January 2026 kicked off the new year with strong gains across the market before mild pullbacks on geopolitical tensions and market valuations. Ultimately, the month eked out small gains with the S&P hitting new highs multiple times throughout the month. The markets pulled back into the end of the month as a new FED chair was picked which brought clarity and volatility to the markets.

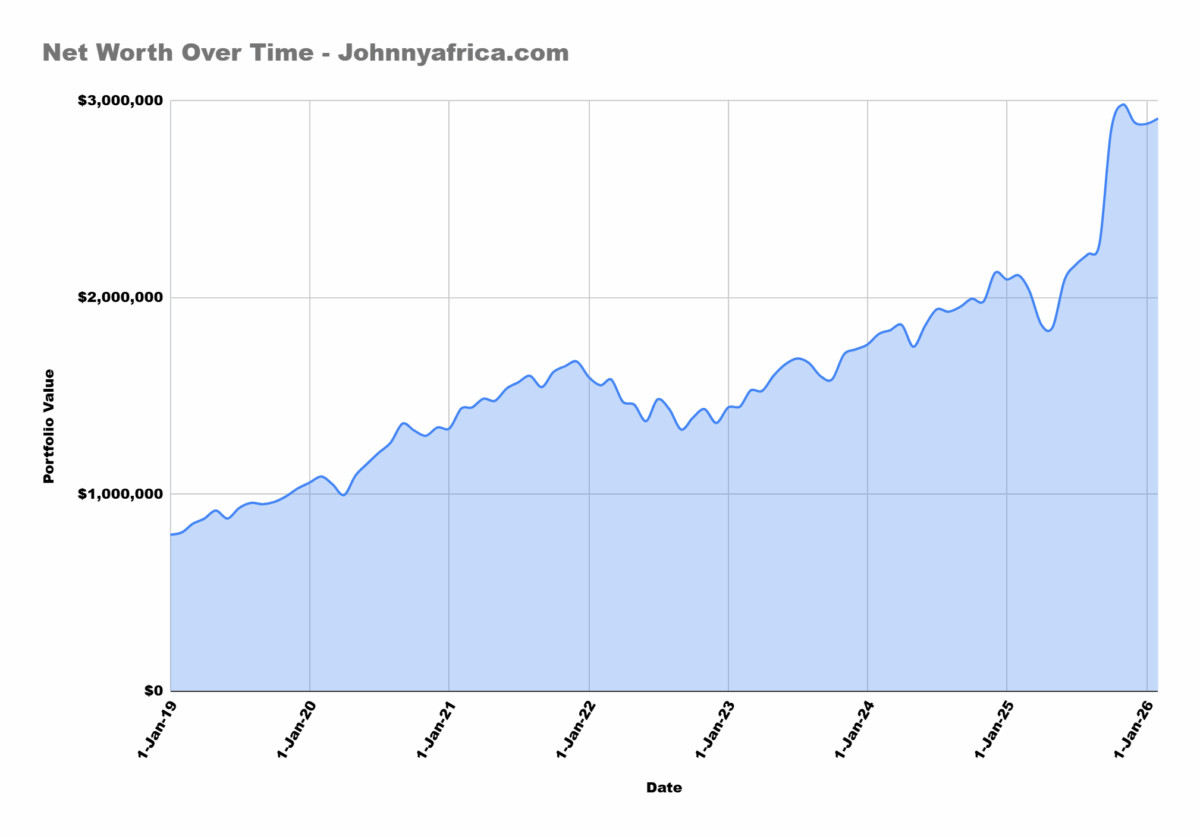

If you haven’t already read my posts before, I achieved Financial independence back in late 2020 early 2021 with a portfolio of roughly $1.3m invested in mainly ETFs. This ballooned to $1.7m during the peak of the markets in early 2022 before coming back down to Earth later in 2022. The portfolio has since regained new all time highs as markets rally beyond the previous highs.

This post will be part of a monthly series of portfolio updates that summarizes how my portfolio performed, what trades I executed, what my monthly expenses were, and my general outlook on the economy/markets. This is by no means financial advice so do not look look at me for sage advice. I make stupid trades and make even worse losses quite frequently.

This is simply the performance of my portfolio and how it has performed on a month to month basis.

Monthly Highlights – January 2026

- Net worth is at $2.9m as of January 2026 Month end

- flat for the month

- In January, we traveled to Saudi Arabia

Market Moves

| 10/31/2025 | 9/30/2025 | % Change | |

| Dow Jones | 47,563 | 46,398 | 2.45% |

| S&P 500 | 6,840 | 6,688 | 2.22% |

| Nasdaq | 23,725 | 22,660 | 4.49% |

| Russel 2000 | 2,479 | 2,436 | 1.73% |

What is in my portfolio?

My portfolio is quite simple and straight forward. I have my holdings primarily spread out between a few ETFs, fixed income, and various single name stocks.

ETFs

Again, my primary holdings are in a few ETFs. My primary holdings are in VTI, VGT, and VCR. I’ve always been a big proponent of big tech and have been heavily invested in the Nasdaq for over a decade. This has paid off very well for me given the massive bull market of the 2010s and is essentially what allowed me to FIRE so quickly.

I used to hold more dividend generating stocks as I was really into this type of investing at a period of time. I currently do not have many dividend specific ETFs as I prefer growth more than income. This kind of goes against the ethos of financial independence but I have enough money coming in from other sources that I don’t need to focus so much on consistent income from my investments.

As markets rallied again to all time highs, I didn’t add much to my position like I did in May 2025. I’m comfortable holding a bit more cash than normal and will wait for more opportunities to arise.

Single name stocks

Some of the single name stocks I own are the following

- RDDT

- ANET

- TEM

- NFLX

- RITM

- ASML

- ARES

These single name stocks make up less than 5% of my total portfolio. I tend to not buy much single name stocks anymore as there’s no point to take on unnecessary risks when I’m already so diversified with my ETFs.

Real Estate

I currently own no real estate. I used to own property in the US but have sold it in 2022 before rates started rising. I am not a big fan of real estate. While it definitely can be a good investment, I don’t think it beats investing in the markets. In addition, real estate is highly illiquid with high transaction costs that few people consider.

Finally, as someone that travels around the world and does not like to be tied down to one location, real estate doesn’t make sense as managing it from afar creates a bunch of headaches. I much prefer to have my money liquid and in the stock market.

Fixed Income

I also purchased I-Bonds in 2022 at the height of inflation peak when I-Bonds were paying 9.5%. The rates have come down significantly since then as inflation itself has come down and I no longer bother with I-Bonds.

In the recent high interest rate environment, I had allocated a small portion of my portfolio to fixed income products, specifically purchasing treasury bills with 3-6 month expiry. These were paying out 5.5% which was a great guaranteed income generator. In recent months on the back of anticipated FED rate cuts, this rate was always going to come down which meant stocks should increase.

Well the FED cut rates for the first time since COVID in Sep 2024 which means treasury bill returns will be decreasing for the foreseeable future. My last treasury bill expired in July 2024 and that cash was used to buy the market. I suspect I will not buy any fixed income products for the foreseeable future.

Market Commentary – January 2026

January felt like a tug-of-war between big macro risk and selective optimism. On the positive side, markets kicked off with strong tech and AI headlines — big names still powering indices and driving sector rotations — and some regional equity markets hit record highs early in the month. Investors were also watching rates closely, pricing in the idea that the Fed might hold steady or even pivot later in the year, which kept risk assets supported for stretches.

But that optimism had a counterweight: geopolitical flare-ups, especially around tariffs and Middle East tensions, drove sudden bouts of volatility and safe-haven demand that pushed gold and other commodities higher, and pushed traders into defensive positioning.

At the same time, markets didn’t move in a straight line. There were sharp swings — like the mid-January sell-off tied to trade policy headlines and tariff threats that rattled tech stocks. Like it’s always been under Trump, these things come and go so quickly if you blink, you miss the rally back. Commodities like gold and silver went parabolic and started mooning upwards unlike I’ve ever seen. Silver has gone up 270% in the last year and has become of the best performing assets out there at the expense of a weakened Dollar. As quickly as it went up, it crashed down 30% in a day in the worst one day sell off in decades.

The highly speculative nature that has befallen the commodities market has stolen the thunder away from the Crypto market. A lot of the volatility chasers have put their money and leverage into commodities meaning Crypto has done nothing for the past few months after its crash.

In short: January was a reminder that 2026 is shaping up to be about diversity of themes — AI optimism, rate timing, geopolitics, and safe-haven dynamics all battling for investor attention.

Market Value of Portfolio

Here is a history of my portfolio value. As you can see, it’s moved in line with the markets as should be the case since most of my holdings are in ETFs that track the S&P 500 and the Nasdaq.

In Sep 2025, I added my partner’s portfolio to the mix. I’ve avoided doing this for some time as this blog was mainly for my personal purposes but as we are a family now, it’s time to just aggregate everything for the blog purposes.

| Ticker | Quantity | Market Value |

| VGT | 2120 | $1,585,590 |

| VTI | 2500 | $851,425 |

| VCR | 400 | $159,676 |

| VDC | 350 | $79,426 |

| TQQQ | 500 | $27,000 |

| VHT | 250 | $71,820 |

| ARES | 100 | $14,967 |

| RITM | 2500 | $27,350 |

| ANET | 35 | $4,961 |

| RDDT | 100 | $18,027 |

| META | 75 | $53,738 |

| Total Stocks | $2,893,979 |

Trades executed for the month of January 2026

January was an active month of trading for me. The new year always brings mild volatility and often times sees a nice new years push. This was the case in January as stocks rallied to kick off the first half of the month. Everything from tech to meme had a nice New Year rally. I sold covered calls on my existing holdings to capture some of the gains and bought small positions into the mining craze.

I bought SLV as a way to FOMO into the Silver trade with a hard stop loss. I don’t understand exactly why it’s moon-shotted so aggressively. While the Dollar has weakened significantly over the past year, I could understand that Silver was playing catch-up to Gold. However, in the last month or two, Silver has moon-shotted unlike anything I’ve seen from Metals in my career investing

It’s up 60% YTD and 270% over 1y. That’s Bitcoin and NVDA-esque. I think Trump wants the Dollar to stay weak which allows for metals and mining to stay strong which has been evidenced with the huge appreciation of the South African Rand. Just as quickly as it rose however, it crashed down 30% in a day which is insane and triggered my stop loss.

My portfolio is still very tech heavy and while the theme of the past few months has been a rotation out of Tech, I do think it’s only a matter of time before the big players have their run again. I bought into META and AMZN in the months of Dec and Jan. They have lagged the market for some time but I think their business models are still primed for growth in today’s market.

Summary of stock and ETF purchases

| Ticker | Transaction | Quantity | Premium | ||

| GOOG | Sell 320 Put | 1 | $6 | ||

| VGT | Sell 740 Put | 1 | $12 | ||

| OKLO | Sell $130 Call | 2 | $8 | ||

| SLV | Buy | 100 | |||

| META | Buy | 60 |

Portfolio withdrawals and expenses

Withdrawals from my portfolio is an important part of the financial independence ethos. The 4% withdrawal rate rule is one of the main concepts of the FIRE movement which I try to adhere to. Generally, I prefer to sell from my portfolio when markets are near or at all time highs to capture, and only when I actually need the cash.

For the month of January 2026, we took a trip to the Kingdom which was always high on my list. Saudi Arabia exceed my expectations as a country in almost every way. The people were incredibly friendly and the natural beauty of AlUla was out of this world.

We made no withdrawals from the portfolio as we had enough cash coming in from my blog as well as leftover cash from other sources. My blog generates money every month to the tune of $5k or more and I cover exactly how I earn money from blogging in other posts.

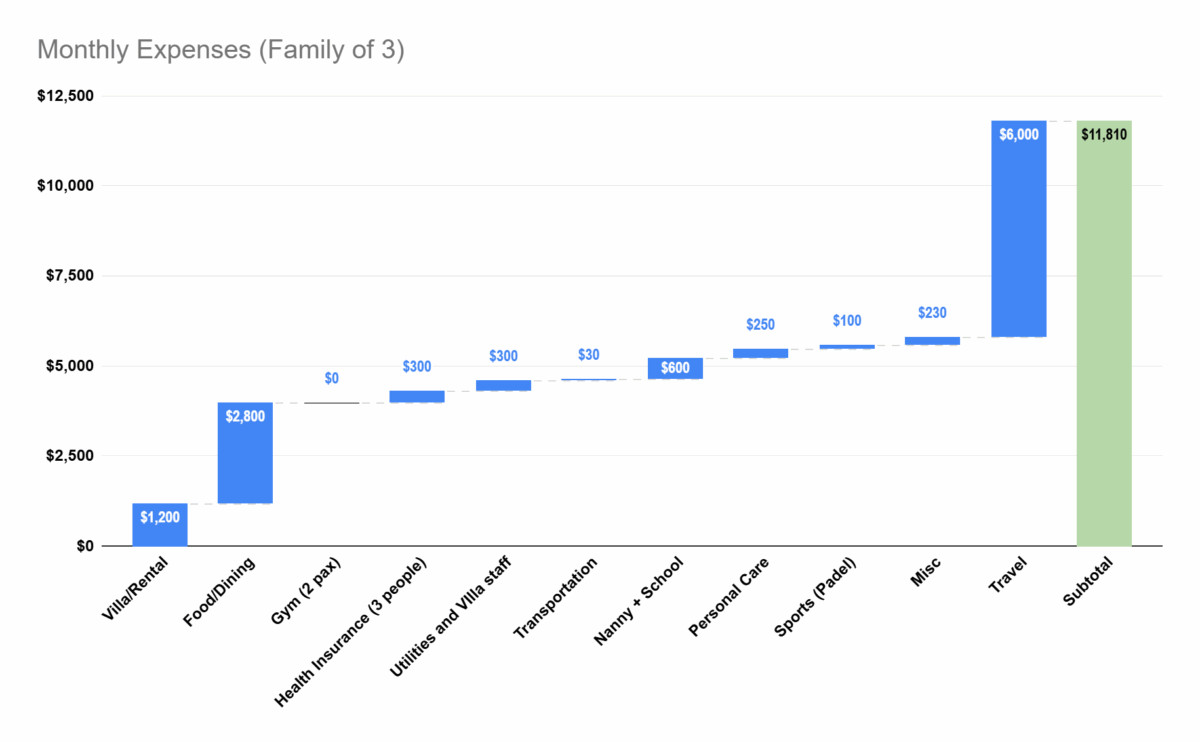

Expenses for January 2026

Living in Bali, we are able to keep our expenses (relatively) low given the lower cost of living. However, we live life to the fullest and do whatever we want, whenever we want. We choose to live in a very nice villa, a super nice gym, and eating out at the nicest restaurants in Bali. Our expenses for the month were very high given that we bought a lot of flights and traveled around Saudi Arabia.

Historically, I was accrual accounting our expenses but I’ve decided going forward I will cash account all our expenses which is much more realistic as far actual financial management goes. A lot of our expenses in Bali are paid for upfront for multiple months. Things like rent are paid upfront as well as the gym (discount for paying multiple months upfront).

In total, our expenses for the month are as follows in Bali.

Earnings for the month

While the portfolio is the main source of financial security, we still have income coming from other sources. After all, if you can make money doing something you love, why not?

In our case, we have income coming from my blog which I will detail the numbers in the next section. My partner works part time at a travel related company and also brings in income to help with the monthly expenses.

| ($) | |

| Blog Income | $7,180 |

| P2’s Income | $3,100 |

| Total Income | $10,400 |

My January 2026 Blog Earnings

I always give a run down on my monthly blogging income on these monthly portfolio reports because this is about my blog after all. My blog generates quite a lot of money from many years of hard work that it is a huge supplement to my FIRE portfolio.

- Johnny Africa 2025 Blog earnings

- Johnny Africa 2024 Blog earnings

- Johnny Africa 2023 Blog earnings

- Johnny Africa 2022 Blog earnings

My full 2025 blog earnings report has finally been released via my post in the links above. I made a total of $75k from blogging in 2025 which was an absolute monstrous and record year.

I earn money from blogging primarily from ads and sponsorships. My ads are managed by Mediavine which I joined in May 2024. In addition to Mediavine advertisements, I also earn money from Affiliate programs, sponsorships, and travel planning. More details on these things in my how to make money blogging posts.

Joining TravelPayouts

I joined TravelPayouts in June 2025 as it’s been majorly hyped by all other bloggers in the travel space. TravelPayouts is a affiliate program aggregator that allows you to combine affiliate programs like Booking.com, GetYourGuide, Trip.com, Rentalcars etc. all in one platform. They also have numerous AI tools that help automate the process of adding affiliate links to your blog.

I’m testing it out for a few months to see if it provides any additional benefit. Most of my affiliate programs in the past have been from Booking.com but travelpayouts will automatically add other affiliate programs to my blog posts in hopes of boosting income.

Here is a breakdown of my monthly earnings.

| Category | Amount Earned ($) |

|---|---|

| Mediavine Ads | $1,850 |

| Sponsorships | $4,700 |

| Affiliate Programs | $630 |

| Travel Consulting | $0 |

| Grand Total | $7,180 |

I’m still amazed my blog has held up so strong in the wake of the AI firestorm, Google algorithm changes, and everything going on. Mediavine has however consistently declined over the year. Although January is always the slowest month as it is right after the holiday rush, my RPMs are 2/3 of what they were when I joined almost 2 years ago. I might look at switching my Ad provider network if this continues.