Bali is a place that captures the imagination like few other destinations on earth. Its emerald rice terraces, pristine beaches, cliffside cafes, and boutique villas make it feel like paradise in every way. For tourists, it’s a dream escape. For some, it becomes more than a vacation — it becomes a vision of owning a piece of the island. The idea is simple, seductive, and sold with confidence: buy a villa, rent it out to tourists, and watch your money grow while enjoying life in paradise.

If you’ve ever looked at property listings in Canggu, Uluwatu, or Seminyak, you’ve probably seen the glossy images of infinity pools, modern interiors, and marketing pitches claiming “guaranteed returns” of 15–20% per year. Agents talk about high occupancy rates, luxury positioning, and the ever-growing tourist market, creating the impression that investing in Bali real estate is a surefire way to achieve financial freedom.

But beneath the veneer of lifestyle fantasy and impressive renderings lies a reality that few marketers disclose. Bali real estate, particularly for foreigners, is fraught with legal, financial, and operational challenges. It is not a conventional investment; it is a cash-intensive, high-risk, low-return business, with almost none of the benefits of traditional real estate investments.

This post will explore why I think Bali real estate is a poor investment choice for most foreign buyers, breaking down ownership structures, zoning rules, building versus buying, rental economics, and the all-important concept of opportunity cost.

Pre-reading disclaimer

By no means should this post be taken as investment advice. Everything here is entirely my own observation of the Bali market and my opinions. Just because I have a certain view of the market does not mean it is correct and certainly does not mean people don’t make money investing in Bali villas.

However, I’m not just talking complete nonsense either. These are my credentials for what it’s worth

- Lived in Bali for years. I’ve stayed in countless villas from short term to long term (1 bedroom, 2 bedroom, 3 bedroom, 7 bedroom etc.)

- I have many friends who have built villas for their personal use or bought villas for the purpose of renting on Airbnb

- I’ve owned real estate before (In NYC)

- I used to work in Financial Services and have a strong finance background

- I’ve done extensive research into building a villa for personal use

I’ve never purchased a villa in Bali but I’ve had countless conversations about the subject with many people. Ultimately, I could never justify it over simply investing my money in the stock market. Renting a villa in Bali is great until problems arise which has become very common given how people like to construct as fast and as cheaply as possible.

Understanding Bali’s Real Estate Market

To grasp why investing in Bali is so risky, you need to understand the market and legal framework. Bali’s property sector is unlike anything you’ll find in Australia, Europe, or the U.S., particularly when it comes to foreign ownership.

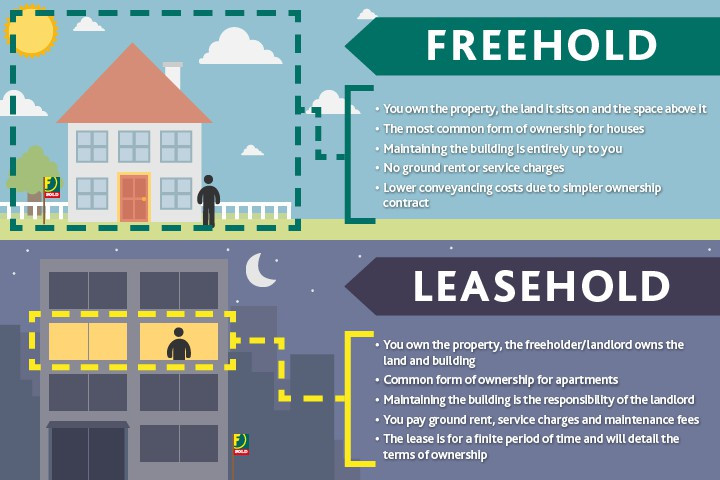

Freehold vs. Leasehold

In Indonesia, foreigners cannot legally own freehold land, known locally as Hak Milik. This form of ownership is reserved exclusively for Indonesian citizens. Foreigners hoping to acquire property face a limited set of alternatives, each with its own legal and financial complications.

The most common method is leasehold (Hak Sewa), in which the buyer leases the land for a fixed term, usually 20–30 years, sometimes with an option to extend. When the lease expires, ownership of both the land and any structures on it reverts to the landowner. This creates a fundamental challenge for foreign investors: you are essentially buying a long-term rental contract, not a permanent asset.

What happens to the land and the villa after the lease expires you’re probably wondering?

If you do not agree to an extension with the land owner, the entire land and villa goes to the owner. That means in 25-30 years, the landowner will have a nice little villa to crash on (assuming the villa even lasts that long which it likely won’t).

Some investors attempt to navigate the legal restrictions using nominee arrangements, where an Indonesian national holds the freehold title on your behalf. While this can work in practice, it is legally risky and technically illegal. If the nominee decides to assert ownership, you may have no legal recourse, leaving your investment vulnerable.

Another alternative is Hak Pakai, or “Right of Use,” which allows foreigners to “own” property through an Indonesian company (PT PMA). While this is legal, it comes with high setup and compliance costs, and it is far more complicated than standard real estate ownership in other countries.

Even when navigating leasehold structures correctly, buyers face a ticking clock. A 25-year lease may seem long, but it means that depreciation is baked into your investment from day one. Every year, the lease term shortens, and future resale value declines correspondingly.

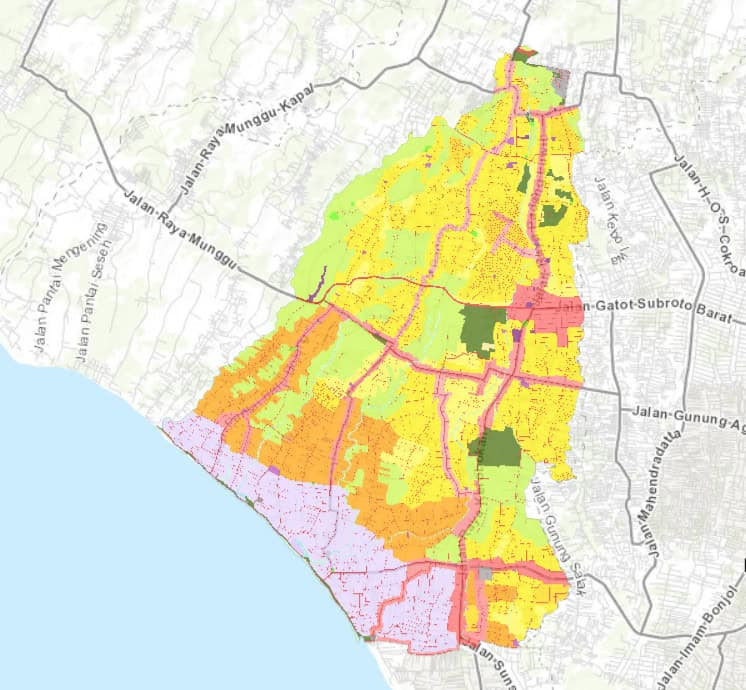

Zoning Regulations

Even if you secure a leasehold title, zoning restrictions add another layer of complexity. Bali divides land into several zoning categories, each with specific allowable uses.

- Tourism zones are intended for hotels, resorts, and short-term rental properties. Villas in these zones can legally operate as vacation rentals.

- Residential zones may allow you to build a private villa, but short-term tourist rentals are often prohibited. Many villas operate in residential zones illegally, creating potential legal issues if local authorities decide to enforce zoning laws.

- Green zones are reserved for agriculture and preservation. Construction here is strictly forbidden, but unscrupulous developers sometimes market plots in these zones anyway.

The challenge is that zoning enforcement is inconsistent. A villa that appears legal today may fall afoul of regulations tomorrow, especially if the government begins a crackdown. Many investors fail to account for the risk that their property may not be legally rentable or, in extreme cases, could be ordered to be demolished.

The Cash-Only Problem

One of the most fundamental hurdles for foreign investors in Bali is that there is no access to bank financing. Indonesian banks generally do not provide mortgages to non-residents, and private financing options are rare and expensive. This means that purchasing a villa in Bali is almost always a 100% cash transaction, unlike real estate in the U.S., Europe, or Australia, where leverage allows investors to multiply their returns.

Without leverage, your potential ROI is naturally constrained. Tying up $200,000 or more in cash in a property that produces uncertain rental income is a high-risk proposition. If the villa underperforms, you cannot mitigate losses with a mortgage structure. Furthermore, the asset is illiquid — you can’t easily sell it if you need cash, particularly as a foreigner in an unfamiliar market.

Buying vs. Building a Villa

Once you have identified a legal plot, the next decision is whether to buy an existing villa or construct your own. Both options have advantages, but both are fraught with challenges.

Buying an Existing Villa

Buying an existing villa may seem simpler, as the property is already built and sometimes generating rental income. You can inspect quality and see what you are purchasing. However, several significant downsides exist.

Many resale villas are approaching the end of their lease term, which diminishes the long-term value and limits resale options. Quality varies dramatically, and what appears pristine in marketing photos can conceal structural or plumbing issues. Prices in prime areas are inflated, often far above what the property is realistically worth when factoring in rental potential. For foreigners, resale is further complicated by legal restrictions on ownership, which narrows the pool of potential buyers.

Off-plan villas are one of the most popular ways to buy into the Bali market. These are villas that have designs in place but are not yet completed. Generally, if you get in before a villa is completed, the price will be lower. Off-plan villas are one of the main ways for villa complexes to be built since you, along with other investors, are pooling money together so the developer can complete the project.

The risk for off-plan villas are that the project is delayed. The running joke in Bali is not if it is delayed, but by how much. In addition, these villa projects often times deviate from the sketches as so many different parties are involved in the construction. What you see may not be what you ultimately get (and it’s likely not as good as initially advertised).

Building a Villa

Constructing a villa offers the allure of a custom design and potentially lower per-square-meter costs. But the reality of building in Bali is far more complicated than it seems.

Contractors are often unreliable, and cost overruns are common. Materials can be inconsistent in quality, and shortcuts are frequently taken. Construction timelines of 12–18 months are typical, during which your capital is idle. Permitting is bureaucratic and confusing, often requiring local connections or informal payments to navigate successfully. Even when construction is complete, the tropical climate can rapidly degrade structures, furniture, and appliances. A villa that looks brand-new today may require significant repairs or refurbishments within a few years.

Ultimately, whether you buy or build, you are entering a high-risk, cash-intensive, management-heavy business, not acquiring a secure, appreciating asset.

You’re still a long term renter

If you decide to buy a villa whether resale or off plan, you’re essentially a very long term renter. You’re locking in a lower price per year than if you were to just rent a villa for 1-2y on the open market.

If you buy a resale/off-plan villa for 5bn with 25y left, you’re looking at 250m a year which is probably much cheaper than what you could rent it for on a yearly basis.

The flipside to this is that you get none of the benefits of a traditional real estate investment in that you own an asset (since it is depreciating), and you get all the headaches of being a home owner. This means you’ll need to deal with all the repairs, maintenance, taxes, banjar fees, etc.

Again, it’s possible that you could have an appreciating asset with buying a Bali villa. For those that bought during the pandemic, the land value has increased so much that owners of solid villas will surely had made money, even with a few years being shaved off the lease-hold. However, this is a very idiosyncratic example and by no means represents the average market.

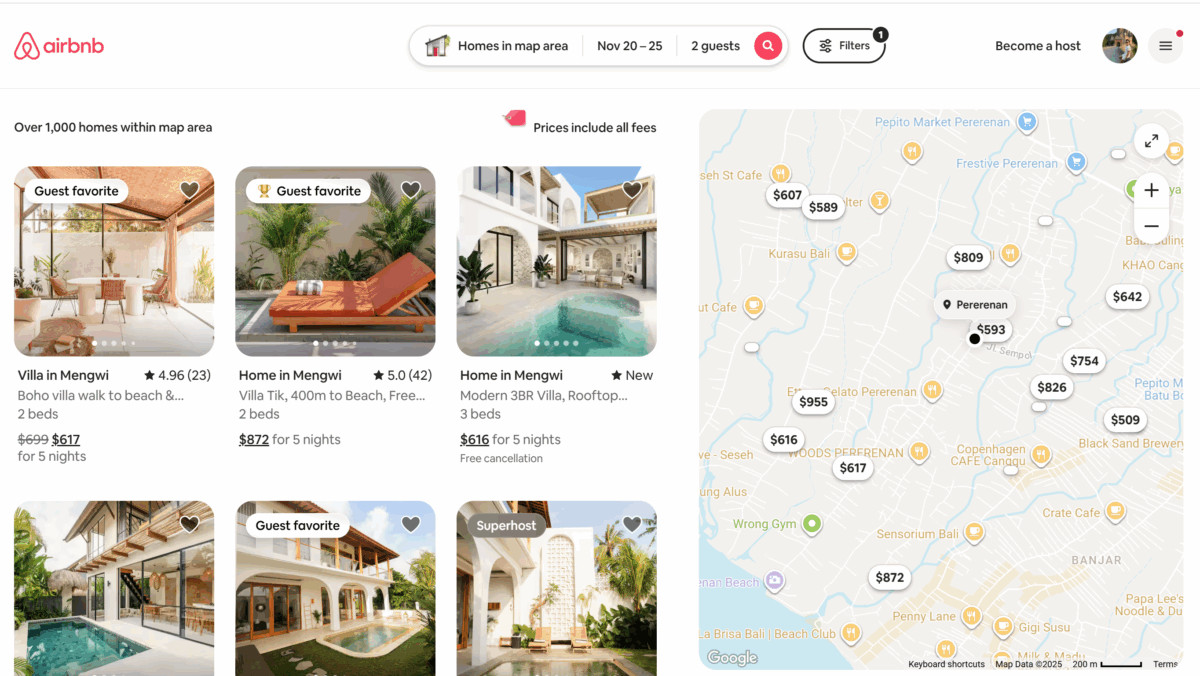

You’re in the Hotel Business, not real estate

If you’re planning to buy a villa and rent it out on Airbnb for rental income, you are not in the real estate investment business. For starters, you don’t actually own anything. You’ve leased land for 25-30 years so you are in fact just renting long term. In return, you hope to rent out your “long term villa” to others for a profit.

When you buy a villa to rent out on Airbnb or Booking.com, you’re not securing a passive asset. You’re effectively entering the hospitality industry. That means you must think like a hotel operator, not a landlord.

Guests don’t sign long-term contracts. Instead, they arrive for a few nights or weeks at a time, and each booking must be won through marketing, guest reviews, and online visibility. Revenue is completely tied to occupancy rates, which fluctuate with seasons, global travel demand, and competition.

The Realistic ROI: A $200,000 Villa Example

Developers often present rosy projections with assumptions like 80% occupancy and minimal costs with slogans like “Make your money back in 5 years”.

For the purpose of this analysis, we will use a $200,000 pre-made villa in a popular area like Canggu or Pererenan. This would assume you make a net profit of $40,000 a year (not gross profit) in order to actually “make your money back in 5 years”. Let’s see how that actually pans out in practice.

Occupancy rate

The main metric for Bali villa investing is the occupancy rate. Occupancy rates will vary wildly depending on your villa’s location, rating, price, seasonality, and construction. Every villa management agency will advertise occupancy rates of 80-90% which means that every month, the villa is rented 24-27 days out of the month.

While I’m sure some villas hit this mark, the vast majority do not as it is wildly optimistic. You might hit these numbers if you’re lucky during high season, but low season will surely lower that number. Your villa will have inevitable issues that you’ll need to address which means you’ll need to close it down for periods of time further lowering your occupancy rate.

Let’s analyze the economics using a more optimistic scenario of 75% occupancy, which is on the high end for most villas. If you can achieve this number, you’re doing quite well. We will assume an average nightly rate of $150 USD.

Step 1: Gross Revenue

274 nights × $150/night = $41,100 gross annual revenue

Even at this high occupancy, this is only slightly higher than most realistic projections.

Step 2: Expenses

Operating a villa is expensive, and many costs are recurring and unavoidable.

- Airbnb or booking platform fees typically average around 5%, or $2,055 per year.

- If you employ a villa management company to handle bookings, guest communication, and day-to-day operations, management fees are typically 25% of gross revenue, equaling $10,275 per year.

- Staff, utilities, and maintenance costs — including a housekeeper, gardener, pool maintenance, electricity, internet, and water — total roughly $3,400 annually.

- Maintenance and repairs for tropical villas are substantial. Setting aside 7–10% of gross revenue for minor repairs and furniture/appliance replacements comes to approximately $3,500 per year.

- Insurance, permits, and miscellaneous expenses can easily add another $1,000 per year.

- Taxes on rental income are roughly 10%, or $4,110 annually.

After subtracting these costs from the gross revenue:

$41,100 – $24,340 = $16,760 net income per year

Step 3: ROI

$16,760 ÷ $200,000 = 8.4% ROI annually

At first glance, 8.4% may look respectable. But consider:

- We assumed very high occupancy of 75%, which is optimistic. Realistic occupancy often hovers closer to 50–60%.

- Maintenance costs can spike unexpectedly due to storms, floods, or poor contractor work. Bali rainy seasons are the true test of your villas build quality with many villas experience issues.

- Lease depreciation and difficulty selling the villa are not accounted for in this calculation.

Once these factors are considered, the real-world ROI is likely much lower in the best case scenario.

Do you make your money back in 5 years?

If you earn 8.3% a year, assuming nothing changes with your villa, regulations, tourism trends, and everything else, it will take you 12 years to pay off the price you paid on the villa. To pay off your villa in 5 years is pretty ludicrous and I would love to see real data of villas that actually pulled this off.

Let’s say you’re able to really optimize your expenses and further maximizing your revenues beyond this example and are able to pay off the villa in 8 years.

You’ve actually not made any money yet. In 8 years, you’ve made $200k in net profit, however, what is your villa worth after 8 years?

You’re 8 years down in your lease so it’s likely under 20 years by this point. Your villa has seen 8 years of rainy seasons which means you’ll need an act of God for it to not be beat up. For reference, I’ve seen many beautiful villas that show huge signs of wear and tear after just 1 year.

This concept is called depreciation which can be a series of posts in and of itself. I won’t try to estimate the depreciation level of a typical Bali villa because I simply don’t understand the economics of this enough.

However, there is little to no chance the villa will be worth $200k after 8 years. Therefore, while you’ve made money in those 8 years, you’ve lost money on your initial principal. You can continue renting it out for the next 8 years but then you really need to start talking about opportunity cost.

The Forgotten Factor: Opportunity Cost

Even if the villa performs slightly better than average, the investment must be considered in context. One of the most overlooked factors is opportunity cost: the potential gains you give up by investing in a villa instead of other assets.

Having lived in Bali for many years and talking to many ambitious real estate investors, the concept of opportunity cost never seems to make it into the conversation which blows my mind.

As a reminder, there are no mortgages in Indonesia so any villa investment you make is entirely 100% cash upfront. If we use the villa example from the previous section, that means you’ll be taking $200k in cash and paying it upfront.

Comparing to the S&P 500

Suppose you instead invested $200,000 in an S&P 500 index fund, which historically returns around 9% per year. Over ten years, that $200,000 would grow to approximately $470,000, more than doubling your capital thanks to compound interest.

| Year | Interest | Accrued Interest | Balance |

|---|---|---|---|

| 0 | – | – | $200,000.00 |

| 1 | $18,000.00 | $18,000.00 | $218,000.00 |

| 2 | $19,620.00 | $37,620.00 | $237,620.00 |

| 3 | $21,385.80 | $59,005.80 | $259,005.80 |

| 4 | $23,310.52 | $82,316.32 | $282,316.32 |

| 5 | $25,408.47 | $107,724.79 | $307,724.79 |

| 6 | $27,695.23 | $135,420.02 | $335,420.02 |

| 7 | $30,187.80 | $165,607.82 | $365,607.82 |

| 8 | $32,904.70 | $198,512.53 | $398,512.53 |

| 9 | $35,866.13 | $234,378.66 | $434,378.66 |

| 10 | $39,094.08 | $273,472.73 | $473,472.73 |

In contrast, the villa at 8.3% ROI generates $166,000 over ten years, assuming no appreciation. Factor in realistic occupancy and unexpected expenses, and the villa’s total return drops further. The opportunity cost becomes staggering.

Of course, this can be mitigated simply by investing your rental income into the S&P or Nasdaq and letting it grow. However, it still does not take into these important things:

- Depreciation

- Villa condition

- Rental market changes

- Regulatory changes

Comparing to the Nasdaq 100

If you chose a more aggressive index like the Nasdaq 100, which has returned roughly 12% annually over the past two decades, your $200,000 could grow to $620,000 in ten years. That’s 3x your initial investment, all while being liquid, passive, and largely free of management headaches.

| Year | Interest | Accrued Interest | Balance |

|---|---|---|---|

| 0 | – | – | $200,000.00 |

| 1 | $24,000.00 | $24,000.00 | $224,000.00 |

| 2 | $26,880.00 | $50,880.00 | $250,880.00 |

| 3 | $30,105.60 | $80,985.60 | $280,985.60 |

| 4 | $33,718.27 | $114,703.87 | $314,703.87 |

| 5 | $37,764.46 | $152,468.34 | $352,468.34 |

| 6 | $42,296.20 | $194,764.54 | $394,764.54 |

| 7 | $47,371.74 | $242,136.28 | $442,136.28 |

| 8 | $53,056.35 | $295,192.64 | $495,192.64 |

| 9 | $59,423.12 | $354,615.75 | $554,615.75 |

| 10 | $66,553.89 | $421,169.64 | $621,169.64 |

Even under highly optimistic assumptions for the villa, the opportunity cost of not investing in equities is massive.

Time is Money

As you can see from this example, the math really doesn’t work out when it comes to a Bali villa rental. However, we’ve not even taken into account the time value of money.

Renting a villa out in Bali is not 100% passive. Sure, you pay the villa management agency good money to manage your Airbnb but it’s unlikely you’ll get away with doing no work. You still need to monitor the condition of your villa, deal with taxes, visas, and any type of bureaucratic issues that might come up.

Investing in the markets is a brainless, one click of a mouse endeavor. For all the work you’ll do owning a villa in Bali, that time can probably be better used to do something else, whether it be financial or non-financial.

No Liquidity in a Bali Villa

Investing in a Bali villa ties up your liquidity entirely. The entire $200k investment is in your Bali asset so you’re at the mercy of your rental income.

If this money was simply invested in the stock market, it’s an easy click of a button to access the cash you need for whatever you need in your life. This type of financial freedom cannot be understated in its ability to reduce stress and financial issues in life!

Hidden Costs That Eat Into ROI

Beyond the obvious expenses, there are additional costs that are often ignored:

- Furniture and appliances deteriorate quickly in the tropical climate and require replacement every 3–5 years.

- Major renovations are typically necessary every 3-5 years to keep the villa competitive in the rental market.

- Vacancy risk can reduce income dramatically if tourism dips or if oversupply pushes occupancy down. Worse yet, the area that your villa is located might be the hotspot now but things in Bali move quickly. In 5 years, it might no longer be trendy and people will want to travel to completely different areas.

- Personal use reduces rental income but is often included in “lifestyle” calculations, misleading buyers about the true ROI.

Even optimistic projections rarely factor in these ongoing costs, which can further erode the already modest returns.

Bali has gotten expensive

Like the rest of the world, prices in Bali skyrocketed after the Pandemic ended with land prices in the most popular areas seeing 50-100% growth.

Land in the most visited parts of Bali like Canggu, Pererenan, Seseh, and Uluwatu have reached jaw-dropping numbers. You’ll need land to construct any villa so the more expensive your land is, the pricier the villa. Land in places like Pererenan and Seseh have reached well over 1 Billion IDR ($60k USD) per Are on a 30 year lease. 1 Are = 100 square meters and it is the de facto measurement for land in Bali.

Because land has become ever more expensive, villa developers are building smaller and smaller villas condensed into the tiniest amount of space possible. Nowadays, it’s very popular to have townhouses (each townhouse shares a wall with the other) with little to no green space as that becomes more economical. The term villa is also used so casually that you forget that a villa in the rest of the world would be some huge estate in Lake Como. In Bali, it’s simply any residence with a private pool.

The problem with Bali villas nowadays is that every developer recycles the same cookie-cutter, low quality, stale, and uninspiring design in all their projects. They want to produce as quickly and as cheaply as possible. Sure these villas look great when photographed for Instagram, but the reality is that they are small, cut corners, and deteriorate quickly in the Bali environment.

Regulatory and Political Risks

Bali’s property market is also subject to regulatory uncertainty. Short-term rental rules are inconsistent and enforcement is increasing in certain areas. Taxes are becoming stricter, and foreigner restrictions may evolve, affecting your ability to operate or sell. Unlike investments in developed countries, you are not protected by a stable legal framework.

The Indonesian Government has repeatedly threatened to have more regulation on Airbnb. At any moment, they can change the zoning laws or short term rental laws and you, as a foreigner with no rights, will be out of luck.

Competition and Trends change rapidly

One of the harsh realities of Bali’s real estate market is that new villas are being built at a staggering pace. Walk through Canggu, Uluwatu, or Pererenan today, and you’ll see construction sites on nearly every block. Investors from around the world are pouring money into new builds, each with the same dream of renting their property on Airbnb and earning high returns.

The result? An ever-expanding supply of villas chasing the same pool of tourists. The question is, will there be an increasing amount of tourists to meet the supply?

Increasing Competition

Unlike established hotel markets with tight regulation and zoning limits, Bali’s villa construction is often poorly controlled. Developers can build quickly, and demand from foreign investors ensures that projects keep multiplying. Every month, dozens of new listings appear on Airbnb and Booking.com, competing directly with existing villas.

This flood of supply drives a race to the bottom in pricing. Owners often reduce nightly rates just to secure bookings, which erodes profitability. What may have been a strong investment a few years ago quickly becomes a marginal one when hundreds of nearly identical properties enter the market nearby.

The way to make sure your villa doesn’t get lost in the fray is having something unique and not the same as all the other cookie-cutter villas out there. This may require more capital outlay but hopefully it means a higher nightly price and occupancy rate.

The Fashion Cycle of Bali’s Hotspots

Another overlooked risk is that Bali’s most popular areas don’t stay “hot” forever. Seminyak was once the epicenter of Bali tourism, full of trendy cafes, shops, and nightlife. Today, it’s seen as overcrowded and dated, with many tourists opting for Canggu or Uluwatu instead. I remember first visiting Bali in 2015 when Seminayk was the hotspot. Nowadays, I visit Seminyak once a year (maybe).

The same trend is already happening in Canggu. What was once a surfer’s village has become congested with traffic, construction noise, and rising prices. Tourists who crave the “authentic Bali experience” are already moving on to places like Pererenan, Seseh, or even less-developed parts of the island. Personally, I already try to avoid Batu Bolong as much as possible and certainly do not venture out to Berawa during the day (night time yes).

This cycle means that a villa in today’s hottest neighborhood could be tomorrow’s overlooked asset. If tourists shift their attention elsewhere, your occupancy will fall — even if your villa is beautiful and well-managed.

Oversupply + Shifting Demand = Risky ROI

When you combine ever-increasing competition with the natural tendency of tourists to chase new, less-crowded areas, the investment risk grows significantly. High occupancy projections quickly become outdated, and rental income becomes harder to sustain. Meanwhile, your costs — staff, utilities, maintenance, and management — remain fixed or even rise with inflation.

This dynamic ensures that most Bali villas are in a constant struggle just to maintain profitability. For every story of a “successful” villa investment, there are dozens of others where returns are underwhelming, or owners end up selling at a loss.

There are opportunities to make money with Bali Real Estate

While I don’t think Bali real estate is a good investment overall, there are of course instances where it can be profitable. There are obviously people making money renting their villas in Bali otherwise it would not be the booming industry that it is. I firmly believe most of them will not beat simple index fund investing, if that’s even a concept they’d understand.

However, there are a handful of instances where a Bali rental villa could perhaps even beat investing in index funds.

Primarily, I think villas that have a unique and beautiful design will rent out very well. People want that quintessential Bali experience and are willing to pay more for the right place. This also means you’ll likely spend more money on the construction. Nevertheless, assuming the owners of the villa bought the land at a good time (during the Pandemic) for a low price, ROI can be significantly increased.

Making money on a leasehold land

While a 30y leasehold is by default a depreciating asset, sometimes this might not be the case if the value of the land increases significantly during that period. Let’s say you bought 30y land in Pererenan in 2021 at the height of the Pandemic. In 2025, even though you have 26 years left on the lease, you could sell this land and make a hefty profit given land prices were so cheap during the Pandemic and Pererenan was not the hotspot it is now.

This is not really traditional real estate investing however, but more speculation, or rather educated gambling. On the flip side, if you bought stocks in 2021, you would likely be up 2-3x in 2025.

Real Estate Developers can make the big bucks

The people that make the big bucks in Bali real estate are the development companies that create the villa projects around the island. They take money from investors, find contractors, and build the villa with little to no exposure. They pocket a fee for being the project managers, take on small amounts of risk, and ride off into the sunset.

This is not a profession for most people however. You really need to be deeply ingrained in the ecosystem, live & breath bureaucracy and regulations, and market the hell out of your product.

Lifestyle Purchase vs. Investment

After examining all factors — legal structure, cash outlay, operating expenses, opportunity cost, and regulatory risk — it’s clear that Bali villas rarely make sense as investments.

However, they can make sense as lifestyle purchases. If your goal is to own a personal retreat in paradise and you accept modest rental income as a bonus, a villa can fulfill that dream. The key is to separate emotional desires from financial logic.

I’ve been in this situation myself. So many of the villas in Bali suffer from the same vanilla construction design. Coupled with low quality materials, rushed project management, it’s common you run into a lot of issues with the villas. Good villas that are unique, well designed, and managed strongly will rent out quickly.

I spent so long trying to find a good villa for my family that there were often times that I wanted to just build my own villa, fully knowing that it’s a terrible financial decision, just so I know for a fact that I would have the villa I want.

However, at that point, it’s not so much about the investment angle as it is about growing into a home that you can call your own. This means customizing it the way you like so it hopefully makes you happy every time you step foot inside. It’s hard to quantify that in Dollars but I think it’s worth quite a lot.

Final Thoughts

Bali real estate is aggressively marketed as a dream investment, but the reality is sobering. Leasehold constraints, zoning regulations, cash-only purchases, high management costs, and low net returns combine to make it a risky and inefficient use of capital.

Even under optimistic scenarios, a Bali villa struggles to match the returns of equity markets. Of course, you can make money buying and renting a villa in Bali. However, as I illustrated in my examples, a lot of things need to go right and for a long time in order for the numbers to pan out. In addition, you need to pray that your villa is of good quality and won’t suffer big issues that will eat into the ROI.

If you decide to build your own villa, the costs will be considerably lower but you will need to actively supervise your project to ensure the builders are doing what you paid for, otherwise risking major problems down the line. When you factor in opportunity cost, the picture becomes even clearer: money tied up in a villa is money that could have grown far more reliably elsewhere.

Have you considered that at the end of the leasehold you can tell the landowner you will demolish all structures if they don’t give you a leasehold extension?

Yes that’s definitely an option in theory. However, you’d be paying cash to completely destroy your asset which already has no value (if owner didn’t want to extend).

[…] First off, how much cash do you actually have to spend? This isn’t like buying a used car; property prices can jump around. You’ll need to consider not just the sticker price of the villa but also closing costs, legal fees, and any immediate renovation or furnishing needs. Sometimes, a seemingly good deal might need a lot of work right away, which adds to the initial outlay. It’s wise to have a buffer for unexpected expenses that pop up during the buying process. For instance, if you’re looking at properties in the $100,000 to $300,000 range, you need to be realistic about what that gets you and what extra funds you’ll need for setup. Remember, investing in Bali real estate as a foreigner has its own set of hurdles and costs, and while Labuan Bajo isn’t Bali, some principles of careful budgeting apply everywhere Investing in Bali real estate as a foreigner. […]

I’ve never even been to Bali, much less considered buying property there, but this was a fascinating read. It would be great to see more content like this on your blog. I enjoy reading your monthly updates as well as thoughtful analysis like this that combines travel, finance, etc.

Thanks for the kind words! Will keep the content coming 🙂