and it was a bit more than I had initially thought I would spend, but a little bit of the good life never hurt nobody.

Car and Car Insurance – 3000R+750R

A car is an absolute necessity in this city. After buying my first car ever, I actually started to enjoy driving. It also doesn’t hurt that my car is a BMW and has some power. Nevertheless, it’s been a few months now and the novelty has worn off, but the car payments have not. With a car costing 150,000R, my car payments come out to something around 2,400R a month. In addition, car insurance is a necessity in this country as traffic can get hectic and people can drive pretty crazy. Getting my insurance through Hollard, I pay 630R a month which is incredibly reasonable, especially for an expat.

After living here for a few months, I’ve concluded that people here are much more car obsessed than people back home. People would gladly spend the majority of their paycheck on their car instead of their accommodations. Cars here are like a status symbol, which is likely why I see more German luxury cars here than in Germany. If I took half of the money I put into my rent (5,000R), and added that into my car payment instead, so 7,500R, I could likely drive a Porsche. I could also live somewhere decent for 5,000R as well (not in Sandton of course).

Gas – 700R

Gas prices are everyone’s least favorite topic of conversation. Prices never seem to want to go down, and you can’t stop using it, especially in this country. There is no public transportation, no bicycling culture, and certainly no carpooling. Gas is as about as inelastic of a commodity here as water.

No matter how much you have to drive, you just have to suck it up and pay the costs; there really are no alternatives. Gas prices currently hover around 13R/liter, which equates to about $4.80/gallon. Keep in mind gas prices are not only attribute to the price of crude oil but also to that of the usd zar exchange rate as all energy commodities are quoted in dollars. So even if crude prices decrease, if the rand depreciates (which it has been big time recently) against the dollar, gas prices in SA may still increase!

A full tank on my Diesel car costs me about 700R-750R. Thankfully, living in Sandton has its perks and my commute to work is about 10km round trip. Couple that the fact that I just don’t drive much in general, and I can fill up my car every 6 weeks or so. People are shocked when I tell them this as people drive around so much and regularly fill up their cars every week.

Sometimes I wonder how the average person in this country affords gas if the GDP Per Capita is somewhere around 7,500$. Gas isn’t cheap and even if you’re only driving say 100$ worth of gas a month, that’s still a huge chunk of the paycheck gone.

Gym – 1,000R

Without a doubt, something a man cannot live without. This was one of the first things I sought out upon moving and am glad to be gyming where I am. At 800R a month for Planet Fitness Platinum, this is expensive but this is one of the top gyms in the city so a premium is expected. Less fancy gyms can cost much less and there are even more expensive gyms like Virgin Active Alice Lane running at something like 1600R/month! I’ve actually been to both clubs now and they are definitely on par with each other. The Alice lane gym is smaller than Planet Platinum and in my opinion does not warrant the premium it charges.

Cellphone – 100R

Without a doubt, one of my proudest money savings moments. I’ve figured out how to live cheaply in a market dominated by expensive cell phone prices and plans. Purchasing an unlocked cellphone from the US before coming here, I’ve essentially paid much less for the phone itself than I would have here as electronics run a 30-50% premium. Coupled with the fact that I really do not call anyone, have wifi at home, work, and the gym, I signed a contract for 500mb a month for 39R/month with Vodacom. Add another 30R for talking and that’s about all I need for a month. People here regularly pay over 1000R a month which is just ridiculous.

Electricity – 500R

An utility one can’t do much about but just pay for, I split this two ways and have deduced that we usually use about 800R a month. Because our electricity is pre-paid, I have a meter right next to my door telling me how much electricity I have so I’m now so much more conscious about using power than before where I would just get a bill of surprises at the end of the month.

Wifi/TV – 600R

My TV programming is actually included in the rent price of my apartment but I will be honest, the TV here is shit. It’s mostly recycled garbage American TV shows no one cares about, movies from 10 years ago, and a few random South Africa channels. Not that I watched much TV back home, I suppose one could wish that they’d have ESPN in this part of the world :(. Internet is a mission to set up. It’s a necessity for most people and certainly for me. It took me about a month to get it all squared away. With Afrihost, I’ve managed to secure about as cheap of a plan as it gets for fast speed internet around 900R a month. Expensive for any 1st world standards, especially since we only have 10mbps, but that is how it is here.

Food/Entertainment – Variable

Here is the big one. Anyone that’s lived in New York would agree with me that a huge part of one’s salary goes to these two things. It’s actually quite alarming if you pull your credit card bill into excel and sum up all your nights at dinner bars. It isn’t the rent, the phone bills, the transportation, or even quick take out meals for lunch and dinner, but rather the times you are out eating and drinking with friends. Nights will easily add up to 100$ and then some before you’ve even feel like you’ve spent 20$.

Food and alcohol are cheaper in this South Africa no doubt. Lunch costs me on average 30R and dinner will run be around 50R. However, a quick lunch and dinner in NYC would cost me 15-20$. It’s not the casual meals that killed me in NYC but rather going out to dinner at a proper restaurant and having drinks with friends. This would regular run me 100$ a night. Because of the strong social culture in NYC, coupled with the fact that it’s easy to go anywhere without worrying about drinking and driving, these nights occurred quite often.

Enter South Africa. In the span of about four months, I’ve managed to hit up almost all the nice and high end restaurant in Joburg and a very good meal with alcohol cost 400R. There’s not a shortage of restaurants in this city, but it’s a farcry from my restaurant experience in NYC. However, the culture is much different. Because you must drive, you cannot go out and drink to your heart’s desire. Things are incredibly spread out here and a cab out will be easily 200-300R. Spontaneity goes out the window because you must plan every little detail of the night and there is rarely that one restaurant that just opened down the street with the rave reviews. So what does this all mean? Many less nights out, and much less money spent. A night in NYC where you weren’t planning on going out, a friends text at 11pm changes your mind, leading to 100$ spent that night for no reason. This just does not happen here.

After completing the Joburg culinary scene already, I have little desire to go out for dinner. Going out here is fun but again, it requires planning so many times I am content to stay at home and not get pulled over by the cops. Overall, I’d say my food and entertainment bill is somewhere around 5000R a month. Quite high for most South African standards and obviously this can change with one big night out but it is still a fraction of what I spent before.

Adding It All Up

Rent – 14000R

Car – 2300R

Insurance – 750R

Gas – 700R

Gym – 1000R

Internet – 600R

Cellphone – 100R

Electricity – 500R

Food/Entertainment – 7000R

= 26,050R/month for all regular expenses

Obviously there are just random things every month you end up paying for but this about sums up the must pay expenses of my life in South Africa so far. So what happens to the rest of the money? Life in SA is pretty good as long I sit my ass in this chair that I’m writing this blog post for the rest of my days, but I have many places that I’d like to see in Africa and it isn’t cheap.

As soon as you start traveling around Africa, you realize a few things:

- No Africans travel around Africa and hence

- Africa is NOT a cheap place to travel around because:

- It is all catered to Europeans/Americans/Australians all earning Euros, Pounds, and Dollars

- You realize just how poor you are earning rand when you are comparing yourself to these people and doing the same trips that these guys are doing

- Most trips around Africa are quoted in USD or EUR and the exchange rate is currently shit

- Africa is NOT a cheap place to travel around because:

What do things cost?

What do most things cost here? Well it’s entirely dependent on where you are. Sandton, where I live commands the ultimate premium for all things in South Africa. So here are some examples from Sandton, and you can expect noticeable discounts if you go further out of the city, or to another city like Durban or Pretoria.

- Beer: 25-30R

- Glass of Wine: 40-60R

- Shot of non top shelf liquor: 30-40R

- 300g Fillet at steakhouse: 150-200R

- Cinema Ticket: 75R

- Taxi ride from Sandton CBD to Rosebank: 150R

Savings Accounts/CDs

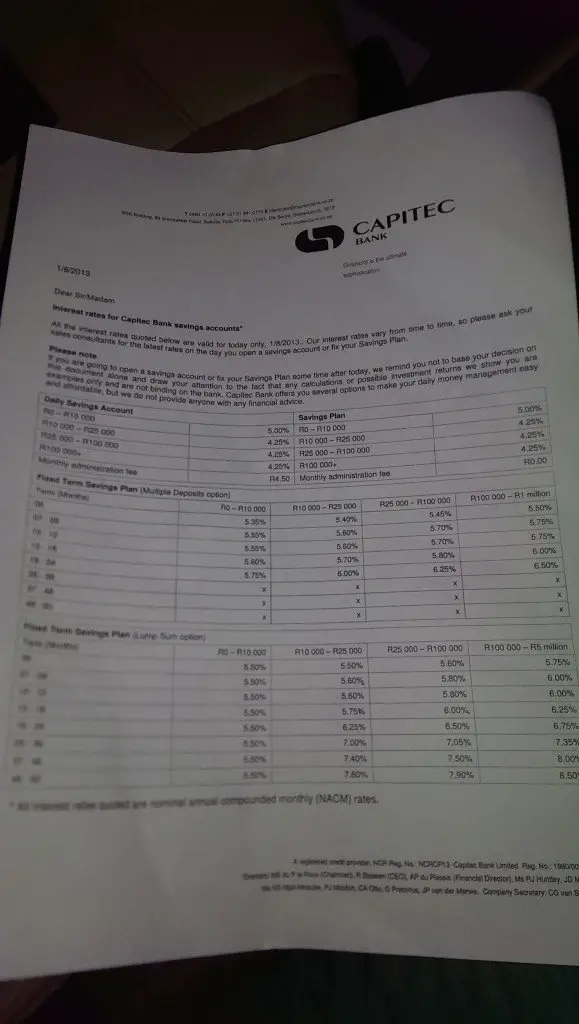

Feeling a little discouraged after reading this post? Worry not, there are ways to make money here likely not available back home. I’ve only recently discovered this but now is a good of a time as any. South Africa has a ridiculous inflation rate hovering somewhere around 6% a year. Being a 3rd world country, with people going on strike more than they work, the country is seen as a riskier investment than others. While American banks currently pay less than 1% on a certificate of deposit, and pretty much nothing on a savings account, South Africa is the opposite. Savings accounts at banks will regularly yield 4%!!! And if you’re not cash strapped, and can invest your money for a few years without having to touch it, there are bank CDs here paying almost 6+%!

The highest I’ve seen is a bank called African Bank that will pay you 9.5% on a 5 year CD! That is ridiculous. 9.5% is higher return than most mutual funds generate over a year. Capitec, another SA bank, is a close second with 8.5%, and the rest all have CDs returning 6-7% per annum. Also, these CDs all give you the option of taking the interest payment in cash, or reinvesting it to compound the interest! That’s like a 50% return on that African Bank 5y CD over 5 years! I suppose this is the one positive aspect of getting paid in Rand, a currency that’s depreciated almost 15% against the dollar since I moved to the country, that I can invest in things like this.

For the follow-up article to this comparing New York and Johannesburg costs of living, click here.

Hi Johnny!

I know you wrote this 3 years ago but I am thinking of moving to Johannesburg for a year or two. I want to live in the city or near the city. I am in the saving process. What would you say I would need to save up or have to live out there for about a year. I will be pretty much getting a car and moist of the typical expenses.

Hi louise! I think if you are looking for just a decent but nothign extravagant place in the city center like sandton, morningside heights etc, you can have a one bedroom furnished for about R10000 a month. A car with gas and insurance will be around R4000 nowadays. In a month I think if you have R30,000 to R40,000 you will be living quite comfortably. But it really depends on how you live and what type of things you like to do!

Hi Johnny

I have been offered a job in Joburg South Africa. We are a family of 3 (7 year old son). The annual package is R 3 million which includes everything except for our airfares to visit our home country. We plan to live in/ around Waterfall suburb in a 4 bed house. Our son will be attending private school which which I believe will cost around R 130k per annum. We plan to have 2 reasonably sized cars. We plan to have a full time maid. We do not eat out much. A couple of drinks at home once a week and decent outing every weekend.

Need your advise on:

1. How much money would we spend on renting a house?

2. What should I assume will be my monthly outgo other than the house rent?

3. I have referred to various websites and anywhere between 60 – 80k per month is the number I get (including rent). Is this a fair estimate?

Will appreciate any feedback not he same.

Hi Raul, that is quite a sizeable salary in South AFrica. It will be more than enough for you to live well in Johannesburg with a young family. I think if you’re looking to live outside of the city like you mentioned, you can find a upmarket 3-4 bedroom house in a nice area of the city for R20,000-25,000 a month. I of course don’t have kids so your budget will vary for this but with just a 7 year old I think it shouldn’t be more than R20,000 for the three of you guys if you don’t eat out too much. I think if you budget 80k for all your expenses a month, you will be living the high-life. Enjoy!

Thanks a lot Johny for the quick reply. Appreciate it.

Hie Johnny

Im so worried about xenophobia,robbery and car theft in SA can you suggest the safest towns to stay in SA .Professionally I am a data scientist/software engineer

Hi ,

Not going to live there, but traveling through to visit a friend, so your figures are fabulous for me to see at this point in time.

Cheers Nathan…

Thanks for the awesome expenditure breakdown. With the lower cost of living and of course earnings, you would hardly ever have to claim US tax exclusion on your foreign income.

Great reading this!

Thanks for posting.

I m moving to Joburg for 3 months soon, and I do not know where to find houseshare, and if it is as doable as in Europe.

Do you have any tips on websites to check, or things to be aware of?

Thanks!

Hi Luisa, congrats on your pending move! Roomshares are quite easy to find in Joburg. I almost ended up living with random strangers after my lease was up to save money. The best resources in my opinion are Gumtree.co.za and olx.co.za, which are the biggest online classifieds websites in South Africa (like craigslist in the US and UK). I would give that a shot and monitor what comes up.

Hi Johnny!

Thank you for the fantastic blog . It’s one of the best information channels on figuring out cost of living in Jozi. I read all the comments and saw that people do have sometimes quite limited finances even if expats. I mean that living in Jozi and having good, not great, standards of living costs especially if one is paid local standards salaries. I think what is not mentioned a lot is maybe “safety”. Am I wrong to assume that purchasing safety costs quite a lot? I mean safe home, safe transportation, safe day to day life. I may exaggerate, and here is what puzzles me. In order to get a neat one bedroom flat at a safe and well surveilled building in an ok neighborhood would cost me around R8000p/m. If add utilities of R800p/m and, since I don’t drive, my transportation monthly pass R1000 plus taxi for R500p/m, this all totals R10300p/m.

Here is my puzzle: how can I make it with a monthly salary of about R17100 (I won’t be taxed)? Is what I describe correct, and is my life in Jozi going to be veery tight financially (affecting my social life for sure)? I should add that I will have health insurance by my employer. My employer does not pay my relocation from South Africa, so all my personal trips to Europe, if needed, should be covered by me. I do get paid a fixed R10000 for my relocation to Jozi, which is anyway not enough (airfare+visa). I live in North Europe and I haven’t decided yet if I will take the position or not. It is by the way for one and a half year. I am very interested to read your opinions. Thanks!

Hi there, thanks for the kind words!

Sandton is not cheap that’s for sure, but if you’re ok with having roommmates, you could easily find a place in a good location for 5k and under. This will free up some of your income for other things. Socially, I think you can still enjoy a lot of the things around town, especially as drinks are quite cheap. Avoid swanky places in Sandton CBD, Melrose Arch etc. and you’ll be ok. Your income is about R24k before tax, which is almost R300k per year. I knew plenty of people living in Sandton that lived off this and they had cars!

Hi there. As for me , having lived and worked in South Africa for 4 years since 2012, I can say that the information here is correct. Sandton is actually dubbed “the richest square mile in Africa”, so you can’ t expect anything to be cheap there. But some places are quite cheap. if you stay in Spruitview earning around R30 000 per month, you can make a living and some savings. A small family of 4 can rent a 2 bedroomed house with kitchen with fitted furniture , dining room and bathroom for about R6500.

per month, everything else is almost similar like for car, gas, insurance. you can minimise on food by cooking for yourself at home. its way cheaper.

some schools are labelled as no fee schools, so usually in primary schools you don’t pay fees. you can find decent, cheaper clothing in shops like Jet Stores and Markhams. Clinics are for free, but to visit a private doctor you need like R400 for consultation only. I’m not sure of Hospitals like Vosloorus Hospital . Include a few weekend outings with kids to places like Gold Reef City or Joburg ZOO, you can still lead a normal life and be left with like R10 000 savings per month.

shopping Malls and roads are generally world class, yes , I mean World class, even better than most of malls in this part of Europe.

Tips…..1.. make it a habit NOT to travel late at night,

………….2…The roads are really good, but don’t be fooled to over speed , cameras are almost everywhere and you’ll be shocked by over speeding bills.

……..3…if you are in Johannesburg you pay for e- tolls, so just set up everything correctly and in time to enjoy deductions.

………4…don’t be very kind to strangers. you don’t have to give a lift to someone you don’t know, even if they promise to pay you. after all, the transportation industry is well set up so people commute well in taxes or their cars. so save yours.

…….5.. ALWAYS lock your car and take the keys with you, there are several car thefts there. And always lock the garage and the gate,

I hope you will enjoy your stay in South Africa guys.

Hi Johny ,I would work at Johannsberg for 1-2 years with wife and 2 kids.company is offering R30K.Tell me how much will be school fee for Ist class -4 years baby

Hi there, I think 30k a month with two kids is doable in Johannesburg. It’s too little to live in Sandton where I lived, but if you’re living further away from the CBD, then it should be doable.

Sadly, I don’t have kids so I can’t comment on how much schooling costs in the country but from what I gathered, the private schools were not cheap. Public schools are included in your taxes so to that regard, I think you’ll be ok!

Hi there. As for me , having lived and worked in South Africa for 4 years since 2012, I can say that the information here is correct. Sandton is actually dubbed “the richest square mile in Africa”, so you can’ t expect anything to be cheap there. But some places are quite cheap. if you stay in Spruitview earning around R30 000 per month, you can make a living and some savings. A small family of 4 can rent a 2 bedroomed house with kitchen with fitted furniture , dining room and bathroom for about R6500.

per month, everything else is almost similar like for car, gas, insurance. you can minimise on food by cooking for yourself at home. its way cheaper.

some schools are labelled as no fee schools, so usually in primary schools you don’t pay fees. you can find decent, cheaper clothing in shops like Jet Stores and Markhams. Clinics are for free, but to visit a private doctor you need like R400 for consultation only. I’m not sure of Hospitals like Vosloorus Hospital . Include a few weekend outings with kids to places like Gold Reef City or Joburg ZOO, you can still lead a normal life and be left with like R10 000 savings per month.

shopping Malls and roads are generally world class, yes , I mean World class, even better than most of malls in this part of Europe.

Tips…..1.. make it a habit NOT to travel late at night,

………….2…The roads are really good, but don’t be fooled to over speed , cameras are almost everywhere and you’ll be shocked by over speeding bills.

……..3…if you are in Johannesburg you pay for e- tolls, so just set up everything correctly and in time to enjoy deductions.

………4…don’t be very kind to strangers. you don’t have to give a lift to someone you don’t know, even if they promise to pay you. after all, the transportation industry is well set up so people commute well in taxes or their cars. so save yours.

…….5.. ALWAYS lock your car and take the keys with you, there are several car thefts there. And always lock the garage and the gate,

I hope you will enjoy your stay in South Africa guys.

Great tips and totally ont he spot about Sandton, it’s an alternate reality versus the rest of the country and certainly not representative of the rest of South Africa. The one plus about living in Sandton was I never had to go very far so I never needed e-tolls 🙂

Hi Johnny, I’d like to point out that having over R20-25k expenses a month is VERY high compared to the average South African. There’s probably not many south africans that can relate to your experiences, but I can see how other Western outsiders would. Great write up!

Yes Graham, I 100% agree that my expenses aren’t the norm. It didn’t take me long to realize the huge income disparity in the country and how unrealistic my lifestyle was compared to most people. However, South Africa has by far the most income disparity I’ve ever seen and among my coworkers and peer group, I wasn’t that far out of the norm. But you’re right, I also wrote this post mostly with other ex-pats and potential expats in mind!

Hi johnny,

Could you please help me in cost of living in Johannesburg.

Is it enough to have good and enjoyment life in 15000R? Excluding accommodation.

Thanks.

Hi Tapal, I think if you live in certain neighborhoods in Jozi it would be possible for sure. 15k a month means you’ll have about 10-12k left after tax. Living in Sandton would be tough because apartments are so expensive but if you looked closer to town, I’m sure you could amke it fit your budget!

Hello My name is Ravi and coming to johnsberg for work company is sponsering me al the expenses except the food and they pay me the salary of 9000 rand .So how much I can save from that please help me

Hey Johnny!

Nice blog!

Iam thinking of working in south africa at IBM in sandton. I will earn 10,700 ZAR each month.

Is it possible to live from this kind of money? They told me i could live of this salary just fine. But after some research i think it will be a very hard task.

I have some savings, but i am not willing to lose money every month while working 40hrs s week.

I had something like this in mind:

Rent 4000

Gym 800

ensurance 1000

car ensurance 500

groceries 2500

petrol 600

Internet 500

electricity 500

Cellphone 70

Is this possible?

Thnx

Hi Gijs, 10700R a month living in Sandton will be quite difficult. I’m not sure if it’s possible to be honest. After tax, that will be about 8000R a month and with that money, it will be hard to live on. If you can secure rent for under 3000R which is possible, then perhaps you can rent a used car for 1500R, and then you’ll have some money left for the other expenses.

I think you’ll definitely be dipping into your savings so not sure if it’s worth it but that’s just me!

I am a Filipina and from the Philippines interested in moving to Johannesburg next year. I find your blog very helpful but I have a few questions.

Work – did you apply on your own or do you work with a branch of your company in SA? How easy was this for you?

Salary/Tax – I am a corporate trainer and would like to pursue the same in Joburg. Saw and read information online re postings in Joburg and there are a reasonable number of vacancies. The median salary annually of my position is between R397000.

You are classified as single, no dependent (if im correct) :

What is the percentage of tax deducted monthly under your classification and as an expat? I will be under that category as well.

How much net income should I take home to be comfortable if let’s say I choose to live in a R5000 – R6000 apartment? plus car rentals since i wont have a car initially.

Thank you for your help. I am really looking forward to your response because I will be making adjustments as early as this year in my life and career so I can pursue my move to SA.

Salamat Johnny!

Hi Grace! I think you’ll really enjoy South Africa if you do make the move. I was relocated with my company in the states so I didn’t have to go through the process of looking for a job.

I think it really depends on where you want to live in Joburg. The central business district (Sandton) is pricey as all foreigners on ex-pat packages and wealthy finance people drive the prices up here. As soon as you go outside of Sandton (Fourways, Rivonia, etc., and even Morningside), the prices drop drastically. I think 5-6k a month for rent is certainly doable for that.

Cars are not cheap in SA. Everyone is car OBSESSED and people will blow a third of their monthly paycheck on one just because it’s so associated with status. My advice is to get a used car, preferably something 4-6 years old as cars depreciate very fast in SA and you will certainly find the best deals.

As far as taxes go, SA doesn’t tax lightly, but it’s nothing like some European countries. Take a look at the tax bracket picture in this post for an idea of how much tax to expect taken out. Hope this helped, and good luck Grace!

This is a great write up, thanks for the helpful times, it very much helped me with my relocation from Canada to Johannesburg recently. Even now, your post is accurate to the prices in Johannesburg.

No commentary on the South African ticket game?? Come on son…

Hi Johnny, thanks so much for this blog, it is super useful!

I know it’s been a little quiet for a while, but I was wondering if you could help clarify the driving situation. I don’t drive, and it sounds like that will definitely be an issue. Besides expensive taxis, how good/ well connected is the public transportation system? How safe are they? In other words, am I really screwed without a car?! :/

And probably the stupidest question of the year but…is it a bike-friendly city??

Thanks in advance for the help!

Cheers

Hi Bella, it’s funny you should mention. I asked the same question abotu riding a bike. My South African friends responded with enthusiasm and encouragement until I clarified that it was a bicycle, to which they roared in laughter. Aside from the hilly terrain of Joburg, there is not a single bike lane in the city and with how crazy the taxis drive, I wouldn’t recommend it.

Depending on where you live, you could potentialy get by on just Uber. I lived in Sandton CBG and my office was walking distance so a car wasn’t necessary much of the time. UberX is cheap enough that you could use that regularly and probably still spend less money than a car.

As for public transport, it’s pretty non-existent in Sandton, unless you somehow figured out how to ride the minibus taxis, which is an adventure in and of itself!

Great, thanks a lot for clarifying, sounds like I’ll have to download Uber!

Cheers!

Yes, it is a game changer in SA, especially with the corrupt police :). Do be careful though because I have heard that SA taxi drivers are really pissed off at Uber drivers and try to beat them up!