It’s half way through 2017 and it’s been quite the eventful first half of the year for credit card rewards. I like to take inventory of all the cards I have and use. I also have to monitor cards that have upcoming annual fees and decide whether those cards are ultimately worth keeping. The first half of 2017 saw plenty of action. American Express completely revamped their Platinum card and subsequently offered a number of lucrative sign-on bonuses which I eagerly participated in.

I still like Chase credit cards the best and think the Ultimate Rewards points system reigns supreme. Overall, I applied for five new cards in the first half of the year. Once I spent enough to collect the sign on bonus, I always went back to my Chase trifecta combo, alternating between the Chase Sapphire Reserve, Freedom Unlimited, and Freedom.

I’ve had to book numerous flights this year around the US and abroad, including a dive trip to the Caribbean, and two RT flights to Europe. I’ve yet to pay $1 from my own pocket thanks to my seemingly endless supply of points and miles.

Summary

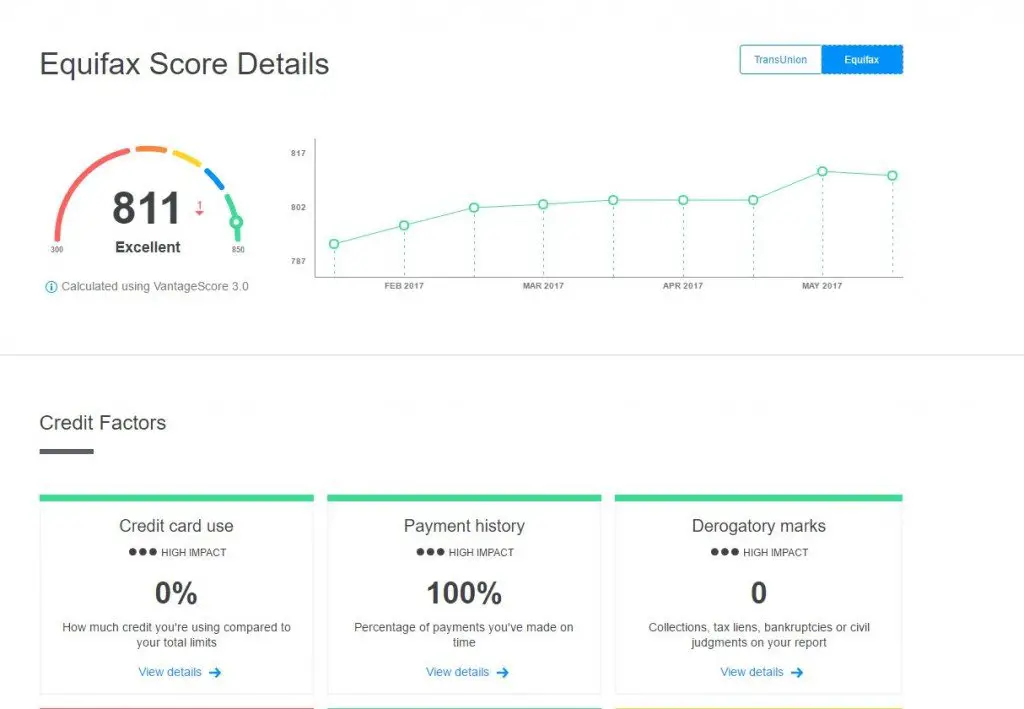

All in all, as of the end of June, I have 18 active credit cards. I applied for 5 new credit cards cards in 2017, and have canceled two. Those not familiar with credit cards might ask, how is your credit score not a pile of ashes at this point? Read this post for more information, and my credit score has actually gone up well into the 800s as evidenced by the below graph! I use a spreadsheet to track all of my credit cards which has really simplified my life.

I will go into detail on the cards I’ve opened, whether I will keep it long term, and what cards I hope to get in the upcoming months.

Current Inventory

Card Name |

Annual Fee |

Issuer |

Keep/Cancel |

| Cash Rewards | $0 | USBank | Keep |

| Quicksilver | $0 | Capital One | Keep |

| Spark Cash | $0 | Capital One | Keep |

| Blue Cash Preferred | $0 | American Express | Keep |

| Gold Business | $175 | American Express | Cancel |

| Platinum | $550 | American Express | Keep |

| Platinum Delta | $195 | American Express | Cancel |

| Gold Delta | $95 | American Express | Cancel |

| Merrill+ Visa Signature | $0 | Bank of America | Keep |

| BankAmericard Cash | $0 | Bank of America | Keep |

| Freedom | $0 | Chase | Keep |

| Freedom Unlimited | $0 | Chase | Keep |

| Ink Plus | $95 | Chase | Cancel |

| Sapphire Reserve | $450 | Chase | Keep |

| Hyatt Card | $75 | Chase | Keep |

| AAviator Red | $99 | Barclaycard | Cancel |

| Jetblue Plus | $99 | Barclaycard | Cancel |

Current Rewards Balances

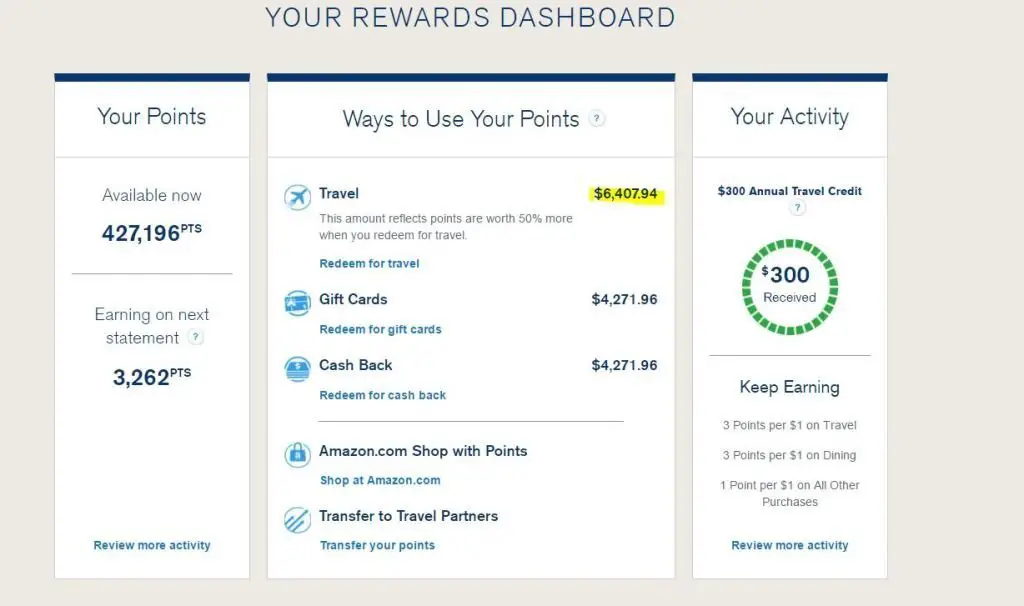

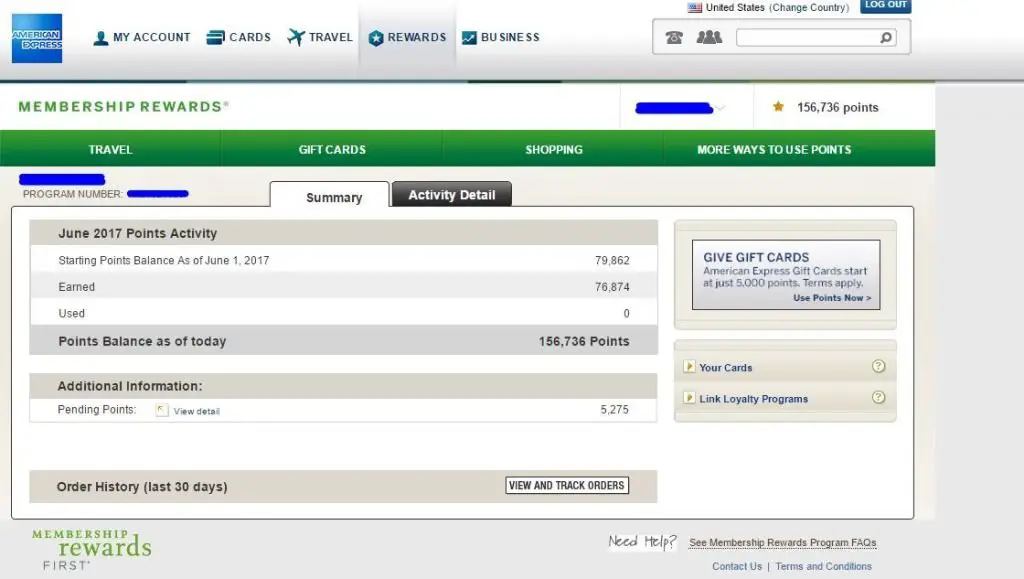

I applied for two new AMEX cards in 2017 which in bonuses alone yielded 150,000 AMEX Membership Reward points. In addition, I continue to add on to my Chase UR points balance as I find those to be the most valuable. Using the valuations system at The Points Guy, I came up with my “estimated” dollar value. Personally, I think his valuations are too high for my purposes. However, if I decided I only ever want to fly Business and First class, his points valuation would be more accurate.

- Chase Ultimate Rewards – 430,000 points (~$9,500)

- AMEX points – 160,000 (~$3,200)

- United Miles – 50,000 (~$750)

- American Miles – 120,000 (~$1,700)

- Delta Miles – 100,000 (~$1,200)

- Jetblue – 40,000 (~$500)

- Total dollar value of my credit cards ~$16,850

New Credit Cards in 2017

American Express Platinum

Annual fee: $450 going up to $550

Rewards: 75,000 point sign on bonus, $200 Uber credit, $200 flight credit, 5x on flights, 1x on everything else, full access to Delta and Centurion lounges, Priority Pass Select, Hilton Gold status, SPG/Marriot Gold Status, and more

Why I Applied: The new AMEX platinum benefits were a bit of a letdown to be honest. This was a card I’ve been waiting to get for awhile because of its numerous perks. In particular, I wanted access to the Delta lounges and Centurion lounges which are an absolute savior when traveling through the US. There’s already been a handful of times where my flight has been delayed many hours and I am relaxing with a negroni in my hands on a nice leather couch. Lastly, the card comes in heavy metal, literally. It’s double the weight of the Chase Sapphire Reserve so if anything, it makes for a cool party trick.

Keep? This is up in the air. The Centurion lounge and Delta lounge benefits are absolutely clutch. The Centurion lounge has legitimate gourmet food cooked by reputable chefs. Dinner and a drink here would be at least $20-$30 in the airport so this alone could be worth the price of the fee. The annual fee is effectively $150 after all the credits ($550 – $200 uber – $200 flight) which I think is a good price to pay. Lastly, AMEX’s purchase protection program is second to no one. In reality, what is more likely to happen is that I will cancel this card, and get the business AMEX platinum. The business version nearly identical benefits but it will come with another sweet sign on bonus in the 50,000-100,000 range.

American Express Gold Business

Annual fee: $175, waived for the first year

Rewards: 75,000 sign on points, 3x points on a category of your choice

Why I Applied: The sign on bonus of 75,000 AMEX points was too good to pass up. Using ThePointsGuy’s valuation of AMEX points, this sign on bonus alone is worth about $1,500. I don’t value AMEX points nearly that high because I think their valuations are skewed towards people that want to fly business and value free nights at big hotel chains.

Keep? The $175 is a steep price to pay. While I do have minor business expenses, there’s not enough value in this card for me to keep and pay the fee.

American Express Platinum Delta

Annual fee: $195, not waived

Rewards: 70,000 delta miles, 2x delta miles on delta purchases, companion pass after the first year

Why I Applied: I applied for the Delta Gold card in 2016 which had a 50,000 mile sign on bonus. I’ve been flying almost exclusively with Delta in the past year, and their reward system is actually much better than I thought. With the addition of the Delta Gold card, I accumulated about 150,000 miles from these cards alone. I’ve already booked a trip to Europe this year so I am down to ~100,000 miles now.

Keep? The thing with airline credit cards is they’re only really useful if you’re checking bags as that can add up quickly. I’m religious in never checking bags which has served me well. The zone 1 boarding is a nice plus but it’s not enough for me to pay $195 a year. The companion pass can be lucrative and more than pay for the annual fee but from what I’ve read, it’s not so easy to actually redeem that companion ticket. For now, the answer is no but I will research more when it comes time to pay the fee.

Barclaycard American Airlines AAviator Red

Annual fee: $99, not waived

Rewards: 50,000 AAdvantage Miles, 2x AA miles on AA purchases, 10% back on redeemed miles

Why I Applied: I think American Airlines is the worst of the big 3 in America. Their miles system is even worse. However, this card recently upped its sign on bonus to 50,000 miles after just using the card once. The $99 annual fee is not waived so I am essentially paying $99 for 50,000 miles. Even with how bad AA miles are, I think this is still a great deal. I applied for the Citi AAdvantage Platinum Select last year so I will have around 120,000 American miles soon. Round trip flights from NYC to Australia/New Zealand are 80,000 miles so I will make a visit down under courtesy of these cards.

Keep? I’m not a fan of American Airlines and I rarely fly them so this card will not be renewed.

Chase Hyatt Visa

Annual fee: $75, not waived

Rewards: 2 free nights at any Hyatt in the world, 1 free night at category 1-4 Hyatt hotel

Why I Applied: I was actually hoping to wait to get this card but Hyatt announced they would amend the sign on bonus to 40,000 Hyatt points from the current 2 free nights. 40,000 Hyatt points will get you more than 2 free nights in many of their properties. However, the top of the line category 6 and 7 hotels cost much more and that’s where the 2 free nights come in handy. I’ll use this sign on bonus to take a nice free stay at the Park Hyatt Maldives where rooms cost up to $1,000. My girlfriend will also get this card and we will combine our bonuses for a 4 night stay (saving almost $4,000) which I’ve completely detailed in this post.

Keep? The Hyatt card earns 2x points for restaurants and flights. Since you can now transfer Chase points to Hyatt points at a 1:1 rate, there is no point to ever use this card since the Sapphire Reserve earns 3x points on restaurants and travel. However, this card does give me a free night at a Hyatt category 1-4 hotel every year, as well as Hyatt status. A free night is almost certainly worth more than $75 if used correctly so I will most likely keep this card.

Canceled Credit Cards in 2017

Citi Prestige

Annual fee: $450

Rewards: 50,000 sign on bonus, 2x Citi ThankYou points on restaurants, 3x on flights booked with the airline, Points are worth 25% more when redeemed for travel, Priority pass, 4th night free at a hotel

Why I canceled: Before the Citi Prestige, there was only the American Express Platinum in the “premium” card space. This added some much needed competition which ultimately led to numerous other banks getting in on the premium card space, like the Chase Sapphire Reserve, and the USBank Altitude. If you look at the Citi Prestige’s benefits, they are similar but not as great as the Chase Sapphire Reserve. The Sapphire Reserve earns 3x on restaurants (vs 2x on the prestige), and 3x on ALL travel (vs 3x on just flights with the Prestige).

The only thing the Prestige had going for it was the book 3 nights and get the 4th night free at a hotel. If only I could take advantage of this perk, but I rarely every stay at a hotel for more than 3 nights otherwise, this could result in some serious savings. Another great perk of this card is the trip delay insurance. If I’m delayed at the airport for more than 3 hours, which happens all the time, I can go and treat myself to a fancy dinner. At the end of the day, it’s impossible for me to justify keeping a watered down version of the Chase Sapphire Reserve while paying the $450 fee.

Citi AAdvantage Platinum Select

Annual fee: $95

Rewards: 50,000 point sign on bonus, 2x AAdvantage miles per $1 spent on American Airlines, Free checked bag, Zone 1 boarding

Why I canceled: I opened this card specifically for the 50,000 free miles. The annual fee was waived for the first year making it a no brainer. Once I spent the $3,000 to get the bonus, I never used it again. Since I never check bags, the only reason to keep this card is the zone 1 boarding which is not worth the $95 a year. I will reopen this card in 2 years time and pocket the 50,000 miles again.

Potential future credit cards in 2017

- Chase Marriott – this card used to offer a 100,000 sign on point bonus but is now only 80,000. I will wait for this to go up to 100,000 again before pulling the trigger

- AMEX Starwood Card – This card will likely get discontinued in the coming years since Marriott bought SPG. They recently offered a 30,000 point sign on bonus which I wish I got in on but I was already working on the AMEX Platinum and AMEX Gold Business cards.

- USBank Altitude Card – This is another premium level card that has an annual fee of $400 but inclues a $325 travel credit, 50k sign on points worth $750. It also comes with the standard premium offerings like Priority pass, free Gogo wifi, etc. but it doesn’t differentiate itself in many meaningful ways.

- American Express Blue Business Plus – This is a new card from AMEX that I think was much needed on their part. It offers 2x MR points on all purchases, which is superior to even the AMEX Platinum. The annual fee is also $0 and the card earns Membership reward points. If I canceled my AMEX platinum and AMEX Gold business cards because I no longer wanted to pay the annual fees, I would also forfeit all of my MR points. With this card, I have a free way to stash MR points for a future date. Plus it also comes with a 20,000 sign on bonus which can never hurt!

Total noob here. What happens to the unused points when you cancel a card? BTW your post on Madagascar helped a lot for my own trip. Thanks.

If the credit card is a airlines miles card (United Explorer Plus, AMEX Delta, etc.), those miles won’t be lost because they’re on your frequent flyer account already (separate from the bank issuing the credit card). If your credit card is points/cash back (Chase Sapphire, Citi Premier etc.), then all those points will forever be lost. Make sure to always use the points up before canceling!

Also, glad to have helped out with your Madagascar itinerary! Hope you enjoyed the country as much as I did!

I have to thank you for the great information you provide! Awesome work.

Thanks and glad you found it helpful!