January 2025 was a monumental month as it marks the beginning of the 2nd Trump reign which is sure to bring in even more volatility and fireworks than his first term. It’s pretty clear that big money is his main motivation and passion. Everyone wants to get on his good side and he is all about putting the most capitalist and money centric people in every position possible. This probably means stocks will do good during his term.

Markets have already rallied quite a bit since he won in November and January was a month of ups and downs. Markets rallied to new all time highs during the month after a small pullback in December before selling off big into the end of January. The DeepSeek AI project out of China scared the hell of out of US investors.

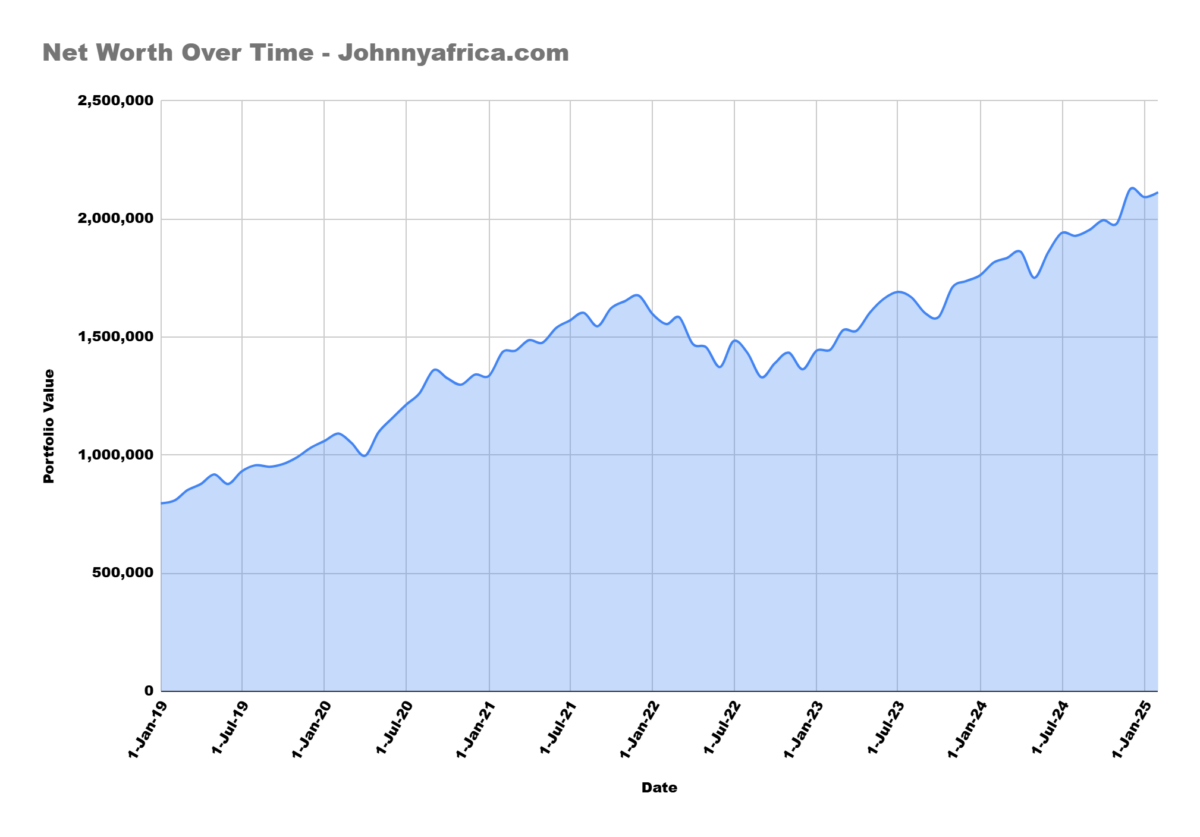

If you haven’t already read my posts before, I achieved Financial independence back in late 2020 early 2021 with a portfolio of roughly $1.3m invested in mainly ETFs. This ballooned to $1.7m during the peak of the markets in early 2022 before coming back down to Earth later in 2022. The portfolio has since regained new all time highs as markets rally beyond the previous highs.

This post will be part of a monthly series of portfolio updates that summarizes how my portfolio performed, what trades I executed, what my monthly expenses were, and my general outlook on the economy/markets. This is by no means financial advice so do not look look at me for sage advice. I make stupid trades and make even worse losses quite frequently.

This is simply the performance of my portfolio and how it has performed on a month to month basis.

Monthly Highlights – January 2025

- Net worth is near $2.1m as of January 2025 Month end

- +$50k for the month

- Traveling all through New Zealand, Cook Islands, and French Polynesia in the month of January

Market Moves

| 1/31/2025 | 12/31/2024 | % Change | |

| Dow Jones | 44,545 | 42,544 | 4.49% |

| S&P 500 | 6,041 | 5,882 | 2.63% |

| Nasdaq | 19,627 | 19,311 | 1.61% |

What is in my portfolio?

My portfolio is quite simple and straight forward. I have my holdings primarily spread out between a few ETFs, fixed income, and various single name stocks.

ETFs

Again, my primary holdings are in a few ETFs. My primary holdings are in VTI, VGT, and VCR. I’ve always been a big proponent of big tech and have been heavily invested in the Nasdaq for over a decade. This has paid off very well for me given the massive bull market of the 2010s and is essentially what allowed me to FIRE so quickly.

I used to hold more dividend generating stocks as I was really into this type of investing at a period of time. I currently do not have many dividend specific ETFs as I prefer growth more than income. This kind of goes against the ethos of financial independence but I have enough money coming in from other sources that I don’t need to focus so much on consistent income from my investments.

I added to my ETF positions in January 2025 as the market rallied to all time highs.

Single name stocks

Some of the single name stocks I own are the following

- RDDT

- ANET

- TEM

- NFLX

- RITM

- ASML

- ARES

These single name stocks make up less than 5% of my total portfolio. I tend to not buy much single name stocks anymore as there’s no point to take on unnecessary risks when I’m already so diversified with my ETFs.

Real Estate

I currently own no real estate. I used to own property in the US but have sold it in 2022 before rates started rising. I am not a big fan of real estate. While it definitely can be a good investment, I don’t think it beats investing in the markets. In addition, real estate is highly illiquid with high transaction costs that few people consider.

Finally, as someone that travels around the world and does not like to be tied down to one location, real estate doesn’t make sense as managing it from afar creates a bunch of headaches. I much prefer to have my money liquid and in the stock market.

Fixed Income

I also purchased I-Bonds in 2022 at the height of inflation peak when I-Bonds were paying 9.5%. The rates have come down significantly since then as inflation itself has come down and I no longer bother with I-Bonds.

In the recent high interest rate environment, I had allocated a small portion of my portfolio to fixed income products, specifically purchasing treasury bills with 3-6 month expiry. These were paying out 5.5% which was a great guaranteed income generator. In recent months on the back of anticipated FED rate cuts, this rate was always going to come down which meant stocks should increase.

Well the FED cut rates for the first time since COVID in Sep 2024 which means treasury bill returns will be decreasing for the foreseeable future. My last treasury bill expired in July 2024 and that cash was used to buy the market. I suspect I will not buy any fixed income products for the foreseeable future.

Market Commentary – January 2025

January 2025 was one for the books. Trump took over as president and the new era of unfettered capitalism was off to the races. Markets rallied throughout January before hitting a huge pullback with the DeepSeek news out of China.

The Nasdaq dropped almost 5% at one point before being bought back up and closing near all time highs at the end of the month. This dip reminds me of the dip we had back in August 2024 which was a huge buying opportunity. Only time will tell if it was a similar move.

January was an overall positive month which generally sets the tone for the rest of the year if you believe in market statistics.

The January Barometer isn’t just a catchy phrase—it has some statistical weight behind it. According to historical data from the S&P 500:

- Since 1950, the January Barometer has been accurate about 75% of the time, meaning that in years when January was positive, the market ended up higher for the year.

- In years when January was negative, the S&P 500 closed lower for the year about 60% of the time. While not as strong, it still suggests some predictive power.

- In 2022, January was down a grim 5.3%, and guess what? The S&P 500 closed the year down over 19%, making it one of the worst performances since the financial crisis.

- In 2024, January was up 2.27%, and guess what? The S&P 500 closed the year up over 29%, far outpacing historical annual returns.

January 2025 had a roughly 3% rally in the S&P 500 and a 2.3% rally in the Nasdaq. This is a good sign for the rest of the year. Also, I would not be a betting man against Trump who only cares about enriching himself and his circle of billionaires. The stock market has always been a report card of sorts for him and I suspect he would not be happy to see a negative year in his first term

Market Value of Portfolio

Here is a history of my portfolio value. As you can see, it’s moved in line with the markets as should be the case since most of my holdings are in ETFs that track the S&P 500 and the Nasdaq.

| Ticker | Quantity | Market Value | Price |

| VGT | 1450 | $898,855 | 619.9 |

| VTI | 2080 | $624,499 | 300.24 |

| VCR | 400 | $156,700 | 391.75 |

| VDC | 300 | $65,073 | 216.91 |

| TSLA | 100 | $40,028 | 400.28 |

| TQQQ | 1000 | $83,170 | 83.17 |

| FBGRX | 400 | $93,060 | 232.65 |

| VHT | 250 | $67,945 | 271.78 |

| ARES | 100 | $19,808 | 198.08 |

| RITM | 2500 | $28,900 | 11.56 |

| ANET | 35 | $3,985 | 113.86 |

| ASML | 50 | $36,850 | 736.99 |

In total, my portfolio is sitting somewhere around $2.1m which also includes cash and fixed income positions as of Jan 2025.

Trades executed for the month of January 2025

January 2025 was an active month of trading me. I bought stocks and crypto on multiple days as the markets just showed no signs of abating.

I scooped up more shares of my favorite ETFs on the dip as well as purchasing Tempest AI for fun just to play around a bit. It seemed to garner some attention over the month so I thought why not?

Summary of stock and ETF purchases

| Ticker | Transaction | Quantity |

| VGT | Buy | 10 |

| IGM | Sell Feb 21 $100 Put | 5 |

| TEM | Buy | 100 |

Portfolio withdrawals and expenses

Withdrawals from my portfolio is an important part of the financial independence ethos. The 4% withdrawal rate rule is one of the main concepts of the FIRE movement which I try to adhere to. Generally, I prefer to sell from my portfolio when markets are near or at all time highs to capture, and only when I actually need the cash.

For the month of January 2025, we were finishing up travels on the south island of New Zealand before heading to Cook Islands for 10 days. This country really probably has some of the best beaches I’ve ever seen in my life. The lagoon in Aitutaki is completely out of this world stunning.

After the Cook Islands, we went to French Polynesia which has been an all time bucket list item of mine. I did the shark diving from Fakarava which has been on my diving bucket list since I started scuba diving over a decade ago!

I made no withdrawals from the portfolio as I had enough cash coming in from my blog as well as leftover cash from other sources. My blog generates money every month to the tune of $6-8k and I cover exactly how I earn money from blogging in other posts.

My January 2025 Blog Earnings

I always give a run down on my monthly blogging income on these monthly portfolio reports because this is about my blog after all. My blog generates quite a lot of money from many years of hard work that it is a huge supplement to my FIRE portfolio.

My full 2024 blog earnings report has finally been released via my post in the links above. I made a total of $72k from blogging in 2024 which was an absolute monstrous and record year. 2024 was the last hurrah for traditional blogging and the last of the good days before the major Google algorithm changes.

I earn money from blogging primarily from ads and sponsorships. My ads are managed by Mediavine which I joined in May 2024. In addition to Mediavine advertisements, I also earn money from Affiliate programs, sponsorships, and travel planning. More details on these things in my how to make money blogging posts. Here is a breakdown of my monthly earnings.

| Category | Amount Earned ($) |

|---|---|

| Mediavine Ads | $1,600 |

| Sponsorships | $1,300 |

| Affiliate Programs | $200 |

| Travel Planning | $0 |

| Grand Total | $3,100 |

Blogging income has gone down precipitously in Jan 2025. After the disastrous Google algorithm updates that I talk about extensively in my 2024 blog earnings report, the effects are still pronounced.

The entire world is shifting towards AI and a more video based world. People are relying less and less on traditional Google searches for the content they want. Traffic therefore will continue to trend down and earnings as well.

I suspect the era of small time blogging like myself is over. Google will double down on their AI dreams and favoritism for big websites like Reddit which they have partnerships with. Sad times, but that is the inevitable path of capitalism! Thankfully, I purchased Reddit stock which has done exceptionally well.