There are a lot of things to consider when moving to another country. Among the many important factors, your credit score may not be at the top of your list which is very important if you want to open new credit cards while living outside of the US. However, it is worth thinking about how a move could impact your credit rating and what you can do to protect it. That’s because different countries have different systems for tracking credit, so even if you have a good credit score in your home country, it may not translate to the new country.

Additionally, certain factors like bankruptcy or late payments can impact your score differently depending on where you are. So before you make the big move, be sure to do your research and understand how your credit will be affected.

What is a credit score?

A credit score is a numeric representation of your creditworthiness. In other words, it’s a way for lenders to gauge how likely you are to repay a loan. Credit scores are based on information in your credit report, including your payment history, the amount of debt you have, and the length of your credit history. A high score indicates that you’re a low-risk borrower, while a low score means you’re a higher-risk borrower. That’s why it’s so important to keep an eye on your credit score – it can have a big impact on your financial future.

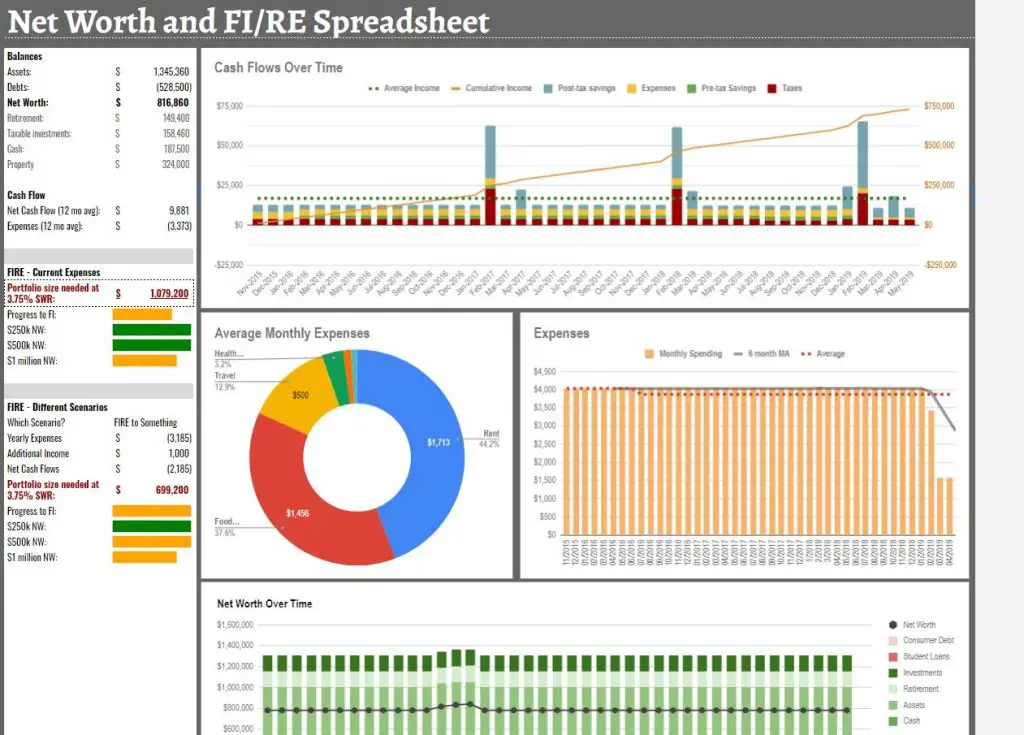

What really affects your credit score?

I’ll give you a hint. It’s not applying for too many credit cards. FICO breaks down the factors that feed into their scoring method but the most significant points can be broken down in the following.

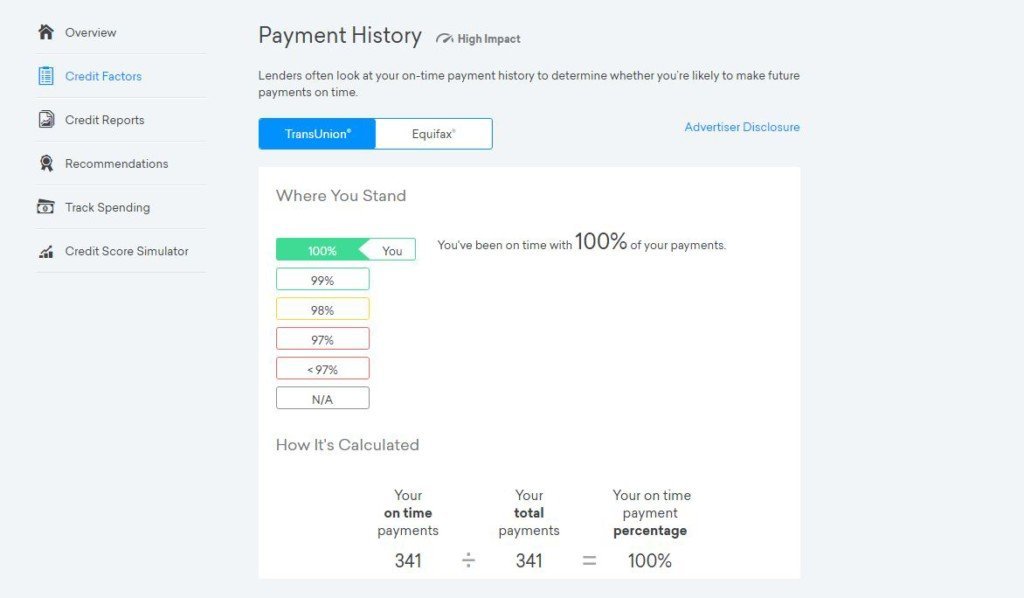

Payment History

Without a doubt, the most important component of a credit score is paying your credit cards on time. The whole point of someone lending you money is so they get the money back with a little bit extra on top (interest). Lenders don’t care if you carry a balance forward every month, as long as you pay on time. In fact, they’d rather you carry a balance so they get paid interest every month.

However, if you miss or default on a payment, this will have severe impacts on your score. This is telling future lenders that if they lend you money, they may not get it back. You might have your reasons, and they might have the best of intentions. Companies that are processing thousands of applications a day do not have time for any special reasons, and your credit score will reflect that.

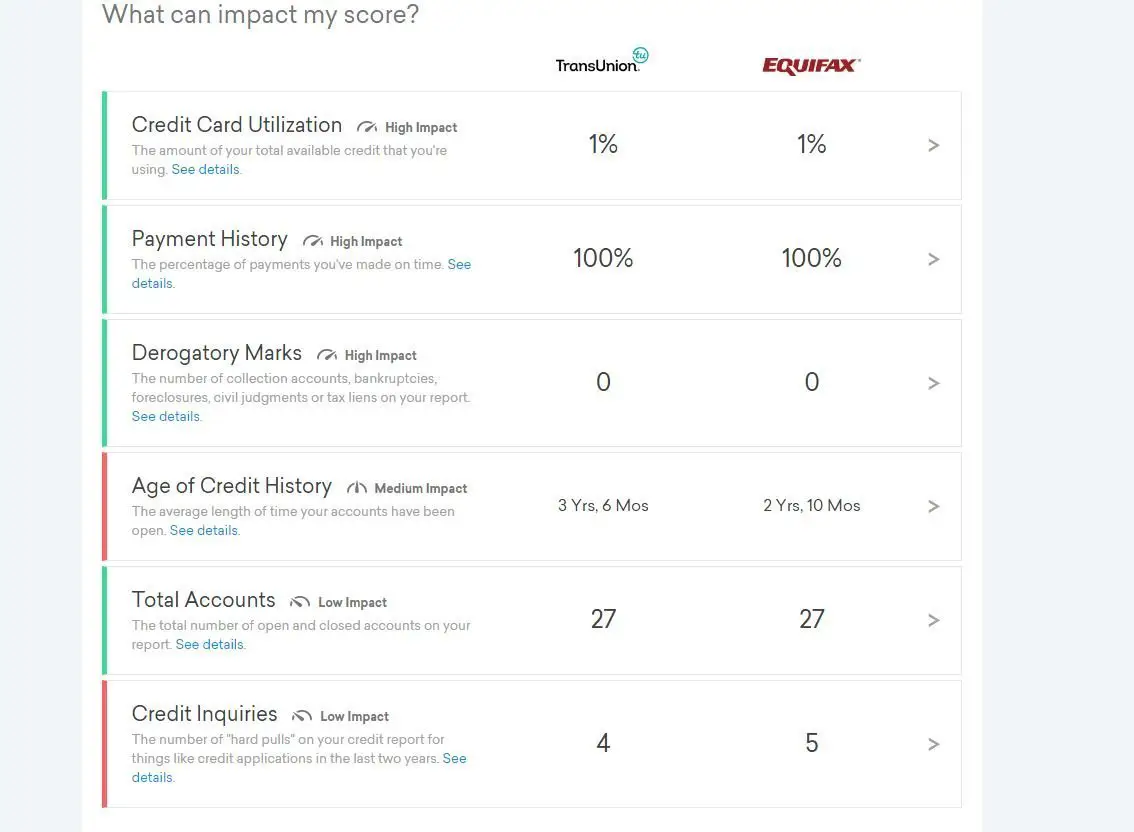

Credit Utilization

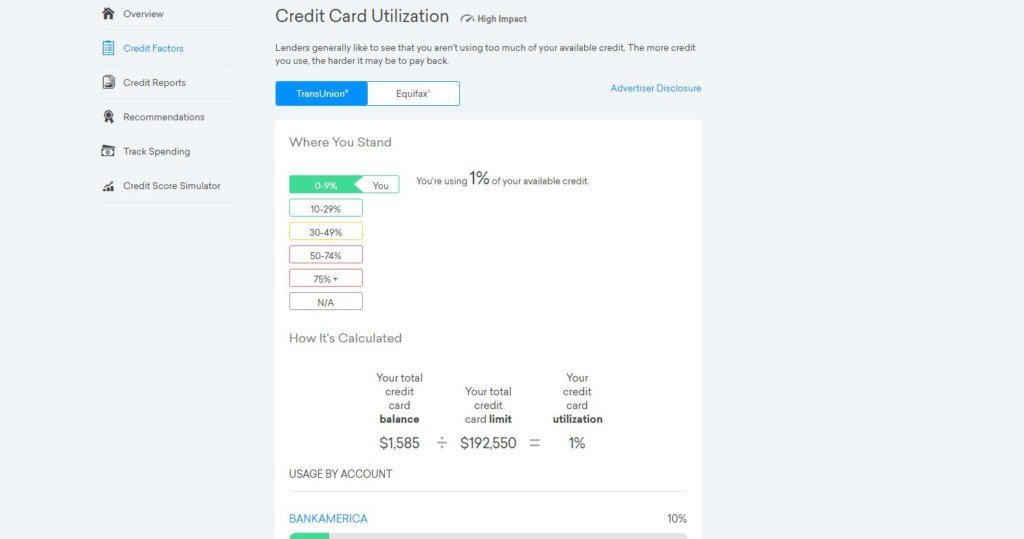

The second most important aspect of the credit score is how much credit you utilize. This can simply summarized as

total credit use / total credit limit = credit utilization %

Banks like to see someone that’s responsible with their credit, but they also want to see someone that does not use too much of the credit they have. You want your credit utilization percentage to be as low as possible because this tells lenders you aren’t planning on maxing out your credit and making a run for it.

This is actually where having multiple credit cards will really benefit your credit score. The more cards you have, the higher your total credit limit, and hence the lower your credit utilization % will be. For example:

Person A:

- 1 credit card with $20,000 limit

- Spends $2,000 a month

- Credit utilization = $2,000 / $20,000 = 10%

Person B:

- 10 credit cards with a combined limit of $200,000

- Spends $2,000 a month

- Credit utilization = $2,000 / $200,000 = 1%

It’s clear that person B with multiple credit cards, a large total credit limit, and a small utilization percentage will have a higher credit score and look more credit worthy in the eyes of lenders.

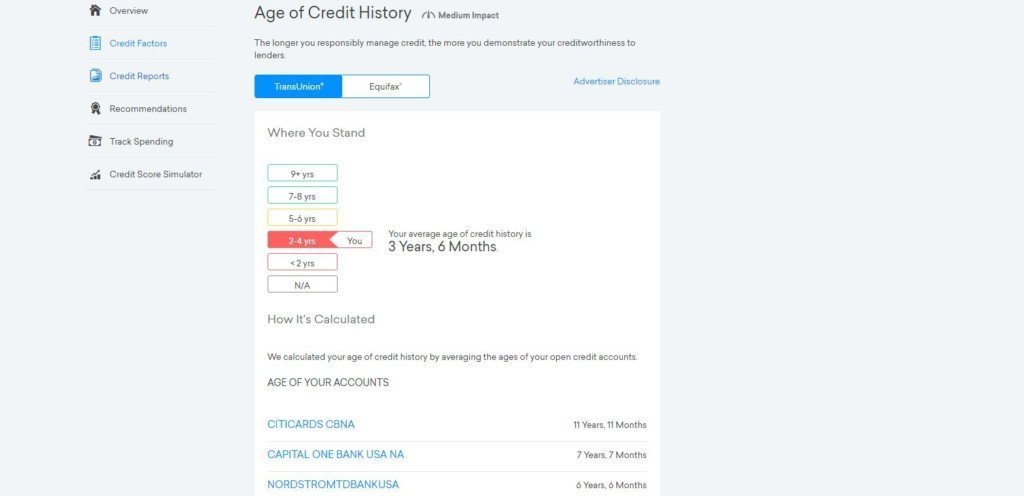

Credit History – Average age of credit

This is the most complicated piece of the credit score puzzle. Lenders like to see that you have a long history of good standing credit. The longer the better because to them, if you’ve been able to keep a credit account in good standing for 10 years, there’s a good chance you will be able to do the same for an additional account. It’s calculated based on the duration of your active accounts divided by total accounts. For example:

- You have 2 credit cards that have been open for 10 years, your average age of credit will be (2 x 10) / 2 = 10 years

- If you apply for 2 new credit cards, your new average age of credit will now become (2 x 10) / 4 = 5 years

- In 2 years time, assuming you apply for no additional accounts, your new average age of will be (2 x 12) + (2 x 2) / 4 = 7 years

Does my credit score matter when moving abroad?

Whether you have an outstanding credit score or a poor one, it will have no bearing on your financial situation when you move abroad. This means it will neither help you nor will it negatively affect your financial health. Instead, you’ll essentially be starting again. Fortunately, there are lots of things you can do to start building your credit score back up in your new country of residence.

How to build a good credit score when moving abroad

- Keep up with payments on any outstanding debts. This includes credit cards, student loans, and any other bills that you may have. Unlike your score, debts will stay with you wherever you go. Missing a payment can negatively impact your credit score, so it’s important to stay on top of things.

- Try to build up a good history of payments in your new country. This can be done by using a credit card responsibly and making sure to always pay your bills on time. Establishing a good payment history in your new country will go a long way in building a good credit score.

- Keep an eye on your credit report. Make sure that all of the information on there is accurate and up-to-date. If you spot any errors, be sure to dispute them right away. You can use a soft enquiry to check your report, which will not affect your score.

By taking these steps, you can help ensure that your finances are in a healthy state as you begin your new life.

Are you allowed to keep US credit cards when living abroad?

If you’re about to live abroad or planning on a long stint out of the country, you might ask yourself am I even allowed to keep my credit card if I’m no longer living in the US?

The answer is absolutely yes.

You are not the first US citizen to live outside of the US and certainly not the last. Many retirees will retire abroad and all of their finances will still be done in US Dollars. This means banks will want to keep their relationships and business with these clients. If you’re moving abroad, do not cancel all of your credit cards unless you are churning like me and know which ones need to be.

Credit cards in the rest of the world

The reason you’ll want to keep your credit cards is that the offerings in the rest of the world pale in comparison to how generous US credit cards are. I’ve lived in South Africa and Germany and can safely say that the credit card offerings are a joke. If you can even find one that does not charge you an annual fee, you can guarantee that there is no such nothing as meaningful sign on bonuses and point earning potential that is anywhere close to their US counterparts.

This is why I recommend any expat or expat to be to apply for US credit cards before they move abroad.

Interchange fees

Banks charge merchants a fee when you use your credit card. In the US, one of the main reasons they can offer such lucrative rewards is because the interchange fee is somewhere between 2 and 3% per transaction. That means if you pay $100 at a restaurant, that restaurant will pay $2 to $3 to the bank as a fee.

In Europe for example, the EU has capped interchange fees to 0.3% which means the same $100 transaction will only be $0.3 at most. This means banks don’t make nearly the amount of money that they do. So what happens if you use a US credit card in Europe? Do you still get the same amount of points?

Yes.

My favorite card is the Chase Sapphire Reserve which earns a whopping 3x Ultimate Rewards points on dining and travel. If I go to a delicious restaurant in Puglia, Italy and pay the equivalent of $100 for my bill, this means my bank (Chase) will only earn $100 * 0.3% = $0.30. However, they promised me 3x on dining so I still get 300 points which is worth much more than 30 cents. In fact 300 points is worth at least $4.50 because you can redeem these points at a 50% premium when done for travel.

So in fact, living abroad and earning all these points means my bank is losing money while I pocket rewards that would never be possible from the same credit cards in my country of residence.

In summary

When building your credit score, credit reference agencies will only gather information from your financial activity in your country of residence. This means that when you move abroad, you’ll have to build your score back up and essentially start again. Whilst your credit score may not travel overseas, any outstanding debts will. It’s vitally important that you stay on top of these repayments, otherwise you could impact your financial wellbeing in your new country of residence.